Global Metal Hydride Market By Product Type (Binary Metal Hydrides, Ternary Metal Hydrides, Coordination Complexes, and Cluster Hydrides), By Applications (Hydrogen Storage, Hydrogen Compressors, Heat Pumps, Heat Storage, Batteries, Thermo boosters, and Other Applications), By End-Use Industry (Energy, Automotive, Aerospace, and Other Industries), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: August 2025

- Report ID: 155006

- Number of Pages: 221

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways:

- Global Metal Hydrides Market Scope:

- Product Type Analysis

- Application Analysis

- End-Use Industry Analysis

- Key Market Segments:

- Market Dynamics:

- Drivers

- Restraints

- Opportunity

- Trends

- Geopolitical Impact Analysis

- Regional Analysis

- Market Share & Key Players Analysis:

- Key Development:

- Report Scope

Report Overview

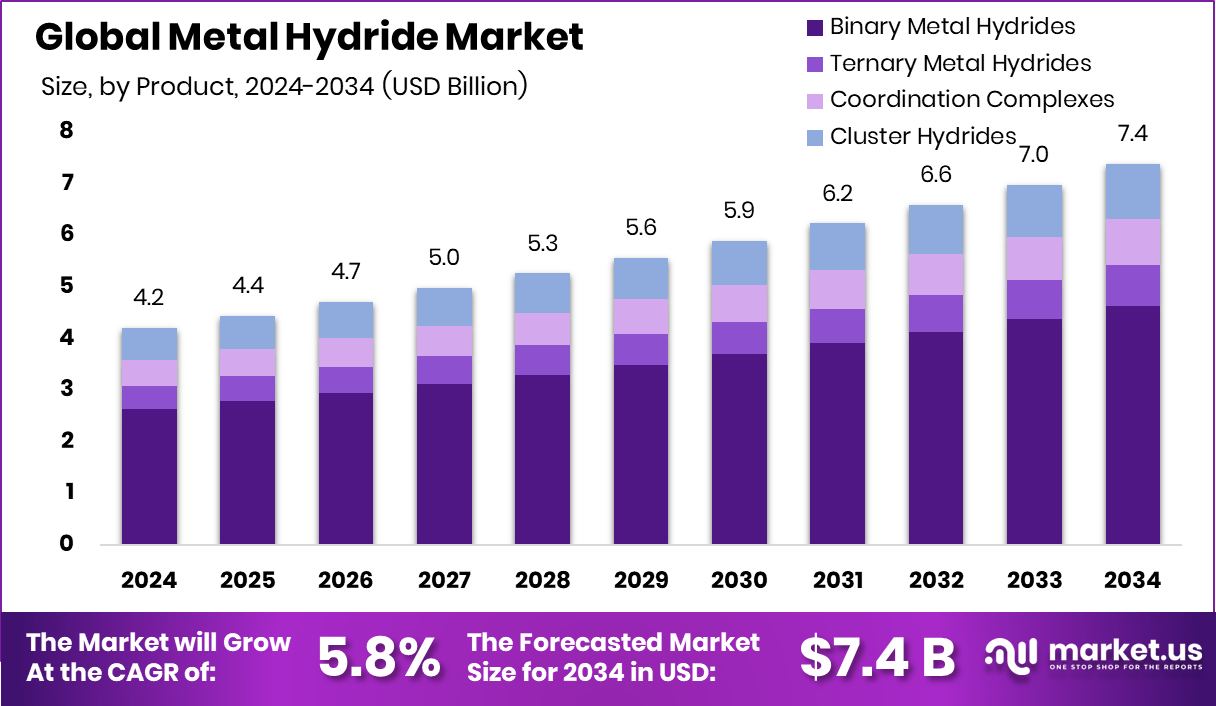

In 2024, the Global Metal Hydride Market was valued at US$4.2 billion, and between 2025 and 2034, this market is estimated to register a CAGR of 5.8%, reaching about US$7.4 billion by 2034.

Metal hydrides are compounds formed when hydrogen bonds with a metal or an alloy. They are considered a form of solid-state hydrogen storage, where hydrogen atoms are absorbed into the metal’s structure, forming a new compound. Multiple energy and industry sectors are beginning to harness hydrogen as a nearly emission-free pathway to generate power and fuel and to address a key challenge facing future energy systems, which is energy storage.

The major drawbacks of the metal hydrides are high cost, slow hydrogen absorption and release kinetics, and sensitivity to impurities like oxygen and water. Its adoption in new applications where hydrogen should play a key role in the clean energy transition, such as heavy industry, long-distance transport, and energy storage, accounts for less than 1% of global demand in 2023, despite 40% growth compared with 2022.

- According to the International Energy Agency (IEA), global hydrogen demand reached more than 97 Mt in 2023 and reached almost 100 Mt in 2024. By 2030, renewable hydrogen demand would reach up to 16 PJ in Europe, 29 PJ in the United States, 36 PJ in China, and 22 PJ for the rest of the world, driving the metal hydride market.

Key Takeaways:

- The global metal hydrides market was valued at US$4.2 billion in 2024.

- The global metal hydrides market is projected to grow at a CAGR of 5.8% and is estimated to reach US$7.4 billion by 2034.

- In the product segment, binary metal hydrides dominate the market with around 62.7% of the total market share.

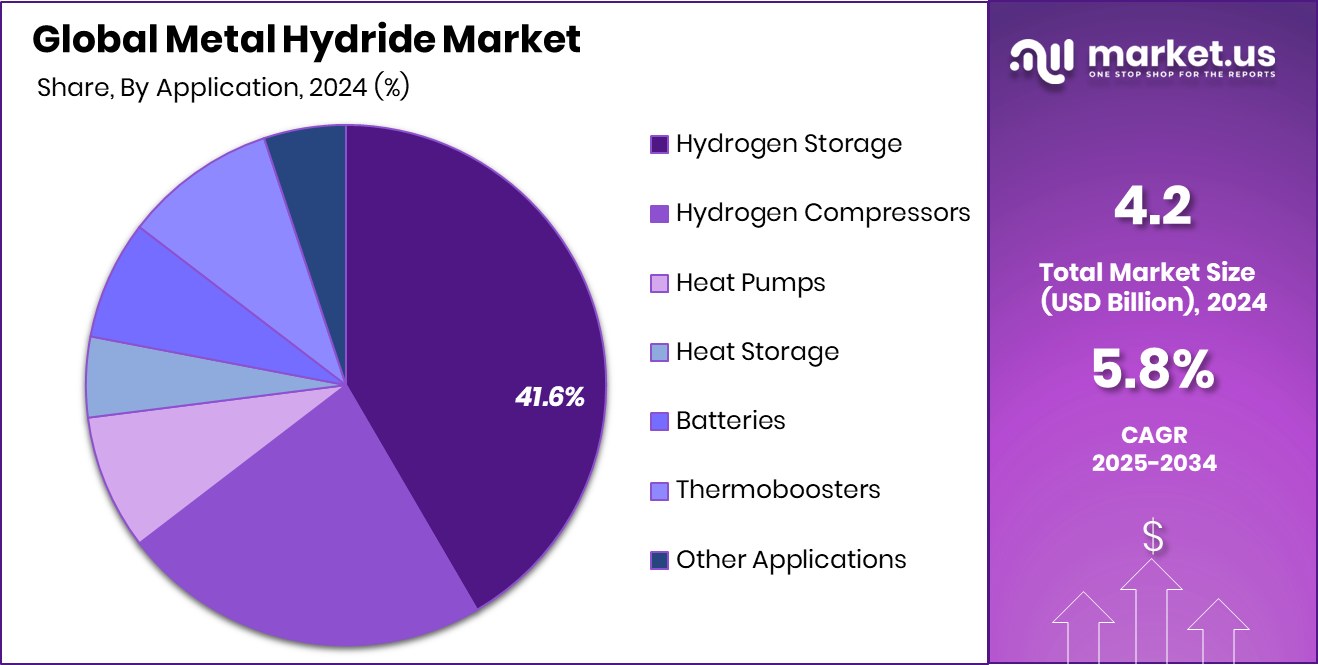

- Among the applications, metal hydrides used for hydrogen storage held the majority of revenue share in 2024 at 44.6%.

- Based on industries, the metal hydride market was led by the energy industry with a substantial market share of 41.6% in 2024.

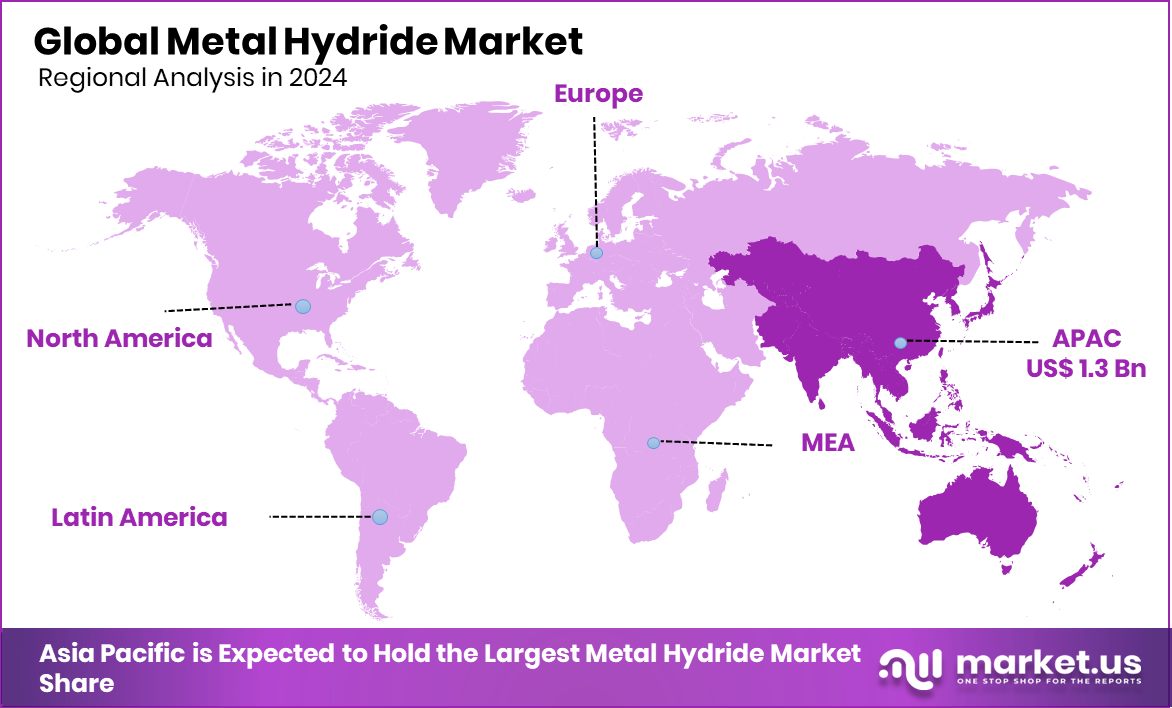

- In 2024, the Asia Pacific was the biggest market of metal hydrides, constituting around 32.4% of the total market share, valued at approximately US$1.36 billion.

Global Metal Hydrides Market Scope:

Product Type Analysis

Binary Metal Hydrides Dominate the Market, Valued at US$2.6 Billion.

The metal hydride market is segmented based on product type as binary metal hydrides, ternary metal hydrides, coordination complexes, and cluster hydrides. In 2024, binary metal hydride held a dominant market position, capturing more than a 62% share of the global market.

Binary metal hydrides are often favored over other metal hydrides due to their simpler structure, ease of synthesis, and potential for high hydrogen storage capacity. While complex metal hydrides like borohydrides can offer higher storage capacities, binary hydrides such as those of magnesium and lanthanum offer a good balance of properties that make them attractive for various applications. Additionally, the hydrogen storage capacity of binary hydrides can be tailored by alloying them with other metals to form intermetallic compounds.

Application Analysis

Metal Hydrides Used for Hydrogen Storage Dominated the Market Due to Fuel Demand.

Based on application, the market is divided into hydrogen storage, hydrogen compressors, heat pumps, heat storage, batteries, thermoboosters, and other applications. In 2024, hydrogen storage held a dominant market position, capturing a market of 41.6%.

Metal hydrides offer a comparatively safer method of hydrogen storage than high-pressure gas or cryogenic liquid storage. While they offer promise in other applications, overcoming specific technical and economic barriers is crucial for wider adoption in those areas. For instance, metal hydrides are key components in nickel-metal hydride (NiMH) batteries, but their lower energy density compared to lithium-ion batteries limits their use in applications where weight and space are critical.

End-Use Industry Analysis

Energy Sector Dominates the Metal Hydride Market with around 46.4% of the Total Market Share.

Based on end-use industry, the market can be segregated into energy, automotive, aerospace, and other industries. In 2024, the energy sector in the category dominated the global metal hydride market with a market share of 46.4%. The inherent properties of metal hydrides, particularly their low gravimetric hydrogen density and high cost, currently limit their suitability for widespread adoption in automotive and aerospace applications where weight and cost are crucial factors.

However, the less demanding weight constraints and emphasis on long-term storage in the energy sector allow metal hydrides to offer a promising solution for various applications, including grid energy storage, backup systems, and heat pumps.

Key Market Segments:

By Product Type:

- Binary Metal Hydrides

- Ternary Metal Hydrides

- Coordination Complexes

- Cluster Hydrides

By Application:

- Hydrogen Storage

- Hydrogen Compressors

- Heat Pumps

- Heat Storage

- Batteries

- Thermoboosters

- Other Applications

By End-Use Industry:

- Energy

- Automotive

- Aerospace

- Other Industries

Market Dynamics:

Drivers

Demand for Energy and Fuel Drives the Metal Hydride Market

The global demand for power and fuel is the major driver of the metal hydride market. Rising global energy use is driven by factors such as increasing cooling demand resulting from extreme temperatures, growing consumption by industry, the electrification of transport, and the expansion of the data center sector. According to the IEA, global energy demand grew by 2.2% in 2024, faster than the average rate over the past decade. Demand for all fuels and technologies expanded in 2024.

Multiple energy and industry sectors are beginning to harness hydrogen as a nearly emission-free pathway to generate power and fuel and to address a key challenge facing future energy systems, which is energy storage. The hydrogen gas needs either high pressures or low temperatures to be contained efficiently, which presents unique challenges in creating and locating suitable storage facilities.

Hydrogen metal hydride systems address this by turning hydrogen into a solid. Storing hydrogen in a compact, metal form offers distinct advantages due to its ability to avoid the stringent requirements for large, high-pressure, or low-temperature environments. When needed, the hydrogen in the metal hydride can be released by applying heat and subsequently used in applications from fueling vehicles to generating electricity for communities.

Restraints

Heavy Weight and High Prices of Metal Hydride Storage Systems Might Be Significant Obstacles for the Market.

Metal hydride storage systems represent a promising hydrogen storage option for industry. The biggest disadvantages of this storage option are still its comparatively heavy weight and high price, which might pose significant challenges to the industry. While the stationary use of metal hydrides holds a lot of potential, they are less suitable for mobile applications. This is mainly because they are filled with metal or alloy, which makes the containers weigh significantly more than when empty. This makes the storage units comparatively heavy and also very expensive due to the high material costs.

For instance, according to the International Energy Agency, in 2023, modern solid bioenergy use accounts for the majority of renewable fuel demand, which is 75%, followed by liquid biofuels at 20% in the transport sector and biogases at 5%, primarily in the buildings sector. Renewable hydrogen and e-fuels are used in only small quantities today as renewable fuels, primarily in the transport sector, due to their heavyweight.

Opportunity

Hydrogen-powered Vehicles Are Anticipated to Create More Opportunities in the Market.

Metal hydrides are being explored for use in vehicles, particularly for hydrogen storage in fuel cell vehicles and as a component in nickel-metal hydride (NiMH) batteries, creating more opportunities in the market. Metal hydrides, being one option to store hydrogen, not only achieve high volumetric hydrogen storage densities, but also enable various auxiliary functions like high-power thermal applications or hydrogen compression. In shipping and aviation, the use of hydrogen and hydrogen-based fuels is gaining interest, especially where policy support is in place, though slow market penetration has led to the cancellation of some ambitious projects for the supply of these fuels.

For instance, the German Aerospace Center (DLR) has conducted research on various metal hydride applications in future hydrogen-powered aircraft. The results of this evaluation reveal the high potential of metal hydrides for hydrogen boil-off capture, hydrogen safety sensors, and cabin air-conditioning. Similarly, Heliocentris has developed metal hydride storage canisters for powering UGVs, demonstrating the potential for long-duration operation without the need for recharging.

Trends

Government Initiatives Supporting the Hydrogen Economy

Demand for low-emission hydrogen grew almost 10% in 2023, but it still accounts for less than 1 Mt. Government action has intensified recently, through the implementation of mandates, incentive schemes, and market development tools. For instance, the EU project RISE exemplifies international collaboration in metal hydride research, involving partners from Germany, Croatia, Norway, South Africa, and Indonesia. Similarly, there are a number of existing or recently completed projects worldwide related to the implementation of metal hydride compressors for different applications, such as the EU-funded ATLAS-H2, ATLAS-MHC, COSMHYC, and COSMHYC XL projects.

Furthermore, there is a US DoE-funded project aimed at the development of a metal hydride compressor for high-pressure hydrogen delivery to refuel fuel cell-powered vehicles. According to the IEA, this could boost demand for hydrogen to over 6 MTPA by 2030. In December 2023, the International Organization for Standardization (ISO) published a technical specification that provides the basis for a full ISO standard for the methodology for determining the GHG emissions associated with hydrogen production, conditioning, and transport.

Geopolitical Impact Analysis

Impact of Geopolitical Tensions

Geopolitical tensions can significantly impact the metal hydride market by disrupting supply chains, increasing price volatility, and affecting investment decisions. These tensions can manifest as trade wars, sanctions, conflicts, or even changes in government policies, all of which can create uncertainty and instability in the market. For instance, in April 2025, China’s Ministry of Commerce imposed export restrictions on seven rare earth elements used in the defense, energy, and automotive sectors in response to U.S. tariff policies enacted in early 2025.

The new restrictions apply to samarium, gadolinium, terbium, dysprosium, lutetium, scandium, and yttrium, and require companies to secure special export licenses to export the minerals and magnets. Scandium hydride and its complex hydrides are primarily known for their potential in hydrogen storage and as an additive in advanced materials. And, hence, these tariffs can impact the metal hydride market, driving up the prices of the products.

Regional Analysis

Asia Pacific Held the Largest Share of the Global Metal Hydride Market

In 2024, the Asia Pacific dominated the global metal hydride market, holding about 32.4%, valued at approximately US$1.3 billion. The dominance of the region is attributed to the strong government support, ambitious hydrogen roadmaps, and significant investments in clean energy infrastructure. China is the biggest market in the Asia Pacific, owing to the various projects and technological advancements in the country.

In the power sector, progress is particularly strong in Japan and Korea, where companies are moving forward with several major demonstrations, and the governments have established the first auctions for hydrogen and ammonia-based electricity generation. Japan introduced a supply-side subsidy, and South Korea launched a clean hydrogen power auction system to bridge the cost gap between low-carbon hydrogen and the fossil fuels it is aiming to replace. Additionally, the presence of companies like Nippon Denko and Tokuyama Corporation, which work towards the research and development of metal hydrides, helps boost the market in the region.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Metal hydride is a very niche market, where several players compete for market share. Several major players in the market are American Elements, Sigma-Aldrich Chemicals, Albemarle Corporation, Ganfeng Lithium Group, Santa Cruz Biotechnology, Nippon Denko, and Tokuyama Corporation. To gain a competitive edge in the market, various participants engage in strategic activities, such as product development, mergers, partnerships, and investments.

Key Development:

- In September 2024, Panasonic Energy presented its nickel-metal hydride battery system for railway vehicles at InnoTrans in Berlin. Key features of the Ni-MH battery system include its compact and scalable design, allowing for flexible mounting on vehicles.

- In April 2023, Hydrexia Energy Technology, a leading integrated hydrogen technology solution provider in China with extensive global reach, announced that it had launched its pioneering Metal Hydride Trailer (MH-100T) for hydrogen storage and distribution. The rollout of the first generation of trailers marked a major technological breakthrough that significantly helped promote hydrogen technology in the fast-growing global market.

The following are some of the major players in the industry:

- American Elements

- Albemarle Corporation

- Ganfeng Lithium Group Co., Ltd.

- Santa Cruz Biotechnology Inc.

- Vizag Chemical

- Nippon Denko Co., Ltd.

- Tokuyama Corporation

- Triveni Chemicals

- Other Key Players

Report Scope

Report Features Description Market Value (2024) US$4.2 Bn Forecast Revenue (2034) US$7.4 Bn CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Binary Metal Hydrides, Ternary Metal Hydrides, Coordination Complexes, Cluster Hydrides), By Applications (Hydrogen Storage, Hydrogen Compressors, Heat Pumps, Heat Storage, Batteries, Thermoboosters, Other Applications), By End-Use Industry (Energy, Automotive, Aerospace, Other Industries) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape American Elements, Albemarle Corporation, Ganfeng Lithium Group Co., Ltd., Santa Cruz Biotechnology Inc., Vizag Chemical, Nippon Denko Co., Ltd., Tokuyama Corporation, Triveni Chemicals, Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- American Elements

- Albemarle Corporation

- Ganfeng Lithium Group Co., Ltd.

- Santa Cruz Biotechnology Inc.

- Vizag Chemical

- Nippon Denko Co., Ltd.

- Tokuyama Corporation

- Triveni Chemicals

- Other Key Players