Global Metal Fabrication Equipment Market Size, Share, Growth Analysis By Type (Cutting, Machining, Welding, Bending, Others), By Material Type (Steel, Aluminum, Copper, Others), By Mode of Operation (Automatic, Manual), By End User (Automotive, Aerospace & Defense, Construction, Electronics, Energy, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169398

- Number of Pages: 280

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

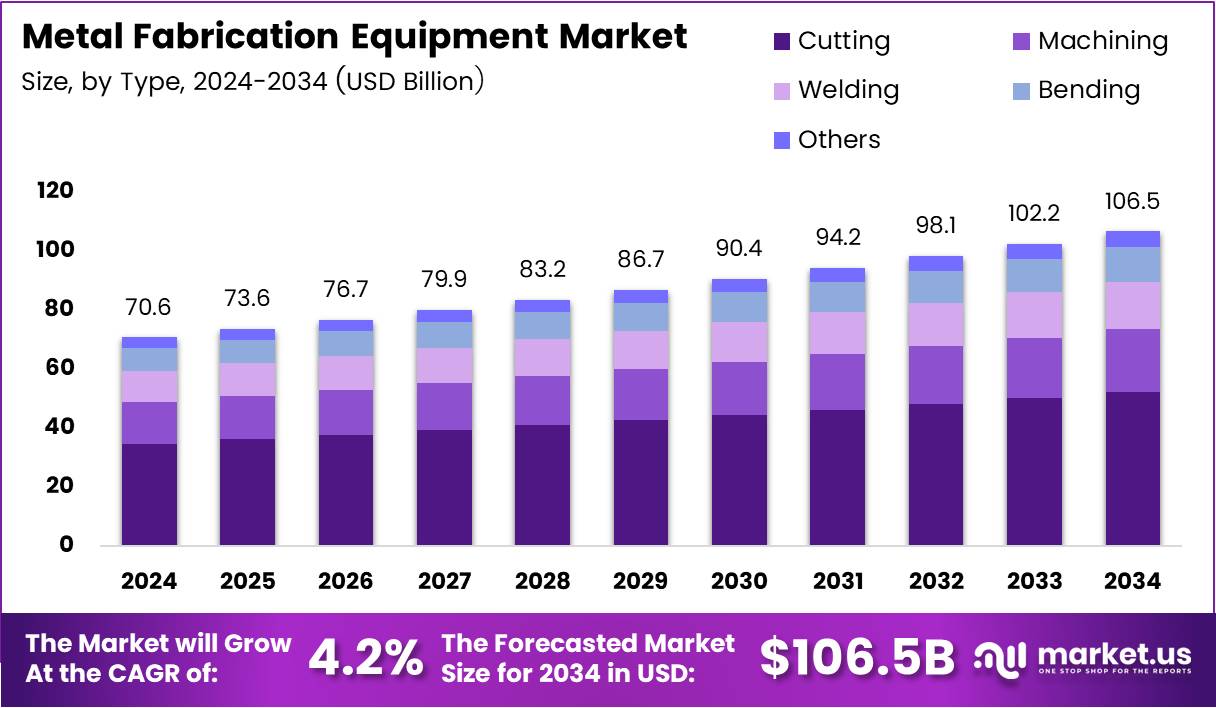

Global Metal Fabrication Equipment Market size is projected to reach USD 106.5 Billion by 2034 from USD 70.6 Billion in 2024, registering a CAGR of 4.2% during the forecast period. This market encompasses machinery and tools used for cutting, bending, welding, and machining metal components across diverse manufacturing applications.

Metal fabrication equipment represents essential industrial machinery that transforms raw metal materials into finished products through various processes. These systems include laser cutters, CNC machines, press brakes, and automated welding stations. Manufacturing facilities rely on this equipment to produce components for automotive, aerospace, construction, and electronics industries with precision and efficiency.

The market demonstrates robust expansion driven by increasing industrial automation and digital transformation across manufacturing sectors. Advanced technologies such as robotics, IoT connectivity, and artificial intelligence are reshaping traditional fabrication processes. Furthermore, growing demand for lightweight materials in electric vehicles and renewable energy applications accelerates equipment modernization initiatives among manufacturers globally.

Investment opportunities emerge from the rapid adoption of Industry 4.0 principles and smart manufacturing solutions. Companies are upgrading legacy systems to achieve higher productivity, reduce material waste, and improve operational efficiency. Additionally, modular construction trends and prefabricated building components drive demand for high-throughput fabrication machinery capable of handling complex geometries and diverse material specifications.

Government initiatives supporting domestic manufacturing capabilities and infrastructure development projects further stimulate market growth. Regulatory frameworks promoting energy efficiency and emission reduction encourage manufacturers to invest in modern, eco-friendly fabrication technologies. These policies create favorable conditions for equipment suppliers to introduce innovative solutions that align with sustainability objectives and operational requirements.

According to Manufacturing Tomorrow, there were 101.7 thousand metal fabrication robots in service in the US in 2023. Current trends suggest this figure will more than triple by 2030, highlighting the accelerating automation adoption within the metalworking industry and demonstrating the sector’s commitment to technological advancement and productivity enhancement.

Key Takeaways

- Global Metal Fabrication Equipment Market valued at USD 70.6 Billion in 2024, projected to reach USD 106.5 Billion by 2034

- Market growing at a CAGR of 4.2% during the forecast period

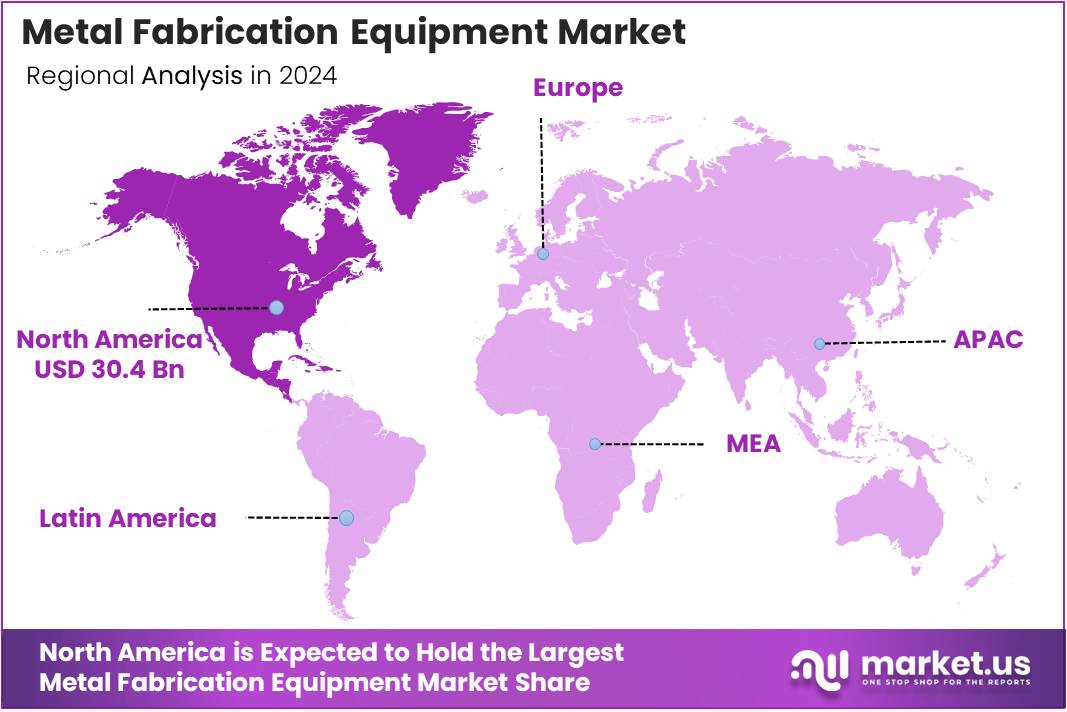

- North America dominates with 43.20% market share, valued at USD 30.4 Billion

- Cutting equipment segment leads by type with 34.5% market share

- Steel material type holds dominant position with 57.2% market share

- Automatic mode of operation accounts for 67.9% of the market

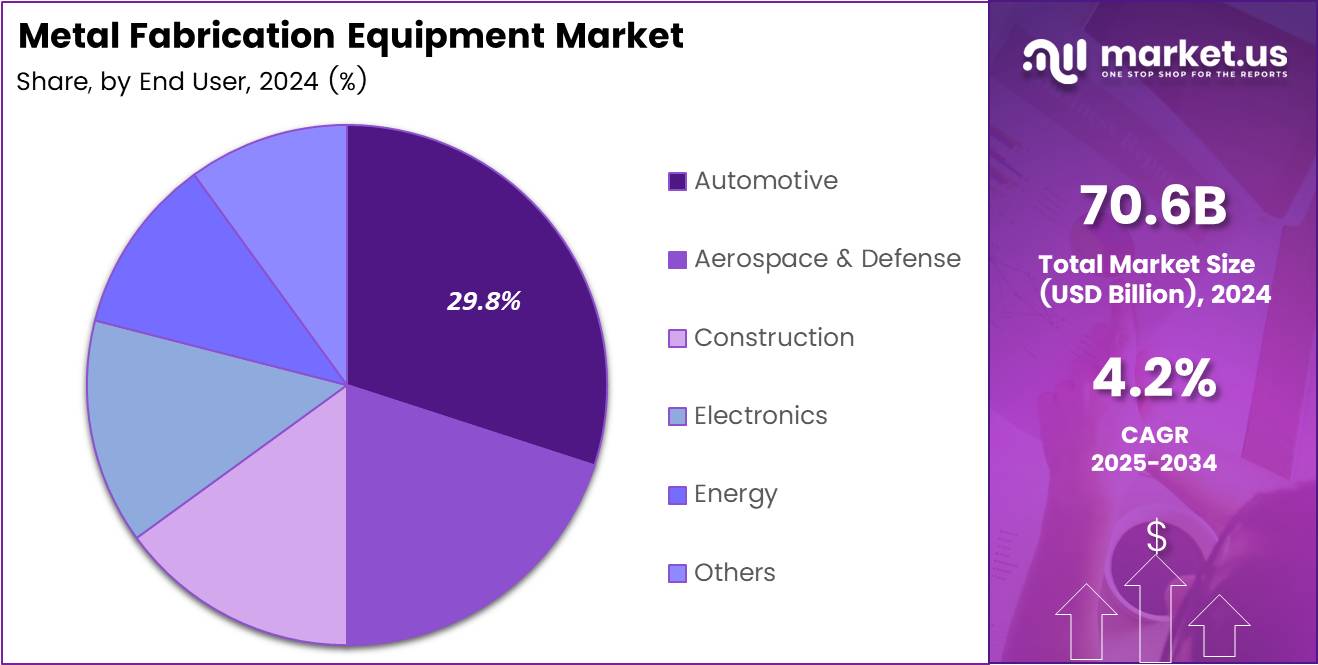

- Automotive end-user segment represents 29.8% of total market demand

By Type Analysis

Cutting dominates with 34.5% due to its fundamental role in metal fabrication processes and widespread application across industries.

In 2024, Cutting held a dominant market position in the By Type segment of Metal Fabrication Equipment Market, with a 34.5% share. This equipment includes laser cutters, plasma cutters, and waterjet systems that provide precise material separation capabilities. Industries increasingly adopt advanced cutting technologies to achieve tighter tolerances and reduce material waste. Moreover, automation integration in cutting equipment enhances throughput while maintaining consistent quality standards across production runs.

Machining equipment facilitates precise shaping and finishing operations on metal components through milling, drilling, and turning processes. CNC machining centers offer multi-axis capabilities that enable complex geometries and intricate designs. Consequently, manufacturers leverage these systems to produce high-precision parts for aerospace and medical device applications. Additionally, machining equipment supports rapid prototyping and small-batch production requirements effectively.

Welding equipment joins metal components through various techniques including arc, laser, and resistance welding methods. This segment experiences steady demand from automotive and construction sectors requiring strong, durable connections. Furthermore, automated welding systems improve consistency and reduce labor costs significantly. Modern welding equipment incorporates advanced controls for better quality management and traceability.

Bending equipment shapes metal sheets and plates into desired forms using press brakes and roll forming machines. This category serves construction, HVAC, and appliance manufacturing industries extensively. Similarly, bending operations require precision tooling to achieve accurate angles and minimize springback effects. Others include auxiliary equipment such as deburring machines, punching systems, and surface treatment tools that complement primary fabrication processes.

By Material Type Analysis

Steel dominates with 57.2% due to its superior strength, versatility, and widespread availability across manufacturing applications.

In 2024, Steel held a dominant market position in the By Material Type segment of Metal Fabrication Equipment Market, with a 57.2% share. Steel fabrication equipment handles carbon steel, stainless steel, and alloy steel materials for structural and mechanical applications. This segment benefits from robust demand in construction, automotive, and industrial machinery sectors globally. Additionally, steel’s excellent weldability and formability make it the preferred choice for heavy-duty applications requiring durability and load-bearing capacity.

Aluminum equipment processes lightweight materials essential for aerospace, transportation, and packaging industries seeking weight reduction solutions. Consequently, specialized cutting and welding systems address aluminum’s unique thermal and mechanical properties effectively.

Modern aluminum fabrication equipment incorporates advanced cooling systems to prevent material distortion during processing. Furthermore, growing electric vehicle adoption drives increased demand for aluminum components and associated fabrication machinery.

Copper equipment handles conductive materials critical for electrical, electronics, and telecommunications applications requiring excellent conductivity properties. This segment serves specialized markets including power generation, circuit board manufacturing, and heat exchanger production.

Moreover, copper fabrication requires precise temperature control and specialized tooling to maintain material properties throughout processing. Others encompass equipment for titanium, brass, bronze, and exotic alloys used in specialized industrial and medical applications.

By Mode of Operation Analysis

Automatic dominates with 67.9% due to superior productivity, consistency, and reduced labor dependency in modern manufacturing environments.

In 2024, Automatic held a dominant market position in the By Mode of Operation segment of Metal Fabrication Equipment Market, with a 67.9% share. Automated systems integrate robotics, CNC controls, and programmable logic to execute fabrication tasks with minimal human intervention.

These solutions deliver consistent quality, higher throughput, and improved workplace safety across production facilities. Subsequently, manufacturers prioritize automation investments to address labor shortages and enhance competitive positioning in global markets.

Manual equipment relies on operator skill and experience to perform fabrication tasks using conventional machinery and hand tools. This segment remains relevant for custom fabrication shops, maintenance operations, and low-volume production runs requiring flexibility.

However, manual operations face challenges related to labor availability, training requirements, and consistency concerns. Nevertheless, skilled craftsmen continue using manual equipment for specialized applications, repair work, and prototyping activities where automation proves economically unviable or technically impractical.

By End User Analysis

Automotive dominates with 29.8% due to massive production volumes and continuous demand for precision metal components and assemblies.

In 2024, Automotive held a dominant market position in the By End User segment of Metal Fabrication Equipment Market, with a 29.8% share. This sector requires extensive fabrication equipment for body panels, chassis components, engine parts, and structural elements. Electric vehicle transition accelerates demand for lightweight fabrication solutions and battery enclosure manufacturing equipment. Additionally, automotive manufacturers seek advanced automation to maintain cost competitiveness while meeting stringent quality and safety standards.

Aerospace and Defense sectors demand high-precision fabrication equipment for aircraft components, satellite structures, and military hardware production. Consequently, this segment prioritizes equipment capable of handling exotic materials and achieving extremely tight tolerances. Furthermore, rigorous quality certifications and traceability requirements drive investment in advanced monitoring and inspection-integrated fabrication systems throughout these industries.

Construction industry utilizes fabrication equipment for structural steel, architectural metalwork, and building system components across commercial and residential projects. Similarly, modular construction trends increase demand for prefabricated metal assemblies and standardized building components. Electronics sector requires precision miniature fabrication equipment for enclosures, heat sinks, connectors, and shielding components used in consumer and industrial electronic devices.

Energy segment encompasses equipment for oil and gas infrastructure, renewable energy systems, and power generation facilities requiring heavy-duty fabrication capabilities. This sector demands large-scale equipment for pipeline fabrication, wind turbine components, and solar panel mounting structures. Others include equipment serving medical device manufacturing, appliance production, furniture fabrication, and general industrial applications requiring custom metal components.

Key Market Segments

By Type

- Cutting

- Machining

- Welding

- Bending

- Others

By Material Type

- Steel

- Aluminum

- Copper

- Others

By Mode of Operation

- Automatic

- Manual

By End User

- Automotive

- Aerospace & Defense

- Construction

- Electronics

- Energy

- Others

Drivers

Rising Integration of Advanced Automation and Robotics Drives Metal Fabrication Equipment Market Growth

Manufacturing facilities increasingly adopt automated fabrication systems to enhance productivity and maintain competitive advantages in global markets. Robotic integration enables consistent quality output while reducing operational costs and minimizing workplace safety risks.

Furthermore, labor shortages across developed economies accelerate automation adoption as companies seek reliable production solutions. Advanced robotics handle repetitive tasks efficiently, allowing skilled workers to focus on complex operations requiring human expertise and decision-making capabilities.

Expanding demand for precision metal components across aerospace and automotive sectors propels equipment modernization initiatives among manufacturers worldwide. These industries require extremely tight tolerances and superior surface finishes that manual processes cannot consistently deliver.

Consequently, companies invest in high-precision CNC machines and laser systems to meet stringent quality specifications. Additionally, electric vehicle production demands lightweight components requiring advanced fabrication technologies capable of handling aluminum and composite materials effectively.

Increased adoption of energy-efficient and high-throughput fabrication machinery reflects industry focus on sustainability and operational optimization. Modern equipment incorporates servo drives, regenerative systems, and intelligent controls that reduce energy consumption significantly compared to legacy machinery.

Similarly, modular construction and prefabricated metal structures drive demand for equipment capable of producing standardized components at scale with minimal setup time and material waste throughout production cycles.

Restraints

High Initial Capital Investment Restrains Metal Fabrication Equipment Market Expansion

Modern CNC and laser systems require substantial upfront investment that creates financial barriers for small and medium-sized manufacturers. Advanced fabrication equipment often costs hundreds of thousands to millions of dollars, making acquisition decisions challenging for companies with limited capital resources.

Furthermore, additional expenses for installation, training, and facility modifications increase total ownership costs significantly. Consequently, many smaller fabricators continue operating older equipment despite productivity and quality limitations compared to contemporary systems.

Shortage of skilled technicians for operating digitized fabrication equipment presents ongoing challenges for manufacturers investing in advanced technologies. Modern systems require operators with programming knowledge, computer skills, and understanding of digital manufacturing principles beyond traditional metalworking expertise.

Subsequently, companies struggle to recruit qualified personnel or must invest heavily in training existing workforce members. This skills gap slows technology adoption and reduces return on investment for sophisticated equipment requiring specialized operational knowledge and maintenance capabilities.

Economic uncertainty and fluctuating raw material costs create hesitation among manufacturers considering major equipment purchases and facility upgrades. Market volatility affects long-term planning and makes justifying capital expenditures more difficult for management teams.

Additionally, rapid technological advancement creates concerns about equipment obsolescence and stranded investments in systems that may become outdated before recovering initial costs through operational improvements and productivity gains.

Growth Factors

Rapid Expansion of Metal Additive Manufacturing Creates New Growth Opportunities

Metal additive manufacturing applications expand rapidly as technology matures and costs decline, opening new possibilities for complex component production. This approach enables design freedom impossible with traditional subtractive methods while reducing material waste substantially.

Industries increasingly adopt metal 3D printing for tooling, spare parts, and customized components requiring intricate geometries. Furthermore, aerospace and medical sectors leverage additive manufacturing for lightweight structures and patient-specific implants that traditional fabrication cannot produce economically.

Increasing penetration of IoT-enabled predictive maintenance solutions transforms equipment reliability and operational efficiency across manufacturing facilities. Smart sensors monitor machine conditions continuously, detecting anomalies before failures occur and minimizing unplanned downtime.

Consequently, manufacturers reduce maintenance costs while extending equipment lifespan through data-driven service interventions. Additionally, cloud connectivity enables remote diagnostics and expert support, improving response times and reducing reliance on on-site technical personnel.

Rising demand for customized, small-batch fabrication capabilities drives investment in flexible manufacturing systems and quick-changeover equipment. Modern markets increasingly require personalized products and rapid delivery, challenging traditional mass production approaches.

Similarly, adoption of green manufacturing practices and low-emission metalworking systems aligns with corporate sustainability goals and regulatory requirements. Equipment manufacturers develop solutions incorporating closed-loop cooling, fume extraction, and energy recovery to minimize environmental impact throughout fabrication operations.

Emerging Trends

Surge in Hybrid Fabrication Technologies Shapes Future Manufacturing Capabilities

Hybrid fabrication technologies combining laser, plasma, and mechanical cutting methods offer unprecedented versatility and efficiency for diverse material processing requirements. These systems switch between cutting modes automatically based on material type, thickness, and quality specifications without operator intervention.

Consequently, manufacturers reduce equipment footprint while expanding processing capabilities across different applications. Furthermore, integrated systems minimize material handling and setup time between operations, improving overall production efficiency significantly.

Growing use of digital twins for real-time production optimization enables manufacturers to simulate and refine processes before physical implementation. Virtual models predict equipment performance, identify bottlenecks, and test process modifications without disrupting actual production activities.

Subsequently, companies reduce trial-and-error experimentation while accelerating process development and optimization cycles. Additionally, digital twins support operator training in safe virtual environments before working with expensive physical equipment.

Proliferation of cloud-connected fabrication equipment enables remote monitoring, data analytics, and collaborative manufacturing across distributed facilities. Cloud platforms aggregate performance data from multiple machines, providing insights into overall equipment effectiveness and production trends.

Similarly, increased focus on lightweight metal fabrication for electric vehicles and renewable energy industries drives development of specialized equipment handling aluminum, magnesium, and advanced high-strength steels. These applications require precise thermal management and specialized tooling to maintain material properties throughout processing operations.

Regional Analysis

North America Dominates the Metal Fabrication Equipment Market with a Market Share of 43.20%, Valued at USD 30.4 Billion

North America leads the global market with a commanding 43.20% share, valued at USD 30.4 Billion, driven by advanced manufacturing infrastructure and high automation adoption rates. The region benefits from strong automotive, aerospace, and construction sectors demanding sophisticated fabrication equipment.

Moreover, United States manufacturers prioritize technology upgrades to maintain competitive advantages and address persistent labor shortages. Government initiatives supporting domestic manufacturing and infrastructure investment further stimulate equipment demand across various industrial segments throughout the region.

Europe Metal Fabrication Equipment Market Trends

Europe demonstrates robust market presence supported by precision engineering heritage and stringent quality standards across manufacturing sectors. German and Italian equipment manufacturers lead global innovation in CNC technology and laser systems. Furthermore, European Union regulations promoting sustainability drive adoption of energy-efficient fabrication equipment. The region’s aerospace and automotive industries maintain strong demand for advanced processing capabilities despite economic headwinds.

Asia Pacific Metal Fabrication Equipment Market Trends

Asia Pacific exhibits the fastest growth trajectory fueled by rapid industrialization, expanding manufacturing capacity, and infrastructure development across emerging economies. China, Japan, and South Korea lead regional demand with massive automotive production and electronics manufacturing bases. Additionally, government initiatives supporting advanced manufacturing and technology transfer accelerate equipment modernization. Lower labor costs historically delayed automation adoption, but rising wages now drive increased interest in automated fabrication systems.

Middle East and Africa Metal Fabrication Equipment Market Trends

Middle East and Africa show steady growth potential driven by oil and gas infrastructure projects, construction activities, and economic diversification initiatives. Gulf nations invest heavily in manufacturing capabilities to reduce resource dependency and create employment opportunities. However, political instability and economic volatility in certain regions constrain consistent market expansion. Infrastructure development and renewable energy projects create opportunities for fabrication equipment suppliers throughout the region.

Latin America Metal Fabrication Equipment Market Trends

Latin America presents moderate growth opportunities supported by automotive manufacturing in Mexico and Brazil plus mining and construction activities across the region. Economic challenges and currency fluctuations create uncertainty for major capital equipment investments. Nevertheless, nearshoring trends and regional trade agreements drive manufacturing facility expansion. Local fabrication capabilities improve gradually as companies modernize equipment to meet international quality standards and export requirements.

Key Metal Fabrication Equipment Company Insights

The global Metal Fabrication Equipment Market features established manufacturers with comprehensive product portfolios and extensive service networks supporting diverse industrial applications worldwide. Leading companies invest heavily in research and development to maintain technological leadership and address evolving customer requirements. Strategic acquisitions, partnerships, and regional expansion initiatives characterize competitive dynamics as suppliers seek growth opportunities across emerging markets.

Amada Corporation maintains strong market presence through innovative press brake technology and comprehensive sheet metal fabrication solutions serving automotive and electronics sectors globally. The company emphasizes automation integration and digital connectivity to enhance equipment productivity and operational efficiency.

Trumpf Group leads laser cutting technology development and offers integrated manufacturing systems combining multiple processes within unified platforms. Their solutions serve high-precision applications in aerospace, medical device manufacturing, and advanced electronics production worldwide.

Bystronic Laser AG specializes in laser cutting and bending equipment featuring advanced automation capabilities and intelligent material handling systems. The company focuses on delivering complete production cells that maximize throughput while minimizing operator intervention requirements.

Shenyang Machine Tool Co. Ltd represents significant Asian manufacturing capacity with comprehensive CNC machining and turning solutions serving domestic and international markets. Their equipment portfolio addresses diverse price points and application requirements across various industrial segments.

Other key players including DMG Mori, General Technology Group Dalian Machine Tool, Okuma Corporation, Sandvik AB, Yamazaki Mazak Corporation, and Hypertherm Associates contribute to competitive market dynamics through specialized technologies and regional market expertise. These companies collectively drive industry innovation while expanding global manufacturing capabilities and supporting diverse customer applications across multiple end-user sectors worldwide.

Key Companies

- Amada Corporation

- Trumpf Group

- Bystronic Laser AG

- Shenyang Machine Tool Co. Ltd

- DMG Mori

- General Technology Group Dalian Machine Tool Co., Ltd.

- Okuma Corporation

- Sandvik AB

- Yamazaki Mazak Corporation

- Hypertherm Associates Inc

Recent Developments

- In February 2025, S&W Metal Products acquired York Haven Fabricators, expanding manufacturing capacity and strengthening regional market presence. This strategic acquisition enhances production capabilities and enables better service delivery to existing and new customer segments across northeastern United States markets.

- In October 2025, Bystronic announced plans to acquire Coherent’s tools for materials processing business unit, significantly expanding technology portfolio and market reach. This acquisition strengthens Bystronic’s position in laser processing equipment and broadens solutions available for advanced manufacturing applications globally.

- In October 2025, Monroe Capital supported Westbourne Capital Partners’ acquisition of Harvey Vogel, a metal fabrication company serving diverse industrial sectors. This transaction reflects continued private equity interest in fabrication sector consolidation and operational improvement opportunities within fragmented market landscape.

- In March 2025, United Performance Metals announced acquisition of Fabrisonic LLC, adding ultrasonic additive manufacturing capabilities to existing metal distribution operations. This strategic move positions the company to offer innovative fabrication technologies alongside traditional metal supply services for advanced manufacturing customers.

Report Scope

Report Features Description Market Value (2024) USD 70.6 Billion Forecast Revenue (2034) USD 106.5 Billion CAGR (2025-2034) 4.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Cutting, Machining, Welding, Bending, Others), By Material Type (Steel, Aluminum, Copper, Others), By Mode of Operation (Automatic, Manual), By End User (Automotive, Aerospace & Defense, Construction, Electronics, Energy, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Amada Corporation, Trumpf Group, Bystronic Laser AG, Shengyang Machine Tool Co. Ltd, DMG Mori, General Technology Group Dalian Machine Tool Co., Ltd., Okuma Corporation, Sandvik AB, Yamazaki Mazak Corporation, Hypetherm Associates Inc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Metal Fabrication Equipment MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Metal Fabrication Equipment MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Amada Corporation

- Trumpf Group

- Bystronic Laser AG

- Shenyang Machine Tool Co. Ltd

- DMG Mori

- General Technology Group Dalian Machine Tool Co., Ltd.

- Okuma Corporation

- Sandvik AB

- Yamazaki Mazak Corporation

- Hypertherm Associates Inc