Global Membrane Filtration Market By Product Type (Reverse Osmosis (RO), Nanofiltration (NF), Ultrafiltration (UF), and Microfiltration (MF)), By Module Design (Spiral Wound, Tubular Systems, Plate And Frame, and Hollow Fiber), By Membrane Material (Ceramic and Polymeric), By Application (Water And Wastewater, Food And Beverage, Pharmaceutical, Industrial Processing, and Other), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 176829

- Number of Pages: 370

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

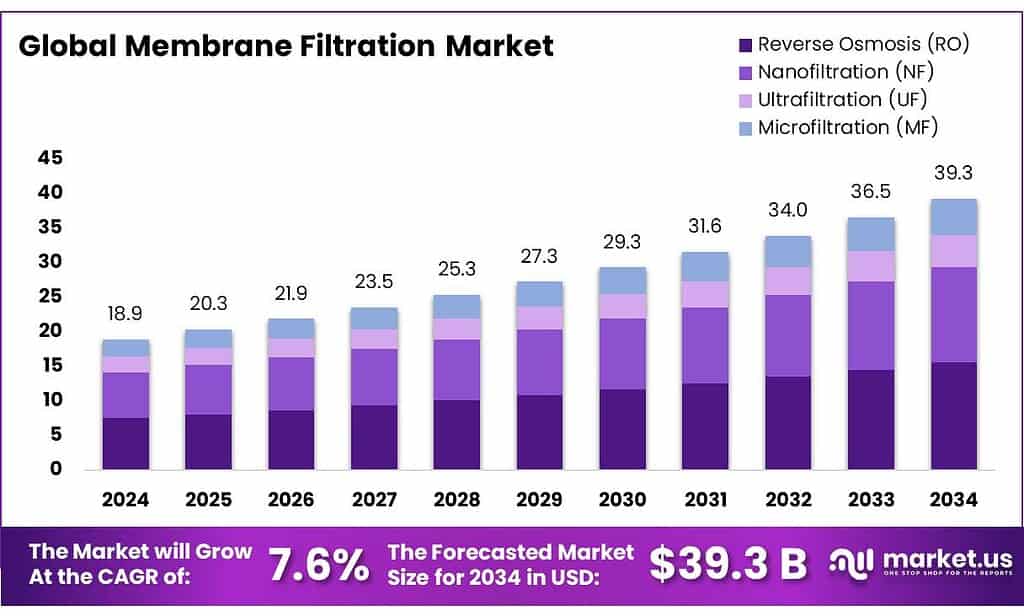

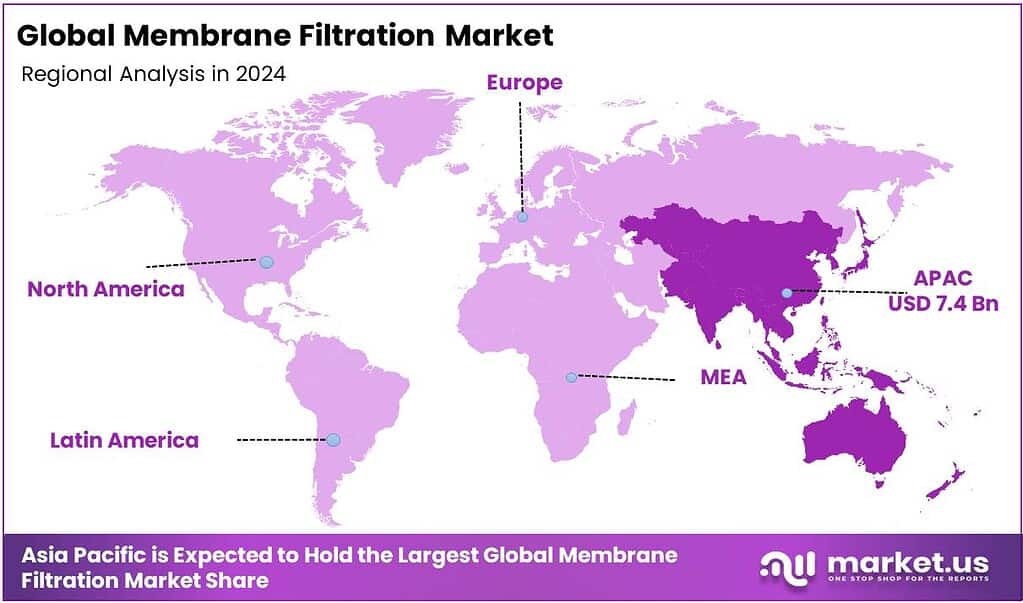

Global Membrane Filtration Market size is expected to be worth around USD 39.3 Billion by 2034, from USD 18.9 Billion in 2024, growing at a CAGR of 7.6% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 38.9% share.

Membrane filtration is a physical separation process that uses a semi-permeable barrier to remove particles, microorganisms, and dissolved substances from liquids or gases. It is a pressure-driven technology where a feed stream is forced against a specialized membrane, dividing it into two distinct outputs that are permeate, the purified fluid that passes through, and retentate, the concentrated material held back.

- Approximately 70% of the Earth’s surface is covered by water. However, only 2.5% of this is freshwater, with the remaining 97.5% being saline. Of the freshwater available, only about 1% is accessible for use, supporting a global population of around 8 billion individuals.

A portion of the accessible water is contaminated due to industrial activities, wastewater treatment processes, improper disposal of sewage sludge, oil extraction, mining operations, and the residues of pesticides and fertilizers used in agriculture, creating a lack of access to clean water. Consequently, the membrane filtration market is primarily driven by the increasing demand for clean water, the need to address water scarcity, and regulatory pressures across industries.

- According to the World Health Organization (WHO), water pollution causes significant deaths, with estimates around 1 million annual fatalities from unsafe water, sanitation, and hygiene (WASH), including 395,000 young children, primarily from diarrheal diseases, further propelling the membrane filtration market.

In addition, reverse osmosis (RO) membrane filtration is the most widely used technology due to its high efficiency in removing contaminants, including dissolved salts and microorganisms, making it essential for water treatment and desalination. Similarly, the market is dominated by polymeric membranes, which offer cost-effective, flexible solutions suitable for large-scale applications, particularly in the water and wastewater sectors.

Furthermore, membrane filtration is expanding in industries such as pharmaceuticals and biotechnology, where strict quality standards necessitate precise filtration. However, challenges such as membrane fouling, high energy consumption, and costly cleaning processes continue to drive innovation toward fouling-resistant and energy-efficient solutions. Despite these challenges, the Asia Pacific region remains the largest market, driven by rapid industrialization and growing water treatment needs.

- Asia Pacific holds over 60% of global groundwater withdrawals, a key driver for advanced treatment solutions such as membrane filtration to manage water scarcity and contamination.

Key Takeaways:

- The global membrane filtration market was valued at USD 18.9 billion in 2024.

- The global membrane filtration market is projected to grow at a CAGR of 7.6% and is estimated to reach USD 39.3 billion by 2034.

- On the basis of types of membrane filtration, reverse osmosis (RO) dominated the market, constituting 39.7% of the total market share.

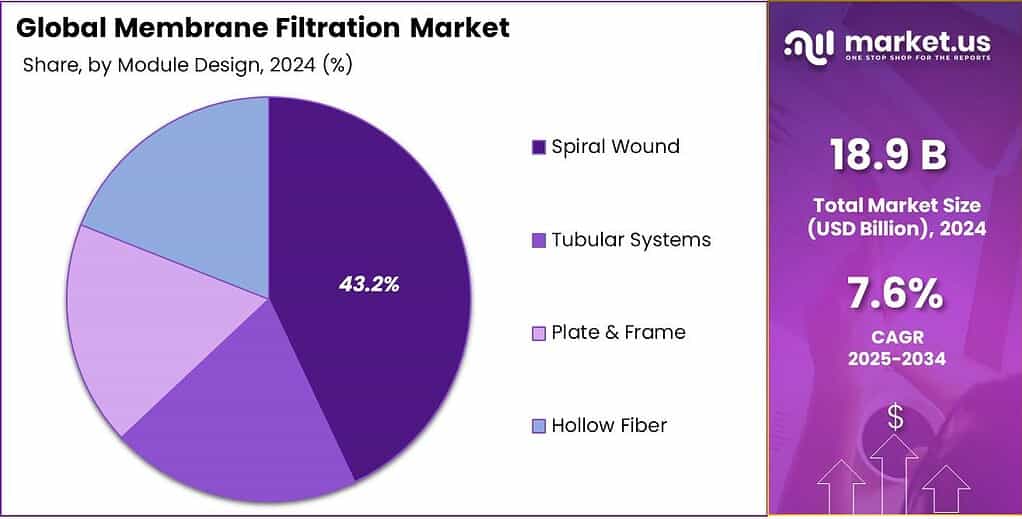

- Based on the module design, spiral wound dominated the membrane filtration market, with a substantial market share of around 43.2%.

- Based on the membrane material, the polymeric membrane led the market, comprising 75.4% of the total market.

- Among the applications of membrane filtration, water & wastewater held a major share in the market, 42.4% of the market share.

- In 2024, the Asia Pacific was the most dominant region in the membrane filtration market, accounting for 38.9% of the total global consumption.

Product Type Analysis

Reverse Osmosis (RO) Membrane Filtration is a Prominent Segment in the Market.

The market is segmented based on types of membrane filtration into reverse osmosis (RO), nanofiltration (NF), ultrafiltration (UF), and microfiltration (MF). The reverse osmosis (RO) membrane filtration led the market, comprising 39.7% of the market share, primarily due to its superior capability in removing a broader range of contaminants, including dissolved salts, heavy metals, and microorganisms. While nanofiltration and ultrafiltration excel at removing larger particles or specific ions, RO’s versatility in achieving near-total purification of water makes it more suitable for a variety of industries. Additionally, RO membranes are well-established, with a longer past usage and a large body of operational experience, contributing to their preference in industrial and municipal water treatment settings.

Module Design Analysis

Spiral Wound Design Dominated the Membrane Filtration Market.

On the basis of the module design, the membrane filtration market is segmented into spiral wound, tubular systems, plate & frame, and hollow fiber. The spiral wound design dominated the market, comprising 43.2% of the market share, due to its compact, space-efficient structure and higher surface area. The spiral wound configuration maximizes the available membrane surface in a limited space, allowing for more efficient filtration, especially in large-scale applications such as reverse osmosis (RO) systems. Additionally, it offers better flow dynamics, which reduces the buildup of fouling and enhances the overall performance. Compared to tubular systems, which require larger footprints, spiral wound membranes are more cost-effective in terms of material usage and system design. Their relatively straightforward assembly and ease of scaling up further contribute to their widespread adoption in various industries.

Membrane Material Analysis

Polymeric Membrane Filtration Products Are Mostly Utilized in the Food Service Sector.

Based on the membrane material, the market is divided into ceramic and polymeric. The polymeric membrane dominated the market, with a majority of market share of 75.4%, primarily due to its lower cost, flexibility, and ease of manufacturing. Polymeric materials can be produced at a larger scale and in various configurations, such as thin-film composites, allowing for more cost-effective solutions across a range of industries.

Additionally, they are more adaptable to different operating conditions, with customizable properties for specific applications. Similarly, the maintenance and cleaning of polymeric membranes are simpler. Ceramic membranes, while offering higher thermal and chemical resistance, are often more expensive to produce and are more brittle, making them less suitable for large-scale or high-volume applications.

Application Analysis

The Water And Wastewater Sector held a Major Share of the Membrane Filtration Market.

Among the applications of membrane filtration, 42.4% of the total global consumption is for the water & wastewater sector. Membrane filtration is predominantly used in the water and wastewater sector due to the high demand for clean and safe water, as well as the growing demand for wastewater treatment in urban and industrial areas.

In contrast, applications in sectors such as food & beverage, pharmaceuticals, or industrial processing tend to be more specialized, with stricter regulations and higher costs associated with high-purity requirements, limiting the use of membrane filtration. While these sectors use membranes, the scale and complexity of water treatment operations generally lead to a higher prevalence of membrane technologies in the water sector, where the need is most acute and widespread.

Key Market Segments:

By Product Type

- Reverse Osmosis (RO)

- Nanofiltration (NF)

- Ultrafiltration (UF)

- Microfiltration (MF)

By Module Design:

- Spiral Wound

- Tubular Systems

- Plate & Frame

- Hollow Fiber

By Membrane Material

- Ceramic

- Polymeric

By Application

- Water & Wastewater

- Food & Beverage

- Pharmaceutical

- Industrial Processing

- Other

Drivers

Stringent Regulatory Frameworks Drive the Membrane Filtration Market.

Stringent regulatory frameworks drive the membrane filtration adoption, particularly in the municipal water and wastewater sector. For instance, in the European Union, the revised Urban Wastewater Treatment Directive entered into force in January 2025, mandating enhanced tertiary and quaternary treatment that includes more aggressive removal of nutrients and micropollutants from urban wastewater across Member States.

Similarly, in the United States, the U.S. Environmental Protection Agency (EPA) finalized the National Primary Drinking Water Regulation (NPDWR) in April 2024, establishing legally enforceable maximum contaminant levels (MCLs) for multiple per- and polyfluoroalkyl substances (PFAS), including PFOA and PFOS at 4 parts per trillion (ppt) and other PFAS at defined limits, requiring public water systems to monitor and reduce these contaminants under the Safe Drinking Water Act framework. These frameworks tie compliance to performance outcomes, enforceable contaminant limits, and expanded treatment requirements, systematically increasing the operational scope and installation of membrane filtration systems in regulated sectors.

Restraints

Membrane Fouling Presents a Significant Challenge to the Membrane Filtration Market.

Membrane fouling, a significant challenge for the membrane filtration market, is primarily driven by the accumulation of organic and inorganic matter on membrane surfaces. For instance, in reverse osmosis (RO) systems, fouling contributes to a 10-30% reduction in filtration efficiency, leading to increased energy demands and operational costs.

Additionally, in some systems, fouling can require biannual cleaning intervals, with chemicals such as citric acid and sodium hydroxide being used in the process. The U.S. Water Alliance estimated that membrane cleaning consumes up to 15-25% of the total operational cost in water treatment facilities employing RO technology.

According to the International Desalination Association (IDA), energy consumption in desalination plants can rise by 30-40% when membranes are fouled, as the system requires higher pressures to maintain water flux. The combination of frequent cleaning and escalating energy costs presents significant operational challenges, prompting industry efforts to develop fouling-resistant membranes and energy-efficient solutions.

Opportunity

Increasing Demand for Clean Water Creates Opportunities in the Membrane Filtration Market.

The increasing demand for clean water, driven by population growth, urbanization, and industrialization, represents a significant opportunity for the membrane filtration market. The challenge of population growth is exacerbated by industrial and agricultural activities, which contribute to the contamination and depletion of freshwater resources.

- According to the United Nations, the global population is expected to reach 9.7 billion by 2050, with over 2 billion individuals experiencing water scarcity due to the combined effects of population growth and expanding urban areas.

Consequently, governments are increasingly investing in advanced water treatment technologies, emphasizing the use of membrane filtration in addressing water scarcity. These regulatory pushes and growing environmental awareness underline the importance of membrane filtration systems in providing potable water. As urbanization and industrialization continue to stress water resources, the adoption of membrane filtration technologies will be critical in securing clean water supplies.

Trends

Expanded Use in Pharmaceuticals and Biotech Applications.

The expanded use of membrane filtration in pharmaceuticals and biotechnology sectors is a prominent trend, driven by the technical requirements of advanced therapies and biologics. Membrane technologies, particularly ultrafiltration (UF) and reverse osmosis (RO), are integral to the production of biopharmaceuticals, ensuring the separation and purification of proteins, vaccines, and other biologics. The U.S. Food and Drug Administration (FDA) issued guidelines underscoring the importance of membrane filtration in the manufacture of sterile injectable drugs and biologics, noting its role in removing microbial contaminants, endotoxins, and other impurities. The FDA’s Current Good Manufacturing Practice (CGMP) regulations stipulate the use of validated filtration processes to meet the required product purity standards.

Moreover, the European Medicines Agency (EMA) highlights the role of membrane filtration in the filtration of biologic drugs during their production process. Moreover, the biotechnology sector’s reliance on membrane filtration technologies is further driven by the increasing complexity of drug formulations, requiring highly specific filtration methods to maintain the safety and efficacy of therapeutic products.

Geopolitical Impact Analysis

Shifts in Trade Policies to Affect Membrane Filtration Market Amid Geopolitical Tensions.

The geopolitical tensions are having a noticeable impact on the membrane filtration market, primarily through disruptions in global supply chains, shifts in trade policies, and fluctuations in raw material availability. The conflict in Ukraine has strained the supply of critical materials such as stainless steel and polymers, essential for manufacturing filtration membranes. Similarly, the U.S. tariffs on steel and aluminum have made essential water infrastructure components more expensive, with price hikes as much as 25% for consumers.

The European Commission reported significant disruptions in supply chains for these materials, with countries such as Germany, a key hub for membrane production, facing challenges in accessing high-quality raw materials from Eastern Europe due to trade restrictions and transportation bottlenecks. Simultaneously, geopolitical tensions have led to a reassessment of reliance on certain regions for key components. For instance, the U.S. Department of Commerce issued guidelines recommending a more localized approach to sourcing membrane filtration components, particularly in the face of potential disruptions from China, which dominates the production of high-performance polymeric membranes. These recommendations align with broader U.S. and EU policy shifts aiming to reduce dependence on foreign suppliers, especially for critical infrastructure.

Regional Analysis

Asia Pacific Held the Largest Share of the Global Membrane Filtration Market.

In 2024, the Asia Pacific dominated the global membrane filtration market, holding about 42.4% of the total global consumption, driven by rapid industrialization, urbanization, and increasing water scarcity. The growing demand for clean water is a major factor behind the adoption of membrane filtration technologies, particularly in countries such as China, India, and Japan.

- According to the Organisation for Economic Co-operation and Development (OECD), with an average economic growth rate of 6.1% in emerging Asia, regional water demand is expected to increase by 55% by 2050.

China is the largest national market in the region and is a primary growth engine, with its overall daily treatment capacity exceeding 200 million cubic meters, a figure that positions it as the world’s largest single wastewater treatment market. Similarly, the Indian government’s initiatives, such as Jal Jeevan Mission, which is extended till 2028, aiming to provide clean drinking water to rural households, explicitly promote the adoption of advanced filtration technologies. These factors position APAC as a critical region for the expansion of membrane filtration technologies.

- According to the City and Township Sewage Treatment and Resource Utilization Development Plan 2024 issued by the National Development and Reform Commission (NDRC), the Ministry of Housing and Urban-Rural Development (MOHURD), and the Ministry of Ecology and Environment, China aimed to achieve a sewage treatment rate exceeding 95% in county-level cities and a recycled water utilization rate surpassing 25% in water-scarce prefecture-level cities in 2025.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis:

To gain a competitive edge in the membrane filtration market, players focus on innovation in membrane materials by developing fouling-resistant and energy-efficient membranes to enhance performance and reduce operational costs. Similarly, players are increasingly investing in strategic partnerships and collaborations with municipal governments, water treatment plants, and industrial sectors to offer tailored solutions.

Additionally, they emphasize geographic expansion, with companies targeting regions facing water scarcity or stringent environmental regulations, such as the Middle East, Asia Pacific, and North America. Moreover, customer services, including membrane cleaning technologies and maintenance contracts, are prioritized.

Key Development:

- In December 2025, DuPont introduced a low-energy, fouling-resistant reverse osmosis (RO) element aimed at enhancing the efficiency and reliability of seawater desalination systems. The FilmTec SW30XLE-400/34 RO element specifically addresses biofouling, a persistent and costly challenge in the operation of seawater reverse osmosis systems.

- In September 2025, Pall Corporation, a leading provider of filtration, separation, and purification solutions, introduced the Membralox GP-IC ceramic membrane systems. This innovative ceramic membrane features graduated permeability along the length of the filter. The unique design improves processing efficiency, reduces capital and operational costs, and has the potential to recover up to 95% of value-added products, thereby enhancing overall filtration performance.

The Major Players in The Industry

- Alfa Laval

- GEA Group

- DuPont

- Pall Corporation

- Veolia

- 3M

- Pentair

- Porvair Filtration Group

- Donaldson Company, Inc.

- MMS Membrane Systems

- Koch Separation Solutions

- ProMinent

- SPX Flow

- Toray Industries, Inc.

- Mann+Hummel

- Other Key Players

Report Scope

Report Features Description Market Value (2024) US$18.9 Bn Forecast Revenue (2034) US$39.3 Bn CAGR (2025-2034) 7.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Reverse Osmosis (RO), Nanofiltration (NF), Ultrafiltration (UF), and Microfiltration (MF)), By Module Design (Spiral Wound, Tubular Systems, Plate & Frame, and Hollow Fiber), By Membrane Material (Ceramic and Polymeric), By Application (Water & Wastewater, Food & Beverage, Pharmaceutical, Industrial Processing, and Other) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Alfa Laval, GEA Group, DuPont, Pall Corporation, Veolia, 3M, Pentair, Porvair Filtration Group, Donaldson Company, Inc., MMS Membrane Systems, Koch Separation Solutions, ProMinent, SPX Flow, Toray Industries, Inc., Mann+Hummel, and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Alfa Laval

- GEA Group

- DuPont

- Pall Corporation

- Veolia

- 3M

- Pentair

- Porvair Filtration Group

- Donaldson Company, Inc.

- MMS Membrane Systems

- Koch Separation Solutions

- ProMinent

- SPX Flow

- Toray Industries, Inc.

- Mann+Hummel

- Other Key Players