Global Medical Recruitment Market By Product Type (Recruitment Services, Homecare Services, Managed Services, and Specialist Care Services), By Application (Pharmaceuticals & Biotechnology, Nursing/Healthcare, Medical Devices, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 149805

- Number of Pages: 384

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

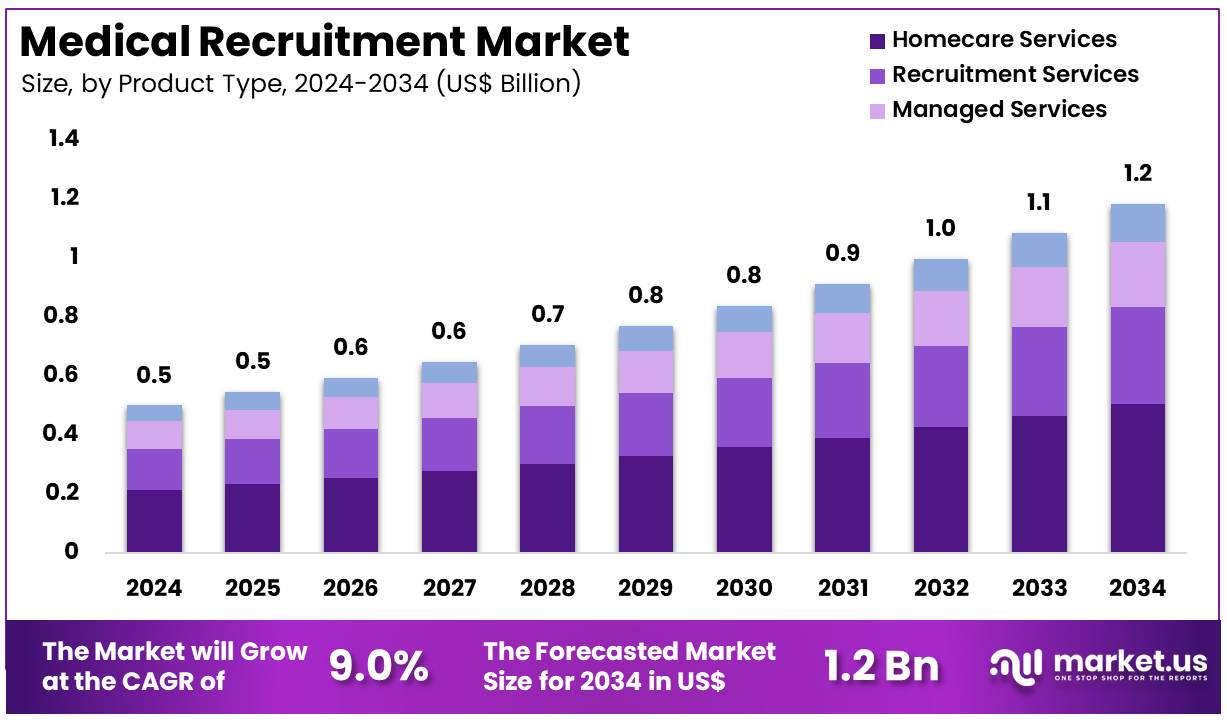

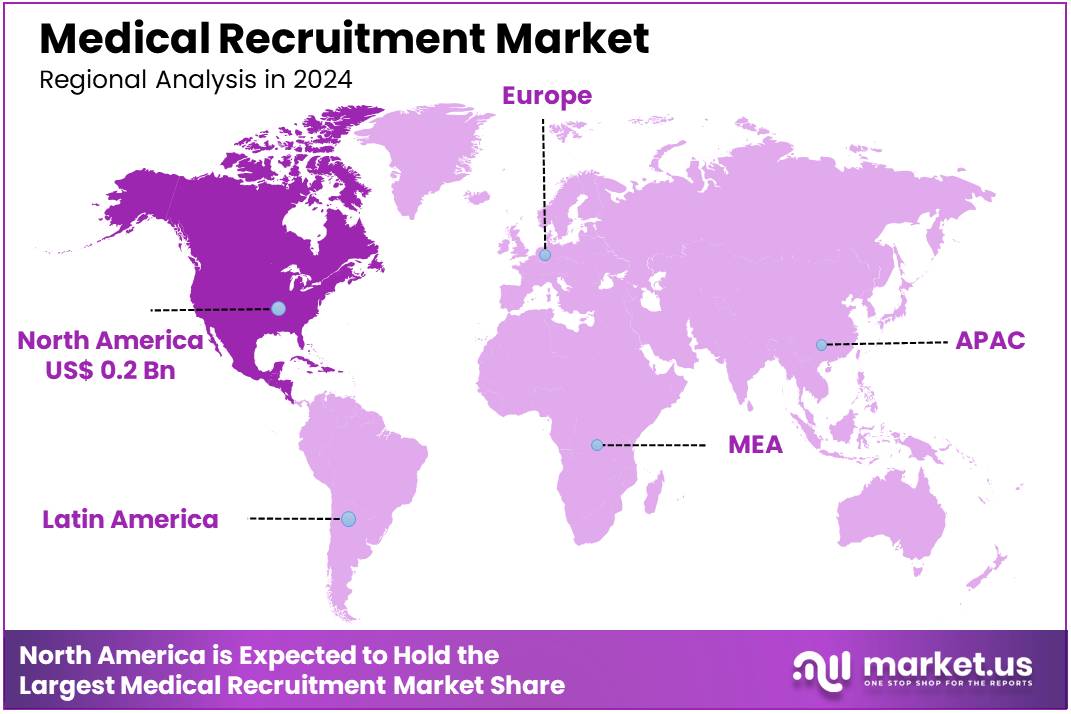

Global Medical Recruitment Market size is expected to be worth around US$ 1.2 Billion by 2034 from US$ 0.5 Billion in 2024, growing at a CAGR of 9.0% during the forecast period 2025 to 2034. In 2024, North America’s market share exceeded 37.2%, translating into a revenue of US$ 0.2 Billion.

Increasing demand for skilled healthcare professionals drives the growth of the medical recruitment market, which serves a critical role in sourcing and placing qualified talent across hospitals, clinics, pharmaceutical companies, and research institutions. This market addresses shortages in nursing, specialized physicians, allied health professionals, and administrative staff, ensuring healthcare facilities maintain operational efficiency and deliver high-quality patient care.

In June 2021, Park Group of Hospitals significantly expanded, establishing itself as one of North India’s fastest-growing private super-specialty hospital chains, highlighting the rising need for robust recruitment solutions to support such rapid growth. Opportunities in the market emerge from the adoption of digital platforms and AI-powered recruitment tools that streamline candidate sourcing, screening, and placement processes.

Recent trends indicate increased demand for temporary and contract staffing, reflecting the dynamic nature of healthcare workforce needs influenced by fluctuating patient volumes and public health emergencies. Additionally, the expansion of telemedicine and outpatient services requires recruiters to adapt to new skill sets and workforce models. Medical recruitment agencies also capitalize on growing investments in healthcare infrastructure, which boost employment opportunities across specialties.

The increasing focus on employee retention and training within healthcare organizations further enhances demand for specialized recruitment services. As healthcare systems evolve, the medical recruitment market continues to innovate, leveraging data analytics and global talent networks to match professionals with critical roles efficiently. Sustained growth in chronic diseases, aging populations, and technological advancements in medicine drive the ongoing necessity for a well-qualified healthcare workforce, positioning the medical recruitment market as an indispensable component of the healthcare ecosystem.

Key Takeaways

- In 2024, the market for medical recruitment generated a revenue of US$ 0.5 billion, with a CAGR of 9.0%, and is expected to reach US$ 1.2 billion by the year 2034.

- The product type segment is divided into recruitment services, homecare services, managed services, and specialist care services, with homecare services taking the lead in 2024 with a market share of 42.7%.

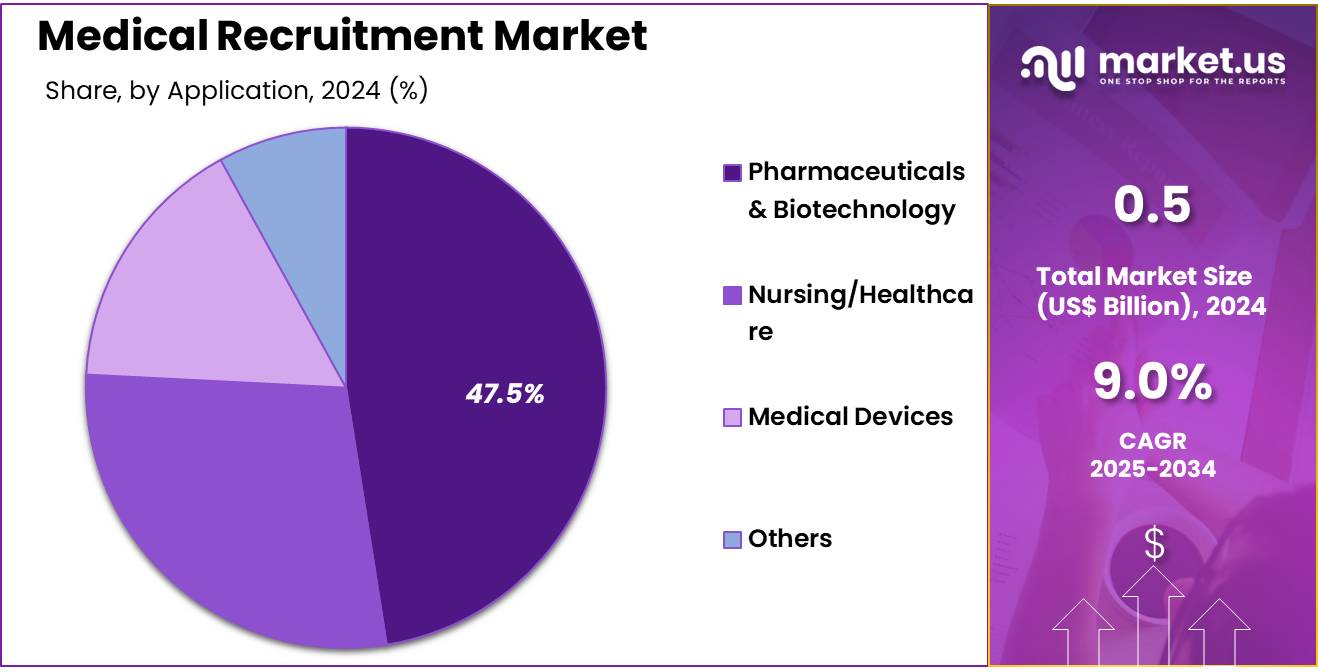

- Considering application, the market is divided into pharmaceuticals & biotechnology, nursing/healthcare, medical devices, and others. Among these, pharmaceuticals & biotechnology held a significant share of 47.5%.

- North America led the market by securing a market share of 37.2% in 2024.

Product Type Analysis

The homecare services segment claimed a market share of 42.7%. Rising demand for in-home healthcare due to an aging population and increased prevalence of chronic diseases drives this expansion. Healthcare providers seek skilled professionals who can deliver personalized care in home settings, boosting the need for specialized recruitment services.

Technological advancements, such as telehealth integration, enhance the scope and efficiency of homecare services, attracting further investment. Additionally, the shift toward value-based care models encourages home-based treatment options, supporting sustained demand for qualified caregivers through recruitment channels. Regulatory emphasis on quality and safety in homecare also fuels growth in this segment.

Application Analysis

The pharmaceuticals & biotechnology held a significant share of 47.5% due to continuous innovation and expansion in drug development and biotechnological research. Increasing investments in R&D and clinical trials intensify the need for highly qualified professionals in pharmaceutical and biotech fields. Regulatory complexities and stringent compliance requirements create demand for specialized recruitment expertise to source talent adept in navigating these challenges.

The growing focus on personalized medicine and biologics further amplifies recruitment activities. Additionally, the rapid advancement of medical technologies and therapeutic solutions in this sector will sustain strong hiring trends, making this segment a critical growth area in medical recruitment.

Key Market Segments

By Product Type

- Recruitment Services

- Homecare Services

- Managed Services

- Specialist Care Services

By Application

- Pharmaceuticals & Biotechnology

- Nursing/Healthcare

- Medical Devices

- Others

Drivers

Persistent Healthcare Staffing Shortages are driving the market

The ongoing and widespread shortages of healthcare professionals are a primary driver for the medical recruitment market. Healthcare facilities across the globe are struggling to find and retain qualified staff, leading to a greater reliance on recruitment services to fill critical roles. For example, the American Hospital Association highlighted in a 2023 report the significant workforce challenges, noting projections that indicate a continued shortage of nurses and physicians in the coming years.

The US Bureau of Labor Statistics projected in 2023 an average of about 194,500 openings for registered nurses each year, on average, over the decade ending in 2032. This substantial demand necessitates active recruitment efforts to ensure adequate staffing levels and maintain quality patient care, thereby driving the growth of the medical recruitment market.

Restraints

Stringent Credentialing and Licensing Requirements are restraining the market

The complex and often lengthy credentialing and licensing processes for healthcare professionals can act as a restraint on the medical recruitment market. Each state or country often has its own specific requirements, making the process of placing medical staff across different regions time-consuming and administratively burdensome.

The healthcare industry widely acknowledges that navigating these regulations can slow down the hiring process. This complexity can delay the placement of needed medical professionals, particularly when cross-state or international recruitment is involved, thus posing a challenge to the efficiency of the recruitment market.

Opportunities

Growing Demand for Specialized Healthcare Professionals creates growth opportunities

The increasing demand for healthcare professionals with specialized skills is creating significant growth opportunities within the medical recruitment market. Advances in medical technology and the rising prevalence of complex health conditions have led to a greater need for experts in fields such as cardiology, oncology, and radiology.

A survey in late 2024 indicated that 94% of Indian doctors believe the standard medical curriculum is insufficient and are seeking continuous, specialized upskilling to meet the demands of modern healthcare. This highlights the growing need for recruitment services that can identify and place professionals with these advanced skills. This trend towards specialization in healthcare is expanding the scope and demand for targeted recruitment services.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic conditions and geopolitical factors exert considerable influence on the medical recruitment market. Economic downturns can lead to budget constraints in healthcare organizations, potentially slowing down hiring or increasing the preference for temporary staffing solutions to manage costs. Conversely, periods of economic growth often see increased investment in healthcare and a greater demand for permanent staff.

Geopolitical events, such as conflicts or pandemics, can create sudden surges in demand for medical professionals in specific regions or specializations, as seen during the COVID-19 pandemic. Additionally, international relations and immigration policies can affect the cross-border movement of healthcare workers. While these factors can create fluctuations in hiring trends, the fundamental and growing need for healthcare professionals globally ensures a relatively stable demand for recruitment services in the long term.

Current US tariffs are likely to have a more indirect impact on the medical recruitment market compared to sectors dealing with physical goods. Tariffs on medical equipment or pharmaceuticals could potentially affect the financial health of healthcare providers, which might, in turn, influence their hiring budgets. Increased costs for medical supplies due to tariffs can put pressure on hospital finances. However, the direct recruitment of medical professionals is primarily driven by staffing needs and regulatory requirements rather than the cost of imported goods.

Although a strained financial environment for healthcare facilities could lead to more cautious hiring, the underlying shortages of medical staff would still necessitate recruitment efforts. Therefore, while tariffs might have some peripheral economic effects on the healthcare sector, the core drivers of the medical recruitment market, staffing shortages and the need for specialized skills, are expected to remain the dominant forces.

Latest Trends

Increased Adoption of Digital Recruitment Platforms is a recent trend in the market

A notable recent trend in the medical recruitment market is the increased adoption of digital recruitment platforms and technologies. These tools leverage AI and data analytics to streamline the hiring process, improve candidate sourcing, and enhance the overall efficiency of recruitment.

For instance, many healthcare organizations and recruitment agencies are now using online job boards, social media, and AI-powered matching systems to connect with potential candidates. The healthcare staffing market is poised to grow due to the integration of technology in recruitment processes. This shift towards digital platforms is making the recruitment process faster and more targeted.

Regional Analysis

North America is leading the Medical Recruitment Market

North America dominated the market with the highest revenue share of 37.2% owing to a persistent shortage of healthcare professionals across various sectors. The Health Resources and Services Administration (HRSA) projects a continued shortage of registered nurses (RNs) through 2037. Their data from 2022 onwards indicates a consistent gap between the supply and demand for RNs.

Furthermore, the Bureau of Labor Statistics projects that healthcare occupations, overall, are expected to grow much faster than the average for all occupations. This increasing demand, coupled with existing shortages, necessitates robust recruitment activities to fill these roles.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to the increasing demand for healthcare services due to a growing and aging population in many countries within the region. Several Asia Pacific nations are expanding their healthcare infrastructure, leading to a greater need for medical professionals.

The increasing awareness of the importance of quality healthcare and rising healthcare expenditure are also likely to drive the need for recruitment services to secure qualified medical personnel. The expansion of the private healthcare sector in several Asia Pacific economies will further contribute to the growth of the medical recruitment market as these entities compete for talent.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the medical recruitment market drive growth by leveraging technology, expanding service offerings, and forming strategic partnerships. They invest in artificial intelligence (AI) and machine learning to enhance candidate matching and streamline the hiring process. Companies also focus on diversifying their portfolios by offering temporary, permanent, and locum tenens staffing solutions to meet varying client needs. Emphasizing compliance with international healthcare standards and regulations ensures the delivery of qualified professionals across borders. Additionally, they engage in mergers and acquisitions to broaden their market reach and capabilities.

AMN Healthcare Services, Inc., a leading player in this sector, offers a comprehensive range of healthcare staffing solutions, including travel nursing, physician recruitment, and allied health staffing. Established in 1985 and headquartered in Dallas, Texas, AMN Healthcare has expanded its services through strategic acquisitions, such as the purchase of Connetics USA in 2022, to enhance its international recruitment capabilities. The company serves healthcare facilities across the United States, providing flexible staffing options to address workforce shortages and ensure quality patient care. AMN Healthcare’s commitment to innovation and quality service has positioned it as a trusted partner in the medical recruitment market.

Top Key Players

- AMN Healthcare

- Aya Healthcare

- CHG Healthcare

- Accountable Healthcare Staffing

- E. Smith

- Rep-Lite

- Alpha Apex Group

- Clive Henry Group

Recent Developments

- In March 2023, Medwing, a European startup focused on healthcare recruitment, raised USD 47 million in Series C funding. The platform, operational in Germany and the U.K., connects around 5,500 medical employers with 500,000 healthcare professionals, aiming to streamline staffing in the healthcare sector.

- In February 2022, Hackensack Meridian Health in New Jersey launched the Hospital at Home program at JFK University Medical Center in Edison, offering acute care services to patients in their homes as an alternative to traditional hospital stays.

Report Scope

Report Features Description Market Value (2024) US$ 0.5 Billion Forecast Revenue (2034) US$ 1.2 Billion CAGR (2025-2034) 9.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Recruitment Services, Homecare Services, Managed Services, and Specialist Care Services), By Application (Pharmaceuticals & Biotechnology, Nursing/Healthcare, Medical Devices, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape AMN Healthcare, Aya Healthcare, CHG Healthcare, Accountable Healthcare Staffing, B.E. Smith, Rep-Lite, Alpha Apex Group, Clive Henry Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Medical Recruitment MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Medical Recruitment MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- AMN Healthcare

- Aya Healthcare

- CHG Healthcare

- Accountable Healthcare Staffing

- E. Smith

- Rep-Lite

- Alpha Apex Group

- Clive Henry Group