Global Meat Ingredients Market Size, Share Analysis Report By Product Type (Fresh Processed Meat, Raw And Cooked Meat, Pre-Cooked Meat, Others), By Ingredient (Binders, Extenders, Fillers, Colouring Agents, Flavouring Agents, Preservatives, Texturing Agents, Salts, Others), By Meat Type (Mutton, Chicken, Beef, Pork, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 174219

- Number of Pages: 367

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

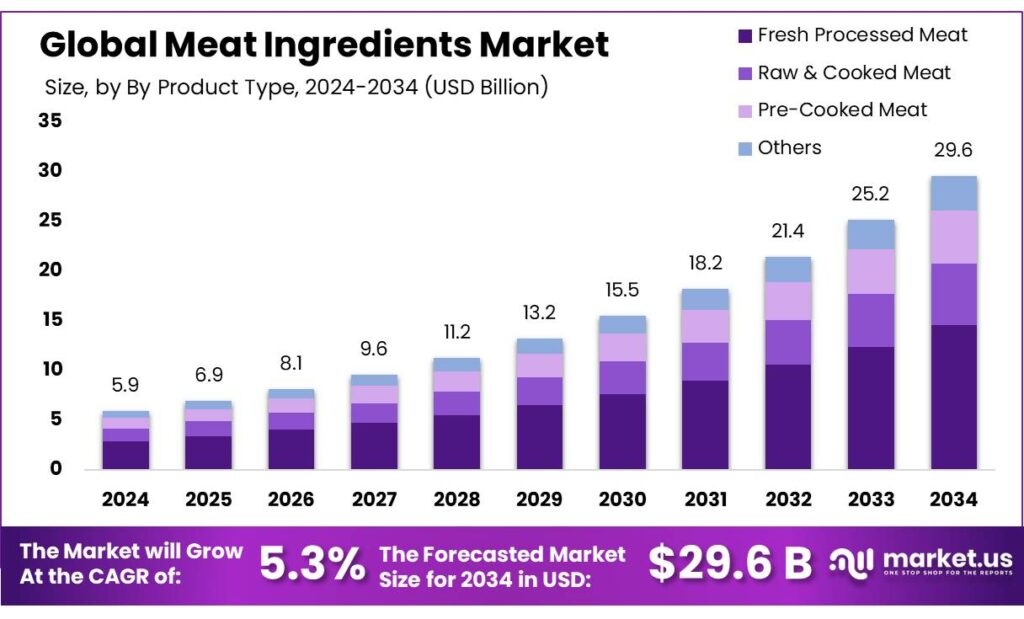

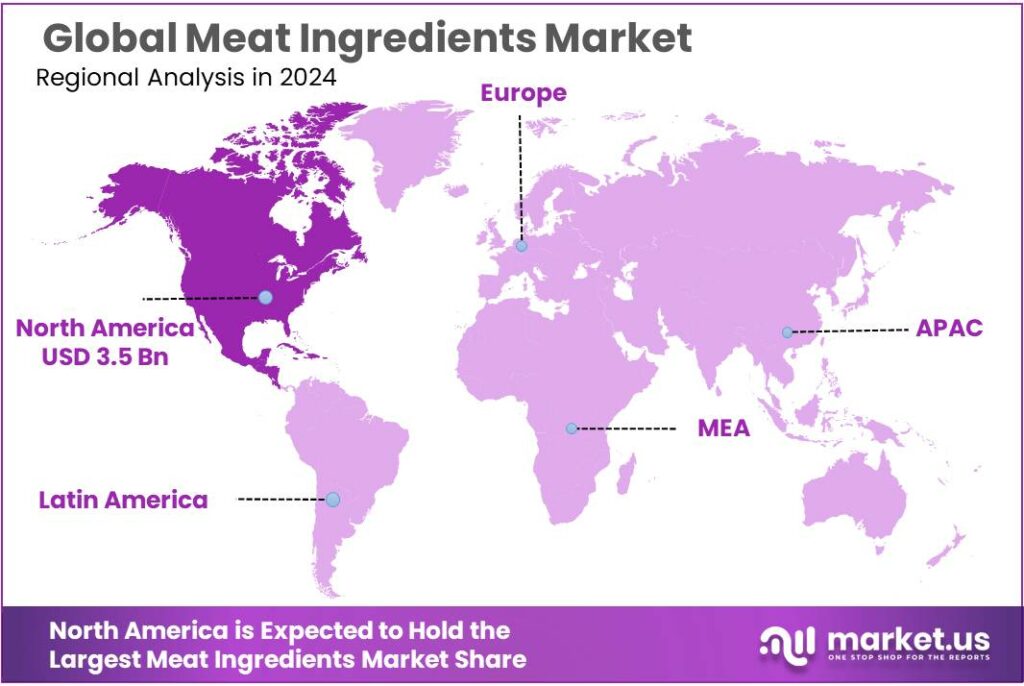

Global Meat Ingredients Market size is expected to be worth around USD 29.6 Billion by 2034, from USD 5.3 Billion in 2024, growing at a CAGR of 5.3% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 39.6% share, holding USD 3.5 Billion in revenue.

The meat ingredients industry covers the functional and protective inputs that help meat products stay safe, consistent, and appealing from processing to retail. It includes binders and texturizers, cure systems and preservatives, seasonings and flavor carriers, and processing aids that improve mixing, water retention, and slicing performance. Demand for these inputs tracks the scale of global meat output: the FAO reports world meat production reached 374 million tonnes in 2024, up by 7 million tonnes from 2023, with poultry, pig, and cattle meat leading volumes.

Industrially, the sector sits at the intersection of high-throughput processing, cold-chain logistics, and increasingly strict food-safety governance. Meat processors rely on ingredients to reduce batch-to-batch variability and to manage microbiological risk in a supply chain where products may travel long distances and spend days in distribution. Food safety pressure is structural rather than cyclical: WHO estimates unsafe food causes 600 million foodborne disease cases and 420,000 deaths each year, and it also highlights an economic burden of about US$110 billion in productivity losses and medical expenses in low- and middle-income countries.

Key demand drivers are best understood through the lens of safety, consistency, and “reformulation pressure.” First, ingredients that support pathogen control and process stability remain central because food safety and inspection are tightly governed and continuously funded—FSIS showed 2025 estimated discretionary appropriations of $1,244,231,000, reinforcing the priority placed on inspection capacity and modernized oversight.

Key Takeaways

- Meat Ingredients Market size is expected to be worth around USD 29.6 Billion by 2034, from USD 5.3 Billion in 2024, growing at a CAGR of 5.3%.

- Fresh Processed Meat held a dominant market position, capturing more than a 49.2% share in the Meat Ingredients Market.

- Binders held a dominant market position, capturing more than a 46.7% share in the Meat Ingredients Market.

- Chicken held a dominant market position, capturing more than a 42.8% share in the Meat Ingredients Market.

- North America led the Meat Ingredients Market, holding a dominant position at 39.6% and valued at USD 3.5 Bn.

By Product Type Analysis

Fresh Processed Meat dominates with 49.2% driven by convenience-focused consumption and consistent demand across food channels.

In 2024, Fresh Processed Meat held a dominant market position, capturing more than a 49.2% share in the Meat Ingredients Market. This strong position reflects steady consumer preference for products that balance freshness with extended usability. Fresh processed meat continues to fit well into modern eating habits, especially among working populations looking for reliable protein options that save preparation time while maintaining familiar taste and texture.

By Ingredient Analysis

Binders dominate with 46.7% as processors focus on yield, texture, and cost control.

In 2024, Binders held a dominant market position, capturing more than a 46.7% share in the Meat Ingredients Market by ingredient, driven by their everyday role in processed meat production. Binders are widely used to improve water retention, texture, and sliceability in products such as sausages, nuggets, patties, and restructured meats. Their value lies in helping processors achieve consistent quality even when raw meat quality varies.

In 2024, rising demand for affordable processed meat products pushed manufacturers to rely more on binders to control formulation costs while maintaining acceptable taste and mouthfeel. By 2025, binders continued to remain essential as producers worked to reduce cooking losses and improve production efficiency without changing product formats. Their dominance also reflects their ease of use and compatibility with existing processing lines, making them a practical choice for both large-scale plants and mid-sized meat processors.

By Meat Type Analysis

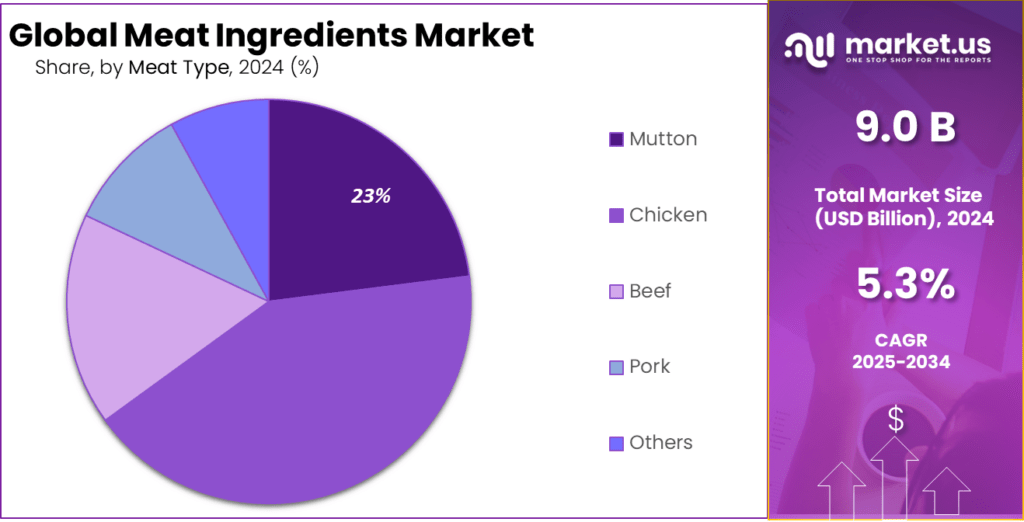

Chicken leads with 42.8% as consumers favor affordable and versatile meat options.

In 2024, Chicken held a dominant market position, capturing more than a 42.8% share in the Meat Ingredients Market by meat type, reflecting its strong presence across both fresh and processed meat products. Chicken is widely preferred by processors because it is easy to handle, cooks faster, and adapts well to different formulations using seasonings, binders, and coatings.

In 2024, rising consumer demand for lighter, everyday protein choices supported higher production of chicken-based nuggets, sausages, ready-to-cook cuts, and frozen snacks. Moving into 2025, chicken continued to gain attention as processors focused on portion-controlled and value-added products that fit modern eating habits. Its neutral flavor profile also allows manufacturers to experiment with different tastes without changing the base meat, keeping chicken at the center of ingredient usage and formulation strategies.

Key Market Segments

By Product Type

- Fresh Processed Meat

- Raw & Cooked Meat

- Pre-Cooked Meat

- Others

By Ingredient

- Binders

- Extenders

- Fillers

- Colouring Agents

- Flavouring Agents

- Preservatives

- Texturing Agents

- Salts

- Others

By Meat Type

- Mutton

- Chicken

- Beef

- Pork

- Others

Emerging Trends

Stronger Poultry Safety Rules Push “Protection” Ingredients

One of the latest trends shaping the Meat Ingredients market is the rising focus on food-safety controls in poultry and processed meat, which is pushing processors to use more “protection” ingredients—solutions that help reduce microbial risk, improve shelf life, and keep product quality steady during distribution. This trend is not driven by marketing alone; it is driven by compliance, plant economics, and brand risk. When a processor ships nationwide, even small variations in hygiene or product stability can lead to costly rework, returns, or recalls. As a result, ingredient systems that support safer processing and more predictable shelf performance are becoming a core part of operations.

This shift is happening while poultry volumes remain strong, which means safety improvements must work at scale. USDA’s Economic Research Service projects U.S. broiler availability at 102.7 pounds per person in 2025, highlighting how large the chicken pipeline remains and why processors keep investing in consistent, repeatable controls across high-throughput lines. At the global level, FAO forecasts world meat production to reach 384 million tonnes in 2025, up 1.4% from 2024, with growth mainly driven by poultry—another sign that “safe growth” is the industry’s priority, not just “more output.”

Government action is reinforcing the same direction. In the United States, FSIS published its proposed rule and determination titled “Salmonella Framework for Raw Poultry Products” on August 7, 2024, signaling a more structured approach to reducing Salmonella risk in raw poultry supply chains. FSIS also continued related work, including a notice on exploring practical strategies to reduce Salmonella in poultry, published December 15, 2025—showing this is not a one-off topic but an ongoing regulatory focus.

Drivers

Rising Meat Output and Food-Safety Demands Drive Ingredient Use

One major driving factor for the Meat Ingredients market is the steady rise in meat production and the growing need to keep large volumes of products consistent, safe, and appealing from factory to fork. When processors make more sausages, nuggets, deli slices, marinated cuts, and ready-to-cook meals, they naturally rely more on ingredients that help with binding, juiciness, texture, flavor stability, and shelf life. In simple terms, higher throughput pushes manufacturers to use more functional systems—because small quality issues become expensive at scale.

In 2024, the U.S. alone produced about 107.6 billion pounds of total red meat and poultry, showing how big modern processing volumes are and how much support is needed from functional ingredients in everyday production lines. At the same time, demand signals remain firm. USDA data indicates 226 pounds of red meat and poultry were available per U.S. consumer in 2025, with broiler availability projected at 102.7 pounds in 2025, keeping chicken-based processed formats highly active. When consumption stays strong, brands and co-packers keep running plants at high utilization, and ingredient usage follows.

Globally, the story is similar. OECD–FAO estimates global meat production rose to about 365 Mt in 2024 (up 1.3%), led largely by poultry. FAO’s outlook also points to world meat production reaching 384 million tonnes in 2025 (carcass weight equivalent), up about 1.4% from 2024—again indicating growing volumes that require stable formulations and controlled quality across different markets.

Restraints

Health Concerns and Dietary Guidelines Restrain Meat Ingredients Demand

One major factor holding back growth in the Meat Ingredients market is rising health concerns linked to high consumption of processed and red meats, which are driving shifts in eating habits and dietary recommendations. As people become more aware of how diet affects long-term health, governments and health organizations increasingly advise moderation in meat intake, particularly processed forms that often use multiple functional ingredients.

According to the World Health Organization (WHO) and the International Agency for Research on Cancer (IARC), processed meat has been classified as a Group 1 carcinogen, meaning there is convincing evidence it causes colorectal cancer, and red meat is classified as Group 2A, meaning it is probably carcinogenic to humans. Studies show that every 50 g portion of processed meat eaten daily can increase colorectal cancer risk by about 18 %, signalling clear caution for heavy consumption.

These health findings are reflected in public dietary guidelines that recommend people limit red and processed meat to reduce cancer risk and other chronic diseases like heart disease and type 2 diabetes. As consumers learn more about these risks, many are rebalancing their diets toward lean proteins such as poultry, fish, plant-based alternatives, and legumes.

This shift means that traditional meat formulations, which rely on a suite of specialty ingredients to enhance shelf life, texture and flavor, face pressure from declining consumption patterns in certain market segments. For example, where previously consumers might have chosen sausages or deli meats regularly, an increasing number now opt for lower-processed protein options due to health advice and personal wellness goals.

Opportunity

Reformulation for Lower Sodium and “Clean” Labels Opens Growth

One major growth opportunity for the Meat Ingredients market is helping meat processors reformulate products so they stay tasty and safe while using less sodium and simpler labels. This matters because public health targets are getting louder, and shoppers are reading packs more closely than before. The World Health Organization notes that adults globally consume about 4,310 mg/day of sodium on average, which is more than double its recommended limit of <2,000 mg/day (about <5 g/day of salt). When a big part of the population is above recommended intake, food companies feel pressure to reduce salt—especially in processed foods where sodium is often high.

This is where meat ingredients become a solution, not just an add-on. Salt is not only about taste; it also helps with water binding, texture, and food safety. So, when processors reduce sodium, they often need functional systems to keep product performance stable. The U.S. FDA’s voluntary sodium reduction program highlights this direction clearly. In its Phase II draft targets, FDA points to reducing average sodium intake to about 2,750 mg/day, covering 163 food categories and acknowledging sodium’s technical and safety roles. That creates a practical opening for suppliers of meat ingredients: blends that support salt reduction while maintaining bite, juiciness, and shelf stability can become “must-have” tools for processors trying to meet voluntary targets and retailer expectations.

The timing also supports this opportunity because meat volumes are not shrinking worldwide—meaning reformulation needs scale. The OECD–FAO Agricultural Outlook estimates global meat production rose to 365 Mt in 2024 (up 1.3%), led largely by poultry. FAO’s meat market review projects global meat production reaching 384 million tonnes in 2025, again driven mainly by poultry expansion.

In real plant terms, the growth is in “performance reformulation.” That includes salt-reduction toolkits, texture protection (binders and hydrocolloid systems that prevent dryness), and preservation support. It also includes label-friendly solutions that can replace or reduce ingredients consumers dislike, without increasing waste or recalls. As labeling expectations evolve, companies that provide clear guidance, application support, and consistent results earn long-term supply contracts—because processors cannot afford variability at scale.

Regional Insights

North America dominates with 39.6%, supported by a strong processing base worth USD 3.5 Bn.

In 2024, North America led the Meat Ingredients Market, holding a dominant position at 39.6% and valued at USD 3.5 Bn. This strength is closely tied to the region’s scale of meat processing and its need for reliable inputs such as binders, seasonings, preservatives, and functional blends that keep products consistent across large production runs.

The United States remains a key anchor market, with USDA reporting total red meat and poultry production in 2024 rising to 107.6 billion pounds, which directly supports steady ingredient demand across beef, pork, and poultry processing lines.

Industry volumes are reinforced by strong poultry economics and high-throughput supply chains. USDA’s Economic Research Service notes U.S. poultry sector sales of $70.2 billion in 2024 (with broilers accounting for $45.4 billion), reflecting the scale of value-added formats that typically use multiple meat ingredients to manage texture, yield, and shelf performance.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Kemin Industries, Inc., established in 1961, is a privately held ingredient supplier serving over 120 countries. With a workforce of around 3,000 employees, Kemin supports meat processors through antioxidants, antimicrobials, and shelf-life solutions. In 2024, its meat ingredient portfolio remained focused on quality preservation and food safety performance.

Associated British Foods plc, founded in 1935, operates across 50+ countries with over 130,000 employees. In 2024, its ingredient segment supported meat processing through enzymes, yeast extracts, and functional components, helping manufacturers maintain product consistency and processing efficiency.

Kerry Group plc plays a strong role in meat ingredients through taste, seasoning, and functional systems. Founded in 1972, the company operates in over 150 countries with more than 23,000 employees. In 2024, Kerry continued focusing on value-added meat solutions that improve flavor stability, texture, and shelf life across processed meat categories.

Top Key Players Outlook

- Kerry Group plc

- Kemin Industries, Inc.

- Ingredion Incorporated

- DuPont

- Associated British Foods plc

- Essentia Protein Solutions

- Wenda Ingredients

- Advanced Food Systems, Inc.

- Corbion N.V.

- NEXIRA

Recent Industry Developments

In 2024, DuPont de Nemours, Inc. continued to play a meaningful role in the meat ingredients sector by leveraging its broad food-science and functional ingredient capabilities to help meat, poultry and alternative protein producers improve texture, stability, binding and shelf performance. While DuPont reported full-year net sales of USD 12.4 bn in 2024 and employed around 24,000 people worldwide, its Nutrition & Biosciences and related food-focused technologies are used by processors to deliver functional systems that enhance product quality and processing efficiency.

In 2024, Kerry Group plc total group revenue of ~€7.98 bn in 2024, with €6.9 bn coming from the Taste & Nutrition segment, where meat-related ingredients are a key focus for food manufacturers seeking quality and consistency. Kerry achieved 3.3 % volume growth in Taste & Nutrition even as pricing pressures eased, showing steady market demand for its ingredient solutions.

Report Scope

Report Features Description Market Value (2024) USD 5.9 Bn Forecast Revenue (2034) USD 29.6 Bn CAGR (2025-2034) 5.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Fresh Processed Meat, Raw And Cooked Meat, Pre-Cooked Meat, Others), By Ingredient (Binders, Extenders, Fillers, Colouring Agents, Flavouring Agents, Preservatives, Texturing Agents, Salts, Others), By Meat Type (Mutton, Chicken, Beef, Pork, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Kerry Group plc, Kemin Industries, Inc., Ingredion Incorporated, DuPont, Associated British Foods plc, Essentia Protein Solutions, Wenda Ingredients, Advanced Food Systems, Inc., Corbion N.V., NEXIRA Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Kerry Group plc

- Kemin Industries, Inc.

- Ingredion Incorporated

- DuPont

- Associated British Foods plc

- Essentia Protein Solutions

- Wenda Ingredients

- Advanced Food Systems, Inc.

- Corbion N.V.

- NEXIRA