Global Marketing Cloud Platform Market Size, Share and Analysis Report By Component (Solutions (Campaign Management, Customer Data Platform, Others), Services (Professional Services, Managed Services, Others)), By Deployment Mode (Public Cloud, Private Cloud, Hybrid Cloud), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises), By End-User Industry (Retail and E-commerce, Banking, Financial Services, and Insurance, Others), By Application (Customer Segmentation and Targeting, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 174429

- Number of Pages: 388

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Key Insight Summary

- Component Analysis

- Deployment Mode Analysis

- Organization Size Analysis

- End-User Industry Analysis

- Application Analysis

- Increasing Adoption Technologies

- Investment and Business Benefits

- Usage

- Emerging Trends

- Growth Factors

- Key Market Segments

- Regional Analysis

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

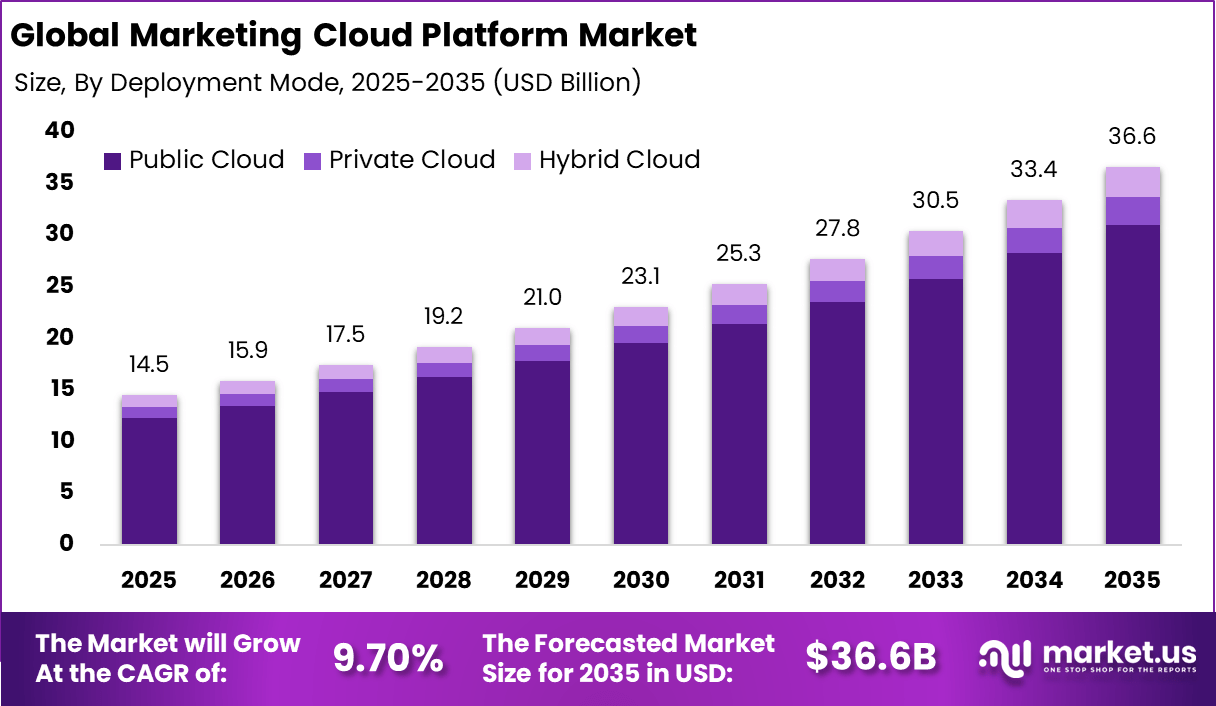

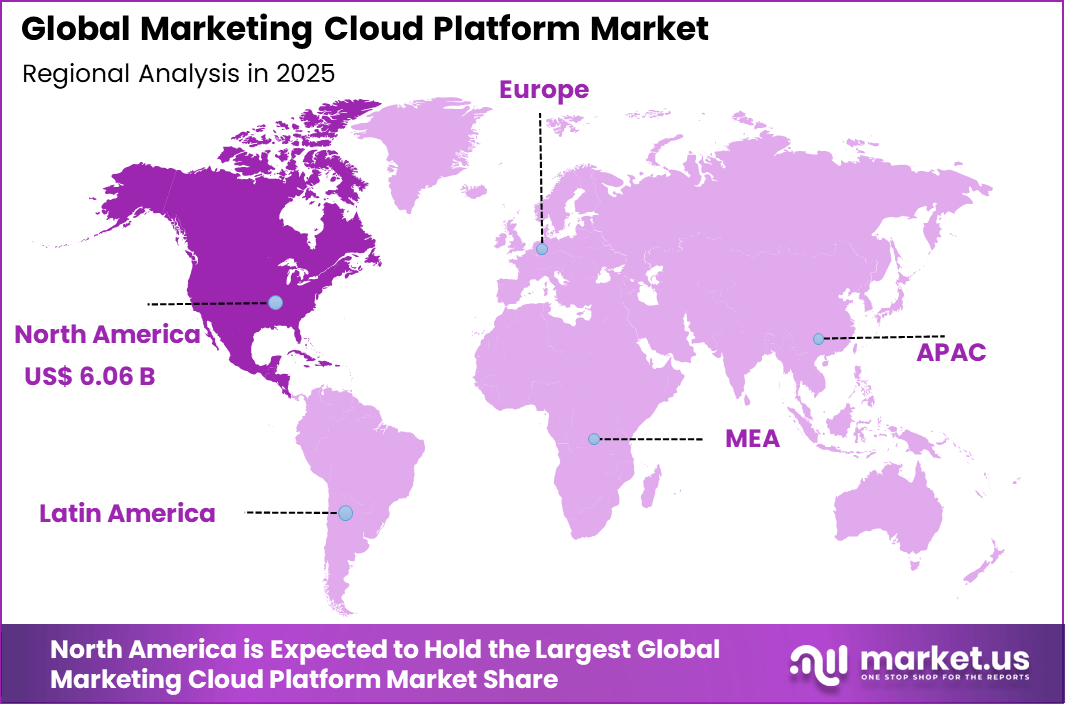

The Global Marketing Cloud Platform Market generated USD 14.5 billion in 2025 and is predicted to register growth from USD 15.9 billion in 2026 to about USD 36.6 billion by 2035, recording a CAGR of 9.70% throughout the forecast span. In 2025, North America held a dominan market position, capturing more than a 41.8% share, holding USD 6.06 Billion revenue.

The marketing cloud platform market refers to integrated digital platforms that help organizations manage, execute, and analyze marketing activities across multiple channels. These platforms support email marketing, social media management, customer journey orchestration, content management, and campaign analytics. Marketing cloud platforms centralize customer data to enable consistent communication and engagement.

Adoption spans enterprises, mid-sized businesses, and digital-first organizations across industries. These platforms support coordinated and data-driven marketing operations. Market development has been influenced by the growing complexity of customer engagement channels. Businesses interact with customers through websites, mobile apps, email, and social platforms. Using separate tools is inefficient; marketing cloud platforms offer unified control and visibility.

One major driving factor of the marketing cloud platform market is the demand for personalized customer engagement. Businesses aim to deliver relevant messages based on customer behavior and preferences. Marketing cloud platforms enable segmentation and targeted communication. Personalized experiences improve engagement and conversion. Customer-centric strategies drive adoption.

Demand for marketing cloud platforms is influenced by increased digital marketing spending. Organizations allocate larger budgets to online and performance-based campaigns. Efficient management of these investments requires advanced platforms. Marketing cloud solutions support planning and optimization. Spending growth strengthens demand.

Top Market Takeaways

- By component, solutions captured 78.3% of the marketing cloud platform market, powering integrated tools for omnichannel campaigns and analytics.

- By deployment mode, public cloud dominated with 84.7% share, enabling rapid scaling and data-driven personalization.

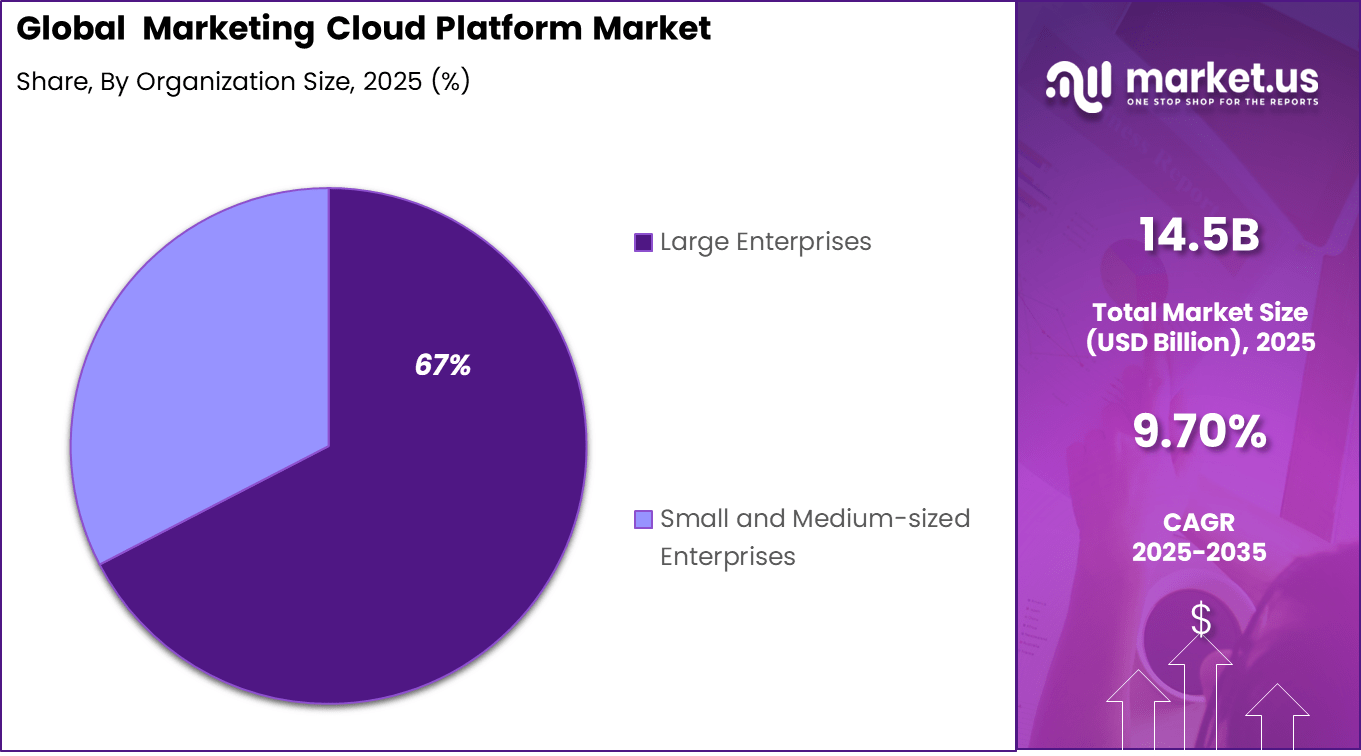

- By organization size, large enterprises held 67.4%, utilizing platforms to manage high-volume customer interactions.

- By end-user industry, retail and e-commerce led at 32.9%, leveraging marketing clouds for targeted promotions and loyalty programs.

- By application, customer segmentation and targeting accounted for 41.6%, driving precise messaging and higher engagement rates.

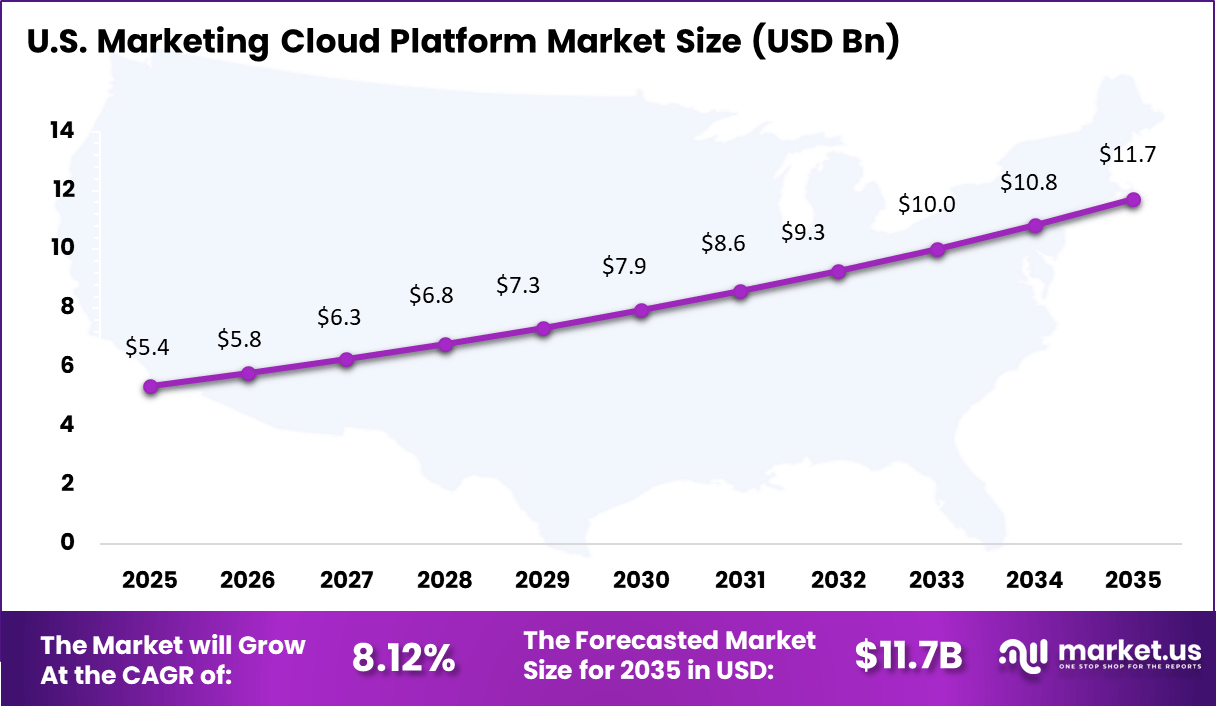

- North America represented 41.8% of the global market, with the U.S. valued at USD 5.37 billion and growing at a CAGR of 8.12%.

Key Insight Summary

General Adoption and Usage Rates

- About 94% of enterprises use cloud services as of early 2026.

- Around 74% of large enterprise workloads are cloud-hosted.

- Cloud hosting among SMBs ranges between 44% and 63%.

- SaaS is projected to represent 85% of all business software by end of 2025.

- Organizations use an average of 371 SaaS applications.

- Large enterprises average 131 SaaS apps.

- Mid-sized companies reduced usage to about 101 apps to control SaaS sprawl.

Marketing-Specific Adoption

- 88% of marketers use analytics and measurement tools.

- 86% rely on CRM platforms.

- 84% actively use first-party data.

- 63% of marketers use generative AI today.

- Over 80% of companies are expected to deploy AI-enabled apps by 2026.

- More than 70% of high-performing companies use marketing automation.

- Marketers engage customers through an average of 10 channels.

- Top-performing teams personalize across 6 channels.

Platform Performance and Market Share

- Salesforce Marketing Cloud is used by over 12,370 companies.

- More than 90% of Fortune 500 companies use Salesforce tools.

- HubSpot leads marketing automation by volume.

- HubSpot, ActiveCampaign, and Adobe together control 50% of the market.

- Mobile devices generated 58.67% of global website traffic by end 2025.

- About 78% of digital ad spend is directed toward mobile platforms.

Usage Challenges in 2026

- Organizations waste 30%-32% of cloud budgets due to inefficiencies.

- Only 31% of marketers are satisfied with data unification capabilities.

- Around 87% of organizations report a cloud skills gap.

- Digital transformation projects face delays of about 5 months due to skill shortages.

Component Analysis

Solutions account for 78.3% of the marketing cloud platform market, reflecting strong demand for integrated marketing capabilities. These solutions combine campaign management, analytics, personalization, and customer data tools into unified platforms. Enterprises prefer comprehensive solutions to reduce system fragmentation and improve marketing efficiency.

The dominance of solutions is supported by the need for real-time customer insights and automated marketing workflows. Businesses use these platforms to manage large volumes of customer data across multiple channels. This supports consistent messaging and improved customer engagement.

As marketing complexity increases, solution-centric platforms remain essential. Continuous enhancements in AI-driven analytics further strengthen adoption. Solutions continue to represent the core value offering in the market.

Deployment Mode Analysis

Public cloud deployment leads the market with an 84.7% share, highlighting the importance of scalability and accessibility. Public cloud platforms allow organizations to manage marketing operations without maintaining on-site infrastructure. This model supports rapid deployment and flexible resource scaling.

Marketers benefit from anytime access to tools and data across regions. Public cloud environments also support frequent updates and feature improvements. These advantages reduce operational complexity for marketing teams. As digital marketing activities expand, public cloud adoption remains strong. Cost efficiency and global accessibility reinforce this preference. Public cloud continues to be the dominant deployment model.

Organization Size Analysis

Large enterprises account for 67.4% of market demand, driven by complex marketing requirements. These organizations manage extensive customer bases and multi-channel campaigns. Marketing cloud platforms support centralized control and data integration.

Large enterprises use these platforms to coordinate marketing activities across business units and geographies. Advanced analytics and automation improve campaign performance. This supports measurable return on marketing investment.

As enterprise marketing strategies evolve, reliance on cloud platforms increases. Large organizations continue to lead adoption due to scale and budget capacity. This segment remains a key contributor to market revenue.

End-User Industry Analysis

Retail and e-commerce represent 32.9% of end-user adoption, making it the leading industry segment. These businesses rely heavily on personalized marketing to drive customer engagement and sales. Marketing cloud platforms enable targeted promotions and customer journey management.

The sector benefits from real-time data analysis and behavioral insights. Platforms support omnichannel engagement across web, mobile, and in-store touchpoints. This improves customer experience and retention. As competition intensifies, retail and e-commerce firms invest in advanced marketing tools. Data-driven decision-making supports revenue growth. This industry continues to drive platform adoption.

Application Analysis

Customer segmentation and targeting account for 41.6% of application demand. Businesses use these capabilities to group customers based on behavior, preferences, and demographics. Accurate segmentation supports more relevant marketing campaigns. AI-driven segmentation improves targeting accuracy and response rates.

Marketing teams can deliver personalized content at scale. This increases campaign effectiveness and customer satisfaction. As personalization becomes a standard expectation, segmentation tools remain critical. Continuous refinement of customer profiles supports long-term engagement. This application remains central to platform usage.

Increasing Adoption Technologies

Data management and analytics technologies play a key role in platform adoption. Marketing cloud platforms collect and process large volumes of customer data. Analytics tools convert this data into actionable insights. Improved insight quality supports better decisions. Data-driven capabilities increase platform value.

Automation technologies also support adoption. Automated campaign execution reduces manual effort. Trigger-based messaging improves responsiveness. Automation ensures consistency across channels. Efficiency gains encourage adoption.

One key reason organizations adopt marketing cloud platforms is improved campaign effectiveness. Unified data enables accurate targeting and timing. Better alignment improves response rates. Marketing performance becomes more measurable. Results-driven outcomes support adoption.

Another reason is improved collaboration across marketing teams. Centralized platforms enable shared access to data and tools. Teams coordinate campaigns more effectively. Reduced silos improve execution speed. Collaboration benefits drive usage.

Investment and Business Benefits

Investment opportunities in the marketing cloud platform market exist in industry-specific solutions. Different sectors require tailored engagement and compliance features. Vertical-focused platforms improve relevance and adoption. Customization supports differentiation. Industry alignment attracts investment.

Another opportunity lies in platforms offering advanced analytics and orchestration. Solutions that connect data, automation, and insights attract enterprise interest. Integrated intelligence improves outcomes. Scalable platforms support long-term growth. Innovation-driven offerings gain attention.

Marketing cloud platforms improve marketing efficiency by reducing tool fragmentation. Centralized execution lowers operational complexity. Automated workflows save time and resources. Efficiency gains improve productivity. Marketing operations become more predictable.

These platforms also improve customer experience consistency. Coordinated messaging reduces confusion. Personalized engagement strengthens relationships. Improved experience supports brand loyalty. Long-term customer value increases.

Usage

- Used by enterprises to manage email, social, and digital marketing campaigns

- Applied in customer segmentation and audience targeting activities

- Deployed for personalized content delivery across digital touchpoints

- Utilized in marketing analytics to track campaign performance

- Integrated with CRM systems to align marketing with sales outcomes

Emerging Trends

Key Trend Description AI-powered personalization Hyper-targeted campaigns using predictive customer insights. Omnichannel orchestration Seamless experiences across email, app, social, and web. Headless composable architecture Modular APIs enable flexible tech stack integration. Real-time journey optimization Dynamic content adjustments based on live behavior. Privacy-first compliance tools Built-in consent management for regulations like GDPR. Growth Factors

Key Factors Description Digital customer engagement rise Shift to personalized multichannel interactions. Data analytics maturity Rich first-party data fuels sophisticated campaigns. E-commerce expansion Integrated platforms support direct-to-consumer growth. Remote marketing teams Cloud scalability enables distributed operations. ROI measurement demands Advanced attribution drives platform investments. Key Market Segments

By Component

- Solutions

- Campaign Management

- Customer Data Platform

- Email Marketing

- Social Media Marketing

- Content Management

- Marketing Analytics

- Others

- Services

- Professional Services

- Managed Services

- Others

By Deployment Mode

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises

By End-User Industry

- Retail & E-commerce

- Banking, Financial Services, and Insurance

- Healthcare

- Media & Entertainment

- Travel & Hospitality

- Manufacturing

- Others

By Application

- Customer Segmentation & Targeting

- Lead Management & Nurturing

- Multi-channel Campaign Orchestration

- Customer Engagement & Personalization

- Marketing Measurement & ROI

- Others

Regional Analysis

North America accounted for 41.8% share, supported by advanced digital marketing adoption and strong focus on data driven customer engagement across industries. Enterprises in retail, media, banking, and technology have widely adopted marketing cloud platforms to manage customer data, automate campaigns, and deliver personalized experiences across multiple channels.

Demand has been driven by growth in omnichannel marketing, rising use of analytics, and need for real time customer insights. The region’s mature cloud infrastructure and high marketing technology spend have further supported steady market expansion.

The U.S. market reached USD 5.37 Bn and is projected to grow at an 8.12% CAGR, reflecting sustained demand from large enterprises and digital first businesses. Adoption has been driven by the need to manage complex customer journeys and deliver consistent messaging across email, mobile, social media, and web channels. Marketing cloud platforms have helped U.S. companies improve targeting accuracy, campaign speed, and performance measurement.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

The marketing cloud platform market is being driven by the growing imperative for organisations to unify fragmented customer interactions and data sources into cohesive, actionable insights. As digital touchpoints proliferate across social media, web, mobile, email, and other channels, enterprises require integrated platforms that consolidate customer profiles, automate campaign execution, and personalise engagement at scale.

Marketing cloud platforms leverage advanced automation, analytics, and data integration to optimise campaign performance, enhance segmentation accuracy, and enable real-time decision making. This consolidation supports strategic objectives such as improved customer experience, increased operational efficiency, and stronger alignment between marketing activities and business outcomes.

Restraint Analysis

A significant restraint in the marketing cloud platform market relates to the complexity and resource requirements associated with deployment, integration, and ongoing management. Many organisations operate with disparate systems and legacy technologies that must be aligned or replaced to fully realise the benefits of a unified marketing cloud.

Integrating structured and unstructured data from CRM, ecommerce systems, web analytics, and other sources often demands specialised technical skills and substantial investment in data governance. Smaller enterprises may find these implementation costs and skill requirements challenging, which can slow adoption and limit the depth of marketing cloud utilisation.

Opportunity Analysis

Emerging opportunities in the marketing cloud platform market are linked to the expansion of real-time personalisation, predictive analytics, and AI-driven optimisation. Platforms that can analyse behavioural signals, customer intent, and lifecycle context in real time provide marketers with strategic advantages in delivering relevant experiences and adaptive messaging.

There is also opportunity in industry-specific platform offerings tailored to distinct vertical requirements such as retail, financial services, healthcare, and media, where compliance, customer expectations, and engagement patterns differ. Enhanced integration with commerce, service, and loyalty systems further extends the value of marketing clouds by supporting end-to-end customer journeys and cross-functional collaboration.

Challenge Analysis

A central challenge confronting this market relates to balancing automation and control with transparency and interpretability of AI-driven insights. Marketing cloud platforms increasingly incorporate machine learning models to automate audience segmentation, content recommendations, and campaign delivery timing.

However, stakeholders often require clear visibility into how these models generate insights to maintain strategic oversight and comply with data governance policies. Ensuring that AI features support explainable results and align with organisational objectives without overwhelming users with complexity remains an operational and design challenge for platform providers and adopters alike.

Competitive Analysis

Market leaders such as Salesforce, Inc., Adobe Inc., and Oracle Corporation dominate the marketing cloud landscape. Their platforms offer integrated solutions for customer data management, personalization, and omnichannel campaign execution. AI is used to improve customer segmentation and predictive targeting. SAP SE strengthens adoption through deep enterprise integration. These players benefit from strong brand trust and long-term enterprise relationships across global markets.

Technology driven providers such as International Business Machines Corporation and Microsoft Corporation focus on AI-led marketing insights and data analytics. Their cloud ecosystems support scalable marketing automation and real-time decision making. SAS Institute Inc. and Teradata Corporation enhance the market with data intelligence and customer analytics capabilities. These vendors address complex data environments and regulated industries that require secure and compliant marketing operations.

Mid-market and engagement focused players such as HubSpot, Inc., Marketo, Inc., and Sprinklr, Inc. emphasize usability and omnichannel engagement. Zeta Global Holdings Corp. and Emarsys eMarketing Systems AG support personalized commerce marketing. Other vendors expand regional reach. This competitive environment supports continuous innovation and broader marketing cloud adoption.

Top 5 companies in the Marketing Cloud Platform Market

Company Core Platform Focus Key Technology Strength Primary End-User Segment Competitive Positioning Salesforce, Inc. End-to-end marketing cloud AI-driven personalization, customer data platform Large enterprises, global brands Market leader with deep CRM integration Adobe Inc. Experience and marketing management AI-powered content, analytics, journey orchestration Media, retail, enterprises Strong in content-led marketing ecosystems Oracle Corporation Marketing automation and CX Data-driven campaign management, analytics Large enterprises Strong enterprise data and cloud capabilities SAP SE Customer experience and marketing Integration with ERP and commerce platforms Enterprises, B2B organizations Strong enterprise system integration Microsoft Corporation Marketing and customer insights AI, cloud analytics, omnichannel engagement Mid to large enterprises Cloud-first approach with scalable AI tools Top Key Players in the Market

- Salesforce, Inc.

- Adobe Inc.

- Oracle Corporation

- SAP SE

- International Business Machines Corporation

- Microsoft Corporation

- HubSpot, Inc.

- Marketo, Inc.

- SAS Institute Inc.

- Teradata Corporation

- Acoustic, LP

- Zeta Global Holdings Corp.

- Sprinklr, Inc.

- Emarsys eMarketing Systems AG

- Act-On Software, Inc.

- Others

Recent Developments

- October, 2025: Adobe rolled out Experience Cloud updates with AI-powered Audience and Experimentation Agents, plus enhanced AEM for long-video support and metadata tagging in content workflows.

- June, 2025: Salesforce launched Marketing Cloud Next at Connections, blending nine acquisitions into an agentic AI platform on Data Cloud for real-time, personalized marketing across channels.

- May, 2025: Salesforce signed a deal to buy Informatica for about $8 billion in equity, boosting Marketing Cloud and Data Cloud with top-tier data management for AI-driven campaigns and customer insights.

Report Scope

Report Features Description Market Value (2025) USD 14.5 Bn Forecast Revenue (2035) USD 36.6 Bn CAGR(2025-2035) 9.70% Base Year for Estimation 2024 Historic Period 2020-2024 Forecast Period 2025-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Solutions (Campaign Management, Customer Data Platform, Others), Services (Professional Services, Managed Services, Others)), By Deployment Mode (Public Cloud, Private Cloud, Hybrid Cloud), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises), By End-User Industry (Retail and E-commerce, Banking, Financial Services, and Insurance, Others), By Application (Customer Segmentation and Targeting, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Salesforce, Inc., Adobe Inc., Oracle Corporation, SAP SE, International Business Machines Corporation, Microsoft Corporation, HubSpot, Inc., Marketo, Inc., SAS Institute Inc., Teradata Corporation, Acoustic, LP, Zeta Global Holdings Corp., Sprinklr, Inc., Emarsys eMarketing Systems AG, Act-On Software, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Marketing Cloud Platform MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample

Marketing Cloud Platform MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

Salesforce, Inc. Adobe Inc. Oracle Corporation SAP SE International Business Machines Corporation Microsoft Corporation HubSpot, Inc. Marketo, Inc. SAS Institute Inc. Teradata Corporation Acoustic, LP Zeta Global Holdings Corp. Sprinklr, Inc. Emarsys eMarketing Systems AG Act-On Software, Inc. Others