Global Marketing Analytics Market Size, Share and Analysis Report By Application (Social media marketing, E-mail Marketing, Search Engine Marketing, Content Marketing, Others), By Deployment Model (Cloud, On-Premises), By Organization Size (SME, Large Enterprises), By End User (Retail & Consumer Goods, BFSI, Healthcare, Media & Communication, Industrial, Others) , By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 171767

- Number of Pages: 378

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Quick Market Facts

- Increasing Adoption Technologies

- U.S. Marketing Analytics Market Size

- Application Analysis

- Deployment Model Analysis

- Organization Size Analysis

- End User Analysis

- Emerging Trends

- Growth Factors

- Driver

- Restraint

- Opportunity

- Challenge

- Key Market Segments

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

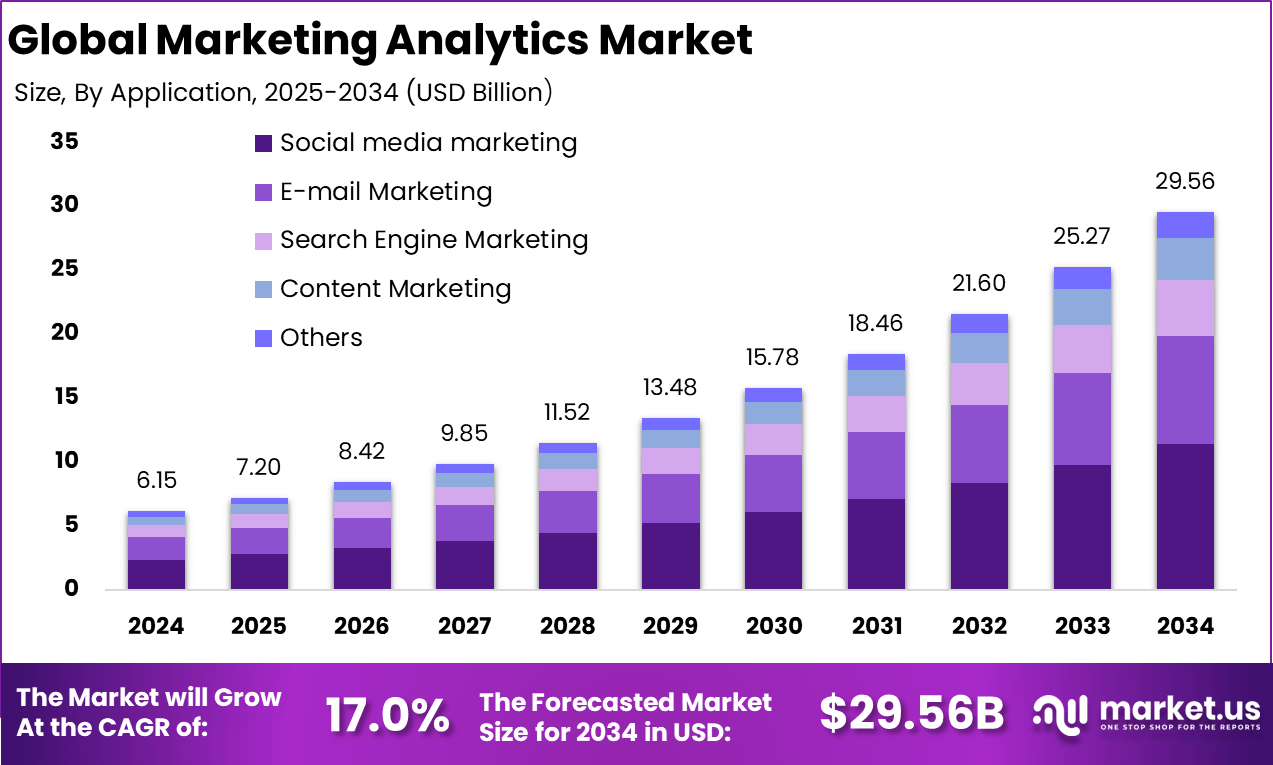

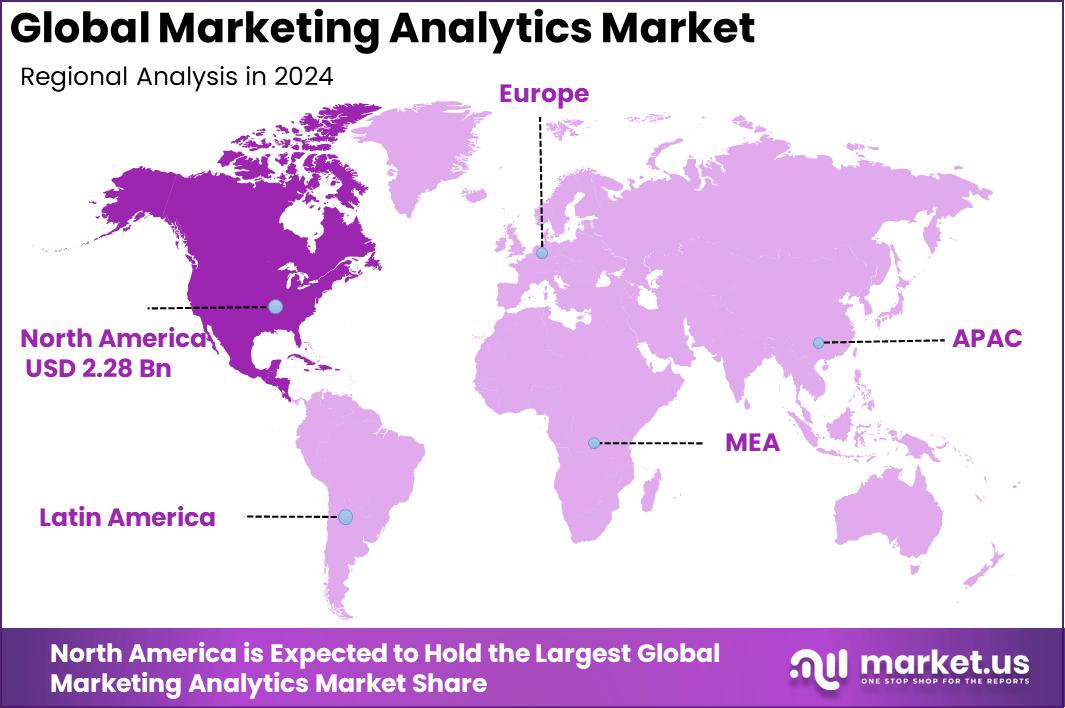

The Global Marketing Analytics Market size is expected to be worth around USD 29.56 billion by 2034, from USD 6.15 billion in 2024, growing at a CAGR of 17.0% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 37.2% share, holding USD 2.28 billion in revenue.

The marketing analytics market refers to software, tools, and services used by organizations to collect, measure, analyze, and interpret data from marketing activities. These systems help marketers understand customer behavior, assess campaign performance, and optimize marketing spend. Marketing analytics enables businesses to make decisions grounded in data rather than intuition, supporting more efficient allocation of resources and improved customer engagement.

Growth in this market is driven by increasing use of digital marketing channels such as social media, search, email, and mobile platforms. As organizations generate more data from these sources, they require analytics tools to transform raw data into actionable insights. Marketing analytics platforms provide reporting, predictive modeling, segmentation, and visualization, which support strategic and tactical decisions.

According to WebFX, only 44% of marketers believe they have high quality data on their target audiences, while 87% view data as the most underused asset within their organizations. At the same time, 79% of leading marketers consider marketing analytics critical for future success. Adoption of enabling technologies is rising, with 54% of businesses evaluating cloud computing and business intelligence tools, and use of CRM software shown to improve reporting accuracy by up to 42%.

For instance, in August 2025, Teradata earned Forrester leader status in analytics platforms. San Diego’s focus on AI-driven data for marketing fuels enterprise scale. VantageCloud handles petabyte queries for ad optimization. U.S. retailers use it to unify POS and online signals. This powers precise targeting in competitive markets.

Cloud-based analytics platforms are widely adopted in the marketing analytics market. Cloud deployment enables scalability and faster data processing. It also allows teams to access insights from different locations. This supports modern marketing operations. Advanced data integration and visualization technologies are also gaining adoption. These tools combine data from multiple sources into unified dashboards.

Key Takeaway

- Social media marketing led application usage with a 38.7% share, as brands continue to focus on engagement, campaign performance tracking, and customer insights across digital platforms.

- On-premises deployment accounted for 55.4%, reflecting enterprise preference for greater data control, security, and customization of analytics environments.

- Large enterprises represented 68.2% of adoption, driven by high data volumes, complex marketing operations, and advanced analytics requirements.

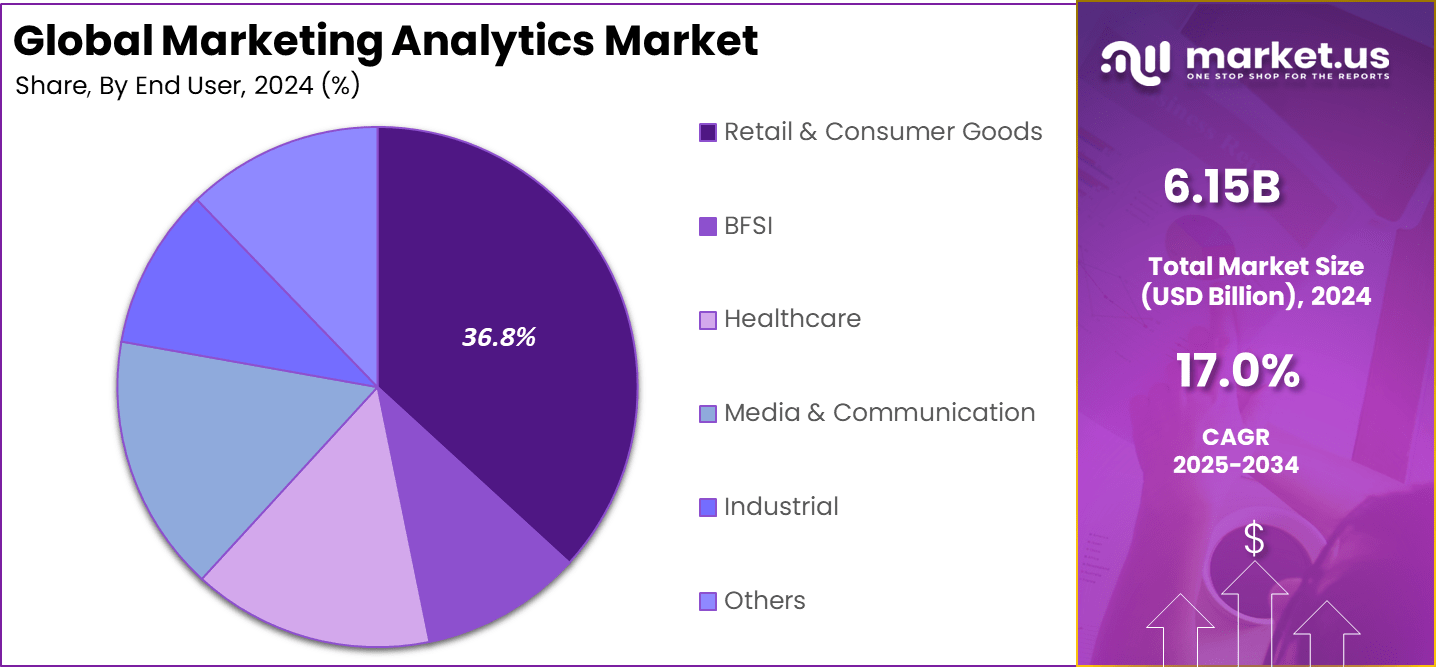

- Retail and consumer goods captured 36.8%, supported by strong demand for customer behavior analysis, personalization, and omnichannel performance measurement.

- North America held a 37.2% share, supported by mature digital marketing ecosystems and early adoption of advanced analytics tools.

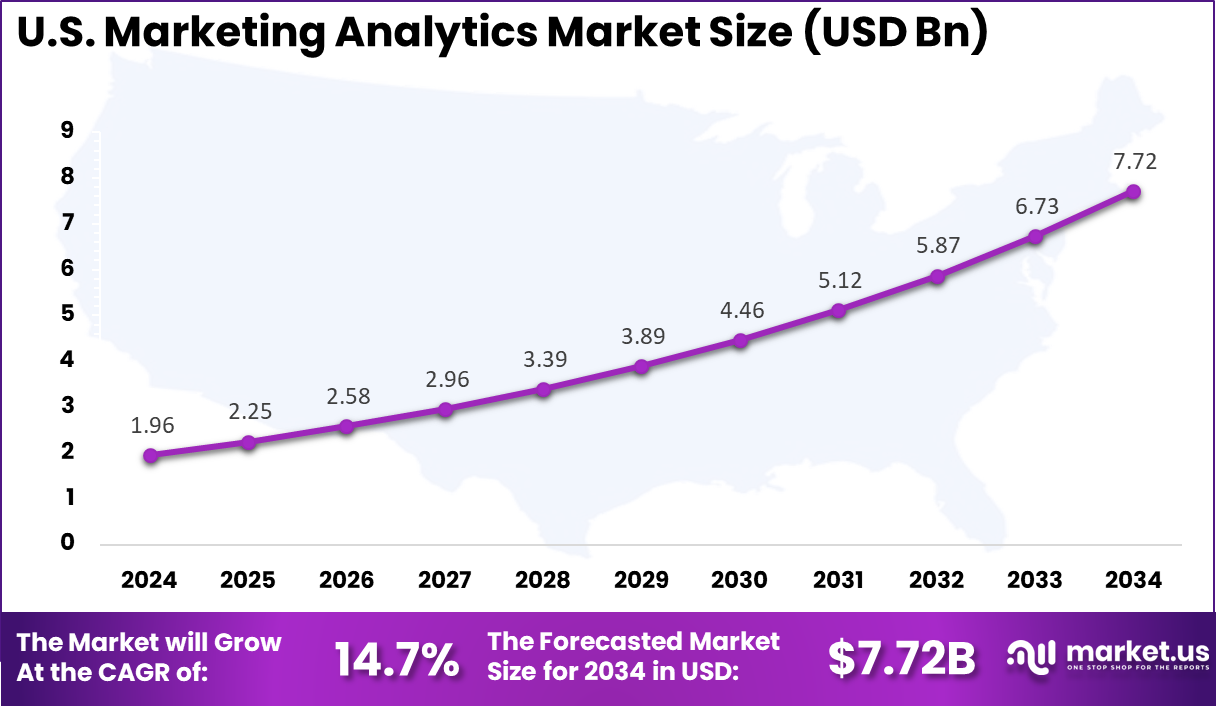

- The U.S. marketing analytics market reached USD 1.96 billion in 2024 and is expanding at a 14.7% CAGR, driven by data-driven marketing strategies and growing investment in analytics platforms.

Quick Market Facts

Performance and ROI Benchmarks

- Global e-commerce conversion rates remain below 2%, highlighting continued pressure on optimization and personalization efforts.

- B2C email remains one of the most effective channels, delivering an average conversion rate of 2.8%, followed closely by B2B email at 2.4%.

- Short-form video delivers the strongest return, with 21% of marketers identifying it as the highest-ROI content format.

- Email segmentation significantly improves engagement, generating 30% higher open rates and 50% higher click-through rates compared with non-segmented campaigns.

- Long-term use of predictive analytics shows clear payoff, as 86% of executives using these tools for over two years report improved ROI.

Current Challenges

- Data fragmentation remains widespread, with 98% of marketers acknowledging the need for a unified cross-channel view, yet 71% still measure performance in isolated silos.

- Speed of insight is limited, as only 33% of marketers strongly agree they can access insights quickly enough to drive meaningful action.

- Skills gaps persist, with just 1.9% of companies confident they have the right talent to fully utilize marketing analytics.

- Data underuse is a major concern, as 87% of marketers describe data as their most under-utilized organizational asset.

Emerging Trends in 2025

- AI adoption is accelerating, with 19.65% of marketers planning to deploy AI agents to automate marketing tasks in 2025.

- First-party data strategies are gaining importance as third-party cookies are phased out, reshaping targeting and measurement approaches.

- Digital audio advertising continues to grow, with spending projected to exceed USD 12.16 billion in 2025.

Increasing Adoption Technologies

Artificial intelligence and machine learning lead adoption by enabling predictive modeling of customer behaviors and automated campaign adjustments. These technologies analyze vast datasets to forecast trends and segment audiences with precision beyond manual methods. Cloud-based platforms further accelerate uptake by offering scalable access to advanced processing without heavy infrastructure costs.

Real-time analytics and AI-driven sentiment analysis gain traction for instant decision-making on social media and feedback data. Integration of first-party data tools addresses privacy shifts, while automation streamlines workflows like content optimization. Businesses favor these for their ability to handle dynamic market conditions effectively.

Companies adopt marketing analytics primarily to replace guesswork with data-backed decisions that enhance campaign performance and resource allocation. It allows precise measurement of ROI across channels, helping identify high-impact tactics quickly. This approach reduces waste and builds confidence in marketing investments.

Personalization emerges as a core driver, as analytics reveals customer preferences for tailored experiences that boost engagement and loyalty. Firms also pursue competitive edges by spotting trends and competitor moves early through ongoing data monitoring. Adoption ensures agility in responding to evolving consumer expectations and market dynamics.

U.S. Marketing Analytics Market Size

The market for Marketing Analytics within the U.S. is growing tremendously and is currently valued at USD 1.96 billion, the market has a projected CAGR of 14.7%. The market is growing due to rising demand for data-driven decisions in a competitive landscape. Businesses leverage tools to track customer journeys across channels, optimizing campaigns in real time.

E-commerce expansion fuels the need for personalized insights, while AI integration speeds analysis of vast datasets. Retailers and brands prioritize ROI measurement amid privacy regulations, pushing the adoption of advanced platforms. This momentum reflects maturing digital strategies across enterprises.

For instance, in October 2025, Google Analytics enhanced cross-channel measurement at Google Marketing Live, introducing AI-powered predictive insights and attributed brand searches for superior ROI tracking. Based in Mountain View, Google’s tools solidify North American leadership in comprehensive customer journey analytics.

In 2024, North America held a dominant market position in the Global Marketing Analytics Market, capturing more than a 37.2% share, holding USD 2.28 billion in revenue. This dominance stems from advanced digital infrastructure and high e-commerce penetration, enabling real-time data processing across channels.

Businesses here lead in adopting AI for customer insights, refining campaigns with precision. Mature tech ecosystems support seamless integration of analytics tools, while strong privacy regulations drive secure first-party data use. Retail giants and large enterprises fuel growth through personalized marketing that lifts sales and loyalty.

For instance, in September 2025, HubSpot unveils INBOUND updates with Breeze AI for North American marketers. Agents handle retail campaign data, unifying insights for consumer trends. Regional teams deploy fast for social and email analytics. Growth ties to dense tech adoption here.

Application Analysis

In 2024, The Social media marketing segment held a dominant market position, capturing a 38.7% share of the Global Marketing Analytics Market. Teams use these tools to watch how posts perform, track user feelings, and see what content spreads fast. Real-time stats let marketers tweak ads on the fly, boosting likes and shares. This focus helps brands connect better with young crowds on platforms full of quick videos and stories. Data shows clear wins in engagement when insights guide posts.

Growth comes from linking social buzz to real sales. Businesses spot top influencers and hot trends early, cutting waste on weak campaigns. With privacy rules tightening, smart data handling keeps trust high. Marketers now predict viral hits by studying past patterns. This edge makes social media analytics a must for staying ahead in crowded feeds.

For Instance, in November 2025, Accenture invests in Alembic to boost social media campaign measurement. The AI platform analyzes post performance and user reactions in real time. Marketers gain clear views on what drives engagement across feeds, helping refine content for better reach. This fits social media’s need for quick insights on trends and sentiment.

Deployment Model Analysis

In 2024, the On-Premises segment held a dominant market position, capturing a 55.4% share of the Global Marketing Analytics Market. Companies choose this for a tight grip on private customer info, key in banking and health fields. No cloud risks mean steady access even offline. Custom setups fit exact needs, like blending old systems with new tools. Reliability draws firms handling big data loads daily.

It sticks around despite cloud hype due to strict rules on data staying local. Hybrids mix on-site security with cloud speed for reports. Teams value control over updates and costs long-term. Regulated sectors lean here to avoid fines. This setup supports heavy analytics without slowdowns.

For instance, in February 2025, Adobe Systems, Inc. highlighted AEM On-Premise strengths in deployment choices. It offers full control for custom setups in mid-size and enterprise e-commerce. Teams manage data locally with features like product recommendations and loyalty tools.

Organization Size Analysis

In 2024, The Large Enterprises segment held a dominant market position, capturing a 68.2% share of the Global Marketing Analytics Market. They manage vast campaigns over many channels, drowning in customer and ad data. Tools cut through noise to reveal buying signals and weak spots. Deep budgets fund top systems for instant tweaks across global teams. Scale demands this power to match rivals.

These firms track full paths from ads to purchases, sharpening spending. Real-time views unite sales and marketing for smooth flows. Smaller outfits adopt slower, but giants pioneer features like AI predictions. Their lead shapes tools for everyone, pushing industry standards higher over time.

For Instance, in August 2025, Microsoft releases Dynamics 365 Customer Insights updates. Copilot aids large-scale data unification for marketing insights. Enterprises build agents that analyze behaviors securely, fitting complex setups. Focus stays on enterprise-grade tools for deep analytics.

End User Analysis

In 2024, The Retail & Consumer Goods segment held a dominant market position, capturing a 36.8% share of the Global Marketing Analytics Market. Shops dig into buying habits to stock right and craft personal deals. Sales data turns into plans for better displays and timely discounts. This lifts foot traffic and repeat visits in stores and online. Quick insights beat stockouts and overbuys.

Loyalty builds as analytics flags drifting shoppers for win-back offers. E-commerce data mixes with in-store to refine all tactics. Chains see fast returns from targeted emails and app pushes. Customer views drive smarter pricing, too. This segment thrives on turning data into daily sales gains.

For Instance, in December 2025, Salesforce reports AI agents drive Cyber Week retail sales records. Personalized recommendations via analytics boosted purchases by analyzing buying patterns. Retailers used real-time data for targeted promos across stores and online. This highlights the analytics role in consumer goods peaks.

Emerging Trends

In the marketing analytics market, a significant trend is the integration of advanced artificial intelligence and machine learning into analytics platforms. These technologies enhance the ability to uncover patterns, segment audiences dynamically, and forecast campaign outcomes with greater precision. As organisations seek deeper insights from complex datasets, AI-driven analytics supports automated interpretation and more informed strategic decisions.

Another emerging trend is the growing adoption of unified analytics dashboards that combine data from multiple touchpoints such as social media, email, paid advertising, websites, and customer relationship management systems. By aggregating cross-channel data into a single view, marketing teams can better understand customer journeys, optimise spend, and improve attribution models that link activities to outcomes.

Growth Factors

A key growth factor in the marketing analytics market is the expanding volume and variety of customer data generated through digital interactions. As consumers engage with brands across devices and platforms, organisations require analytics tools that can process large datasets and turn raw signals into actionable insights. The ability to handle big data effectively strengthens marketing precision and ROI measurement.

Another important factor supporting growth is the increasing demand for accountability in marketing spend. Businesses are under pressure to justify investments in campaigns and demonstrate measurable impact on revenue and customer engagement. Analytics platforms that deliver performance metrics and outcome modelling help align marketing activities with broader organisational goals, reinforcing the value of analytics adoption.

Driver

A principal driver of the marketing analytics market is the need for personalised customer experiences. Modern consumers expect communications and offerings tailored to their preferences, behaviour, and past interactions. Analytics enables segmentation, predictive modelling, and targeted messaging that support higher engagement rates and improved conversion outcomes, driving continued investment in analytics capabilities.

Another driver is the pressure to adapt quickly to market changes and competitive dynamics. Marketing teams must respond to evolving trends, shifting consumer sentiment, and external disruptions with agility. Real time and near real time analytics empower teams to adjust strategies promptly, optimise campaigns on the fly, and capitalise on emerging opportunities.

Restraint

A notable restraint in this market is the challenge of data quality and consistency. Marketing analytics depends on accurate, timely, and coherent datasets. However, organisations often manage information stored in disparate systems with varying formats, which can hinder the effectiveness of analytics and lead to unreliable insights without thorough data cleansing and governance.

Another restraint relates to privacy regulations and data protection concerns. Laws governing personal data such as consent requirements and usage limitations impose restrictions on how customer information can be collected and analysed. Compliance obligations can constrain analytics practices and require additional investment in privacy-centric processes and technology.

Opportunity

A strong opportunity exists in the expansion of real time analytics and predictive insights that support proactive decision making. Platforms that can anticipate customer needs, forecast demand, and signal shifts in behaviour provide strategic advantage and deeper alignment between marketing efforts and business performance objectives.

Another opportunity lies in enhancing integration with business intelligence and operational systems. Deeper connectivity between marketing analytics and enterprise resource planning, customer service, and sales platforms can deliver end-to-end visibility into customer interactions and lifecycle outcomes. This broader visibility enhances cross functional collaboration and supports more cohesive organisational strategies.

Challenge

One of the main challenges for the marketing analytics market is balancing technological sophistication with usability. Advanced features such as predictive modelling and AI insights can be powerful, but they often require specialised skills to interpret and apply effectively. Ensuring that analytics tools are accessible and actionable for marketing professionals remains essential for value realisation.

Another challenge is securing organisational alignment in analytics adoption. Establishing shared definitions, consistent metrics, and unified reporting practices across departments can be difficult in large organisations. Misalignment in measurement approaches can reduce confidence in analytics outputs and slow the adoption of data-driven practices.

Key Market Segments

By Application

- Social media marketing

- E-mail Marketing

- Search Engine Marketing

- Content Marketing

- Others

By Deployment Model

- Cloud

- On-Premises

By Organization Size

- SME

- Large Enterprises

By End User

- Retail & Consumer Goods

- Social media marketing

- E-mail Marketing

- Search Engine Marketing

- Content Marketing

- Others

- BFSI

- Social media marketing

- E-mail Marketing

- Search Engine Marketing

- Content Marketing

- Others

- Healthcare

- Social media marketing

- E-mail Marketing

- Search Engine Marketing

- Content Marketing

- Others

- Media & Communication

- Social media marketing

- E-mail Marketing

- Search Engine Marketing

- Content Marketing

- Others

- Industrial

- Social media marketing

- E-mail Marketing

- Search Engine Marketing

- Content Marketing

- Others

- Others

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

Key Players Analysis

Accenture, Adobe, Google, Salesforce, Microsoft, IBM, Oracle, SAP, and SAS Institute lead the marketing analytics market with enterprise platforms that combine data integration, customer insights, and advanced analytics. Their solutions help organizations measure campaign performance, understand customer behavior, and improve return on marketing spend. These companies focus on AI driven insights, real time dashboards, and integration with CRM and digital marketing tools.

CleverTap, HubSpot, Experian, Mailchimp, Pegasystems, NGDATA, and Teradata strengthen the market with customer centric analytics, segmentation, and personalization capabilities. Their platforms enable marketers to track user journeys, predict engagement, and optimize multichannel campaigns. These providers emphasize usability, automation, and faster insight generation.

McKinsey, Semrush, Supermetrics, Wipro, and other players expand the landscape with consulting led analytics, performance measurement, and marketing intelligence tools. Their offerings support attribution modeling, competitive analysis, and campaign optimization. These companies focus on strategic insights, flexibility, and integration across data sources.

Top Key Players in the Market

- Accenture PLC

- Adobe Systems, Inc.

- CleverTap

- Experian PLC

- HubSpot

- IBM Corporation

- Mailchimp

- McKinsey & Company

- Microsoft Corporation

- NGDATA, Inc.

- Oracle Corporation

- Pegasystems, Inc.

- Salesforce

- SAS Institute, Inc.

- SAP SE

- Semrush

- Supermetrics

- Teradata Corporation

- Wipro Ltd.

- Others

Recent Developments

- In October 2025, Salesforce launched Marketing Cloud Engagement Plus, an AI-upgraded edition with hyper-personalization and real-time data activation across channels. The platform automates campaign adjustments and integrates deeply with Commerce Cloud, helping brands boost ROI through predictive customer insights. This solidifies U.S. dominance in scalable marketing automation.

- In October 2025, HubSpot unveiled the Loop Marketing Playbook and Breeze AI Agents at INBOUND 2025, replacing traditional funnels with AI-driven workflows and a new Data Hub for unified customer data. These tools enable smarter segmentation and analytics, powering personalized experiences for growing businesses. HubSpot’s innovations keep North America ahead in accessible martech.

Report Scope

Report Features Description Market Value (2024) USD 6.1 Bn Forecast Revenue (2034) USD 29.5 Bn CAGR(2025-2034) 17% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Application (Social media marketing, E-mail Marketing, Search Engine Marketing, Content Marketing, Others), By Deployment Model (Cloud, On-Premises), By Organization Size (SME, Large Enterprises), By End User (Retail & Consumer Goods, BFSI, Healthcare, Media & Communication, Industrial, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Accenture PLC, Adobe Systems, Inc., CleverTap, Experian PLC, Google, HubSpot, IBM Corporation, Mailchimp, McKinsey & Company, Microsoft Corporation, NGDATA, Inc., Oracle Corporation, Pegasystems, Inc., Salesforce, SAS Institute, Inc., SAP SE, Semrush, Supermetrics, Teradata Corporation, Wipro Ltd., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Marketing Analytics MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

Marketing Analytics MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Accenture PLC

- Adobe Systems, Inc.

- CleverTap

- Experian PLC

- HubSpot

- IBM Corporation

- Mailchimp

- McKinsey & Company

- Microsoft Corporation

- NGDATA, Inc.

- Oracle Corporation

- Pegasystems, Inc.

- Salesforce

- SAS Institute, Inc.

- SAP SE

- Semrush

- Supermetrics

- Teradata Corporation

- Wipro Ltd.

- Others