Global Magnetic Sensitive Transistor Market Size, Share Analysis Report By Type (Analog Magnetic Sensitive Transistor, Digital Magnetic Sensitive Transistor), By Application (Automotive, Consumer Electronics, Industrial, Healthcare, Aerospace & Defense, Others), By End-User (OEMs, Aftermarket), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151398

- Number of Pages: 271

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

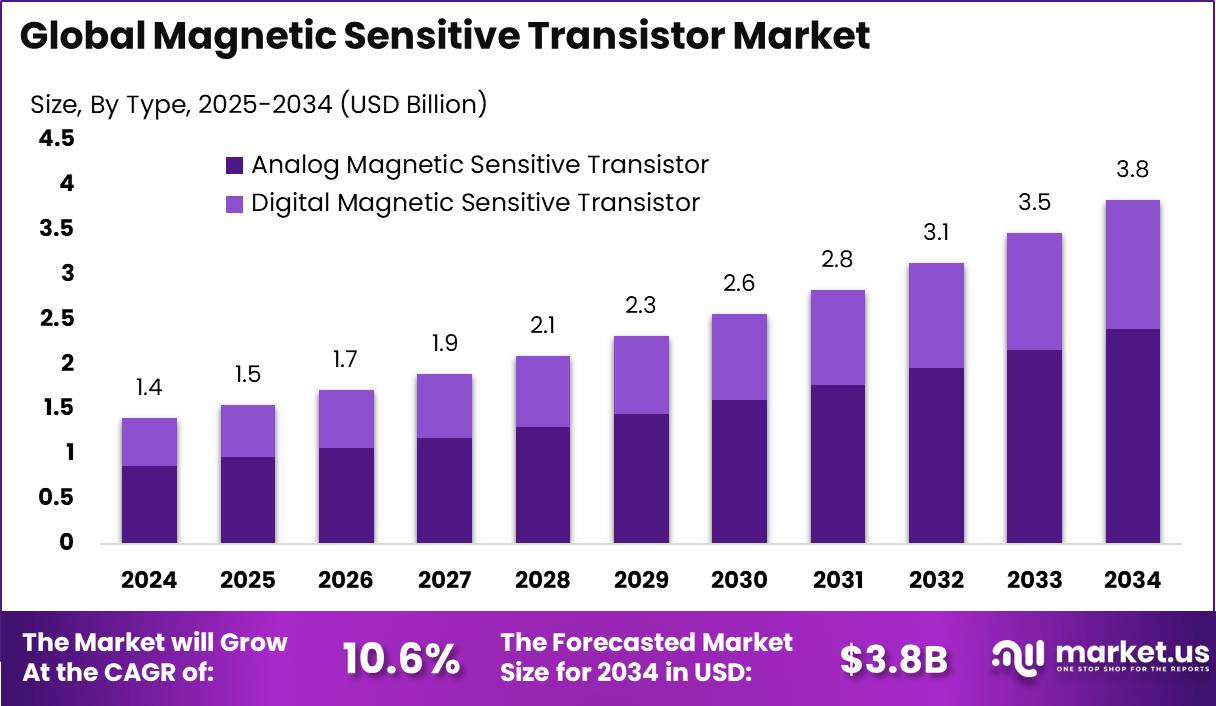

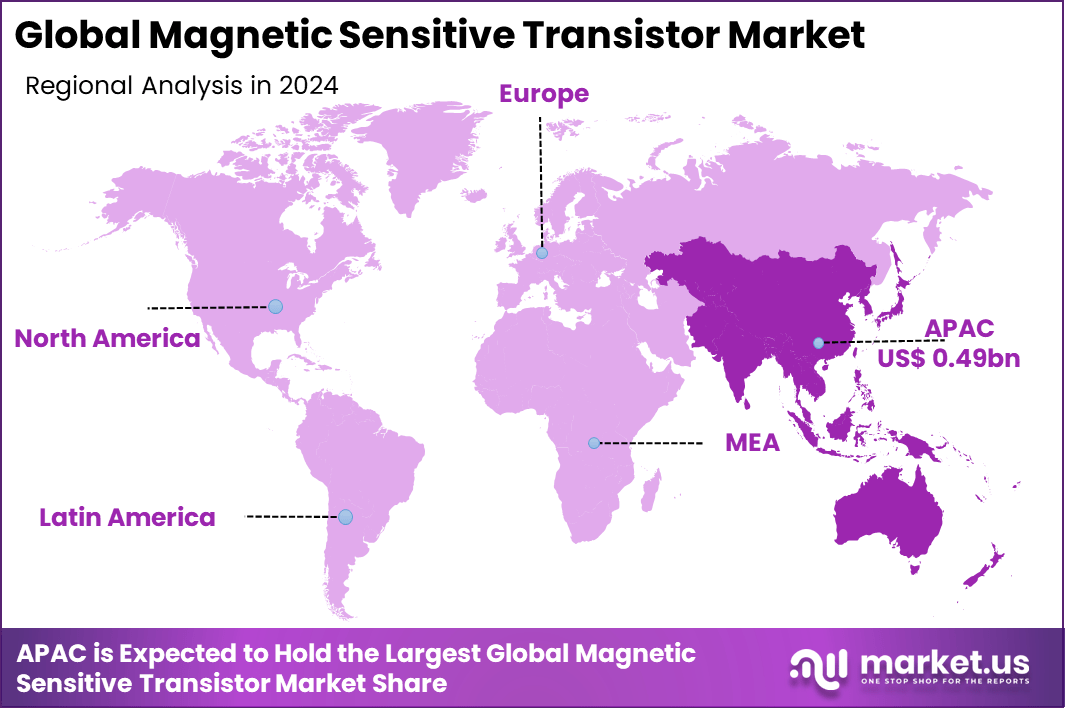

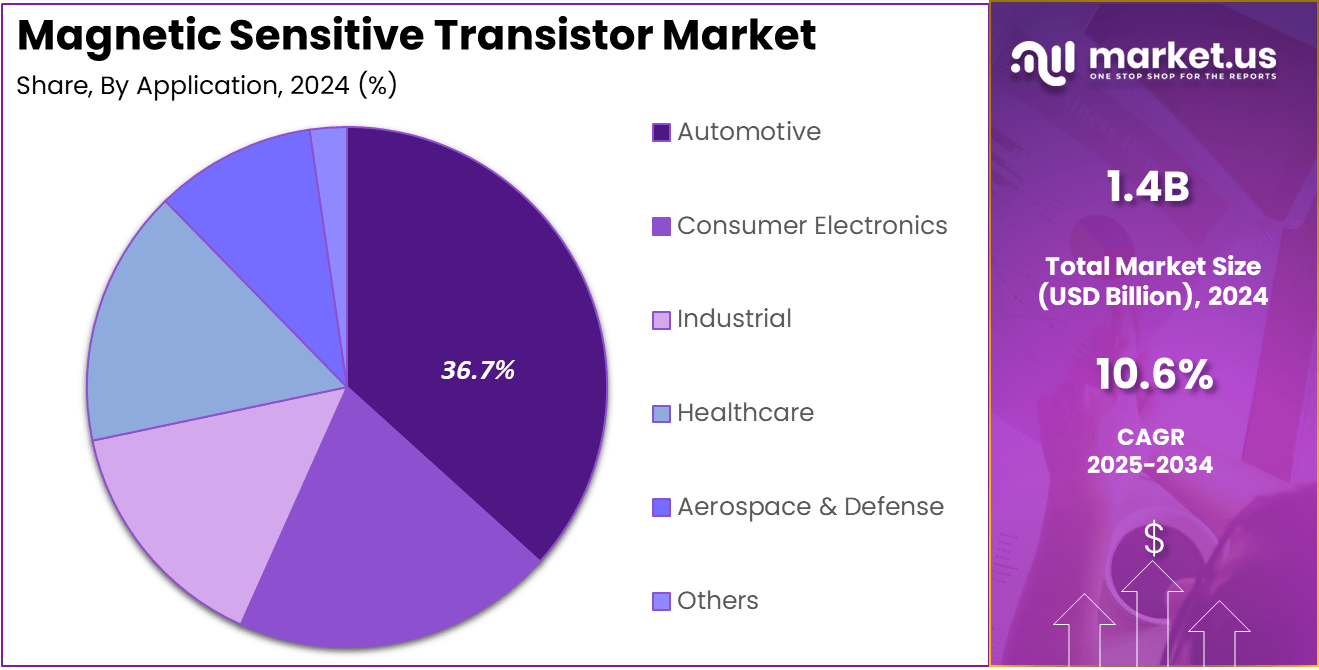

The Global Magnetic Sensitive Transistor Market size is expected to be worth around USD 3.8 billion by 2034, from USD 1.4 billion in 2024, growing at a CAGR of 10.6% during the forecast period from 2025 to 2034. In 2024, Asia Pacific held a dominant market position, capturing more than a 35.2% share, holding USD 0.49 billion in revenue.

The Magnetic Sensitive Transistor market is undergoing gradual evolution driven by increasing demand for compact, accurate magnetic sensing in applications such as automotive systems, industrial equipment, and consumer electronics. Its relevance is underscored by the push toward miniaturisation, which enhances device efficiency and performance while reducing size and weight.

Top driving factors encompass the proliferation of electric and hybrid vehicles, where precise magnetic transistors are essential for battery and motor control systems. Simultaneously, the advancement of Industry 4.0 and automation frameworks has elevated the use of these sensors in robotics, conveyor operations, and factory equipment, boosting their significance.

Demand analysis shows that both analog and digital variants of magnetic sensitive transistors are gaining traction. Analog types serve continuous signal applications like motor control and current sensing, valued for reliability and precision. Digital types suit digital systems in consumer devices and healthcare, offering low noise and easy integration.

For instance, Infineon Technologies provides advanced Magnetic Sensitive Transistors (MSTs) that support accurate magnetic field detection for applications in automotive, industrial, and consumer electronics. These sensors enable key functions such as position sensing, current measurement, and speed monitoring. Their growing use in electric vehicles and automation systems is accelerating demand for high-performance magnetic sensing solutions.

Increasing adoption of new technologies includes material innovations and miniaturised designs that improve sensitivity, lower power usage, and boost accuracy. Emerging uses in smart gadgets, gesture sensing, and Internet of Things devices underscore this trend. In the industrial sector, combining magnetic sensing with wireless and IoT systems facilitates real‑time monitoring and efficiency gains.

Key Takeaway

- The Global Magnetic Sensitive Transistor Market is projected to reach USD 3.8 Billion by 2034, up from USD 1.4 Billion in 2024, growing at a CAGR of 10.6% driven by increasing use in automotive and industrial sensing systems.

- In 2024, Asia Pacific led the market with over 35.2% share, generating USD 0.49 Billion in revenue, supported by strong electronics manufacturing ecosystems in countries like China, Japan, and South Korea.

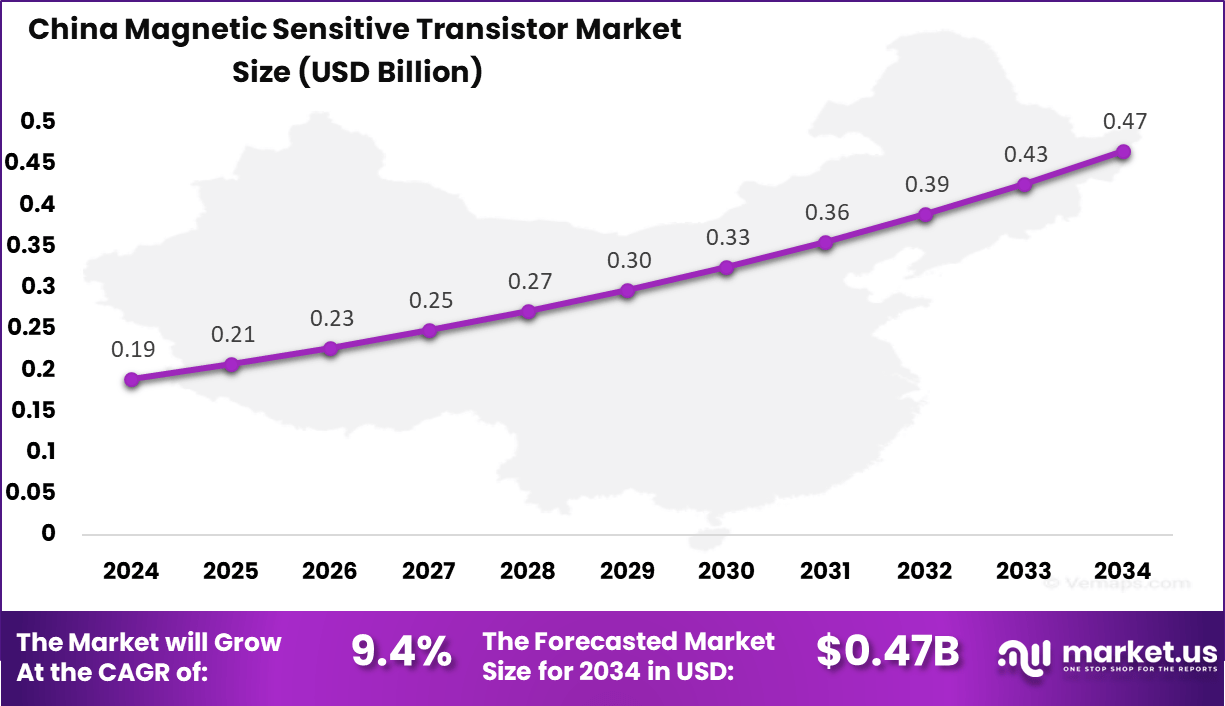

- China contributed USD 0.19 Billion, growing at a CAGR of 9.4%, as the country scales up production of electric vehicles and sensor-integrated electronics.

- Analog Magnetic Sensitive Transistors accounted for 62.5% of the market by type, reflecting widespread adoption in simple, low-power magnetic field detection applications.

- The Automotive sector led all applications with 36.7% share, driven by increased integration of magnetic sensors in ABS systems, steering angle detection, and gear position monitoring.

- OEMs were the leading end-users with 57.8% share, as they embed these transistors directly into electronic components and modules for mass production.

China Market Size

The market for Magnetic Sensitive transistors within China is growing tremendously and is currently valued at USD 0.19 billion, the market has a projected CAGR of 9.4%. The country’s growth in industrial automation, automotive production, and consumer electronics is the main factor fueling this market.

The demand for high-precision magnetic sensing components such as MSTs has skyrocketed as Chinese firms pioneer worldwide innovation in electric vehicles and smart devices. Furthermore, China’s status as a major worldwide hub for MST production and application is complemented by robust government backing for semiconductor self-reliance and technological progress, which also stimulates investment and growth in this field.

For instance, In June 2022, IEEE underscored the rising significance of magnetic sensors in power grids and electric vehicles, with China emerging as a major driver of this trend. The nation’s emphasis on clean energy, smart infrastructure, and electric mobility has led to increased demand for advanced magnetic sensors, including Magnetic Sensitive Transistors (MSTs), to improve system efficiency and performance.

In 2024, Asia Pacific held a dominant market position in the Global Magnetic Sensitive Transistor Market, capturing more than a 35.2% share, holding USD 0.49 billion in revenue. The Asian region’s active automotive and consumer electronics production sectors, along with the presence of major sensor manufacturers in China and Japan, contributed to the global size of the magnetic sensitive transistor market.

For instance, In March 2025, a study referenced from Nature Scientific Reports (2020) examined the evolution of magnetic sensing technologies and their expanding industrial applications. It emphasized the growing role of magnetic sensors in automotive, medical, and energy sectors.

The study noted that innovations in magnetic sensing are enhancing system efficiency and performance, especially in rapidly developing markets like China and the Asia Pacific, where demand for advanced sensors in electric vehicles, smart grids, and industrial automation is accelerating.

Type Analysis

In 2024, The Analog Magnetic Sensitive Transistor segment held a dominant market position, capturing a 62.5% share of the Global Magnetic Sensitive Transistor Market. This dominance is due to the widespread use of analog MSTs in applications such as automotive, industrial automation, and consumer electronics, where high accuracy and reliability are paramount.

Analog MSTs are widely used due to their low power consumption, simple design, and affordability. The availability of continuous and real-time magnetic field sensing makes them highly sought after in significant applications.

For Instance, in March 2025, Analog Devices, Inc. introduced its Silicon Carbide Smart Switches for high-voltage power conversion applications. These devices integrate a silicon carbide power switch with an integrated driver, offering protection and telemetry features. This innovation supports the increasing demand for efficient energy solutions, positioning Analog Devices as key player in the magnetic sensitive transistor market.

Application Analysis

In 2025, the Automotive segment held a dominant market position, capturing a 36.7% share of the Global Magnetic Sensitive Transistor Market. The growth in this industry has primarily been propelled by the rising acceptance of electric vehicles (EVs), autonomous driving technologies, and advanced driver-assistance systems (ADAS).

MSTs play a vital role in accurately sensing motor position, current measurements, and magnetic field detection in these contexts. Moreover, the heightened emphasis on safety, energy efficiency, and performance enhancement in contemporary vehicles has intensified the need for MSTs within automotive systems.

For instance, In October 2024, AMS OSRAM emphasized the vital role of position sensors in advancing automotive technologies, especially for ADAS and electric vehicles. Magnetic Sensitive Transistors (MSTs) are central to these innovations, offering accurate position feedback for key components like motors and steering systems. These advancements are enabling manufacturers to enhance vehicle safety, efficiency, and overall performance.

End-User Analysis

In 2024, the OEMs segment held a dominant market position, capturing more than a 57.8% share. This commanding lead was primarily driven by the integration of magnetic sensitive transistors into new vehicles during original equipment manufacturing – a sector that consistently demands the latest sensor innovations to meet safety, emissions, and efficiency standards.

Automakers increasingly rely on these transistors for applications such as battery management systems, position sensing, and current monitoring, particularly within electric and hybrid vehicles. The high-volume nature of OEM contracts further consolidated the segment’s market dominance, enabling larger-scale deployments and stronger supplier relationships.

The OEMs segment led the market because it benefits from several structural advantages. First, original equipment manufacturers maintain stringent design-in cycles, ensuring that suppliers of finely tuned and validated components – such as magnetic sensitive transistors – are preferred. Second, the push toward advanced driver-assistance systems (ADAS), which require sophisticated magnetic sensing, has further elevated the importance of OEM-grade transistors.

For Instance, in November 2022, Millennium Semiconductor discussed the growing adoption of magnetic-based reed switch sensors in OEM consumer electronics. These sensors are gaining traction due to their ability to offer reliable and cost-effective solutions for position sensing, especially in applications such as smartphones, wearables, and home automation systems.

Key Market Segments

By Type

- Analog Magnetic Sensitive Transistor

- Digital Magnetic Sensitive Transistor

By Application

- Automotive

- Consumer Electronics

- Industrial

- Healthcare

- Aerospace & Defense

- Others

By End-User

- OEMs

- Aftermarket

Drivers

Advancements in Sensing Technology

Magnetic Sensitive Transistors (MSTs) are crucial for improving the accuracy of magnetic field detection, which is necessary for the creation of industrial automation systems, automotive sensors, and smart devices. The need for MSTs that provide improved sensitivity and accuracy is increasing quickly as sensing technologies advance.

These improvements directly impact the effectiveness of applications in emerging technologies like autonomous vehicles and advanced manufacturing systems by allowing for more effective and accurate detection and control.

For instance, In For instance, in January 2024, Texas Instruments Incorporated debuted its latest automotive chip technologies at CES, aimed at enabling automakers to create smarter and safer vehicles. These innovations, including advanced radar sensors, are designed to enhance vehicle sensing capabilities and support the development of autonomous driving systems.

Restraint

High Manufacturing Costs

Due to their complex design and manufacturing process, Magnetic Sensitive Transistors (MSTs) have a high production cost. This factor could hinder widespread adoption, particularly in markets with narrow margins or price sensitivity.

The high manufacturing costs associated with specialized manufacturing techniques, strict quality control, and expensive materials pose a serious challenge to the widespread use of MSTs in cost-sensitive industries like consumer electronics and low-cost automation applications.

Opportunities

Rising Demand for Wearable Technology

The growing market for wearable technology, such as fitness trackers, smartwatches, and health monitoring gadgets, requires small, efficient magnetic sensors that can function effectively near. This makes MSTs a valuable option for devices that require high accuracy in measuring magnetic fields in small form factors without affecting the design or functionality of existing wearable devices.

For instance, in November 2024, EE Times reported on a breakthrough in TMR-driven switch technology, specifically designed for wearable medical devices. This technology enables more efficient, compact, and reliable sensors for health monitoring applications. As the demand for wearable technology continues to surge, especially in the medical sector, innovations like these TMR-driven switches are playing a pivotal role.

Challenges

Regulatory and Standardization Issues

A major challenge in the MST market is that there are no universally accepted standards of performance across industries. Specific regulatory requirements in various fields, including automotive and healthcare, may necessitate the implementation of more testing and certification procedures.

It leads to extended development cycles, increased expenses, and delayed time to market. The lack of established protocols in MSTs hinders their integration into global supply chains, as it may restrict their usage to specific locations or uses.

For instance, In February 2024, G.B. Pharma highlighted how stricter regulations like MDR 2017/745 are challenging medical device manufacturers to meet higher safety and performance standards. Similar regulatory pressures are seen in the MST market, where compliance with evolving industry norms is crucial for ensuring product quality and market approval.

Latest Trends

A key role in improving the manufacturing processes of MSTs is played by artificial intelligence (AI). AI-driven automation is being used for activities like predictive maintenance, performance monitoring, and defect detection, which enhances scalability and lowers operational expenses. This integration is helping to produce high-quality MSTs at a reduced cost, which in turn promotes market expansion.

For instance, in May 2025, STMicroelectronics N.V. unveiled a breakthrough in sensor technology by combining activity tracking and high-impact sensing in a miniature, AI-enabled sensor designed for personal electronics and IoT applications. This innovation is aimed at enhancing the functionality of wearable devices and connected products, offering improved performance and more precise monitoring capabilities.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

One of the leading players in the market, Infineon Technologies AG has introduced its XENSIV™ 4th generation of magnetic switches, which are designed to support functional safety up to ASIL B in automotive applications.

These high-precision magnetic switches are part of Infineon’s broader portfolio of sensors aimed at providing energy-saving solutions for the automotive, industrial, and consumer sectors. By enhancing the performance and safety of various systems, Infineon continues to solidify its leadership in sensor technologies.

Top Key Players in the Market

- Infineon Technologies AG

- NXP Semiconductors N.V.

- STMicroelectronics N.V.

- Texas Instruments Incorporated

- Analog Devices, Inc.

- Honeywell International Inc.

- Allegro MicroSystems, LLC

- Melexis NV

- Micronas Semiconductor Holding AG

- Diodes Incorporated

- ROHM Semiconductor

- ON Semiconductor Corporation

- Asahi Kasei Microdevices Corporation

- Sensitec GmbH

- AMS AG

- TDK Corporation

- Renesas Electronics Corporation

- TE Connectivity Ltd.

- Murata Manufacturing Co., Ltd.

- Panasonic Corporation

- Others

Recent Developments

- In February 2025, Melexis NV introduced the MLX90425, a high-performance magnetic position sensor chip designed specifically for vehicle electrification applications. This advanced sensor offers exceptional resistance to stray magnetic fields, making it highly suitable for use in automotive powertrain systems, where precision and reliability are paramount.

- In April 2025, Allegro MicroSystems, LLC announced the launch of its XtremeSense™ TMR current sensors, which are set to revolutionize clean energy generation, distribution, and storage. These sensors are designed for high-voltage, power-dense applications, offering superior noise performance and high-precision current measurements.

Report Scope

Report Features Description Market Value (2024) USD 1.4 Bn Forecast Revenue (2034) USD 3.8 Bn CAGR (2025-2034) 10.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Analog Magnetic Sensitive Transistor, Digital Magnetic Sensitive Transistor), By Application (Automotive, Consumer Electronics, Industrial, Healthcare, Aerospace & Defense, Others), By End-User (OEMs, Aftermarket) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Infineon Technologies AG, NXP Semiconductors N.V., STMicroelectronics N.V., Texas Instruments Incorporated, Analog Devices, Inc., Honeywell International Inc., Allegro MicroSystems, LLC, Melexis NV, Micronas Semiconductor Holding AG, Diodes Incorporated, ROHM Semiconductor, ON Semiconductor Corporation, Asahi Kasei Microdevices Corporation, Sensitec GmbH, AMS AG, TDK Corporation, Renesas Electronics Corporation, TE Connectivity Ltd., Murata Manufacturing Co., Ltd., Panasonic Corporation, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Magnetic Sensitive Transistor MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Magnetic Sensitive Transistor MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Infineon Technologies AG

- NXP Semiconductors N.V.

- STMicroelectronics N.V.

- Texas Instruments Incorporated

- Analog Devices, Inc.

- Honeywell International Inc.

- Allegro MicroSystems, LLC

- Melexis NV

- Micronas Semiconductor Holding AG

- Diodes Incorporated

- ROHM Semiconductor

- ON Semiconductor Corporation

- Asahi Kasei Microdevices Corporation

- Sensitec GmbH

- AMS AG

- TDK Corporation

- Renesas Electronics Corporation

- TE Connectivity Ltd.

- Murata Manufacturing Co., Ltd.

- Panasonic Corporation

- Others