Global Lung Cancer Therapeutics Market By Type (NSCLC and SCLC), By Therapy (Targeted Therapy, Radiotherapy, Chemotherapy, Photodynamic Therapy, and Laser Therapy), By End-user (Hospital & Clinics and Cancer Research Centers & Laboratories), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: July 2023

- Report ID: 104223

- Number of Pages: 206

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

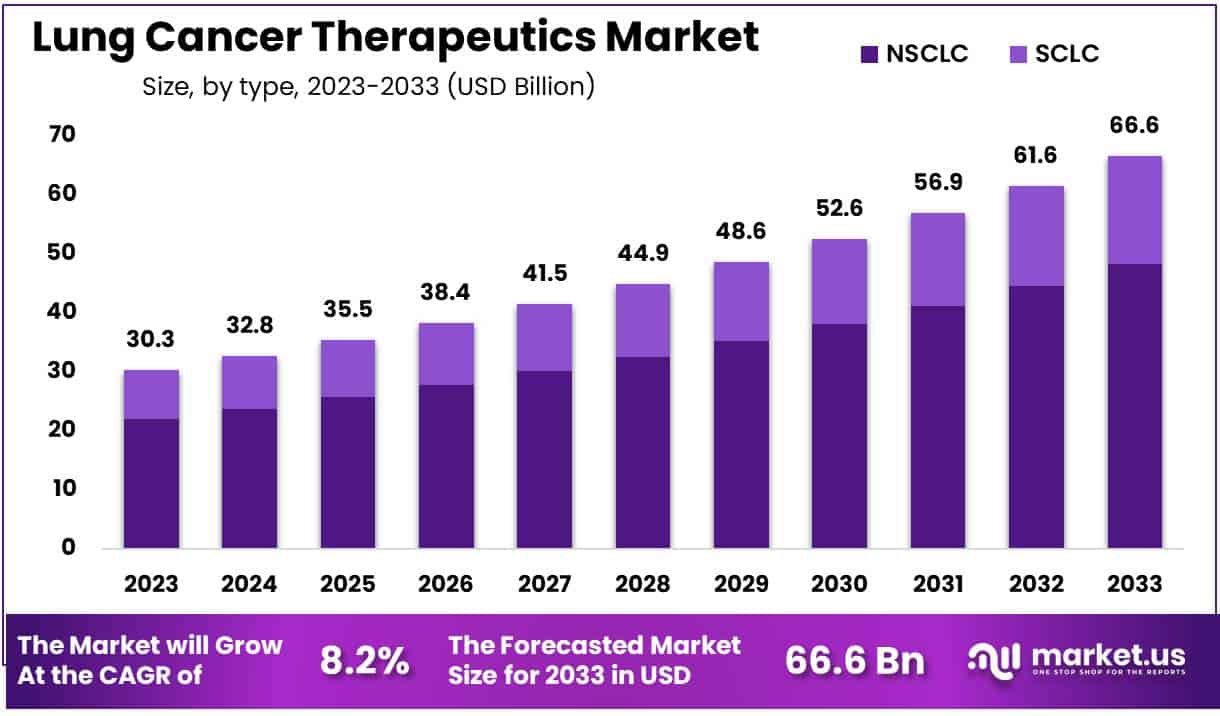

Global Lung Cancer Therapeutics Market size is expected to be worth around US$ 66.6 billion by 2033 from US$ 30.3 billion in 2023, growing at a CAGR of 8.2% during the forecast period 2024 to 2033.

Increasing incidence rates of lung cancer drive the demand for advanced therapeutics, as lung cancer remains the most common form of cancer in certain populations, representing approximately 30% of all cancer diagnoses, according to the International Association for the Study of Lung Cancer. Rising investments in targeted therapies and precision medicine fuel innovation in this market, with a focus on treatments that address specific genetic mutations associated with lung cancer.

For example, a ten-year clinical trial published in July 2023 highlighted that patients with an epidermal growth factor receptor (EGFR) mutation experienced significantly improved survival rates when treated with osimertinib. This success in precision medicine underscores the importance of genomic profiling and presents a valuable opportunity for clinical laboratories to support physicians in tailoring treatment plans.

Immunotherapies and combination therapies also continue to gain traction, as they offer promising options for patients who may not respond to traditional treatments. The market benefits from ongoing research into novel biomarkers and predictive diagnostics, enhancing early detection and treatment personalization.

Pharmaceutical companies and research institutions increasingly focus on reducing side effects while maximizing therapeutic efficacy, further driving innovation. With expanding applications across various stages of lung cancer, the therapeutics market aims to improve patient outcomes through continuous advancements in both drug development and treatment methodologies.

Key Takeaways

- In 2023, the market for lung cancer therapeutics generated a revenue of US$ 30.3 billion, with a CAGR of 8.2%, and is expected to reach US$ 66.6 billion by the year 2033.

- The type segment is divided into NSCLC and SCLC, with NSCLC taking the lead in 2023 with a market share of 72.5%.

- Considering therapy, the market is divided into targeted therapy, radiotherapy, chemotherapy, photodynamic therapy, and laser therapy. Among these, targeted therapy held a significant share of 40.8%.

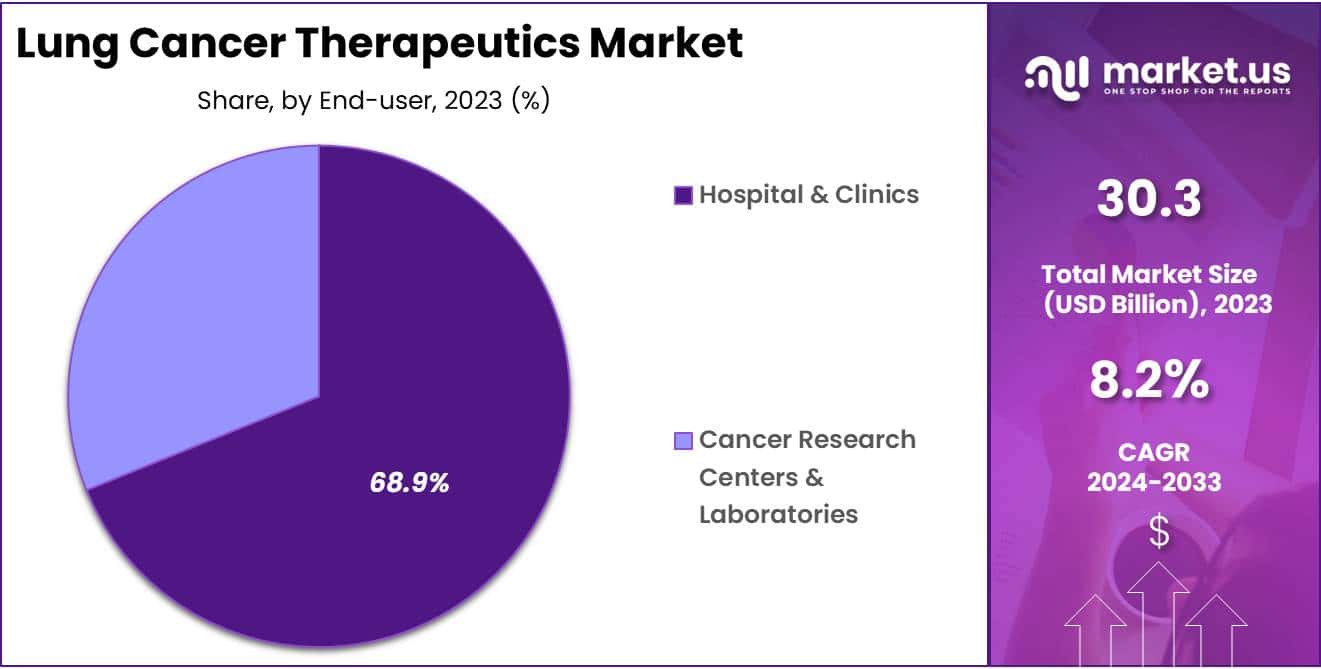

- Furthermore, concerning the end-user segment, the market is segregated into hospital & clinics and cancer research centers & laboratories. The hospital & clinics sector stands out as the dominant player, holding the largest revenue share of 68.9% in the lung cancer therapeutics market.

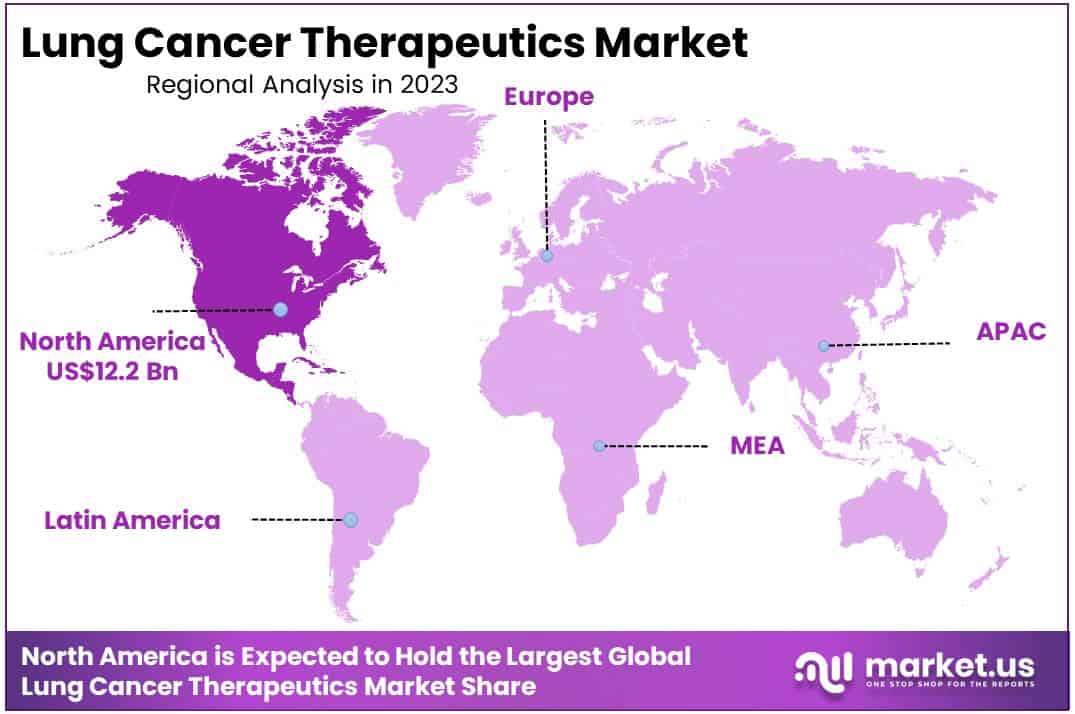

- North America led the market by securing a market share of 40.2% in 2023.

By Type Analysis

The NSCLC segment led in 2023, claiming a market share of 72.5% owing to its high prevalence and advancements in treatment options. As the most common type of lung cancer, non-small cell lung cancer (NSCLC) accounts for the majority of lung cancer diagnoses, which amplifies the need for targeted therapies and innovative treatments.

Rising awareness of early diagnosis and screening programs supports demand for NSCLC therapeutics, enhancing patient outcomes and survival rates. Precision medicine advancements, including biomarker-based therapies, address specific mutations in NSCLC patients, which is likely to further drive this segment’s growth.

Additionally, immunotherapy developments provide effective treatment options, attracting significant investments in NSCLC research and treatment advancements. Growing healthcare infrastructure and funding for lung cancer research in emerging markets also create favorable conditions for NSCLC therapeutics. These combined factors are anticipated to bolster the NSCLC segment, positioning it as a key driver in the overall lung cancer therapeutics landscape.

By Therapy Analysis

The targeted therapy held a significant share of 40.8% due to its efficacy in treating specific cancer cell types with minimal impact on healthy cells. As a therapy that personalizes treatment based on individual tumor characteristics, targeted therapy has become highly popular for its precision and improved patient outcomes. The rising incidence of lung cancer and increasing reliance on biomarker testing to identify patients suitable for targeted therapies amplify demand.

Expanding research and development efforts focus on discovering novel targets and therapies for lung cancer, thereby boosting this segment’s growth. Targeted therapies, such as EGFR inhibitors and ALK inhibitors, offer effective treatment options for certain NSCLC patients, making them an attractive alternative to conventional chemotherapy.

Moreover, increased regulatory approvals for targeted drugs and supportive government policies contribute to the segment’s expansion. Enhanced reimbursement structures in developed markets further support targeted therapy growth, likely establishing it as a preferred treatment within lung cancer therapeutics.

By End-user Analysis

The hospital & clinics segment had a tremendous growth rate, with a revenue share of 68.9% as these facilities remain primary sites for diagnosis, treatment, and patient management. Rising lung cancer incidence rates drive patient inflows to hospitals and clinics, which offer comprehensive services for diagnosis, staging, and therapy.

The integration of advanced treatment options, including immunotherapy and precision-targeted therapies, in hospital settings enhances their role in managing lung cancer cases. An increasing number of specialized oncology centers and clinics within hospitals meet the growing demand for personalized cancer care, contributing to segment growth. Enhanced access to healthcare infrastructure in emerging markets, supported by government initiatives, further supports the expansion of hospitals and clinics.

Additionally, collaborations between hospitals and research organizations facilitate clinical trials and patient access to novel therapies, strengthening their position in the lung cancer therapeutics market. Consequently, these factors project hospitals and clinics as critical players in the treatment landscape, likely driving their continued growth in this sector.

Key Market Segments

By Type

- NSCLC

- SCLC

By Therapy

- Targeted Therapy

- Radiotherapy

- Chemotherapy

- Photodynamic Therapy

- Laser Therapy

By End-user

- Hospital & Clinics

- Cancer Research Centers & Laboratories

Drivers

Growing Prevalence of Lung Cancer is Driving the Market

Growing prevalence of lung cancer significantly drives the lung cancer therapeutics market. In 2020, the American Cancer Society reported approximately 228,820 new cases and 135,720 deaths due to lung cancer in the U.S. alone, underscoring the urgent demand for effective treatments. As this disease remains one of the leading causes of cancer-related deaths, healthcare providers are expected to focus on advancing therapeutic options to improve patient outcomes.

The rise in cases of non-small cell lung cancer, particularly among older adults and smokers, highlights a critical need for specialized therapies. Advances in targeted treatments, immunotherapies, and novel delivery systems are likely to expand the market. With an increasing emphasis on early diagnosis and personalized medicine, the lung cancer therapeutics market is projected to experience substantial growth.

Restraints

High Cost of Treatment is Restraining the Market

High costs associated with lung cancer treatment impede the growth of the lung cancer therapeutics market. Expensive therapies, particularly immunotherapies and targeted drugs, often place a substantial financial burden on patients and healthcare systems. This economic strain limits patient access to advanced treatments and restricts market penetration, especially in low- and middle-income regions.

Additionally, the high cost of clinical trials and drug development adds to the overall expense, making it challenging for companies to offer cost-effective solutions. Insurance coverage limitations further exacerbate this issue, hampering widespread adoption of innovative therapies. Addressing these cost-related barriers is essential to enabling more equitable access to effective treatments in the lung cancer therapeutics market.

Opportunities

Rising R&D Activities are Creating Opportunities in the Market

Rising research and development activities present significant opportunities for the lung cancer therapeutics market. In July 2023, Iovance Biotherapeutics completed a preliminary analysis of its Phase II trial for Lifileucel (LN-145), a tumor-infiltrating lymphocyte (TIL) therapy targeting metastatic non-small cell lung cancer (NSCLC).

Following a positive review by the US FDA, which suggested the trial design may qualify for accelerated approval, Lifileucel emerged as a promising option for patients with advanced NSCLC who have exhausted other FDA-approved treatments.

As more companies invest in developing innovative therapies and targeted treatments, the market is anticipated to experience notable growth. Increased R&D activities will likely drive breakthroughs, leading to more advanced, accessible, and personalized options in lung cancer care.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly affect the lung cancer therapeutics market by influencing investment, pricing, and accessibility. Economic downturns can restrict healthcare budgets, limiting patient access to advanced and costly therapies, especially in low- and middle-income regions.

Conversely, economic growth encourages investment in healthcare infrastructure, increasing the adoption of innovative treatments. Geopolitical tensions disrupt global supply chains, delaying the availability of essential drugs and materials and potentially raising costs for providers and patients alike. However, international trade agreements and cross-border collaborations foster advancements and facilitate broader distribution of targeted therapies.

Additionally, growing governmental support for cancer research and patient access initiatives further propels the adoption of novel treatments. This positive trend indicates that, despite economic and geopolitical challenges, the lung cancer therapeutics market will likely continue to expand.

Latest Trends

New Drug Approvals Driving Growth in the Lung Cancer Therapeutics Market

Increasing approvals of innovative drugs drive significant growth in the lung cancer therapeutics sector. Regulatory bodies worldwide support advanced treatment options that target specific mutations and improve patient outcomes.

For example, in June 2022, the European Commission granted approval to Novartis for Tabrecta, designed to treat METex14 skipping advanced non-small cell lung cancer. Such developments are expected to enhance treatment precision, addressing the unique needs of patient subgroups. The introduction of targeted therapies alongside immunotherapies likely optimizes clinical outcomes and minimizes side effects.

Growing research in molecular biology and genetics is anticipated to support the discovery of novel drugs tailored to specific genetic profiles. This surge in approvals aligns with the rising demand for personalized treatment, positioning the market for robust growth and a more comprehensive range of therapeutic options.

Regional Analysis

North America is leading the Lung Cancer Therapeutics Market

North America dominated the market with the highest revenue share of 40.2% owing to advancements in treatment options and the high incidence of lung cancer in the region. The demand for innovative therapeutics has risen sharply as new diagnostic technologies enable earlier and more accurate detection.

According to the American Cancer Society, the United States recorded approximately 228,820 new lung cancer cases and 135,720 related deaths in 2020, highlighting the significant need for effective treatment options. Immunotherapy and targeted therapy advancements have provided new avenues for treatment, improving survival rates and patient outcomes.

Additionally, government support for cancer research funding and collaboration between pharmaceutical companies and research institutions have accelerated the introduction of novel therapies. Increased awareness about lung cancer screening programs and proactive healthcare policies have further strengthened the market’s growth trajectory, making North America a leading region in lung cancer therapeutics innovation.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to an increase in lung cancer cases and rapid improvements in healthcare infrastructure. Rising air pollution and smoking rates in densely populated countries like China and India contribute significantly to the region’s high lung cancer incidence. Healthcare reforms and investments aimed at expanding oncology services are likely to facilitate broader access to treatment.

Additionally, pharmaceutical companies are expected to focus on developing cost-effective therapies to cater to the region’s diverse socio-economic demographics. Partnerships between local research institutions and global pharmaceutical firms are projected to foster innovative approaches to treatment, including precision medicine and immunotherapies.

The growing middle class in Asia Pacific is also expected to increase demand for advanced healthcare services, positioning the region as a key market for lung cancer therapeutics expansion in the coming years.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The major players in the lung cancer therapeutics market are actively engaged in the development and introduction of innovative products, as well as implementing strategic initiatives aimed at enhancing their competitive positioning. Key players in the lung cancer therapeutics market adopt multiple strategies to drive growth and improve treatment outcomes.

They invest significantly in research to develop innovative therapies, including immunotherapies and targeted drugs, which offer improved efficacy over traditional treatments. Strategic partnerships with biotechnology firms and research institutions accelerate clinical trials and enhance drug development capabilities.

Companies also focus on expanding their presence in emerging markets, where the demand for advanced cancer treatments continues to rise. Additionally, they prioritize educational outreach to healthcare providers to support early diagnosis and promote the latest therapeutic options for patients.

Top Key Players

- Pfizer Inc.

- Merck & Co

- Hoffmann-La Roche

- Eli Lilly and Company

- Bristol-Myers Squibb Company

- BoehringerIngelheim

- AstraZeneca

- Amgen

Recent Developments

- In April 2022, AstraZeneca and Daiichi Sankyo announced that the United States FDA had accepted their supplemental Biologics License Application for Enhertu (trastuzumab deruxtecan), intended for the treatment of adult patients with unresectable or metastatic non-small cell lung cancer (NSCLC). This acceptance is significant for the lung cancer therapeutics market, as it expands the treatment options available for advanced NSCLC, addressing unmet needs and fostering market growth.

- In May 2021, Amgen received FDA approval for LUMAKRAS, a targeted therapy for non-small cell lung cancer (NSCLC). This approval supports the growth of the lung cancer therapeutics market by introducing a novel treatment specifically aimed at a challenging cancer type, improving therapeutic outcomes, and driving innovation in the market.

Report Scope

Report Features Description Market Value (2023) USD 30.3 billion Forecast Revenue (2033) USD 66.6 billion CAGR (2024-2033) 8.2% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (NSCLC and SCLC), By Therapy (Targeted Therapy, Radiotherapy, Chemotherapy, Photodynamic Therapy, and Laser Therapy), By End-user (Hospital & Clinics and Cancer Research Centers & Laboratories) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Pfizer Inc., Merck & Co, Hoffmann-La Roche, Eli Lilly and Company, Bristol-Myers Squibb Company, BoehringerIngelheim, AstraZeneca, and Amgen. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Lung Cancer Therapeutics MarketPublished date: July 2023add_shopping_cartBuy Now get_appDownload Sample

Lung Cancer Therapeutics MarketPublished date: July 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Pfizer Inc.

- Merck & Co

- Hoffmann-La Roche

- Eli Lilly and Company

- Bristol-Myers Squibb Company

- BoehringerIngelheim

- AstraZeneca

- Amgen