Global Low Noise Amplifiers Market Size and Forecast Industry Analysis Report By Frequency Range (Less Than 6GHz, 6GHz to 60 GHz, Greater than 60 GHz), By Material (Silicon, Silicon Germanium, Gallium Arsenide), By Application (Satellite Communication System, Test & Measurement, Wi-Fi, Networking, Cellular Telephones, Others), By Industry Vertical (Consumer Electronics, Medical, Industrial, Defence, Automotive, IT & Telecom, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook by 2025-2034

- Published date: Sept. 2025

- Report ID: 159137

- Number of Pages: 251

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

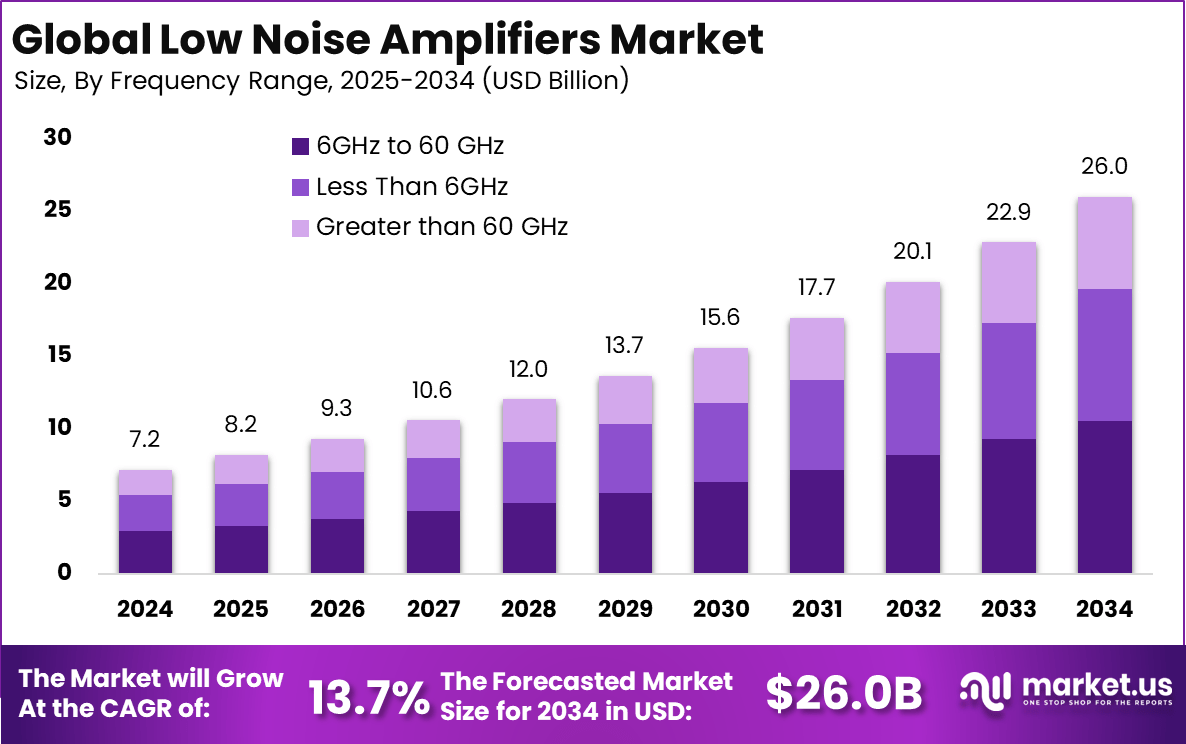

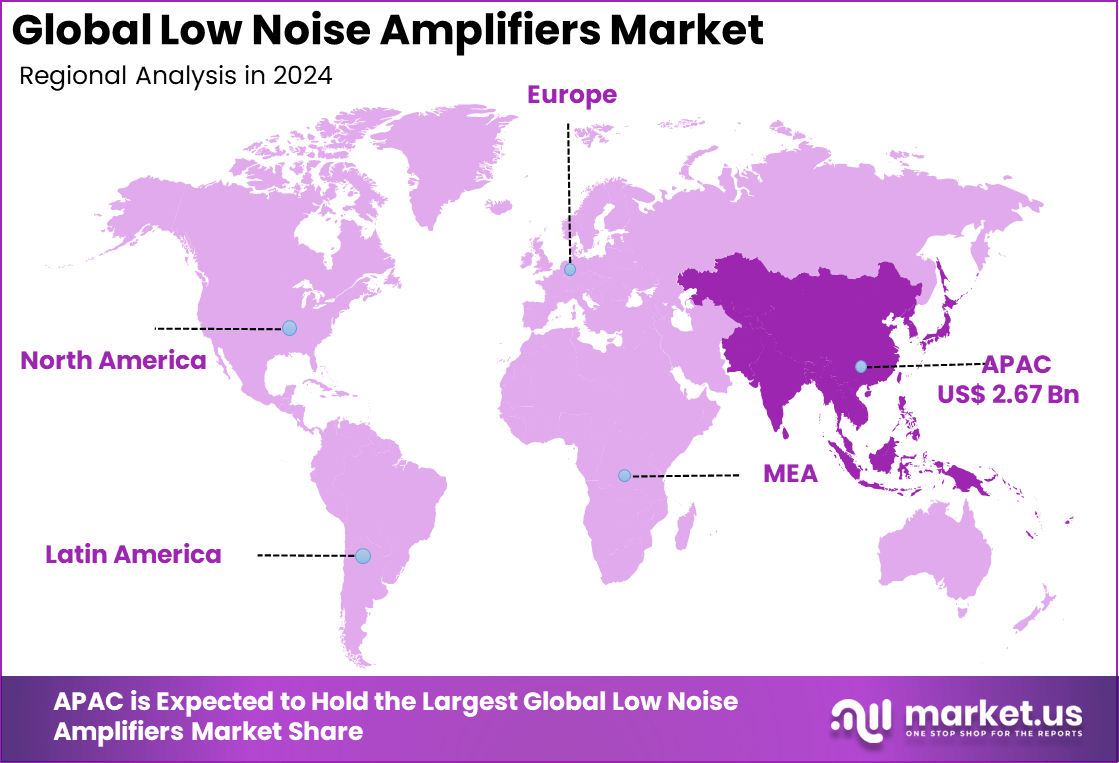

The Global Low Noise Amplifiers Market size is expected to be worth around USD 26.0 billion by 2034, from USD 7.2 billion in 2024, growing at a CAGR of 13.7% during the forecast period from 2025 to 2034. In 2024, Asia Pacific held a dominant market position, capturing more than a 37.2% share, holding USD 2.67 billion in revenue.

The Low Noise Amplifiers (LNA) Market refers to the industry that develops and supplies electronic amplifiers designed to boost weak signals while minimizing additional noise. LNAs are essential in communication systems, radar, satellite receivers, IoT devices, and medical equipment, where signal integrity and sensitivity are critical.

The market is driven by the rapid expansion of wireless communication systems, including 5G, satellite communications, and IoT networks. Growing adoption of smart devices and connected infrastructure is boosting demand for high-performance LNAs. The defense and aerospace industries are major contributors, requiring LNAs for radar, surveillance, and navigation systems.

For instance, in December 2024, AmpliTech Group announced a breakthrough in cryogenic Low-Noise Amplifiers (LNAs) specifically designed for quantum computing applications. These advanced LNAs are optimized for extremely low temperatures, crucial for maintaining quantum states in quantum computers.

Demand is strongest in the telecommunications sector, where LNAs are used in base stations, satellite ground equipment, and smartphones to improve sensitivity and coverage. The aerospace and defense industries represent a significant share of demand, with LNAs integrated into radar, electronic warfare systems, and space communication. Consumer electronics, including wearables, smart home devices, and Wi-Fi systems, are also driving adoption.

Key Insight Summary

- By frequency range, the 6 GHz to 60 GHz segment led the market with 40.7% share, supported by rising demand in 5G, radar, and advanced communication systems.

- By material, Silicon Germanium (SiGe) dominated with 45.8% share, due to its high performance and cost-efficiency in RF applications.

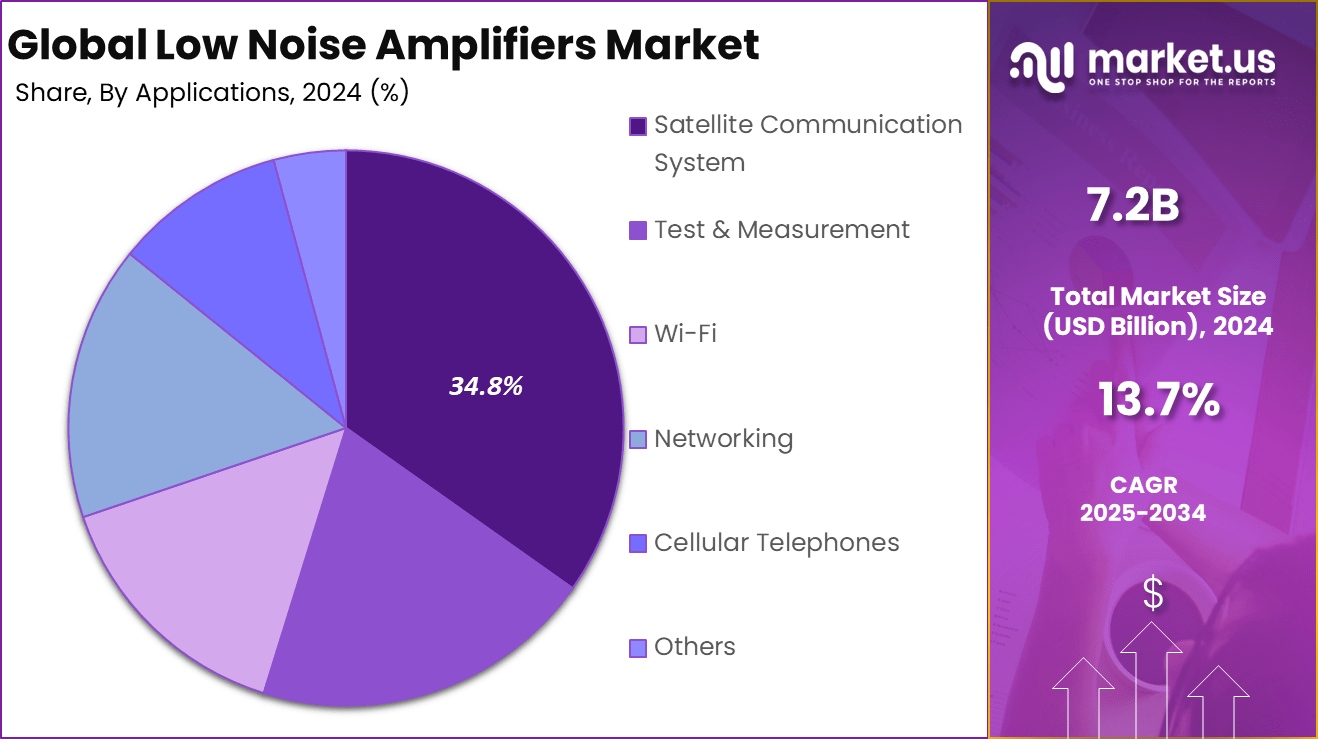

- By application, the Satellite Communication System segment held 34.8% share, reflecting the surge in satellite internet and global connectivity initiatives.

- By industry vertical, Consumer Electronics captured 30.7% share, driven by smartphones, IoT devices, and wireless applications.

- Regionally, Asia Pacific accounted for 37.2% share, supported by robust semiconductor manufacturing and telecom expansion.

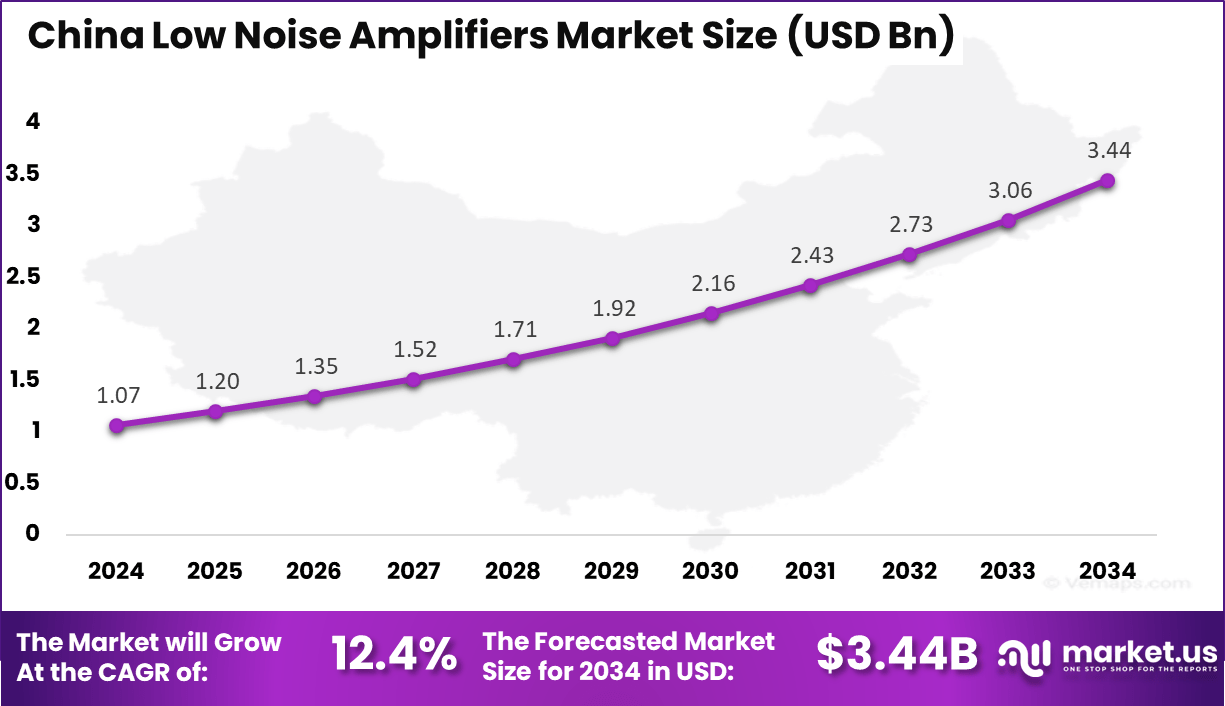

- Within the region, China’s market reached USD 1.07 Billion in 2024, expanding at a strong CAGR of 12.4%, highlighting its leadership in LNA adoption and production.

Analysts’ Viewpoint

Key technologies driving the adoption of LNAs include massive MIMO, millimeter-wave (mmWave) systems for 5G and beyond, energy-efficient GaAs and SiGe devices, and integration with emerging IoT platforms. Miniaturization continues to be a focus, with manufacturers designing smaller LNA solutions for compact devices without sacrificing performance.

As wireless and autonomous vehicle technologies evolve, LNAs are being integrated into radar systems and ADAS to improve accuracy and safety at higher frequencies. Organizations are choosing LNAs for their ability to increase receiver sensitivity, improve network coverage, and filter out noise in crowded spectrum environments.

In 5G and IoT, for example, these amplifiers help extend battery life, allow for more reliable connections, and enhance the quality of data transmission over long distances. Automotive makers, medical device manufacturers, and defense companies all benefit from integrating LNAs to support more advanced functionality and system reliability in demanding conditions.

Major investment is flowing into research and development for customized and application-specific LNA designs to meet unique industry requirements for gain, frequency, and power consumption. Integration with IoT and wireless infrastructure, as well as the trend toward energy-efficiency and miniaturization, are enabling growth opportunities.

China Market Size

The market for Low Noise Amplifiers within China is growing tremendously and is currently valued at USD 1.07 billion, the market has a projected CAGR of 12.4%. The market is growing due to the country’s rapid advancements in 5G deployment, space exploration, and the expansion of IoT technologies.

China’s investments in telecommunications infrastructure, satellite communications, and autonomous vehicles are driving the demand for high-performance LNAs that ensure reliable and noise-free signal transmission. Additionally, China’s focus on becoming a global leader in technology and innovation, along with its strong manufacturing capabilities, further fuels the growth.

In 2024, Asia Pacific held a dominant market position in the Global Low Noise Amplifiers Market, capturing more than a 37.2% share, holding USD 2.67 billion in revenue. This dominance is due to the rapid expansion of 5G networks, increasing satellite communication activities, and growing investments in IoT and automotive technologies.

Countries like China, Japan, and South Korea are at the forefront of technological advancements, driving demand for high-performance LNAs. Additionally, the region’s strong manufacturing base, coupled with significant government support for innovation in telecommunications and space exploration, further bolstered the market’s growth.

For instance, in August 2020, Renesas strengthened its position in the Asia Pacific market with the launch of a new RF amplifier for 4G/5G infrastructure, targeting active antenna systems. This development supports the growing demand for Low Noise Amplifiers (LNAs) in the region, driven by the rapid expansion of 5G networks.

Frequency Range Analysis

In 2024, the 6 GHz to 60 GHz band accounted for 40.7% of the low noise amplifiers market. This range has gained priority due to its suitability for high-frequency communications, particularly in 5G networks and advanced radar systems. Devices operating within this spectrum demand amplifiers that can minimize noise while delivering strong signal integrity, making this frequency range a cornerstone in modern wireless ecosystems.

The adoption is also rising in aerospace and defense where high-frequency radar requires precise reception of weak signals. Satellite ground stations and backhaul connections further depend on this range, boosting usage across industries that rely on performance at higher frequencies.

For Instance, in March 2025, Analog Devices introduced a new family of wideband low-noise amplifiers spanning 1 GHz to 40 GHz. These LNAs are designed for radar, satellite communications, and electronic warfare applications, offering improved performance in high-frequency domains.

Material Analysis

In 2024, Silicon germanium-based amplifiers led with 45.8% share, showing their strong relevance in today’s high-frequency systems. Their capability to combine low noise with higher gain and better thermal performance makes them particularly effective for compact, high-performance electronic devices. Wide-scale acceptance also stems from their cost competitiveness when compared to some other advanced compound materials.

Another key advantage of silicon germanium is its ability to bridge the gap between traditional silicon and expensive III-V semiconductors. This makes it flexible for consumer-grade devices and telecom equipment alike, where efficiency and signal clarity are equally critical.

For instance, in August 2025, GlobalFoundries introduced its high-performance 130nm BiCMOS Silicon Germanium (SiGe) platform designed to enhance Low Noise Amplifier (LNA) performance. This platform aims to meet the growing demand for advanced communication systems, including 5G, satellite communication, and automotive radar applications.

Application Analysis

In 2024, the satellite communication systems represented 34.8% of the market. Satellites require highly sensitive amplifiers to capture extremely weak signals transmitted over long distances. Low noise amplifiers are indispensable here, as they directly influence the clarity and reliability of data transmission across communication, navigation, and remote sensing satellites.

The increasing deployment of low-Earth orbit (LEO) satellites for broadband services is elevating the importance of LNAs. As these constellations grow, demand for amplifiers with high resilience and reduced power loss continues to expand, reinforcing satellites as one of the most important application areas.

For Instance, in December 2024, AmpliTech Group Inc. successfully delivered a prototype of ultra-low noise amplifiers (LNAs) for a Fortune 50 company’s satellite communication system. These LNAs are designed to improve signal quality and reliability in satellite communications, where minimizing noise is crucial for clear data transmission over long distances.

Industry Vertical Analysis

In 2024, Consumer electronics accounted for 30.7% of the market. Smartphones, tablets, wearables, and wireless devices rely heavily on LNAs to boost signal reception while conserving battery life. With the growth of connected devices, the need for high-performance yet power-efficient LNAs has become essential.

This demand is further supported by applications in Wi-Fi routers, Bluetooth-enabled devices, and IoT products. As users seek seamless connectivity, the role of LNAs has been reinforced, making consumer devices the most visible point of adoption in everyday life.

For Instance, in February 2023, Infineon Technologies unveiled a new low-power Low Noise Amplifier (LNA) aimed at wearables and Internet of Things (IoT) devices. The LNA is designed to meet the growing demand for efficient signal amplification in compact, battery-powered devices.

Emerging trends

Emerging trends in the LNA market include a strong push toward miniaturization of components and increased energy efficiency. As devices shrink in size, LNAs must maintain high performance in smaller packages, which is crucial for mobile electronics and IoT applications.

Additionally, LNAs are increasingly being customized to meet diverse requirements across telecommunications, automotive, and aerospace sectors. The focus on energy-efficient designs reflects a broader industry move to reduce power consumption while maintaining signal clarity, which is vital for battery-operated and portable devices.

Growth factors

Growth factors driving the LNA market include the rapid rollout of 5G networks and the early development of 6G technologies. LNAs play a critical role in boosting weak signals at high frequencies, essential for 5G base stations and user devices.

The surge in smartphone adoption and demand for improved connectivity underpin this trend. Moreover, expanding applications in satellite communication, radar, and medical imaging contribute to the growing need for low noise amplifiers, especially those capable of operating efficiently at millimeter-wave frequencies typical in advanced wireless systems.

Key Market Segments

By Frequency Range

- Less Than 6GHz

- 6GHz to 60 GHz

- Greater than 60 GHz

By Material

- Silicon

- Silicon Germanium

- Gallium Arsenide

By Application

- Satellite Communication System

- Test & Measurement

- Wi-Fi

- Networking

- Cellular Telephones

- Others

By Industry Vertical

- Consumer Electronics

- Medical

- Industrial

- Defence

- Automotive

- IT & Telecom

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Expanding Global 5G Infrastructure

The rapid rollout of 5G networks globally is driving strong demand for low noise amplifiers. 5G technology uses higher frequency bands that require sensitive amplification to ensure signal clarity and strength. LNAs are essential in reducing noise and boosting weak signals in 5G base stations, small cells, and mobile devices, supporting high-speed data transmission.

For instance, as telecom operators expand 5G infrastructure in urban areas, the use of LNAs grows to maintain reliable connectivity and network performance. This technological shift across both developed and emerging markets pushes LNA adoption. The increase in IoT devices that depend on fast and stable wireless communication also contributes to this trend.

For instance, in September 2025, MathWorks highlighted its expertise in RF system design and satellite communications at European Microwave Week. The company demonstrated how its advanced simulation tools support the growing demand for high-performance communication systems, including Low Noise Amplifiers (LNAs), crucial for satellite communication.

Restraint

High Development and Production Costs

Despite their importance, LNAs face market restraints due to high development and manufacturing costs. Advanced fabrication processes and specialized materials like gallium arsenide and silicon germanium are expensive, making LNAs costly to produce. These costs represent a barrier for small manufacturers and price-sensitive markets, limiting the broader adoption of LNAs in some regions.

Moreover, designing LNAs with low noise, high gain, and compact size while maintaining power efficiency adds complexity and expense. For instance, in regions with limited R&D investment, companies may find it challenging to incorporate the latest LNA technologies due to budget constraints. This restraint slows market penetration, especially in cost-sensitive consumer electronics sectors

For instance, in september 2025, GlobalFoundries introduced its 130nm BiCMOS Silicon Germanium (SiGe) platform for high-performance mobile and industrial use. It improves Low Noise Amplifiers with better noise performance and efficiency but adds higher production costs, which may limit affordability in cost-sensitive applications.

Opportunities

Rising Adoption of 5G and Future Technologies

The ongoing expansion of 5G networks and early development of 6G present significant opportunities for LNAs. These amplifiers play a vital role in handling weak signals at millimeter-wave frequencies common in advanced wireless communications. As telecom infrastructure evolves, LNAs will be needed more frequently to support new applications like smart cities, autonomous vehicles, and industrial IoT.

For instance, telecom companies installing 5G base stations in dense urban environments rely on LNAs to maintain signal quality and reduce interference. Consumer electronics, from smartphones to wearables, also require LNAs for consistent connectivity in high-speed networks. This growing demand driven by next-generation wireless technologies creates a strong market potential for LNAs over the coming decade.

For instance, in June 2025, Qualcomm announced its agreement to acquire Alphawave Semi for approximately $2.4 billion. This acquisition is expected to bolster Qualcomm’s position in data centers and 5G infrastructure, areas where LNAs play a crucial role in signal amplification.

Challenges

Managing Regulatory and Technical Complexities

LNAs face challenges related to evolving regulatory standards and technical issues like interference and thermal management. Wireless communication protocols vary by region and frequently update, creating compliance challenges for LNA manufacturers. Dense frequency bands used in 5G and military applications make interference control complex, impacting signal quality.

Thermal management is another technical challenge, as LNAs operating at high power can face overheating, affecting reliability. For example, urban 5G deployments and defense systems require stable and efficient LNAs that can handle these conditions. Addressing these challenges demands ongoing R&D investment and close collaboration between semiconductor and telecom industries to develop advanced LNA solutions suitable for next-gen systems.

For instance, in March 2025, Alphawave launched its new connectivity business featuring 3nm digital signal processor (DSP) chiplets. These chiplets are designed to provide high-performance processing for advanced communication systems, offering an alternative to traditional Low Noise Amplifiers (LNAs).

Key Players Analysis

The Low Noise Amplifiers (LNA) market is led by prominent semiconductor companies driving innovation and growth. STMicroelectronics reported $2.77 billion in Q2 2025 revenues, focusing on advanced semiconductor development.

Analog Devices launched new LNAs improving gain and noise performance for telecom and radar applications. Infineon Technologies targets automotive and defense sectors with cutting-edge compound semiconductor technologies, strengthening its portfolio amid rising demand for 5G and IoT networks.

Major players like Qualcomm, Texas Instruments, and Broadcom are pivotal in the LNA market. Qualcomm invests heavily in 5G and IoT expansion, enhancing signal processing capabilities. Texas Instruments continues broadening its product lines with high-linearity LNAs suited for communication infrastructure.

Broadcom integrates LNAs into RF front-end modules that support consumer electronics and telecom devices. Renesas and Microchip also ramp up R&D investments to address increasing needs in automotive radar and industrial uses.

Other key players such as Skyworks Solutions, NXP Semiconductors, and ON Semiconductor focus on customizable LNAs for emerging 5G-6G and satellite communication markets. Skyworks enhances its Sky5 platform integrating LNAs for 5G flexibility, while NXP develops low-noise, low-power solutions for IoT and automotive fields. ON Semiconductor boosts production capacity to meet growing demand.

Top Key Players in the Market

- STMicroelectronics

- Analog Devices

- Infineon Technologies

- Microchip Technology

- Renesas Electronics

- Qualcomm

- Maxim Integrated

- Cree

- Texas Instruments

- ON Semiconductor

- NXP Semiconductors

- Skyworks Solutions

- Lattice Semiconductor

- Broadcom

- IIVI Incorporated

- Others

Recent Developments

- In April 2024, Microchip Technology announced its acquisition of Neuronix AI Labs, a company specializing in technology that reduces computer-vision AI cost and power consumption. This acquisition enhances Microchip’s capabilities in edge computing and AI applications, potentially influencing LNA designs for such systems.

- In June 2024, Renesas Electronics completed the acquisition of Transphorm, Inc., a global leader in gallium nitride (GaN) technology. This acquisition enables Renesas to offer GaN-based power products and related reference designs, which could impact the development of high-performance LNAs.

Report Scope

Report Features Description Market Value (2024) USD 7.2 Bn Forecast Revenue (2034) USD 26 Bn CAGR(2025-2034) 13.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Frequency Range (Less Than 6GHz, 6GHz to 60 GHz, Greater than 60 GHz), By Material (Silicon, Silicon Germanium, Gallium Arsenide), By Application (Satellite Communication System, Test & Measurement, Wi-Fi, Networking, Cellular Telephones, Others), By Industry Vertical (Consumer Electronics, Medical, Industrial, Defence, Automotive, IT & Telecom, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape STMicroelectronics, Analog Devices, Infineon Technologies, Microchip Technology, Renesas Electronics, Qualcomm, Maxim Integrated, Cree, Texas Instruments, ON Semiconductor, NXP Semiconductors, Skyworks Solutions, Lattice Semiconductor, Broadcom, IIVI Incorporated, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Low Noise Amplifiers MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample

Low Noise Amplifiers MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample -

-