Global Low Migration Inks Market Size, Share Analysis Report By Type (UV-Curable Inks, Water-based Inks, And Others), By Printing Process (Flexography, Digital, Offset, Gravure, And Others), By Substrate (Paper and Paperboard, Plastic, And Others), By Application (Rigid Packaging And Flexible Packaging), By End-use (Food And Beverage, Pharmaceutical, Cosmetic And Personal Care, Tobacco, And Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 161477

- Number of Pages: 385

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

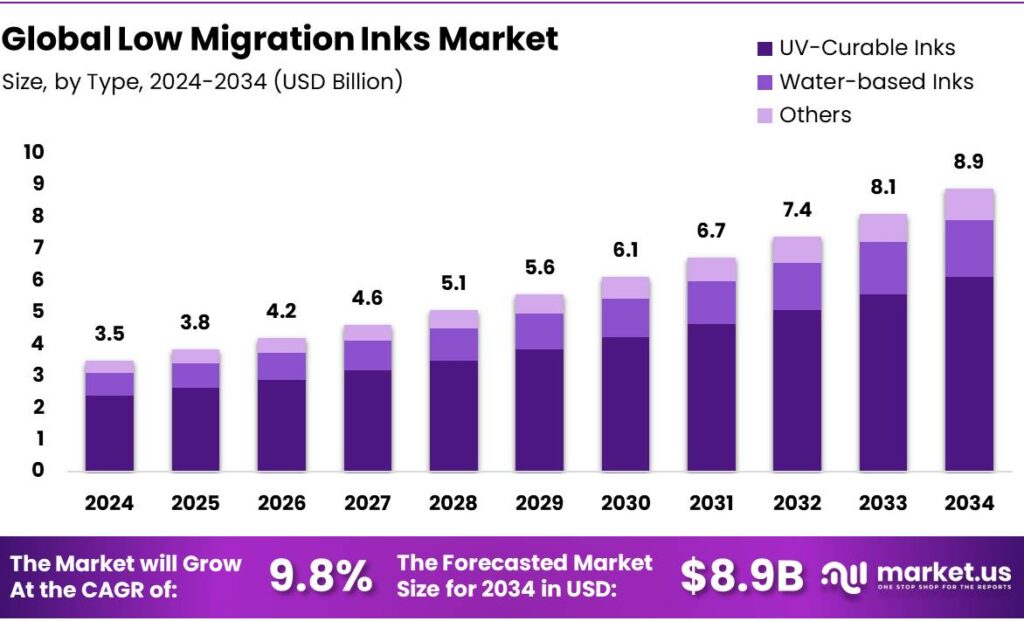

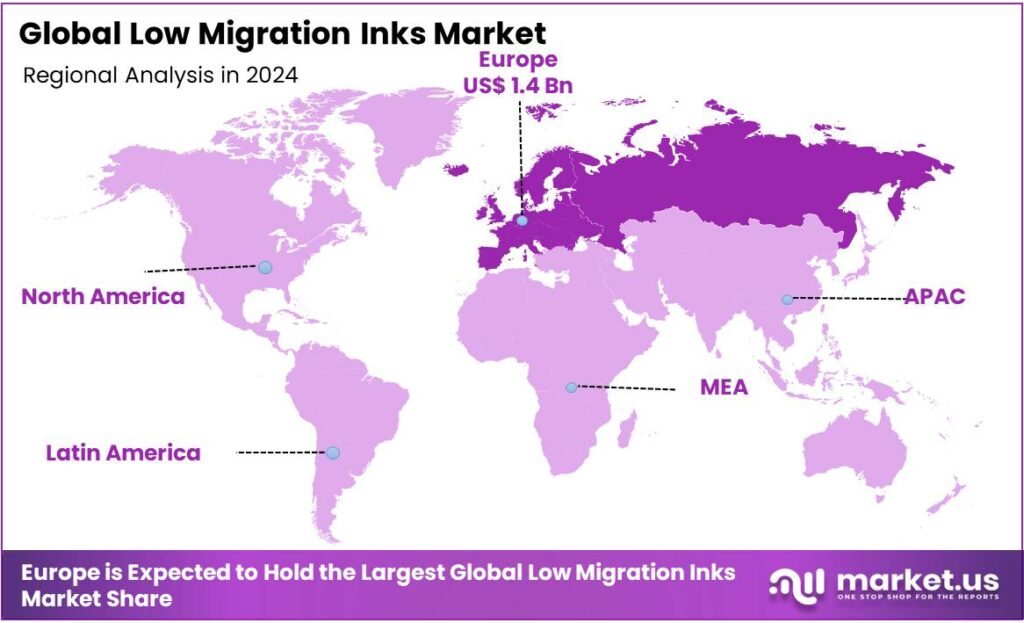

The Global Low Migration Inks Market size is expected to be worth around USD 8.9 Billion by 2034, from USD 3.5 Billion in 2024, growing at a CAGR of 9.8% during the forecast period from 2025 to 2034. In 2024 Europe held a dominant market position, capturing more than a 39.6% share, holding USD 1.4 Billion in revenue.

Low migration (LM) inks are specially formulated printing inks designed to minimize the transfer of ink components to products, such as food, beverages, or pharmaceuticals. They are crucial for food-safe packaging as they use selected raw materials and pigments to ensure the ink doesn’t leach into the contents, thereby preventing contamination and protecting consumer safety. They are formulated with components that have a higher molecular weight and are less likely to migrate through packaging materials. As consumer awareness and regulatory frameworks increase, the demand for low migration inks increases.

Additionally, several companies are investing in R&D to explore more applications of these inks, creating opportunities in the market. Similarly, as there is global focus on sustainable products, there is a demand for sustainably produced inks. However, the market faces challenges regarding the potential adhesion issues and the high cost of the material.

- According to the European Food Safety Authority (EFSA), low-migration (LM) inks reduce harmful substance migration by over 80% compared to traditional inks, effectively minimizing potential health hazards. In 2022, the EU’s RASFF notification system revealed that 34% of food contamination incidents in packaged food were related to the migration of packaging inks.

Key Takeaways

- The global low migration inks market was valued at USD 3.5 billion in 2024.

- The global low migration inks market is projected to grow at a CAGR of 9.8% and is estimated to reach USD 8.9 billion by 2034.

- Based on the types of low migration inks, UV-cured inks dominated the market, with around 68.9% of the total global market.

- Among the substrates, plastic is the most utilized in the low migration inks market, with 52.4% of the market share.

- Based on printing processes, mainly low migration inks are used for the flexography process, approximately 44.5%.

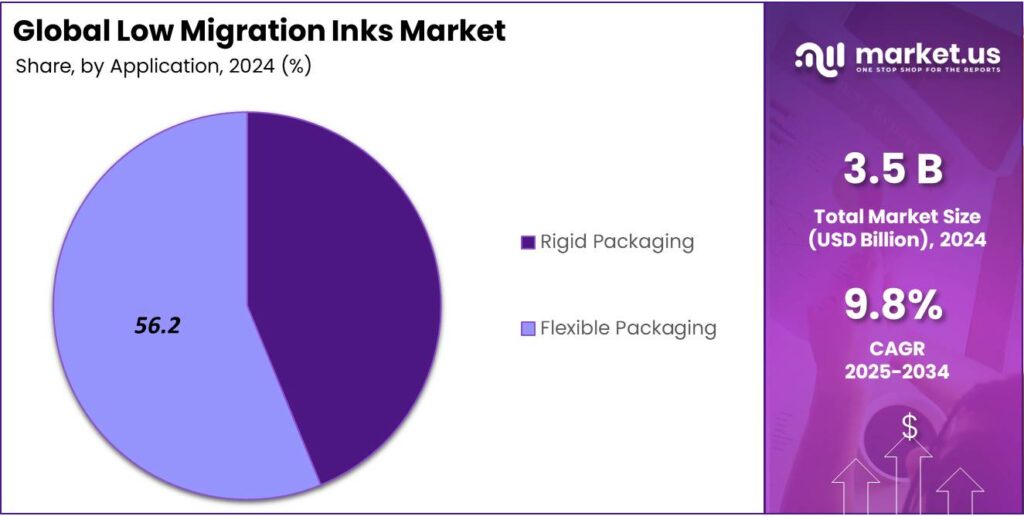

- Based on the applications of the low migration inks, flexible packaging held the majority of revenue share in 2024 at 56.2%.

- Among the end-uses of the low migration inks, the food & beverage industry accounted for the largest revenue share, which is 61.7%, in the market.

- Europe was at the forefront of the low migration inks market, accounting for around 39.6% of the total global consumption.

Type Analysis

UV-Curable Inks Dominate the Low Migration Inks Market.

The low migration inks market is segmented based on types as UV-curable inks, water-based inks, and others. The UV-curable inks dominate the market, comprising around 68.9% of the shares. UV-curable low migration inks are more widely utilized than water-based or other alternatives due to their fast curing speed, excellent adhesion, and minimal risk of migration. Unlike water-based inks, which require longer drying times and may struggle on non-porous substrates such as plastic or foil, UV-curable inks harden instantly under ultraviolet light, making them ideal for high-speed packaging lines.

In addition, they offer superior chemical resistance and print durability, which is crucial for food, pharmaceutical, and cosmetic packaging. Similarly, UV inks are solvent-free, reducing the emission of volatile organic compounds (VOCs) and aligning with environmental regulations. Their precise formulation allows for better control over ingredients, ensuring compliance with strict migration limits.

Printing Process Analysis

Low Migration Inks Are Majorly Used in Flexography Processes.

On the basis of printing process, the low migration inks market is segmented into flexography, digital, offset, gravure, and others. Approximately 44.5% of the revenue in the low migration inks market is generated by the flexography process. Low migration ink is more commonly utilized in flexographic printing due to the process’s compatibility with a wide range of packaging materials. Flexography uses quick-drying, low-viscosity inks that are ideal for printing on flexible, non-porous substrates like plastic films, foils, and laminates.

It supports high-speed, large-volume production while maintaining print quality and regulatory compliance. Compared to digital printing, which is slower and less cost-effective for long runs, or gravure and offset, which require more expensive setup and are less adaptable to flexible substrates, flexography provides a balanced solution that aligns well with low migration requirements and industry-specific safety standards.

Substrate Analysis

Plastic is Predominantly Used as a Substrate for Low Migration Inks.

Based on substrates, the low migration inks market is segmented into paper and paperboard, plastic, & others. The plastic substrate dominated the market with 52.4% of the market share. Plastic substrates are more commonly used with low migration inks as they are widely employed in food, pharmaceutical, and cosmetic packaging applications where migration control is critical. Unlike paper or paperboard, plastic materials such as polyethylene, polypropylene, and PET act as effective barriers to moisture, oxygen, and contaminants, preserving product integrity.

However, their non-porous nature makes it easier for ink components to remain on the surface. Low migration inks are designed to minimize the risk by reducing the mobility of potentially harmful substances. Additionally, plastics are preferred for flexible packaging formats like pouches, blister packs, and wraps, where durability, sealability, and visual appeal are essential.

Application Analysis

The Low Migration Inks Market is Led by the Flexible Packaging.

Based on the applications of the low migration inks, the market is divided into rigid packaging and flexible packaging. In 2024, flexible packaging held a dominant market position, capturing more than a 56.2% market share. Low migration inks are more utilized in flexible packaging than in rigid packaging, as flexible packaging materials, such as films, foils, and laminates, are often in direct or indirect contact with food and pharmaceuticals, where strict safety standards are essential.

Flexible packaging is lightweight, versatile, and widely used for snacks, fresh foods, and pharmaceuticals, increasing the need for inks that minimize chemical migration. Additionally, flexible substrates are typically non-porous and require specialized low-migration inks to prevent contamination while maintaining print quality. In contrast, rigid packaging like glass or metal is less prone to chemical migration due to its inert surface, reducing the necessity for low migration inks. The flexible packaging’s material characteristics and applications drive greater demand for low migration inks.

End-Use Analysis

The Food and Beverage Industry Held a Dominant Position in the Low Migration Inks Market.

Based on the end-uses of the low migration inks, the market is divided into food & beverage, pharmaceutical, cosmetic & personal care, tobacco, and others. In 2024, the food and beverage industry held a dominant market position, capturing more than a 61.7% market share. Low migration inks are more extensively used in the food and beverage industry, as these products have direct contact with packaging materials where ink migration poses significant health risks.

Since food and beverages are consumed daily by a broad population, including vulnerable groups such as children and the elderly, stringent safety standards prioritize minimizing chemical transfer from inks. While the pharmaceutical, cosmetic, and tobacco industries require safety, their packaging often involves additional protective layers or secondary packaging that reduce direct ink contact with the product. Additionally, the food and beverage sector faces stricter regulatory scrutiny globally, driving the adoption of low migration inks to ensure consumer safety and compliance. This makes the food and beverage industry the primary user of these specialized inks.

Key Market Segments

By Type

- UV-Curable Inks

- Water-based Inks

- Others

By Printing Process

- Flexography

- Digital

- Offset

- Gravure

- Others

By Substrate

- Paper & Paperboard

- Plastic

- Others

By Application

- Rigid Packaging

- Flexible Packaging

By End-Use

- Food & Beverage

- Bakery & Confectionery

- Dairy Products

- Beverages

- Frozen & Processed Foods

- Others

- Pharmaceutical

- Cosmetic & Personal Care

- Tobacco

- Others

Drivers

Regulatory Frameworks Drive the Low Migration Inks Market.

Regulatory frameworks play a pivotal role in driving the low migration inks market, especially in food packaging, pharmaceuticals, and cosmetics, where consumer safety is paramount. Food packaging compliant inks are tested under standardized migration test conditions to prove that under these conditions, they do not migrate above the defined acceptable limits. In the United States, the Food and Drug Administration (FDA) regulates substances that may come into direct or indirect contact with food, mandating compliance with strict limits on the migration of potentially harmful chemicals.

Similarly, the European Union enforces Regulation (EC) No. 1935/2004, which requires that materials in contact with food must not transfer constituents in quantities that could endanger human health.

These inks are formulated and made in accordance with the EuPIA (European Printing Ink Association) Good Manufacturing Practices (GMP). This regulation, along with Swiss Ordinance SR 817.023.21, which lists permitted substances in printing inks, has led many manufacturers to reformulate their products.

For instance, Nestlé requires all suppliers to meet stringent internal packaging safety standards, influencing upstream suppliers to adopt low migration inks. As consumers become more health-conscious and regulations tighten globally, packaging companies are compelled to use inks with controlled migration properties to remain compliant and avoid recalls or penalties.

Restraints

Potential Adhesion Issues Might Pose a Challenge for the Low Migration Inks Market.

Despite their safety and regulatory advantages, low migration inks face challenges such as potential adhesion issues, which can limit their broader adoption. Adhesion problems often arise when printing on non-porous or specialty substrates such as certain plastics and foils commonly used in food and pharmaceutical packaging. These surfaces may require additional surface treatments, such as corona or plasma treatment, to ensure proper ink adhesion, increasing process complexity.

Furthermore, low migration inks typically use specialized, high-purity raw materials that comply with strict migration limits, making them more expensive than conventional inks. This cost factor can be a barrier for small and medium-sized printers or companies operating in cost-sensitive markets.

For instance, in flexible packaging applications, ensuring both low migration compliance and high print durability may require multi-step printing and curing processes, raising operational costs. Balancing performance, compliance, and cost remains a key challenge for manufacturers and end users in the low migration inks market.

Opportunity

Applications of the Low Migration Inks in the Electronics Industry Create Opportunities in the Market.

Low migration inks are increasingly finding applications in the electronics industry, creating new opportunities for innovation and product safety. As electronic devices become smaller and more complex, there is a growing need for precision printing on sensitive components such as flexible circuits, sensors, and touch panels. In these applications, low migration inks help prevent the leaching of harmful substances that could interfere with electronic functionality or compromise device reliability over time.

For instance, printed circuit boards (PCBs) used in medical devices and wearables require inks that are both chemically stable and non-reactive to ensure long-term performance.

Additionally, as regulations on hazardous substances in electronics, such as RoHS (Restriction of Hazardous Substances) in the EU, become stricter, manufacturers are seeking low migration inks that comply with environmental and safety standards. Several companies test their low migration inks for the artificial sweat immersion test and abrasion resistance for printing on wearable devices. This has led to increased use of UV-curable, solvent-free inks in the electronics sector, enabling high-resolution, durable prints with minimal risk of contamination.

Trends

Shift Towards Sustainable Low Migration Inks.

The shift towards sustainable low-migration inks is an ongoing trend driven by increasing environmental concerns and regulatory pressure to reduce harmful emissions and waste. Traditional solvent-based inks often contain volatile organic compounds (VOCs) that contribute to air pollution and pose health risks. The manufacturers are transitioning to water-based and UV-curable low migration inks that offer safer alternatives with lower environmental impact.

For instance, in December 2024, INX International announced a brand extension for INXhrc RC natural-based inks, a UV/LED dual-cure low-migration formulation for plastic and foam-based packaging. INXhrc RC LM is a Nestlé-compliant, high-performance ink solution with clean, renewable, and sustainable ingredients used for the printing of low-migration applications on rigid container packaging.

Similarly, brands committed to sustainable packaging, such as Unilever and Danone, are pushing their supply chains to adopt eco-friendly printing solutions that meet both safety and sustainability standards. This trend aligns with broader industry goals to achieve carbon neutrality and supports circular economy initiatives in the packaging and labeling sectors.

Geopolitical Impact Analysis

Geopolitical Tensions Are Impacting the Low Migration Inks market by disrupting the Essential Supply Chains in the Market.

The geopolitical tensions, particularly those involving major economic blocs such as the European Union, China, Russia, and the United States, are having a notable impact on the low migration inks market. Supply chain disruptions resulting from trade restrictions, sanctions, and conflicts have led to shortages and price volatility of key raw materials used in low migration ink formulations, such as photoinitiators, pigments, and specialty solvents.

For instance, sanctions on Russian exports and strained EU-China trade relations have affected the availability of certain chemical intermediates, forcing manufacturers to seek alternative, and often more expensive, sources. Additionally, rising energy costs in Europe due to the ongoing conflict in Ukraine have increased manufacturing expenses, particularly for energy-intensive ink curing technologies, such as UV.

Furthermore, the companies are facing delays in cross-border shipments and increased regulatory scrutiny, especially when sourcing from unstable regions, such as China and Southeast Asia. Some manufacturers are localizing production or diversifying suppliers to reduce dependency on geopolitically sensitive markets.

Moreover, export-oriented countries such as Germany and Japan, which are significant players in the global printing and packaging industries, are experiencing slower growth due to reduced international demand and logistical bottlenecks. These challenges are prompting the industry to reassess sourcing strategies and prioritize resilience alongside regulatory compliance and product safety.

Regional Analysis

Europe Held the Largest Share of the Global Low Migration Inks Market.

In 2024, Europe dominated the global low migration inks market, holding about 39.6% of the market share, valued at approximately US$1.4 billion. The region holds the largest share of the global low migration inks market due to its stringent regulatory environment, advanced packaging industry, and strong consumer awareness around food safety.

The European Union enforces comprehensive regulations such as Regulation (EC) No 1935/2004 and the Swiss Ordinance SR 817.023.21, which outline strict limits on chemical migration from packaging materials into food. These laws have driven widespread adoption of low migration inks, particularly in countries such as Germany, France, and Switzerland, where compliance is closely monitored.

Major European food and beverage companies, including Nestlé and Danone, have adopted internal packaging safety standards, further accelerating demand for compliant inks. Similarly, Europe leads in sustainable packaging initiatives, which have encouraged the use of UV-curable and water-based low migration inks that offer both environmental and safety benefits. With a mature printing industry and strong regulatory oversight, Europe continues to set the benchmark for low migration ink usage globally.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The major market players in the Low Migration Inks market are Sun Chemical, INX International Ink, Flint Group, Hubergroup, Siegwerk Druckfarben, Altana, Epple Druckfarben, Marabu, Artience, Encres Dubuit, Kao Collins, Rucoinx, Huizhou ZhongZhiXing Color Technology, and Zeller+Gmelin Corporation. Several players in the low migration inks market maintain a competitive edge through strategic activities, such as product development and partnerships.

The players in the market majorly invest in research and development to explore different applications of these inks and to develop more products that are more sustainable. In addition, several players partner with different food or pharmaceutical, or packaging companies to provide their packaging inks.

The major players in the industry

- Sun Chemical

- INX International Ink Co.

- Flint Group

- Hubergroup

- Siegwerk Druckfarben AG & Co. KGaA

- Altana

- Epple Druckfarben AG

- Marabu GmbH

- Artience Co., Ltd.

- Encres Dubuit

- Kao Collins Corporation

- RUCOINX

- Huizhou ZhongZhiXing Color Technology Co., Ltd

- Zeller+Gmelin Corporation

- Other Key Players

Key Development

- In July 2025, Sun Chemical launched SunCure Advance ECO UV sheetfed inks for folding carton applications. These inks feature press color stability, fast curing, and low misting and are created to run on high-speed presses.

- In March 2024, the Flint Group launched Novasens P670 Prime, a high-performance, low odor, low migration (LOLM) process ink series formulated to meet the needs of sheetfed offset packaging printers worldwide.

Report Scope

Report Features Description Market Value (2024) USD 3.5 Bn Forecast Revenue (2034) USD 8.9 Bn CAGR (2025-2034) 9.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (UV-Curable Inks, Water-based Inks, Others), By Printing Process (Flexography, Digital, Offset, Gravure, Others), By Substrate (Paper and Paperboard, Plastic, Others), By Application (Rigid Packaging, Flexible Packaging), By End-use (Food & Beverage, Pharmaceutical, Cosmetic & Personal Care, Tobacco, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Sun Chemical, INX International Ink, Flint Group, Hubergroup, Siegwerk Druckfarben, Altana, Epple Druckfarben, Marabu, Artience, Encres Dubuit, Kao Collins, Rucoinx, Huizhou ZhongZhiXing Color Technology, Zeller+Gmelin Corporation, and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Sun Chemical

- INX International Ink Co.

- Flint Group

- Hubergroup

- Siegwerk Druckfarben AG & Co. KGaA

- Altana

- Epple Druckfarben AG

- Marabu GmbH

- Artience Co., Ltd.

- Encres Dubuit

- Kao Collins Corporation

- RUCOINX

- Huizhou ZhongZhiXing Color Technology Co., Ltd

- Zeller+Gmelin Corporation

- Other Key Players