Global Loan Servicing QA Platform Market Size, Share Report By Component (Software, Services), By Deployment Mode (Cloud-Based, On-Premises), By Organization Size (Large Enterprises, Small and Medium Enterprises), By Application (Mortgage Loans, Personal Loans, Auto Loans, Student Loans, Business Loans, Others), By End-User (Banks, Credit Unions, Non-Banking Financial Institutions, Mortgage Lenders, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec.2025

- Report ID: 169236

- Number of Pages: 275

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- By Component: Software

- By Deployment Mode: On-Premises

- By Organization Size: Large Enterprises

- By Application: Mortgage Loans

- By End-User: Banks

- US Market Size

- Emerging Trends

- Growth Factors

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

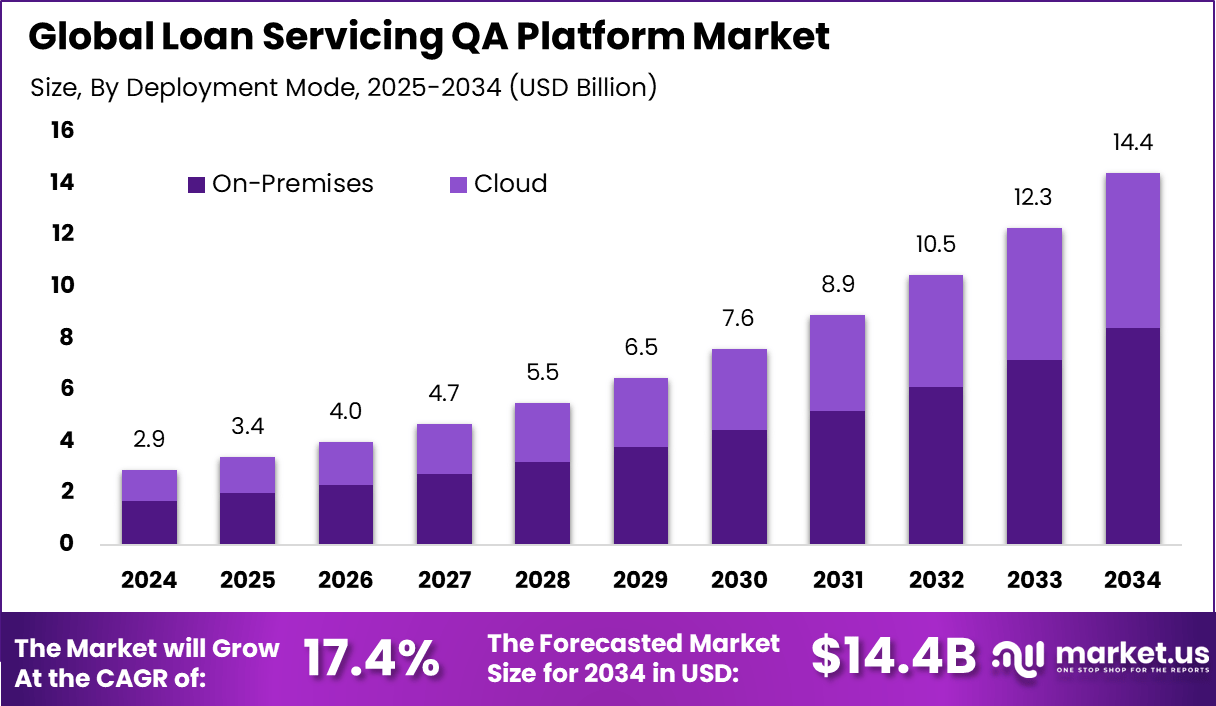

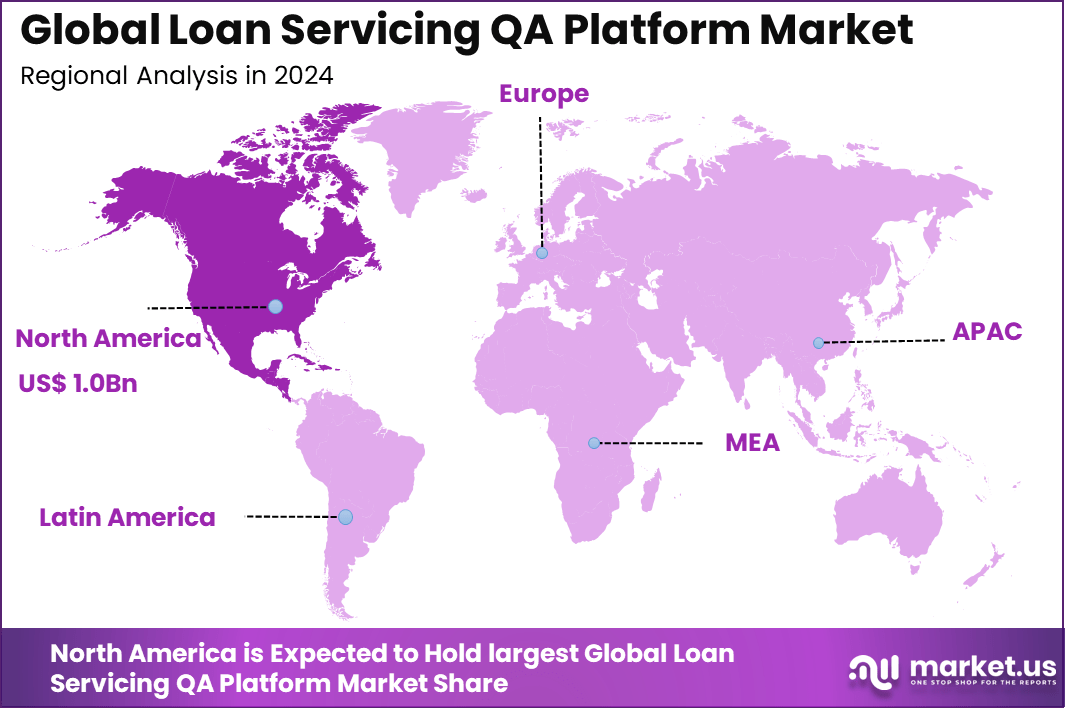

The Global Loan Servicing QA Platform Market generated USD 2.9 billion in 2024 and is predicted to register growth from USD 3.4 billion in 2025 to about USD 14.4 billion by 2034, recording a CAGR of 17.4% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 35.3% share, holding USD 1.0 Billion revenue.

The loan servicing QA platform market has expanded as lenders and financial institutions strengthen their oversight of servicing operations. Growth reflects increasing regulatory scrutiny, rising loan volumes and the need for accurate, consistent servicing activities across payment processing, customer communication and compliance tasks. QA platforms now play a central role in ensuring servicing quality across mortgages, consumer loans and commercial portfolios.

The loan servicing QA platform market has expanded as lenders and financial institutions strengthen their oversight of servicing operations. Growth reflects increasing regulatory scrutiny, rising loan volumes and the need for accurate, consistent servicing activities across payment processing, customer communication and compliance tasks. QA platforms now play a central role in ensuring servicing quality across mortgages, consumer loans and commercial portfolios.

Top Market Takeaways

- Software accounted for 76.5%, showing that financial institutions rely heavily on automated tools to enhance accuracy and compliance in loan servicing workflows.

- On-premises deployment held 58.4%, reflecting continued preference for local control over sensitive borrower information and quality audit processes.

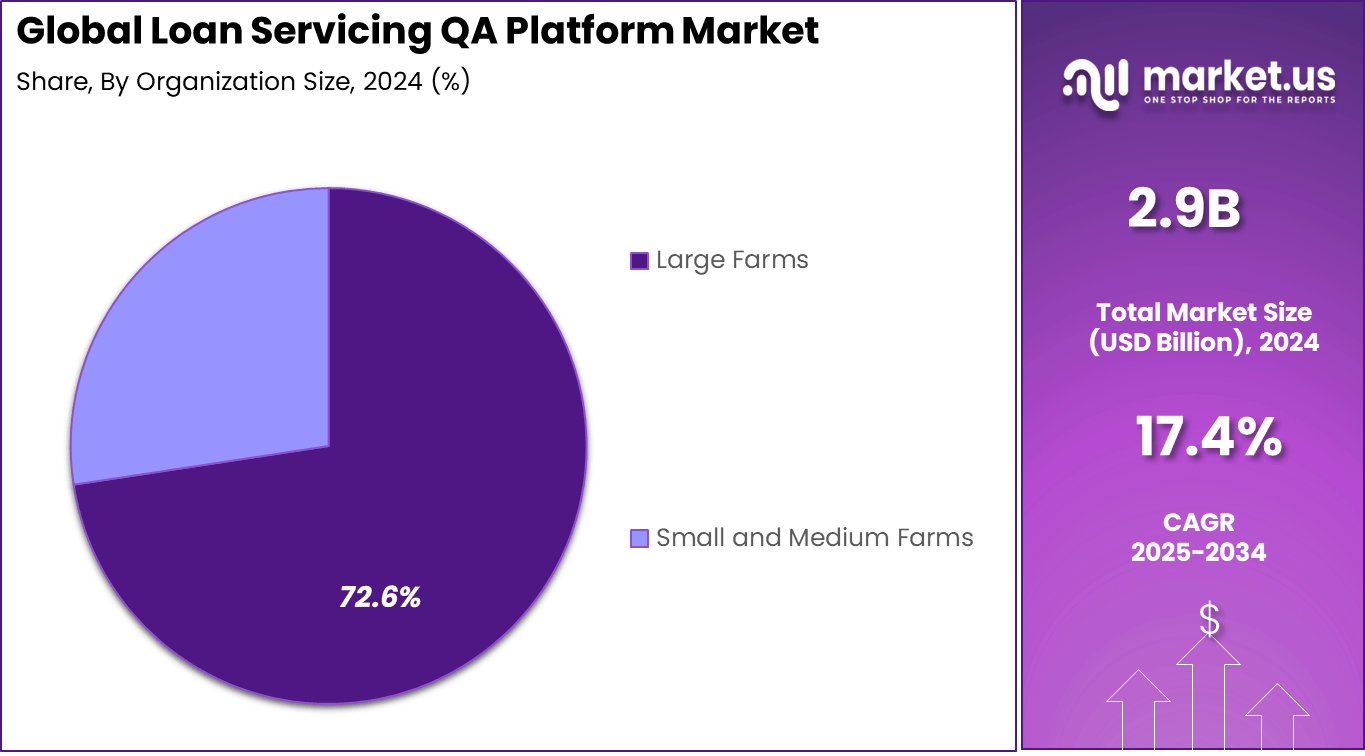

- Large enterprises represented 72.6%, indicating that organizations with high loan volumes drive most investment in structured QA platforms.

- Mortgage loans captured 37.4%, supported by rising demand for precise servicing checks and regulatory scrutiny in housing finance.

- Banks held 39.4%, highlighting their strong focus on reducing servicing errors and improving borrower experience through structured QA systems.

- North America recorded 35.3%, driven by advanced lending markets and strong regulatory expectations.

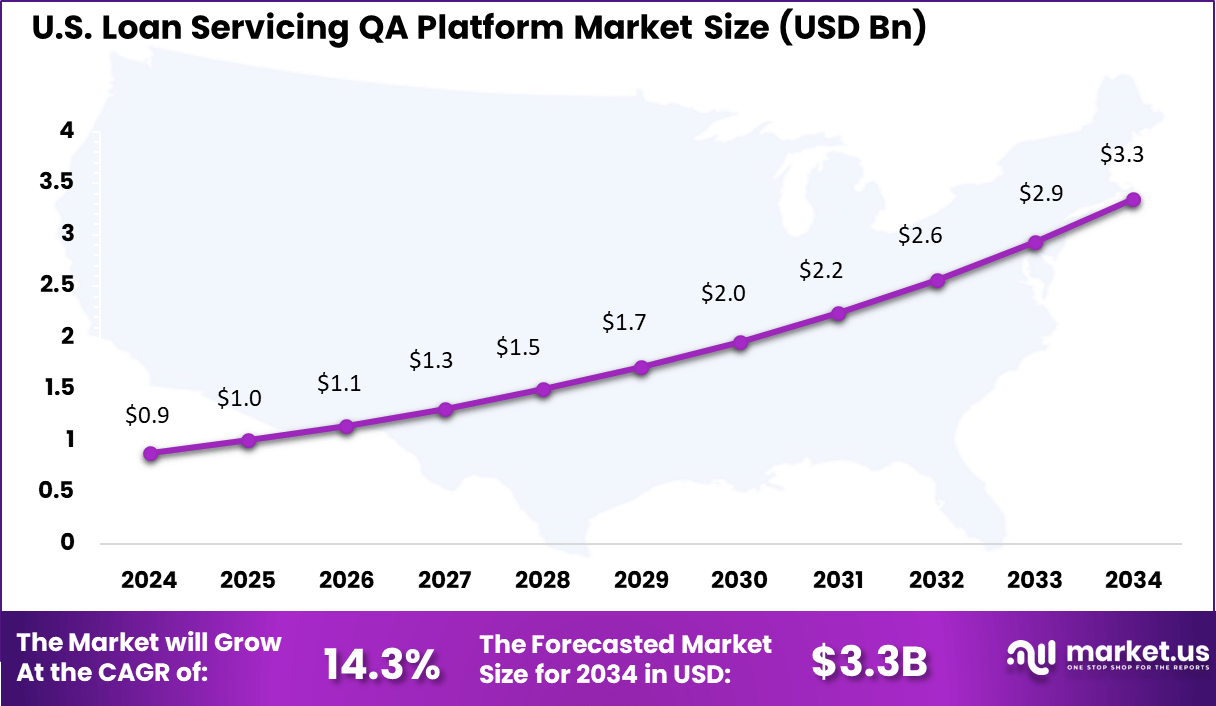

- The U.S. market reached USD 0.88 billion with a 14.3% CAGR, showing steady adoption of QA automation across loan servicing departments.

By Component: Software

Software takes 76.5% of the component segment in loan servicing QA platforms. It stands out by automating quality checks on loan data and processes, which helps teams catch errors before they cause problems. Financial operations depend on this to maintain accuracy in payments and records without slowing down work.

The tools integrate smoothly with daily tasks, pulling in info from various sources to flag issues instantly. This reduces manual reviews and keeps compliance on track for lenders handling routine servicing. Over time, it frees up staff to handle more complex cases.

By Deployment Mode: On-Premises

On-premises deployment leads with 58.4% in the market. Organizations choose it for direct control over sensitive loan information stored on internal servers. This setup minimizes outside access risks and allows custom adjustments to fit specific workflows.

Reliable performance comes without depending on external connections, which suits high-volume periods. Teams access and modify systems quickly to align with local requirements. It offers stable costs and quick response times for busy loan operations.

By Organization Size: Large Enterprises

Large enterprises hold 72.6% of the organization size share. They need robust platforms to oversee massive loan books across multiple locations and loan types. These systems connect with current tools to manage risks and reporting efficiently.

The scale requires strong quality assurance to limit mistakes in approvals and collections. This supports tight operations and regulatory demands in expansive setups. It results in better control over diverse lending activities.

By Application: Mortgage Loans

Mortgage loans account for 37.4% of applications. The segment demands thorough verification of borrower details, property info, and rules at each stage. QA platforms automate these steps to prevent delays or rework in home financing.

Lenders apply the tools to review docs early and ensure smooth closings. Steady housing needs make this area key for reliable processes that support borrower confidence. It handles the unique checks tied to real estate lending.

By End-User: Banks

Banks represent 39.4% of end-users in the loan servicing QA platform space. They turn to these tools to manage diverse loan types while staying on top of regulations and customer needs. The platforms help process payments and updates quickly across retail and commercial accounts.

For banks, QA means real-time monitoring to prevent defaults and improve service. This setup supports everything from daily collections to risk alerts, keeping branches efficient. It fits their role as main handlers of personal and business lending.

US Market Size

The U.S. stands at USD 0.88 Bn within the loan servicing QA platform space. It drives much of the North American strength through high loan activity in housing and personal finance. Local demand for precise servicing tools pushes adoption among key players. The market shows a 14.3% CAGR. This pace reflects steady tech upgrades in loan handling and rising needs for error-free processes. It points to ongoing shifts toward better QA in financial services.

North America accounts for 35.3% of the regional share in loan servicing QA platforms. The area leads thanks to advanced banking networks and a push for digital tools in lending. High loan activity, especially in housing and consumer finance, drives the need for quality checks.

Emerging Trends

The landscape of loan servicing QA platforms is being shaped by growing adoption of intelligent automation and analytical capabilities. Platforms are increasingly integrating machine learning models that support early identification of repayment risks, pattern detection in borrower behavior, and continuous monitoring of servicing quality. These capabilities reduce manual intervention and improve accuracy by allowing institutions to act on insights drawn from large datasets.

Another trend is the shift toward modular and highly configurable architectures. Lenders now manage a wider mix of loan products, and this diversity requires systems that can adjust to different workflows, documentation rules, and compliance frameworks. Modern QA platforms offer customizable modules that allow lenders to adapt servicing operations to product type, loan volume, and regional regulations.

Growth Factors

A major growth driver is the rising need for operational efficiency within lending organizations. Manual servicing processes are resource intensive and prone to errors, particularly when institutions handle large loan volumes. Automation offered by QA platforms enables faster verification of payment records, more accurate documentation checks, and smoother communication with borrowers.

Institutions that adopt these solutions report improvements in process quality because routine servicing tasks become standardized and significantly less vulnerable to inconsistencies. This improvement in servicing performance has strengthened demand for QA systems across banks, credit unions, and digital lenders. Regulatory obligations also contribute strongly to market growth. The lending environment is governed by complex requirements for documentation accuracy, auditability, and borrower transparency.

QA platforms support compliance by providing structured audit trails, automated rule based checks, and consistent monitoring of servicing practices. These capabilities reduce compliance risks and help institutions respond quickly to regulatory updates. As lending expands across digital channels and new borrower categories, institutions face higher scrutiny from regulators.

Key Market Segments

By Component

- Software

- Services

By Deployment Mode

- Cloud-Based

- On-Premises

By Organization Size

- Large Enterprises

- Small and Medium Enterprises

By Application

- Mortgage Loans

- Personal Loans

- Auto Loans

- Student Loans

- Business Loans

- Others

By End-User

- Banks

- Credit Unions

- Non-Banking Financial Institutions

- Mortgage Lenders

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

A major driver for the loan servicing QA platform market is the growing need for higher accuracy and consistency in servicing operations. Lenders manage large volumes of payment data, escrow records, and borrower communications, and manual handling increases the risk of errors.

Automated QA systems help institutions verify servicing tasks more accurately and maintain cleaner audit trails. This improvement in process reliability builds trust with borrowers and regulators. Insights from industry sources indicate that many lenders now use such platforms to reduce servicing discrepancies and improve the quality of oversight across portfolios.

The expansion of digital lending also supports this growth. More borrowers apply for loans online, and lenders must process and monitor these loans quickly while keeping servicing standards stable. QA platforms help standardize servicing procedures, making it easier for institutions to manage high loan volumes without compromising on review quality.

Restraint

One major restraint is the cost of adopting and integrating a QA platform. Many lenders still depend on older software or manual workflows, and shifting to a modern QA system requires investment in technology, training, and data migration. Smaller institutions, in particular, may find these costs too high, making them hesitant to transition.

Industry commentary shows that the financial and operational disruption during implementation can slow adoption even when the long-term benefits are clear. Another restraint comes from concerns about system suitability and data integrity.

Loan servicing varies widely by loan type, repayment structure, and regulatory environment. If a QA platform does not align well with existing workflows or fails to interpret servicing rules correctly, it may introduce new inconsistencies instead of reducing them. Institutions remain cautious about adopting platforms that might not fully support their servicing complexity or data structure.

Opportunity

A strong opportunity for this market lies in rising compliance pressures. Regulations related to documentation, borrower disclosures, and payment accuracy are becoming more detailed, and lenders face growing scrutiny. QA platforms that help institutions track compliance, identify exceptions early, and maintain transparent audit records are gaining interest.

As oversight increases, such platforms are positioned to become essential tools rather than optional improvements. There is also opportunity in supporting multi-product and multi-region loan portfolios. As lenders expand into new loan categories and geographic markets, QA platforms that offer configurable servicing rules and adaptable workflows will appeal strongly.

These systems allow institutions to scale operations without building separate servicing setups for each product line. This flexibility increases demand for platforms that can grow along with expanding loan businesses.

Challenge

A key challenge is the difficulty of integrating QA platforms with legacy systems. Many lenders use older servicing software that stores historical data in formats that modern systems cannot easily interpret. Moving this data into a new platform is time-consuming and may require manual cleanup. This migration risk often delays adoption, as institutions cannot afford errors in long-term borrower records.

Data security presents another major challenge. Loan servicing involves sensitive financial information that must be protected consistently. When data is centralized on a QA platform, institutions must ensure the system follows strict access controls and secure storage practices. Any weakness in these areas can create exposure to breaches or misuse. This concern makes lenders cautious when selecting platforms, especially when servicing large or long-term portfolios.

Competitive Analysis

Sagent, Black Knight, Fiserv, FIS Global, and CoreLogic lead the loan servicing QA platform market with robust systems that automate compliance checks, audit workflows, and portfolio risk monitoring. Their platforms support mortgage servicers, banks, and fintech lenders with real-time quality controls and standardized review processes. These companies focus on data accuracy, regulatory alignment, and seamless servicing-system integration.

Wipro Gallagher Solutions, Mortgage Cadence, Tavant, ICE Mortgage Technology (Ellie Mae), LoanLogics, LendingQB, Qualia, and SitusAMC strengthen the competitive landscape with modular QA tools designed for defect detection, automated scoring, and secondary review management. Their solutions help servicers streamline audits, reduce manual workload, and enhance transparency across loan files.

Aspire Systems, Cognizant, First American, Ocwen, Mr. Cooper Group, Altisource, Clayton Holdings, and others broaden the market with specialized QA services, analytics engines, and outsourced quality reviews. Their capabilities support servicers seeking scalable oversight and independent file audits. These companies focus on remediation tracking, performance benchmarking, and portfolio-wide quality intelligence.

Top Key Players in the Market

- Sagent

- Black Knight

- Fiserv

- FIS Global

- CoreLogic

- Wipro Gallagher Solutions

- Mortgage Cadence

- Tavant Technologies

- Ellie Mae (ICE Mortgage Technology)

- LoanLogics

- LendingQB

- Qualia

- SitusAMC

- Aspire Systems

- Cognizant

- First American Financial Corporation

- Ocwen Financial Corporation

- Mr. Cooper Group

- Altisource

- Clayton Holdings

- Others

Recent Developments

- October, 2025 – Sagent announced a partnership with Verituity to integrate cloud-based digital payout capabilities into its loan servicing suite. The new solution modernizes payment rails, secures refunds and disbursements, and enables faster, more efficient digital payouts to borrowers and suppliers.

- September, 2025 – Fiserv launched Content Next™, a next-gen, cloud-based content management and workflow solution built for AI-driven document storage and reporting insights. This platform supports operational agility for banks and servicers, accelerating digital transformation and streamlining workflow management.

Report Scope

Report Features Description Market Value (2024) USD 2.9 Bn Forecast Revenue (2034) USD 14.4 Bn CAGR(2025-2034) 17.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software, Services), By Deployment Mode (Cloud-Based, On-Premises), By Organization Size (Large Enterprises, Small and Medium Enterprises), By Application (Mortgage Loans, Personal Loans, Auto Loans, Student Loans, Business Loans, Others), By End-User (Banks, Credit Unions, Non-Banking Financial Institutions, Mortgage Lenders, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Sagent, Black Knight, Fiserv, FIS Global, CoreLogic, Wipro Gallagher Solutions, Mortgage Cadence, Tavant Technologies, Ellie Mae (ICE Mortgage Technology), LoanLogics, LendingQB, Qualia, SitusAMC, Aspire Systems, Cognizant, First American Financial Corporation, Ocwen Financial Corporation, Mr. Cooper Group, Altisource, Clayton Holdings, Others. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Loan Servicing QA Platform MarketPublished date: Dec.2025add_shopping_cartBuy Now get_appDownload Sample

Loan Servicing QA Platform MarketPublished date: Dec.2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Sagent

- Black Knight

- Fiserv

- FIS Global

- CoreLogic

- Wipro Gallagher Solutions

- Mortgage Cadence

- Tavant Technologies

- Ellie Mae (ICE Mortgage Technology)

- LoanLogics

- LendingQB

- Qualia

- SitusAMC

- Aspire Systems

- Cognizant

- First American Financial Corporation

- Ocwen Financial Corporation

- Mr. Cooper Group

- Altisource

- Clayton Holdings

- Others