Global Lip Powder Market Size, Share, Growth Analysis By Product (Palettes, Pen), By End User (Under 18, Up to 30, Up to 45, Above 45), By Sales Channel (Specialty Outlets, Supermarkets/Hypermarkets, Convenience Stores, Beauty Stores, E-Retailers, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173666

- Number of Pages: 388

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Product Analysis

- By End User Analysis

- By Sales Channel Analysis

- Key Market Segments

- Drivers

- Restraints

- Growth Factors

- Emerging Trends

- Regional Analysis

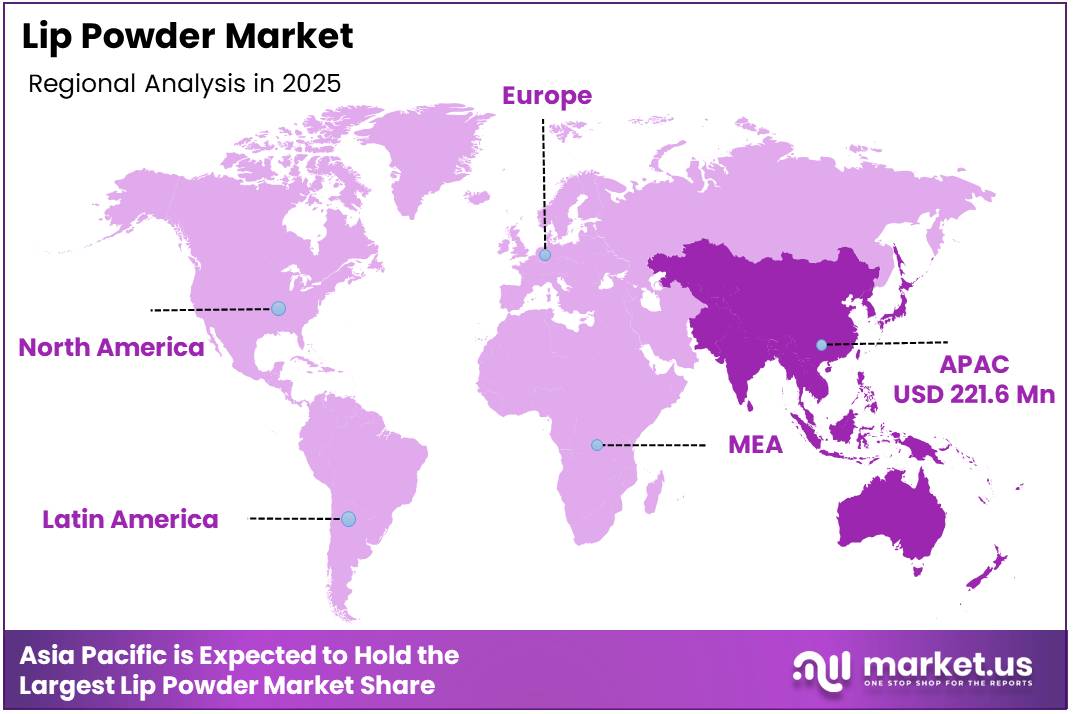

- Asia Pacific Dominates the Lip Powder Market with a Market Share of 42.6%, Valued at USD 221.6 Million

- Key Lip Powder Company Insights

- Recent Developments

- Report Scope

Report Overview

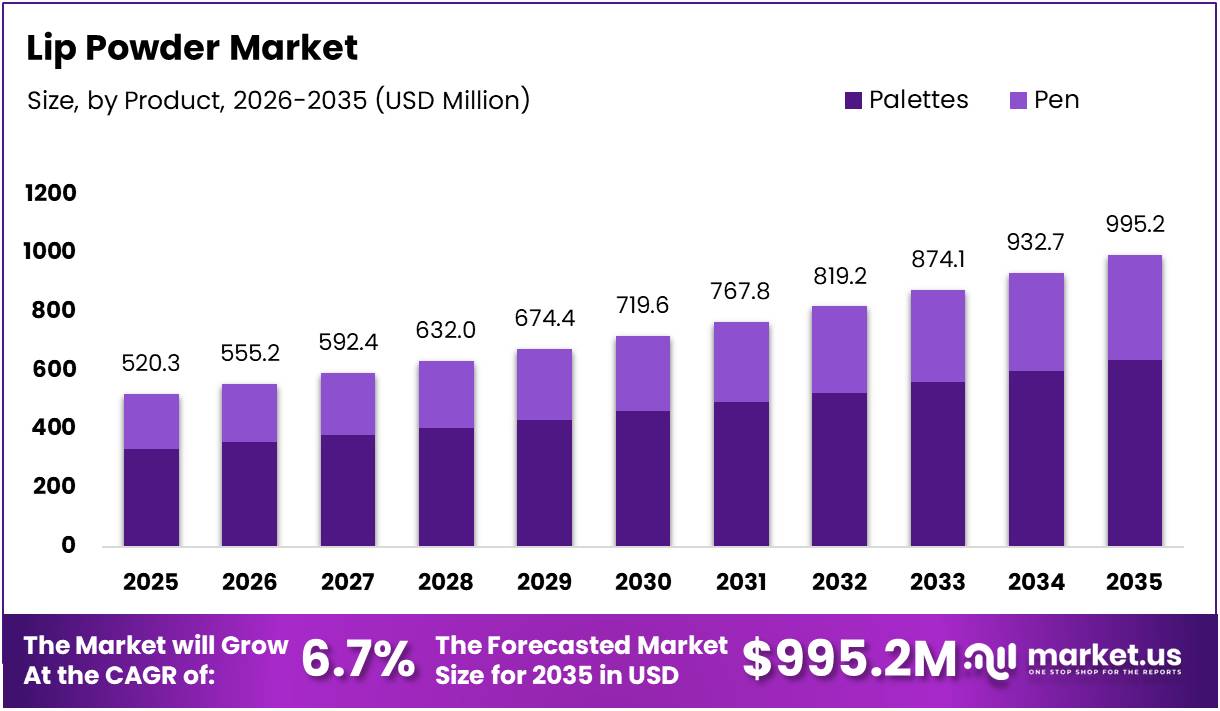

The Global Lip Powder Market size is expected to be worth around USD 995.2 Million by 2035, from USD 520.3 Million in 2025, growing at a CAGR of 6.7% during the forecast period from 2026 to 2035.

The Lip powder market represents an innovative segment within color cosmetics, offering consumers lightweight, long-wearing lip color solutions. Unlike traditional lipsticks or glosses, lip powders deliver matte finishes with buildable coverage and exceptional staying power. This category encompasses various formulations designed to provide comfortable wear while maintaining vibrant pigmentation throughout the day.

Industry analysts observe remarkable momentum as consumer preferences shift toward multifunctional beauty products. The market demonstrates consistent expansion driven by increasing demand for smudge-proof, transfer-resistant lip formulations. Growing awareness about innovative makeup technologies further accelerates adoption rates. Brands continuously innovate, introducing hybrid products that combine powder technology with moisturizing benefits, effectively addressing traditional matte formula concerns.

Significant opportunities exist within customization and personalization segments as consumers seek unique color experiences. E-commerce platforms facilitate direct-to-consumer engagement, enabling brands to reach broader demographics efficiently. Social media influencers drive product discovery, particularly among younger audiences seeking trendy, Instagram-worthy lip looks. Premium and luxury segments show promising potential as consumers prioritize quality over price points in their beauty investments.

Governmental bodies maintain stringent cosmetic safety regulations, ensuring product formulations meet established quality standards. The FDA oversees cosmetic ingredient approvals in North America, while European regulations emphasize transparency in labeling requirements. Manufacturers must comply with clean beauty mandates, reformulating products to exclude controversial ingredients. These regulatory frameworks ultimately enhance consumer confidence while encouraging sustainable manufacturing practices across the industry.

Market dynamics reveal fascinating shifts in lip product consumption patterns among key demographics. According to research, 40% of US women ages 18-34 now use four or more different types of lip products, demonstrating diverse beauty routines. Furthermore, nearly 70% of Gen Z make-up wearers told Circana that they use gloss, indicating sustained interest in versatile lip formats. These statistics underscore evolving preferences where consumers experiment with multiple textures and finishes simultaneously.

Key Takeaways

- The Global Lip Powder market is projected to grow from USD 520.3 Million in 2025 to USD 995.2 Million by 2035, registering a 6.7% CAGR.

- By product, Palettes lead the market with a dominant share of 64.1%, highlighting strong demand for multi-shade and customizable formats.

- By end user, the Up to 30 age group holds the largest share at 43.2%, reflecting higher adoption among younger consumers.

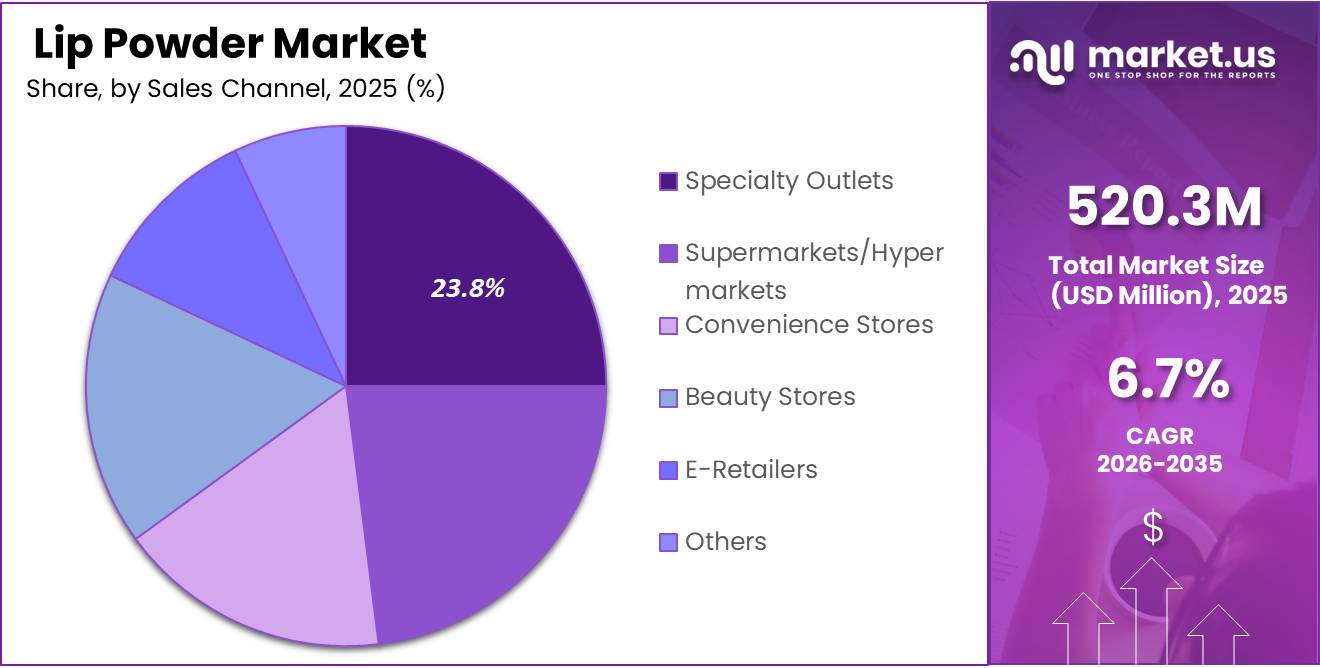

- By sales channel, Specialty Outlets account for the highest share at 23.8%, driven by expert guidance and curated offerings.

- Asia Pacific dominates with a 42.6% market share, valued at USD 221.6 Million, making it the largest regional contributor.

By Product Analysis

Palettes dominate with 64.1% due to their versatility and customizable color options.

In 2025, Palettes held a dominant market position in the By Product Analysis segment of Lip Powder Market, with a 64.1% share. Palettes have emerged as the preferred choice among consumers seeking variety and flexibility in their makeup routines. These products offer multiple shades in a single compact, allowing users to mix and match colors to create personalized looks. The convenience of carrying several lip powder shades simultaneously appeals to both professional makeup artists and everyday consumers.

Pen format lip powders represent an emerging segment catering to consumers who prioritize precision and ease of application. These innovative applicators provide controlled delivery of product, making them ideal for creating defined lip lines and achieving professional results. The pen format particularly appeals to younger demographics and beginners who find traditional application methods challenging.

By End User Analysis

Up to 30 age group dominates with 43.2% due to high beauty consciousness and social media influence.

In 2025, Up to 30 age group held a dominant market position in the By End User Analysis segment of Lip Powder Market, with a 43.2% share. This demographic represents the most active consumer base for lip powder products, driven by heightened beauty awareness and extensive social media engagement. Young adults are heavily influenced by digital beauty trends, influencer recommendations, and viral makeup tutorials.

The Under 18 segment represents an emerging consumer base exploring cosmetic products as they develop personal style preferences. This demographic shows growing interest in age-appropriate beauty products, often influenced by peer recommendations and youth-oriented social media content. Parents increasingly support safe cosmetic experimentation for teenagers, creating market opportunities for brands offering gentle, beginner-friendly lip powder formulations specifically designed for younger skin.

Up to 45 age group consumers demonstrate sophisticated beauty routines and established brand loyalties developed through years of product experience. This segment values quality formulations that address specific concerns such as long-lasting wear and hydration. They seek products offering both aesthetic appeal and skincare benefits, preferring lip powders with nourishing ingredients that complement mature skin while delivering professional results.

Above 45 consumers represent a discerning market segment prioritizing comfort, quality, and subtle elegance in their cosmetic choices. This demographic appreciates products that enhance natural beauty without emphasizing fine lines or causing dryness. They favor moisturizing formulations with buildable coverage and sophisticated color palettes that complement their refined personal style, making them valuable customers for premium lip powder products.

By Sales Channel Analysis

Specialty Outlets dominate with 23.8% due to expert guidance and exclusive product offerings.

In 2025, Specialty Outlets held a dominant market position in the By Sales Channel Analysis segment of Lip Powder Market, with a 23.8% share. These dedicated beauty destinations provide curated shopping experiences that attract discerning consumers seeking professional advice and premium product selections. Specialty outlets employ trained beauty consultants who offer personalized recommendations and product demonstrations that enhance customer satisfaction.

Supermarkets/Hypermarkets serve as convenient shopping destinations where consumers purchase lip powder products alongside regular grocery shopping. These large-format stores offer competitive pricing, frequent promotional activities, and extensive product ranges from mass-market brands. The accessibility and one-stop shopping convenience make these channels particularly attractive to budget-conscious consumers and those preferring to physically examine products before purchasing.

Convenience Stores cater to impulse purchases and emergency beauty needs, providing quick access to essential lip powder products in neighborhood locations. These outlets stock popular mainstream brands and travel-sized options that appeal to consumers seeking immediate solutions. Their extended operating hours and strategic locations near residential areas and transit hubs position them as practical alternatives for last-minute purchases.

Beauty Stores specialize exclusively in cosmetic and personal care products, creating immersive shopping environments dedicated entirely to beauty exploration. These retailers offer comprehensive brand selections, testing stations, and beauty advisors who provide detailed product knowledge. The focused beauty environment encourages extended browsing and informed purchasing decisions, attracting passionate beauty consumers who appreciate specialized retail experiences.

E-Retailers have transformed lip powder accessibility through digital platforms offering unprecedented convenience, extensive product reviews, and doorstep delivery services. Online channels provide consumers with comprehensive product information, competitive pricing comparisons, and access to international brands unavailable in local stores.

Others encompass diverse distribution channels including direct selling, departmental stores, pharmacy chains, and emerging marketplace models that contribute to overall market accessibility. These alternative channels address specific consumer preferences and regional distribution nuances, ensuring lip powder products reach various customer segments through multiple touchpoints, supporting comprehensive market penetration.

Key Market Segments

By Product

- Palettes

- Pen

By End User

- Under 18

- Up to 30

- Up to 45

- Above 45

By Sales Channel

- Specialty Outlets

- Supermarkets/Hypermarkets

- Convenience Stores

- Beauty Stores

- E-Retailers

- Others

Drivers

Rising Consumer Preference for Lightweight and Long-Lasting Lip Formats Drives Market Growth

The lip powder market is experiencing significant momentum as consumers increasingly seek lightweight, matte, and long-lasting lip color options. Unlike traditional lipsticks that can feel heavy or sticky, lip powders offer a feather-light texture that provides comfortable all-day wear. This format appeals particularly to younger consumers who prioritize both aesthetics and comfort in their makeup routines.

Social media platforms and beauty influencers are playing a crucial role in driving product adoption. As influencers showcase innovative application techniques and styling ideas on platforms like Instagram and TikTok, consumer curiosity and purchase intent for lip powders continue to rise. This digital word-of-mouth marketing has proven more effective than traditional advertising in reaching target demographics.

Additionally, the demand for multifunctional beauty products is pushing market expansion. Modern consumers value versatility, and lip powders with blendable textures that can be layered or mixed with other products offer practical solutions for creating customized looks. This functionality appeals to budget-conscious buyers seeking maximum value from fewer products while maintaining creative flexibility in their makeup application.

Restraints

Limited Consumer Awareness Compared to Traditional Lip Products Restrains Market Growth

Despite growing interest, the lip powder market faces significant challenges related to consumer familiarity. Traditional lipsticks and liquid lip colors have dominated the market for decades, creating strong brand loyalty and purchasing habits. Many consumers remain unaware that lip powder formats exist or understand their unique benefits compared to conventional options. This knowledge gap limits market penetration, particularly among older demographics who are less exposed to emerging beauty trends.

The application complexity of lip powders presents another notable barrier to widespread adoption. First-time users often struggle with proper application techniques, as lip powders require different methods than familiar lipstick or gloss formats. The learning curve can be frustrating, leading some consumers to abandon the product after initial unsuccessful attempts. Without proper guidance or demonstrations, potential buyers may perceive lip powders as impractical or difficult to use.

Furthermore, achieving desired coverage and preventing patchiness requires practice and skill development. This technical requirement contrasts sharply with the straightforward application of traditional lip products, making lip powders less accessible to casual makeup users or those seeking quick, foolproof solutions for everyday wear.

Growth Factors

Product Innovation in Advanced Formulations Creates Growth Opportunities

The lip powder market presents substantial growth potential through innovative product development. Manufacturers are increasingly focusing on transfer-proof formulations that address consumer concerns about smudging and color bleeding throughout the day. Additionally, incorporating hydrating ingredients and vitamins into lip powder formulas helps overcome the traditional perception that powder-based products are drying, making them more appealing to consumers with sensitive or dry lips.

The clean beauty movement offers another significant expansion avenue. As consumers become more conscious about ingredient transparency and ethical sourcing, demand for vegan and cruelty-free lip color solutions continues rising. Brands that position their lip powders within this clean beauty framework can capture health-conscious and environmentally aware consumer segments effectively.

E-commerce platforms and direct-to-consumer platforms are revolutionizing market accessibility. Online channels allow niche lip powder brands to reach global audiences without traditional retail overhead costs. Digital platforms also enable brands to provide tutorial content, customer reviews, and virtual try-on features that help overcome application complexity concerns. This distribution model supports market growth by connecting innovative products directly with interested consumers worldwide.

Emerging Trends

Shift Toward Soft-Focus Makeup Aesthetics Shapes Market Trends

Current beauty trends are significantly influencing lip powder market development. The popularity of soft-focus, blurred-lip aesthetics represents a departure from traditional high-definition makeup looks. Consumers are embracing diffused, natural-looking lip colors that create a subtle, sophisticated appearance. Lip powders naturally deliver this coveted blurred effect, positioning them perfectly within contemporary makeup trends favored by fashion-forward consumers.

Dual-use product formulations are gaining traction as brands launch lip and cheek powder combinations. These multifunctional products appeal to minimalist consumers and travelers seeking streamlined beauty routines. By offering cohesive color coordination between lips and cheeks, these innovative formulations simplify makeup application while ensuring harmonious looks.

Packaging innovation is transforming consumer experience with lip powders. Air-cushion and sponge-applicator designs are becoming increasingly popular, addressing application complexity concerns by providing integrated tools that simplify product usage. These user-friendly packaging solutions make lip powders more accessible to beginners while offering convenient touch-up options for experienced users. This packaging evolution supports market growth by reducing barriers to entry and enhancing overall product appeal.

Regional Analysis

Asia Pacific leads the global lip powder market with a commanding share of 42.6%, valued at USD 221.6 million. The region’s dominance stems from the thriving beauty industry in South Korea, Japan, and China, where K-beauty trends and innovative cosmetic formulations drive substantial consumer demand. Rising disposable incomes and preference for long-lasting lip products further accelerate market growth across the region.

North America Lip Powder Market Trends

North America maintains a strong presence in the lip powder market, supported by high consumer awareness and established cosmetics retail channels. The region’s demand is fueled by growing preference for smudge-proof and transfer-resistant lip products, alongside increasing adoption of clean beauty formulations among health-conscious consumers.

Europe Lip Powder Market Trends

Europe exhibits steady growth in the lip powder segment, driven by fashion-forward consumers and premium beauty product demand. The region’s market expansion is supported by stringent quality standards, sustainability-focused purchasing behavior, and the influence of social media beauty trends across key markets including the UK, France, and Germany.

Middle East and Africa Lip Powder Market Trends

The Middle East and Africa region demonstrates emerging potential in the lip powder market, particularly in affluent Gulf countries where luxury cosmetics consumption is rising. Growing urbanization, increasing female workforce participation, and expanding retail infrastructure contribute to gradual market development across the region.

Latin America Lip Powder Market Trends

Latin America presents growing opportunities for lip powder products, driven by Brazil and Mexico’s vibrant beauty cultures and increasing middle-class spending power. The region’s market growth is supported by rising social media influence, growing beauty consciousness among younger demographics, and expanding distribution networks across urban centers.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Lip Powder Company Insights

BUXOM Cosmetics continues to strengthen its position in the global lip powder market through its innovative approach to long-wearing, high-pigment formulations that cater to millennials and Gen Z consumers seeking bold, statement-making lip products. The brand’s strategic focus on combining lip care benefits with intense color payoff has resonated particularly well with consumers prioritizing multifunctional beauty products in 2025.

BY TERRY maintains its luxury positioning in the lip powder segment by leveraging its heritage in high-performance cosmetics and premium ingredient selection, appealing to affluent consumers willing to invest in sophisticated, dermatologically-tested formulations. The brand’s emphasis on skincare-infused makeup continues to differentiate it in an increasingly crowded marketplace where consumers demand both aesthetic appeal and beneficial properties.

CLE COSMETICS has carved a niche in the clean beauty space within the lip powder market, attracting environmentally conscious consumers through its commitment to sustainable sourcing and minimalist formulations free from controversial ingredients. The brand’s transparent approach to ingredient disclosure and eco-friendly packaging solutions positions it favorably as regulatory scrutiny and consumer awareness around cosmetic safety intensify globally.

Clinique Laboratories, LLC leverages its dermatologist-developed reputation and extensive distribution network to capture market share among consumers with sensitive skin or allergy concerns, offering hypoallergenic lip powder options that address an underserved segment. The brand’s clinical credibility and established trust with healthcare professionals provide competitive advantages in markets where safety certifications and medical endorsements influence purchasing decisions significantly.

Top Key Players in the Market

- BUXOM Cosmetics

- BY TERRY

- CLE COSMETICS

- Clinique Laboratories, LLC

- Flower Beauty

- L’Oréal S.A.

- MAC Cosmetics

- Maybelline LLC

- NARS Cosmetics

- NYX PROFESSIONAL MAKEUP

Recent Developments

- In May 2025, Shinsegae announced plans to acquire C&C International as part of its strategy to enter the global colored cosmetics manufacturing segment, strengthening its production capabilities and expanding its international beauty portfolio.

- In October 2025, L’Oréal completed the acquisition of Kering Beauté, including the luxury fragrance brand Creed, for $4.7 billion, significantly enhancing its premium fragrance and high-end beauty brand portfolio.

Report Scope

Report Features Description Market Value (2025) USD 520.3 Million Forecast Revenue (2035) USD 995.2 Million CAGR (2026-2035) 6.7% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Palettes, Pen), By End User (Under 18, Up to 30, Up to 45, Above 45), By Sales Channel (Specialty Outlets, Supermarkets/Hypermarkets, Convenience Stores, Beauty Stores, E-Retailers, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape BUXOM Cosmetics, BY TERRY, CLE COSMETICS, Clinique Laboratories, LLC, Flower Beauty, L’Oréal S.A., MAC Cosmetics, Maybelline LLC, NARS Cosmetics, NYX PROFESSIONAL MAKEUP Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BUXOM Cosmetics

- BY TERRY

- CLE COSMETICS

- Clinique Laboratories, LLC

- Flower Beauty

- L'Oréal S.A.

- MAC Cosmetics

- Maybelline LLC

- NARS Cosmetics

- NYX PROFESSIONAL MAKEUP