Global Life Science Tools Market By Technology (Genomic, Cell Biology, Proteomics, Lab supplies and others), By Product (Next Generation Sequencing, Sanger Sequencing, Nucleic acid preparation, Nucleic acid Microarray, PCR and qPCR, Flow Cytometry, Mass Spectrometry, Separation Technologies, NMR and others), By End-User (Biopharmaceutical Company, Government & Academic Institutes, Industry, Health care and others), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: March 2024

- Report ID: 116548

- Number of Pages: 362

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

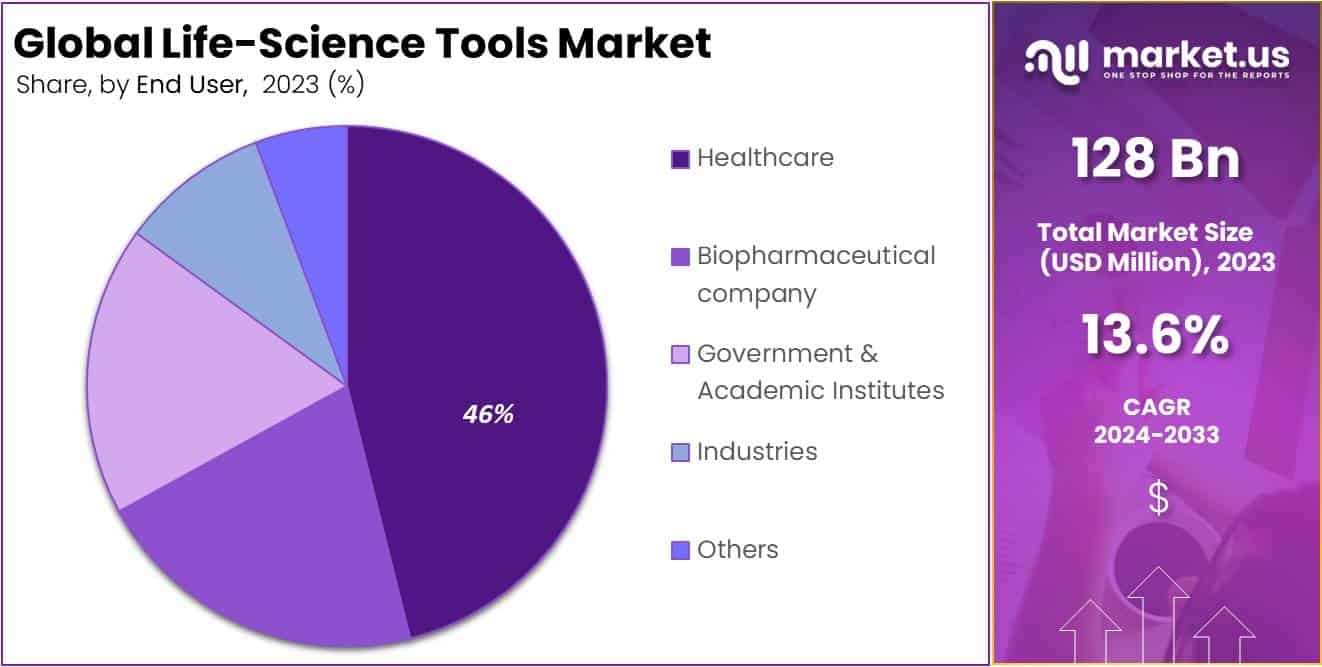

The Global Life Science Tools Market size is expected to be worth around USD 456 Billion by 2033, from USD 128 Billion in 2023, growing at a CAGR of 13.6% during the forecast period from 2024 to 2033.

The market for life-science tools include a variety of analytical tools, supplies, reagents, equipment, and other services for diverse applications ranging from transferring patients to conducting X-rays and preparing samples. Advances in life-sciences contribute to raising the standard of living in number of landscapes such as medicine, agriculture, pharmaceutical, food science industries, and health. An important role is played in understanding of environment and other living things aided by study of life sciences.

The market for life-science tools experiences a major thrive owing to rapid advancements by life-science tools’ companies in screening, NMR, MS Chromatography and various other products. The market is further boosted by growth of gene and cell therapies and their scaling ultimatum. FDA approvals are increasing leading a healthy outlook for gene therapies in near future. In addition, the number of clinical trials is anticipated to hike by virtue of the advancements in recombinant DNA technology.

- Food and Drug Administration projected more than 210 applications for cell and gene therapy clinical trials by 2029 annually.

Furthermore, the incorporation of treatment comprising monoclonal antibodies are evolving rapidly in the field of cancer therapy.

Key Takeaways

- Projected market growth from USD 128 billion in 2023 to USD 456 billion by 2033, with a CAGR of 13.6%.

- Cell Biology technology leads, holding a 39.7% market share in 2023, boosted by significant funding and AI enhancements.

- Next Generation Sequencing dominates products, representing 28.4% of the market, renowned for its high-throughput, cost-efficient genomic analysis.

- Healthcare is the largest end-user segment, capturing 46.1% of the market, driven by genomic and proteomic applications in diagnostics and treatment.

- Market expansion fueled by advancements in sequencing, chromatography, and regulatory approvals, enhancing biopharma and life sciences integration.

- High costs of software implementation and infrastructure, alongside regulatory product recalls, present significant market challenges.

- Opportunities arise from cutting-edge technologies like CRISPR/Cas9, single cell analysis, and spatial omics, driving market innovation and growth.

- North America dominates the market with a 40.5% share in 2023, attributed to advanced technological adoption and strong genomic medicine sector.

- Asia-Pacific expected to grow rapidly, propelled by strategic investments and expanding market opportunities in life science tools.

Technology Analysis

Based on technology the market is fragmented into Genomic, Cell Biology, Proteomics, Lab supplies and other technologies. Amongst these, cell biology technology dominated the global life-sciences market capturing a praiseworthy market share of 39.7% in the year 2023. The domination showcased by the segment owes to increased funding by National Institutes of Health for cell biology and widespread applications of cell biology technology in the area of drug discovery. Furthermore, the advances incorporated into cell biology includes the use of artificial intelligence.

- For instance, lifescience business Deepcell, founded by Stanford University maintains cell morphology atlas reached 100 crores photos, to enhance AI models for cell characterization and isolation to unveil patterns remained unseen by humans.

Product Analysis

Based on product, the market for life-sciences tools is broadly categorized into Next Generation Sequencing, Sanger Sequencing, Nucleic acid preparation, Nucleic acid Microarray, PCR and qPCR, Flow Cytometry, Mass Spectrometry, Separation Technologies, NMR and other segments. An impressive market shares of 28.4% is occupied by next generation sequencing technology.

This owes to advancements in technology including de novo assembly sequencing, transcriptome sequencing, resequencing at DNA or RNA level, and whole genome sequencing. The technology proves to be cost effective providing exceptional sequencing speed, high resolution, and precision in genomic analysis.

Further benefits of next generation sequencing over conventional sequencing techniques include rapid turnaround times for multiple sample number, reduced cost, and upgraded sensitivity in detecting low frequenting variations. The segment promises to expand during the forecast period due to its importance in discovering new genes linked to cancer coupled with identification of fluctuations occurring with carcinogenesis.

End User Analysis

Based on end use, the market fractionates into Biopharmaceutical Company, Government & Academic Institutes, Industry, Health care and other segments. An indispensable role is performed by Healthcare segment apprehending a large market revenue share of 46.1% in the year 2023.

The segment further comprise of clinics, diagnostic laboratories, physician offices, hospitals and community centres. The segmental predominance is highly ascribed to the rising adoption of genomic and proteomic workflow in hospitals aiding in treatment and diagnosis of diverse medical abnormalities.

In addition, the ongoing efforts in the field of genomics by clinics and hospitals further propels the market growth of life-science tools. Predictions are made regarding the enhancements in patient care due to adoption of genomic sequencing by hospitals, thereby cutting down the medical expenses.

- For instance, one of the first hospital system, Partners Healthcare in United States offer public genomic sequencing, analysis, and interpretation service

Key Segments Analysis

By Technology

- Genomic

- Cell Biology

- Proteomics

- Lab supplies

- Other

By Product

- Next Generation Sequencing

- Sanger Sequencing

- Nucleic acid preparation

- Nucleic acid Microarray

- PCR and Qpcr

- Flow Cytometry

- Mass Spectrometry

- Separation Technologies

- NMR

- other

By End user

- Biopharmaceutical Company

- Government & Academic institutes

- Industry

- Health care

- Other

Market Drivers

The market for life-science tools is witnessing tremendous growth by virtue of advancements in techniques in the areas of sequencing technologies, NMR, chromatography methods, and sequencing technologies. Investments are made in research and development for products and services related to life-sciences, which is gradually propelling the market expansion.

The market is on rise due to the acquisitions in life-sciences and biopharma industries bolstering its strong presence in the market place. Improvements are made in infrastructure as compared to the previous time where only few market players had the infrastructure to manage the complete value chain of biological production. Increased approvals by regulatory authorities such as Food and Drug Administration (US) further drives the market of life-science tools to a large extent.

- For instance, Tebentafusp-tebn monoclonal antibody was approved by Food and Drug Administration in January 2022, that aids in the treatment of metastatic uveal melanoma.

Market Restraints

High cost of software implementation

The market for life-science tools is facing challenges in excellence by virtue of high cost of life science software implementation, complicated programming, need for additional infrastructure, and data management cost.

Recall of products by regulatory authorities

Impediments are brought into existence by increasing number of product recalls by regulatory authorities such as U.S. Food and Drug Administration. The recall of products further causes delay in product launch into the market, restricting the entry of new entrants in the marketplace. Recurring clinical trials also raises cost of the procedures, thereby hikes the cost of overall treatment protocol.

- Class I flow cytometer manufactured by Beckman Coulter (manufacturer of diagnostic system) was recalled by Food & Drug Administration in November 2018.

Opportunities

Wealthy opportunities are gained by major industry players

There is a greater demand for tools and platforms with the advancements in genomic and proteomic technologies, facilitating gene expression analysis, biomarker discovery, and genome sequencing. Major industry players are grabbing lucrative opportunities involved in the development of microarray technologies, mass spectrometry instruments, and innovative sequencing platforms.

The escalating drug discovery and development process by pharmaceutical industries demands highly advanced tools and technologies including molecular modelling software, analytical instruments, screening systems and laboratory automation. Companies further encounters optimistic pull due to emerging technologies such as single cell analysis, spatial omics, CRISPR/Cas9 genome editing. Thus, all these facets collectively offer significant opportunities for market expansion of life-science tools.

Impact of macroeconomic factors / Geopolitical factors

Despite the continued inflation, the life-science tools market has experienced growth. This can be attributed to steady demand for life-science tools and services. Additionally, the investment in R&D assists in the growth of the market. Such investments hinge on healthcare expenditure and public spend on healthcare.

Healthcare expenditure constitutes up to 11% of global GDP, which the World Health Organisation estimated to be about US$ 9 trillion in 2022. Alternatively, according to an article by the American Medical Association, there was a 2.7% increase in the health spending in the US in 2021. Moreover, the life-science tools market is also influenced by taxation policies by regional governments and the national GDP.

Latest Trends

Life-science tools market involves abundant advancements leading to a stretch in growth during the forecast period. Some of the recent advances include:

3D Cell & Organ-on-a-chip

Notable traction is gained by 3D cell culture models and organ-on-a-chip platforms due to its relevance in comparison with previous 2D cell culture systems. This advent assists the researchers to impersonate the intricacy of natural tissue micro-ecosystems and scrutinize functions, disease working, and drug responses at organ level in vitro.

Digitalization and Data Integration

The integration of cloud based platforms, bioinformatics tools, and data repositories into life-science industry has rapidly facilitated collaboration, data sharing and incorporation of multi-omics datasets purposing holistic scrutinization.

CRISPR Technology

Researches in life-science landscape has revolutionized with the advent of CRISPR-Cas 9 gene editing technology, allowing the researchers to accurately edit and manipulate genome. The recent developments in CRISPR powered technologies has further expanded its roots in areas such as drug discovery, therapeutic development and functional genomics.

Omics Technologies

The evolution in proteomics, transcriptomic, genomic and metabolomics allow scientific researchers to achieve greater perception into biological systems and disease mechanisms.

Regional Analysis

A dominant market revenue shares of 40.5% is withheld by North America, commanding the global life-science tools market in the year 2023. The dominance of the region is highly accredited to the quick witted acquisition of proteomics, diagnostic screening, oncology and genomics.

To diagnose and treat clinical disorders the regions like United States and Canada are highly adopting biopharmaceuticals, novel technologies, and genomic medicines signifying market growth of the region. The regional market is further subjected to extension due to well regulated ecosystems for approval and usage of genomic and tissue diagnostic tests over the projection period.

- For instance, Agilent Technologies launched COVID 19 Severity Test Screening using Agilent Cary 630 FTIR Spectrometer in August 2021.

On the flip side, owing to the scaling efforts and investments by major industry players, Asia-Pacific is projected to witness fastest market growth during the foreseeable days. This allow the region to grab untapped avenues in the global market.

- Atara Bio-Therapeutics T-Cell Operations and manufacturing facility was acquired by FUJIFILM Corporation for USD 100 million in January 2022. This assisted FUJIFILM Corporation to produce commercial and clinical treatments including T-cell and Car-T cell immunotherapies.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The life-science tools market is consolidated in nature with strong presence of established players. Further, the lucrative nature of the industry attracts new players, but the high barriers to entry abate the businesses from entering. Key players compete to either increase or maintain their market share, which keeps the market in a constant state of flux. Businesses seek to cement their positions by strategies like alliances, acquisitions, agreements and product launches. is one of the key companies capturing substantial market share.

Top Key Players in the Life-Science Tools Market

- Zeiss International

- Bruker Corporation

- Hitachi, Ltd

- Thermo Fisher Scientific, Inc.

- Danaher Corporation

- Bio-Rad Laboratories

- Agilent Technologies

- Becton, Dickinson and Company

- Illumina, Inc.

- Shimadzu Corporation

- Oxford Instruments

- Genome Medical, Inc.

Recent Developments

- In January 2023: QIAGEN established an exclusive strategic agreement with California-based population genomics company Helix, to enhance companion diagnostics for genetic disorders.

- In February 2023: A fledging life-science firm Avida Biomed has been acquired by Agilent Technologies, Inc. Avida Biomed creates high performance target enrichment workflows with distinctive features for clinical researchers using next-generation sequencing method to study cancer.

Report Scope

Report Features Description Market Value (2023) USD 128 billion Forecast Revenue (2033) USD 456 billion CAGR (2024-2033) 13.6% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Technology (Genomic, Cell Biology, Proteomics, Lab supplies and others), By Product (Next Generation Sequencing, Sanger Sequencing, Nucleic acid preparation, Nucleic acid Microarray, PCR and qPCR, Flow Cytometry, Mass Spectrometry, Separation Technologies, NMR and others), By End-User (Biopharmaceutical Company, Government & Academic Institutes, Industry, Health care and others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Zeiss International, Bruker Corporation, Hitachi, Ltd, Thermo Fisher Scientific, Inc., Danaher Corporation, Bio-Rad Laboratories, Agilent Technologies, Becton, Dickinson and Company, Illumina, Inc., Shimadzu Corporation, Oxford Instruments, Genome Medical, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Life Science Tools MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample

Life Science Tools MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Zeiss International

- Bruker Corporation

- Hitachi, Ltd

- Thermo Fisher Scientific, Inc.

- Danaher Corporation

- Bio-Rad Laboratories

- Agilent Technologies

- Becton, Dickinson and Company

- Illumina, Inc.

- Shimadzu Corporation

- Oxford Instruments

- Genome Medical, Inc.