Global Letterpress Printing Machines Market Size, Share, Growth Analysis By Press Type (Platen Press, Rotary Press, Cylinder Press, Hybrid Digital-Letterpress), By Automation Level (Automatic, Manual), By Substrate (Paper, Cardboard, Plastic Films, Metallic Foils and Laminates), By Application (Packaging and Labels, Security Printing, Commercial Printing, Specialty and Artisanal Printing), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171894

- Number of Pages: 214

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

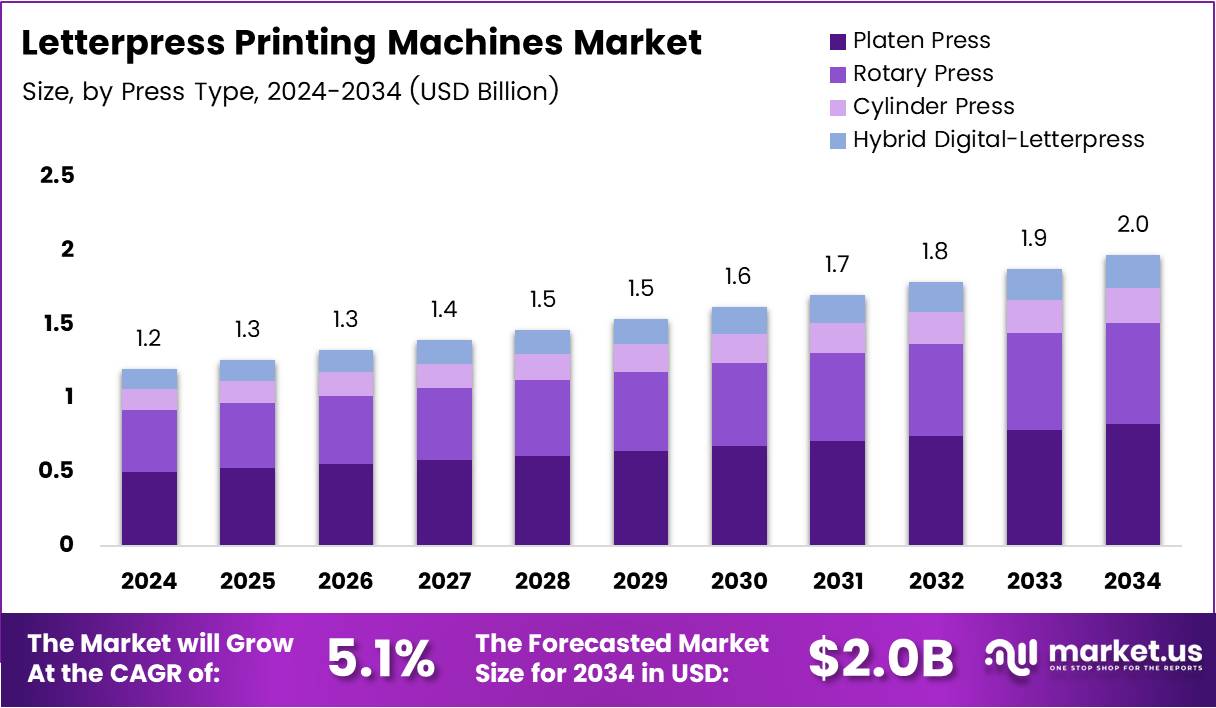

Global Letterpress Printing Machines Market size is expected to be worth around USD 2.0 Billion by 2034 from USD 1.2 Billion in 2024, growing at a CAGR of 5.1% during the forecast period 2025 to 2034.

The Letterpress Printing Machines Market represents specialized printing equipment utilizing traditional relief printing technology. These machines transfer ink from raised surfaces onto various substrates through direct pressure application. This mechanical printing method creates distinctive tactile impressions valued across premium packaging, luxury branding, and artisanal printing sectors.

Market growth stems from expanding demand for premium packaging solutions across retail and consumer goods industries. Luxury brands increasingly adopt letterpress techniques to enhance product differentiation and consumer engagement. The technology delivers unmatched texture and depth impossible through conventional digital methods.

Boutique print shops and artisanal studios drive significant adoption patterns. Small-scale manufacturers leverage letterpress capabilities for custom wedding invitations, specialty stationery, and limited-edition prints. This renaissance reflects broader consumer preferences toward authentic, handcrafted products with distinctive aesthetic qualities.

Europe maintains market leadership through established printing traditions and strong craft communities. Automation advancements enable operators to combine traditional letterpress aesthetics with modern precision controls. Hybrid workflows integrating digital preparation and letterpress finishing gain traction across commercial applications.

Government initiatives supporting traditional crafts and sustainable manufacturing bolster market expansion. Environmental regulations favor letterpress printing using recyclable papers and eco-friendly inks over conventional offset methods. Industry associations promote skill development programs maintaining letterpress expertise across new generations.

The packaging sector presents substantial growth opportunities as brands seek differentiated shelf presence. According to Confetti Design, 64.33% of consumers surveyed prefer eco-friendly packaging innovations, driving adoption of sustainable letterpress solutions. Small-batch production aligns perfectly with craft food, beverage, and cosmetics brands requiring distinctive packaging aesthetics.

Technological integration enhances operational efficiency without compromising traditional print quality. Modern machines incorporate automated feeding systems, precision registration controls, and digital monitoring capabilities. These improvements reduce setup times while maintaining characteristic letterpress depth and impression quality demanded by premium markets.

Key Takeaways

- Global Letterpress Printing Machines Market valued at USD 1.2 Billion in 2024, projected to reach USD 2.0 Billion by 2034.

- Market expanding at CAGR of 5.1% throughout forecast period 2025-2034.

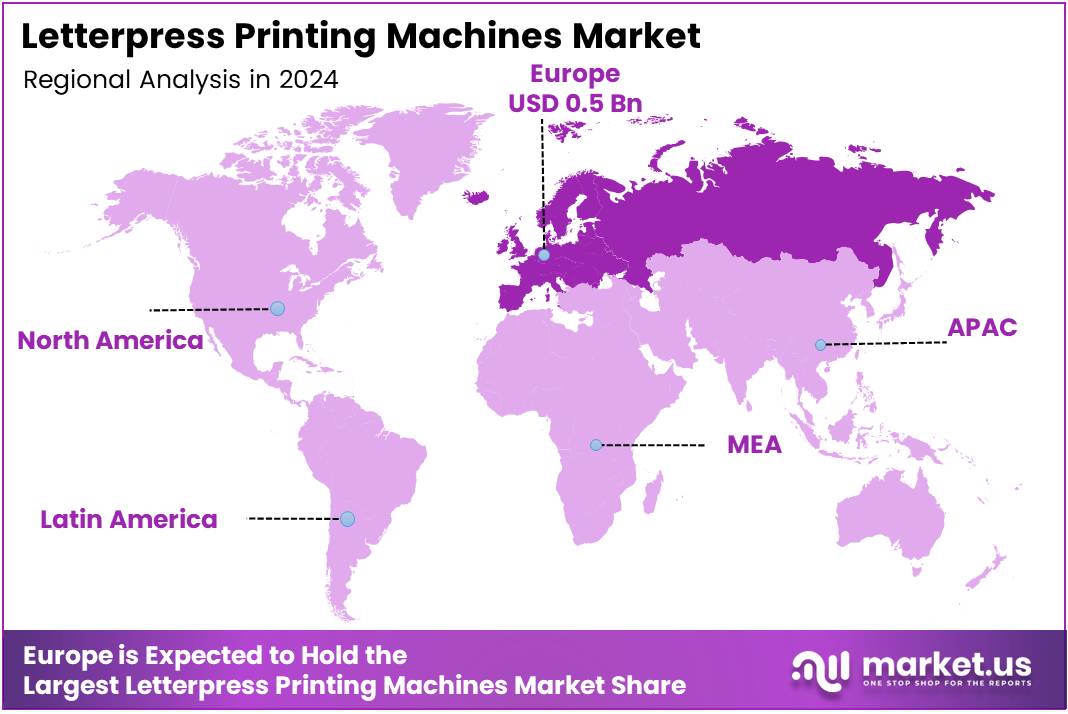

- Europe dominates with 43.80% market share, valued at USD 0.5 Billion.

- Platen Press segment leads with 42.7% share in Press Type category.

- Automatic machines command 69.3% share in Automation Level segment.

- Paper substrate holds 51.1% dominance in Substrate segment.

- Packaging and Labels application accounts for 43.2% market share.

By Press Type

Platen Press dominates with 42.7% due to its versatility and precision in short-run specialty printing.

In 2024, Platen Press held a dominant market position in the By Press Type segment of Letterpress Printing Machines Market, with a 42.7% share. This press type excels in delivering precise impression control essential for premium stationery and invitation printing.

Operators value platen presses for their accessibility and manageable footprint suitable for boutique studios. The vertical pressure mechanism enables consistent results across diverse substrate thicknesses. Educational institutions favor platen models for training programs due to straightforward operation and maintenance requirements.

Rotary Press systems gain traction in high-volume label and packaging production environments. These machines deliver continuous printing capabilities significantly faster than flatbed alternatives. Manufacturers integrate rotary letterpress into inline finishing operations for seamless production workflows. The technology suits long-run applications requiring consistent quality across thousands of impressions.

Cylinder Press models bridge artisanal quality with moderate production volumes. These presses accommodate larger sheet sizes than platen alternatives while maintaining characteristic letterpress depth. Commercial printers utilize cylinder presses for premium business cards, luxury packaging prototypes, and limited-edition art prints requiring exceptional detail reproduction.

Hybrid Digital-Letterpress systems represent innovative convergence of traditional and modern technologies. These machines combine digital imaging precision with letterpress tactile finishing in single-pass operations. Brands leverage hybrid capabilities for variable data printing enhanced with selective letterpress embellishments, creating personalized premium products efficiently.

By Automation Level

Automatic machines dominate with 69.3% due to enhanced productivity and reduced labor dependency.

In 2024, Automatic systems held a dominant market position in the By Automation Level segment of Letterpress Printing Machines Market, with a 69.3% share.

Automated letterpress equipment delivers consistent registration accuracy crucial for multi-color applications and complex designs. Commercial operations prioritize automatic feeders and delivery systems reducing manual handling and operator fatigue. Integration with digital workflow management enables real-time job tracking and quality monitoring. Investment costs justify through labor savings and increased throughput across medium to large production facilities.

Manual letterpress machines maintain significance among artisan printers and educational workshops. These systems offer direct tactile control appealing to craftspeople emphasizing handmade aesthetics. Manual operation allows infinite adjustment possibilities for achieving specific impression depths and ink densities. Smaller studios appreciate lower initial investment and maintenance requirements compared to automated alternatives. The hands-on printing process attracts artists valuing the connection between operator skill and final output quality.

By Substrate

Paper dominates with 51.1% due to widespread use in premium stationery and specialty packaging.

In 2024, Paper held a dominant market position in the By Substrate segment of Letterpress Printing Machines Market, with a 51.1% share. Cotton-based papers deliver superior impression depth and ink absorption characteristics ideal for letterpress applications.

Wedding invitation manufacturers exclusively specify premium paper stocks showcasing letterpress texture advantages. Recycled and sustainable paper options align with eco-conscious brand positioning driving environmental preferences. Paper’s natural fiber structure accepts deep impression without structural damage or substrate breakthrough.

Cardboard substrates serve packaging applications requiring structural rigidity combined with premium finishes. Luxury product packaging utilizes letterpress on heavyweight cardboard creating distinctive unboxing experiences. The material accommodates blind debossing techniques producing subtle textured effects without ink application. Food and beverage brands leverage cardboard letterpress for gift boxes and limited-edition releases.

Plastic Films enable specialty applications demanding moisture resistance and durability. Label manufacturers apply letterpress techniques to synthetic substrates for outdoor products and industrial applications. The material requires specialized inks and modified impression settings compared to traditional paper printing processes.

Metallic Foils and Laminates deliver premium aesthetic effects through letterpress foil stamping processes. Cosmetics and luxury goods packaging incorporates metallic letterpress accents creating elegant shelf presence. These substrates command premium pricing justified through enhanced perceived product value and brand differentiation.

By Application

Packaging and Labels dominates with 43.2% driven by luxury brand differentiation demands.

In 2024, Packaging and Labels held a dominant market position in the By Application segment of Letterpress Printing Machines Market, with a 43.2% share. Premium brands utilize letterpress packaging for creating memorable tactile experiences differentiating products at retail touchpoints.

Craft beverage producers particularly value letterpress labels conveying authentic artisanal brand narratives. Small-batch production economics align perfectly with letterpress capabilities for limited-edition seasonal releases. The technique delivers variable depth and multi-sensory engagement impossible through conventional printing methods.

Security Printing applications leverage letterpress for producing documents requiring tamper-evident features and authentication capabilities. Government institutions utilize letterpress elements in official certificates, licenses, and sensitive document production. The raised printing creates distinctive tactile markers easily verified without specialized equipment. Financial institutions incorporate letterpress security features in check production and premium banking materials.

Commercial Printing encompasses business stationery, corporate identity materials, and promotional collateral requiring distinctive presentation. Professional services firms invest in letterpress business cards projecting quality and attention to detail. The application includes annual reports, investor communications, and corporate gifting items where premium presentation influences recipient perceptions.

Specialty and Artisanal Printing serves creative professionals, artists, and boutique studios producing limited-edition prints and custom designs. Wedding invitation specialists dominate this segment utilizing letterpress for creating heirloom-quality keepsakes. Gallery prints, artist books, and collector editions leverage letterpress techniques for achieving unique aesthetic qualities commanding premium market positioning.

Key Market Segments

By Press Type

- Platen Press

- Rotary Press

- Cylinder Press

- Hybrid Digital-Letterpress

By Automation Level

- Automatic

- Manual

By Substrate

- Paper

- Cardboard

- Plastic Films

- Metallic Foils and Laminates

By Application

- Packaging and Labels

- Security Printing

- Commercial Printing

- Specialty and Artisanal Printing

Drivers

Rising Demand for Premium Packaging Experiences Drives Letterpress Printing Adoption

Luxury brands increasingly prioritize tactile packaging elements creating memorable consumer interactions at critical touchpoints. Letterpress printing delivers unmatched depth and texture impossible through digital alternatives, justifying premium positioning strategies. Retail competition intensifies demand for packaging differentiation beyond visual design alone. Consumer research demonstrates strong preference for products featuring distinctive tactile qualities and perceived craftsmanship.

Boutique print shops proliferate across urban markets serving small businesses requiring unique branding materials. These specialized operations leverage letterpress capabilities for producing custom invitations, specialty stationery, and limited-edition promotional items. Artisanal branding narratives resonate strongly with consumers valuing authentic production methods and traditional craftsmanship. FMCG brands adopt letterpress techniques for seasonal releases and premium product lines requiring elevated shelf presence.

Durable printing requirements across label and stationery sectors favor letterpress technology advantages. The mechanical impression process creates permanent substrate marking resistant to handling wear and environmental exposure. Long-run label applications benefit from letterpress consistency maintaining quality across extended production volumes. Traditional printing techniques enable brand storytelling differentiating products through production methodology transparency and heritage associations.

Restraints

Production Limitations Challenge Letterpress Competitiveness in High-Volume Markets

Letterpress machines demonstrate limited compatibility with high-speed mass production requirements dominating commercial printing sectors. Setup complexity and mechanical operation speeds restrict throughput compared to modern offset and digital alternatives. Large-scale packaging operations requiring tens of thousands of units daily find letterpress economically impractical for primary production methods. The technology suits short to medium runs where quality premiums offset production rate limitations.

Higher setup time requirements significantly impact operational efficiency and job turnaround capabilities. Operators must manually configure impression settings, register multiple colors, and prepare forme assemblies for each production run. These preparation activities consume substantial time before actual printing commences, reducing overall equipment utilization rates. Digital printing eliminates most setup requirements enabling immediate production from digital files.

Skilled labor requirements present ongoing challenges across markets experiencing craft skill shortages. Operating letterpress equipment demands specialized knowledge acquired through extensive training and hands-on experience. Younger workers often lack exposure to mechanical printing principles favoring digital workflows requiring different competency sets. Labor costs associated with skilled letterpress operators exceed wages for digital press technicians performing comparable production volumes.

Growth Factors

Custom Print Products and Hybrid Workflows Create Expansion Opportunities

Wedding and invitation printing markets experience robust growth driven by personalization trends and celebration spending patterns. Couples increasingly invest in custom letterpress invitations creating distinctive event communications reflecting personal style preferences. The segment supports premium pricing structures justified through handcrafted aesthetics and heirloom quality expectations. Personalized print products extend beyond weddings into birth announcements, milestone celebrations, and corporate event invitations.

Hybrid printing workflows combining letterpress finishing with digital preparation gain commercial traction. Operators leverage digital technologies for variable data printing and color reproduction while adding letterpress elements for tactile enhancement. This integration enables cost-effective personalization with selective premium finishing creating optimal value propositions. Commercial printers adopt hybrid approaches expanding service capabilities without abandoning existing digital infrastructure investments.

Eco-friendly printing demand accelerates letterpress adoption utilizing recyclable papers and sustainable ink formulations. Environmental consciousness influences purchasing decisions across consumer segments prioritizing reduced ecological impact. Soy-based and vegetable-derived inks replace petroleum products in letterpress applications without sacrificing print quality. Brands leverage sustainable letterpress credentials in marketing communications appealing to environmentally aware target audiences.

Small-batch packaging requirements from craft producers align perfectly with letterpress production economics and aesthetic qualities. Artisanal food, beverage, and cosmetics brands require distinctive packaging in volumes unsuitable for conventional printing minimums. Letterpress technology enables economically viable short runs maintaining premium quality standards essential for luxury positioning. This segment demonstrates strong growth trajectory as craft production expands across consumer categories.

Emerging Trends

Automation Integration Transforms Modern Letterpress Capabilities

Modern letterpress machines incorporate automation and precision controls enhancing operational efficiency without compromising traditional print characteristics. Manufacturers integrate programmable impression depth adjustment, automated ink distribution systems, and digital registration controls. These technological improvements reduce operator skill requirements while maintaining consistent output quality across production runs. Investment in automated systems attracts commercial printers seeking letterpress capabilities without extensive manual operation dependencies.

Premium label and specialty packaging applications increasingly specify letterpress finishing for brand differentiation. Wine producers, craft spirits brands, and artisanal food companies adopt letterpress labels creating distinctive shelf presence. The technique delivers perceived authenticity and quality associations influencing consumer purchase decisions at competitive price points. Labels featuring letterpress elements command attention in crowded retail environments through tactile differentiation.

Vintage-inspired and retro print designs gain popularity across consumer markets valuing nostalgic aesthetics and traditional craftsmanship. Letterpress naturally delivers authentic period characteristics without artificial distressing or digital simulation. Brands targeting millennial and Gen Z consumers leverage vintage letterpress aesthetics creating emotional connections through design authenticity. This trend spans packaging, stationery, promotional materials, and decorative prints across diverse product categories.

Compact and tabletop letterpress machines democratize technology access for small studios, educators, and hobby printers. Manufacturers develop affordable entry-level equipment requiring minimal space and infrastructure investments. These systems enable creative professionals to explore letterpress techniques without commercial print shop commitments. Growing maker culture and DIY communities embrace accessible letterpress equipment for personal projects and small-scale entrepreneurial ventures.

Regional Analysis

Europe Dominates the Letterpress Printing Machines Market with a Market Share of 43.80%, Valued at USD 0.5 Billion

Europe maintains market leadership through established printing heritage and strong artisanal craft communities. The region holds a dominant 43.80% market share valued at USD 0.5 Billion in 2024.

Traditional printing schools and technical education programs preserve letterpress expertise across generations. Luxury goods concentration in European markets drives demand for premium packaging and specialty printing applications. Government support for traditional crafts and cultural heritage sustains investment in letterpress capabilities and skill development initiatives.

North America Letterpress Printing Machines Market Trends

North America demonstrates robust growth driven by boutique print shop proliferation and artisanal business expansion. Wedding invitation specialists and custom stationery producers concentrate in urban markets supporting premium letterpress services. Craft beverage and specialty food sectors adopt letterpress packaging for brand differentiation and authentic positioning. Technology integration advances as North American manufacturers develop hybrid systems combining digital efficiency with letterpress finishing.

Asia Pacific Letterpress Printing Machines Market Trends

Asia Pacific shows increasing adoption across luxury packaging sectors serving domestic and export markets. Chinese and Japanese manufacturers emerge as equipment suppliers competing on price-performance positioning. Traditional printing appreciation in Asian cultures supports letterpress technology adoption for ceremonial applications and premium stationery. Regional economic growth expands middle-class consumer segments demanding distinctive product packaging and branded materials.

Middle East and Africa Letterpress Printing Machines Market Trends

Middle East markets demonstrate growing interest in premium printing technologies serving luxury retail and hospitality sectors. High-end invitation printing and corporate identity applications drive equipment adoption across urban centers. Limited regional manufacturing necessitates equipment imports from European and Asian suppliers. Market development remains constrained by skilled operator availability and technical support infrastructure limitations.

Latin America Letterpress Printing Machines Market Trends

Latin American markets show emerging adoption patterns concentrated in major metropolitan areas with established printing industries. Artisanal print shops leverage letterpress capabilities for serving creative professionals and event industries. Economic constraints limit market expansion as equipment costs and maintenance requirements challenge smaller operations. Growing appreciation for traditional crafts supports gradual market development despite infrastructure and investment barriers.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Letterpress Printing Machines Company Insights

The global Letterpress Printing Machines Market features specialized manufacturers serving niche printing applications and artisanal production requirements.

Labelmen Machinery Co., Ltd. delivers automated solutions targeting label and packaging sectors with precision engineering capabilities. The company focuses on integrating modern controls with traditional letterpress principles for commercial applications.

CROMA IBÉRICA specializes in European markets providing equipment and technical support for specialty printing operations. Their machines emphasize reliability and ease of maintenance supporting small to medium production environments.

Eidos S.p.A. maintains strong positioning in premium letterpress equipment featuring advanced automation and precision controls. The company serves commercial printers requiring high-quality output with operational efficiency for competitive production economics.

Ernst Reiner GmbH & Co. KG leverages German engineering expertise in developing compact and tabletop letterpress systems. Their product portfolio targets educational institutions, small studios, and entry-level markets seeking accessible letterpress technology.

Market participants generally concentrate on specific geographic regions or application segments rather than pursuing global market dominance. Technical innovation focuses on automation integration, precision control improvements, and hybrid system development.

Manufacturers increasingly collaborate with software developers creating digital workflow solutions compatible with traditional letterpress equipment. After-sales support and operator training services differentiate suppliers in markets where technical expertise remains critical for successful equipment operation and quality output achievement.

Key Companies

- Labelmen Machinery Co., Ltd.

- CROMA IBÉRICA

- Eidos S.p.A.

- Ernst Reiner GmbH & Co. KG

- HANWHA Machinery

- GTO

- Hemingstone Machinery

- Zhejiang Zhongte Machinery Technology Co., Ltd.

- Ruian Lilin Machinery Co., Ltd.

- Lingtie (Xiamen) Machinery Co., Ltd.

Recent Developments

- In October 2025, Taylor Corporation acquired Gooten, a leading print-on-demand technology and fulfillment provider. The acquisition combined Gooten’s OrderMesh platform with Taylor’s manufacturing network strengthening its position in the global print-on-demand market. This strategic move enables enhanced digital workflow integration supporting letterpress and specialty printing applications.

- In January 2025, RoyerComm and Prism Color Corp. merged to form RoyerComm Prism creating a combined commercial printing and packaging services company. The merger expanded operational footprint and capabilities across printing technologies including specialty finishing and premium packaging solutions. Integration enables comprehensive service offerings combining conventional and artisanal printing methods.

- In January 2025, Catapult Print announced a major investment in new printing machinery including new coater and rewind equipment. The investment expands production capacity and supports label printing growth at its Florida facilities. Enhanced equipment capabilities enable the company to serve increasing demand for premium label applications utilizing diverse finishing techniques.

Report Scope

Report Features Description Market Value (2024) USD 1.2 Billion Forecast Revenue (2034) USD 2.0 Billion CAGR (2025-2034) 5.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Press Type (Platen Press, Rotary Press, Cylinder Press, Hybrid Digital-Letterpress), By Automation Level (Automatic, Manual), By Substrate (Paper, Cardboard, Plastic Films, Metallic Foils and Laminates), By Application (Packaging and Labels, Security Printing, Commercial Printing, Specialty and Artisanal Printing) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Labelmen Machinery Co., Ltd., CROMA IBÉRICA, Eidos S.p.A., Ernst Reiner GmbH & Co. KG, HANWHA Machinery, GTO, Hemingstone Machinery, Zhejiang Zhongte Machinery Technology Co., Ltd., Ruian Lilin Machinery Co., Ltd., Lingtie (Xiamen) Machinery Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Letterpress Printing Machines MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Letterpress Printing Machines MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Labelmen Machinery Co., Ltd.

- CROMA IBÉRICA

- Eidos S.p.A.

- Ernst Reiner GmbH & Co. KG

- HANWHA Machinery

- GTO

- Hemingstone Machinery

- Zhejiang Zhongte Machinery Technology Co., Ltd.

- Ruian Lilin Machinery Co., Ltd.

- Lingtie (Xiamen) Machinery Co., Ltd.