Latin America Vacuum Pumps Market By Type (Gas Transfer Pumps (Positive Displacement Pumps (Rotary Pumps (Liquid Ring Pumps, Rotary Vane Pumps, Others), Reciprocating Pumps (Diaphragm Pumps, Piston Pumps, Punger Pumps)), Kinetic Pumps, (Drag Pumps, Fluid Entrainment Pumps, Ion Transfer Pumps)), Entrapment Pumps, (Cryopumps, Getter Pumps, Ion Pumps)), By Pressure (Range, Low (upto 5 mbar), Mid (5-10 mbar), High (above 10 mbar)), By Lubrication (Dry Vacuum, Wet Vacuum), By End Use Industry (Electronics & Semiconductors, Aerospace & Defense, Chemicals, Automotive, Healthcare, Food & Beverage, Industrial Manufacturing, Oil & Gas, Mining, Construction, Energy & Utilities, and Other End-use Industries), Country and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 165181

- Number of Pages: 325

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

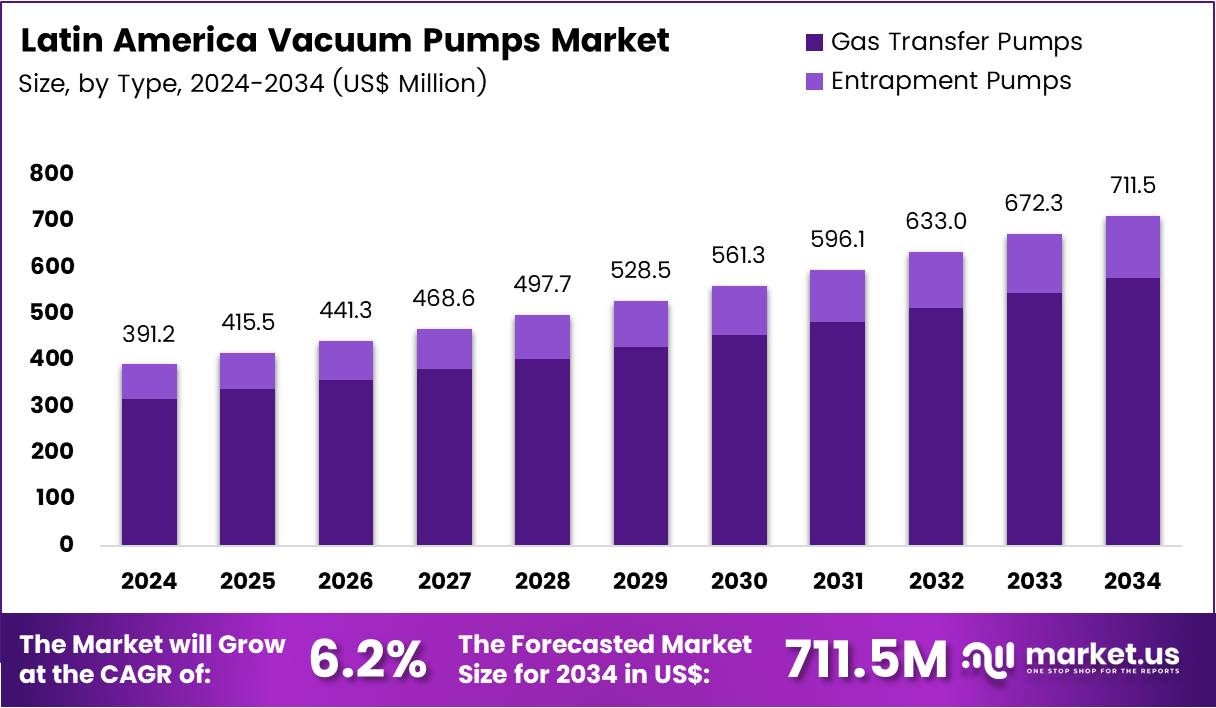

The Latin America Vacuum Pumps Market size is expected to be worth around US$ 711.54 Million by 2034 from US$ 391.23 Million in 2024, growing at a CAGR of 6.2% during the forecast period 2025 to 2034.

The Latin America vacuum pumps market is highly competitive, with prominent players such as Busch Group, Baker Hughes Company, Ebara Corporation, ANEST IWATA Corporation, GRAHAM CORPORATION, Ingersoll Rand, Pfeiffer Vacuum GmbH, Grundfos and Atlas Copco leading the landscape. These companies are strengthening their foothold in the region through strategic initiatives, including partnerships, acquisitions, and the establishment of local manufacturing and service facilities to enhance market reach and customer support.

Latin America Vacuum Pumps Market, Analysis, 2020-2024 (US$ Million)Latin America 2020 2021 2022 2023 2024 CAGR Revenue 261.43 303.77 346.89 368.39 391.23 6.2% Regional players are also adopting aggressive expansion strategies to compete effectively. The market’s competitive nature is fueled by innovation in energy-efficient and eco-friendly vacuum pump technologies. With rising demand from industries such as pharmaceuticals, automotive, and semiconductors, companies are increasingly focusing on offering advanced solutions tailored to diverse industrial needs. Investments in industrial automation are further driving competition as businesses seek to optimize processes.

For example, in April 2024, Busch do Brasil Ltda., a subsidiary of Busch SE, expanded its portfolio by taking over the distribution and service of Pfeiffer Vacuum products in Brazil. Former distributor Avaco will now act as an authorized local sales representative for Busch, underscoring the strategic partnerships that characterize the evolving market dynamics. This move highlights the emphasis on localized solutions to meet growing industry demands effectively.

In November 2024, Ebara Corporation acquired an 80% stake in Asanvil S.A., a Uruguayan pump sales company, through its Brazilian subsidiary, Ebara Bombas América do Sul (EBAS). Following the acquisition, Asanvil became a subsidiary of EBAS. Founded in 2012, Asanvil specializes in the assembly, sales, and after-sales service of standard pumps and related products.

The vacuum pump industry in Latin America is witnessing significant growth, driven by its increasing adoption across diverse industries such as food processing, pharmaceuticals, chemicals, mining, and environmental management. The region’s industrialization efforts, coupled with the rising demand for energy-efficient and sustainable technologies, are boosting the demand for vacuum pumps.

The Latin America Vacuum Pumps market is anticipated to grow at the CAGR of 6.2% over the forecast years 2024-2033 generating the market value of US$ 672.29 Million by the end of 2030. Key contributors to this growth include Brazil, Mexico, Chile, and Argentina, which have established themselves as industrial hubs in the region. Brazil’s real GDP grew by 2.9% in 2023 and is forecasted to increase by 2.8% in 2024, supported by strong consumer spending. Additionally, industrial production recorded a 1.1% growth in December 2023.

Key Takeaways

- The Latin America Vacuum Pumps Market was valued at USD 391.23 million in 2024 and is anticipated to register substantial growth of USD 711.54 million by 2034, with 6.2% CAGR.

- By Type, the market is bifurcated into Gas Transfer Pumps and Entrapment Pumps, with Gas Transfer Pumps taking the lead in 2024 with 81.2% market share.

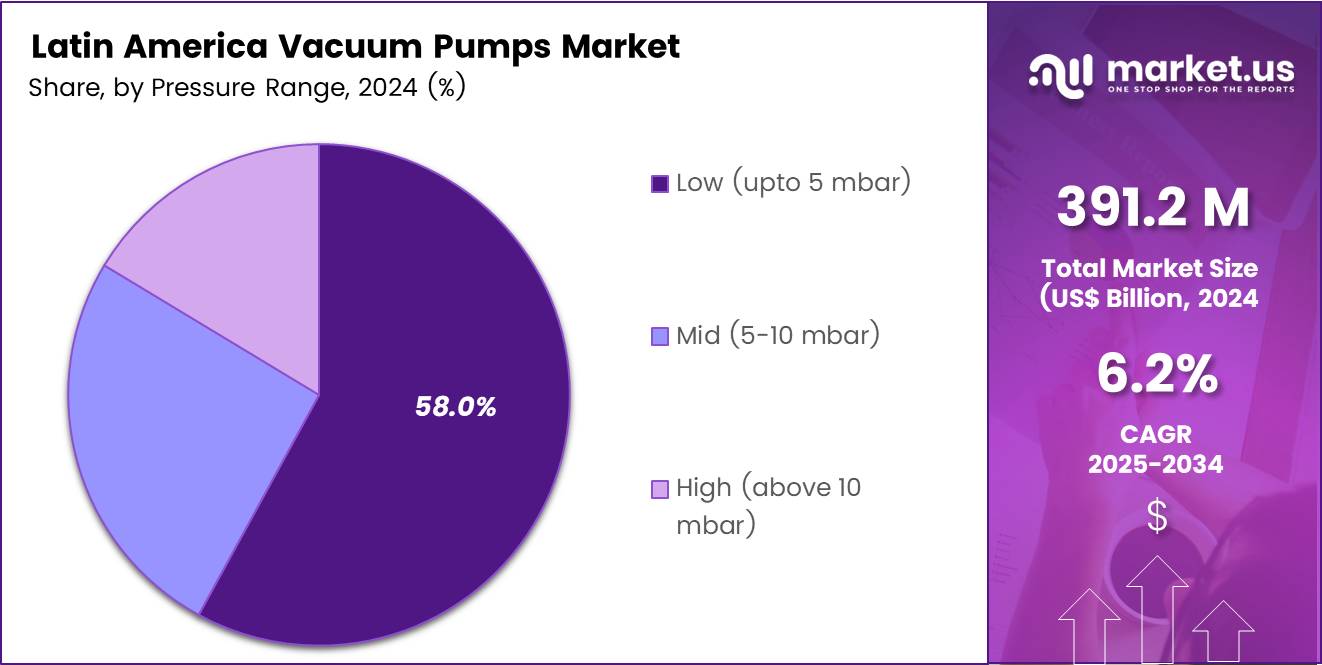

- Based on Pressure Range, the market is divided into Low (upto 5 mbar), Mid (5-10 mbar), and High (above 10 mbar), with Low (upto 5 mbar) leading with dominant market share of 58.0%

- By Lubrication, the market is divided into Dry Vacuum, and Wet Vacuum, with Dry Vacuum dominating the market with 63.0% market share.

- By End Use Industry, the market is classified into Electronics & Semiconductors, Aerospace & Defense, Chemicals, Automotive, Healthcare, Food & Beverage, Industrial Manufacturing, Oil & Gas, Mining, Construction, Energy & Utilities, and Other End-use Industries, with Industrial Manufacturing leading the market share with 20.4% in 2024.

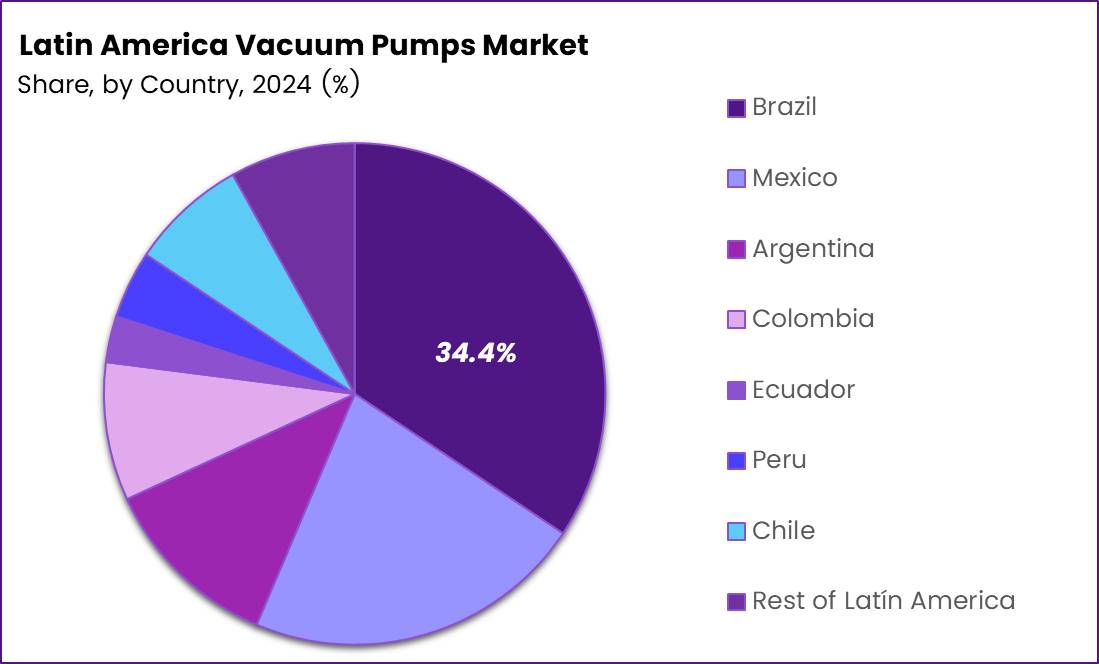

- Brazil maintained its leading position in the Latin America market with a share of over 34.4% of the total revenue.

By Type

Based on Therapy, Gas Transfer Pumps are the largest segment in the vacuum pump market in the Latin America region holding 81.2% share in 2024. The growth is fueled by rising adoption in diverse industries such as electronics, pharmaceuticals, automotive, chemical processing, etc.

The increasing focus on energy efficiency and advancements in vacuum pump technologies by key players are expected to further propel the growth of this segment. Gas Transfer Pumps can be categorized into Positive Displacement Pumps (Rotary and Reciprocating Pumps) and Kinetic Pumps, each catering to specific industrial applications.

Positive Displacement Pumps operate by trapping a fixed volume of gas and mechanically displacing it to create a vacuum. Within this category are Rotary Pumps and Reciprocating Pumps, both of which are integral to diverse applications.

Rotary Pumps include liquid ring pumps, rotary vane pumps, and other pumps. Liquid Ring Pumps are essential for handling vapor-laden gases and wet gas streams, making them popular in chemical processing and petrochemical applications. Their robust design enables them to handle harsh operating conditions. Recent innovations by Gardner Denver have enhanced energy efficiency and reduced water consumption, catering to industries prioritizing sustainability.

Latin America Vacuum Pumps Market, By Type, 2020-2024 (US$ Million)

By Type 2020 2021 2022 2023 2024 CAGR Gas Transfer Pumps 211.08 245.58 280.80 298.60 317.54 6.3% Positive Displacement Pumps 60.37 70.10 80.00 84.91 90.12 6.1% Rotary Pumps 41.13 47.83 54.66 58.10 61.75 6.3% Liquid Ring Pumps 13.88 16.22 18.64 19.91 21.27 6.8% Rotary Vane Pumps 21.29 24.73 28.22 29.96 31.80 6.1% Others 5.96 6.88 7.80 8.23 8.68 5.4% Reciprocating Pumps 19.24 22.28 25.34 26.81 28.37 5.8% Diaphragm Pumps 10.40 12.02 13.65 14.41 15.22 5.6% Piston Pumps 5.65 6.59 7.54 8.03 8.54 6.4% Punger Pumps 3.19 3.67 4.16 4.37 4.60 5.2% Kinetic Pumps 150.71 175.48 200.80 213.69 227.42 6.4% Drag Pumps 73.15 84.92 96.89 102.80 109.08 6.1% Fluid Entrainment Pumps 60.41 70.81 81.57 87.40 93.62 7.1% Ion Transfer Pumps 17.15 19.74 22.34 23.49 24.72 5.1% Entrapment Pumps 50.35 58.19 66.09 69.80 73.70 5.6% Cryopumps 31.26 35.98 40.69 42.81 45.00 5.1% Getter Pumps 14.10 16.44 18.84 20.09 21.39 6.5% Ion Pumps 5.00 5.77 6.55 6.90 7.30 5.7% Total 261.43 303.77 346.89 368.39 391.23 6.2% By Pressure Range Analysis

In 2024, in the Latin America Vacuum Pumps Market, the Low (upto 5 mbar) segment dominated, securing a market share of 58.0%. The low vacuum pressure range, particularly up to 5 mbar, plays a crucial role in specialized applications across sectors requiring higher precision in vacuum conditions. This range is commonly used in industries such as semiconductor manufacturing, medical device sterilization, and high-quality packaging.

In countries like Brazil and Mexico, the semiconductor sector uses vacuum pumps operating at pressures as low as 5 mbar to maintain cleanrooms and facilitate processes like thin-film deposition and etching, essential for producing electronic components. As Latin America’s electronics industry grows, driven by increasing demand for consumer electronics, this specific vacuum range is becoming increasingly important.

According to Presidency of the Republic, Brazil, by 2035, the private sector is expected to invest BRL 85.7 Billion (US$ 14.66 Billion) in infrastructure, machinery, research and development, and the establishment of new industrial plants.

Latin America Vacuum Pumps Market, By Pressure Range, 2020-2024 (US$ Million)

By Pressure Range 2020 2021 2022 2023 2024 CAGR Low (upto 5 mbar) 150.51 175.19 200.40 213.19 226.80 6.4% Mid (5-10 mbar) 67.30 78.14 89.17 94.63 100.43 6.1% High (above 10 mbar) 43.63 50.44 57.32 60.57 64.00 5.7% Total 261.43 303.77 346.89 368.39 391.23 6.2%

By Lubrication Analysis

Dry vacuum pumps dominated the market in 2024 with 63.0% share, growing from 2025 to 2034. Dry vacuum pumps, which operate without the need for lubrication in the pumping chamber, are increasingly gaining traction in Latin America’s vacuum pump market due to their efficiency, low maintenance, and eco-friendly characteristics. Unlike oil-sealed or wet pumps, dry vacuum pumps eliminate the risk of oil contamination, making them ideal for applications requiring clean and consistent vacuum levels.

Primary industries driving demand for dry vacuum pumps is electronics and semiconductors, where even trace amounts of contamination can compromise product integrity. Dry pumps provide the contamination-free environments needed for manufacturing sensitive components such as microchips and sensors, which are in growing demand as Latin America develops its technology infrastructure.

In the food and beverage sector, dry vacuum pumps are used in packaging and freeze-drying processes, where hygiene is paramount. For instance, vacuum-sealed packaging for perishable goods relies on these pumps to maintain product quality without the risk of oil residue. Similarly, pharmaceutical applications such as freeze-drying of vaccines and medicines benefit from the clean operation of dry vacuum pumps.

Latin America Vacuum Pumps Market, By Lubrication, 2020-2024 (US$ Million)

By Lubrication 2020 2021 2022 2023 2024 CAGR Dry Vacuum 163.19 190.03 217.47 231.46 246.34 6.4% Wet Vacuum 98.24 113.74 129.42 136.93 144.90 5.8% Total 261.43 303.77 346.89 368.39 391.23 6.2% By End Use Industry Analysis

In 2024, in the Latin America Vacuum Pumps Market, the Industrial Manufacturing segment dominated, securing a market share of 20.4%. Vacuum pumps are fundamental in processes such as material handling, drying, coating, and degassing, which are essential for industries like metalworking, plastics, textiles, and construction materials. These processes demand precise pressure control and reliable equipment, making vacuum pumps indispensable for maintaining consistent quality and operational efficiency.

In metalworking, vacuum pumps are used in vacuum furnaces for heat treatment processes such as annealing and brazing, ensuring uniform properties in metals. The plastics industry relies on vacuum pumps for processes like plastic extrusion and injection molding, where air removal is critical for achieving defect-free products. Similarly, in the production of high-quality ceramics and glass, vacuum pumps facilitate drying and coating, enhancing durability and performance.

Moreover, the adoption of energy-efficient vacuum pumps is growing as manufacturers aim to reduce energy costs and meet sustainability goals. This trend aligns with Latin America’s increasing focus on green industrial practices, making vacuum pumps crucial for industrial manufacturing advancements.

Latin America Vacuum Pumps Market, By End Use Industry, 2020-2024 (US$ Million)

By End Use Industry 2020 2021 2022 2023 2024 CAGR Electronics & Semiconductors 44.36 52.32 60.64 65.37 70.41 7.6% Aerospace & Defense 9.13 10.40 11.65 12.13 12.62 3.8% Chemicals 13.44 15.57 17.73 18.78 19.89 5.9% Automotive 22.46 25.95 29.46 31.10 32.83 5.5% Healthcare 30.78 35.98 41.33 44.16 47.17 6.8% Food & Beverage 21.96 25.78 29.76 31.94 34.27 7.3% Industrial Manufacturing 52.56 61.27 70.21 74.81 79.71 6.5% Oil & Gas 28.31 32.54 36.76 38.62 40.55 5.0% Mining 10.78 12.30 13.80 14.39 15.00 4.0% Construction 6.10 6.93 7.74 8.04 8.34 3.4% Energy & Utilities 11.61 13.30 14.97 15.67 16.39 4.5% Other End-use Industries 9.95 11.41 12.86 13.37 14.07 4.6% Total 261.43 303.77 346.89 368.39 391.23 6.2% Key Market Segments

By Therapy

- Gas Transfer Pumps

- Positive Displacement Pumps

- Rotary Pumps

- Liquid Ring Pumps

- Rotary Vane Pumps

- Others

- Reciprocating Pumps

- Diaphragm Pumps

- Piston Pumps

- Punger Pumps

- Kinetic Pumps

- Drag Pumps

- Fluid Entrainment Pumps

- Ion Transfer Pumps

- Entrapment Pumps

- Cryopumps

- Getter Pumps

- Ion Pumps

- Rotary Pumps

- Positive Displacement Pumps

By Pressure Range

- Low (upto 5 mbar)

- Mid (5-10 mbar)

- High (above 10 mbar)

By Lubrication

- Dry Vacuum

- Wet Vacuum

By End Use Industry

- Electronics & Semiconductors

- Aerospace & Defense

- Chemicals

- Automotive

- Healthcare

- Food & Beverage

- Industrial Manufacturing

- Oil & Gas

- Mining

- Construction

- Energy & Utilities

- Other End-use Industries

Drivers

Industrialization and Infrastructure Development

Industrialization and manufacturing growth in Latin America are significantly driving the demand for vacuum pumps. As industries like automotive, chemicals, pharmaceuticals, and food processing expand, the need for reliable and efficient vacuum technology increases. Vacuum pumps are essential in various processes such as packaging, material handling, and chemical processing, all of which are pivotal in modern manufacturing operations.

As per the data by United Nations Industrial Development Organization (UNIDO) 2023, the Latin America and the Caribbean (LAC) region covers 15% of the world’s land area but is home to only 8% of the global population. It contributes 6% to the global gross domestic product (GDP) and 5% to the world’s manufacturing value added (MVA).

In 2021, South America produced over half of the region’s MVA, while Central America contributed a third, and the Caribbean accounted for the remaining share. This implies that the region is still in its developing phase and continuously investing more and more into industrialization and expansion of manufacturing units.

The region’s rising industrial activities are being fueled by foreign investments, infrastructure development, and an expanding middle class. Countries like Brazil, Mexico, and Argentina are witnessing a boom in manufacturing activities, creating a robust demand for vacuum pumps, which are critical for maintaining product quality, efficiency, and sustainability in production.

Restraints

High Operational cost and energy requirements

Vacuum pumps, especially older or less efficient models, can consume large amounts of energy to maintain optimal suction or pressure levels in industrial processes. In industries like chemicals, pharmaceuticals, automotive, and food processing, where vacuum pumps are used continuously or in high-demand operations, energy costs can be a major burden. Latin America, like many emerging markets, often experiences fluctuations in energy prices or electricity supply, which can drive up operating costs for businesses.

The high upfront costs of purchasing and installing energy-efficient vacuum systems can be a significant barrier for businesses in Latin America, where capital investment in industrial equipment is sometimes limited by budget constraints.

For example, a common challenge in Chilean mining is the long distance from major power grids, requiring mines to rely on diesel generators or other energy sources, which are expensive and inefficient. The mining companies may face higher operational costs due to the need for reliable energy sources to run vacuum pumps, which can erode profitability, especially when copper prices fluctuate. This issue can also make it difficult for mining companies to adopt more energy-efficient vacuum pump systems, as the initial investment required for such systems might be prohibitive.

The combination of high energy requirements, expensive initial investments, and maintenance costs can serve as a major barrier to the adoption and growth of vacuum pumps in Latin America.

Growth Factors

Growth in Semiconductor and Electronics Manufacturing

Vacuum pumps are essential in semiconductor production for processes like etching, deposition, and cleaning, where high-purity environments are critical. As countries like Mexico and Brazil expand their electronics and semiconductor industries, driven by increased foreign investment and regional manufacturing hubs, demand for advanced vacuum pumps will rise.

Mexico is already a key player in electronics and semiconductor manufacturing, attracting global companies like Intel, Samsung, and Foxconn. These industries require high-precision vacuum pumps for cleanroom applications, vacuum sealing, and thin-film deposition, where contamination-free environments are crucial. The region’s high export rate of semiconductor and growing electronics production which includes consumer electronics, automotive electronics, and telecommunications, will further drive the need for specialized vacuum pumps.

For instance, as per the data by OEC, in 2022, Mexico exported semiconductor devices worth $682 million, ranking as the 19th largest exporter of these devices globally. In the same year, semiconductor devices were the 118th most exported product from Mexico. The primary destinations for Mexico’s semiconductor exports were the United States (US$471 million), Germany (US$44.4 million), Japan ($37.4 million), China ($19.1 million), and Singapore ($13.1 million).

The country is developing a program to support semiconductor manufacturers, akin to the US CHIPS Act, to increase local production of electronic components. This effort is part of a larger strategy to establish Mexico as a regional leader in advanced manufacturing, with Chihuahua in the north already excelling in electronics exports.

Emerging Trends

Integration with Automation and Industry 4.0

As industries in the region continue to modernize and adopt more efficient and cost-effective solutions, vacuum pumps—critical components in sectors like manufacturing, pharmaceuticals, food processing, and oil & gas—are increasingly being integrated with advanced automation systems and Industry 4.0 technologies. This trend is driving improvements in efficiency, productivity, and operational control, while also positioning companies for better competitiveness in the market.

As the region continuously advances in industrial development, there is a significant shift towards the adoption of cutting-edge technologies in vacuum pumps. This includes the implementation of advanced features listed below:

IoT-enabled vacuum pumps are becoming more common, with sensors embedded in pump systems that provide real-time data on key performance parameters such as pressure, temperature, flow rate, and vibration.

By leveraging data analytics and machine learning, vacuum pumps integrated with IoT can predict potential failures or maintenance needs before they occur. This is known as predictive maintenance.

SCADA systems are increasingly being used in conjunction with vacuum pump automation. SCADA allows for centralized control, data collection, and reporting, enabling operators to optimize the performance of vacuum pumps and make immediate adjustments to operating parameters as needed.

Country Analysis

Brazil is leading the Latin America Country in the Vacuum Pumps Market

The vacuum pumps market in Brazil is a crucial segment within the country’s industrial landscape, driven by the growing demand across various industries such as manufacturing, pharmaceuticals, food processing, chemicals, and automotive. Brazil’s industrial sector is expanding, particularly in manufacturing and infrastructure, which significantly boosts the need for vacuum pumps in applications like material handling, packaging, filtration, and air conditioning systems.

For instance, in September 2024, Brazil’s industrial production saw a year-on-year increase of 3.4%, building on an upwardly revised growth of 2.3% in August. From 1976 to 2024, the average annual growth rate for industrial production in Brazil was 1.70%. The sector reached an all-time high of 37.20% in April 1991 and a record low of -27.70% in April 1990.

The market is characterized by a mix of domestic and international players, with Brazilian companies manufacturing and distributing vacuum pumps, while imports also play a significant role. Leading manufacturers, including Busch, Pfeiffer Vacuum, and Edwards, have a strong presence in Brazil, contributing to technological advancements in the sector.

For example, in April 2024, Busch do Brasil Ltda., a wholly owned subsidiary of Busch SE, announced the expansion of its portfolio. The company is taking over the distribution and servicing of Pfeiffer Vacuum products in Brazil. Previously, Avaco, Pfeiffer Vacuum’s distributor in Brazil, will now serve as an authorized local sales representative for Busch.

Key Latin America Vacuum Pumps Company Insights

Key players in the Latin America Vacuum Pumps market includes Busch Group, Baker Hughes Company, Ebara Corporation, ANEST IWATA Corporation, GRAHAM CORPORATION, Ingersoll Rand, Pfeiffer Vacuum GmbH, Grundfos, Atlas Copco, and Other key players

Busch Group is established as a family-owned enterprise, Busch Group is one of the world’s largest manufacturers of vacuum pumps, vacuum systems, blowers and compressors, catering across industries such as chemicals, semiconductors, food and plastics with a service network of over 110 subsidiaries globally.

Baker Hughes is a US-based energy technology and industrial equipment provider operating in over 120 countries; its portfolio spans oilfield services & equipment and industrial & energy technology with offerings such as compressors, pumps, drilling systems and digital solutions geared towards energy transition and industrial efficiency.

Ebara Corporation is headquartered in Tokyo, Ebara Corporation develops and manufactures standard and custom pumps, compressors, vacuum systems, environmental treatment plants and precision machinery, servicing infrastructure, industrial, energy and electronics sectors.

Top Key Players in the Market

- Busch Group

- Baker Hughes Company

- Ebara Corporation

- ANEST IWATA Corporation

- GRAHAM CORPORATION

- Ingersoll Rand

- Pfeiffer Vacuum GmbH

- Grundfos

- Atlas Copco

- Other key players

Key Opinion Leaders:

Name & Title Comment Dr. Alejandro Torres, Industrial Process Engineer “Latin America’s vacuum pump sector is transitioning toward energy-efficient and low-maintenance systems as sustainability standards tighten. Companies are now prioritizing oil-free and dry vacuum technologies for chemical and food applications. Regional manufacturers collaborating with leaders like Busch and Ebara are expected to accelerate localized innovation and reduce dependency on imported components.” Mariana Duarte, Energy Technology Consultant “Industrial segment is seeing a strong pull from Brazil and Mexico’s refineries and LNG terminals, where reliable vacuum and compression systems are critical for process optimization. Despite inflationary pressures, long-term modernization programs in energy infrastructure are expected to sustain steady demand, particularly for durable, high-capacity vacuum solutions integrated with digital monitoring systems.” Eng. Rafael Moreno, Manufacturing Automation Specialist “Latin American factories are adopting smart manufacturing practices, which directly support the integration of connected vacuum pumps in automation lines. Ebara and Busch are strategically positioned to capitalize on this trend by offering smart sensors and predictive maintenance tools. The market’s growth, though steady, depends on political stability and continued investment in industrial digitization.” Recent Developments

- In November 2024, Busch Group acquired the AVT, which offers high-quality, durable spare parts and services for all established industrial furnace manufacturers in the field of atmosphere and vacuum technology. With the integration of the company, the Busch Group expands its position in the market for industrial vacuum solutions and opens new market opportunities.

- In November 2024, Ebara Corp. purchased 80% of the shares in Asanvil S.A.—a Uruguayan pump sales company—through its Brazilian subsidiary, Ebara Bombas América Do Sul (EBAS). Asanvil is now a subsidiary of EBAS. Established in 2012, Asanvil focuses on the assembly, sales, and after-sales service of standard pumps and additional products.

- In October 2023, Atlas Copco announced its next generation of dry claw vacuum pumps – the DZS A series. This new series sets a benchmark for performance, efficiency, and reliability.

Report Scope

Report Features Description Market Value (2024) USD 391.23 Million Forecast Revenue (2034) USD 711.54 Million CAGR (2025-2034) 6.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Gas Transfer Pumps (Positive Displacement Pumps (Rotary Pumps (Liquid Ring Pumps, Rotary Vane Pumps, Others), Reciprocating Pumps (Diaphragm Pumps, Piston Pumps, Punger Pumps)), Kinetic Pumps, (Drag Pumps, Fluid Entrainment Pumps, Ion Transfer Pumps)), Entrapment Pumps, (Cryopumps, Getter Pumps, Ion Pumps)), By Pressure (Range, Low (upto 5 mbar), Mid (5-10 mbar), High (above 10 mbar)), By Lubrication (Dry Vacuum, Wet Vacuum), By End Use Industry (Electronics & Semiconductors, Aerospace & Defense, Chemicals, Automotive, Healthcare, Food & Beverage, Industrial Manufacturing, Oil & Gas, Mining, Construction, Energy & Utilities, and Other End-use Industries) Competitive Landscape Busch Group, Baker Hughes Company, Ebara Corporation, ANEST IWATA Corporation, GRAHAM CORPORATION, Ingersoll Rand, Pfeiffer Vacuum GmbH, Grundfos, Atlas Copco, and Other key players Customization Scope Customization for segments will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Latin America Vacuum Pumps MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Latin America Vacuum Pumps MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Busch Group

- Baker Hughes Company

- Ebara Corporation

- ANEST IWATA Corporation

- GRAHAM CORPORATION

- Ingersoll Rand

- Pfeiffer Vacuum GmbH

- Grundfos

- Atlas Copco

- Other key players