Global Last Mile Drone Delivery Service Market By Capacity (Upto 5 lbs, 6-10 lbs, Above 10 lbs), By End-User (Healthcare, Retail, Food, Logistics), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: July 2024

- Report ID: 123874

- Number of Pages: 231

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

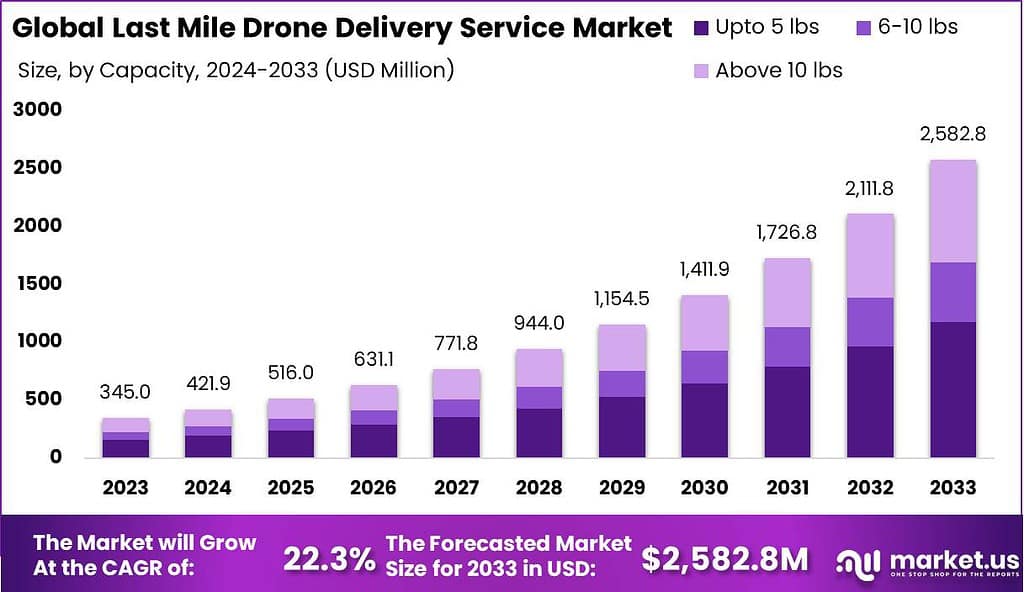

The Global Last Mile Drone Delivery Service Market size is expected to be worth around USD 2,582.8 Million By 2033, from USD 345.0 Million in 2023, growing at a CAGR of 22.3% during the forecast period from 2024 to 2033.

Last mile drone delivery service refers to the transportation of goods and packages from a distribution or fulfillment center directly to the final destination using drones. This innovative approach to logistics has gained significant attention in recent years and has the potential to revolutionize the way goods are delivered, particularly in urban areas. The last mile drone delivery service market encompasses the companies, technologies, and infrastructure involved in providing this service.

One of the key growth factors for the last mile drone delivery service market is the increasing demand for faster and more efficient delivery options. Traditional methods of last-mile delivery, such as trucks and vans, often face challenges like traffic congestion and limited parking spaces, which can result in delays and higher costs. Drones, on the other hand, can bypass these obstacles and deliver packages directly to the intended recipient, significantly reducing delivery times and improving customer satisfaction.

Another factor driving the market is the growth of e-commerce. As online shopping continues to gain popularity, there is a corresponding increase in the volume of packages that need to be delivered. Last mile drone delivery services can provide a cost-effective solution for handling the surge in e-commerce deliveries, especially for lightweight and time-sensitive items. Drones can navigate through urban landscapes more efficiently, avoiding traffic and reaching remote or congested areas that are challenging for traditional vehicles.

Furthermore, last mile drone delivery services offer opportunities for businesses to differentiate themselves and provide unique customer experiences. Companies that adopt this technology can showcase their commitment to innovation and sustainability, attracting environmentally conscious consumers. Additionally, drones can be utilized for specialized services, such as delivering medical supplies to remote locations or providing emergency response during natural disasters, where speed and accessibility are critical.

However, the last mile drone delivery service market also faces challenges that need to be addressed for widespread adoption. One significant challenge is the regulatory framework governing drone operations. The airspace regulations and safety standards for commercial drone operations vary across different countries and regions. Establishing clear guidelines and obtaining necessary approvals from aviation authorities are essential for the safe and legal operation of last mile delivery drones.

Another challenge is the technological limitations of drones, such as limited payload capacity and battery life. While drones are suitable for delivering small packages over short distances, their capabilities may be restricted when it comes to larger or heavier items. Overcoming these limitations through advancements in drone technology, including increased payload capacity and extended flight times, will be crucial for expanding the scope of last mile drone delivery services.

Key Takeaways

- The Global Last Mile Drone Delivery Service Market is anticipated to reach USD 2,582.8 million by 2033, up from USD 345.0 Million in 2023, representing a CAGR of 22.3% over the forecast period from 2024 to 2033.

- In 2023, the “Up to 5 lbs” segment held a dominant position in the market, capturing more than a 45.6% share.

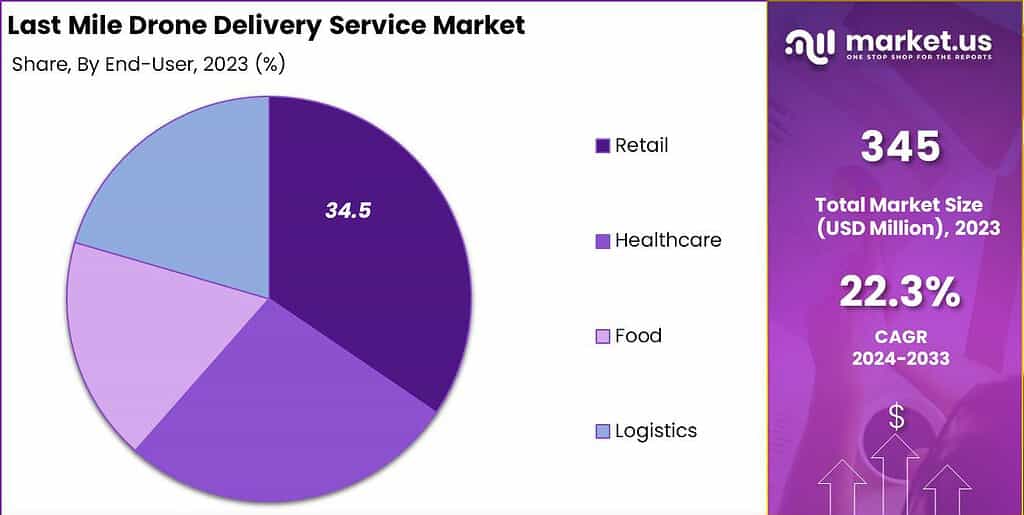

- The Retail segment also led the market in 2023, accounting for over 34.5% of the market share.

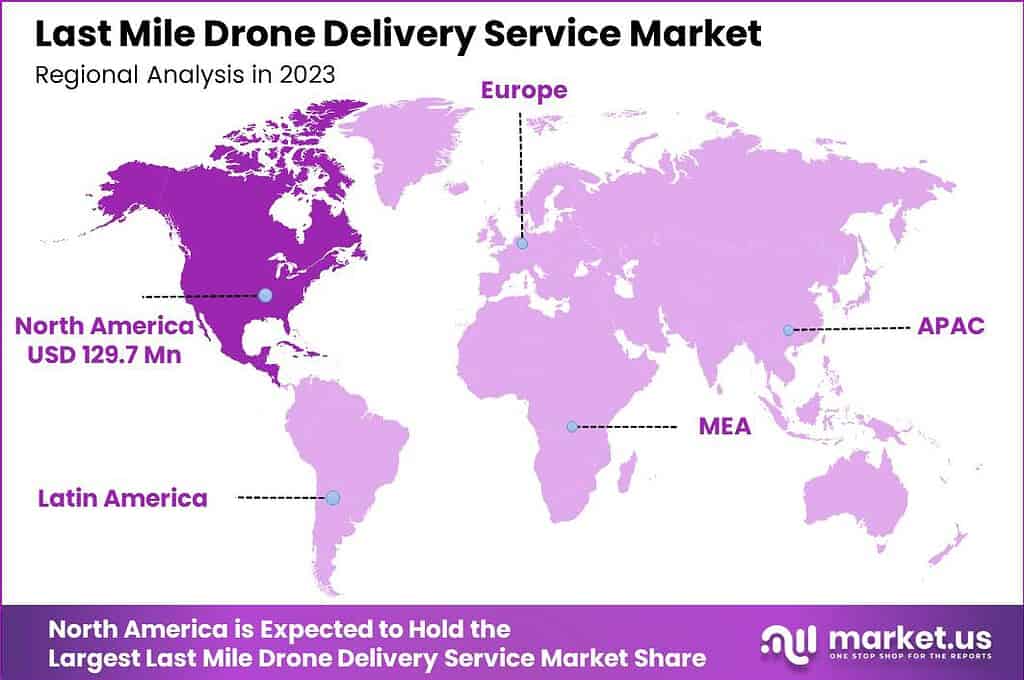

- Geographically, North America dominated the market in 2023, securing more than a 37.6% share with revenues amounting to USD 129.7 billion.

Capacity Analysis

In 2023, the “Up to 5 lbs” segment held a dominant market position in the Last Mile Drone Delivery Service Market, capturing more than a 45.6% share. This segment’s prominence is largely due to the high demand for rapid, efficient delivery of small packages, which are typically associated with e-commerce and medical supplies deliveries.

Drones capable of carrying up to 5 lbs are particularly valued for their cost-effectiveness and operational efficiency. These drones require less power and maintenance compared to their heavier counterparts, making them an ideal choice for frequent, short-range deliveries that form the bulk of last-mile delivery tasks. Additionally, regulatory environments across various regions have been more favorable towards lighter drones, which often fall under less stringent aviation guidelines.

This regulatory leniency has facilitated a wider adoption and deployment of up to 5 lbs drones in urban and suburban areas, where the volume of small package deliveries is continuously increasing. The scalability of using these lightweight drones also proves advantageous for businesses looking to expand their delivery networks without incurring substantial overheads.

Moreover, technological advancements in battery life and navigation systems have significantly enhanced the reliability and range of these lightweight drones, further consolidating their lead in the market. As these drones become smarter and more autonomous, they are able to handle a larger number of deliveries per day, driving efficiency and reducing operational costs for companies.

This segment’s growth is supported by the ongoing trend of consumers demanding faster delivery times, which these drones are well-equipped to meet, reinforcing their leading position in the Last Mile Drone Delivery Service Market.

End-User Analysis

In 2023, the Retail segment held a dominant market position in the Last Mile Drone Delivery Service Market, capturing more than a 34.5% share. This significant market share is primarily attributed to the surge in online shopping, which has escalated the demand for quick and efficient delivery solutions.

Retailers are increasingly adopting drone delivery services to enhance customer satisfaction by offering faster delivery times, which is crucial in a competitive market where delivery speed can be a key differentiator. Furthermore, the integration of drone deliveries helps retailers reduce logistical costs. Traditional delivery methods involving trucks and human labor are more expensive and less efficient for delivering small parcels over short distances.

Drones, on the other hand, offer a cost-effective solution by minimizing fuel costs and bypassing traffic congestion. This efficiency is particularly beneficial for urban areas where quick delivery times are often challenging yet highly demanded by consumers. The Retail segment’s leadership is also bolstered by advancements in drone technology, such as improved battery life, better payload capacities, and enhanced navigation and safety features.

These technological improvements make drones more reliable and capable of handling a variety of delivery tasks, thus broadening their application in the retail industry. As drones continue to evolve, their deployment in retail logistics is expected to expand, further cementing this segment’s position as a leader in the Last Mile Drone Delivery Service Market.

Key Market Segments

By Capacity

- Upto 5 lbs

- 6-10 lbs

- Above 10 lbs

By End-User

- Retail

- Healthcare

- Food

- Logistics

Driver

Expanding E-commerce and Technological Advancements

The Last Mile Drone Delivery Service Market is significantly driven by the rapid expansion of the e-commerce sector, which has escalated the demand for faster and more efficient delivery solutions. As online shopping becomes more prevalent, there is a heightened expectation for quick deliveries, which drones can facilitate by bypassing traditional road traffic and logistic bottlenecks.

Additionally, ongoing advancements in drone technology, such as improved battery life, enhanced payload capacities, and more sophisticated navigation systems, further propel this market. These technological improvements not only make drones more capable of handling various delivery tasks but also increase their operational efficiency and reliability, making them an increasingly viable option for businesses looking to optimize their delivery systems.

Restraint

Regulatory and Safety Challenges

Despite the promising growth trajectory, the Last Mile Drone Delivery Service Market faces significant restraints, primarily due to stringent regulatory challenges. Aviation authorities globally are tasked with the complex regulation of drones, which involves ensuring their safe integration into airspace and minimizing risks to both manned aircraft and the public. The necessity for comprehensive, standardized regulations, alongside effective air traffic management systems, poses a substantial hurdle.

Additionally, there are heightened concerns about privacy and security, as drones often utilize technologies like cameras and GPS, which could potentially lead to unauthorized data access or privacy invasions if not properly managed. These regulatory and safety concerns are pivotal in shaping the operational framework and acceptance of drone delivery services, thus restraining market growth.

Opportunity

Food and Beverage Delivery Innovations

One of the most lucrative opportunities in the Last Mile Drone Delivery Service Market lies in the food and beverage sector. The rising demand for fast, contactless delivery options, especially highlighted during the COVID-19 pandemic, has made drone delivery an attractive solution for restaurants and food service providers.

This sector’s specific needs for quick and safe delivery are well-aligned with the capabilities of drones, which can ensure that food items reach consumers promptly and in good condition. Innovations and investments in drone technology for food delivery are expected to continue, driven by both consumer demand and the potential for significant operational efficiencies.

Challenge

High Initial Costs and Infrastructure Requirements

Implementing drone delivery systems entails significant initial investments and infrastructure development, which can be a major challenge, especially for small to medium-sized enterprises. Establishing the necessary facilities for drone operations, such as launch and landing pads, as well as integrating these systems into existing logistical operations, requires substantial capital.

Moreover, the need for ongoing maintenance and updates to the drone fleets adds to the operational costs. These financial and infrastructural demands can act as a barrier to entry and may limit the adoption of drone delivery services, particularly in regions with less developed technological infrastructure.

Growth Factors

- E-commerce Expansion: The exponential growth of the e-commerce industry drives the need for more efficient delivery systems. Drones provide a speedy alternative to traditional delivery methods, helping businesses meet customer expectations for fast delivery times.

- Technological Advancements: Innovations in drone technology, including improved battery life, GPS accuracy, and load-carrying capacity, enhance the feasibility and efficiency of drone deliveries.

- Increased Consumer Demand for Quick Delivery: As consumer expectations for rapid delivery services rise, drones offer a viable solution by reducing delivery times and reaching areas where traditional vehicles may have limited access.

- Regulatory Progress: Changes in regulations that facilitate the broader use of drones for commercial deliveries can significantly propel market growth. As countries adapt their airspace regulations to accommodate drones, the potential for market expansion increases.

- Sustainability Initiatives: Drones present an environmentally friendly alternative to traditional delivery vehicles by reducing road traffic and associated emissions. Companies focusing on reducing their carbon footprint are increasingly considering drones as part of their logistics strategy.

Emerging Trends

- Integration with AI and Machine Learning: The incorporation of AI and machine learning technologies into drone operations enhances route optimization, delivery precision, and overall efficiency, setting a trend for future developments in the sector.

- Urban Air Mobility (UAM) Initiatives: Cities around the world are exploring UAM as a way to alleviate ground traffic congestion. Drones are a key component of this trend, providing insights into how aerial delivery services could be integrated into broader urban transportation networks.

- Customization and Personalization of Delivery Services: Drones offer the potential for highly personalized delivery services, such as the immediate delivery of medical supplies or quick-response consumer goods delivery, which are becoming increasingly popular.

- Partnerships with Food and Beverage Industries: There is a growing trend of partnerships between drone delivery services and the food and beverage industry to facilitate quick-service restaurant deliveries and other perishable goods, showcasing a promising area of expansion.

- Advanced Deployment in Rural and Remote Areas: Drones are increasingly being seen as a solution for delivering goods to remote and underserved regions, where traditional delivery services may not be economically viable. This trend is expanding the reach of e-commerce and other services into new markets.

Regional Analysis

In 2023, North America held a dominant market position in the Last Mile Drone Delivery Service market, capturing more than a 37.6% share with revenues amounting to USD 129.7 billion. This region’s leadership is underpinned by its advanced technological infrastructure and the presence of major drone manufacturers and technology companies, which are pivotal in driving innovation and adoption of drone delivery services.

The region’s robust regulatory framework, which is progressively adapting to accommodate new drone technologies, also supports the expansion of drone delivery services. North America benefits from high consumer readiness to adopt new technologies, including drone delivery, which is seen as a next-step innovation in the logistics and retail sectors.

The integration of drones into commercial delivery systems in this region has been accelerated by the increasing need for swift and flexible delivery solutions, particularly in vast urban areas where traffic congestion can delay traditional delivery methods. Moreover, significant investments from venture capitalists and leading tech companies into drone delivery startups have propelled the development and operational scaling of these services.

The growth in North America is further buoyed by ongoing partnerships between drone delivery companies and state governments to pilot and refine these services in multiple U.S. states. These initiatives are expected to generate substantial data, helping to optimize routes, increase safety, and improve service reliability across the region. As these efforts continue, North America is likely to maintain its lead in the global Last Mile Drone Delivery Service market, driven by technological advancements, supportive policies, and strong market demand.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The last mile drone delivery service market is experiencing rapid growth, driven by key players who are pioneering innovations and expanding their reach. Amazon Prime Air is a significant player, leveraging its vast logistics network and technological expertise to streamline drone deliveries, promising rapid and efficient service. Wing, a subsidiary of Alphabet Inc., has been instrumental in developing autonomous drone technology, focusing on regulatory compliance and safety.

Zipline has carved out a niche by delivering medical supplies in remote areas, showcasing the potential of drone deliveries in critical and time-sensitive scenarios. DHL Parcelcopter is another key player, utilizing its extensive logistics infrastructure to integrate drone technology into its delivery services, improving efficiency in hard-to-reach locations.

Matternet focuses on urban drone deliveries, partnering with healthcare systems to transport medical samples and supplies swiftly. Rakuten Drone, part of the Japanese e-commerce giant Rakuten, is advancing in the market by offering drone delivery services in densely populated urban environments, emphasizing quick and reliable service.

Antwork is making strides in the Asian market, particularly in China, by providing drone delivery solutions that cater to various industries. Aergility and Aerialoop are emerging players, pushing the boundaries of drone technology with innovative solutions for last-mile delivery.

Aerit is focusing on sustainable and efficient delivery solutions, aiming to reduce the environmental impact of traditional delivery methods. Dove Air is another key player, emphasizing precision and reliability in its drone delivery services.

Top Key Players in the Market

- Aergility

- Aerialoop

- Aerit

- Antwork

- DHL Parcelcopter

- Dove Air

- Zipline

- Matternet

- Rakuten Drone

- Amazon Prime Air

- Wing

Recent Developments

- In 2023, Amazon Prime Air expanded its drone delivery services to deliver medications via Amazon Pharmacy in College Station, Texas. Customers can receive their medications within 60 minutes of ordering. Additionally, Amazon announced its new drone design, the MK30, which will launch in 2024 and features enhanced capabilities and reduced noise.

- Zipline has been expanding its operations and now serves eight countries. In 2023, it was reported that Zipline’s drones have flown over 64 million miles, delivering nearly 10 million items, mainly focusing on medical supplies. The company aims to provide faster and more sustainable delivery solutions.

- April 2023: Wing expanded its operations, partnering with Walmart to increase drone delivery services in the Dallas-Fort Worth area. They introduced larger drones for heavier deliveries.

- June 2023: Antwork improved their drone technology to handle increased delivery volumes in China. They collaborated with local businesses to integrate drone deliveries into their logistics chains.

Report Scope

Report Features Description Market Value (2023) USD 345.0 Mn Forecast Revenue (2033) USD 2,582.8 Mn CAGR (2024-2033) 22.3% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Capacity (Upto 5 lbs, 6-10 lbs, Above 10 lbs), By End-User (Healthcare, Retail, Food, Logistics) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Aergility, Aerialoop, Aerit, Antwork, DHL Parcelcopter, Dove Air, Zipline, Matternet, Rakuten Drone, Amazon Prime Air, Wing Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is last mile drone delivery?Last mile drone delivery refers to the use of unmanned aerial vehicles (drones) to transport goods and packages from a distribution center to the final delivery destination, typically a customer's home or business.

How big is Last Mile Drone Delivery Service Market?The Global Last Mile Drone Delivery Service Market size is expected to be worth around USD 2,582.8 Million By 2033, from USD 345.0 Billion in 2023, growing at a CAGR of 22.3% during the forecast period from 2024 to 2033.

What are the key factors driving the growth of the Last Mile Drone Delivery Service Market?Increased e-commerce demand, need for faster delivery, advancements in drone technology, and cost efficiency.

What are the current trends and advancements in the Last Mile Drone Delivery Service Market?Integration of AI and machine learning, use of autonomous drones, expansion of delivery networks, and regulatory advancements.

What are the major challenges and opportunities in the Last Mile Drone Delivery Service Market?Challenges include regulatory hurdles, safety concerns, and technological limitations. Opportunities lie in improving logistics efficiency, reducing delivery costs, and expanding into rural areas.

Who are the leading players in the Last Mile Drone Delivery Service Market?Leading players include Aergility, Aerialoop, Aerit, Antwork, DHL Parcelcopter, Dove Air, Zipline, Matternet, Rakuten Drone, Amazon Prime Air, Wing

Last-Mile Drone Delivery Service MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample

Last-Mile Drone Delivery Service MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Aergility

- Aerialoop

- Aerit

- Antwork

- DHL Parcelcopter

- Dove Air

- Zipline

- Matternet

- Rakuten Drone

- Amazon Prime Air

- Wing