Global Lable Printing Machine Market Size, Share, Growth Analysis By Technology (Digital Label Printing Machines, Analog / Conventional Label Printing Machines), By Printing Method (Roll-to-Roll Printing, Sheet-Fed Printing, In-Line Printing, Off-Line Printing), By Substrate Material (Paper, Plastic Films [Polyethylene (PE) Films, Polypropylene (PP) Films, Polyvinyl Chloride (PVC) Films, Polyester (PET) Films], Fabric & Textile, Others), By Ink Type (UV-Curable Inks, Water-Based Inks, Solvent-Based Inks, Others), By Application (Food & Beverages, Pharmaceuticals & Healthcare, Personal Care & Cosmetics, Chemical & Industrial Goods, Automotive, Logistics & Packaging, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 175621

- Number of Pages: 378

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

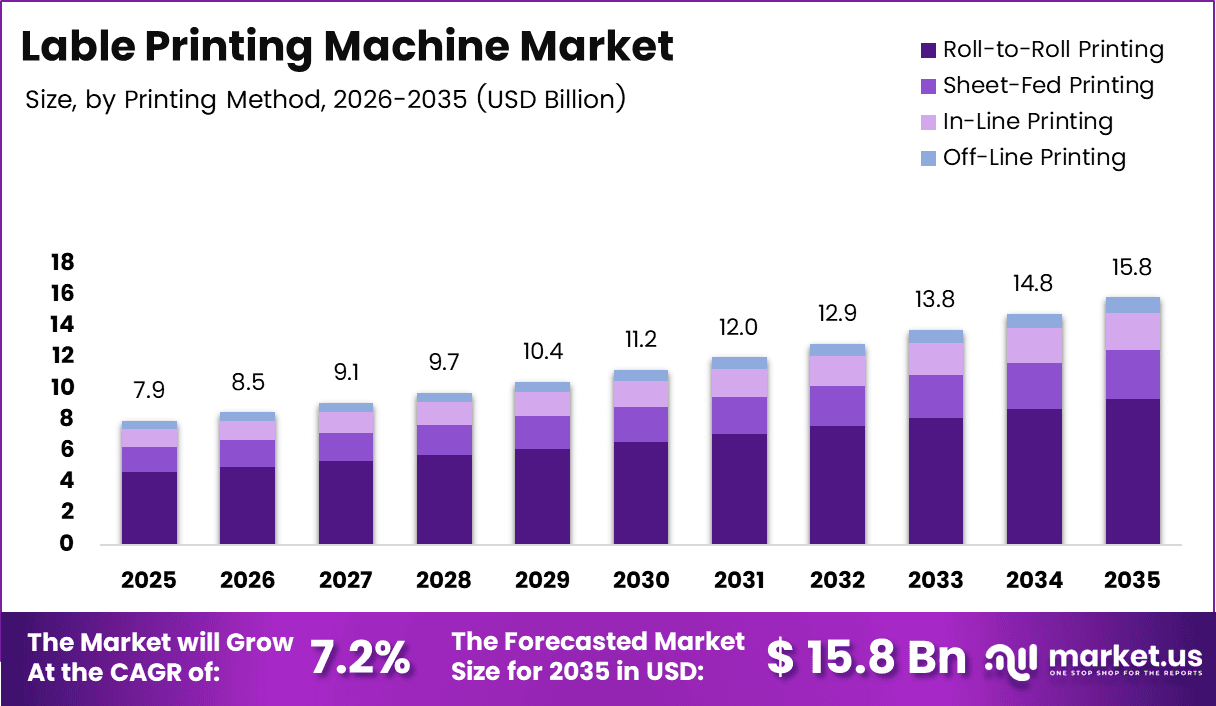

The Global Lable Printing Machine Market size is expected to be worth around USD 15.8 billion by 2035, from USD 7.9 billion in 2025, growing at a CAGR of 7.2% during the forecast period from 2026 to 2035.

The Global Label Printing Machine Market refers to equipment enabling high-quality label production across packaging, logistics, retail, and industrial applications. It includes digital and conventional systems supporting diverse substrates, inks, and formats. This market underpins product identification, regulatory compliance, branding efficiency, and traceability across global supply chains.

From an analyst viewpoint, a Global Label Printing Machine represents a capital-intensive asset enabling speed, precision, and customization. These machines increasingly support short runs, variable data, and smart labeling requirements. Consequently, manufacturers prioritize automation readiness, workflow integration, and cost efficiency to enhance buyer return on investment.

The market continues growing steadily, driven by packaged goods expansion and e-commerce logistics acceleration. Moreover, rising demand for sustainable packaging encourages adoption of efficient digital label printing machines. Governments further influence growth by enforcing labeling regulations related to food safety, pharmaceuticals, chemicals, and environmental disclosures worldwide.

In parallel, growth opportunities emerge from emerging economies investing in domestic manufacturing and organized retail infrastructure. Additionally, government incentives supporting smart factories and Industry 4.0 adoption indirectly boost advanced label printing machine demand. As a result, suppliers focus on scalable, modular machines suited for small and mid-sized enterprises.

Regulatory frameworks increasingly mandate traceability, multilingual labeling, and durable print quality. Therefore, compliance requirements accelerate replacement cycles for outdated equipment. Meanwhile, low operating costs and energy-efficient printing technologies improve total cost ownership, strengthening transactional intent among commercial buyers evaluating long-term investments.

According to manufacturer disclosures, the CHEETAH series leverages dry toner technology delivering speeds up to 30 meters per minute. Similarly, the PANTHER series, using UV inkjet systems, achieves speeds up to 70 meters per minute, supporting wide-format printing up to 508 millimeters for high-volume production environments.

According to product testing sources, the Brother QL-800 is recognized for paper label reliability through extensive hands-on evaluations. Additionally, according to manufacturer specifications, VALEZUS T2200 processes 320 images per minute with 8,000 sheet capacity, while VALEZUS T1200 delivers 160 ppm, supporting AFP, IPDS, PS, and PDF workflows with low operating costs.

Key Takeaways

- The Global Label Printing Machine Market is projected to grow from USD 7.9 billion in 2025 to USD 15.8 billion by 2035, registering a 7.2% CAGR.

- Digital Label Printing Machines dominate the technology segment with a market share of 75.2%, driven by flexibility and short-run efficiency.

- Roll-to-Roll Printing leads the printing method segment, accounting for 58.9% of the total market due to continuous high-speed production.

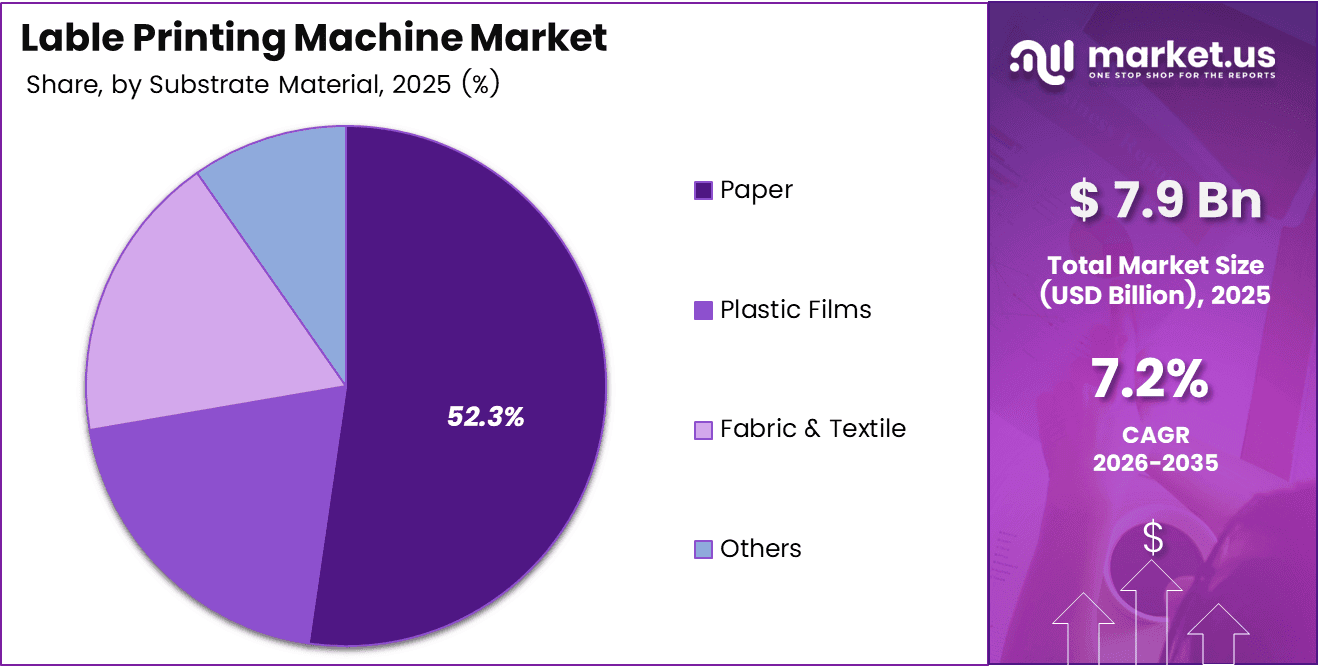

- Paper remains the largest substrate material segment with a share of 52.3%, supported by cost efficiency and recyclability.

- UV-Curable Inks represent the leading ink type segment, holding 44.7% of the market due to fast curing and durability.

- Food & Beverages is the largest application segment, contributing 34.4% of overall market demand.

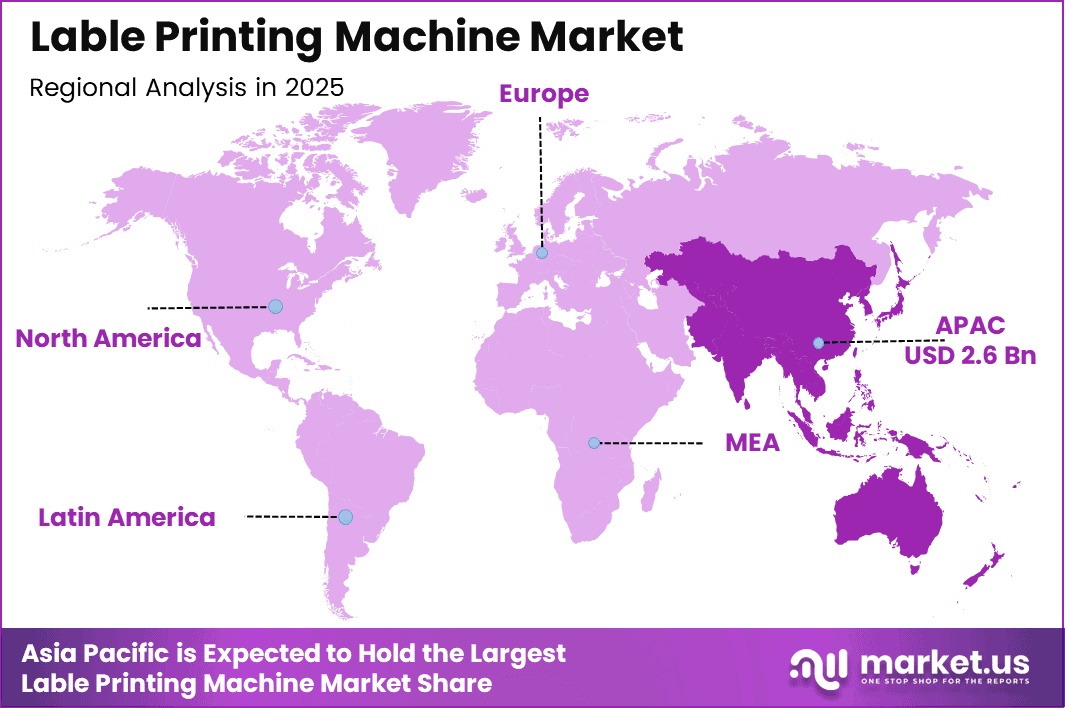

- Asia Pacific is the dominating region with a market share of 33.4%, valued at USD 2.6 billion in 2025.

Technology Analysis

Digital Label Printing Machines dominate with 75.2% due to flexibility, speed, and customization capabilities.

In 2025, Digital Label Printing Machines held a dominant 75.2% share in the technology segment of the global label printing machine market. These systems support short-run production, variable data printing, and quick changeovers, enabling faster response to changing brand requirements. Increasing demand for customized, on-demand, and small-batch packaging continues to accelerate digital technology adoption.

Analog or conventional label printing machines continue to serve long, high-volume production runs where cost efficiency is critical. These machines remain suitable for standardized labels with stable demand patterns. However, limited flexibility, longer setup times, and reduced adaptability constrain their use in dynamic manufacturing environments.

Printing Method Analysis

Roll-to-Roll Printing dominates with 58.9% owing to continuous production efficiency.

In 2025, Roll-to-Roll Printing accounted for a leading 58.9% share in the printing method segment. This method enables uninterrupted, high-speed label production while minimizing material waste. Its efficiency and scalability make it the preferred choice for large-volume and cost-sensitive label manufacturing operations.

Sheet-Fed Printing is primarily adopted for specialty labels and lower-volume applications requiring higher substrate thickness and printing precision. While it offers flexibility for customized formats, lower operating speeds limit its competitiveness in mass-production scenarios.

In-Line Printing improves operational efficiency by integrating printing and finishing processes into a single workflow. This reduces manual handling and shortens turnaround times. However, higher system complexity and upfront costs can act as limiting factors for smaller production facilities.

Off-Line Printing separates printing and finishing stages to provide greater operational flexibility. This approach supports diverse production requirements and customization. However, it increases labor dependency and overall processing time.

Substrate Material Analysis

Paper dominates with 52.3% due to cost efficiency and recyclability.

In 2025, paper accounted for a dominant 52.3% share in the substrate material segment. It is widely used across food, retail, and logistics industries due to its affordability, print clarity, and environmental acceptance. Continued emphasis on sustainable packaging further supports paper label demand.

Plastic films are valued for their durability, moisture resistance, and performance reliability in challenging environments. These materials are commonly used in industrial, chemical, and personal care labeling applications. Demand continues to rise alongside the growth of performance-driven packaging solutions.

Fabric labels are primarily used in textile, apparel, and footwear industries where softness and durability are essential. They support wash resistance, long-term readability, and brand identification. Growing demand for branded garments continues to support steady adoption of fabric-based labeling solutions.

Other substrate materials are applied in niche and specialized labeling applications requiring unique performance characteristics. These include metallic foils, composite materials, and specialty coatings used for security, promotional, or industrial labels. Demand remains limited but stable due to specific end-use requirements.

Ink Type Analysis

UV-Curable Inks dominate with 44.7% due to fast curing and durability.

In 2025, UV-curable inks held a dominant 44.7% share in the ink type segment. These inks enable instant curing, strong adhesion, and consistent print quality across multiple substrates. Their ability to support high-speed production makes them highly suitable for modern label printing operations.

Water-based inks are gaining traction due to low emissions and compliance with environmental regulations. They are increasingly used in food and pharmaceutical labeling applications where safety is critical. Sustainability initiatives continue to encourage their adoption.

Solvent-based inks provide durability and resistance for outdoor and industrial labels. However, stricter environmental regulations limit wider usage. Other ink types support specialty and niche printing requirements.

Application Analysis

Food & Beverages dominate with 34.4% driven by regulatory and branding needs.

In 2025, Food & Beverages held a leading 34.4% share in the application segment. High product turnover, strict regulatory requirements, and strong branding needs drive continuous demand for advanced label printing solutions. Labels play a critical role in compliance, traceability, and consumer engagement.

Pharmaceuticals and healthcare applications rely heavily on precise and compliant labeling to ensure safety and traceability. Demand remains stable due to regulatory enforcement and quality standards. Accuracy, reliability, and consistency are key purchasing considerations in this segment.

Personal care and cosmetics emphasize premium design and visual differentiation to attract consumers. Chemical, automotive, logistics, and other industrial sectors prioritize durability and functional labeling. These industries collectively contribute to steady and diversified market growth.

Key Market Segments

By Technology

- Digital Label Printing Machines

- Analog / Conventional Label Printing Machines

By Printing Method

- Roll-to-Roll Printing

- Sheet-Fed Printing

- In-Line Printing

- Off-Line Printing

By Substrate Material

- Paper

- Plastic Films

- Polyethylene (PE) Films

- Polypropylene (PP) Films

- Polyvinyl Chloride (PVC) Films

- Polyester (PET) Films

- Fabric & Textile

- Others

By Ink Type

- UV-Curable Inks

- Water-Based Inks

- Solvent-Based Inks

- Others

By Application

- Food & Beverages

- Pharmaceuticals & Healthcare

- Personal Care & Cosmetics

- Chemical &Industrial Goods

- Automotive

- Logistics &Packaging

- Others

Drivers

Rising Demand for High-Speed, High-Precision Labeling Drives Market Growth

The Global Label Printing Machine Market is strongly driven by rising demand for high-speed and high-precision labeling in FMCG and packaging industries. Companies increasingly require fast production to meet short product life cycles. As a result, advanced label printing machines help improve efficiency and reduce turnaround time.

Expanding regulatory requirements for product traceability and compliance labeling further support market growth. Governments mandate clear labeling for food safety, pharmaceuticals, and chemicals. Therefore, manufacturers invest in reliable label printing machines to ensure accuracy, consistency, and legal compliance across different markets.

Moreover, increasing adoption of short-run and on-demand label printing boosts demand. Brand owners prefer flexibility to launch limited editions and seasonal products. Digital label printing machines support this shift by reducing waste and setup costs, improving operational responsiveness.

Additionally, the growth of private label brands fuels demand for customized labeling solutions. Retailers seek unique designs and frequent updates. Consequently, flexible label printing machines become essential tools for brand differentiation and cost control.

Restraints

High Capital Costs Limit Adoption of Advanced Label Printing Machines

Despite growth, the Global Label Printing Machine Market faces restraints due to high initial capital investment. Advanced digital and hybrid machines require significant upfront spending. Small and medium enterprises often delay purchases, limiting market penetration in cost-sensitive regions.

Maintenance expenses further restrict adoption. Regular servicing, spare parts, and software upgrades increase long-term ownership costs. As a result, buyers carefully evaluate return on investment before upgrading existing equipment.

Another major restraint is the shortage of skilled operators. Digital and hybrid label printing technologies demand technical expertise. Limited availability of trained professionals slows implementation and increases operational risks.

Therefore, companies must invest in training programs. However, this adds to operational costs, discouraging smaller firms from adopting advanced label printing solutions.

Growth Factors

Expansion of Sustainable Label Printing Creates New Growth Opportunities

The market offers strong growth opportunities through sustainable and eco-friendly label printing technologies. Increasing use of recyclable materials aligns with environmental regulations. Consequently, demand rises for machines compatible with water-based inks and sustainable substrates.

Untapped demand in emerging manufacturing economies presents another opportunity. Rapid industrialization and organized retail growth increase labeling needs. Advanced label printing machines help local manufacturers meet global quality standards.

Integration of smart labeling capabilities, including RFID and NFC printing, also drives opportunity. These technologies support tracking, authentication, and inventory management across supply chains.

Additionally, rising demand for personalized and variable data printing supports marketing-driven applications. Brands increasingly use customized labels to enhance customer engagement and campaign effectiveness.

Emerging Trends

Rapid Shift Toward Digital and Automated Label Printing Technologies

One major trend is the rapid shift from conventional printing to digital and hybrid label printing systems. These systems offer flexibility, faster changeovers, and reduced material waste. As a result, adoption continues accelerating.

Automation and AI-enabled workflow management are increasingly used in label printing. These technologies improve job scheduling, quality control, and productivity while reducing human errors.

The growing popularity of water-based inks and low-VOC printing technologies reflects environmental concerns. Companies prioritize sustainable operations to meet regulatory and consumer expectations.

Furthermore, adoption of compact and modular label printing machines is rising. Space-constrained facilities prefer flexible layouts, supporting efficient production without large infrastructure investments.

Regional Analysis

Asia Pacific Dominates the Global Label Printing Machine Market with a Market Share of 33.4%, Valued at USD 2.6 Billion

Asia Pacific leads the Global Label Printing Machine Market due to rapid industrialization and expanding packaging demand. In 2025, the region accounted for 33.4% of the global market, valued at USD 2.6 billion. Strong growth in FMCG logistics, pharmaceuticals, and e-commerce drives consistent equipment investments. Moreover, rising manufacturing capacity across developing economies supports sustained demand.

North America Label Printing Machine Market Trends

North America shows steady growth supported by advanced packaging standards and strict labeling regulations. High adoption of digital printing technologies improves operational efficiency. Additionally, demand for sustainable packaging solutions encourages upgrades to energy-efficient and compliant label printing machines across food and healthcare sectors.

Europe Label Printing Machine Market Trends

Europe benefits from strong regulatory frameworks focused on product safety and traceability. Manufacturers prioritize precision labeling and eco-friendly printing solutions. Furthermore, technological advancements and automation adoption support replacement demand, especially within established packaging and industrial goods markets.

Middle East and Africa Label Printing Machine Market Trends

The Middle East and Africa region experiences gradual growth driven by expanding retail and logistics sectors. Increasing investment in food processing and pharmaceutical manufacturing supports labeling needs. However, market expansion remains moderate due to infrastructure and capital investment limitations.

Latin America Label Printing Machine Market Trends

Latin America demonstrates emerging growth supported by improving industrial output and organized retail development. Demand for cost-effective and flexible labeling solutions rises across consumer goods and logistics. Additionally, regulatory alignment with international labeling standards encourages gradual technology adoption.

U.S. Label Printing Machine Market Trends

The U.S. market remains technology-driven, focusing on digital and automated label printing solutions. High demand for customized and short-run labels supports advanced equipment adoption. Regulatory compliance and sustainability initiatives further influence purchasing decisions across end-use industries.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Global Lable Printing Machine Company Insights

From an analyst perspective, the Global Label Printing Machine Market in 2025 is shaped by technology leadership, operational flexibility, and strong customer alignment. Key players increasingly focus on digital transformation, sustainability, and automation to address evolving packaging requirements across FMCG, pharmaceuticals, and logistics sectors.

Mark Andy, Inc. continues to demonstrate strong market positioning through its focus on modular and flexible label printing platforms. The company benefits from serving both small converters and large-scale producers. Its emphasis on productivity improvement and workflow efficiency supports consistent adoption across mature and emerging markets.

OMET Srl maintains relevance by addressing demand for high-performance and precision-driven label printing solutions. The company’s approach aligns with growing needs for premium labeling and shorter production cycles. As brand owners prioritize quality and speed, OMET’s technology orientation strengthens its competitive standing.

Nilpeter A/S plays a strategic role in supporting hybrid and digital label printing transitions. The company’s solutions are well-suited for converters seeking adaptability without sacrificing print quality. Its focus on automation readiness and reduced setup time reflects broader market demand for operational efficiency.

Bobst Group SA remains influential due to its strong engineering expertise and integrated printing and converting capabilities. The company addresses complex labeling requirements across diverse end-use industries. Its commitment to innovation and smart manufacturing supports long-term value creation in the label printing ecosystem.

Overall, these players collectively shape market direction through technology advancement, customer-centric solutions, and continuous innovation. Their strategies reflect broader industry trends toward digitalization, compliance-driven labeling, and sustainable production practices, reinforcing steady market expansion through 2025.

Top Key Players in the Market

- Mark Andy, Inc.

- OMET Srl

- Nilpeter A/S

- Bobst Group SA

- HP Inc.

- Xeikon NV

- Domino Printing Sciences plc

- Durst Phototechnik AG

- Konica Minolta, Inc.

- Seiko Epson Corporation

- Screen Holdings Co. Ltd.

- Fujifilm Holdings Corporation

- Canon Inc.

- Heidelberg Druckmaschinen AG

- Koenig & Bauer AG

- Other Key Players

Recent Developments

- In December 2025, Inovar Packaging Group acquired Enterprise Marking Products (EMP), a flexographic label printing specialist based in Fishers, Indiana, USA. In date, this acquisition strengthens Inovar’s Midwest presence and expands its capabilities in durable and industrial label printing solutions.

- In September 2025, Bar Graphic Machinery (BGM), following its acquisition by Duplo in August 2025, announced the appointment of a new Managing Director. In date, this leadership change reflects a strategic focus on operational alignment and future growth under Duplo’s ownership.

Report Scope

Report Features Description Market Value (2025) USD 7.9 billion Forecast Revenue (2035) USD 15.8 billion CAGR (2026-2035) 7.2% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology (Digital Label Printing Machines, Analog / Conventional Label Printing Machines),By Printing Method (Roll-to-Roll Printing, Sheet-Fed Printing, In-Line Printing, Off-Line Printing), By Substrate Material (Paper, Plastic Films, [Polyethylene (PE) Films, Polypropylene (PP) Films, Polyvinyl Chloride (PVC) Films, Polyester (PET) Films], Fabric & Textile, Others),

By Ink Type (UV-Curable Inks, Water-Based Inks, Solvent-Based Inks, Others), By Application (Food & Beverages, Pharmaceuticals & Healthcare, Personal Care & Cosmetics, Chemical & Industrial Goods, Automotive, Logistics & Packaging, Others)Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Mark Andy, Inc., OMET Srl, Nilpeter A/S, Bobst Group SA, HP Inc., Xeikon NV, Domino Printing Sciences plc, Durst Phototechnik AG, Konica Minolta, Inc., Seiko Epson Corporation, Screen Holdings Co. Ltd., Fujifilm Holdings Corporation, Canon Inc., Heidelberg Druckmaschinen AG, Koenig & Bauer AG, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Lable Printing Machine MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Lable Printing Machine MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Mark Andy, Inc.

- OMET Srl

- Nilpeter A/S

- Bobst Group SA

- HP Inc.

- Xeikon NV

- Domino Printing Sciences plc

- Durst Phototechnik AG

- Konica Minolta, Inc.

- Seiko Epson Corporation

- Screen Holdings Co. Ltd.

- Fujifilm Holdings Corporation

- Canon Inc.

- Heidelberg Druckmaschinen AG

- Koenig & Bauer AG

- Other Key Players