Global Kids Toys Market Size, Share, Growth Analysis By Product Type (Building Toys, Games and Puzzles, Building Sets, Figurine Toys, Action Figures, Dolls, Plush, Sports and Outdoor Toys, Others), By End User (Unisex Toys, Toys for Boys, Toys for Girls), By Distribution Channel (Hypermarket/Supermarket, Specialty Stores, Departmental Stores, Online Channels, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169978

- Number of Pages: 300

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

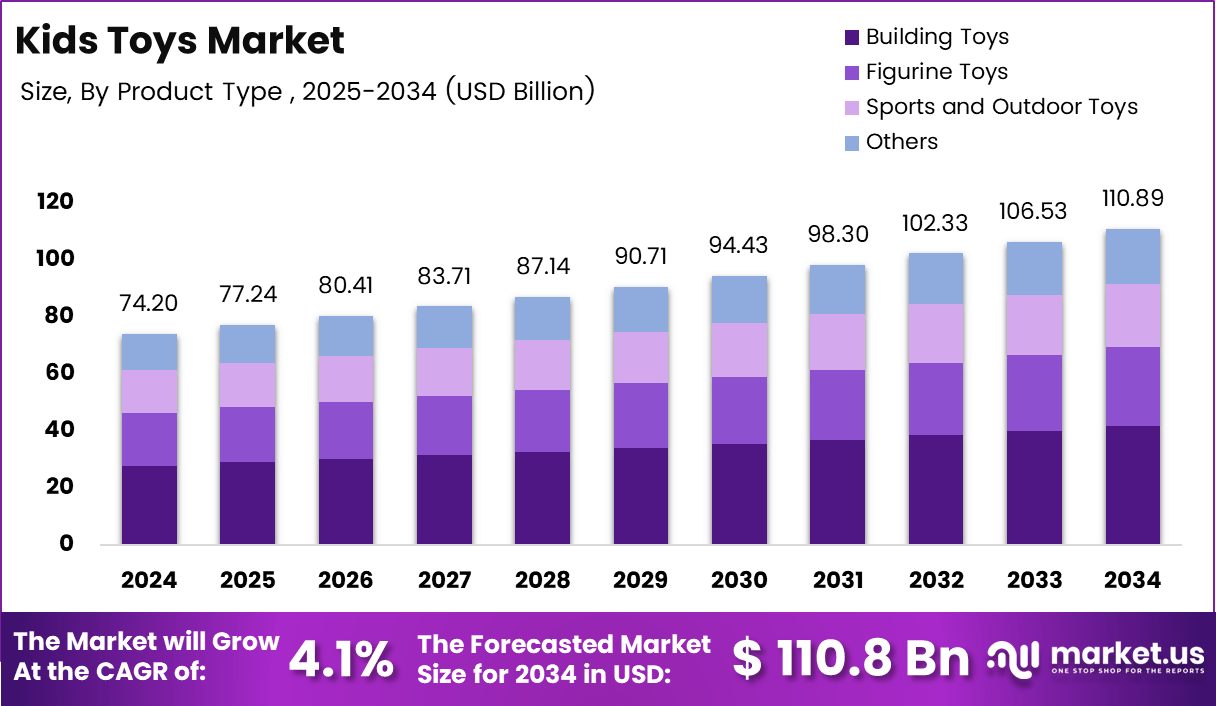

The Global Kids Toys Market size is expected to be worth around USD 110.8 Billion by 2034, from USD 74.2 Billion in 2024, growing at a CAGR of 4.1% during the forecast period from 2025 to 2034.

The Kids Toys Market represents a rapidly expanding consumer segment shaped by evolving learning preferences, higher parental spending, and rising demand for early-development products. The category covers sensory toys, learning toys, arts and crafts, and baby essentials, all designed to stimulate foundational skills. Growth strengthens as parents increasingly prioritize cognitive and emotional development in the first six years.

Moreover, the market experiences strong momentum as governments promote early childhood education programs, safety regulations, and quality-certification frameworks. These initiatives enhance product trust and encourage innovation across educational toys, open-ended play tools, and sustainable materials. Manufacturers respond with safer, eco-friendly, and development-focused offerings that support skill building during fast-paced cognitive growth.

Additionally, emerging opportunities arise from rising digital fatigue among young families, encouraging parents to choose physical play tools over screens. Skill-enhancing toys such as rattles, teethers, stacking toys, and motor-skill products gain traction. The sector benefits from urban parenting trends, higher awareness of developmental milestones, and demand for toys promoting creativity, communication, and sensory exploration.

Furthermore, expanding e-commerce penetration strengthens market access, enabling parents to discover age-specific learning toys from 0–6 years. Retailers highlight toys that enhance fine motor skills, language readiness, and problem-solving, aligning well with growing preference for structured home-learning environments. As gifting culture expands globally, creative toys, craft kits, and early learning sets experience consistent adoption.

According to the Study, 80% of brain growth occurs before age 3, while the first 12 months experience the fastest development. The recommendation of no screen time for children under 18 months (except video calls) further boosts demand for real-world interaction toys. The organization also notes that infants exposed to screens before age 1 face higher risks of delayed speech and reduced focus.

Additionally, studies emphasize that early gross motor development between 6 to 12 months reflects a phase of exceptional physical growth, reinforcing demand for sensory, motor, and movement-supporting toys. These insights strengthen market opportunities for safe, sustainable products that encourage natural exploration, hands-on learning, and meaningful parent-child bonding across the Kids Toys Market.

Key Takeaways

- The global Kids Toys Market reached USD 74.2 billion in 2024 and is projected to grow to USD 110.8 billion by 2034.

- The market expands at a steady 4.1% CAGR, driven by rising demand for early-learning and sensory development toys.

- By product type, Building Toys lead the segment with a dominant 37.5% share in 2024.

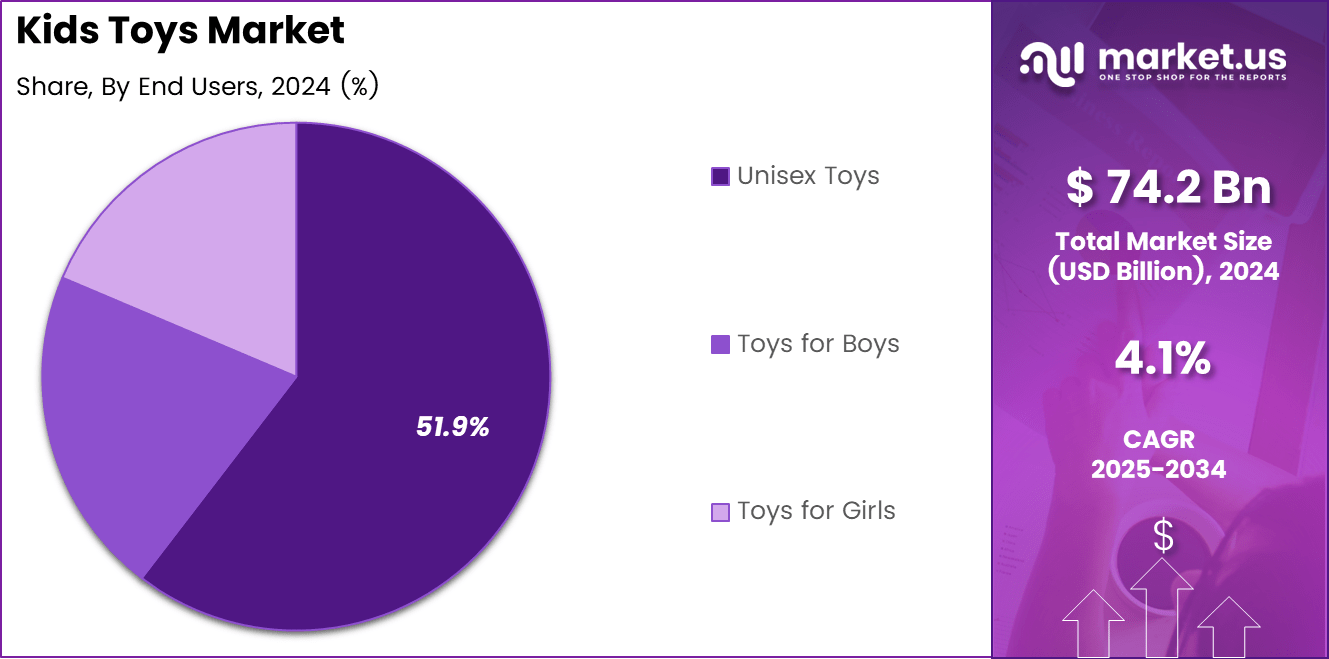

- Unisex Toys remain the largest end-user segment, capturing a major 51.9% share of total demand.

- Hypermarket/Supermarket channels dominate distribution with a 33.8% segment share in 2024.

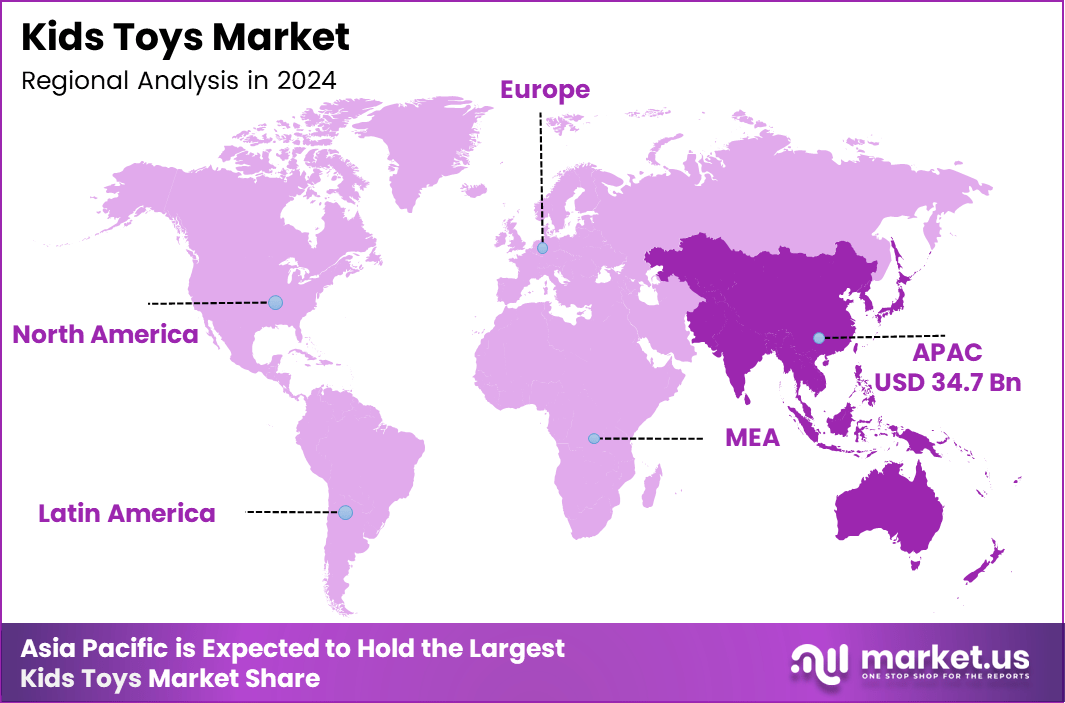

- Asia Pacific represents the leading regional market, contributing 46.8% share valued at USD 34.7 billion.

- North America shows strong adoption of STEM and licensed toys, supporting premium segment expansion.

- Europe maintains a significant demand for sustainable and educational toys driven by strict safety standards.

By Product Type Analysis

Building Toys dominate the Kids’ Toys Market with a share of 37.5% due to strong creative engagement.

In 2024, Building Toys held a dominant market position in the By Product Type Analysis segment of the Kids Toys Market, with a 37.5% share. These toys enhance problem-solving, creativity, and fine motor skills, encouraging structured play. Parents prefer building sets for cognitive development, driving steady adoption across early learning stages.

Games and Puzzles continue gaining traction as families embrace skill-building indoor activities. These toys support memory, logic, and pattern recognition, making them essential for balanced development. Their appeal increases as parents seek screen-free engagement options that promote concentration and stimulate analytical thinking among children of various age groups.

Building Sets expand rapidly as themed collections, engineering kits, and modular constructs attract interest. Their versatility encourages repeated play, strengthening logical reasoning. Rising demand for STEM-aligned products enhances market relevance, especially among parents who want early exposure to spatial learning, sequencing, and mechanical understanding through engaging, hands-on activities.

Figurine Toys sustain demand through imaginative storytelling and role-play. Children use figurines to build narratives, improving communication and emotional expression. These toys remain an integral part of developmental play, enabling young users to explore creativity while enhancing cognitive associations through repeatable, character-driven engagement experiences.

Action Figures continue to appeal to children through dynamic themes and adventure-based play patterns. They support pretend play that builds imagination and emotional intelligence. The category remains stable as children enjoy character-based interactions that encourage creative thinking, storytelling, and social communication during collaborative play scenarios.

Dolls show consistent adoption as nurturing-themed play encourages empathy, care, and communication in early years. Dolls allow children to practice social behavior, improving emotional development. Their strong cultural relevance ensures a long-standing presence across households, focusing on role-play and comforting interaction.

Plush toys maintain popularity due to their comfort-oriented design and emotional bonding value. These soft toys help young children build sensory awareness while offering reassurance. Their universality strengthens long-term demand, especially among toddlers who rely on tactile engagement for early emotional development and stress relief.

Sports and Outdoor Toys grow as parents encourage physical activity and motor-skill development. Outdoor play enhances coordination, strength, and social interaction. These toys support healthy routines, making them increasingly preferred in households focused on balanced physical and cognitive development during early childhood.

Others include art kits, sensory toys, and novelty items that address diverse developmental needs. These products support creativity, experimentation, and sensory stimulation. Broader adoption strengthens category relevance as parents prioritize holistic skill development across emotional, cognitive, and physical growth milestones in early childhood.

By End User Analysis

Unisex Toys dominate with a 51.9% share, driven by inclusive designs and universal appeal.

In 2024, Unisex Toys held a dominant market position in the By End User Analysis segment of the Kids Toys Market, with a 51.9% share. Their broad usability across age groups increases adoption. Parents prefer unisex designs for creative flexibility, developmental neutrality, and long-term relevance across multiple learning stages.

Toys for Boys continue exhibiting strong demand through adventure, construction, and action-oriented play themes. These toys support imagination, spatial reasoning, and hands-on exploration. Their cultural acceptance across markets ensures stable adoption as families look for products that stimulate curiosity and independent problem-solving skills.

Toys for Girls gain steady traction due to rising interest in creative, nurturing, and craft-focused play. These toys promote communication, empathy, and fine motor development. Expanding diversity in themes encourages balanced growth, making this segment relevant for households prioritizing expressive and social skill development.

By Distribution Channel Analysis

Hypermarket/Supermarket dominates the market with a 33.8% share due to easy accessibility and a wide assortment.

In 2024, Hypermarket/Supermarket held a dominant market position in the By Distribution Channel Analysis segment of the Kids Toys Market, with a 33.8% share. These outlets offer broad product choices, competitive pricing, and convenience, driving higher footfall and increased impulse purchasing across family shoppers.

Specialty Stores remain important for curated collections offering age-specific and skill-focused toys. Parents visit these stores for expert recommendations, premium selections, and developmentally aligned products. Personalized guidance improves purchase decisions, supporting sustained relevance among consumers prioritizing quality and learning-oriented toys.

Departmental Stores maintain steady sales as they offer diverse lifestyle products and seasonal toy assortments. Their organized retail environment supports browsing behavior, encouraging parents to explore new categories. Strong brand presence and promotional displays help retain stability across urban shopping zones.

Online Channels expand rapidly as families increasingly prefer home delivery, broad catalogues, and detailed product reviews. Digital convenience boosts adoption, especially for parents seeking age-appropriate, educational, and sustainable toys. Rising penetration of mobile commerce further accelerates online channel growth across regions.

Others include local stores, pop-up shops, and niche retailers offering unique, handcrafted, or sensory-specific toys. These outlets support personalized buying experiences, making them relevant for parents seeking specialized products that address individual developmental needs or creative preferences.

Key Market Segments

By Product Type

- Building Toys

- Games and Puzzles

- Building Sets

- Figurine Toys

- Action Figures

- Dolls

- Plush

- Sports and Outdoor Toys

- Others

By End User

- Unisex Toys

- Toys for Boys

- Toys for Girls

By Distribution Channel

- Hypermarket/Supermarket

- Specialty Stores

- Departmental Stores

- Online Channels

- Others

Drivers

Rising Demand for STEM-Based Educational Toys Drives Market Growth

The Kids Toys Market experiences steady growth as STEM-based educational toys become more popular among parents seeking better learning outcomes. These toys help children build early problem-solving and cognitive skills. Demand strengthens as schools and educators recommend play-based learning tools to support early development in a structured, engaging format.

Licensed character toys also strengthen the market as global entertainment franchises expand across streaming platforms, films, and gaming. Children easily connect with familiar characters, increasing repeat purchases. Manufacturers collaborate with entertainment studios to launch collectible figures, themed playsets, and story-based toys that boost emotional engagement and long-term brand loyalty.

Parental spending rises on premium toys made from safe and sustainable materials. Families prefer non-toxic, durable, and eco-friendly options that ensure safety and long-term value. Brands offering organic fabrics, responsibly sourced wood, and BPA-free plastics gain wider acceptance as parents prioritize well-being and environmental responsibility in every purchase.

E-commerce growth accelerates access to multi-category toys. Online platforms offer competitive prices, wider choices, verified reviews, and convenient delivery. Digital sales rise as parents explore curated collections, personalized recommendations, and exclusive online releases. This shift supports strong market expansion and increases brand visibility in both domestic and international markets.

Restraints

Growing Concerns Over Plastic Waste Restrain Kids’ Toys Market Growth

Environmental concerns slow market expansion as parents become more aware of plastic waste generated from disposable toys. Short product life cycles and excessive packaging raise sustainability issues. Regulatory bodies encourage manufacturers to reduce plastic use, increasing pressure to redesign products and adopt greener materials that comply with new environmental standards.

Production costs continue to rise as raw material prices fluctuate globally. Manufacturers manage higher expenses across plastics, metals, textiles, and electronics used in modern toys. These cost increases affect pricing, supply chain efficiency, and overall profitability. Companies face challenges in maintaining affordability while delivering high-quality products across competitive market segments.

Counterfeit toys pose significant restraints by reducing brand trust and compromising safety standards. Unregulated manufacturers flood markets with low-quality copies lacking safety testing. These products often contain harmful materials, weak components, or choking hazards. Brand reputation declines when counterfeit toys enter online marketplaces, leading to stricter monitoring and complex enforcement efforts.

Growth Factors

Development of AI-Enabled Interactive Toys Creates Growth Opportunities

AI-enabled interactive toys present new opportunities as they enhance personalized learning through adaptive features. These toys respond to voice, expression, or gestures, creating engaging experiences. Parents value intelligence-driven play for improving communication and emotional development. Companies invest in advanced sensors and machine learning to provide safe, age-appropriate interaction.

Emerging markets provide strong expansion potential as rising disposable incomes increase toy purchases. Urbanization encourages families to adopt branded and educational toys. Retail modernization, improved logistics, and digital payment systems fuel demand. Global brands enter these markets to establish manufacturing bases, expand distribution networks, and introduce culturally relevant product lines.

Sustainable toy materials offer another major opportunity as consumers shift toward eco-friendly alternatives. Biodegradable plastics, recycled polymers, and plant-based materials support responsible production. Companies adopting green practices gain competitive advantages and align with government sustainability goals. These innovations help reduce long-term waste and meet growing expectations for environmentally conscious products.

Emerging Trends

Surge in Collectible and Limited-Edition Toys Shapes Market Trends

Collectible toys gain momentum as both children and adults seek rare, themed, or limited-edition items. These collectibles foster community-driven engagement and create strong aftermarket value. Manufacturers collaborate with entertainment creators to release exclusive designs that attract hobbyists and dedicated fan bases globally.

DIY and creative craft kits trend upward as parents encourage hands-on learning. These kits support creativity, motor skill development, and focus. Children enjoy building, painting, and customizing their own projects. Demand increases for art-based toys that inspire imagination and provide productive screen-free play experiences at home or in classrooms.

Augmented reality-integrated toys reshape play patterns by merging digital and physical experiences. Smart devices bring characters, objects, and stories to life through interactive AR features. This hybrid play enhances engagement and educational value. Toy makers integrate apps, games, and storytelling tools to create immersive, future-ready play ecosystems.

Social media becomes a strong influence on toy discovery. Parents and children follow influencers, toy reviewers, and unboxing channels that showcase trending products. Viral content accelerates purchase decisions and boosts demand for new releases. Platforms such as Instagram, YouTube, and TikTok drive awareness, shaping preferences across global audiences.

Regional Analysis

Asia Pacific Dominates the Kids Toys Market with a Market Share of 46.8%, Valued at USD 34.7 Billion

Asia Pacific holds the leading position in the Kids Toys Market with a strong share of 46.8%, valued at USD 34.7 Billion, supported by rising birth rates, expanding middle-class households, and increasing demand for educational and character-based toys. Rapid urbanization and higher adoption of premium, STEM-focused, and eco-friendly toys continue to elevate regional growth. Additionally, government-led early learning programs encourage structured play, boosting demand across developing economies.

North America Kids’ Toys Market Trends

North America shows steady market growth driven by high parental spending, increasing preference for licensed character toys, and widespread acceptance of STEM-based learning tools. The region benefits from strong digital infrastructure, enabling higher adoption of online toy purchases. Moreover, growing emphasis on safety-certified and sustainable kids’ products enhances premium segment expansion.

Europe Kids Toys Market Trends

Europe experiences consistent demand for sustainable, educational, and high-quality toys due to strong regulatory standards and cultural emphasis on early childhood development. Eco-friendly materials and Montessori-inspired learning products remain highly popular among parents. Increasing digital literacy among children further supports interactive and tech-enabled toy categories across major European countries.

Latin America Kids’ Toys Market Trends

Latin America records a gradual expansion in the kids’ toys market as improving economic conditions and rising urban populations enhance purchasing power. Demand grows for affordable multifunctional toys, especially in Brazil and Mexico. Government initiatives promoting early childhood education also support wider adoption of cognitive and sensory development toys.

Middle East and Africa Kids Toys Market Trends

The Middle East and Africa show emerging growth supported by rising young populations and increasing investments in early childhood learning. Demand strengthens for premium, culturally aligned, and educational toys across urban centers. Expanding retail channels and improving digital penetration further contribute to steady regional market development.

United States Kids’ Toys Market Trends

The US demonstrates strong market maturity with high demand for licensed brands, STEM-focused toys, and digital interactive products. Parents increasingly invest in sustainable and safety-certified materials, driving premiumization. E-commerce penetration continues to rise, supported by convenience, diverse product availability, and fast-shipping models that shape consumer purchasing behavior.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Kids Toys Company Insights

In 2024, the global kids’ toys market continues to evolve rapidly, shaped by innovation, shifting consumer preferences, and strategic positioning by major players.

Clementoni S.p.A. remains a strong force in the educational and developmental toy segment, leveraging its long-standing heritage to deliver learning-focused products that resonate with parents prioritizing cognitive growth. The company’s emphasis on STEAM (Science, Technology, Engineering, Art, and Math) aligned toys has helped it maintain relevance in a market increasingly driven by educational value and interactive play experiences, reinforcing its commitment to quality and sustainability.

Hasbro, Inc. continues to capitalize on its extensive portfolio of iconic brands and global licensing partnerships, ensuring widespread appeal across diverse age groups. In 2024, Hasbro’s strategic focus on franchise expansion, digital integration, and multi-channel marketing has bolstered its visibility, particularly within action figures, board games, and role-play categories. This broad approach has enabled the company to balance traditional toy sales with new digital engagements, strengthening customer loyalty and market penetration.

Bella Luna Toys, a leader in thoughtfully designed, gender-neutral toys, has carved a meaningful niche by aligning product offerings with contemporary parental values around inclusivity and open-ended play. The brand’s emphasis on sustainability and creative simplicity has resonated strongly with eco-conscious consumers, helping it stand out in an increasingly crowded marketplace focused on premium and purposeful playthings for young children.

Mattel, Inc. remains a cornerstone in the global toy industry, propelled by enduring franchises such as Barbie, Hot Wheels, and Fisher-Price. In 2024, Mattel’s strategic investments in digital content, brand collaborations, and immersive experiences have strengthened its market position, enabling the company to connect with both nostalgic adults and new generations of children. Through diversified product innovation and robust global distribution, Mattel continues to drive growth and reinforce its legacy in the competitive kids toys landscape.

Top Key Players in the Market

- Clementoni S.p.A.

- Hasbro, Inc.

- Bella Luna Toys

- Mattel, Inc.

- VTech Holdings Limited

- TOMY Company, Ltd.

- Ravensburger

- Giochi Preziosi SpA

- Goliath Games LLC

- KIRKBI A/S

Recent Developments

- In Aug 2025, toy marketplace Snooplay raised INR 8 crore in a pre Series A1 funding round led by Pravek Family Office, with participation from strategic angel investors.The Noida based platform had earlier raised USD 535,000 in a seed round, supporting growth across curated, age appropriate, and learning focused toy categories.

- In Jan 2024, Spin Master finalized its acquisition of Melissa & Doug in a deal valued at almost US$1 billion, marking the largest acquisition in the company’s history.The transaction represents a major strategic expansion into the wooden toy market, strengthening Spin Master’s presence in educational and developmental play segments.

Report Scope

Report Features Description Market Value (2024) USD 74.2 Billion Forecast Revenue (2034) USD 110.8 Billion CAGR (2025-2034) 4.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Building Toys, Games and Puzzles, Building Sets, Figurine Toys, Action Figures, Dolls, Plush, Sports and Outdoor Toys, Others), By End User (Unisex Toys, Toys for Boys, Toys for Girls), By Distribution Channel (Hypermarket/Supermarket, Specialty Stores, Departmental Stores, Online Channels, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Clementoni S.p.A., Hasbro, Inc., Bella Luna Toys, Mattel, Inc., VTech Holdings Limited, TOMY Company, Ltd., Ravensburger, Giochi Preziosi SpA, Goliath Games LLC, KIRKBI A/S Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Clementoni S.p.A.

- Hasbro, Inc.

- Bella Luna Toys

- Mattel, Inc.

- VTech Holdings Limited

- TOMY Company, Ltd.

- Ravensburger

- Giochi Preziosi SpA

- Goliath Games LLC

- KIRKBI A/S