Global Kids Bicycle Market Size, Share, Growth Analysis By Product (Battery Operated, Conventional), By Type (Mountain Bikes, Hybrid Bikes, Road Bikes, Cargo Bikes, Others), By Age Group (3 to 4 years, 4 to 6 years, 6 to 8 years, 8 to 15 years), By Distribution Channel (Supermarkets & Hypermarkets, Convenience Stores, Online, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170953

- Number of Pages: 213

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

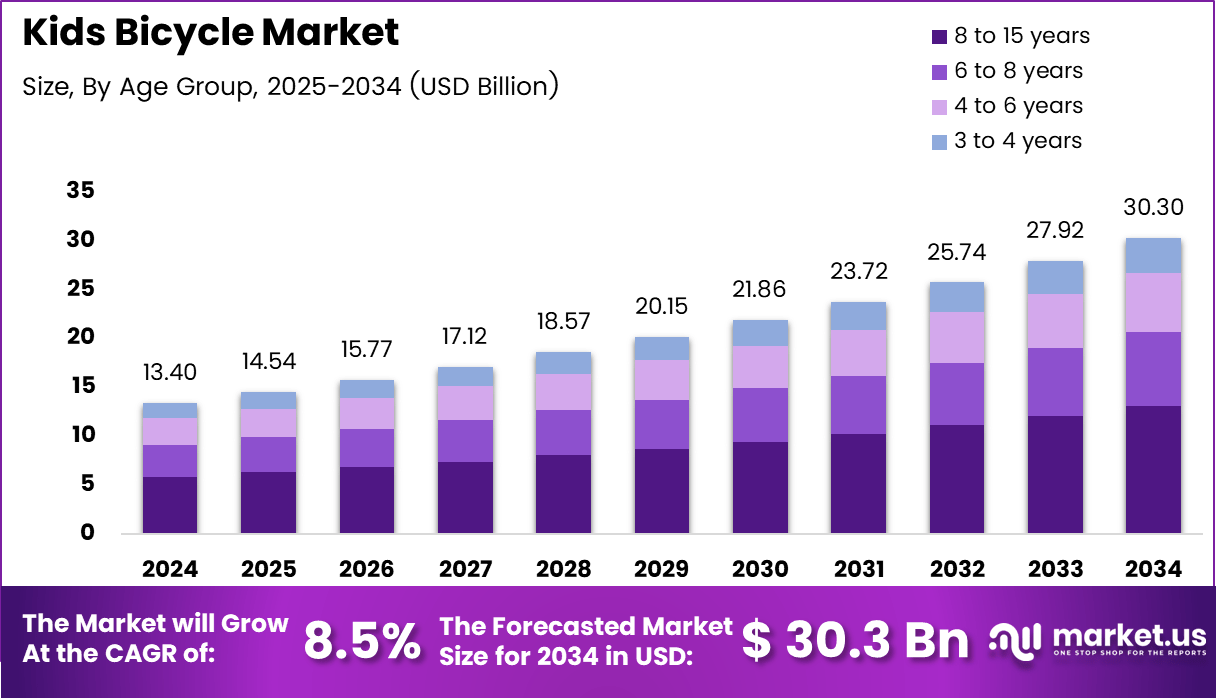

The Global Kids Bicycle Market size is expected to be worth around USD 30.3 billion by 2034, from USD 13.4 Billion in 2024, growing at a CAGR of 8.5% during the forecast period from 2025 to 2034.

The kids bicycle refers to a human powered, size specific cycling product designed for children’s balance, coordination, and physical development. Importantly, it includes balance bikes, training wheel bicycles, and early pedal bikes. From an analyst perspective, kids bicycles support motor skill development, outdoor activity, and early mobility independence in children.

The kids bicycle market represents the organized ecosystem of manufacturing, distribution, and consumption of children focused bicycles worldwide. Moreover, this market spans entry level balance bikes to advanced gear assisted models, sold through specialty stores and digital channels. Consequently, demand reflects parental safety priorities, urban infrastructure readiness, and lifestyle driven wellness trends.

From a growth standpoint, rising awareness around childhood fitness and reduced screen dependency is strengthening demand. Additionally, increasing urbanization encourages planned recreational spaces, promoting cycling among young children. As a result, the market is witnessing steady adoption across both developed and emerging economies, supported by improving household purchasing power.

Furthermore, government investment in active mobility and child safety regulations is creating a supportive environment. For instance, investments in bicycle lanes, school level sports initiatives, and child safety standards encourage early cycling habits. Simultaneously, regulations around product safety, braking systems, and helmet use are enhancing parental confidence in kids bicycles.

From an opportunity lens, innovation around lightweight frames, adjustable sizing, and ergonomics remains critical. Moreover, balance bicycles are gaining attention due to skill building advantages over traditional training wheels. Therefore, manufacturers focusing on age progressive designs and safety certified components are expected to capture long term value in this evolving market.

Behavioral research further validates strong market fundamentals. According to study, parents of 4 to 6 year olds reported that 85% of children could cycle independently, while only 15% required ongoing support. This highlights early cycling readiness across a majority population segment.

Additionally, the same study indicates that the age of independent cycling onset strongly predicts cycling proficiency among 7 to 11 year olds. However, researchers noted limited clarity on stopping skill differences between balance bike users and training wheel learners. This knowledge gap supports continued product innovation and educational positioning within the kids bicycle market.

Key Takeaways

- The Global Kids Bicycle Market is projected to grow from USD 13.4 billion in 2024 to USD 30.3 billion by 2034, registering a CAGR of 8.5%.

- Conventional bicycles dominate the product segment with a market share of 79.3%, driven by affordability and widespread parental acceptance.

- Mountain Bikes lead the type segment, accounting for 35.8% of the global kids bicycle market due to versatility and durability.

- The 8 to 15 years age group represents the largest share at 43.1%, supported by higher riding independence and repeat purchases.

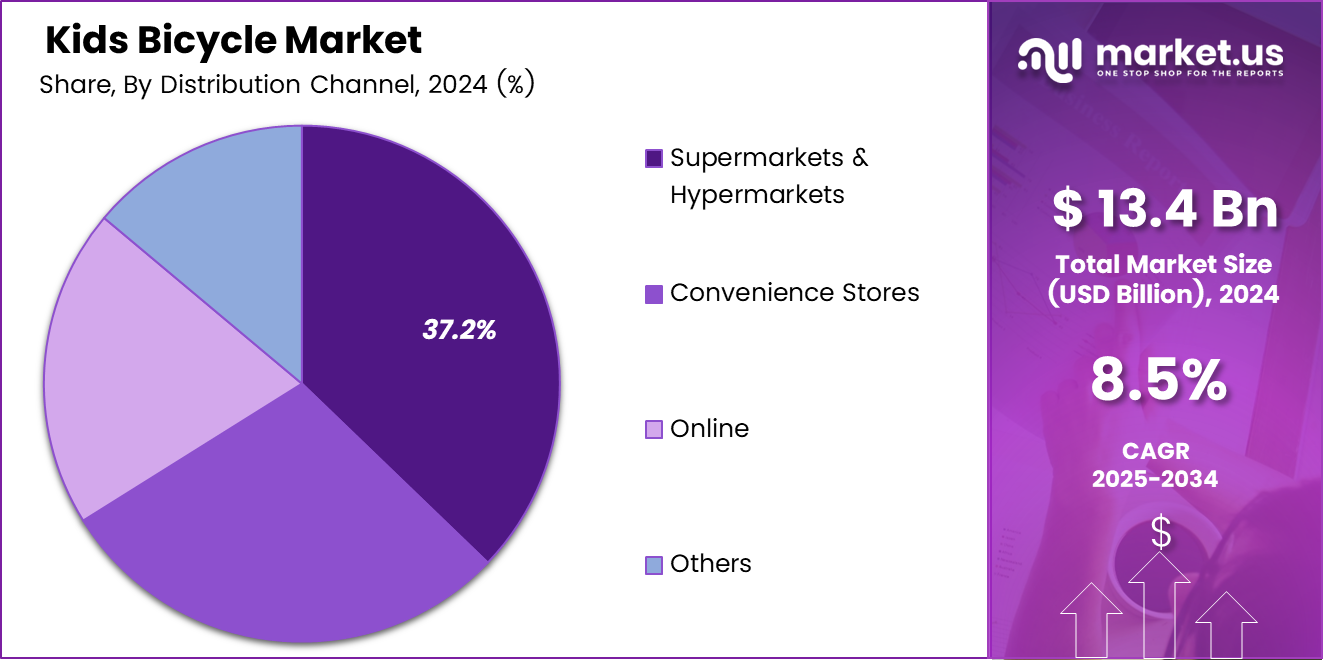

- Supermarkets and Hypermarkets are the leading distribution channel with a share of 37.2%, reflecting preference for physical inspection and price driven buying.

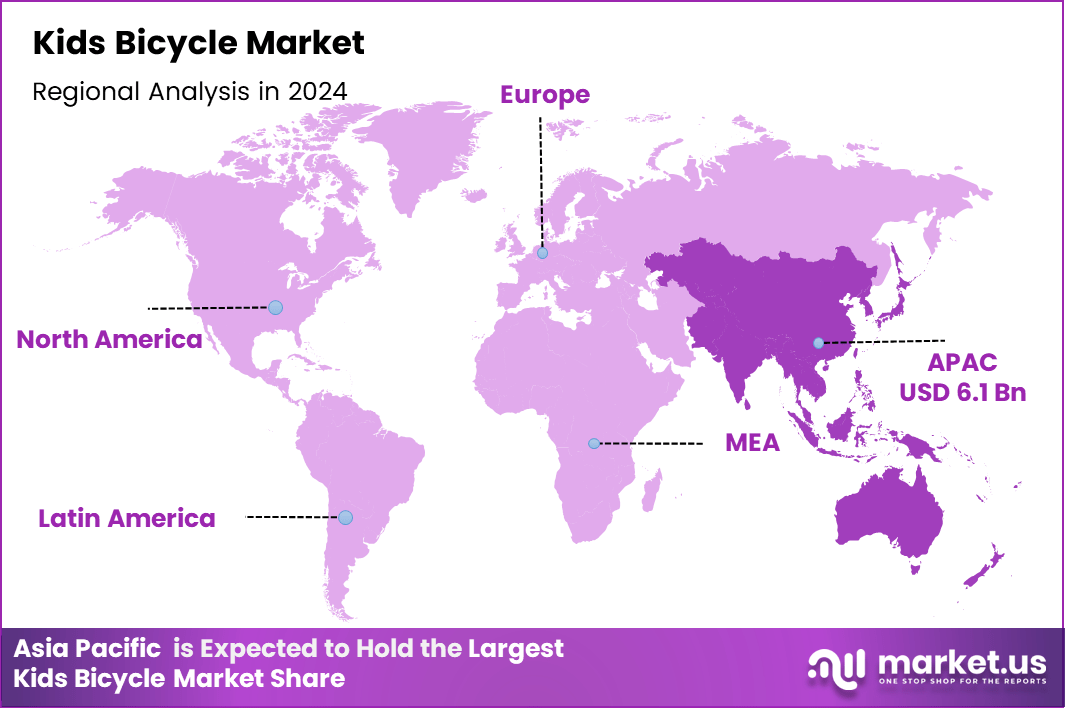

- Asia Pacific is the dominant regional market with a share of 45.8%, valued at USD 6.1 billion, supported by a large child population and urbanization.

By Product Analysis

Conventional bicycles dominate with 79.3% due to affordability, durability, and wide parental acceptance.

In 2024, Conventional held a dominant market position in the By Product Analysis segment of Kids Bicycle Market, with a 79.3% share. Conventional bicycles remain preferred because parents value mechanical simplicity, lower maintenance, and long-term usability. Moreover, these bicycles support balance development and physical activity, aligning with child fitness and safety expectations.

In contrast, Battery Operated bicycles cater to niche demand driven by novelty and assisted riding features. However, higher pricing, charging dependency, and limited outdoor suitability restrict broader adoption. Nevertheless, this segment attracts urban parents seeking controlled-speed options for younger children, particularly for supervised recreational use.

By Type Analysis

Mountain Bikes lead with 35.8% as they offer versatility, durability, and suitability across varied terrains.

In 2024, Mountain Bikes held a dominant market position in the By Type Analysis segment of Kids Bicycle Market, with a 35.8% share. Their robust frames, wider tires, and shock absorption enhance stability, making them suitable for parks, trails, and daily play, thereby driving consistent demand.

Hybrid Bikes attract parents seeking balanced performance for both paved paths and light off-road use. Their adaptable design supports casual riding while maintaining comfort, making them suitable for suburban environments and mixed-surface usage.

Road Bikes focus on lightweight frames and speed efficiency, appealing mainly to older children with advanced riding skills. However, narrower tires and limited terrain compatibility reduce their mass-market appeal.

Cargo Bikes and Others serve specialized needs, including carrying small loads or offering unique designs. These types remain limited to specific use cases and experimental purchasing behavior.

By Age Group Analysis

8 to 15 years dominates with 43.1% driven by higher riding independence and skill development.

In 2024, 8 to 15 years held a dominant market position in the By Age Group Analysis segment of Kids Bicycle Market, with a 43.1% share. Children in this group show strong autonomy, longer usage cycles, and participation in outdoor activities, increasing replacement and upgrade demand.

The 6 to 8 years segment benefits from transition-stage learning, where children move from training wheels to independent riding. Demand remains stable due to skill progression and parental encouragement.

The 4 to 6 years category focuses on early balance development, often supported by lightweight frames and safety features. Purchases are frequently influenced by safety certifications and adjustability.

The 3 to 4 years segment remains entry-level, with demand tied to first-time riding exposure. Growth stays moderate due to short usage duration.

By Distribution Channel Analysis

Supermarkets & Hypermarkets dominate with 37.2% due to accessibility and price-driven purchasing.

In 2024, Supermarkets & Hypermarkets held a dominant market position in the By Distribution Channel Analysis segment of Kids Bicycle Market, with a 37.2% share. Parents prefer these outlets for immediate availability, physical inspection, and bundled seasonal promotions.

Convenience Stores serve limited demand, mainly for basic models and emergency purchases. Restricted variety and space constraints limit their overall contribution.

Online channels continue gaining traction through wider selection, doorstep delivery, and comparative pricing. However, concerns around sizing and assembly slow full-scale dominance.

Other channels, including specialty stores and local retailers, remain relevant for personalized guidance and after-sales support, especially in urban and semi-urban regions.

Key Market Segments

By Product

- Battery Operated

- Conventional

By Type

- Mountain Bikes

- Hybrid Bikes

- Road Bikes

- Cargo Bikes

- Others

By Age Group

- 3 to 4 years

- 4 to 6 years

- 6 to 8 years

- 8 to 15 years

By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Online

- Others

Drivers

Rising Parental Focus on Physical Activity and Outdoor Play Drives Market Growth

Parents are increasingly prioritizing physical activity and outdoor play as part of early childhood development. As screen time rises, bicycles are viewed as a simple and effective way to encourage movement, balance, and coordination among young children. This growing awareness directly supports demand for kids bicycles across urban and suburban households.

Higher disposable income levels are also enabling families to spend more on branded and feature rich kids bicycles. Parents are willing to invest in better quality products that offer improved safety, durability, and design. Features such as adjustable seats, training wheels, and appealing colors are gaining importance in purchase decisions.

Urban development is further strengthening this trend through the expansion of parks, playgrounds, and dedicated cycling tracks. Safe cycling spaces reduce parental concerns and motivate children to ride bicycles more frequently. These facilities help embed cycling into daily recreational routines.

In addition, schools and community organizations are actively promoting sports and cycling programs. School events, cycling days, and local initiatives create early exposure and positive habits. This structured encouragement continues to support steady growth in the kids bicycle market.

Restraints

Safety Concerns Related to Road Traffic Accidents Limit Market Adoption

Safety remains a major restraint for the kids bicycle market, especially in densely populated urban areas. Parents often worry about road traffic accidents involving child cyclists. Limited cycling lanes and high vehicle congestion reduce confidence in allowing children to ride bicycles independently.

Another challenge is the short product lifecycle linked to rapid age and size changes in children. Kids outgrow bicycles quickly, leading to frequent replacements. This discourages some parents from investing in higher priced models, particularly when usage periods are short.

Price sensitivity is more pronounced in developing regions, where affordability plays a critical role. Many households prefer basic bicycles over premium or branded options. As a result, demand for advanced features is limited in cost conscious markets.

Additionally, lack of awareness around proper safety gear, such as helmets and protective pads, adds to parental hesitation. Without adequate safety education and infrastructure, these concerns continue to restrain broader market expansion.

Growth Factors

Increasing Demand for Adjustable and Multi Stage Bicycles Creates New Opportunities

A key growth opportunity lies in the rising demand for adjustable and multi stage bicycles that grow with the child. Parents are actively seeking products that offer longer usability through adjustable frames, seats, and handlebars. This directly addresses concerns around short product lifecycles.

Sustainability is also shaping new opportunities, with growing interest in eco friendly materials and packaging. Parents are becoming more conscious of environmental impact and prefer bicycles made from recyclable materials or sustainable manufacturing processes.

The expansion of organized retail and e commerce platforms is improving product accessibility. Online channels allow parents to compare models, prices, and features easily. Wider availability supports informed purchasing and increases reach across smaller cities and towns.

Moreover, rising awareness of childhood obesity is driving demand for active mobility products. Health focused campaigns encourage outdoor activity, positioning kids bicycles as a practical solution for regular exercise and healthier lifestyles.

Emerging Trends

Integration of Lightweight Frames and Ergonomic Designs Shapes Market Trends

One of the key trends in the kids bicycle market is the integration of lightweight frames and ergonomic designs. These features improve riding comfort and control, making it easier for children to learn and enjoy cycling. Parents increasingly value designs that reduce fatigue and enhance safety.

Character themed and licensed kids bicycles are also gaining popularity. Bicycles featuring cartoon characters, superheroes, or animated themes attract children and influence purchase decisions. This trend helps brands differentiate products and strengthen emotional appeal.

Another notable trend is the rising adoption of balance bikes as a precursor to pedal bicycles. Balance bikes help children develop coordination and confidence before transitioning to traditional bicycles. Parents view them as an effective learning tool for early riders.

Together, these trends reflect a shift toward child centric design, learning focused products, and emotionally engaging offerings, shaping the evolving landscape of the kids bicycle market.

Regional Analysis

Asia Pacific Dominates the Kids Bicycle Market with a Market Share of 45.8%, Valued at USD 6.1 Billion

Asia Pacific accounted for a dominant share of 45.8% in the kids bicycle market, with a valuation of USD 6.1 billion, supported by a large child population and rising urban household incomes. The region benefits from increasing awareness of physical fitness among parents and strong adoption of bicycles for both recreation and short distance mobility. Expanding urban parks, school level sports programs, and affordable local manufacturing further reinforce sustained demand across developing and emerging economies.

North America Kids Bicycle Market Trends

North America represents a mature yet stable market, driven by high parental emphasis on outdoor activities and structured child fitness routines. Strong suburban infrastructure, availability of safe cycling tracks, and seasonal recreational spending support consistent sales. Product demand is further shaped by safety features, adjustable designs, and increasing interest in early age cycling skills development.

Europe Kids Bicycle Market Trends

Europe shows steady growth due to a strong cycling culture and supportive government policies promoting sustainable mobility from an early age. Well developed urban cycling lanes and school based cycling initiatives encourage regular bicycle use among children. Demand is also supported by environmental awareness and parental preference for active, low emission transportation alternatives.

Middle East and Africa Kids Bicycle Market Trends

The Middle East and Africa market is gradually expanding, supported by rising urbanization and growing middle class populations in select countries. Investments in recreational infrastructure, residential communities, and school sports facilities are improving cycling accessibility. Market growth remains moderate due to climate constraints and uneven road safety conditions across regions.

Latin America Kids Bicycle Market Trends

Latin America demonstrates emerging growth potential, driven by increasing youth population and gradual improvements in urban recreational spaces. Bicycles are widely viewed as affordable recreational products for children, especially in urban and semi urban areas. Government backed public park development and community sports programs are expected to support long term market expansion.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Kids Bicycle Company Insights

Giant Bicycles continues to hold a strong position in the global kids bicycle market by leveraging its scale, manufacturing expertise, and consistent focus on product durability. In 2024, the company’s emphasis on lightweight frames, child friendly ergonomics, and reliable braking systems supports parental confidence and repeat purchases. Its wide retail reach and balanced pricing strategy are expected to sustain steady demand across both urban and semi urban markets.

Dynacraft Wheels remains a key player by addressing the mass market segment with affordable, visually appealing kids bicycles. In 2024, its strength lies in combining practical design with strong visual themes that attract younger consumers while meeting parental expectations on safety. The company’s ability to respond quickly to changing consumer tastes positions it well for volume driven growth in entry level and replacement cycles.

Trek Bicycle Corporation is positioned toward the premium end of the kids bicycle market, focusing on performance inspired design and long term product value. In 2024, Trek’s approach of integrating high quality components, lightweight materials, and safety focused engineering is expected to appeal to experienced cycling families. Its strong brand credibility supports higher price acceptance and sustained loyalty.

SCOTT Sports SA leverages its performance cycling heritage to differentiate its kids bicycle offerings through advanced design and durability. In 2024, the company’s focus on age specific geometries and ride quality enhances its appeal among consumers seeking sport oriented products for children. This positioning is anticipated to support gradual market expansion, particularly among aspirational and performance conscious buyers.

Top Key Players in the Market

- Giant Bicycles

- Dynacraft Wheels

- Trek Bicycle Corporation

- SCOTT Sports SA

- Cycling Sports Group, Inc.

- GT Bicycles

- MERIDA BIKES

- Avon

- Islabikes

Recent Developments

- In Apr 10, 2025, Guardian Bikes announced a $19 million financing agreement with JPMorganChase to launch the first large scale bicycle frame manufacturing operation in the United States. The investment supports domestic manufacturing, supply chain resilience, and expanded production capacity for the direct to consumer kids’ bike brand.

- In sep 2025, Guardian Bikes was named a top choice for design, durability, and child friendly features in the Best Kids Bikes rankings by Consumer365. The recognition highlights the brand’s focus on safety innovation and quality engineering in the children’s bicycle market.

- In Dec 13, 2025, Southwest Disposal, in partnership with the Las Cruces Public School District initiative Safe Routes to School, distributed 178 new bikes to local school children in Las Cruces. This community driven effort supports youth mobility, encourages active transportation, and strengthens access to safe cycling opportunities for students.

Report Scope

Report Features Description Market Value (2024) USD 13.4 billion Forecast Revenue (2034) USD 30.3 billion CAGR (2025-2034) 8.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Battery Operated, Conventional), By Type (Mountain Bikes, Hybrid Bikes, Road Bikes, Cargo Bikes, Others), By Age Group (3 to 4 years, 4 to 6 years, 6 to 8 years, 8 to 15 years), By Distribution Channel (Supermarkets & Hypermarkets, Convenience Stores, Online, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Giant Bicycles, Dynacraft Wheels, Trek Bicycle Corporation, SCOTT Sports SA, Cycling Sports Group, Inc., GT Bicycles, MERIDA BIKES, Avon, Islabikes Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Giant Bicycles

- Dynacraft Wheels

- Trek Bicycle Corporation

- SCOTT Sports SA

- Cycling Sports Group, Inc.

- GT Bicycles

- MERIDA BIKES

- Avon

- Islabikes