Global Ketogenic Diet Food Market Product(Supplements, Beverages, Snacks, Others), Distribution Channel(Supermarket/Hypermarket, Online, Specialist Retailers, Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb 2024

- Report ID: 24494

- Number of Pages: 263

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

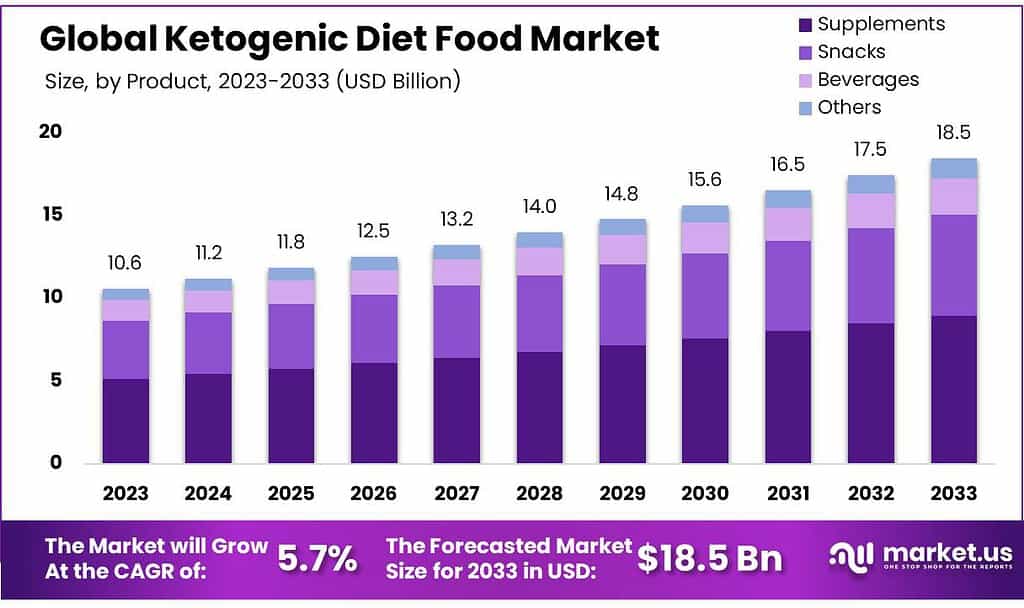

The Ketogenic Diet Food Market size is expected to be worth around USD 18.5 billion by 2033, from USD 10.6 Bn in 2023, growing at a CAGR of 5.7% during the forecast period from 2023 to 2033.

The Ketogenic Diet Food Market refers to the global industry involved in the production, distribution, and consumption of food products specifically designed to align with the principles of the ketogenic diet.

This diet emphasizes low-carbohydrate, high-fat intake to induce a state of ketosis, where the body relies on ketones for energy rather than glucose. The market encompasses a variety of food items formulated to support individuals following the ketogenic lifestyle, catering to their dietary needs and preferences.

Key Takeaways

- Market Growth: Ketogenic Diet Food Market is projected to grow at 5.7% CAGR, reaching USD 18.5 billion by 2033 from USD 10.6 billion in 2023.

- Product Dominance: In 2023, supplements held a 48.5% market share, popular for supporting ketosis and promoting fat burning.

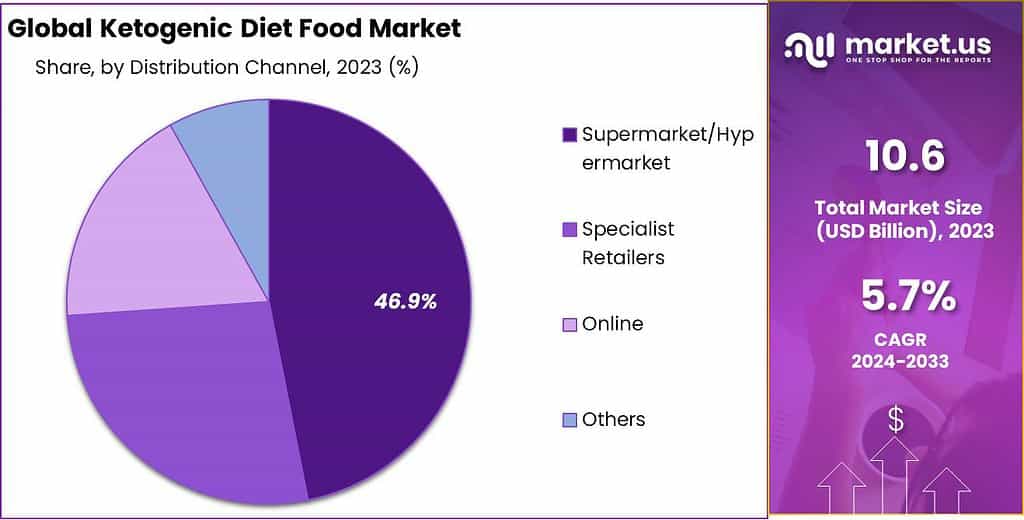

- Distribution Channels: Supermarkets/hypermarkets dominated with 46.9% market share in 2023, followed by specialist retailers, online platforms, and others.

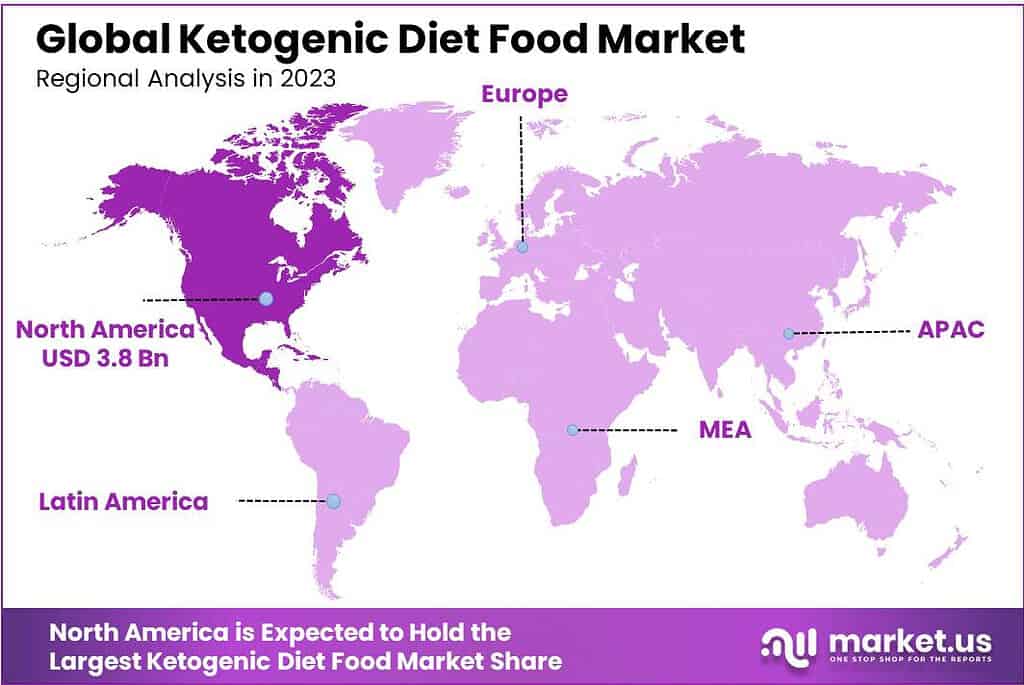

- Geographical Presence: North America led with over 36.5% revenue share in 2023, driven by the United States’ significant market presence.

- Regional Growth: Asia Pacific is anticipated to be the fastest-growing region, with a 6.2% CAGR from 2023-2032, driven by increasing obesity rates.

Product Analysis

In 2023, supplements were the big players in the ketogenic diet food market. They grabbed over 48.5% of the market, showing how much people were into those capsules and powders. These supplements, packed with the right keto-friendly ingredients, were popular choices among those looking to maintain ketosis and promote fat burning in their bodies.

Snacks were an integral part of the ketogenic food market, drawing huge crowds. From crunchy nuts to cheesy bites, snacks accounted for an immense percentage of ketogenic food sales and revenue.

When it comes to beverages, they made quite a splash too. Think keto-friendly shakes, drinks, and even enhanced water options. These were catering to the on-the-go lifestyle, offering a quick fix for staying in that fat-burning zone without compromising on taste. Beverages carved out a notable share in the market, appealing to those seeking convenient yet compliant options.

And then, there were the ‘others.’ This segment encompassed various products that didn’t fit snugly into the supplement, snack, or beverage categories. This catch-all segment included things like specialty condiments, baking ingredients, and meal replacement options.

While diverse, these ‘other’ products collectively contributed a significant portion to the ketogenic food market. Overall, supplements were the top dog in 2023, but snacks, beverages, and the versatile ‘others’ held their ground too, each catering to different needs and preferences within the ketogenic diet food market.

Distribution Channel Analysis

In 2023, supermarkets and hypermarkets were the kings of the ketogenic diet food market. They owned more than 46.9% of the market share, making them the top spot for folks looking to grab their keto-friendly groceries in one go. These big retail spaces provided a wide array of options, from fresh produce to packaged goods, offering convenience and variety under one roof.

Specialist retailers also played an integral part in this market. Specializing in ketogenic products and catering to more selective customer bases, specialist retailers held their own in this competitive sector – not as dominantly but still holding respectable shares by offering expert knowledge and high-quality items from this niche market.

2023 saw online channels becoming an invaluable asset in terms of shopping convenience and availability, drawing in many ketogenic diet enthusiasts from home. Their flexible nature and accessibility are attributed to their rising star status.

The “others” category encompassed all distribution channels that did not fall neatly within supermarket/hypermarket, specialist retailer, or online categories, such as convenience stores, pharmacies, or direct sales from manufacturers. Although some individual vendors might not have held as significant market dominance as top channels alone, collectively their share contributed significantly to the ketogenic diet food market.

In summary, supermarkets/hypermarkets led the charge in 2023, followed by specialist retailers, online platforms, and a diverse range of ‘other’ distribution channels. Each channel had its strengths, catering to different consumer preferences and convenience factors within the ketogenic food market landscape.

Key Market Segments

Product

- Supplements

- Beverages

- Snacks

- Others

Distribution Channel

- Supermarket/Hypermarket

- Online

- Specialist Retailers

- Others

Drivers

The keto diet has gotten super popular because more folks care a lot about their health now. People have figured out that eating low-carb, high-fat foods like keto stuff can be really good for you. This has made lots of folks want foods that match this way of eating. They want stuff that helps with losing weight, keeps energy levels up, and makes them healthier overall.

Growing obesity and associated health concerns have also been an influential force. Society grappling with health concerns linked to excessive sugar and carb intake has discovered ketogenic dieting as a viable solution; increasing awareness about health problems associated with traditional diets has pushed more individuals towards adopting alternative eating habits, thus spurring the ketogenic food market.

Ketogenic products have also played a crucial role. As more food manufacturers and retailers enter this market niche, keto-friendly options have increased significantly – making it easier for individuals to adopt and sustain a ketogenic lifestyle. Additionally, social media plays an integral part.

Platforms such as Instagram and TikTok have popularized ketogenic dieting via influencers sharing success stories, recipes, and health-related tips – helping drive its market expansion and market awareness. In essence, the ketogenic diet food market has been propelled by a combination of health awareness, concerns about traditional diets, increased availability, and the influential power of social media. These drivers continue to stoke the flames of interest and demand in the ketogenic food market.

Restraints

Keto diet food manufacturers have experienced some difficulties as their market continues to expand, hindering their progress along the way. One of the main obstacles has been misconceptions surrounding the keto diet itself. Some individuals still harbor doubts or misunderstandings regarding its long-term effects on health; there have been concerns raised regarding its high-fat content’s effect on heart health which has caused hesitation from certain consumers, thereby slowing market expansion as not everyone feels confident to leap living the keto lifestyle.

Another challenge comes from the limited variety and availability of keto-friendly options, especially in certain regions or smaller stores. While the market has been expanding, there’s still a gap in availability compared to traditional food choices. The keto diet has faced some problems that have slowed down how many people get into it. One problem is that it’s not always easy to find lots of keto-friendly options. This makes it hard for some folks to stick to the keto diet because they can’t always find the right foods in stores.

Also, many people see the keto diet as really strict and tough to follow. They think cutting out a lot of carbs from their meals is hard and not very fun. Because of this, some people decide not to try keto at all, which keeps the keto market from growing more. However, the higher cost of keto-specific products compared to regular alternatives has also acted as an impediment. Foods, supplements, and ingredients specifically tailored for keto may be more costly, making full commitment difficult for some consumers.

Cost factors have proven a barrier when adopting the keto diet. In summary, the doubts about health effects, limited availability of options, perceptions of restriction, and the higher costs of certain keto products have acted as restraints on the growth of the ketogenic diet food market. Addressing these challenges could help the market expand further by making the diet more accessible and appealing to a wider audience.

Opportunities

The keto food market can grow a lot if more people know and understand what’s good about the keto diet. When folks learn about its benefits and realize it’s not as strict as they thought, they might be more willing to try it. If we show that keto isn’t so tough or limiting, more folks might give it a shot. Expanding the range of available keto-friendly foods represents a substantial opportunity.

Introducing a wider variety of delicious options that adhere to keto guidelines could draw in more interest and participation. Whether in snacks, meals, or beverages, offering diverse and enjoyable choices aligning with the keto rules can attract a broader audience.

Making sure you can find keto foods easily is super important for the keto market to grow. If these foods are in lots of stores, online, and maybe even in restaurants, it’ll be much simpler for people to follow the keto diet. When it’s easy to get these foods, more folks might decide to try out the keto lifestyle. Making the keto diet more affordable presents a substantial opportunity for market growth.

Lowering the costs of keto-specific products could remove a significant barrier for those hesitant due to financial constraints. Affordable options might encourage a larger segment of consumers to consider and adopt the keto diet, contributing to market expansion.

Challenges

The keto diet food market faces numerous difficulties that impede its expansion. One major difficulty associated with keto is people’s misconceptions and doubts surrounding it. Some individuals may question its long-term health benefits while some worry about consuming an abundance of fat which may negatively impact heart health, making it hard for some individuals to fully trust and embrace keto lifestyle.

Another challenge associated with keto diets is finding enough keto-friendly options easily. In certain areas it may be difficult to source suitable foods, making keto difficult for those wishing to experiment but lacking access to suitable supplies nearby.

The keto diet can seem challenging and restrictive to some. Eliminating carbs from meals doesn’t seem appealing to everyone and could potentially discourage some from trying it altogether. Additionally, keto-specific products may be more expensive than their regular options and this increased expense might not fit everyone’s budget, making it harder for some individuals to commit to the keto diet.

Overall, ketogenic diet food market growth has been hindered by uncertainty around health effects, limited options available and perceptions of strictness as well as higher costs associated with certain keto products. Addressing these challenges would help make keto more accessible and attractive to a wider audience.

Regional Analysis

North America held the highest revenue share at over 36.5% in 2023. The major market for the ketogenic diet industry is the United States. The U.S. millennials are likely to increase awareness of health and healthy eating habits and will increase the Ketogenic Diet Food market share over the next few decades.

Asia Pacific is expected to be the fastest-increasing regional market, with a 6.2% CAGR from 2023-2032. There are significant long-term opportunities in the keto foods industry due to increasing obesity rates in Asia Pacific countries like India and China. These market trends will likely increase demand for ketogenic foods.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Competitive Landscape

Due to the presence of many international and domestic players, the Ketogenic Diet Food market is fragmented around the globe. These companies hold a large market share in North America and Europe as well as the Asia Pacific. Manufacturers are embracing a variety of marketing key strategies to capitalize on the ketogenic diet’s growing popularity as a tool for weight management. These include new product launches, collaborations, and expanding distribution channels.

Nestle S.A. and Know Brainer Foods partnered to launch a new line of keto butter creamers in March 2021. These business growth strategies will likely drive demand for ketogenic diet products over the forecast period. There are some of the major companies in the global market for ketogenic diets are Danone S.A., Nestle S.A., Pruvit Ventures, Inc., Atrium Innovations Inc., Zenwise Health, Brainer Foods, Brainer Foods LLC, Gratitude Health Inc., and Ample Foods Danone S.A., Keto, And Company, Pruvit Ventures Inc., and Others.

Market Key Players

- Ample Foods

- Danone SA

- Nestlé SA

- Pruvit Ventures, Inc.

- The Keto Company

- Zenwise Health

- Perfect Keto, LLC

- Know Brainer Foods LLC

- Bulletproof 360 Inc.

- Ancient Nutrition

- Glanbia PLC

- TDN Nutrition

- Other Key Players

Recent Developments

In September 2022, You Go! Foods recently unveiled Keto Tortilla Chips across the U.S. to meet consumer demand for keto snack chips. Their tortilla chips can be found at major retailers as well as through You Go! Foods’ website; private-label sale agreements are already in place with early private-label sales commitments being met as early as now.

In January 2022, Sun Basket and Pruvit Ventures recently collaborated to offer consumers ketogenic meal kits they can make at home, creating an all-stock merger transaction under PSB Holdings as part of an all-stock merger transaction. Sunbasket and Pruvit became wholly-owned subsidiaries of PSB Holdings which serves as their parent holding company.

Report Scope

Report Features Description Market Value (2022) USD 10.6 Bn Forecast Revenue (2032) USD 18.5 Bn CAGR (2023-2032) 5.7% Base Year for Estimation 2022 Historic Period 2018-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Product(Supplements, Beverages, Snacks, Others), Distribution Channel(Supermarket/Hypermarket, Online, Specialist Retailers, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Ample Foods, Danone SA, Nestlé SA, Pruvit Ventures, Inc., The Keto Company, Zenwise Health, Perfect Keto, LLC, Know Brainer Foods LLC, Bulletproof 360 Inc., Ancient Nutrition, Glanbia PLC, TDN Nutrition, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of Ketogenic Diet Food Market?Ketogenic Diet Food Market size is expected to be worth around USD 18.5 billion by 2033, from USD 10.6 Bn in 2023,

What is the CAGR for the Ketogenic Diet Food Market?The Fruit and Vegetable Juice Market is expected to grow at a CAGR of 5.7% during 2023-2033.Who are the key players in the Ketogenic Diet Food Market?Ample Foods, Danone SA, Nestlé SA, Pruvit Ventures, Inc., The Keto Company, Zenwise Health, Perfect Keto, LLC, Know Brainer Foods LLC, Bulletproof 360 Inc., Ancient Nutrition, Glanbia PLC, TDN Nutrition, Other Key Players

-

-

- Ample Foods

- Danone S.A.

- Nestle S.A.

- Pruvit Ventures, Inc.

- Atrium Innovations Inc.

- Keto And Company

- Zenwise Health

- Perfect Keto

- Know Brainer Foods

- Other Key Players