Global Jumbo Bags Market Size, Share, Growth Analysis By Bag Type (Туре А, Туре в, Type C, Type D), By Capacity (750 kg to 1500 kg, 200 kg to 750 kg, Less than 200 kg, Above 1500 kg), By End Use (Building & Construction, Chemicals & Fertilizers, Food Products & Agriculture, Pharmaceuticals, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 155199

- Number of Pages: 375

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

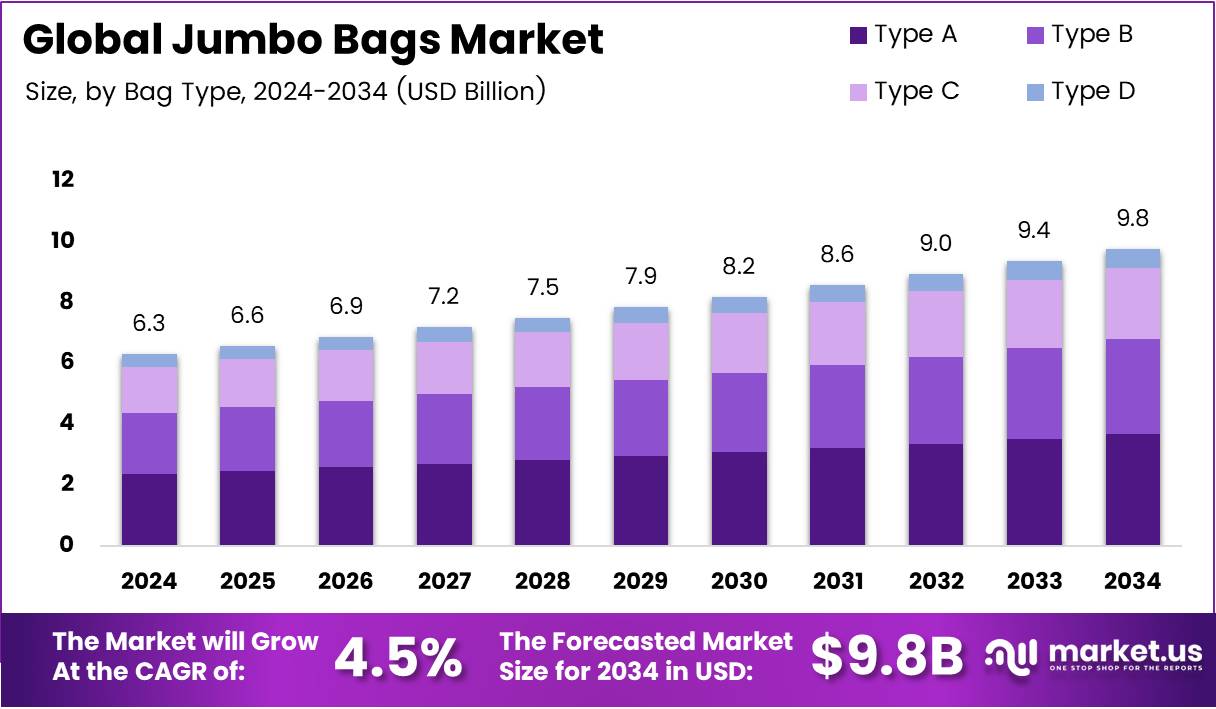

The Global Jumbo Bags Market size is expected to be worth around USD 9.8 Billion by 2034, from USD 6.3 Billion in 2024, growing at a CAGR of 4.5% during the forecast period from 2025 to 2034.

The Jumbo Bags market, also known as FIBCs (Flexible Intermediate Bulk Containers), plays a significant role in global logistics and packaging. These large, robust bags are used to transport and store bulk products such as chemicals, agricultural products, and minerals. Due to their capacity and durability, they are favored in various industries.

Growth in the Jumbo Bags market has been driven by rising demand from multiple sectors, including agriculture, construction, and chemicals. As industries shift toward more efficient bulk packaging solutions, Jumbo Bags offer an environmentally friendly, cost-effective alternative to traditional packaging methods. This trend is expected to continue over the next several years.

The increasing demand for eco-friendly packaging solutions further supports growth opportunities in this market. Additionally, the rising need for high-quality, reusable packaging products presents an attractive opportunity for manufacturers to innovate. Businesses that can meet these requirements are likely to capitalize on growing consumer preference for sustainable packaging options.

Governments worldwide have also recognized the potential of the Jumbo Bags market. Many regions are introducing policies to regulate and promote the use of these bags. Regulations focusing on safety standards and environmental impacts are likely to influence the market’s growth, with an emphasis on recycling and minimizing waste generation. Government investments can boost technological advancements and market expansion.

According to Volza, in 2023, the EU imported approximately 612,000 tonnes of FIBCs (Jumbo Bags), highlighting the increasing demand in the region. Germany, the Netherlands, and France were the largest importers, with Germany being the top market in volume. This underlines the strong demand for Jumbo Bags in European markets, especially in logistics.

As the global trade of Jumbo Bags continues to rise, so too does the opportunity for market players to expand their reach. The growing number of businesses adopting FIBCs presents ample potential for manufacturers and suppliers to target new markets. This growth, combined with supportive regulations, points to a favorable outlook for the Jumbo Bags industry.

Key Takeaways

- Global Jumbo Bags Market size is expected to reach USD 9.8 Billion by 2034, from USD 6.3 Billion in 2024, growing at a CAGR of 4.5%.

- Type A leads the market with a 37.5% share, favored for its versatility and cost-effectiveness.

- 750 kg to 1500 kg capacity range dominates with a 44.9% market share, ideal for transporting bulk materials.

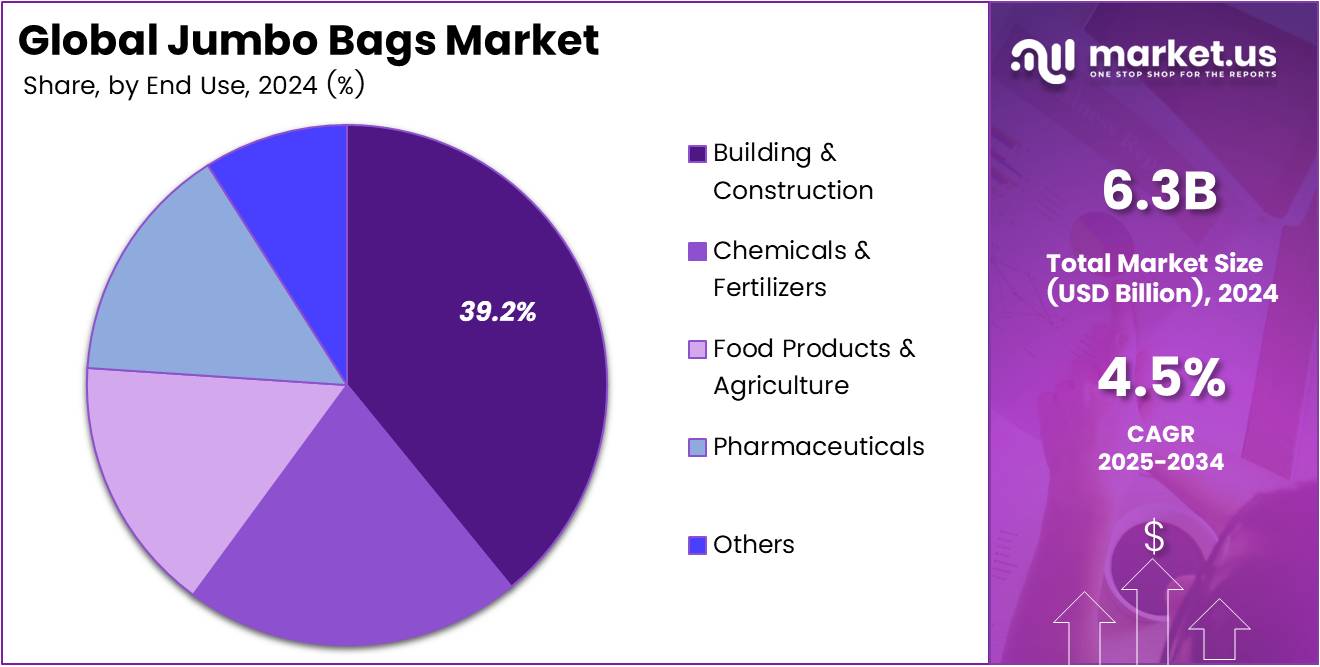

- Building & Construction sector holds the largest share in end-use, capturing 39.2% of the market.

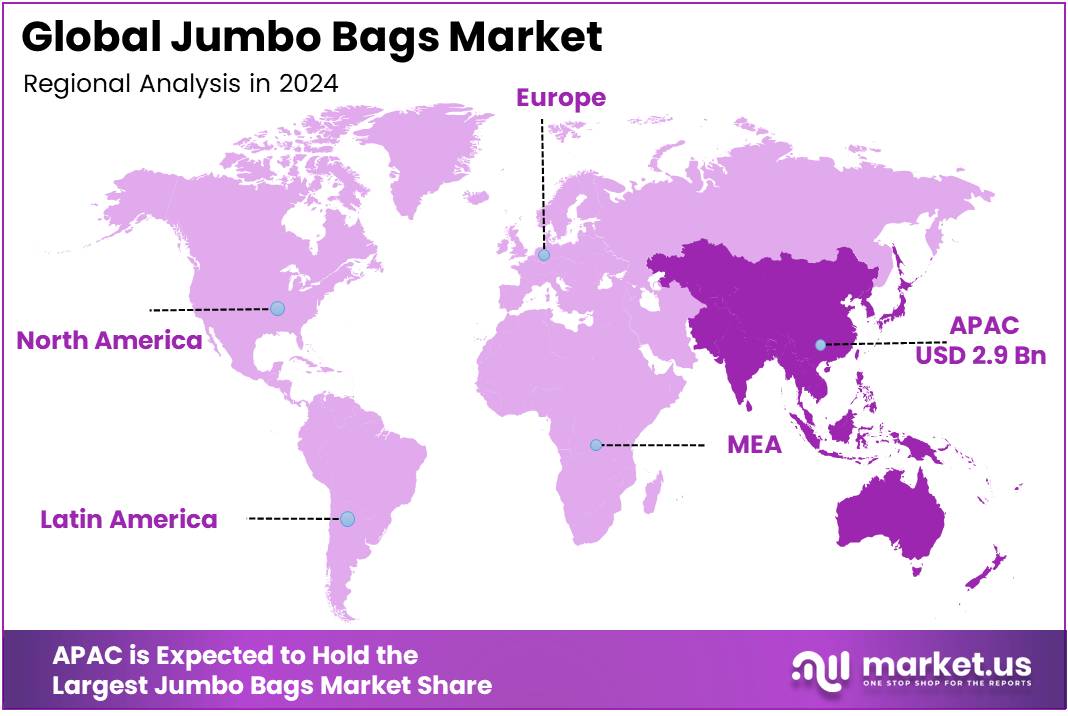

- Asia Pacific leads the global market with 47.2% share, valued at USD 2.9 billion, driven by industrial growth and infrastructure development.

Bag Type Analysis

Type A dominates with 37.5% due to its versatile design and wide industry applications.

In 2024, Type A emerged as the leading segment within the Jumbo Bags Market, accounting for 37.5% of the market share. This bag type’s dominance is attributed to its versatile design, which suits a wide range of applications across industries. Type A’s robust structure and cost-effectiveness make it a popular choice among manufacturers and distributors.

Following closely, Type B captured a significant share, known for its slightly different specifications that cater to specific storage and transport needs. Despite the strong position of Type A, Type B contributed substantially to the overall market share.

Type C and Type D bag types, while effective, occupy a smaller portion of the market. These types offer specialized features such as enhanced durability or resistance to extreme conditions, but their adoption remains limited compared to Type A and Type B bags.

The continued innovation in bag materials and designs is expected to drive further growth in Type A bags, reinforcing its dominant position in the coming years.

Capacity Analysis

750 kg to 1500 kg dominates with 44.9% due to its optimal size for bulk transportation across industries.

In 2024, the 750 kg to 1500 kg capacity range dominated the Jumbo Bags Market, holding a market share of 44.9%. This capacity range is widely preferred across industries due to its optimal balance between size and weight, making it ideal for transporting bulk materials efficiently.

The 200 kg to 750 kg segment also plays a crucial role in the market, catering to smaller-scale applications where high capacity is not required. This segment continues to attract customers in specialized sectors.

On the other hand, the less than 200 kg capacity segment holds a smaller share, suitable for lightweight products or smaller quantities. Despite its limited share, this segment remains relevant in niche markets.

The above 1500 kg segment, while accounting for a smaller portion, continues to grow in industries requiring larger capacity bags for massive bulk handling.

End Use Analysis

Building & Construction dominates with 39.2% due to the high demand for durable bags for heavy materials.

In 2024, the Building & Construction sector held the largest share in the end-use segment of the Jumbo Bags Market, capturing 39.2% of the market. The sector’s demand for large, durable bags for transporting construction materials such as sand, gravel, and cement significantly contributed to this dominant position.

The Chemicals & Fertilizers sector followed closely, with a notable demand for sturdy bags that can handle granular substances. This segment’s growth is supported by the increasing need for efficient packaging solutions in the agricultural and chemical industries.

Food Products & Agriculture also holds a significant share of the market, as jumbo bags are widely used for transporting grains, seeds, and other bulk agricultural products. The Pharmaceuticals segment, while contributing a smaller share, relies on specialized jumbo bags for the safe transportation of bulk pharmaceutical materials.

The Others category continues to encompass a variety of smaller end-use applications, with bags finding diverse uses across various industries.

Key Market Segments

By Bag Type

- Туре А

- Туре в

- Type C

- Type D

By Capacity

- 750 kg to 1500 kg

- 200 kg to 750 kg

- Less than 200 kg

- Above 1500 kg

By End Use

- Building & Construction

- Chemicals & Fertilizers

- Food Products & Agriculture

- Pharmaceuticals

- Others

Drivers

Increasing Demand for Bulk Packaging Drives Market Growth

The demand for bulk packaging is increasing across various industries, which is driving the growth of the jumbo bags market. As businesses look to store and transport large quantities of products more efficiently, jumbo bags offer a practical solution. They are widely used in industries like agriculture, chemicals, construction, and food processing, where bulk packaging is essential. The convenience and efficiency provided by jumbo bags contribute to their growing popularity.

Furthermore, the rise in international trade and export activities also boosts the demand for jumbo bags. As global trade continues to expand, companies require packaging solutions that can safely and cost-effectively handle large volumes of goods during transportation. Jumbo bags are an ideal choice due to their strength, durability, and ability to carry heavy loads.

Another factor driving market growth is the increasing focus on eco-friendly and sustainable packaging solutions. Jumbo bags made from recyclable materials cater to businesses looking for environmentally conscious alternatives to traditional packaging. These bags offer a sustainable option while maintaining their efficiency and cost-effectiveness.

Moreover, the cost-effectiveness of jumbo bags compared to other packaging methods contributes significantly to their widespread adoption. They provide businesses with an affordable solution for bulk packaging, further fueling their demand in various sectors.

Restraints

Environmental Concerns and Regulations Restrict Market Growth

Despite the advantages, environmental concerns related to the use of plastic in jumbo bags pose a challenge. The growing awareness about plastic pollution is prompting businesses and consumers to seek alternatives that have less environmental impact. This has led to increased scrutiny of packaging materials, including jumbo bags, which are often made from plastic.

In addition, stringent regulations regarding plastic use in certain regions are also limiting the growth of the jumbo bags market. Governments around the world are implementing policies to reduce plastic waste, which impacts the production and usage of plastic-based packaging products, including jumbo bags. These regulations force companies to reconsider their packaging choices and adapt to new rules.

Another issue is the lack of awareness about proper disposal methods for jumbo bags. Improper disposal can contribute to environmental harm, and many consumers are not familiar with how to recycle or dispose of jumbo bags responsibly. This lack of awareness can affect the long-term sustainability of the jumbo bags market if businesses and consumers do not adopt eco-friendly disposal practices.

Growth Factors

Expansion of E-Commerce and Innovation Drives Market Growth

The growth of e-commerce and the retail sector presents significant opportunities for the jumbo bags market. As online shopping continues to rise, there is a growing need for effective and efficient packaging solutions to handle large volumes of goods. Jumbo bags are increasingly being used in the packaging of products for bulk delivery, especially in industries like food, chemicals, and construction.

Innovation in biodegradable and recyclable jumbo bags is also opening new growth avenues. With the rising demand for sustainable packaging, companies are focusing on developing eco-friendly alternatives to traditional plastic bags. These biodegradable and recyclable jumbo bags offer a solution to the environmental concerns associated with conventional plastic, making them an attractive option for businesses that prioritize sustainability.

Additionally, the agricultural sector presents a growing opportunity for jumbo bags. These bags are increasingly being adopted for bulk storage and transportation of agricultural products, such as grains, fertilizers, and seeds. The agricultural industry’s need for cost-effective, durable, and eco-friendly packaging solutions is further driving the growth of the jumbo bags market.

Emerging Trends

Sustainability and Technological Innovations Shape Market Trends

There is a clear trend toward rising consumer preference for sustainable packaging solutions, which is influencing the jumbo bags market. As businesses focus on reducing their environmental footprint, the demand for eco-friendly packaging materials like biodegradable and recyclable jumbo bags is increasing. Consumers are becoming more conscious of the environmental impact of packaging, pushing companies to adopt more sustainable solutions.

Another significant trend is the integration of smart packaging technology into jumbo bags. This technology enables enhanced traceability, providing real-time tracking of goods. This feature is increasingly valued by businesses, especially in sectors like logistics and supply chain management, where tracking and monitoring are critical.

Additionally, the rise in automation for jumbo bag manufacturing processes is helping improve efficiency and reduce production costs. Automation technologies are allowing manufacturers to produce jumbo bags more quickly and in larger quantities, meeting the growing demand in various industries while keeping production costs low. This trend is shaping the future of the market and making jumbo bags more accessible to businesses worldwide.

Regional Analysis

Asia Pacific Dominates the Jumbo Bags Market with a Market Share of 47.2%, Valued at USD 2.9 Billion

In 2024, the Asia Pacific region is leading the Jumbo Bags Market, accounting for 47.2% of the global share, valued at USD 2.9 billion. The market growth in this region is primarily driven by expanding industrial sectors, increased demand for bulk packaging solutions, and rapid infrastructure development, particularly in countries like China and India. The region’s dominance is further supported by its competitive manufacturing base and cost-effective production capabilities, making it a hub for the global supply of jumbo bags.

North America Jumbo Bags Market Trends

North America holds a significant portion of the global Jumbo Bags Market, supported by a strong demand from the logistics and packaging sectors. The growth in this region is attributed to the robust manufacturing sector and a growing emphasis on eco-friendly packaging solutions. Additionally, increased investment in transportation and warehousing infrastructure is expected to continue driving the adoption of jumbo bags.

Europe Jumbo Bags Market Trends

Europe remains a key player in the Jumbo Bags Market, with steady demand across the agriculture, construction, and chemicals industries. The market in Europe is anticipated to grow steadily, supported by stringent regulations promoting sustainable packaging solutions. The rising awareness of environmental issues is leading to increased preference for reusable and recyclable jumbo bags, thus fostering market growth.

Middle East and Africa Jumbo Bags Market Trends

The Middle East and Africa (MEA) region has witnessed increasing adoption of jumbo bags, driven by the growing demand in industries such as mining, chemicals, and agriculture. The region’s expansion in infrastructure projects is also fueling the need for bulk packaging solutions. The market in MEA is expected to see moderate growth, particularly in countries like the UAE and South Africa, as they continue to invest in industrial and economic diversification.

Latin America Jumbo Bags Market Trends

Latin America’s Jumbo Bags Market is anticipated to grow at a slower pace, driven by the expanding demand in industries like agriculture and construction. Brazil and Mexico are the key contributors in this region, where the adoption of bulk packaging solutions is on the rise. Despite some economic challenges, the market is projected to benefit from increasing industrialization and demand for cost-effective packaging solutions in the coming years.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Jumbo Bags Company Insights

In 2024, the global Jumbo Bags Market is witnessing strong competition from several key players that are shaping the industry’s landscape.

Berry Global Group, Inc. stands out as a leader with its extensive portfolio of durable and innovative packaging solutions. The company’s commitment to sustainability and efficient manufacturing practices positions it as a key player in meeting the growing demand for bulk packaging.

Greif Inc., known for its robust supply chain capabilities, has strengthened its presence in the jumbo bags market with its versatile offerings. Their high-quality industrial packaging solutions cater to diverse industries, including chemicals and agriculture, giving them a competitive edge.

AmeriGlobe L.L.C. continues to make significant strides in the market with a focus on providing high-performance jumbo bags that ensure safety and efficiency for bulk transport. Their emphasis on customer-specific solutions and strong global distribution network enhances their market position.

BAG Corp. has earned a reputation for providing innovative and cost-effective jumbo bag solutions. With a strong emphasis on product quality and operational excellence, BAG Corp. has successfully catered to a variety of industries, from agriculture to construction, making them a prominent player in the global market.

These key companies are driving the market with their innovative product offerings, strategic expansions, and customer-centric approaches, positioning them for sustained growth in the years to come.

Top Key Players in the Market

- Berry Global Group, Inc.

- Greif Inc.

- AmeriGlobe L.L.C.

- BAG Corp.

- Halsted Corporation

- Intertape Polymer Group

- Emmbi Industries Ltd.

- LC Packaging International BV

Recent Developments

- In Apr 2025, Jumbo Bag Limited announced that it expects to receive INR 9.15 million in funding to expand its production capabilities and support its growth initiatives in the jumbo bag market.

- In Jul 2025, Bambrew secures $10.3 million in funding to further its mission of enhancing eco-friendly packaging solutions and advancing its sustainable materials technology.

- In May 2024, Fiberwood bags US$ 8.35 million to enhance its research and development efforts for creating advanced insulation and packaging materials, positioning itself as a leader in eco-conscious solutions.

- In Sep 2024, Novolex acquires assets of American Twisting for undisclosed terms, strengthening its product offerings in the flexible packaging segment and expanding its market reach.

- In Oct 2024, Rani Plast acquires Lithuanian film manufacturer UAB Umaras, allowing it to diversify its portfolio and boost its capacity for producing high-quality plastic films for various industrial applications.

Report Scope

Report Features Description Market Value (2024) USD 6.3 Billion Forecast Revenue (2034) USD 9.8 Billion CAGR (2025-2034) 4.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Bag Type (Туре А, Туре в, Type C, Type D), By Capacity (750 kg to 1500 kg, 200 kg to 750 kg, Less than 200 kg, Above 1500 kg), By End Use (Building & Construction, Chemicals & Fertilizers, Food Products & Agriculture, Pharmaceuticals, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Berry Global Group, Inc., Greif Inc., AmeriGlobe L.L.C., BAG Corp., Halsted Corporation, Intertape Polymer Group, Emmbi Industries Ltd., LC Packaging International BV Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

By Bag Type

- Туре А

- Туре в

- Type C

- Type D

By Capacity

- 750 kg to 1500 kg

- 200 kg to 750 kg

- Less than 200 kg

- Above 1500 kg

By End Use

- Building & Construction

- Chemicals & Fertilizers

- Food Products & Agriculture

- Pharmaceuticals

- Others