Global Jerky Snacks Market Size, Share, Growth Analysis By Product (Beef, Pork, Poultry, Others), By Source (Conventional, Organic), By Flavor (Original, Teriyaki, Peppered, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 157795

- Number of Pages: 301

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

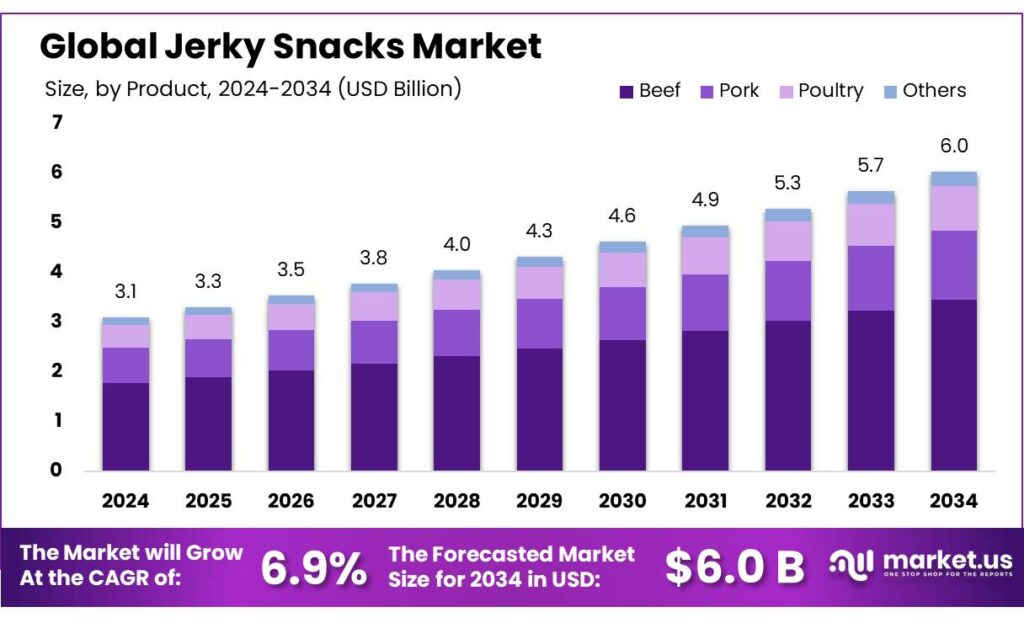

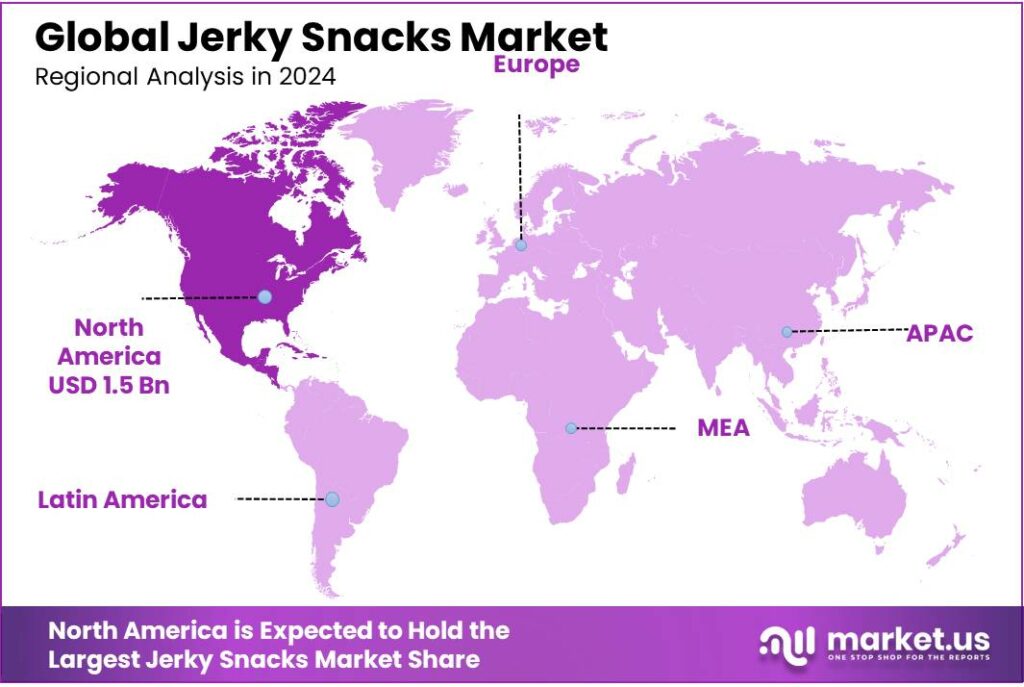

The Global Jerky Snacks Market size is expected to be worth around USD 6.0 Billion by 2034, from USD 3.1 Billion in 2024, growing at a CAGR of 6.9% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 48.9% share, holding USD 1.5 Billion in revenue.

This Jerky Snacks Market demand for high-protein, low-fat, and on-the-go snack options, aligning with the growing trend of health-conscious eating habits. Consumers are increasingly seeking convenient, nutritious alternatives to traditional snacks, favoring products that offer portability without compromising on taste or nutritional value. Additionally, the rise of e-commerce platforms has facilitated direct-to-consumer models, enabling brands to reach a broader audience and personalize offerings to meet specific dietary preferences.

This growth is underpinned by several factors. The Indian food processing industry, encompassing various segments including meat and marine products, is projected to reach a market size of USD 535 billion by FY26. The government’s support through initiatives like the Pradhan Mantri Kisan Sampada Yojana and the Food Processing Industries Development Scheme has been instrumental in enhancing infrastructure and reducing wastage, thereby fostering the growth of value-added products such as jerky snacks.

The Indian government’s initiatives have further bolstered the sector. The reduction of the Goods and Services Tax (GST) on snacks to 5% has made products more affordable, thereby increasing consumer accessibility. Additionally, the Ministry of Food Processing Industries has been actively promoting clean label snacks, aligning with the growing consumer preference for transparency and natural ingredients.

Key Takeaways

- Jerky Snacks Market size is expected to be worth around USD 6.0 Billion by 2034, from USD 3.1 Billion in 2024, growing at a CAGR of 6.9%.

- Beef jerky dominated the Indian jerky snacks market, accounting for a substantial 55.42% of the total revenue.

- Conventional jerky snacks held a commanding 83.6% share of the Indian jerky snacks market.

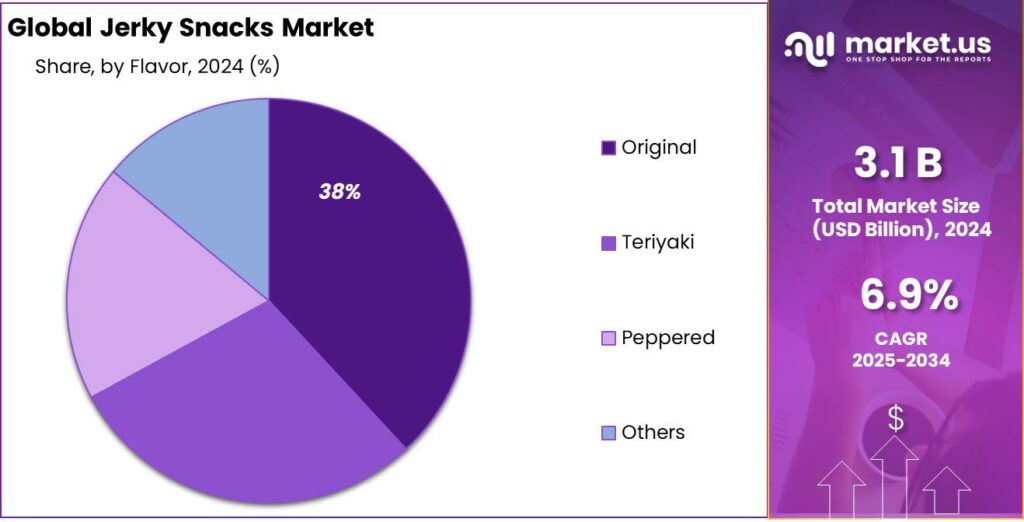

- Original flavor jerky snacks held a dominant position in the Indian market, capturing more than a 38.2% share.

- North America led the global jerky snacks market, capturing a dominant 48.9% share, valued at approximately USD 1.5 billion.

By Product Analysis

Beef Jerky Leads with 55.42% Market Share in 2024

In 2024, beef jerky dominated the Indian jerky snacks market, accounting for a substantial 55.42% of the total revenue. This significant share underscores the strong consumer preference for beef as a protein source, driven by its rich flavor and high protein content. The robust demand for beef jerky is further supported by its extended shelf life and convenience, making it a popular choice among health-conscious and on-the-go consumers.

By Source Analysis

Conventional Jerky Snacks Dominate with 83.6% Market Share in 2024

In 2024, conventional jerky snacks held a commanding 83.6% share of the Indian jerky snacks market, underscoring their widespread appeal among consumers seeking familiar, affordable, and readily available options. This dominance is attributed to the established production processes, cost-effectiveness, and the long shelf life of conventional jerky products, which make them a staple in both urban and rural markets across India

By Flavor Analysis

Original Flavor Jerky Snacks Capture 38.2% Market Share in 2024

In 2024, Original flavor jerky snacks held a dominant position in the Indian market, capturing more than a 38.2% share. This preference underscores the appeal of classic, unaltered meat flavors among Indian consumers. The Original flavor’s simplicity and authenticity resonate with traditional taste profiles, making it a staple choice for many.

Key Market Segments

By Product

- Beef

- Pork

- Poultry

- Others

By Source

- Conventional

- Organic

By Flavor

- Original

- Teriyaki

- Peppered

- Others

Emerging Trends

Surge in Demand for High-Protein, On-the-Go Jerky Snacks

This surge in popularity is attributed to several factors. Consumers are increasingly seeking snacks that align with health-conscious lifestyles, opting for products that are high in protein and low in carbohydrates. Jerky snacks, known for their portability and long shelf life, fit seamlessly into the busy routines of modern consumers. Additionally, the rise of dietary trends such as keto and paleo diets has further fueled the demand for protein-rich snacks like jerky

In response to consumer preferences, manufacturers are innovating by introducing new flavors and formulations. Plant-based jerky options, catering to vegetarians and vegans, are gaining traction in the market. These innovations reflect the industry’s adaptability and commitment to meeting the diverse needs of health-conscious consumers.

Government initiatives supporting healthy eating habits and the promotion of high-protein diets are also contributing to the growth of the jerky snacks market. These programs aim to educate consumers about the benefits of protein-rich snacks and encourage the inclusion of such products in daily diets.

Drivers

Rising Consumer Demand for High-Protein, Convenient Snacks

This surge in demand is largely attributed to the growing awareness among consumers about the benefits of protein-rich diets. High-protein snacks like jerky are perceived as satiating and beneficial for muscle repair and overall health, making them a popular choice among individuals leading active lifestyles. The portability and long shelf life of jerky further enhance its appeal as a convenient snack option for busy professionals, travelers, and fitness enthusiasts.

Moreover, the rise of dietary trends such as keto, paleo, and low-carb diets has contributed to the popularity of jerky snacks. These diets emphasize high protein and low carbohydrate intake, aligning well with the nutritional profile of jerky products. As a result, consumers are increasingly incorporating jerky into their daily snacking routines, further driving market growth.

In response to this demand, manufacturers are innovating by introducing a variety of jerky products catering to diverse consumer preferences. This includes plant-based jerky options made from ingredients like peas and mung beans, offering a protein-rich alternative for vegetarians and vegans. For instance, Beyond Meat introduced its first shelf-stable jerky made from plant proteins, expanding its product range to cater to the growing plant-based food market.

The U.S. Department of Agriculture (USDA) plays a crucial role in ensuring the safety and quality of jerky products through its Food Safety and Inspection Service (FSIS). The FSIS provides guidelines for the safe production of jerky, including recommendations for heating meat to specific temperatures to eliminate harmful bacteria, thereby maintaining consumer trust and product integrity.

Restraints

High Sodium and Preservative Content: A Health Concern for Jerky Snacks

A standard 1-ounce (28-gram) serving of beef jerky can contain approximately 505 milligrams of sodium, accounting for about 20% of the recommended daily intake for a healthy adult. Excessive sodium consumption is associated with increased blood pressure, water retention, and a heightened risk of cardiovascular diseases.

In addition to high sodium content, many jerky products contain preservatives such as sodium nitrite and sodium nitrate, which are used to enhance flavor and prolong shelf life. However, these additives can form nitrosamines when exposed to high heat, compounds that have been linked to an increased risk of certain cancers.

The Hong Kong Consumer Council has reported that meat jerky samples often exceed recommended levels of sugar and sodium, advising consumers to limit their intake and not rely on such products as primary protein sources

To mitigate these health risks, consumers are encouraged to opt for jerky products with lower sodium content, ideally less than 140 milligrams per serving, and those free from harmful preservatives. Additionally, moderating consumption and incorporating a variety of protein sources can contribute to a balanced and health-conscious diet.

Opportunity

Growth Opportunity: Expansion of USDA-Inspected Jerky Production

A significant growth opportunity in the jerky snacks industry lies in expanding production capabilities to meet USDA inspection standards. This expansion not only enhances product credibility but also opens access to broader markets, including interstate and international trade.

The U.S. Department of Agriculture (USDA) supports small and very small meat processors through the Meat and Poultry Inspection Readiness Grant (MPIRG). This initiative assists facilities in upgrading equipment, improving food safety protocols, and achieving compliance with USDA inspection requirements. For instance, in 2021, the USDA awarded grants to various small businesses to help them obtain federal inspection status, thereby enabling them to process and sell meat products across state lines.

Obtaining USDA inspection status involves several steps, including the development of Hazard Analysis Critical Control Point (HACCP) plans, implementation of Sanitation Standard Operating Procedures (SSOPs), and facility upgrades to meet USDA standards. The USDA provides resources and guidelines to assist processors in this process, ensuring that products meet safety and quality standards.

For example, Heartquist Hollow Farm, LLC, received a USDA grant to expand its processing facility, allowing it to offer USDA-inspected meat products to a broader customer base. This expansion not only increased the farm’s revenue but also created new job opportunities in the community.

Regional Insights

North America Dominates Jerky Snacks Market with 48.9% Share in 2024

In 2024, North America led the global jerky snacks market, capturing a dominant 48.9% share, valued at approximately USD 1.5 billion. This substantial market presence underscores the region’s strong consumer demand for high-protein, convenient snack options.

The growth of the jerky snacks market in North America is driven by several key factors. There is a rising consumer preference for protein-rich snacks that align with health-conscious dietary trends. Additionally, the increasing popularity of on-the-go snacking solutions and the expansion of retail channels, including supermarkets, convenience stores, and online platforms, have enhanced the accessibility of jerky products. Innovations in flavor profiles and packaging have also contributed to the market’s expansion, catering to diverse consumer tastes and preferences.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Founded in 1986 in Minong, Wisconsin, Jack Link’s is a leading producer of meat snacks, including beef, turkey, chicken, and pork jerky. The company utilizes its great-grandfather’s recipes and operates multiple facilities across the U.S., including in Wisconsin, South Dakota, and Minnesota. Known for its “Messin’ with Sasquatch” advertising campaign, Jack Link’s has expanded globally, acquiring Unilever’s meat snack division in 2014 and the Golden Island brand from Tyson Foods in 2019.

Founded in 1918 in Seattle, Washington, Oberto Snacks Inc. is a producer of meat snacks, including beef jerky, bacon jerky, and other smoked meats. The company operates under several brand names, such as Oberto, Lowrey’s, Pacific Gold, and Cattleman’s Cut. In 2018, Oberto was acquired by Premium Brand Holdings, expanding its reach and product offerings.

Primarily known for its chocolate products, The Hershey Company entered the meat snack market by acquiring Krave Jerky in 2015. Krave offers all-natural, uniquely flavored meat jerky products. In 2020, Hershey sold Krave to Sonoma Brands, an incubator led by the brand’s founder, Jon Sebastiani, to focus on its core confectionery business.

Top Key Players Outlook

- LINK SNACKS, INC.

- Old Trapper Smoked Products

- Oberto Snacks Inc.

- The Hershey Company

- General Mills Inc.

- Chef’s Cut Real Jerky Co

- Frito-Lay North America, Inc.

- Tillamook Country Smoker

- Conagra Brands

Recent Industry Developments

In 2024, General Mills reported net sales of $19.9 billion, a 1% decrease from the previous year, with a net income of $3.4 billion.

In 2024 The Hershey Company, announced the acquisition of LesserEvil, a Danbury-based producer of organic snacks, for approximately $750 million. This acquisition aligns with Hershey’s strategy to enhance its “better-for-you” snack offerings and broaden its product range beyond confectionery.

Report Scope

Report Features Description Market Value (2024) USD 3.1 Bn Forecast Revenue (2034) USD 6.0 Bn CAGR (2025-2034) 6.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Beef, Pork, Poultry, Others), By Source (Conventional, Organic), By Flavor (Original, Teriyaki, Peppered, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape LINK SNACKS, INC., Old Trapper Smoked Products, Oberto Snacks Inc., The Hershey Company, General Mills Inc., Chef’s Cut Real Jerky Co, Frito-Lay North America, Inc., Tillamook Country Smoker, Conagra Brands Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- LINK SNACKS, INC.

- Old Trapper Smoked Products

- Oberto Snacks Inc.

- The Hershey Company

- General Mills Inc.

- Chef’s Cut Real Jerky Co

- Frito-Lay North America, Inc.

- Tillamook Country Smoker

- Conagra Brands