Japan Cultural Tourism Market Size, Share, Growth Analysis By Tourism Type (Heritage Tourism, Artistic Tourism, Culinary Tourism, Festival Tourism, Religious Tourism), By Traveler Category (Leisure Travelers, Educational Institutions, Pilgrims, History Enthusiasts, General Public), By Tourist Type (Domestic, International), By Booking Channel (Online, Phone Booking, In-Person Booking, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Jan 2026

- Report ID: 173783

- Number of Pages: 350

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

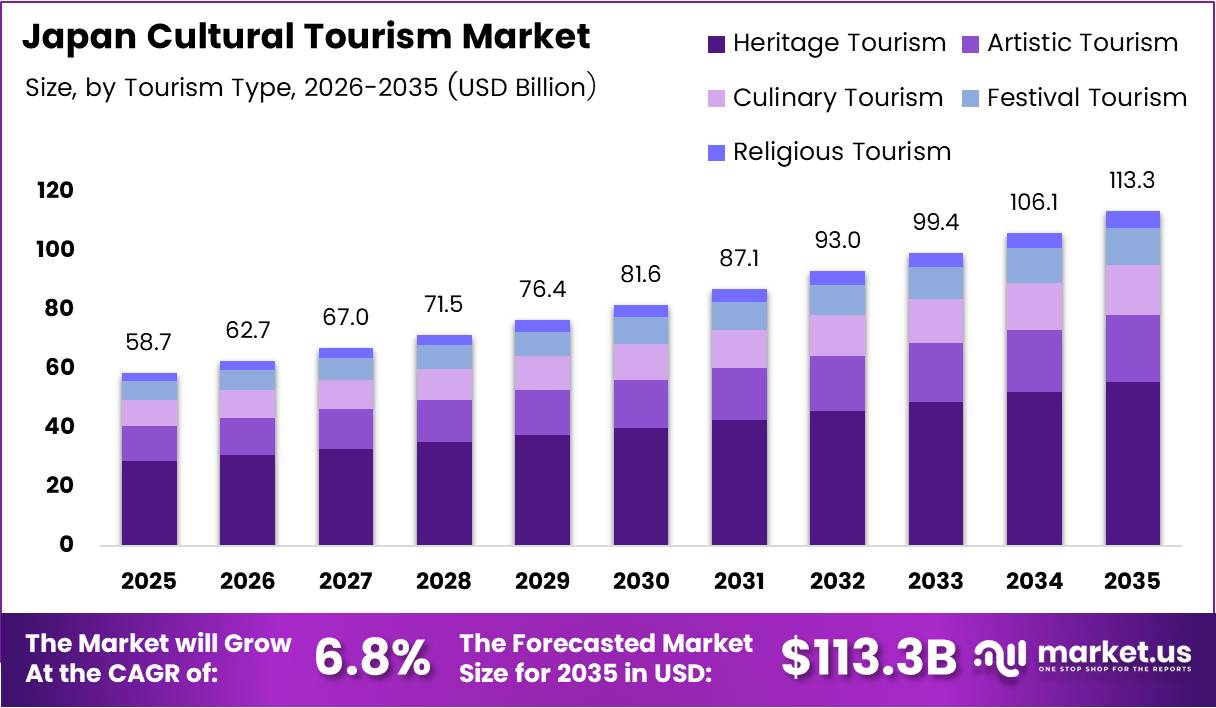

Japan’s Cultural Tourism Market is projected to reach approximately USD 113.3 Billion by 2035, up from USD 58.7 Billion in 2025, expanding at a CAGR of 6.8% during the forecast period from 2026 to 2035.

Cultural tourism in Japan encompasses travel activities centered around experiencing the nation’s rich heritage, traditional arts, culinary traditions, festivals, and religious sites. This market serves diverse visitor segments seeking authentic engagement with Japanese culture through temple visits, craft workshops, museum exhibitions, and seasonal celebrations.

The sector demonstrates robust momentum driven by increasing global fascination with Japanese traditions and lifestyle. Heritage tourism, culinary experiences, and festival participation attract millions annually. Government initiatives actively promote regional cultural assets while improving accessibility through enhanced transportation infrastructure and multilingual services.

Market expansion benefits from strategic preservation efforts targeting historical districts and traditional craft centers. Investment flows into accommodation upgrades near cultural landmarks, particularly heritage ryokans and temple lodgings. Regional authorities develop themed tourism circuits connecting multiple heritage sites, festivals, and artisan communities.

Digital transformation reshapes visitor engagement through virtual previews and booking platforms for cultural experiences. Educational institutions increasingly incorporate cultural immersion programs. Meanwhile, younger demographics show growing interest in blending traditional culture with contemporary expressions like anime heritage trails.

Infrastructure development supports market growth through expanded rail networks and improved rural connectivity. Seasonal variations create year-round opportunities as different regions highlight unique festivals and natural-cultural combinations. Collaborative frameworks between public agencies and private operators enhance service quality and visitor management.

According to Reuters, Japan welcomed 36.87 million international visitor arrivals in 2024, surpassing pre-pandemic levels. International visitor spending reached a record ¥8.1 trillion in 2024, representing a 53% increase versus 2023. The average expenditure per overseas visitor climbed to ¥227,000 in 2024, marking a 6.8% rise, reflecting stronger purchasing patterns and extended stays focused on cultural immersion.

Key Takeaways

- Japan Cultural Tourism Market projected to grow from USD 58.7 Billion in 2025 to USD 113.3 Billion by 2035 at 6.8% CAGR.

- Heritage Tourism dominates tourism type segment with 34.8% market share in 2025.

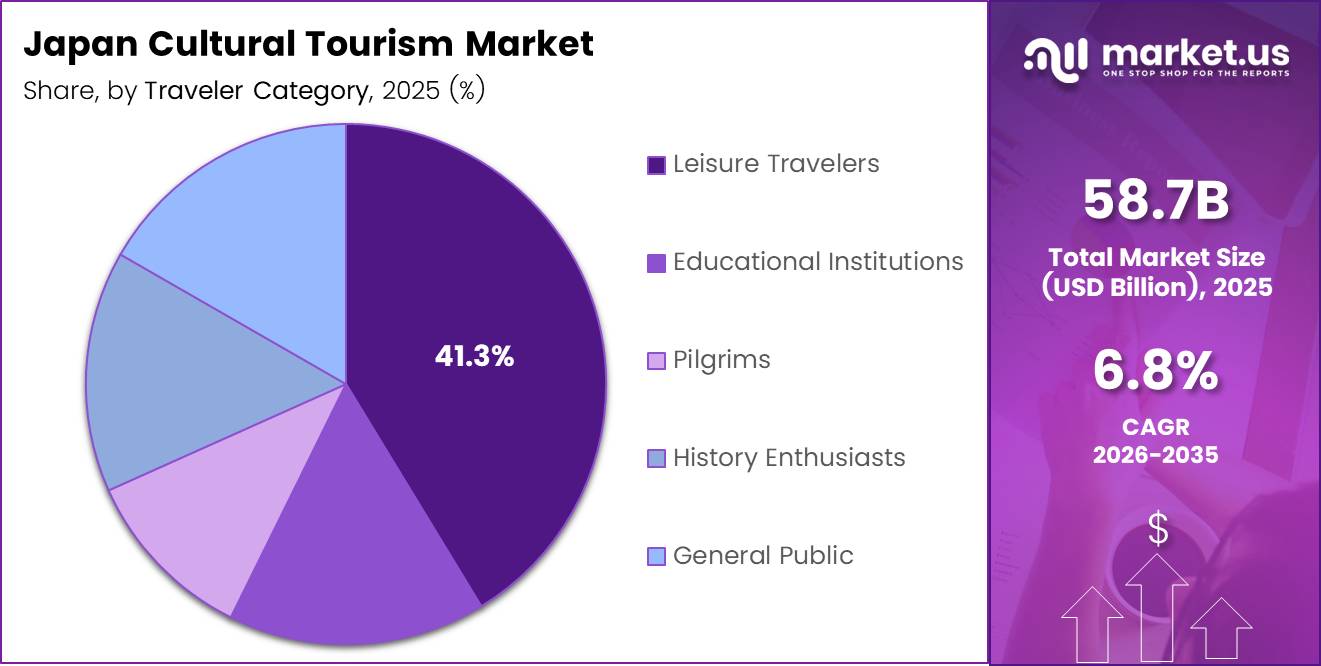

- Leisure Travelers hold 41.3% share in traveler category segment.

- Domestic tourists account for 62.4% of total tourist type segment.

- Online booking channels capture 56.7% of total bookings.

Tourism Type Analysis

Heritage Tourism dominates with 34.8% due to Japan’s extensive UNESCO sites and preserved historical districts.

In 2025, Heritage Tourism held a dominant market position in the By Tourism Type segment, capturing 34.8% share. This segment thrives on visitor interest in castles, samurai residences, traditional merchant quarters, and archaeological sites. Preservation efforts by municipal and national authorities maintain authenticity while enabling controlled tourism access. Educational programming and guided experiences enhance understanding of historical contexts.

Artistic Tourism attracts visitors seeking engagement with traditional and contemporary Japanese art forms. Museums, galleries, and art installations across major cities showcase everything from ancient calligraphy to digital immersive exhibitions. Workshops offering hands-on experiences in pottery, textile dyeing, and brush painting appeal particularly to international travelers.

Culinary Tourism centers on regional food traditions and gastronomic experiences. Travelers pursue authentic dining in traditional settings, cooking classes, and food market tours. Regional specialties drive destination choices, with each prefecture promoting unique ingredients and preparation methods. Sake breweries and tea ceremony experiences add depth to culinary exploration.

Festival Tourism revolves around seasonal celebrations deeply rooted in local communities. Annual events feature traditional performances, processions, and ritual practices. Advance planning and accommodation booking become essential as major festivals draw concentrated visitor numbers. Regional festivals offer alternatives to heavily attended urban celebrations.

Religious Tourism encompasses visits to Shinto shrines, Buddhist temples, and pilgrimage routes. Spiritual seekers and cultural learners alike participate in temple stays, meditation sessions, and ritual observations. Sacred mountain trails and historic pilgrimage paths combine physical activity with cultural immersion.

Traveler Category Analysis

Leisure Travelers dominate with 41.3% driven by vacation-oriented cultural exploration and experience-seeking behavior.

In 2025, Leisure Travelers held a dominant market position in the By Traveler Category segment, commanding 41.3% share. This group pursues cultural tourism primarily for personal enrichment and recreation. Package tours and independent itineraries both cater to diverse interests spanning multiple cultural attractions. Flexible scheduling allows extended time at preferred sites and spontaneous discoveries.

Educational Institutions organize structured cultural tours for students across various academic levels. Study abroad programs incorporate cultural site visits as experiential learning components. Language schools combine classroom instruction with cultural excursions. Universities partner with cultural venues for specialized access and expert-led sessions.

Pilgrims undertake journeys to sacred sites for spiritual fulfillment and religious practice. Traditional pilgrimage routes see steady participation from domestic and international devotees. Temple lodging accommodations provide authentic environments for spiritual reflection. Seasonal pilgrimages align with religious calendars and significant observances.

History Enthusiasts represent dedicated travelers with specific interests in particular historical periods or events. This segment invests significant time researching sites and seeks detailed information during visits. Specialized tours catering to niche historical topics attract these knowledgeable travelers. Academic conferences and historical society events generate focused visitation.

General Public encompasses casual visitors incorporating cultural sites into broader travel itineraries. This diverse group may prioritize accessibility and convenience over deep engagement. Popular landmarks with strong visual appeal attract general public attention. Social media influence drives discovery and visitation patterns within this segment.

Tourist Type Analysis

Domestic tourists dominate with 62.4% reflecting strong local interest in regional cultural exploration and heritage appreciation.

In 2025, Domestic tourists held a dominant market position in the By Tourist Type segment, representing 62.4% share. Japanese residents increasingly explore cultural attractions within their own country, driven by improved regional connectivity and promotional campaigns highlighting lesser-known destinations. Weekend trips and extended holiday travel support consistent domestic demand. Regional rail passes and bundled ticket offerings encourage multi-destination cultural circuits.

International tourists contribute substantial economic impact despite smaller volume share. Overseas visitors typically allocate higher per-trip spending and show strong interest in authentic cultural experiences. Visa policy adjustments and expanded air connectivity facilitate international arrivals. Weak yen valuations during certain periods enhance affordability for foreign currency holders, stimulating extended stays and deeper cultural engagement across multiple regions.

Booking Channel Analysis

Online booking channels dominate with 56.7% due to digital convenience and comprehensive information access.

In 2025, Online channels held a dominant market position in the By Booking Channel segment, capturing 56.7% share. Digital platforms enable travelers to research, compare, and book cultural experiences efficiently. Integrated booking systems combine transportation, accommodation, and attraction tickets. Mobile applications facilitate on-demand reservations and real-time availability checks. Multilingual interfaces broaden accessibility for international users.

Phone Booking maintains relevance for travelers preferring direct communication with service providers. This channel serves customers seeking clarification on specific requirements or customized arrangements. Elderly demographics and those less comfortable with digital tools utilize phone reservations. Tour operators and specialized cultural experience providers often support phone inquiries for complex bookings.

In-Person Booking occurs at tourist information centers, hotel concierge desks, and attraction entry points. Last-minute decisions and spontaneous visits drive walk-up reservations. On-site staff provide immediate assistance and personalized recommendations. Physical ticket counters at major cultural venues continue serving visitors who prefer face-to-face transactions.

Other channels include travel agency bookings, corporate arrangements for group tours, and partnerships with educational institutions. Third-party aggregators and package tour operators bundle multiple cultural experiences. Emerging channels such as social commerce platforms and influencer-driven bookings gradually capture niche segments seeking curated experiences.

Key Market Segments

By Tourism Type

- Heritage Tourism

- Artistic Tourism

- Culinary Tourism

- Festival Tourism

- Religious Tourism

By Traveler Category

- Leisure Travelers

- Educational Institutions

- Pilgrims

- History Enthusiasts

- General Public

By Tourist Type

- Domestic

- International

By Booking Channel

- Online

- Phone Booking

- In-Person Booking

- Others

Drivers

Weak Yen Fuels Extended Cultural Stays Among International Travelers

Currency depreciation significantly enhances Japan’s value proposition for overseas visitors. International travelers enjoy extended purchasing power, enabling longer stays and deeper cultural exploration. This economic advantage encourages travelers to visit multiple cultural sites across different regions rather than limiting themselves to major urban centers.

The favorable exchange rate particularly benefits Western and Asian travelers from strong-currency nations. Visitors allocate more budget toward premium cultural experiences such as private tea ceremonies and artisan workshops. Cultural tourism operators capitalize on this trend by developing premium packages targeting high-spending international segments.

Government tourism agencies actively promote the affordability message through international marketing campaigns. Airlines respond with increased flight capacity to secondary cities with cultural significance. Accommodation providers near heritage sites experience higher occupancy rates as travelers extend their itineraries. This currency-driven momentum creates sustainable growth opportunities across Japan’s cultural tourism ecosystem throughout the forecast period.

Government Investment Strengthens Heritage Preservation and Tourism Infrastructure

National and local governments prioritize funding for heritage site restoration and visitor facility improvements. Budget allocations support structural reinforcements, environmental controls, and accessibility enhancements at cultural properties. These investments ensure long-term preservation while accommodating growing visitor numbers safely and sustainably.

Public-private partnerships facilitate commercialization of heritage districts without compromising authenticity. Regulatory frameworks balance conservation requirements with tourism development objectives. Tax incentives encourage private investment in traditional building renovations for cultural tourism purposes. Infrastructure projects improve transportation links connecting remote cultural destinations to major urban hubs.

Rising Global Demand for Authentic Traditional Experiences Drives Market Expansion

International travelers increasingly seek meaningful engagement with traditional crafts, temple rituals, and festival celebrations. Superficial tourist activities no longer satisfy sophisticated cultural tourists demanding genuine participation. Workshops allowing hands-on involvement in pottery, textile weaving, and calligraphy attract premium pricing and strong booking rates.

Social media amplifies awareness of unique cultural offerings across Japan’s regions. Travelers pursue less-commercialized experiences in rural areas and smaller cities. This demand disperses economic benefits beyond traditional tourism hotspots. Cultural tourism operators develop innovative programs connecting visitors directly with local artisans and practitioners.

Expansion of Regional Rail Networks Enhances Cultural Circuit Accessibility

Transportation infrastructure development unlocks previously underserved cultural destinations. New rail extensions and frequency increases enable convenient day trips and multi-city cultural itineraries. Regional rail passes specifically designed for cultural tourists bundle transportation with attraction admissions at attractive price points.

Improved connectivity allows cultural tourism to function as an economic catalyst for rural revitalization. Smaller cities leverage their unique cultural assets to attract visitors who can now access them efficiently. Coordinated timetables align with major festivals and seasonal attractions. This infrastructure expansion fundamentally reshapes cultural tourism distribution patterns across Japan.

Restraints

Visitor Capacity Controls at UNESCO Sites Limit Growth Potential

Overcrowding threatens the preservation and visitor experience quality at popular heritage locations. Authorities implement entry quotas, advance booking requirements, and time-slot restrictions to manage visitor flows. These necessary controls constrain revenue growth potential during peak seasons. Some high-demand sites face months-long advance booking requirements, deterring spontaneous travelers.

Balancing preservation needs with tourism revenue creates ongoing management challenges. Strict visitor caps prevent operators from maximizing commercial returns during high-demand periods. Cultural sites must invest in crowd management systems and staff resources. Enforcement of capacity limits sometimes generates visitor disappointment and negative experiences when sites reach maximum capacity.

Heritage site managers face pressure from both conservation advocates and economic development stakeholders. Finding optimal visitor levels that preserve site integrity while supporting local economies requires continuous adjustment. During major festivals or seasonal peaks, even large heritage sites struggle with demand that exceeds sustainable capacity levels.

Growth Opportunities

Digitalization Transforms Traditional Craft Workshops into Scalable Tourism Products

Technology enables artisans to offer bookable cultural experiences through online platforms. Digital scheduling systems allow small workshops to efficiently manage international visitor inquiries and reservations. Virtual previews help travelers select experiences matching their interests before committing. This digital infrastructure reduces transaction barriers between rural artisans and global travelers.

Online payment integration and multilingual booking interfaces expand market reach for traditional craftspeople. Workshops can now attract visitors directly without relying on tour operator intermediaries. Digital marketing showcases unique cultural offerings to niche audiences worldwide. This digitalization creates new revenue streams for heritage crafts while preserving traditional knowledge through visitor engagement.

Rural Accommodation Development Around Heritage Sites Creates Dispersed Tourism Growth

Investment in minpaku guesthouses and renovated traditional homes addresses capacity constraints near cultural attractions. Rural accommodation development enables overnight stays in heritage districts and shrine towns. This dispersed model reduces pressure on urban tourism infrastructure while distributing economic benefits to countryside communities. Extended stays encourage deeper cultural immersion and higher per-visitor spending.

Heritage building conversions into guest accommodations preserve architectural authenticity while generating sustainable use. Communities near onsen hot springs and old villages gain economic opportunities through cultural tourism. Accommodation diversity appeals to various traveler segments from budget backpackers to luxury seekers. Regulatory support for rural lodging development accelerates expansion of overnight cultural tourism options.

AI-Powered Cultural Interpretation Platforms Enable Independent Exploration

Multilingual artificial intelligence applications provide detailed cultural context without requiring live guides. Self-guided tourism becomes more meaningful as travelers access expert-level information through mobile devices. Real-time translation and audio explanations accommodate diverse language needs. These platforms reduce operational costs while improving accessibility for international visitors.

Interactive features allow travelers to customize their learning depth and exploration pace. Augmented reality overlays enhance understanding of historical sites and cultural practices. Data analytics help operators understand visitor interests and optimize content. This technology democratizes high-quality cultural interpretation previously available only through expensive private tours.

Integrated Cultural Rail Routes Connect Regional Heritage Clusters

Coordinated tourism circuits linking multiple heritage sites create compelling multi-day itineraries. Transportation operators partner with cultural venues to develop themed routes focused on specific historical periods or cultural elements. Bundled ticketing simplifies logistics and improves value perception. These integrated routes encourage extended stays and broader geographic distribution of cultural tourists.

Marketing cooperation among regional stakeholders amplifies promotional reach and effectiveness. Route development considers seasonal festivals and natural attractions complementing cultural sites. Infrastructure investment prioritizes connections between heritage clusters with thematic coherence. This strategic integration transforms scattered cultural assets into cohesive tourism products.

Emerging Trends

Temple Lodging and Heritage Ryokan Stays Reshape Cultural Accommodation Preferences

Travelers increasingly seek overnight experiences within cultural environments rather than conventional hotels. Temple lodging programs allow guests to participate in morning prayers and meditation sessions. Heritage ryokan inns offer traditional hospitality with cultural programming including tea ceremonies and seasonal kaiseki dining. These immersive accommodations command premium pricing and high satisfaction ratings.

Authenticity drives booking decisions as travelers prioritize genuine cultural engagement over generic tourism. Renovated traditional buildings maintain historical character while incorporating modern comfort amenities. Smaller properties create intimate experiences with direct cultural practitioner interaction. This trend supports preservation economics by creating revenue for maintaining heritage structures.

Festival-Centric Travel Packages Align Tourism with Cultural Calendars

Tour operators develop specialized itineraries synchronized with major festivals and seasonal celebrations. Advance booking systems allow travelers to secure festival access and accommodations months ahead. Package tours bundle transportation, lodging, and prime viewing positions for festival events. This approach addresses logistical challenges that previously deterred independent travelers from attending regional festivals.

Seasonal cultural calendars guide tourism promotion and capacity planning. Lesser-known festivals gain visibility through targeted marketing to cultural enthusiasts. Multi-festival routes allow travelers to experience diverse celebration types across regions. This trend distributes tourism demand temporally and geographically while celebrating Japan’s living cultural traditions.

Anime Heritage Circuits Blend Pop Culture with Traditional Tourism

Younger demographics engage with Japanese culture through anime and manga gateway interests. Tourism products connect fictional story settings with real historical locations and cultural practices. Themed tours incorporate both animation studio visits and traditional craft experiences. This crossover attracts visitors who might not initially consider conventional cultural tourism.

Regional destinations featured in popular anime works leverage entertainment connections to drive visitation. Cultural sites benefit from expanded audience demographics including younger international travelers. Merchandise and themed experiences generate additional revenue streams. This trend demonstrates cultural tourism’s evolution to embrace contemporary cultural expressions alongside traditional heritage.

Blockchain Digital Passports Streamline Multi-Venue Cultural Access

Technology platforms develop digital credential systems for seamless entry across cultural attractions and transportation networks. Blockchain-based passports eliminate repetitive ticketing transactions and physical credential management. Integrated systems enable dynamic pricing and capacity management across venue networks. Travelers benefit from simplified logistics while operators gain better demand visibility and data.

Digital access credentials facilitate new business models including subscription-based unlimited cultural venue access. Interoperability between transportation and attraction ticketing creates comprehensive travel solutions. Security features prevent fraud while maintaining user privacy. This technological infrastructure positions Japan’s cultural tourism sector for enhanced operational efficiency and visitor convenience.

Key Japan Cultural Tourism Company Insights

National Museum of Western Art operates as a cornerstone institution within Tokyo’s museum district, attracting cultural tourists interested in European art collections housed in Le Corbusier’s UNESCO-listed architecture. The museum’s strategic location in Ueno Park positions it within a cultural cluster that encourages extended visitor engagement across multiple attractions. Programming initiatives increasingly target international visitors through multilingual audio guides and special exhibitions coordinated with global art institutions.

21_21 Design Sight represents contemporary cultural tourism by showcasing cutting-edge Japanese design and creative innovation. Located in Tokyo Midtown, the facility attracts design-conscious travelers and creative professionals seeking insights into Japan’s design philosophy. Exhibition programs rotate regularly, encouraging repeat visitation and maintaining relevance with design trends. The venue’s architectural significance as a Tadao Ando creation adds heritage value to contemporary content.

National Museum of Ethnology serves specialized cultural tourism interests through comprehensive anthropological collections and research facilities in Osaka. The institution attracts academic travelers, researchers, and cultural enthusiasts pursuing deep understanding of global cultures including Japanese traditions in comparative context. Extensive collections support long-duration visits and repeat tourism from specialized audiences. Educational programming facilitates cross-cultural understanding while preserving ethnographic knowledge.

Kyoto National Museum anchors cultural tourism in Japan’s historic capital through world-class collections of Japanese and Asian art spanning centuries. The institution’s proximity to major temples and heritage sites creates synergistic visitation patterns. Periodic special exhibitions featuring national treasures and loaned masterworks generate significant international tourist interest. The museum balances preservation responsibilities with public engagement, managing high visitor volumes during peak seasons.

Hakone Open-Air Museum combines sculpture, architecture, and natural landscape into an outdoor cultural tourism destination near Mount Fuji. The venue attracts day-trippers from Tokyo and international visitors seeking alternatives to indoor museum experiences. Permanent collections and rotating exhibitions create varied experiences across different seasons. Family-friendly programming expands the visitor demographic beyond traditional art museum audiences.

Key Players

- National Museum of Western Art

- 21_21 Design Sight

- National Museum of Ethnology

- Kyoto National Museum

- Hakone Open-Air Museum

Recent Developments

- In March 2024, Seiko Group announced the Grand Seiko Museum Ginza would open on April 2, 2024 and showcase over 100 historical Grand Seiko timepieces, expanding Tokyo’s cultural tourism offerings with specialized horological heritage.

- In February 2024, Mori Building announced teamLab Borderless would open February 9, 2024 at Azabudai Hills, featuring over 50 interconnected artworks, revitalizing Tokyo’s digital art tourism landscape.

- In May 2024, Star Asia Group announced it would acquire 100% of Minacia Co., Ltd., a hotel operator running 39 limited-service hotels totaling 5,180 rooms, strengthening accommodation infrastructure supporting cultural tourism growth.

- In November 2024, Ichigo Hotel announced it would acquire The OneFive Marine Fukuoka and Nest Hotel Hakata Ekimae, and sell Nest Hotel Osaka Shinsaibashi, reflecting strategic portfolio optimization within cultural tourism centers.

- In November 2024, Cool Japan Fund announced it invested in Inside Travel Group, describing it as a specialist cultural adventure tour operator, supporting development of curated cultural tourism experiences.

- In March 2025, Cool Japan Fund announced it would invest JPY 5 billion in the Atona Impact Fund, targeting ATONA-branded luxury hot spring ryokans, expanding premium heritage accommodation capacity.

- In September 2025, Hyatt, Kiraku, and Takenaka announced a 22 billion yen final close of a real-estate fund for the Atona luxury onsen ryokan brand (Atona Impact Fund), demonstrating investor confidence in heritage hospitality.

- In September 2025, Seibu Prince Hotels Worldwide announced it would acquire Ace Group International for approximately US$90 million, consolidating hospitality assets serving cultural tourism markets.

- In October 2025, Reuters reported teamLab opened its permanent Kyoto installation Biovortex on October 7, 2025, spanning 10,000 m² and featuring 50+ immersive artworks, establishing Kyoto as a digital art destination complementing traditional heritage.

- In December 2025, Toyota Group announced THE MOVEUM YOKOHAMA would open on December 20, 2025, and Toyota’s info page states online sales begin October 23, 2025, adding automotive cultural heritage tourism to the market.

- In April 2025, the official Expo 2025 Osaka website lists the Expo schedule as April 13 to October 13, 2025, creating significant cultural tourism opportunities during the six-month international exhibition.

Report Scope

Report Features Description Market Value (2025) USD 58.7 Billion Forecast Revenue (2035) USD 113.3 Billion CAGR (2026-2035) 6.8% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Tourism Type (Heritage Tourism, Artistic Tourism, Culinary Tourism, Festival Tourism, Religious Tourism), By Traveler Category (Leisure Travelers, Educational Institutions, Pilgrims, History Enthusiasts, General Public), By Tourist Type (Domestic, International), By Booking Channel (Online, Phone Booking, In-Person Booking, Others) Competitive Landscape National Museum of Western Art, 21_21 Design Sight, National Museum of Ethnology, Kyoto National Museum, Hakone Open-Air Museum Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Japan Cultural Tourism MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Japan Cultural Tourism MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- National Museum of Western Art

- 21_21 Design Sight

- National Museum of Ethnology

- Kyoto National Museum

- Hakone Open-Air Museum