Global Interactive Teller Machine Market By Component (Hardware, Software, Services), By Type (Full-Function ITMs (Full Service), Limited-Function ITMs (Assisted Service)), By Deployment (On-site (Branch), Off-site (Remote/Retail Locations)), By End-User (Banks, Credit Unions, Other Financial Institutions),By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Feb. 2026

- Report ID: 176706

- Number of Pages: 303

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Key Statistics

- Drivers Impact Analysis

- Restraints Impact Analysis

- By Component

- By Type

- By Deployment

- By End User

- Emerging Trends

- Growth Factors

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Key Challenges

- Key Market Segments

- Regional Analysis

- Competitive Analysis

- Future Outlook

- Recent Developments

- Report Scope

Report Overview

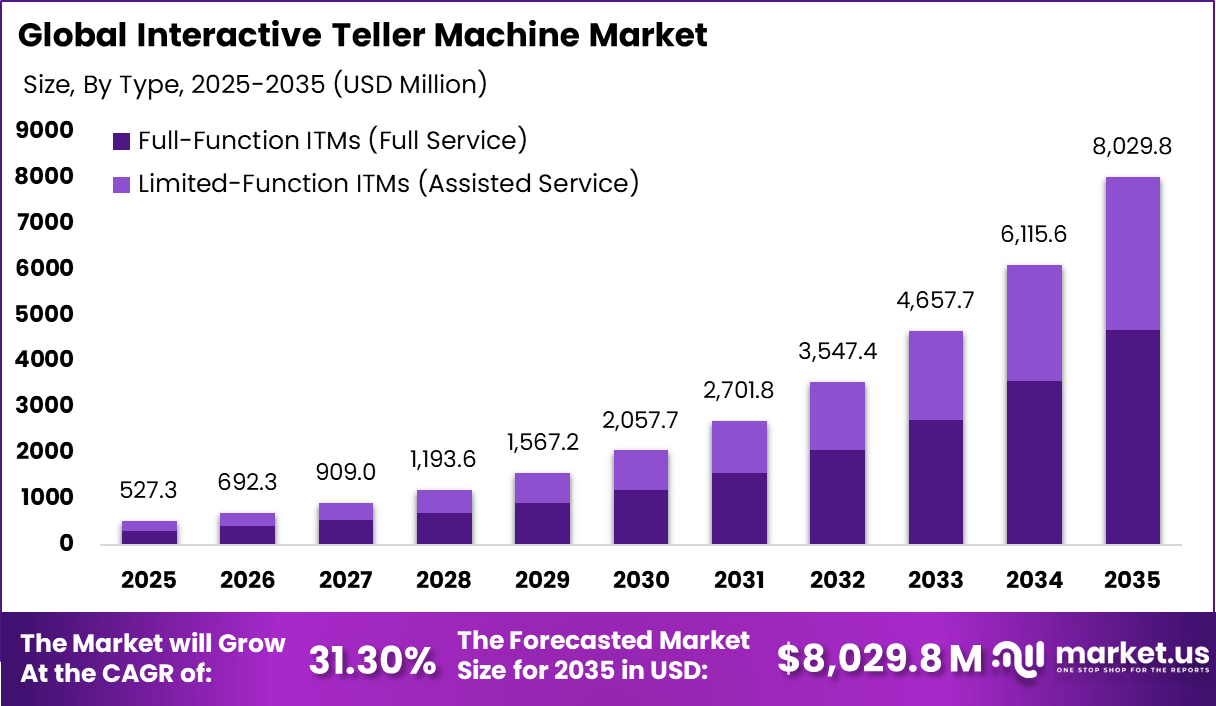

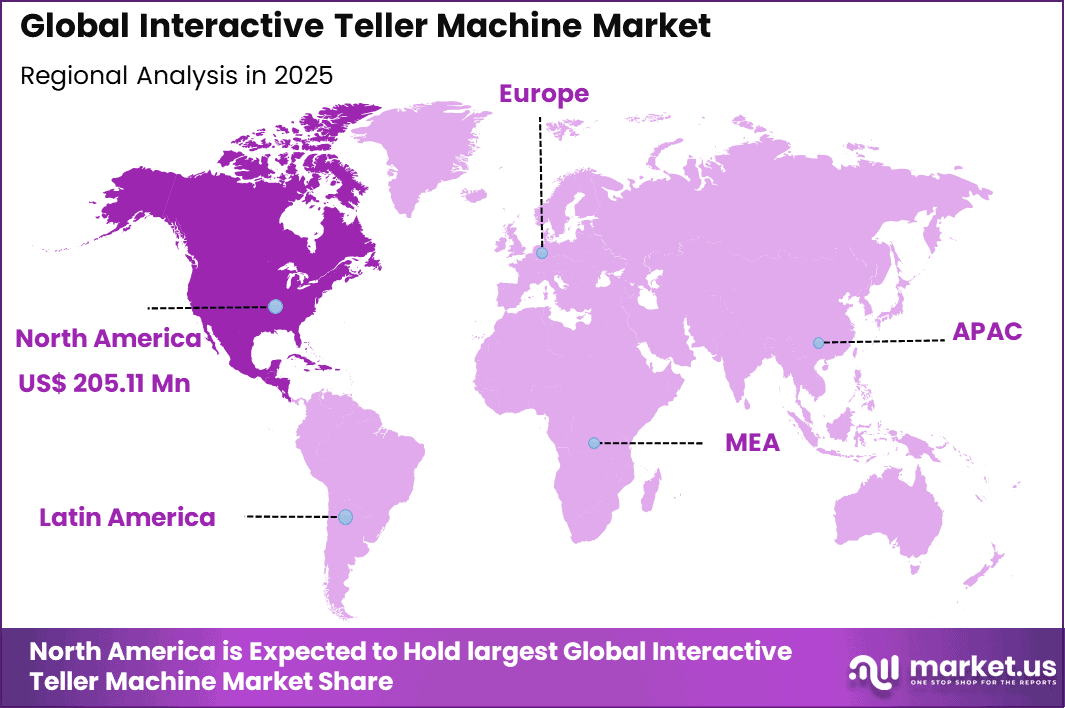

The Global Interactive Teller Machine Market generated USD 527.3 million in 2025 and is predicted to register growth from USD 692.3 million in 2026 to about USD 8,029.8 million by 2035, recording a CAGR of 31.30% throughout the forecast span. In 2025, North America held a dominan market position, capturing more than a 38.9% share, holding USD 205.11 Million revenue.

The Interactive Teller Machine Market refers to banking systems that combine traditional ATM functions with live or remote teller assistance through video, audio, and interactive interfaces. These machines allow customers to perform complex transactions such as cash deposits, withdrawals, account inquiries, check processing, and identity verification without entering a branch. Interactive teller machines are positioned between fully staffed branches and standard ATMs, offering extended service capabilities with lower operational cost.

The market includes hardware, software platforms, communication infrastructure, and backend integration with core banking systems. Financial institutions use these machines to extend service hours and improve customer reach, especially in semi urban and low traffic locations. Industry observations indicate that banks deploying interactive teller machines can reduce in branch staffing needs by more than 40% while maintaining service availability. This operational balance has driven growing institutional interest.

Top Market Takeaways

- By component, hardware accounts for 62.7% of the market, reflecting the high investment in ITM kiosks, cash recyclers, cameras, and biometric/verification modules.

- By type, full-function ITMs represent 58.3%, enabling complex transactions such as cash deposits, cheque processing, account servicing, and video-assisted interactions beyond simple cash withdrawals.

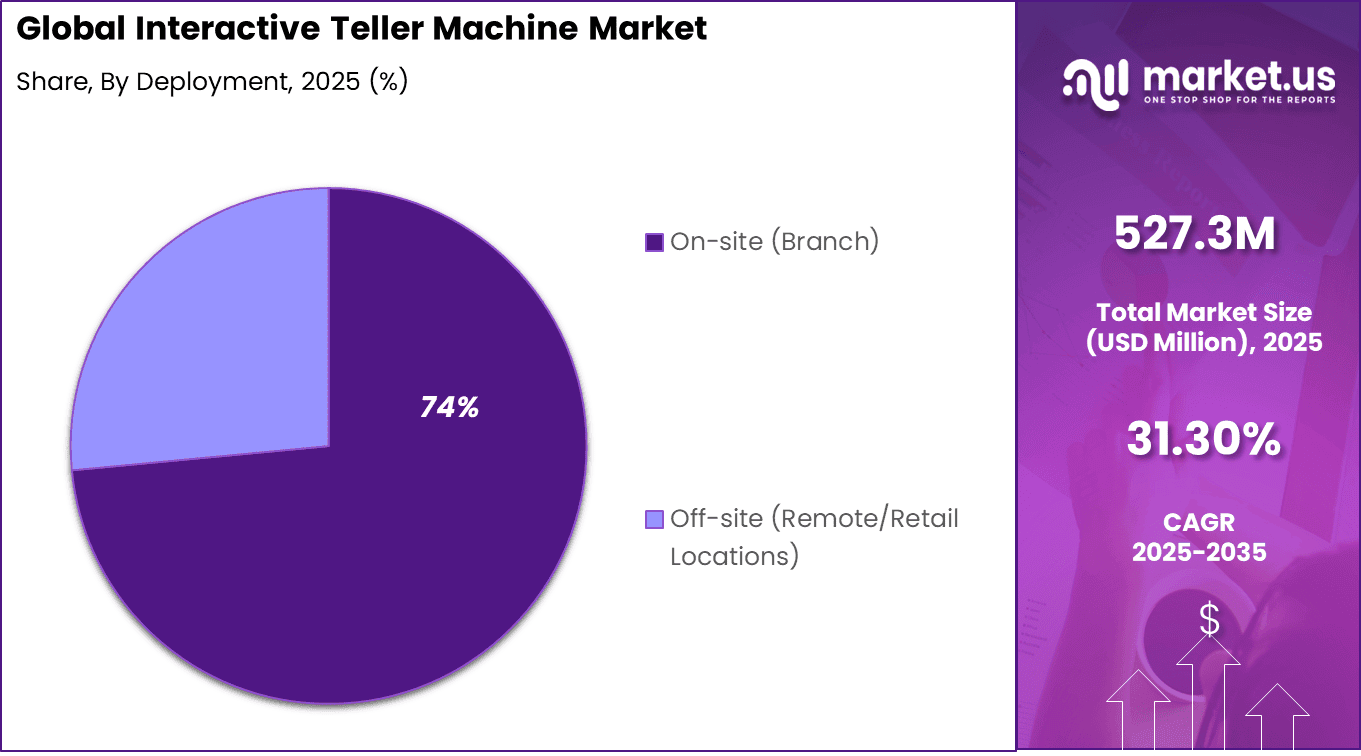

- By deployment, on-site (branch) installations hold 73.5%, as banks use ITMs inside or adjacent to branches to extend service hours, reduce teller workload, and optimize branch formats.

- By end-user, banks comprise 81.4% of demand, adopting ITMs to enhance customer experience, support omnichannel banking, and cut operational costs.

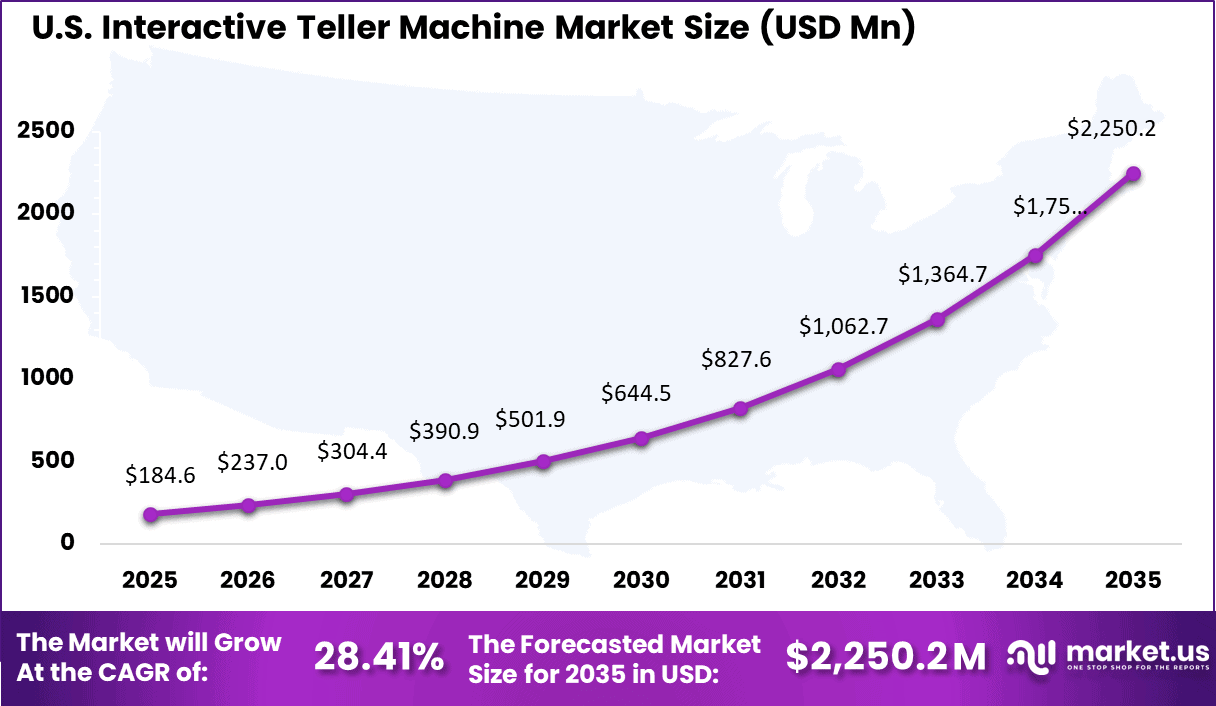

- By region, North America leads with 38.9% of the global market, with the US valued at USD 184.6 million and projected to grow at a CAGR of 28.41%, supported by rapid branch modernization and self-service banking adoption.

Key Statistics

- Video-enabled interactive teller machine deployments increased by 13.6% globally by early 2026, indicating steady adoption across banking networks.

- About 84% of financial institutions using ITMs reported better branch efficiency, with some institutions saving up to USD 50,000 per location annually by replacing or supplementing physical branches in underserved areas.

- Nearly 69% of consumers stated that interacting with a remote teller through an ITM feels comparable to a traditional in-branch experience.

- New modular ITM models introduced in 2026 reduced installation time by 30%, supporting faster rollout and lower deployment disruption.

- Around 43% of users choose ITMs primarily to speak with a teller without waiting in long branch queues.

- Transaction speed motivates 23% of users, while 21% cite overall convenience as the main reason for ITM usage.

- Overall user satisfaction remains high, with 75% of customers reporting a positive experience across both basic and advanced ITM interactions.

Drivers Impact Analysis

Key Driver Impact on CAGR Forecast (~) % Geographic Relevance Impact Timeline Rising demand for branch transformation and cost optimization +7.2% North America, Europe Short to medium term Growing preference for remote assisted and self-service banking +6.4% North America, Asia Pacific Medium term Expansion of banking services in semi-urban and rural areas +5.8% Asia Pacific, Latin America Medium term Declining footfall in traditional bank branches +5.1% North America, Europe Short term Integration of video banking and omnichannel customer service +4.3% Global Medium to long term Restraints Impact Analysis

Key Restraint Impact on CAGR Forecast (~) % Geographic Relevance Impact Timeline High upfront deployment and integration costs -5.4% Emerging Markets Short to medium term Dependence on reliable network connectivity -4.6% Rural and semi-urban regions Medium term Security and data privacy concerns in video banking -3.9% Europe, North America Medium term Customer hesitation toward video-assisted transactions -3.2% Global Short term Complexity of regulatory compliance for remote banking -2.7% Europe Medium to long term By Component

Hardware accounts for 62.7% of the interactive teller machine market, as physical infrastructure remains the core of ITM deployment. These systems rely on high grade kiosks, cash handling modules, secure enclosures, cameras, and biometric peripherals to support assisted transactions.

Reliability and durability are critical because machines operate for extended hours in customer facing environments. Banks continue to prioritize hardware upgrades to improve uptime and security. Advanced sensors and monitoring components help reduce fraud risk and service disruptions. This sustained focus keeps hardware as the dominant component within ITM investments.

By Type

Full function ITMs hold a 58.3% share, driven by demand for machines that replicate teller level services. These ITMs support deposits, withdrawals, transfers, account inquiries, and video assisted interactions within a single interface. Customers value the ability to complete complex transactions without entering a branch lobby.

From an operational view, full function systems help banks extend service availability while controlling staffing costs. Their versatility supports higher transaction volumes per machine. This strengthens adoption across both urban and semi urban banking locations.

By Deployment

On site branch deployment represents 74% of installations, as banks integrate ITMs into existing branch layouts. This approach allows institutions to modernize branches without full closure or relocation. Customers also feel more comfortable using ITMs within familiar banking premises.

Branch based deployment supports hybrid service models where remote tellers assist customers during extended hours. Banks use this setup to optimize floor space and improve service efficiency. As branch transformation continues, on site ITMs remain the preferred deployment mode.

By End User

Banks account for 81.4% of end user adoption, reflecting their direct control over customer service infrastructure. ITMs align with banking goals of improving convenience while maintaining regulatory oversight. These machines support consistent service delivery across multiple locations.

Banks also use ITMs to balance digital and physical banking strategies. By combining automation with human assistance, institutions improve customer engagement without fully eliminating in person support. This strategic fit drives strong bank led adoption.

Emerging Trends

The Interactive Teller Machine market is being shaped by the increasing convergence of digital service capability with human-style engagement in self-service banking. Institutions are upgrading traditional ATM interfaces with live video assistance, enabling real-time interaction with remote tellers through high-definition screens and audio.

This hybrid model bridges the gap between fully digital channels and in-branch experiences, providing personalised support for complex transactions such as cheque deposits, account inquiries, and service enrolments.

The adoption of advanced biometric authentication, touchless interfaces, and user-centric navigation is supporting improved user confidence and accessibility at unmanned locations. The overall experience is therefore being repositioned from simple cash dispensing to a more consultative, service-oriented encounter that reflects the evolving expectations of modern banking customers.

Growth Factors

A fundamental growth driver for the Interactive Teller Machine market is the sustained focus on enhancing customer experience while rationalising physical branch footprint. As customers increasingly prefer digital channels for routine tasks, banks and financial service providers are keen to offer comprehensive services at self-service points.

Interactive Teller Machines provide a scalable way to extend high-value service channels into communities that may not support a full branch, while maintaining the personal touch of live assistance. Another significant growth factor is the need to support financial inclusion in semi-urban and rural areas, where access to full-service branches may be limited.

By enabling remote teller support and secure transaction execution, these machines help institutions reach underserved populations with secure, assisted self-service options that build trust and convenience for users.

Investor Type Impact Matrix

Investor Type Growth Sensitivity Risk Exposure Geographic Focus Investment Outlook Banking technology and ATM solution providers Very High Medium North America, Europe Strong long-term demand from banks Banks and financial institutions High Medium Global Strategic investment for branch optimization Digital banking and fintech investors High Medium to High North America, Asia Pacific Omnichannel service expansion Private equity firms Medium Medium North America, Europe Platform scaling and consolidation Venture capital investors Medium High Asia Pacific Selective interest in smart banking infrastructure Technology Enablement Analysis

Technology Enabler Impact on CAGR Forecast (~%) Primary Function Geographic Relevance Adoption Timeline Video conferencing and remote teller platforms +7.0% Real-time assisted banking Global Short to medium term AI-powered customer authentication and verification +6.1% Secure transactions North America, Europe Medium term Integration with core banking and CRM systems +5.4% Unified customer experience Global Medium term Advanced ATM software with modular service capabilities +4.8% Service expansion beyond cash Global Medium to long term Cloud-based monitoring and device management +4.1% Operational efficiency Global Long term Key Challenges

- High upfront cost for hardware, software, and branch level integration

- Need for stable network connectivity to ensure smooth real time customer interaction

- Customer hesitation in adopting video assisted banking for complex transactions

- Training requirements for bank staff to manage remote teller operations

- Security and privacy concerns related to live video communication and data handling

Key Market Segments

By Component

- Hardware

- Software

- Services

By Type

- Full-Function ITMs (Full Service)

- Limited-Function ITMs (Assisted Service)

By Deployment

- On-site (Branch)

- Off-site (Remote/Retail Locations)

By End-User

- Banks

- Credit Unions

- Other Financial Institutions

Regional Analysis

North America holds a 38.9% share of the interactive teller machine market, supported by early adoption of advanced banking technologies and a strong focus on branch modernization. Financial institutions in the region are using interactive teller machines to extend service hours, reduce in-branch staffing pressure, and improve customer experience through video-assisted transactions.

The United States market is valued at USD 184.6 Mn and is expanding at a CAGR of 28.41%, reflecting aggressive investment in next-generation branch formats. Adoption is driven by the need to lower operating costs while maintaining personalized service for complex transactions. Growth is further supported by wider acceptance of video banking, increased use of automation in retail banking, and efforts to improve financial inclusion in semi-urban and low-density locations.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Analysis

Leading global ATM and banking technology providers such as NCR Corporation, Diebold Nixdorf, Incorporated, and Hyosung Corporation dominate the interactive teller machine market. Their ITM solutions integrate video banking, cash handling, and remote teller support. Strong hardware reliability combined with advanced software platforms supports large-scale bank deployments. These players benefit from long-standing relationships with financial institutions and global service networks.

Asian and regional manufacturers such as GRG Banking Equipment Co., Ltd., Hitachi Channel Solutions, Corp., and Fujitsu, Ltd. focus on secure, multifunctional ITMs for high-traffic locations. OKI Electric Industry Co., Ltd. and Glory, Ltd. strengthen offerings with cash recycling and automation capabilities. These companies emphasize transaction accuracy, fraud prevention, and compliance. Adoption is supported by strong demand in Asia Pacific and emerging markets.

Specialized and independent ATM solution providers such as Triton Systems of Delaware, LLC, Hantle, Inc., and Euronet Worldwide, Inc. address community banks and off-site locations. AURIGA S.p.A. and Cardtronics, Inc. support software integration and managed services. Other vendors enhance competition and customization. This diverse landscape supports steady ITM adoption across retail banking environments.

Top Key Players in the Market

- NCR Corporation

- Diebold Nixdorf, Incorporated

- Hyosung Corporation

- GRG Banking Equipment Co., Ltd.

- Hitachi Channel Solutions, Corp.

- Fujitsu, Ltd.

- OKI Electric Industry Co., Ltd.

- Triton Systems of Delaware, LLC

- Hantle, Inc.

- Nautilus Hyosung America, Inc.

- Euronet Worldwide, Inc.

- Glory, Ltd.

- AURIGA S.p.A.

- uGenius Technology

- Cardtronics, Inc.

- Others

Future Outlook

The Interactive Teller Machine Market shows steady growth as banks and financial institutions look to improve customer experience and reduce operational costs. Demand for interactive teller machines is expected to rise because these systems allow remote, real-time assistance while reducing the need for full branch staffing.

Adoption of advanced features such as video support, secure authentication, and cloud connectivity will support broader deployment. Growth can be attributed to the shift toward digital banking, the need for blended in-branch and remote services, and continued focus on efficiency and customer convenience.

Recent Developments

- November 2025, Diebold Nixdorf rolled out ITMs at Kuwait International Bank, using DN Series with video for complex transactions, slashing branch visits and boosting self-service in select locations.

- August 2025, Diebold Nixdorf launched Branch Automation Solutions portfolio at Intersect Nashville, cloud-native mix of DN Series hardware, Vynamic software, and TCRs to shift 80% teller work to ITMs/ATMs.

Report Scope

Report Features Description Market Value (2025) USD 527.3 Million Forecast Revenue (2035) USD 8,029.8 Million CAGR(2025-2035) 31.30% Base Year for Estimation 2024 Historic Period 2020-2024 Forecast Period 2025-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware, Software, Services), By Type (Full-Function ITMs (Full Service), Limited-Function ITMs (Assisted Service)), By Deployment (On-site (Branch), Off-site (Remote/Retail Locations)), By End-User (Banks, Credit Unions, Other Financial Institutions) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape NCR Corporation, Diebold Nixdorf, Incorporated, Hyosung Corporation, GRG Banking Equipment Co., Ltd., Hitachi Channel Solutions, Corp., Fujitsu, Ltd., OKI Electric Industry Co., Ltd., Triton Systems of Delaware, LLC, Hantle, Inc., Nautilus Hyosung America, Inc., Euronet Worldwide, Inc., Glory, Ltd., AURIGA S.p.A., uGenius Technology, Cardtronics, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Interactive Teller Machine MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample

Interactive Teller Machine MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- NCR Corporation

- Diebold Nixdorf, Incorporated

- Hyosung Corporation

- GRG Banking Equipment Co., Ltd.

- Hitachi Channel Solutions, Corp.

- Fujitsu, Ltd.

- OKI Electric Industry Co., Ltd.

- Triton Systems of Delaware, LLC

- Hantle, Inc.

- Nautilus Hyosung America, Inc.

- Euronet Worldwide, Inc.

- Glory, Ltd.

- AURIGA S.p.A.

- uGenius Technology

- Cardtronics, Inc.

- Others