Global Intelligent Process Automation Market Trend, Industry Analysis Report By Component (Solution, Services), By Deployment (On-premises, Cloud-based), By Enterprise Size (SMEs, Large Enterprises), By Technology (Natural Language Processing, Machine Learning and Deep Learning, Neural Networks, Virtual Agents, Mini Bots, Computer Vision, Other Technologies), By Application (Contact Center Management, Business Process Automation, Application Management, Content Management, Security Management, Other Applications), By Vertical (BFSI, IT & Telecom, Manufacturing, Media & Entertainment, Retail & Ecommerce, Healthcare, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sept. 2025

- Report ID: 157377

- Number of Pages: 361

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Analysts’ Viewpoint

- Role of Generative AI

- U.S. IPA Market Size

- Component Analysis

- Deployment Analysis

- Enterprise Size Analysis

- Technology Analysis

- Application Analysis

- Vertical Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

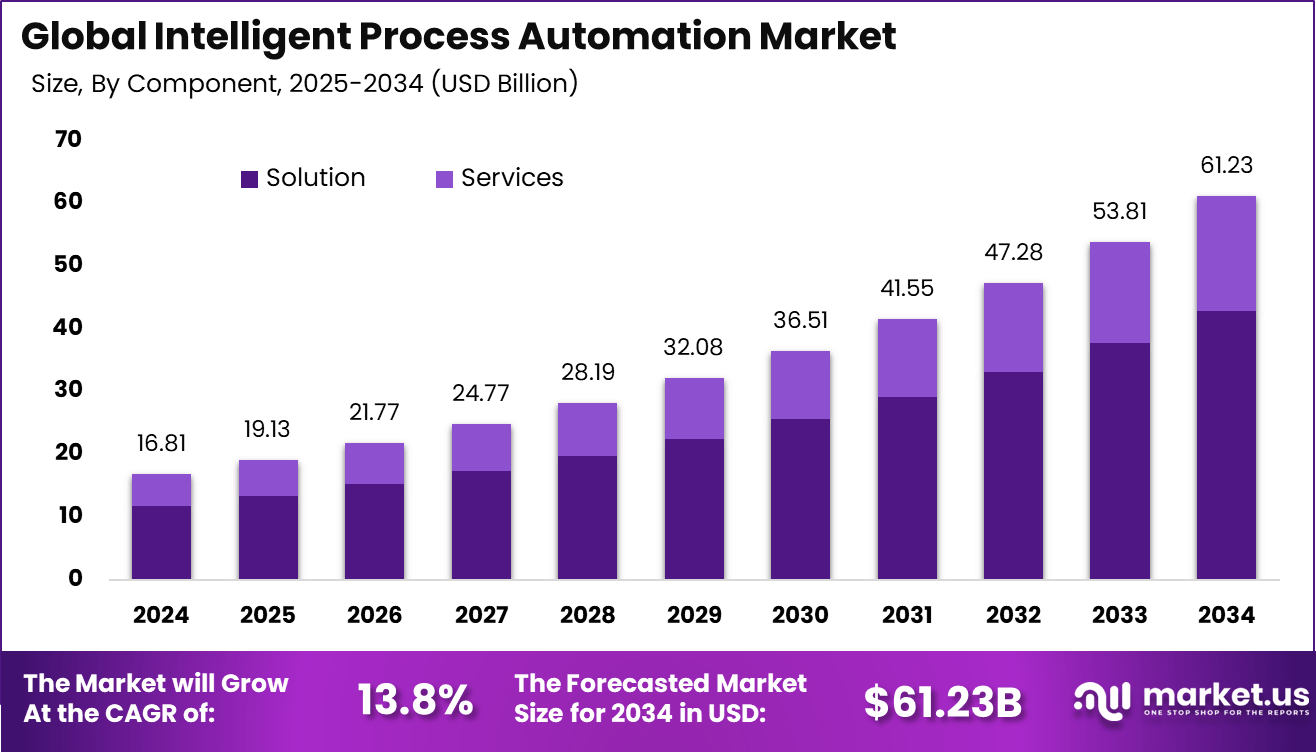

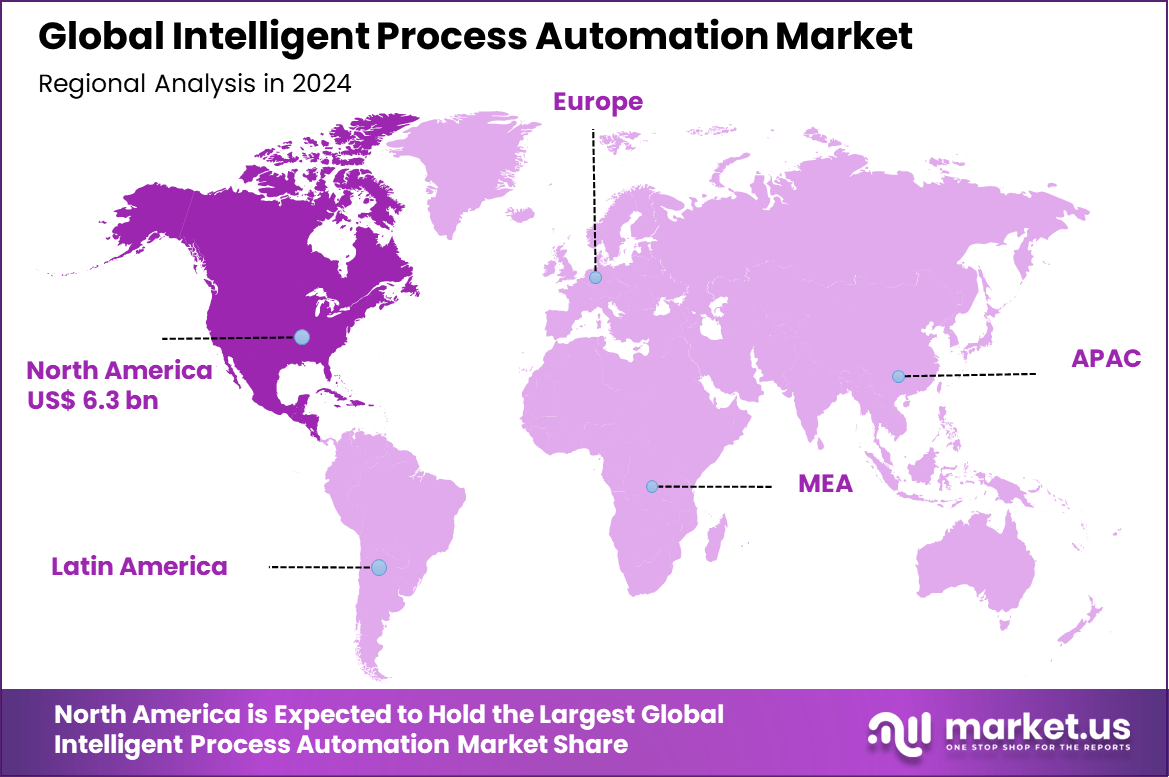

The Global Intelligent Process Automation Market size is expected to be worth around USD 61.23 billion by 2034, from USD 16.81 billion in 2024, growing at a CAGR of 13.8% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 38% share, holding USD 6.3 billion in revenue.

The Intelligent Process Automation market is transforming business operations by integrating automation capabilities with artificial intelligence to streamline workflows and decision-making processes. IPA combines technologies such as robotic process automation, machine learning, and advanced analytics, enabling organizations to automate repetitive, complex, and time-consuming tasks with minimal human intervention.

Several key forces are driving the adoption of IPA. The increasing complexity of business processes and the need to streamline high volume workflows create strong incentives for automation. IPA supports operational resilience and helps firms reduce cost while improving accuracy.

According to SeoSandwitch, 87% of organizations have implemented or are scaling IPA, with 76% considering it essential for digital transformation and 52% planning to boost spending by over 10% in 2025. Adoption is strong among Fortune 500 firms, where 65% are integrating IPA, particularly in finance and accounting, which account for 44% of deployments.

For instance, in February 2025, ADROSONIC announced the launch of its Intelligent Automation Practice to help enterprises enhance efficiency and accelerate digital innovation. The new practice focuses on combining robotic process automation (RPA), AI, and analytics to deliver smarter, end-to-end automation solutions.

Key Takeaway

- By component, Solutions led the market, accounting for 70% share.

- By deployment, Cloud-based platforms dominated with 68% share.

- By enterprise size, Large Enterprises were the main adopters, holding 72% share.

- By technology, Machine and Deep Learning contributed the largest share at 35%.

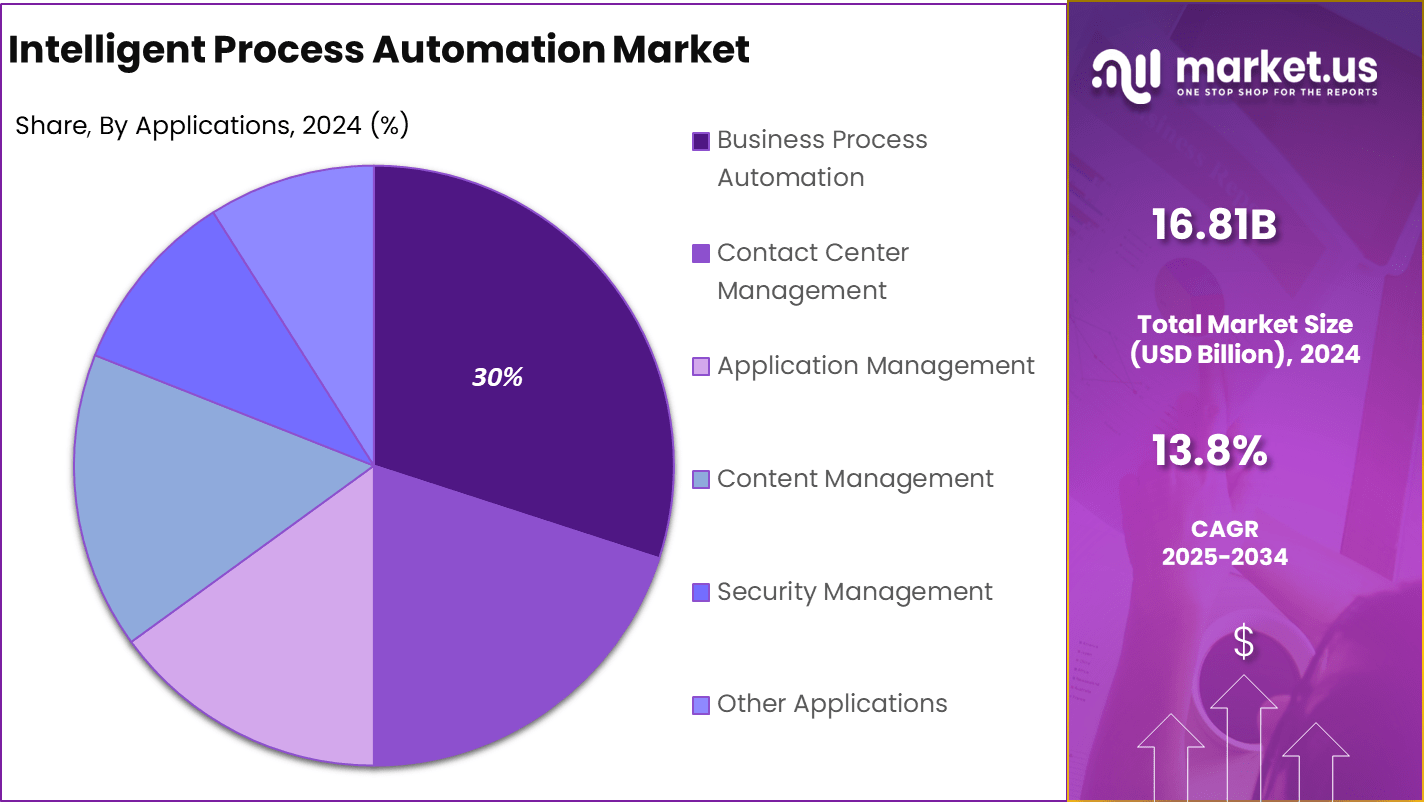

- By application, Business Process Automation accounted for 30% share.

- By vertical, BFSI led adoption, representing 31% share.

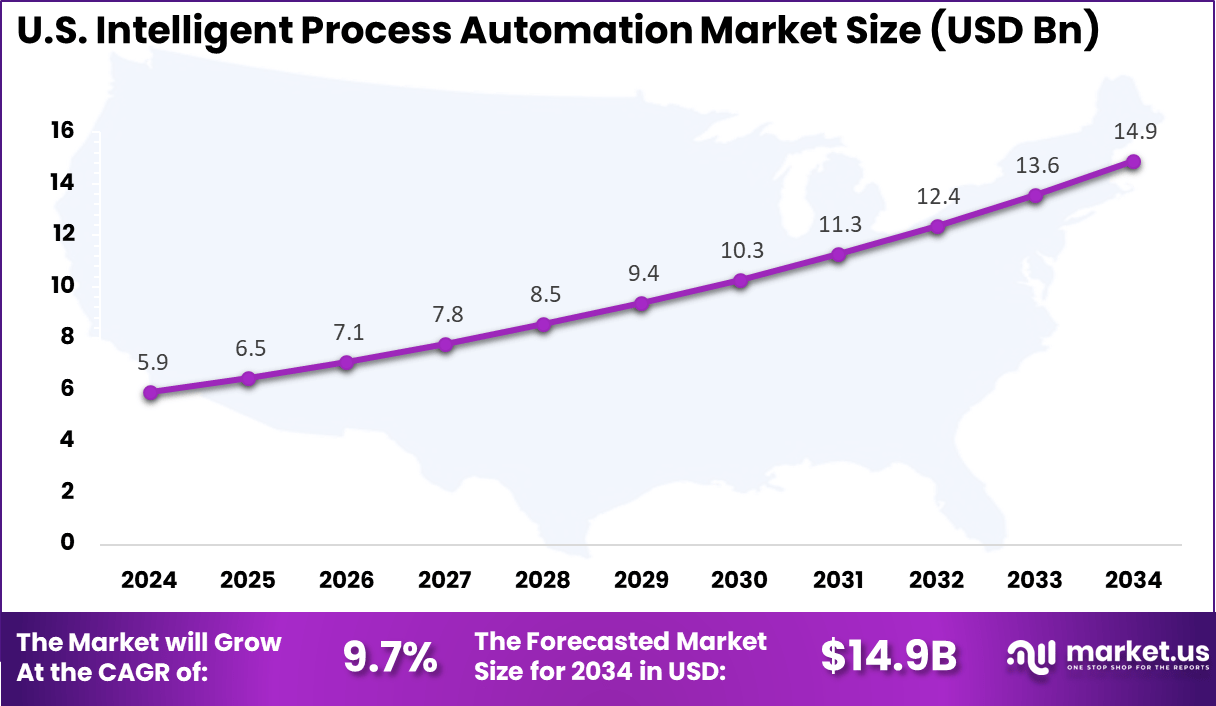

- Regionally, North America held 38% share, while the U.S. market reached USD 5.9 Billion, expanding at a CAGR of 9.7%.

Analysts’ Viewpoint

Substantial investment opportunities are emerging as IPA platforms become more accessible and customizable. Companies are channeling resources into AI-powered automation for financial processing, supply chain optimization, and customer service enhancement. There is bold number of interest in platforms offering seamless API integration, low-code automation tools, and analytics dashboards that provide real-time insights on process health and outcomes.

IPA delivers significant business benefits, with measurable gains in productivity, accuracy, and employee engagement. Employees are able to focus on higher-value work while repetitive activities are automated, improving job satisfaction and retention. The use of automation in compliance-heavy industries reduces operational risk and supports bold number of competitive differentiation through faster innovation cycles and responsive service delivery.

The regulatory landscape for IPA is evolving as industry oversight bodies set guidelines for the implementation and monitoring of intelligent automation systems. Stringent data privacy and security regulations require robust governance frameworks, compelling firms to invest in auditable and transparent IPA deployments.

Role of Generative AI

Key Points Description Unattended automation Generative AI enables fully unattended process automation by handling tasks like document review, data extraction, and composing messages, reducing human intervention and boosting efficiency. Automation interface Serves as a conversational interface for automation tools, allowing employees to trigger tasks with natural language, democratizing access to complex automation. Advanced data analytics Extracts insights from unstructured data and provides predictive analytics for decision-making and product improvement. Enhanced creativity Automates creative tasks, from content generation (text, images, code) to complex decision-making, increasing process adaptability. Customer experience Improves customer service by powering AI chatbots, generating personalized responses, and optimizing digital interactions. U.S. IPA Market Size

The market for Intelligent Process Automation within the U.S. is growing tremendously and is currently valued at USD 5.9 billion, the market has a projected CAGR of 9.7%. The market is growing tremendously due to accelerated digital transformation, a strong focus on operational efficiency, and increasing labor cost pressures.

U.S. enterprises are rapidly adopting IPA to automate complex workflows, enhance customer service, and improve compliance. The widespread integration of AI, machine learning, and analytics into automation platforms is driving demand across sectors like financial services, healthcare, and retail. Additionally, the rise of cloud-based solutions makes IPA more accessible and scalable for businesses of all sizes.

For instance, in May 2025, WNS was recognized as a Leader in Intelligent Automation Services by ISG, reinforcing the United States’ dominant position in the global intelligent process automation market. The recognition highlights WNS’s strong capabilities in deploying automation at scale, integrating AI with process management, and delivering measurable outcomes for enterprises.

In 2024, North America held a dominant market position in the Global Intelligent Process Automation Market, capturing more than a 38% share, holding USD 6.3 billion in revenue. This dominance is due to its advanced digital infrastructure, early adoption of emerging technologies, and strong presence of leading automation vendors.

U.S. based enterprises have been at the forefront of integrating AI, machine learning, and RPA to streamline operations and enhance decision-making. High investment in innovation, favorable regulatory environments, and a skilled workforce further supported IPA deployment across sectors like finance, healthcare, and manufacturing, reinforcing North America’s leadership in this space.

For instance, in January 2025, Aptean announced the acquisition of JobRouter, a provider of intelligent process automation and digital process management solutions, strengthening its presence in North America. The move reflects the region’s dominance in the intelligent process automation market, driven by high adoption rates, strong enterprise demand, and advanced digital infrastructure.

Component Analysis

In 2024, The Solution segment held a dominant market position, capturing a 70% share of the Global Intelligent Process Automation Market. This dominance is due to the growing demand for integrated automation platforms that combine RPA, AI, and analytics into a single, scalable solution.

Organizations prioritize end-to-end process automation tools that can drive efficiency, reduce errors, and support real-time decision-making. The flexibility, ease of deployment, and ability to deliver measurable ROI have made IPA solutions the preferred choice across industries.

For Instance, in June 2025, Emerson introduced new advancements in its intelligent automation solutions, aimed at helping enterprises improve efficiency, reliability, and sustainability. The latest offerings integrate AI, advanced analytics, and process automation to optimize operations across sectors such as energy, manufacturing, and life sciences.

Deployment Analysis

In 2024, the Cloud-Based segment held a dominant market position, capturing a 68% share of the Global Intelligent Process Automation Market. This dominance is due to the need for scalability, cost-efficiency, and remote accessibility.

As organizations increasingly adopt hybrid work models, cloud-based IPA solutions offer faster deployment, reduced infrastructure costs, and seamless integration with existing enterprise systems. Additionally, continuous updates, enhanced security features, and flexibility in scaling operations make cloud deployment a preferred choice for both SMEs and large enterprises.

For instance, in January 2025, Aptean expanded its portfolio by acquiring JobRouter, a provider of cloud-based intelligent process automation and digital process management solutions. This acquisition strengthens Aptean’s ability to deliver scalable, flexible automation tools that align with the growing enterprise shift toward cloud-first strategies.

Enterprise Size Analysis

In 2024, the Large Enterprises segment held a dominant market position, capturing a 72% share of the Global Intelligent Process Automation Market. This dominance is due to their greater financial capacity to invest in advanced automation technologies and their complex operational structures that benefit most from end-to-end process optimization.

Large enterprises are prioritizing IPA to drive digital transformation, improve operational efficiency, and maintain competitiveness. Their ability to deploy customized, large-scale solutions and integrate IPA across departments further reinforces the leadership.

For Instance, in May 2025, TeamViewer announced the release of TeamViewer One, an enhanced intelligent automation platform designed to streamline operations for large enterprises. The solution integrates AI, IoT, and process automation to optimize complex workflows, improve efficiency, and enable remote management at scale.

Technology Analysis

In 2024, the Machine and Deep Learning segment held a dominant market position, capturing a 35% share of the Global Intelligent Process Automation Market. This dominance is due to the growing demand for intelligent systems that can analyze large volumes of data, identify patterns, and make predictive decisions in real time.

Machine and deep learning technologies enhance the cognitive capabilities of IPA platforms, enabling automation of complex, non-linear processes. Their application in areas like fraud detection, customer insights, and process optimization has significantly boosted adoption across sectors.

For Instance, in January 2020, Wysdom.AI announced a collaboration with Automation Anywhere to advance intelligent process automation through machine learning integration. The partnership aimed to combine Wysdom’s expertise in conversational AI with Automation Anywhere’s RPA platform, enabling enterprises to deliver smarter, AI-driven automation.

Application Analysis

In 2024, The Business Process Automation segment held a dominant market position, capturing a 30% share of the Global Intelligent Process Automation Market. This dominance is due to enterprises increasingly seeking ways to optimize repetitive tasks, lower operational expenses, and boost overall productivity.

The integration of RPA with AI allows organizations to manage complex workflows with greater accuracy while enabling employees to focus on strategic, value-added work. Automating essential functions like finance, HR, and supply chain has delivered faster processes, reduced errors, and higher efficiency. Broad adoption across sectors such as banking, healthcare, and manufacturing is further solidifying the market.

For Instance, in May 2025, Nintex launched its Solution Studio, a new offering designed to deliver tailored business process automation solutions for enterprises. The platform allows organizations to customize automation workflows to their specific industry and operational needs, enhancing efficiency and reducing complexity. By combining low-code tools with intelligent automation, Nintex empowers businesses to rapidly design, deploy, and scale process improvements.

Vertical Analysis

In 2024, The BFSI segment held a dominant market position, capturing a 31% share of the Global Intelligent Process Automation Market. This dominance is due to the sector’s strong focus on efficiency, compliance, and customer experience.

Banks and financial institutions are leveraging IPA to automate processes such as loan approvals, claims management, fraud detection, and regulatory reporting. By integrating AI with automation, BFSI organizations reduce manual errors, enhance decision-making, and improve turnaround times, making IPA a critical enabler of digital transformation in the industry.

For Instance, in October 2021, CGI announced a partnership with several banks to pilot intelligent automation solutions aimed at modernizing financial services operations. The initiative focused on using automation to streamline processes such as loan processing, compliance reporting, and customer onboarding.

Emerging Trends

Points Description Hyper-automation Integration of RPA, AI, ML, and process mining to automate complex, cross-department workflows for total business process overhaul. Low-code/no-code automation Democratization of automation with platforms that allow business users to build and adjust workflows without deep technical skills. Human-automation collaboration Emphasizes blending human judgment with machine efficiency, especially for tasks requiring creativity and empathy. Smart data integration Increasing focus on secure, seamless integration of data across business units to power AI-driven insights and mitigate breaches. Industry-specific solutions Growing adoption of process automation tailored to requirements in healthcare, banking, retail, manufacturing, and logistics. Growth Factors

Key Points Description Efficiency & cost savings Automation decreases manual work, minimizes errors, and speeds operations, resulting in significant cost reductions. Digital transformation Businesses are rapidly adopting IPA to stay competitive in an increasingly digital market environment. Advancements in technology Breakthroughs in AI, ML, and cloud computing enable smarter self-learning automation tools and scalable solutions. Enhanced customer service Automated workflows reduce response times, personalize interactions, and drive higher customer satisfaction. Scalability & flexibility Cloud-based IPA allows businesses of all sizes to easily adopt and scale their automation initiatives. Key Market Segments

By Component

- Solution

- Services

- Consulting

- Design & Implementation

- Training & Support

By Deployment

- On-premises

- Cloud-based

By Enterprise Size

- SMEs

- Large Enterprises

By Technology

- Natural Language Processing

- Machine Learning and Deep Learning

- Neural Networks

- Virtual Agents

- Mini Bots

- Computer Vision

- Other Technologies

By Application

- Contact Center Management

- Business Process Automation

- Application Management

- Content Management

- Security Management

- Other Applications

By Vertical

- BFSI

- IT & Telecom

- Manufacturing

- Media & Entertainment

- Retail & ECommerce

- Healthcare

- Others

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Rising Adoption of RPA and AI Integration

The integration of Robotic Process Automation (RPA) with Artificial Intelligence (AI) is accelerating the adoption of Intelligent Process Automation (IPA) across various industries such as BFSI, healthcare, manufacturing, IT/telecom, etc. Enterprises are leveraging AI-powered bots for smarter decision-making, predictive analytics, and enhanced efficiency.

This convergence enables automation of both structured and unstructured tasks, driving productivity gains and operational agility. As digital transformation intensifies, organizations are prioritizing IPA to reduce costs, streamline workflows, and improve customer experiences, fueling substantial growth in the global automation ecosystem.

For instance, in June 2025, the strategic adoption of Robotic Process Automation (RPA) combined with artificial intelligence gained significant momentum across the United States. Companies are advancing their operational capabilities through partnerships with providers like IBN Technologies, leveraging automation to streamline workflows, cut costs, and improve decision-making.

Restraint

Skilled Talent Shortage

A significant challenge facing this market is the shortage of professionals skilled in RPA, AI, and process engineering. As demand for intelligent automation increases, the supply of qualified talent has not kept pace. This talent gap hampers implementation timelines and increases project costs.

Many organizations struggle to find experts capable of designing, deploying, and maintaining IPA solutions, leading to reliance on external consultants or delayed rollouts. Upskilling and workforce development are thus critical to sustaining market momentum.

For instance, in December 2024, IBM’s insights on the AI skills gap emphasized a growing challenge for organizations adopting intelligent process automation. The report revealed that over 65% of business leaders cite talent shortages in AI, automation, and data science as a major barrier to scaling digital transformation.

Opportunities

Expansion Across Various Sectors

Intelligent Process Automation is gaining grip across a wide range of industries, from banking and healthcare to manufacturing and telecom. Each sector presents unique use cases, such as automated claims processing in insurance or predictive maintenance in manufacturing.

As more organizations recognize the value of automation in boosting efficiency and customer experience, the potential for IPA continues to grow. This broad applicability creates a strong opportunity for vendors and enterprises alike to drive innovation and efficiency.

For instance, in September 2025, Augsburg University Hospital in Germany announced its successful deployment of intelligent process automation (IPA) to enhance patient care and administrative efficiency. By integrating IPA into clinical workflows, the hospital streamlined patient admissions, improved diagnostic turnaround times, and reduced manual data entry errors.

Challenges

Cybersecurity & Data Risks

As businesses automate more processes and integrate IPA systems into their core operations, cybersecurity risks increase significantly. These systems often handle sensitive data and connect across departments, making them attractive targets for cyberattacks.

A single vulnerability can expose vast amounts of business-critical information. Companies must ensure robust security frameworks, from data encryption to user access controls, are in place. Without proactive measures, the benefits of IPA could be overshadowed by costly breaches or compliance failures.

For instance, in February 2025, the World Economic Forum’s Global Cybersecurity Outlook 2025 Insight Report highlighted a sharp increase in threats targeting digital infrastructure across industries, particularly in financial services. As organizations scale intelligent process automation, cybersecurity risks escalate, driven by expanded attack surfaces and increased data flow between systems. Without robust controls, automation pipelines can become vulnerable entry points.

Key Players Analysis

The Intelligent Process Automation market is supported by established technology providers that bring strong expertise in automation software and process management. Companies such as Appian, AntWorks, and Automation Anywhere have been central in shaping enterprise adoption by providing scalable automation platforms.

Alongside them, Blue Prism and Celonis have enhanced automation with process mining and digital workforce tools, further expanding enterprise use cases across industries that demand accuracy and faster workflows. The market also benefits from the presence of global software leaders. Fortra, IBM, and Tungsten Automation Corporation (Kofax) deliver automation solutions combined with enterprise security and advanced analytics.

Microsoft and NICE extend the scope of automation by embedding AI-driven tools in existing enterprise ecosystems, making adoption easier for businesses. Meanwhile, Nintex UK Ltd and Pegasystems contribute with workflow management and intelligent decision-making platforms, supporting organizations in achieving process transparency and cost reduction.

The competition is further intensified by innovative players driving AI-powered process optimization. UiPath and WorkFusion are recognized for their robotic process automation platforms that scale across industries, offering flexibility for both small and large enterprises. ThoughtSpot Inc. adds value with analytics-driven automation, enabling enterprises to transform raw data into actionable insights.

Top Key Players in the Market

- Appian

- AntWorks

- Automation Anywhere, Inc.

- Blue Prism Limited

- Celonis

- Fortra, LLC

- IBM Corporation

- Tungsten Automation Corporation (Kofax)

- Microsoft

- NICE

- Nintex UK Ltd

- Pegasystems Inc.

- UiPath

- WorkFusion, Inc.

- ThoughtSpot Inc.

- Other Key Players

Recent Developments

- In July 2025, UiPath was recognized as a Leader in the Gartner Magic Quadrant for Robotic Process Automation (RPA) for the fifth consecutive year. UiPath was positioned highest for its Ability to Execute, reflecting the strength of its agentic automation platform that combines RPA, AI, and orchestration at scale.

- In July 2025, Automation Anywhere announced that it achieved the AWS Generative AI Competency, reinforcing its leadership in intelligent process automation. This recognition highlights the company’s expertise in integrating generative AI into enterprise automation, enabling customers to build smarter, context-aware workflows on AWS.

Report Scope

Report Features Description Market Value (2024) USD 16.81 Bn Forecast Revenue (2034) USD 61.23 Bn CAGR(2025-2034) 13.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Solution, Services), By Deployment (On-premises, Cloud-based), By Enterprise Size (SMEs, Large Enterprises), By Technology (Natural Language Processing, Machine and Deep Learning, Neural Networks, Virtual Agents, Mini Bots, Computer Vision, Other Technologies), By Application (Contact Center Management, Business Process Automation, Application Management, Content Management, Security Management, Other Applications), By Vertical (BFSI, IT & Telecom, Manufacturing, Media & Entertainment, Retail & Ecommerce, Healthcare, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Appian, AntWorks, Automation Anywhere, Inc., Blue Prism Limited, Celonis, Fortra, LLC, IBM Corporation, Tungsten Automation Corporation (Kofax), Microsoft, NICE, Nintex UK Ltd, Pegasystems Inc., UiPath, WorkFusion, Inc., ThoughtSpot Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Intelligent Process Automation MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample

Intelligent Process Automation MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Appian

- AntWorks

- Automation Anywhere, Inc.

- Blue Prism Limited

- Celonis

- Fortra, LLC

- IBM Corporation

- Tungsten Automation Corporation (Kofax)

- Microsoft

- NICE

- Nintex UK Ltd

- Pegasystems Inc.

- UiPath

- WorkFusion, Inc.

- ThoughtSpot Inc.

- Other Key Players