Global Integrated Development Environment as a Service Market Size and Forecast Industry Analysis Report By Component (Software, Services), By Application (Web Development, Mobile Development, Data Science, DevOps, Others), By Deployment Mode (Cloud, On-Premises), By Enterprise Size (Small and Medium Enterprises, Large Enterprises), By End-User (IT and Telecommunications, BFSI, Healthcare, Retail, Education, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook by 2025-2034

- Published date: Sept. 2025

- Report ID: 159198

- Number of Pages: 324

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Analysts’ Viewpoint

- U.S. Market Landscape

- Component Analysis

- Application Analysis

- Deployment Mode Analysis

- Enterprise Size Analysis

- End-User Analysis

- Emerging trends

- Growth factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

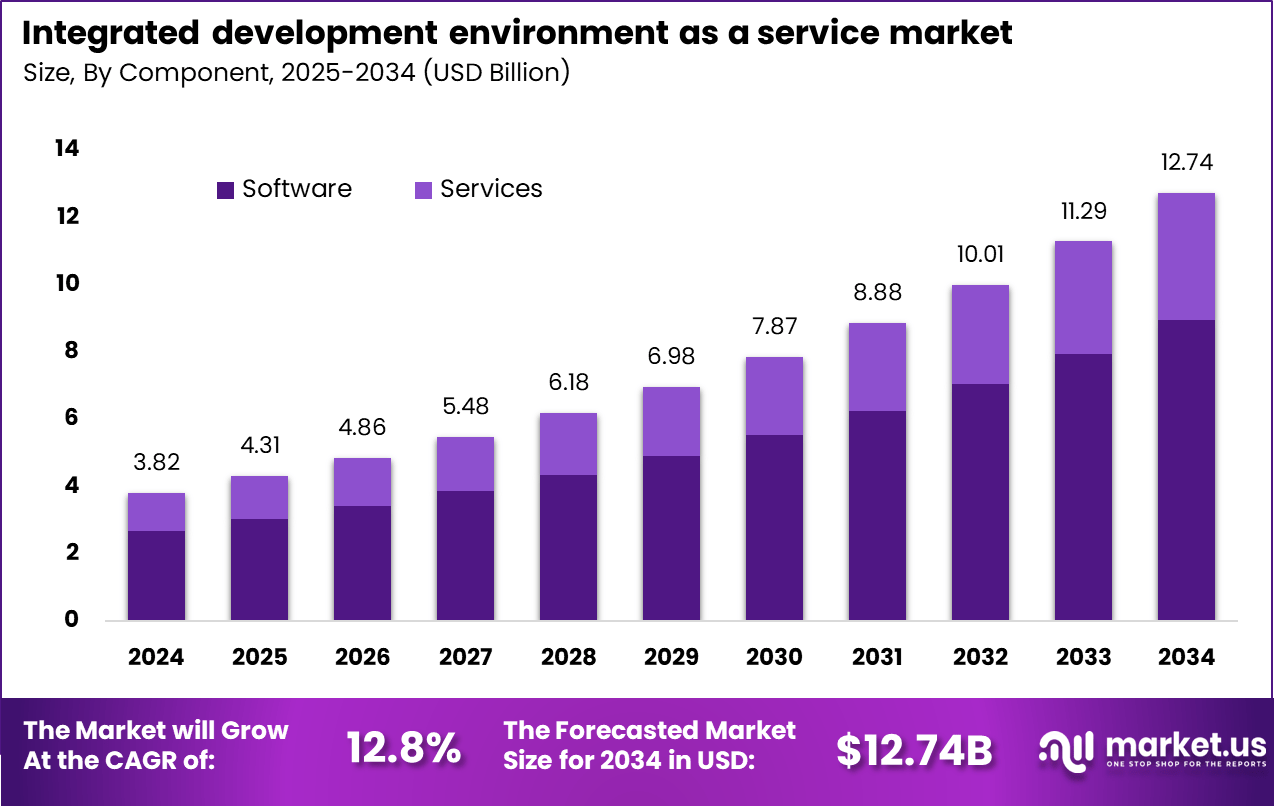

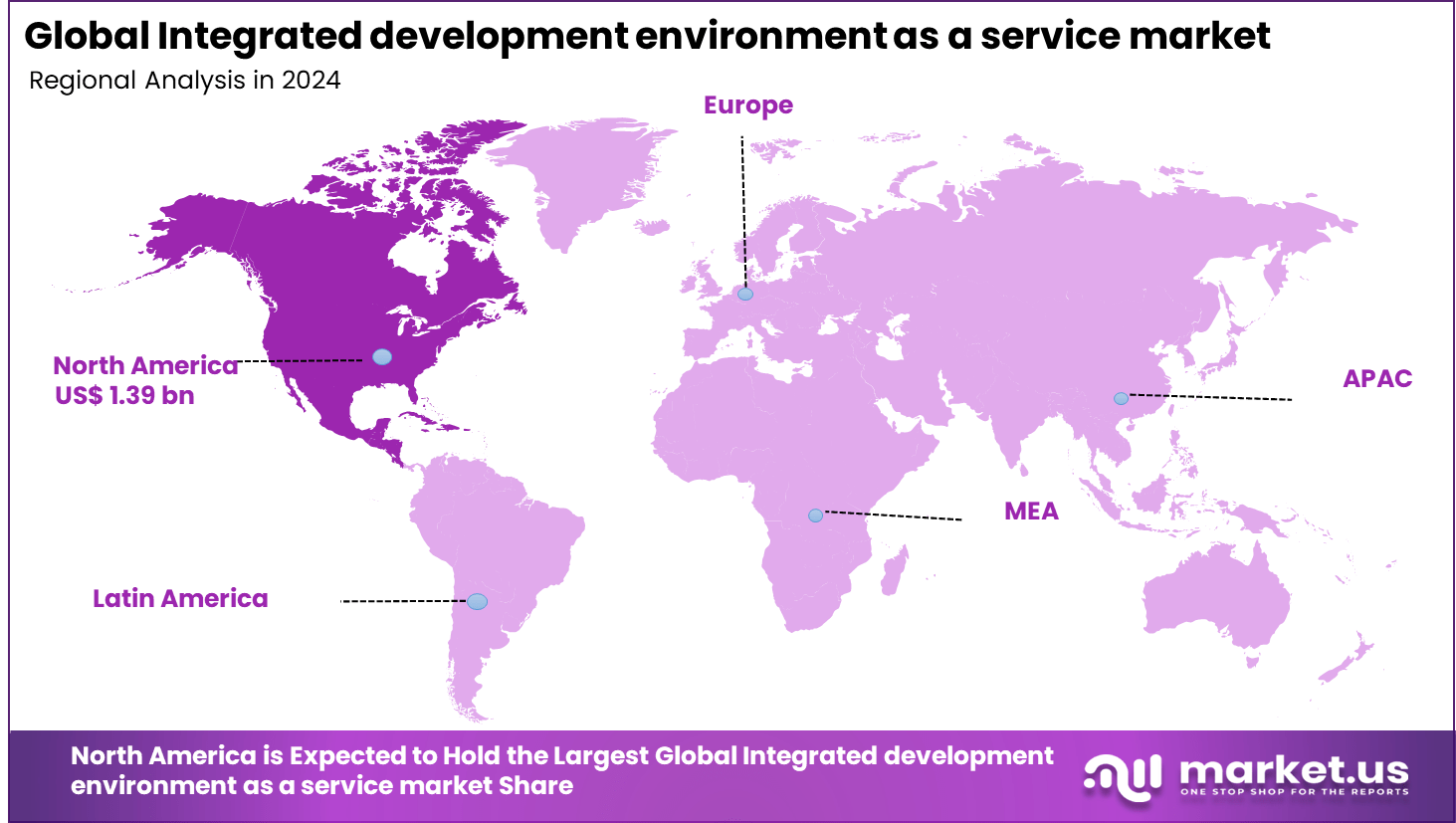

The Global Integrated development environment as a service market size is expected to be worth around USD 12.74 billion by 2034, from USD 3.82 billion in 2024, growing at a CAGR of 12.8% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 36.4% share, holding USD 1.39 billion in revenue.

The Integrated Development Environment as a Service (IDEaaS) market refers to cloud-based platforms that provide developers with tools such as code editors, debuggers, and build automation in an accessible, online environment. These platforms help simplify programming, accelerate development, and enable collaboration without the need for on-premises software installations. IDEaaS supports faster coding, testing, and deployment processes, making it easier for software teams to work from anywhere.

Top driving factors for the IDEaaS market include the growing shift from desktop to cloud-based IDE solutions, driven by the surge in remote work and the need for scalable, flexible development environments. Increasing demand for quicker application development particularly boosts adoption. According to recent data, over 60% of enterprises in the U.S. have adopted cloud-based IDE platforms, reflecting how widespread this trend has become.

For instance, in June 2025, Google Cloud unveiled its new Internal Development Platform (IDP), designed to streamline the development process for cloud-native applications. This IDP aims to replace traditional platform engineering tasks by providing developers with a fully integrated and automated environment to build, test, and deploy applications.

Key Takeaway

- 70.4% of the market share is driven by software components, underscoring the importance of robust software tools in IDE solutions.

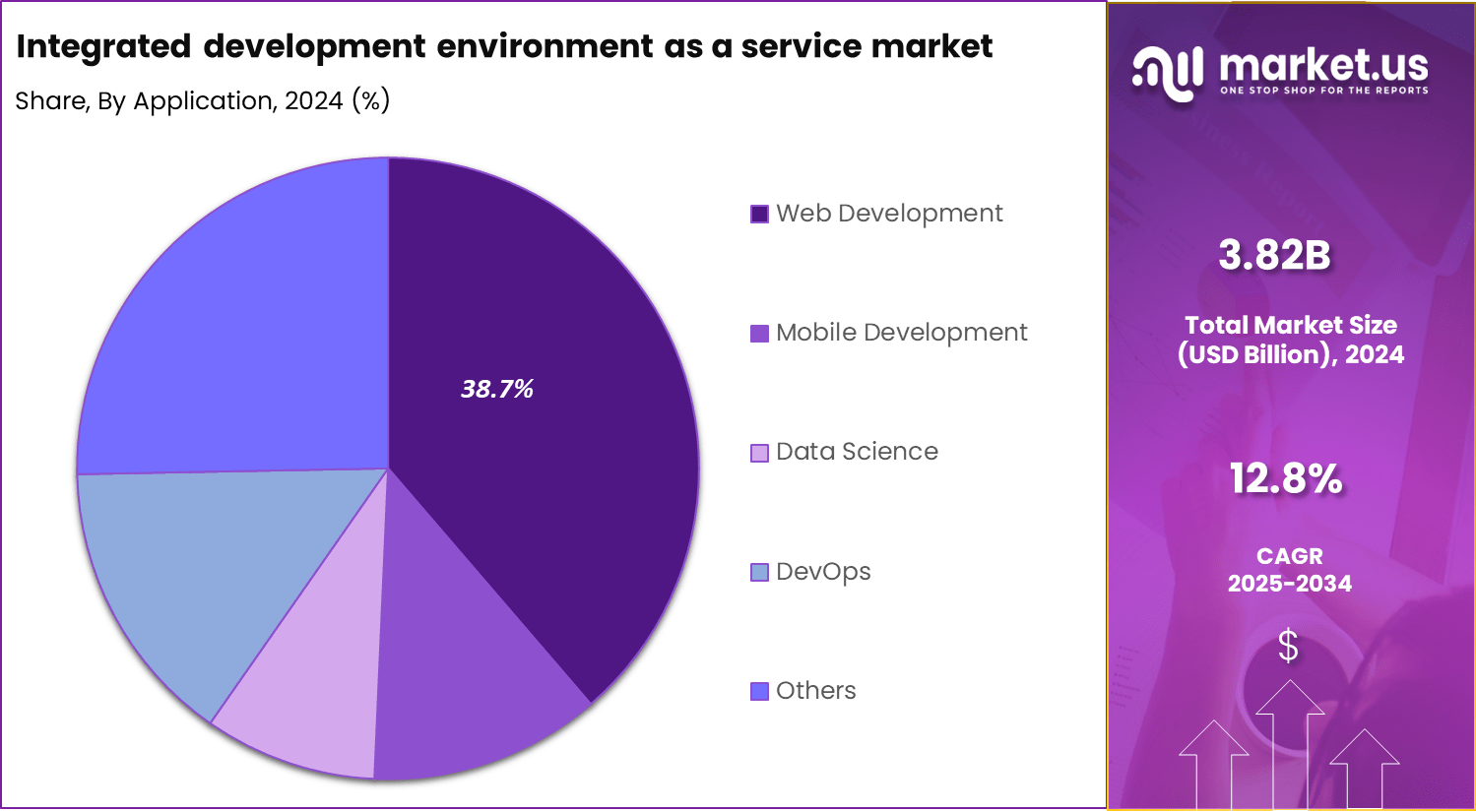

- 38.7% of the application demand is for web development, highlighting the growing need for IDEs in web application creation.

- 58.5% of IDE services are deployed in the cloud, reflecting a strong preference for cloud-based development environments.

- Large enterprises account for 65.8% of the market, indicating their reliance on IDEs to support complex and large-scale development projects.

- IT and telecommunications end-users represent 35.5% of the market, showing the adoption of IDE services in these sectors for development needs.

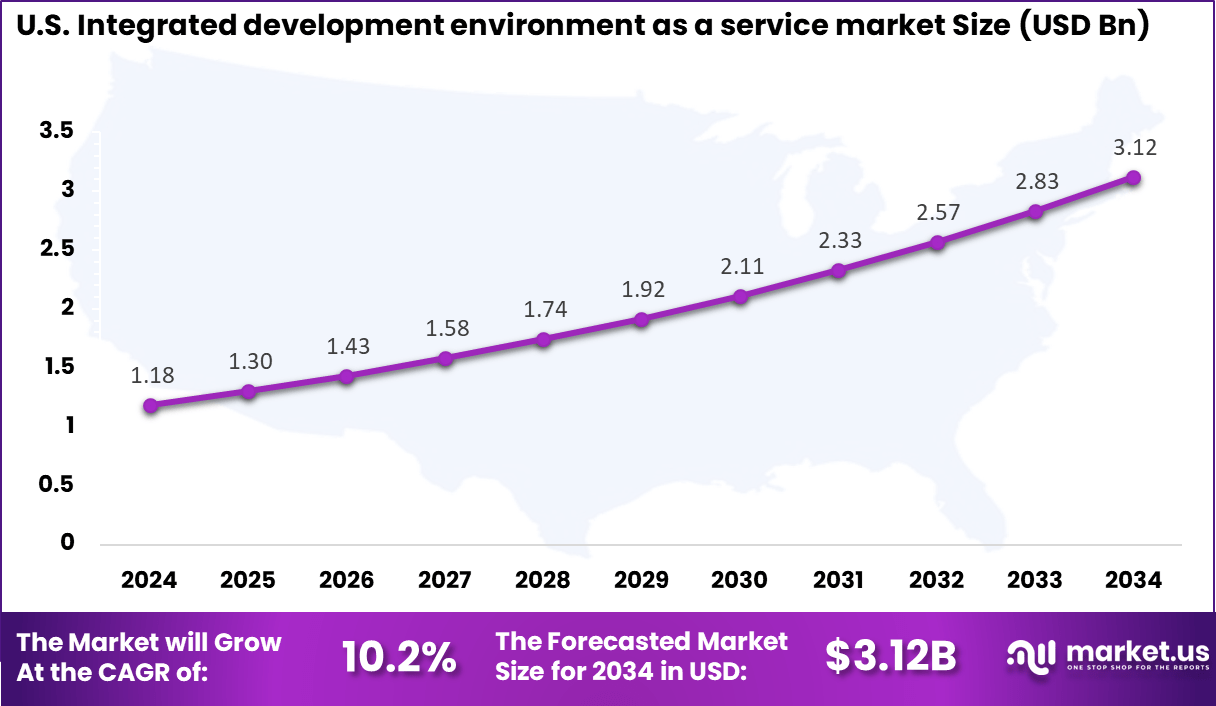

- In North America, the market holds a 36.4% share, with the U.S. leading at 1.18 billion USD, showcasing strong growth and adoption in this region.

Analysts’ Viewpoint

Increasing adoption technologies driving this market include AI, machine learning (ML), DevOps integration, and cloud-native development. These technologies enable automation of routine tasks, continuous integration and delivery, and smarter debugging. The key reasons organizations adopt IDEaaS are to reduce infrastructure costs, improve developer collaboration across distributed teams, and accelerate time to market.

Investment opportunities in IDEaaS stem from the growing demand for cloud-native and AI-powered development tools. Emerging markets in Asia-Pacific and Latin America show rapid software development activity, attracting capital for expanded R&D and innovative services. Mergers and acquisitions are also active as firms seek to enhance capabilities and geographic reach.

Business benefits of IDEaaS include significant cost savings by eliminating the need for dedicated hardware and IT maintenance teams. Companies gain faster deployment cycles, improved code quality, and easier scaling of development resources. Cloud IDEs promote remote work and global collaboration, increasing overall developer productivity. Enhanced security features protect intellectual property and sensitive code.

U.S. Market Landscape

The market for Integrated development environment as a service within the U.S. is growing tremendously and is currently valued at USD 1.18 billion, the market has a projected CAGR of 10.2%. The market is growing rapidly due to the country’s strong focus on technology innovation, widespread cloud adoption, and the increasing shift toward remote and hybrid work models.

U.S. businesses are embracing cloud-based IDEs for their flexibility, scalability, and cost-effectiveness, enabling teams to collaborate seamlessly. The demand for faster development cycles, DevOps integration, and the need to support a diverse range of programming languages further drive the growth of this market.

For instance, in July 2025, AWS launched Kiro, an agentic AI-powered IDE designed to streamline software development by transforming natural language specifications into actionable tasks. This innovation reinforces U.S. dominance in the IDE as a Service market, as AWS leads the way in AI-driven, cloud-based developer tools.

In 2024, North America held a dominant market position in the Global Integrated development environment as a service market, capturing more than a 36.4% share, holding USD 1.39 billion in revenue. This dominance is due to North America’s advanced technological infrastructure, early adoption of cloud computing, and a robust presence of tech giants and startups.

The region’s focus on innovation, skilled workforce, and increasing demand for agile development practices creates an ideal environment for IDEs as a service. Additionally, the growing need for efficient, collaborative, and scalable development tools across various industries has helped sustain North America’s leadership in the market, driving continuous growth and adoption of cloud-based solutions.

For instance, in April 2024, JetBrains launched a cloud-based version of IDE Services, reinforcing North America’s dominance in the Integrated Development Environment (IDE) as a Service market. The service simplifies the management of development environments for large enterprises, with features like AI Enterprise, custom plugin management, and enhanced collaboration tools.

Component Analysis

In 2024, the software dominated the integrated development environment as a service market with 70.4% share. The growing reliance on cloud-native coding tools, debugging programs, and version control systems has positioned software as the core element of these environments.

Developers prefer robust software platforms that allow them to code, test, and deploy within a single interface, which improves productivity and reduces development time. The service element, while important, is often tied to training, support, or integration assistance.

Most organizations primarily invest in the software itself since it brings direct benefits to efficiency and innovation. The clear dominance of software reflects the market’s maturity and the importance of continuous upgrades that help developers meet evolving demands.

For Instance, in July 2025, AWS launched its Agentic IDE, an advanced software development platform designed to enhance productivity by leveraging intelligent agents to assist developers. This IDE integrates AI capabilities to automate routine coding tasks, including code generation, error detection, and project management.

Application Analysis

In 2024, the web development accounted for 38.7% of applications in this market. This segment benefits from the rapid demand for interactive, responsive, and secure websites across industries. As businesses increasingly shift operations and customer interactions online, developers are relying on cloud IDE platforms to design, debug, and scale web applications more seamlessly.

The growing complexity of web architectures has further boosted IDE adoption. Integrated tools for frameworks, libraries, and cross-platform compatibility simplify development processes. As organizations focus on delivering fast, engaging digital experiences, web development will continue to anchor the application landscape.

For instance, in July 2025, AWS introduced enhancements to serverless development with Console to IDE integration and remote debugging for AWS Lambda. These new features streamline the workflow for web developers by allowing them to quickly transition from the AWS Management Console to Visual Studio Code (VS Code) for editing code.

Deployment Mode Analysis

In 2024, Cloud-based deployment held a 58.5% share of the market. Enterprises prefer cloud IDEs for their scalability, ease of collaboration, and reduced infrastructure costs. Developers working in different locations can access code repositories and development environments without needing heavy local setups, which makes cloud deployment highly suitable for distributed teams.

The shift to agile development and DevOps has further accelerated the preference for cloud deployment. Continuous integration and continuous delivery pipelines require flexible and reliable development environments, and cloud-based IDEs meet these needs effectively. This has made cloud the leading model compared to traditional setups.

For Instance, in June 2024, the Eclipse Foundation introduced Theia IDE, an open-source, cloud-native IDE designed to provide a flexible and customizable development environment. Theia aims to compete with other cloud-based IDEs by offering extensibility and integration with various tools and platforms.

Enterprise Size Analysis

In 2024, the large enterprises contributed 65.8% of overall demand. These organizations often manage extensive software portfolios and complex architectures, which increases the need for powerful, integrated development environments. With larger developer teams, the demand for tools that allow collaboration, version control, and high-performance coding support becomes even more critical.

Smaller firms may adopt lightweight development environments, but large enterprises are the primary drivers because they prioritize long-term scalability, security, and advanced functionality. Their ability to invest in customizations and continuous improvements also reinforces this segment’s leadership.

For Instance, in April 2024, JetBrains launched IDE Services, a comprehensive platform designed to help large enterprises manage their JetBrains IDE tool ecosystem more efficiently. This service, which includes features like IDE Provisioner, AI Enterprise, License Vault, and Code With Me Enterprise, is focused on boosting developer productivity at scale.

End-User Analysis

In 2024, the IT and telecommunications sector made up 35.5% of end-user demand. This sector relies heavily on high-quality software systems to support large-scale networks, customer platforms, and infrastructure management tools. IDE as a service enables developers in this space to accelerate application rollouts and manage complex backend systems with greater efficiency.

In telecommunications especially, faster deployment of applications and services is directly linked to customer satisfaction and competitive advantage. IDE platforms cater to these needs by simplifying coding and testing processes, making IT and telecom companies consistent adopters of integrated development tools.

For Instance, in November 2023, AWS launched an IDE extension for AWS Application Composer, designed to enhance the development of modern applications through visual interfaces and AI-generated Infrastructure as Code (IaC). This extension allows IT and telecommunications developers to build applications using a drag-and-drop canvas in their IDE, making it easier to integrate AWS resources like Lambda and DynamoDB.

Emerging trends

Emerging trends in the IDEaaS market include real-time collaboration tools and voice-activated coding, which are transforming how developers interact with their development environments. The rise of remote and hybrid work models has increased demand for cloud IDEs that support multi-user simultaneous editing, debugging, and code sharing, fostering team productivity.

Voice recognition features, although still nascent, offer promising new ways to code, potentially improving accessibility for developers with disabilities and streamlining routine coding tasks. Such novel functionalities reflect the ongoing push toward making IDEs more intuitive and adaptable to diverse user preferences.

Another important trend is the integration of augmented and virtual reality (AR/VR) technologies in some cutting-edge IDEaaS solutions. These immersive technologies provide developers with innovative debugging and development experiences by visualizing code and workflows in 3D environments.

Such integrations are especially useful for projects requiring spatial understanding, complex simulations, or enhanced user interface design. While still a niche application, AR/VR within IDEs underscores the broader diversification of features aiming to improve developer engagement and software quality in the evolving IDEaaS landscape.

Growth factors

Growth factors driving the IDEaaS market are largely linked to the increasing need for collaborative, flexible, and scalable development environments. The surge in cloud adoption and remote work globally has made cloud-based IDEs indispensable for organizations aiming to maintain productivity amid geographically dispersed teams.

Furthermore, agile and DevOps practices require integrated development tools that support continuous integration and deployment, all of which IDEaaS platforms facilitate. Enhanced security protocols and robust data privacy features in cloud IDEs also build trust, encouraging wider enterprise adoption.

Additionally, growth is propelled by expanding programming language diversity and framework support within IDEaaS platforms. Developers working on multi-platform applications need environments that support languages such as Python, Java, JavaScript, and emerging ones seamlessly.

The ability to customize IDEaaS environments through third-party extensions and plugins further adds to their appeal. Demand from sectors like fintech, healthcare, and e-commerce, where rapid software innovation is critical, underlines the sustained growth in IDEaaS adoption across industries.

Key Market Segments

By Component

- Software

- Services

By Application

- Web Development

- Mobile Development

- Data Science

- DevOps

- Others

By Deployment Mode

- Cloud

- On-Premises

By Enterprise Size

- Small and Medium Enterprises

- Large Enterprises

By End-User

- IT and Telecommunications

- BFSI

- Healthcare

- Retail

- Education

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Drivers

Growing Adoption of Cloud Technology

The increasing adoption of cloud technology is a strong driver for the IDE as a Service market. Cloud-based IDEs enable developers to access programming tools from anywhere, facilitating remote collaboration and reducing reliance on specific hardware. This flexibility supports organizations in speeding up application development processes without investing heavily in local infrastructure.

The shift from traditional desktop-based IDEs to web-based cloud IDE solutions continues to fuel demand, as it simplifies software development and deployment workflows. Platforms like AWS Cloud9 and Gitpod allow multiple developers to collaborate in real time, enhancing productivity and teamwork. The rise of remote work and distributed development teams further reinforces this trend, making cloud IDEs a preferred choice.

For instance, in April 2025, TCS (Tata Consultancy Services) announced a collaboration with SAP to enable enterprise-wide adoption of Generative AI (GenAI) and cloud solutions. This partnership focuses on enhancing cloud adoption and flexibility for enterprises, with an emphasis on leveraging AI capabilities for streamlined, scalable operations.

Restraint

High Learning Curve and Complexity

A notable restraint in the IDE as a Service market is the relatively high learning curve associated with many advanced IDE platforms. These environments often bundle multiple sophisticated features such as debugging, automation tools, and integrations that can overwhelm new or less experienced developers.

The complexity can discourage adoption, especially among small businesses or individual developers who may prefer simpler or more familiar tools, leading to slower market penetration. For example, novice developers might struggle to navigate and utilize all the functionalities of platforms like IntelliJ IDEA or PhpStorm without dedicated training.

This barrier can increase onboarding time and reduce overall user adoption rates. The shortage of qualified software developers with sufficient IDE expertise further exacerbates this restraint, limiting how fast organizations can adopt modern cloud-based development environments.

For instance, in September 2025, Cursor IDE, an AI-powered development environment, was found vulnerable to prompt-injection attacks due to the CurXecute vulnerability. This security flaw allowed hackers to exploit the AI agent by feeding it malicious prompts, enabling remote code execution and potentially leading to ransomware attacks and data theft.

Opportunities

Growing Adoption of AI and ML

The integration of AI and machine learning into cloud IDEs presents an exciting opportunity to enhance developer productivity. Features like intelligent code completion, bug detection, and automated refactoring can streamline the development process, reducing errors and improving code quality.

AI-powered tools can learn from developers’ patterns and provide personalized suggestions, accelerating development timelines. These intelligent features make cloud IDEs more attractive by accelerating development cycles and providing developers with smarter tools to handle complex coding tasks, ultimately improving both the quality and speed of software delivery.

For instance, in July 2025, AWS introduced Kiro, an AI-powered IDE designed to streamline software development by automating project planning, implementation, and testing. Currently in preview, Kiro aims to reduce errors and enhance developer productivity through intelligent agents and structured workflows.

Challenges

Intense Market Competition

The IDE as a service market is becoming highly competitive, with many providers striving to differentiate themselves through unique features, user experience, and pricing. This intense competition places pressure on companies to invest heavily in research and development to stay ahead.

At the same time, they must manage costs carefully to maintain profitable margins. Offering superior compliance and security features also becomes a key differentiator, forcing providers to constantly innovate and refine their platforms to meet evolving customer expectations.

For instance, in July 2025, AWS introduced an agentic integrated developer environment, a new initiative designed to streamline the development process and improve efficiency. The move highlights the intensifying competition in the cloud-based IDE market, where major players are continuously striving to offer cutting-edge features like AI-driven automation, enhanced collaboration tools, and seamless integrations.

Key Players Analysis

In the integrated development environment (IDE) as a service market, Amazon Web Services (AWS), Microsoft, Google, and IBM are the leading providers. Their cloud-based IDE platforms are widely used for application development, testing, and deployment. With strong global infrastructure and integration capabilities, these companies enable developers to build scalable applications while supporting collaboration and real-time coding.

Other established technology players such as Oracle, Red Hat, SAP, Salesforce, VMware, Atlassian, GitHub, and Adobe strengthen the market with enterprise-grade IDE offerings. Their platforms integrate coding, version control, and deployment features, supporting both open-source and commercial development environments.

Specialized and emerging providers including JetBrains, Eclipse Foundation, Zoho, Pivotal Software, Codenvy, Cloud9 IDE, Alibaba Cloud, and Tencent Cloud add diversity to the market. Their platforms offer customizable, cost-effective, and user-friendly IDE solutions suited for start-ups, independent developers, and educational institutions.

Top Key Players in the Market

- Amazon Web Services (AWS)

- Microsoft Corporation

- Google LLC

- IBM Corporation

- Oracle Corporation

- Red Hat, Inc.

- JetBrains s.r.o.

- Eclipse Foundation

- SAP SE

- Salesforce.com, Inc.

- Atlassian Corporation Plc

- GitHub, Inc.

- Adobe Systems Incorporated

- Alibaba Cloud

- Tencent Cloud

- VMware, Inc.

- Zoho Corporation

- Pivotal Software, Inc.

- Codenvy, Inc.

- Cloud9 IDE, Inc.

- Others

Recent Developments

- In May 2025, Microsoft announced plans to integrate Anthropic’s AI coding agent into GitHub, alongside its own AI tools and OpenAI’s models. This move expands GitHub’s AI capabilities, offering developers a broader range of tools for tasks like bug fixing and code generation.

- In January 2025, Red Hat introduced the Build module to its partner program, enabling partners to deliver AI-ready solutions across hybrid cloud environments. This initiative supports the development of innovative applications and services leveraging Red Hat’s open-source technologies.

- March 2024, Amazon Web Services (AWS) enhanced its IDE offerings by beginning the phase-out of AWS Cloud9 for new customers, encouraging migration to AWS IDE Toolkits and AWS CloudShell to streamline developer workflows within more integrated environments. This reflects AWS’s focus on evolving developer tools aligned with cloud and AI resource management.

- May 2024, Google launched Project IDX in open beta, a next-generation browser-based IDE focused on AI-centric development. It offers multi-framework support including Flutter, Dart, and Angular, with built-in integrations for Google Cloud services and AI-powered compliance tools.

Report Scope

Report Features Description Market Value (2024) USD 3.82 Bn Forecast Revenue (2034) USD 12.74 Bn CAGR (2025-2034) 12.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software, Services), By Application (Web Development, Mobile Development, Data Science, DevOps, Others), By Deployment Mode (Cloud, On-Premises), By Enterprise Size (Small and Medium Enterprises, Large Enterprises), By End-User (IT and Telecommunications, BFSI, Healthcare, Retail, Education, Others) Regional Analysis North America – The U.S. and Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Amazon Web Services (AWS), Microsoft Corporation, Google LLC, IBM Corporation, Oracle Corporation, Red Hat, Inc., JetBrains s.r.o., Eclipse Foundation, SAP SE, Salesforce.com, Inc., Atlassian Corporation Plc, GitHub, Inc., Adobe Systems Incorporated, Alibaba Cloud, Tencent Cloud, VMware, Inc., Zoho Corporation, Pivotal Software, Inc., Codenvy, Inc., Cloud9 IDE, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Integrated Development Environment as a Service MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample

Integrated Development Environment as a Service MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Amazon Web Services (AWS)

- Microsoft Corporation

- Google LLC

- IBM Corporation

- Oracle Corporation

- Red Hat, Inc.

- JetBrains s.r.o.

- Eclipse Foundation

- SAP SE

- Salesforce.com, Inc.

- Atlassian Corporation Plc

- GitHub, Inc.

- Adobe Systems Incorporated

- Alibaba Cloud

- Tencent Cloud

- VMware, Inc.

- Zoho Corporation

- Pivotal Software, Inc.

- Codenvy, Inc.

- Cloud9 IDE, Inc.

- Others