Global Insurance Agency Software Market By Software (Agency Management Systems (AMS), Customer Relationship Management (CRM), Document Management, Others), By Deployment(Cloud-based, On-premise), By Organization Size (Large Enterprises, Small & Medium Agencies), By Application (Policy Administration, Claims Management,Others By End-User (Insurance Agencies, Brokerages, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 17786

- Number of Pages: 372

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- By Software

- By Deployment

- By Organization Size

- By Application

- By End-User

- Key Reasons for Adoption

- Benefits

- Usage

- Emerging Trends

- Growth Factors

- Key Market Segments

- Regional Analysis

- Driver

- Restraint

- Opportunity

- Challenge

- Competitive Analysis

- Future outlook

- Recent Developments

- Report Scope

Report Overview

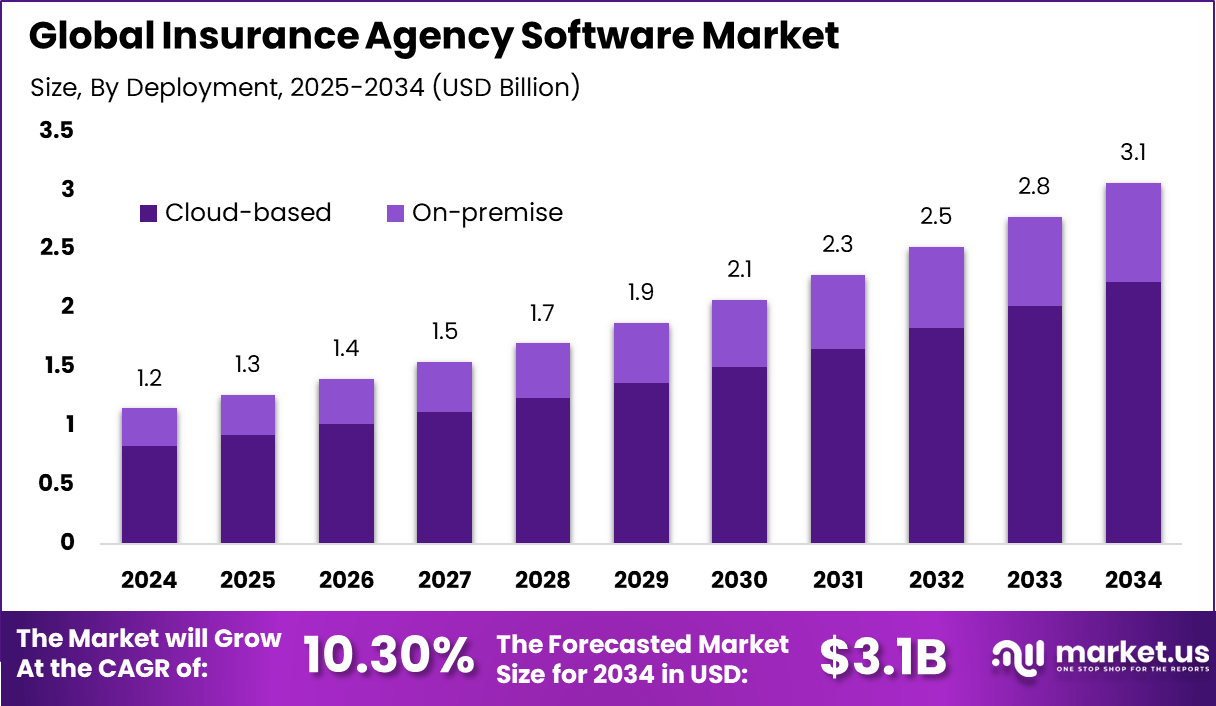

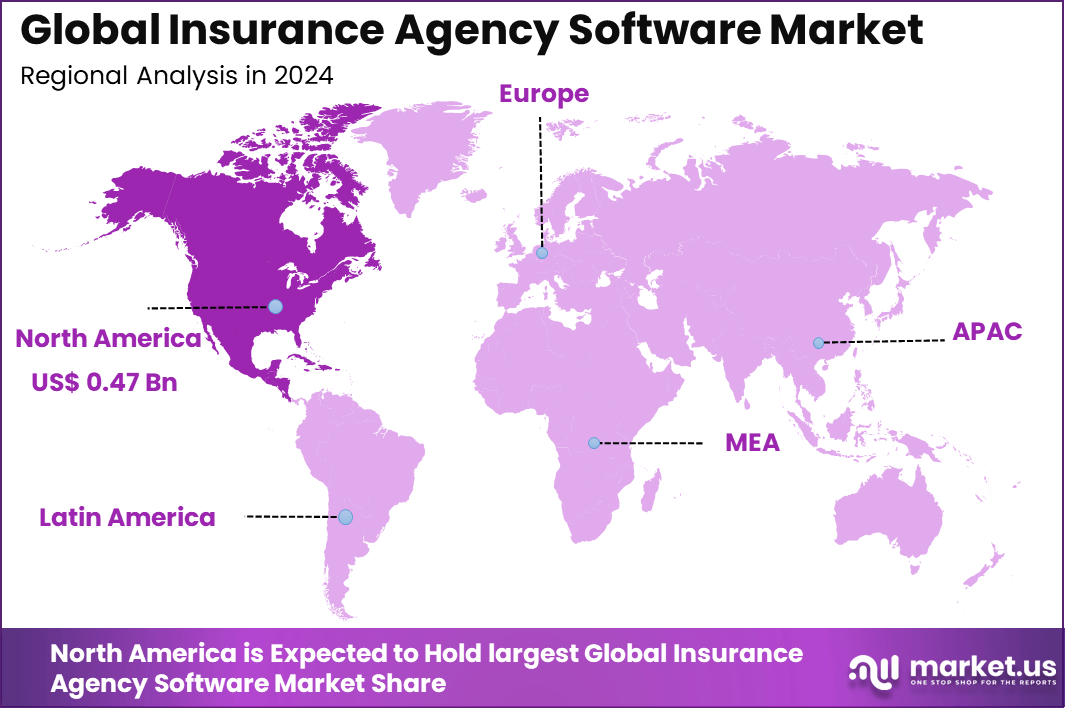

The Global Insurance Agency Software Market generated USD 1.2 billion in 2024 and is predicted to register growth from USD 1.3 billion in 2025 to about USD 3.1 billion by 2034, recording a CAGR of 10.30% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 41.3% share, holding USD 0.47 Billion revenue.

The insurance agency software market has expanded as agencies move from manual processes to integrated digital platforms that streamline quoting, policy administration, customer communication and back office tasks. Growth reflects rising product complexity, increasing customer expectations for faster service and the need for agencies to manage multi carrier workflows efficiently. Digital tools now serve both independent and captive agencies across personal, commercial and specialty insurance lines.

The primary growth drivers include increasing demand for accuracy in premium pricing and risk analysis, rising customer expectations for faster, personalized service, and regulatory requirements mandating digital record-keeping. Automation helps reduce manual errors in policy management and claims processing, which enhances operational efficiency. Adoption of AI and machine learning in software has increased predictive analytics capabilities, boosting the accuracy of underwriting and improving customer engagement.

According to Market.us, The global AI in insurance market is projected to reach about USD 91 billion by 2033, rising from nearly USD 5 billion in 2023 at a CAGR of 32.7% from 2024 to 2033. This growth is driven by the wider use of automated risk assessment, faster claims handling, and personalized policy design supported by advanced analytics and machine learning.

Demand for insurance agency software is accelerated by the rising volume and complexity of insurance products, which require precise data handling and faster processing. Agencies seek seamless digital platforms to deliver multi-channel customer communication, policy servicing, and claims management. Businesses increasingly value software that integrates cross-selling and up-selling functionalities to grow customer retention.

Top Market Takeaways

- By software type, agency management systems (AMS) lead with 53.6% share, providing comprehensive tools for client tracking, policy servicing, commission management, and workflow automation essential for insurance operations.

- By deployment, cloud-based solutions dominate with 72.6% share, favored for scalability, remote access, cost savings, and seamless integration with CRM, analytics, and compliance modules.

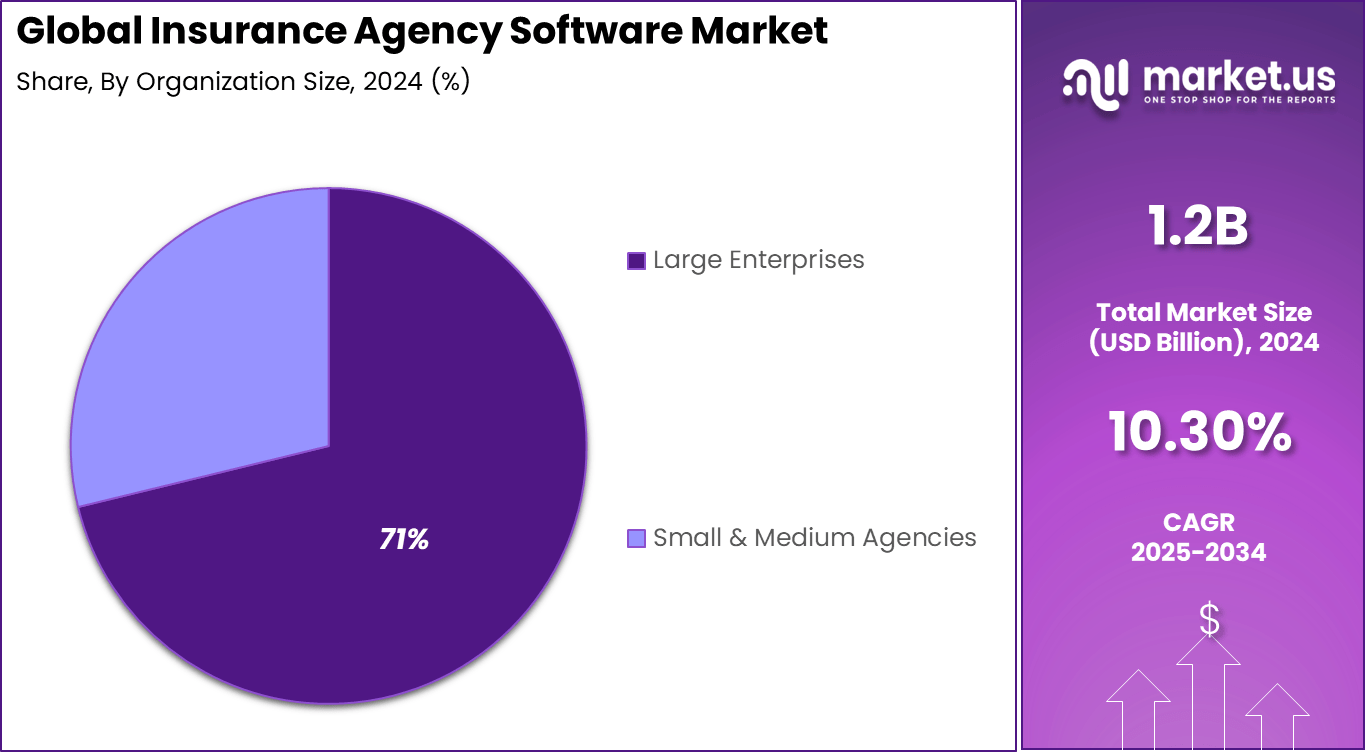

- By organization size, large enterprises hold 71.2% of the market, requiring robust platforms to manage complex portfolios, multi-carrier integrations, and regulatory compliance across extensive operations.

- By application, policy administration commands 46.1% share, streamlining quoting, issuance, renewals, endorsements, and billing while ensuring data accuracy and customer self-service capabilities.

- By end-user, insurance agencies represent 56.8%, leveraging software for daily operations including client onboarding, claims tracking, and performance analytics to boost efficiency.

- Regionally, North America accounts for about 41.3% market share.

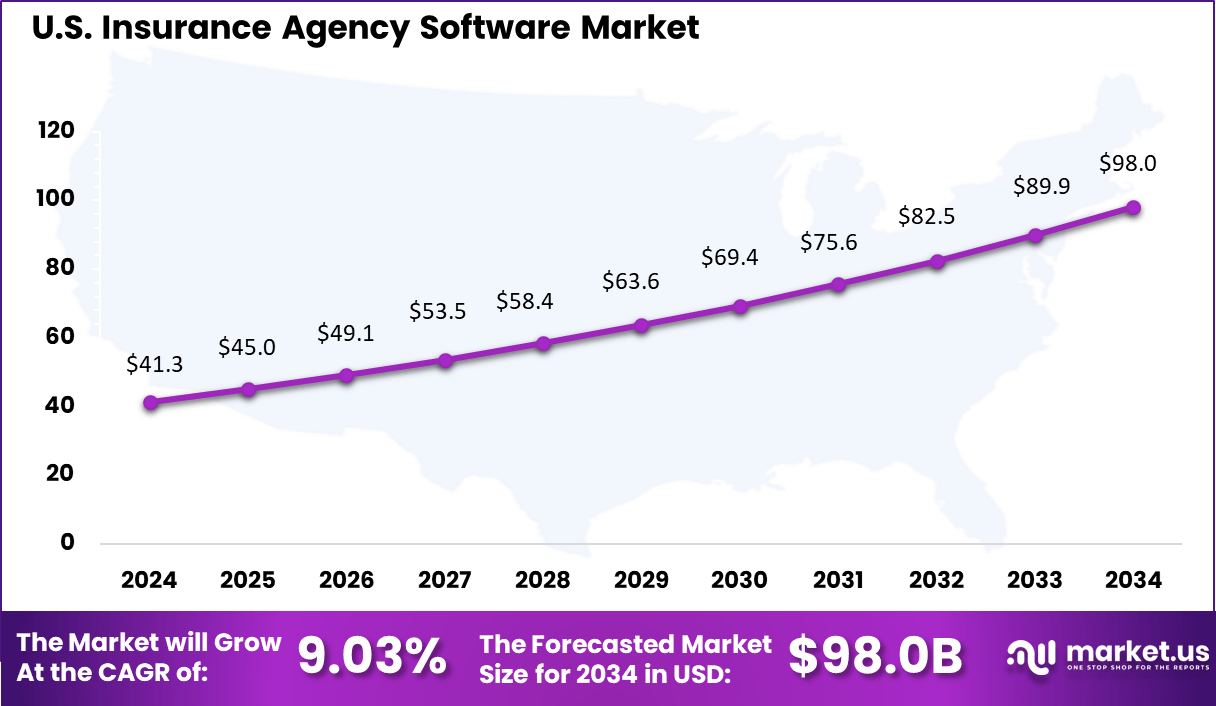

- The U.S. market size is valued at approximately USD 0.43 billion in 2025.

- The market grows at a CAGR of 9.03%, driven by digital transformation, regulatory pressures, and demand for integrated AMS platforms supporting AI analytics and mobile access.

By Software

Agency Management Systems (AMS) lead the insurance agency software market with a strong 53.6% share. These systems provide insurance agencies with comprehensive tools to manage client information, policies, commissions, and workflows efficiently. AMS platforms help streamline operations by integrating customer relationship management (CRM), quote generation, underwriting, and claims management within a single interface.

The scalability and modularity of AMS solutions allow agencies to customize functionalities based on their specific needs, improving productivity and customer service. AMS adoption is driven by the need for automation in handling complex insurance products and maintaining regulatory compliance. Agencies leverage AMS to reduce manual errors, accelerate policy issuance, and enhance client engagement, enabling more agile and competitive business models.

By Deployment

Cloud-based deployment dominates with a substantial 72.6% share, offering insurance agencies flexibility, cost savings, and easy access to data. Cloud solutions reduce the burden of IT infrastructure management and allow agencies to scale operations in response to business growth or market fluctuations. The ability to access software remotely supports hybrid work environments and facilitates real-time collaboration among agents, underwriters, and customers.

Security enhancements and regular software updates managed by cloud providers further increase adoption by ensuring data protection and compliance with evolving regulations. Cloud deployment also enables faster integration with third-party services, such as payment gateways and analytics platforms, making it a preferred model in the digital transformation journey of insurance agencies.

By Organization Size

Large enterprises account for a commanding 71% share of the insurance agency software market. These organizations manage a diverse portfolio of insurance products and a large client base, necessitating sophisticated software that can handle complex workflows, high transaction volumes, and multi-user environments.

Large enterprises emphasize features like multi-branch management, advanced analytics, and comprehensive reporting to optimize operations and strategic planning. Their financial capability enables investment in premium, tailored solutions providing enhanced security, regulatory adherence, and seamless integration with other enterprise systems. The growing size and complexity of large insurance agencies continue to drive demand for robust, scalable agency software.

By Application

Policy administration represents 46.1% of the market application, highlighting its central role in managing the lifecycle of insurance policies. Insurance agency software facilitates quoting, underwriting, issuing, renewals, endorsements, and cancellations – all critical for maintaining customer satisfaction and operational efficiency. Policy administration modules offer automation, reduce processing times, and improve accuracy across product lines.

Agencies rely on these solutions to ensure compliance with regulatory requirements, accurately calculate premiums, and improve back-office efficiency. The increasing trend towards digital-first insurance experiences propels enhancements in policy administration software, including self-service portals and real-time status updates.

By End-User

Insurance agencies form the largest end-user group with 56.8% share in the software market. Agencies depend on technology to streamline client onboarding, policy sales, and retention efforts. Software adoption improves their ability to manage commissions, track leads, and ensure timely communication with carriers and clients.

Agencies benefit from improved operational workflows and data insights, which enhance decision-making and competitive advantage. The rise of independent and broker agencies, along with agency networks serving diverse customer bases, fuels demand for integrated software platforms tailored to agency-specific business models and scale, enabling sustainable growth and enhanced client service.

Key Reasons for Adoption

- Streamline daily operations: Handles policy management, client tracking, and workflows in one place, cutting down on scattered paperwork and emails.

- Boost agent productivity: Automates lead follow-ups, renewals, and reporting so teams focus on selling rather than admin work.

- Improve client communication: Offers portals and reminders for policyholders, making interactions smoother and more timely.

- Ensure compliance: Tracks regulations and audit trails automatically, reducing errors in a heavily regulated field.

- Scale with growth: Manages more clients and lines of business without adding staff proportionally.

Benefits

- Higher efficiency: Speeds up tasks like quoting and claims, freeing time for revenue-generating activities.

- Better customer retention: Personalized service through data insights leads to happier clients and repeat business.

- Cost reductions: Lowers overhead by minimizing paper, manual entry, and compliance mistakes.

- Smarter decision-making: Real-time reports on sales, renewals, and performance guide strategy.

- Competitive edge: Quick service and digital tools attract tech-savvy customers in a crowded market.

Usage

- Managing client policies and renewals from one dashboard

- Tracking leads and automating sales follow-ups

- Processing claims and generating reports

- Handling accounting, billing, and commissions

- Integrating with carriers for seamless quoting and endorsements

Emerging Trends

Key Trends Description AI-Powered Automation Integration of AI for automating client data entry, claims processing, lead generation, and customer service. Cloud-Based Solutions Shift to scalable cloud platforms enabling remote access, real-time collaboration, and data security. Personalized Client Portals Customizable portals providing tailored client experiences, policy management, and self-service options. Data-Driven Insights and Analytics Advanced reporting tools aggregating data for operational efficiency, risk assessment, and client trends. Mobile-First Agency Applications Development of mobile-centric software allowing field agents to manage policies, quotes, and communications. Growth Factors

Key Factors Description Digital Transformation Initiatives Industry-wide adoption of digital tools to streamline operations and enhance customer engagement. Regulatory Compliance Requirements Need for software supporting data privacy, IFRS 17 compliance, and automated audit trails. Growing Demand for Automation Pressure to reduce manual workloads amid staffing shortages and rising operational costs. Expansion of Digital Insurance Platforms Proliferation of online agencies and apps requiring integrated backend management systems. Customer Expectations for Personalization Demand for instant quotes, seamless experiences, and customized services driving software innovation. Key Market Segments

By Software

- Agency Management Systems (AMS)

- Customer Relationship Management (CRM)

- Document Management

- Others

By Deployment

- Cloud-based

- On-premise

By Organization Size

- Large Enterprises

- Small & Medium Agencies

By Application

- Policy Administration

- Claims Management

- Sales & Marketing

- Commission Tracking

By End-User

- Insurance Agencies

- Brokerages

- Managing General Agents (MGAs)

- Independent Agents

Regional Analysis

North America dominated the insurance agency software market with a substantial 41.3% global share, driven by advanced digital infrastructure and a mature insurance ecosystem spanning property, casualty, and life sectors. The region’s growth stems from widespread adoption of cloud-based platforms that streamline policy management, client servicing, and claims processing, alongside regulatory pressures for compliance and data security.

Leading insurers leverage AI-integrated solutions for automation and analytics, enhancing operational efficiency amid rising customer demands for personalized services. North America’s competitive landscape, featuring major tech providers, positions it as the primary innovation center for agency software globally.

The U.S. leads within North America, valued at USD 0.43 billion in 2024 and advancing at a CAGR of 9.03%. This expansion reflects high insurtech penetration, with agencies prioritizing scalable tools for multi-channel distribution and real-time quoting.

Key players like Applied Systems and Vertafore drive market dynamics through robust integrations with carrier systems and CRM functionalities. Regulatory evolution and focus on customer retention further accelerate deployment, cementing the U.S. as the core growth driver for North American insurance agency software adoption.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Digital Transformation and Customer Expectations

The insurance agency software market grows from the push toward digital transformation as agencies seek tools to streamline operations and meet rising customer demands for quick, personalized service. Modern software handles policy management, claims processing, and client interactions efficiently, cutting manual work and boosting productivity. With customers expecting 24/7 access via mobile apps and portals, agencies adopt these platforms to stay competitive.

Cloud-based solutions lead this shift, offering scalability and real-time data access that improve decision-making and client retention. The sector’s rapid expansion, from $3.82 billion in 2024 to $4.23 billion in 2025, shows how these tools help agencies handle growing volumes while enhancing service quality.

Restraint

High Implementation Costs and Legacy Integration

High upfront costs for software purchase, customization, and staff training slow adoption, especially among small agencies with tight budgets. These expenses, plus ongoing maintenance, create financial hurdles that delay upgrades and limit growth for smaller players.

Integrating new systems with old legacy platforms adds complexity, often causing workflow disruptions and extended timelines. This resistance to change in traditional setups restrains market penetration, as agencies weigh benefits against immediate operational risks.

Opportunity

AI Integration and Cloud Expansion

AI and machine learning open doors for smarter risk assessment, fraud detection, and personalized policies, helping agencies serve clients better. Cloud platforms make these features affordable and scalable, drawing in small to medium agencies seeking efficiency without heavy IT costs.

The rise of usage-based insurance and mobile-first services creates demand for flexible software. With market growth projected at 7.8-9.1% CAGR through 2032, vendors partnering with agencies for tailored solutions can capture expanding segments in emerging markets.

Challenge

Data Security and Regulatory Pressures

Data privacy concerns grow as agencies handle sensitive client information, with breaches risking trust and heavy fines under laws like GDPR. Strong cybersecurity becomes essential, yet many struggle to keep pace with evolving threats.

Regulatory changes demand constant software updates for compliance, adding costs and complexity. Balancing innovation with strict rules while ensuring seamless operations tests agencies, requiring ongoing vendor support and training.

Competitive Analysis

The insurance agency software market is competitive and diverse, with key players including Vertafore, Applied Systems, Salesforce, Oracle, Hawksoft, EZLynx, NowCerts, Jenesis Software, AgencyBloc, QQSolutions, Nexsure, InsuredMine, Agency Matrix, ITC, and Partner XE.

These companies focus on delivering comprehensive agency management solutions that streamline customer relationship management, policy administration, quoting, commission tracking, and reporting for insurance agencies of varying sizes.

Differentiation in the market hinges on ease of use, customization, integration capabilities with third-party insurance carriers and financial platforms, and customer support quality. Many providers emphasize cloud-based solutions for scalability, remote accessibility, and data security.

Enhancements in AI-driven analytics, automated workflows, and digital communication tools are shaping the market dynamics, enabling agencies to improve operational efficiency and client engagement. Companies continuously innovate to provide platforms tailored to specific insurance lines, support regulatory compliance, and offer mobile functionality to maintain competitiveness in a rapidly evolving industry.

Top Key Players in the Market

- Vertafore

- Applied Systems

- Salesforce

- Oracle

- Hawksoft

- EZLynx

- NowCerts

- Jenesis Software

- AgencyBloc

- QQSolutions

- Nexsure

- InsuredMine

- Agency Matrix

- ITC

- Partner XE

- Others

Future outlook

The Insurance Agency Software Market will see strong growth through 2035, propelled by digital transformation across insurance operations, with cloud-based platforms leading adoption for scalability and remote access. AI integration for automation, predictive analytics, and personalized client interactions will boost efficiency, while regulatory demands for compliance and data security drive further investment. Asia-Pacific emerges as the fastest-growing region amid rising digital initiatives by small and medium agencies.

Opportunities lie in

- AI-driven automation for claims processing, risk assessment, and customer service to cut costs and speed up operations.

- Cloud solutions enabling real-time data sharing, scalability, and seamless integration with CRM and policy systems.

- Personalized client portals and analytics tools to enhance engagement, retention, and data-driven decision-making.

Recent Developments

- October, 2025, Applied Systems unveiled AI advancements within Applied Insurance AI at Applied Net 2025, embedding intelligence into agency workflows for submissions, servicing, and financial management. The company also announced multiple product enhancements throughout the year.

- April, 2025, Hawksoft hosted its HUG National Conference highlighting software innovations, agent feedback integration, and development processes during a cruise event celebrating 30 years.

Report Scope

Report Features Description Market Value (2024) USD 1.2 Bn Forecast Revenue (2034) USD 3.1 Bn CAGR(2025-2034) 10.30% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Software (Agency Management Systems (AMS), Customer Relationship Management (CRM), Document Management, Others), By Deployment(Cloud-based, On-premise), By Organization Size (Large Enterprises, Small & Medium Agencies), By Application (Policy Administration, Claims Management,Others By End-User (Insurance Agencies, Brokerages, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Vertafore, Applied Systems, Salesforce, Oracle, Hawksoft, EZLynx, NowCerts, Jenesis Software, AgencyBloc, QQSolutions, Nexsure, InsuredMine, Agency Matrix, ITC, Partner XE, and others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

How big is Insurance Agency Software Market?The Global Insurance Agency Software Market is likely to jump from USD 3.3 Billion in 2023 to USD 7.5 Billion by 2033. This projected expansion is anticipated to result from an average 8.5% CAGR in the demand for the insurance agency software over the upcoming decade.

What factors are driving the growth of the Insurance Agency Software market?The growth of the market can be attributed to increasing digitization in the insurance sector, the need for efficient customer management, and the rising demand for streamlined workflow processes.

What role does technological innovation play in shaping the future of the Insurance Agency Software market?Continuous technological advancements, such as the integration of artificial intelligence and machine learning, are revolutionizing the market, offering more sophisticated solutions and predictive analytics.

What are the leading players in the Global Insurance Agency Software Market?Key players in the global insurance agency software market include Applied Systems Inc., Vertafore Inc., EZLynx, HawkSoft, Sapiens International Corporation, QQ Solutions Inc., Jenesis Software, AgencyBloc LLC, Buckhill Ltd., XDimensional Technologies Inc., Insurance Technologies Corporation, Boston Software, InsuredHQ Limited, NowCerts, iLife Technologies, Other Key Players

Insurance Agency Software MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

Insurance Agency Software MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Applied Systems, Inc.

- Vertafore, Inc.

- EZLynx

- HawkSoft

- Sapiens International Corporation

- QQ Solutions, Inc.

- Jenesis Software

- AgencyBloc, LLC

- Buckhill Ltd.

- XDimensional Technologies, Inc.

- Insurance Technologies Corporation

- Boston Software

- InsuredHQ Limited

- NowCerts

- iLife Technologies

- Other Key Players