Global Industrial Tugger Market Market Size, Share, Growth Analysis By Type (Electric Tugger, Gasoline Tugger, Diesel Tugger, Others), By Load Capacity (Upto 5000 lbs, 5,001-10,000 lbs, Above 10,000 lbs), By Application (Warehouse, Manufacturing Plants, Distribution Centers, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 167878

- Number of Pages: 205

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

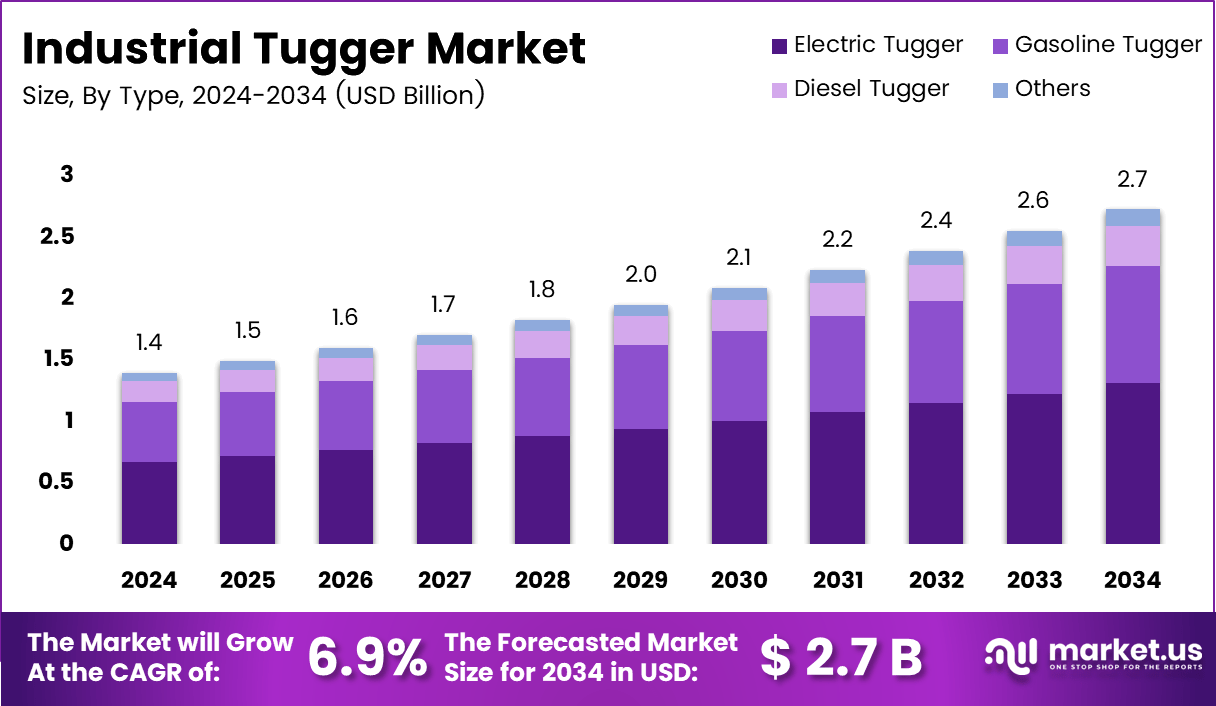

The Global Industrial Tugger Market size is expected to be worth around USD 2.7 billion by 2034, from USD 1.4 billion in 2024, growing at a CAGR of 6.9% during the forecast period from 2025 to 2034.

The Industrial Tugger Market represents a growing segment of modern material-handling equipment solutions used across manufacturing, logistics, and warehouse environments. These systems enhance productivity by pulling multiple load carriers in a single trip, thereby reducing travel time and optimising intralogistics workflows. As industries shift toward lean operations, tugger trains gain steady importance.

Moreover, global warehouses increasingly adopt electric tugger systems to support sustainability objectives and reduce manual strain. Companies prefer tuggers because they improve floor safety and minimise equipment congestion. As facilities expand their footprint and SKU variety, demand grows for flexible tugging platforms capable of transporting mixed load sizes while maintaining operational continuity.

Additionally, the market experiences growth due to rising automation investments across automotive, electronics, aerospace, and FMCG sectors. Governments in several regions continue supporting advanced manufacturing programs, encouraging factories to upgrade internal movement systems. Such policies stimulate the adoption of agile, ergonomic, and energy-efficient tugging equipment built for smart factory integration.

Moving forward, opportunities emerge as industries transition from forklifts to tugger-train systems to achieve safer and more efficient material flow. Tugger adoption is also encouraged by rising labour shortages, prompting companies to consider semi-autonomous or optimised-route solutions. These trends strengthen the shift toward digital fleet management and sensor-enabled tow operations.

Furthermore, innovations accelerate market growth as manufacturers develop systems offering greater modularity and quick trolley exchange. For instance, according to a leading automotive supplier, a custom-built tugger train transports 800×600,600×400, and1200×800 mm trolleys, enabling rapid insertion and removal from either side. This flexibility supports dynamic assembly-line logistics.

In addition, electric tug systems improve operational capability by allowing a single operator to move loads up to 70,000 kg, according to industry data. This substantial capacity reduces workforce dependency and enhances floor productivity. Similarly, process-driven safety improvements boosted one manufacturer’s safety score from 4 to 9, reflecting a 125% enhancement according to internal safety assessments.

Lastly, government-supported industrial hubs continue strengthening production bases. For example, a Northern Ireland manufacturer operates nine sites employing over 1,800 people, demonstrating strong regional manufacturing capability according to regional industry disclosures. These developments collectively reinforce the positive outlook for the Industrial Tugger Market as industries pursue scalable, ergonomic, and efficient material-movement technologies.

Key Takeaways

- The Global Industrial Tugger Market is expected to reach USD 2.7billion by 2034, growing from USD 1.4 billion in 2024.

- The market expands at a CAGR of 6.9% from 2025 to 2034.

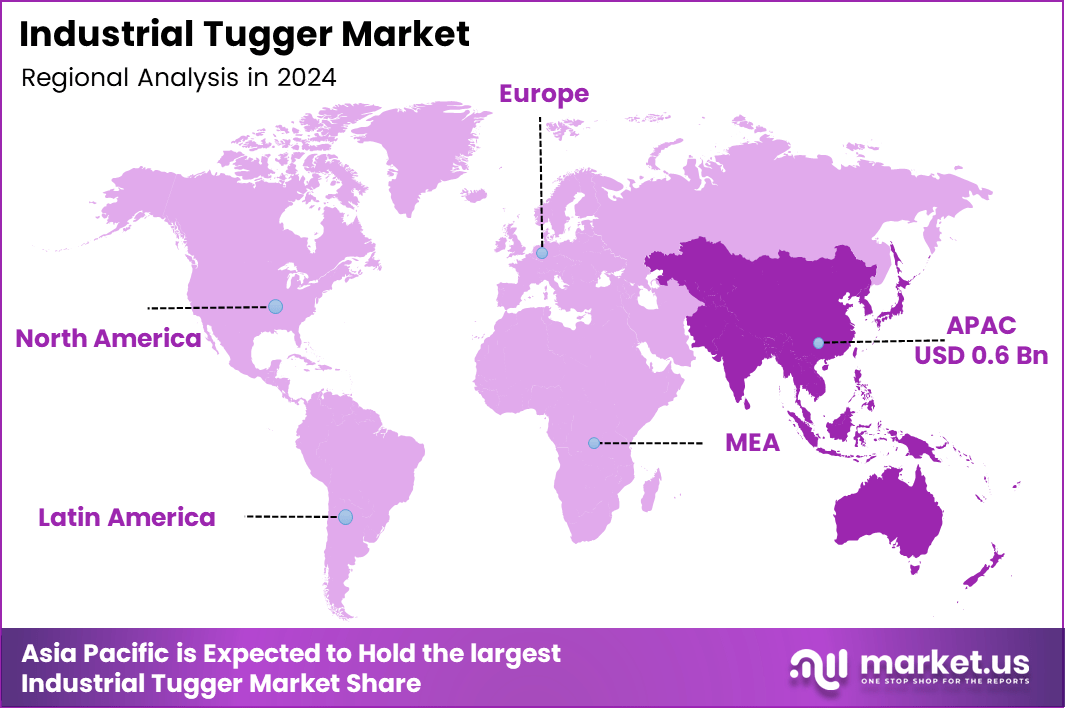

- Asia Pacific dominates the global market with a regional share of 48.3% valued at USD 0.6 billion.

- Electric Tugger leads the Type segment with a dominant share of 48.2% in 2024.

- The up to 5000 lbs load capacity category holds the highest share at 45.7% in 2024.

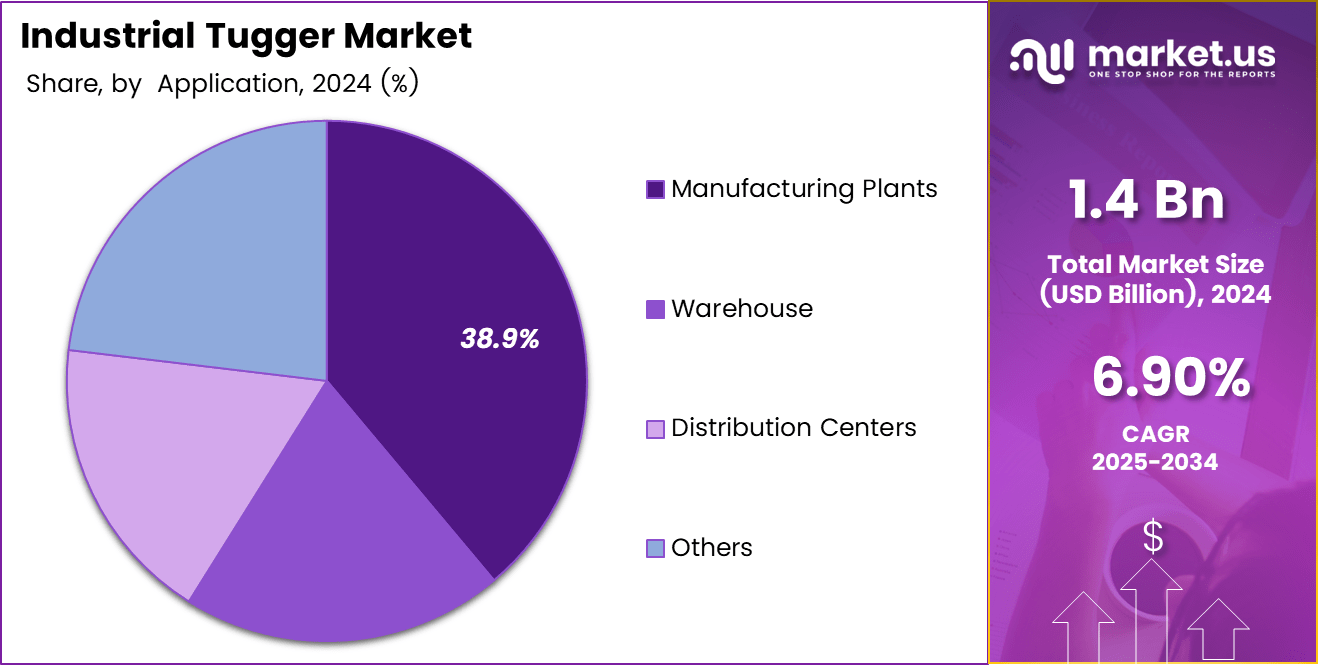

- Manufacturing Plants remain the top application segment with a 38.9% contribution in 2024.

- North America shows strong adoption driven by warehouse modernization and automation trends.

- Europe performs steadily, supported by Industry 4.0 upgrades and sustainability-driven equipment replacement.

By Type Analysis

Electric Tugger dominates with 48.2% due to its higher efficiency and operational flexibility.

In 2024, Electric Tugger held a dominant market position in the By Type Analysis segment of the Industrial Tugger Market, with a 48.2% share. This segment expanded as industries adopted electric-driven movement for lower emissions, smoother acceleration, and reduced operator fatigue. Additionally, companies preferred electric variants to align with sustainability and long-term cost goals.

Gasoline Tugger continued gaining traction as businesses utilized them for medium-duty applications requiring quick refueling. These tuggers supported operational continuity in facilities lacking charging infrastructure. Moreover, industries with intermittent outdoor movement favored gasoline units due to better temperature tolerance, enhanced drivability, and stable performance across wider working environments.

Diesel Tugger remained essential across heavy-duty operations where stronger torque output and extended operating cycles were required. Many manufacturing plants and large yards relied on diesel systems for towing heavy-load trains. Additionally, organizations working in remote areas preferred diesel tuggers due to wider fuel availability and their ability to withstand harsh industrial conditions.

Others included specialized or hybrid tugger variants designed for niche industrial use cases. These options served customized mobility needs across airports, defense installations, and large logistics hubs. Facilities utilized these models when conventional tuggers did not meet unique terrain requirements, specialized towing demands, or operational safety criteria.

By Load Capacity Analysis

Up to 5000 lbs dominates with 45.7% due to its broader adoption in routine industrial operations.

In 2024, up to 5000 lbs held a dominant market position in the By Load Capacity Analysis segment of the Industrial Tugger Market, with a 45.7% share. This segment expanded as warehouses and assembly lines increasingly adopted smaller load tuggers for frequent, shorter transport cycles requiring faster maneuverability and lower operational costs.

The 5,001–10,000 lbs segment gained consistent demand across manufacturing and logistics environments requiring mid-range transport strength. These tuggers were preferred for towing heavier parts, tooling systems, and material bins. Companies adopted this segment for balanced power delivery and improved cycle efficiency while maintaining operational versatility across large industrial floors.

The Above 10,000 lbs category supported heavy-duty workflows where industrial components exceeded routine payload limits. This segment advanced as automotive, metal fabrication, and aerospace manufacturers deployed high-capacity tugger trains. Facilities relied on these systems to enhance safety during the movement of bulky items while reducing the need for multiple transport trips.

By Application Analysis

Manufacturing Plants dominate with 38.9% due to their continuous material movement needs.

In 2024, Manufacturing Plants held a dominant market position in the By Application Analysis segment of the Industrial Tugger Market, with a 38.9% share. This segment expanded as factories adopted tugger trains to streamline just-in-time production flows, minimize forklift dependency, and accelerate intra-plant material circulation across multi-stage manufacturing lines.

Warehouse applications continued rising as facilities integrated tuggers for efficient pallet movement, order picking support, and replacement of manual handling equipment. Operators preferred tuggers for safer navigation through narrow aisles and improved workflow coordination. This segment also benefited from growing e-commerce activities requiring faster internal transport cycles.

Distribution Centers utilized tuggers to strengthen inbound and outbound movement efficiency. Tuggers supported trailer unloading, cross-docking tasks, and internal goods transfers. They also helped reduce congestion in sorting areas by enabling stable, predictable load flow. Consequently, distribution hubs adopted tugger fleets to improve material throughput and optimize daily handling tasks.

Others included airports, medical facilities, and large institutional campuses where tugger systems ensured controlled material transport. These environments adopted tuggers for quieter operation, safer navigation, and handling of specialized carts. The segment grew steadily as non-industrial environments increased investments in structured internal mobility solutions.

Key Market Segments

By Type

- Electric Tugger

- Gasoline Tugger

- Diesel Tugger

- Others

By Load Capacity

- Up to 5000 lbs

- 5,001-10,000 lbs

- Above 10,000 lbs

By Application

- Warehouse

- Manufacturing Plants

- Distribution Centers

- Others

Drivers

Growing Automation of Material Handling in Manufacturing Plants Drives Market Growth

Automation is increasing across manufacturing plants, and this shift strengthens the demand for industrial tuggers. Companies now seek equipment that moves materials smoothly with fewer workers. This creates strong adoption because tuggers support safer workflow transitions and reduce manual strain. The overall push for automated lines continues to accelerate tugger deployment across diverse industries.

The rising need for efficient intralogistics workflows further boosts tugger demand. Modern production plants depend on the consistent movement of components without delays. Industrial tuggers help maintain steady line feeding and structured material transport. This improves layout efficiency and reduces downtime across operations. As factories scale, structured tugger-based workflows become more essential for productivity.

E-commerce expansion sharply increases warehouse activity, driving high-volume tugging requirements. Large fulfillment centers now manage thousands of movement cycles daily. Industrial tuggers support faster replenishment, bulk movement, and order routing. Their reliability helps operators maintain strict delivery commitments. Growing digital retail continues to create strong demand for scalable tugger solutions in major logistics hubs.

Restraints

Limited Operating Ranges for Battery-Powered Industrial Tuggers Restrain Adoption

Battery-powered tuggers face limited operating ranges, creating performance gaps in large facilities. Operators often manage long travel routes that demand sustained energy capacity. When batteries drain faster, operations slow down. This restriction becomes a key challenge for businesses needing continuous movement cycles in wide warehouse or plant environments.

Heavy-duty towing creates high maintenance needs, adding operational burdens for companies. Continuous pulling of loaded carts increases component wear, requiring more frequent servicing. This raises ownership costs and reduces uptime. Facilities with nonstop operations find these cycles challenging, especially when equipment must remain reliable during peak production or distribution schedules.

Maintenance-intensive designs also limit deployment in smaller plants with limited technical staffing. Regular part replacements and inspection requirements add effort that not all facilities can manage. This complicates workflow planning and restricts widespread adoption. Companies evaluating automation often reconsider tuggers when maintenance workloads exceed internal capabilities.

Growth Factors

Integration of AI-Based Fleet Management Creates Strong Market Opportunity

AI-based fleet management is creating new opportunities for industrial tuggers. These systems help coordinate multiple units, optimize routing, and predict maintenance needs. Businesses gain better visibility of movement patterns and reduce unnecessary travel. As factories digitize operations, AI-enabled tugger coordination becomes a valuable upgrade path for efficiency.

Tugger-AGV hybrid systems offer stronger opportunities as smart factories expand. These units combine manual flexibility with automated guidance, allowing operators to shift between modes. Hybrid capabilities support mixed-production floors where full automation is not yet feasible. Manufacturing plants favor these solutions for gradual transition strategies within Industry 4.0 environments.

Replacement of forklifts with safer tugger-train systems continues to open profitable opportunities. Many companies now reduce forklift counts to minimize accidents and narrow-aisle risks. Tugger trains handle more volume with fewer hazards. Their structured pathways create stable, predictable traffic flow, making them appealing substitutes in safety-conscious operations.

Modular tugger designs generate additional opportunities by supporting flexible production lines. Factories frequently change layouts or product variants. Modular units adapt quickly, reducing downtime caused by reconfiguration. This flexibility attracts industries operating in fast-changing assembly environments, especially automotive, electronics, and consumer goods.

Emerging Trends

Shift Toward Autonomous Tugger Trains Drives Market Trends

Autonomous tugger trains are becoming a major trend across large warehouses. Companies prefer them for continuous material flow with minimal labor. These systems enhance safety and reduce human error while maintaining steady movement cycles. As automation investments rise globally, autonomous tugging becomes an integral part of modern intralogistics operations.

IoT-enabled tuggers with real-time route and load monitoring represent another strong trend. Sensors provide continuous visibility into equipment status, cargo weight, and travel paths. This helps prevent overload events and optimizes routing decisions. Data-driven insights allow logistics teams to adjust workflows quickly, making operations more predictable and efficient.

Regional Analysis

Asia Pacific Leads the Industrial Tugger Market with a Dominant Share of 48.3%, Valued at USD 0.6 Billion

Asia Pacific remains the leading region due to rapid industrial automation and increasing investment in large-scale manufacturing hubs. The region’s strong expansion in e-commerce fulfillment centers accelerates tugger adoption across warehouses and logistics networks. With its dominant 48.3% share and valuation of USD 0.6 billion, Asia Pacific continues to benefit from rising demand for efficient intralogistics systems.

North America Industrial Tugger Market Trends

North America experiences steady growth driven by strong warehouse modernization and increasing adoption of electric material-handling systems. The region sees higher integration of autonomous and semi-autonomous tuggers, especially in large distribution centers. Growing emphasis on workplace safety also supports the transition from forklifts to safer tugger-train solutions.

Europe Industrial Tugger Market Trends

Europe shows consistent market expansion supported by advanced manufacturing hubs and Industry 4.0 initiatives. Countries across Western Europe are increasingly automating intralogistics workflows to improve production efficiency. Rising demand for sustainable electric-powered tugger systems aligns with the region’s strict environmental and safety regulations.

Middle East & Africa Industrial Tugger Market Trends

The Middle East & Africa region is gradually adopting industrial tuggers as large logistics zones, free-trade hubs, and industrial parks expand. Investments in warehousing, automotive assembly, and port operations enhance material handling requirements. Although the market is emerging, infrastructure development continues to create new deployment opportunities.

Latin America Industrial Tugger Market Trends

Latin America shows improving market activity driven by manufacturing recovery and the growth of regional distribution networks. Warehouses in Brazil, Mexico, and Chile increasingly modernize operations to handle rising retail demand. Adoption remains moderate but accelerates as companies shift toward efficient towing solutions for high-volume material movement.

United States Industrial Tugger Market Trends

The U.S. market grows steadily with strong automation investments across large manufacturing plants and national logistics networks. High demand for streamlined workflows in automotive, aerospace, and retail distribution supports wider use of industrial tuggers. The shift toward electric and IoT-enabled tugging systems strengthens long-term adoption across U.S. Facilities.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Industrial Tugger Market Company Insights

The global Industrial Tugger Market in 2024 reflects steady automation growth, and leading manufacturers continue strengthening their product capabilities to support large-scale material handling environments. Toyota Material Handling remains a central force due to its broad electric tugger portfolio and strong integration of safety technologies. The company benefits from its wide customer base across manufacturing and logistics, reinforcing adoption of high-efficiency tow solutions in both advanced and emerging economies.

Crown Equipment Corporation maintains strong relevance through its focus on ergonomics, connected fleet management, and durable tugger platforms designed for demanding intralogistics workflows. Its continuous product development aligns with the rising requirement for high-volume warehouse automation, contributing to stronger placement in regional and global distribution hubs.

Hyster-Yale Materials Handling, Inc. supports the market with robust, heavy-duty tugger models favored in industrial plants and long-distance material movement applications. The company’s engineering strength and emphasis on operator-friendly control systems encourage adoption among facilities seeking reliable automated and semi-automated transport solutions.

MITSUBISHI LOGISNEXT CO., LTD. demonstrates strong competitiveness through its expanding electric tugger lineup and technology-driven design approach. Its emphasis on energy-efficient systems, safety automation, and precise load management positions the company well in markets transitioning to low-emission intralogistics equipment.

Overall, these leading companies contribute to the accelerated modernization of warehouse operations, improved material flow, and stronger alignment with sustainability trends. Their advancements in electric mobility, telematics, and modular tugger configurations support the continued evolution of the global Industrial Tugger Market, especially as manufacturers prioritize flexible, safe, and high-performance towing solutions.

Top Key Players in the Market

- Toyota Material Handling

- Crown Equipment Corporation

- Hyster-Yale Materials Handling, Inc.

- MITSUBISHI LOGISNEXT CO., LTD.

- Lift Truck Center, Inc.

- CLARK

- The Raymond Corporation

- Global Equipment Company Inc.

- MasterMover, Inc.

- Cyngn Inc.

Recent Developments

- In Oct 2025, G&J Pepsi deployed the Cyngn Autonomous DriveMod Tugger to automate material movement within its manufacturing and distribution operations. This deployment supports improved operational efficiency, safer facility logistics, and scalable autonomous vehicle adoption across G&J Pepsi’s production sites.

Report Scope

Report Features Description Market Value (2024) USD 1.4 Billion Forecast Revenue (2034) USD 2.7 billion CAGR (2025-2034) 6.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Electric Tugger, Gasoline Tugger, Diesel Tugger, Others), By Load Capacity (Up to 5000 lbs, 5,001-10,000 lbs, Above 10,000 lbs), By Application (Warehouse, Manufacturing Plants, Distribution Centers, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Toyota Material Handling, Crown Equipment Corporation, Hyster-Yale Materials Handling, Inc., MITSUBISHI LOGISNEXT CO., LTD., Lift Truck Center, Inc., CLARK, The Raymond Corporation, Global Equipment Company Inc., MasterMover, Inc., Cyngn Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Toyota Material Handling

- Crown Equipment Corporation

- Hyster-Yale Materials Handling, Inc.

- MITSUBISHI LOGISNEXT CO., LTD.

- Lift Truck Center, Inc.

- CLARK

- The Raymond Corporation

- Global Equipment Company Inc.

- MasterMover, Inc.

- Cyngn Inc.