Global Indoor Amusement Center Market Size, Share and Report Analysis By Facility Type (Arcade Games, AR-VR Games, Indoor Go-karts, Indoor Adventure Parks, Bowling Alleys, Children's Entertainment And Education Area, Trampoline Park, and Others), By Age Group (Below 12 Years, 13-20 Years, 21-30 Years, and Above 30 Years), By Ownership Model (Franchised Centers, Independent Centers, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2026

- Report ID: 178671

- Number of Pages: 304

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

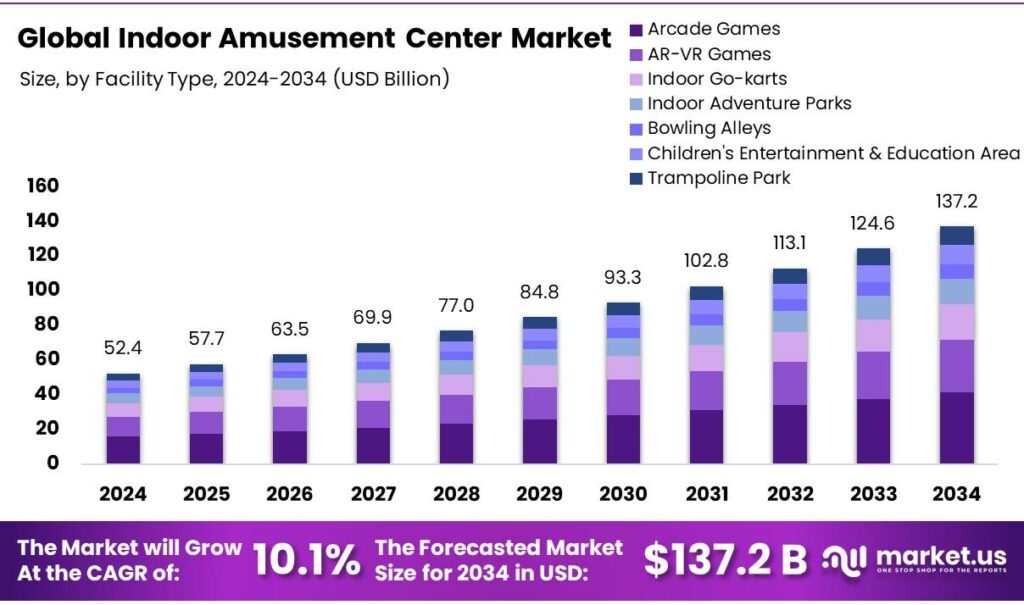

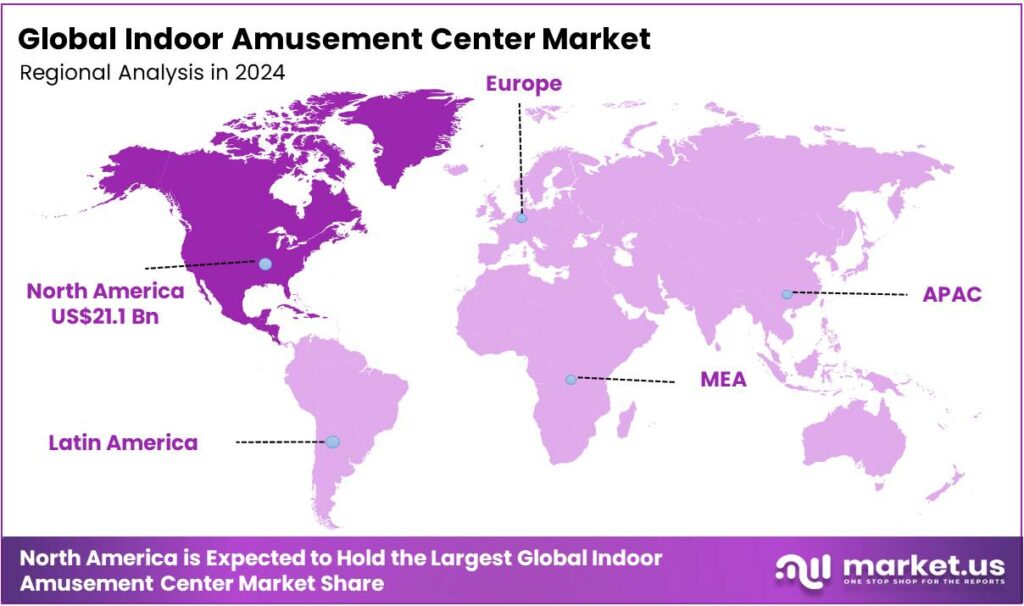

Global Indoor Amusement Center Market size is expected to be worth around USD 137.2 Billion by 2034, from USD 52.4 Billion in 2024, growing at a CAGR of 10.1% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 40.2% share, holding USD 21.1 Billion in revenue.

An indoor amusement center (IAC), commonly known as a family entertainment center (FEC), is an entertainment venue located entirely within a building that offers a variety of recreational activities and attractions. These centers are typically smaller than traditional outdoor amusement parks and are designed to provide a one-stop shop for year-round, weather-proof fun for families, teenagers, and corporate groups.

- According to the Federal Reserve Bank report, personal consumption expenditures on amusement parks and recreational activities in the US alone surged from US$51.3 billion in 2014 to US$87.2 billion in 2024.

The market is primarily driven by consumer demand for accessible, safe, and diverse recreational experiences. North America, particularly the U.S., represents the largest market, supported by high disposable income and a well-established infrastructure for leisure activities. Furthermore, the adoption of themed environments and integrated F&B options is increasingly popular, enhancing customer satisfaction and dwell time.

However, challenges such as operational costs, attraction obsolescence, and external factors such as geopolitical tensions affect the market. Despite these hurdles, IACs remain a key part of urban entertainment, capitalizing on the trend of multi-use leisure destinations.

Key Takeaways:

- The global indoor amusement center market was valued at USD 52.4 billion in 2024.

- The global indoor amusement center market is projected to grow at a CAGR of 10.1% and is estimated to reach USD 137.2 billion by 2034.

- On the basis of facility type, arcade games are most played in indoor amusement centers, constituting 30.2% of the total market share.

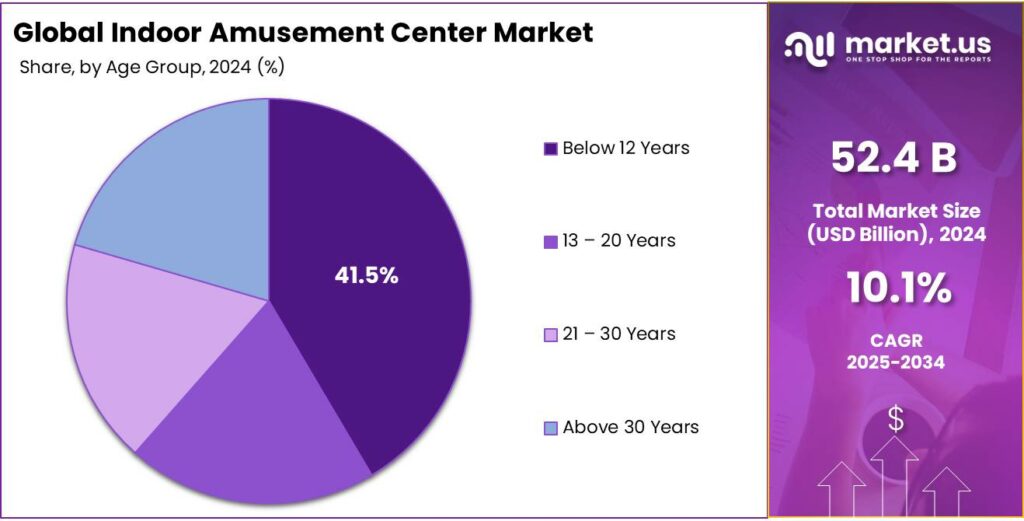

- Based on the age group, most indoor amusement centers are built for individuals below 12 years, comprising 41.5% of the total market.

- Among the ownership models of the indoor amusement center, franchised centers are the most considerable, accounting for around 51.2% of the revenue.

- In 2024, North America was the most dominant region in the indoor amusement center market, accounting for 40.2% of the total global consumption.

Facility Type Analysis

Arcade Games Are a Prominent Segment in the Indoor Amusement Center Market.

The indoor amusement centers market is segmented based on the facility type into arcade games, AR-VR games, indoor go-karts, indoor adventure parks, bowling alleys, children’s entertainment & education area, trampoline park, and others. The arcade games led the indoor amusement center market, comprising 30.2% of the market share. Arcade games are often more popular in indoor amusement centers due to their accessibility, lower cost, and broad appeal.

Unlike more specialized attractions such as AR-VR games or indoor go-karts, arcade games are relatively easy to play, require no advanced skills, and offer instant gratification, making them appealing to a wide range of ages. In addition, they have lower operational and maintenance costs compared to more complex attractions.

Similarly, the quick play cycles and easy-to-understand mechanics keep players engaged without requiring significant time commitment. Furthermore, arcade games often evoke nostalgia, drawing in both younger and older generations. Moreover, their compact size allows for higher density placement in smaller spaces, making them ideal for maximizing foot traffic in high-volume areas of amusement centers.

Age Group Analysis

Individuals Below 12 Years Dominated the Indoor Amusement Center Market.

On the basis of age group, the indoor amusement center market is segmented into below 12 years, 13-20 years, 21-30 years, and above 30 years. The below 12 years dominated the indoor amusement center market, comprising 41.5% of the market share, due to the higher demand for family-oriented, safe, and engaging environments for young children. Younger children typically have fewer leisure options, and their parents seek safe, accessible entertainment where they can supervise them closely.

These centers offer a controlled environment with age-appropriate activities, such as soft play areas, interactive games, and educational entertainment, which appeal to children and parents. Additionally, children under 12 are more likely to visit regularly, fostering customer loyalty and repeat business. In contrast, older age groups tend to prefer more complex or diverse entertainment, such as gaming lounges, sports venues, or social events, which require different types of facilities and infrastructure. This demographic targeting aligns with maximizing engagement and revenue potential for the centers.

Ownership Model Analysis

Most Indoor Amusement Centers Follow Franchised Ownership Models.

Among the ownership models of the indoor amusement center, 51.2% of the indoor amusement centers follow franchised ownership models, outperforming independent centers and other ownership models. Most indoor amusement centers follow franchised ownership models as franchising offers a proven business framework, reducing operational risks for new owners. Franchisees benefit from established brand recognition, marketing strategies, and standardized operational processes, which enhance customer trust and consistency across locations.

Additionally, this model allows for quicker scalability and market penetration, as franchisees can leverage the franchisor’s expertise in site selection, staff training, and customer experience. Similarly, franchisors typically provide ongoing support, including access to centralized supply chains, reducing operational costs for franchisees.

In contrast, independent centers may face challenges with brand development, marketing, and maintaining consistent operational standards. Furthermore, franchise ownership attracts investors by offering a lower-risk, higher-reward business structure, making it more attractive than other ownership models.

Key Market Segments:

By Facility Type

- Arcade Games

- AR-VR Games

- Indoor Go-karts

- Indoor Adventure Parks

- Bowling Alleys

- Children’s Entertainment & Education Area

- Trampoline Park

- Others

By Age Group

- Below 12 Years

- 13-20 Years

- 21-30 Years

- Above 30 Years

By Ownership Model

- Franchised Centers

- Independent Centers

- Others

Drivers

Increasing Disposable Income Drives the Indoor Amusement Center Market.

Increasing disposable income has been a significant driver for the indoor amusement center market. As disposable income rises, consumers are more likely to allocate funds to leisure activities such as entertainment centers. A report by the U.S. National Center for Biotechnology Information (NCBI) indicated that higher disposable income correlates with increased consumer spending on non-essential services, including entertainment and leisure activities.

- According to data from the U.S. Bureau of Economic Analysis (BEA), personal income increased by US$95.7 billion, by 0.4% at a monthly rate in August 2025, disposable personal income (DPI) increased US$86.1 billion, by 0.4%, and personal consumption expenditures (PCE) increased US$129.2 billion, by 0.6%. This economic trend directly correlates with the increased demand for recreational experiences, including indoor amusement centers.

In addition, the growing middle-class segment in developing markets further supports this trend. For instance, according to the Ministry of Culture and Tourism, the total number of domestic tourist trips reached 6.522 billion in 2025, an increase of 907 million trips from 2024. Tourists spent a total of 6.3 trillion yuan (US$906 billion) on domestic travel, up 9.5% from 2024.

Restraints

Operational Costs Might Pose a Challenge to the Indoor Amusement Center Market.

Operational costs and attraction obsolescence represent significant challenges for the indoor amusement center market. According to a report from the U.S. Bureau of Labor Statistics (BLS), the costs associated with maintenance, staffing, and utilities in recreational facilities have consistently increased over the last decade, outpacing general inflation. Additionally, the producer price index (PPI) for property and casualty insurance for commercial sectors has seen persistent annual increases, directly impacting fixed overhead.

Specifically, total employer compensation costs for private industry workers in the leisure and hospitality industry averaged US$19.90 per hour worked in December 2024, accounting for 81.7% of employer costs, reflecting the increasing demand for skilled workers in these settings. Additionally, attraction obsolescence remains a concern.

The U.S. Consumer Product Safety Commission (CPSC) highlighted that outdated or poorly maintained equipment contributes to safety hazards, with most amusement-related injuries linked to malfunctioning rides or attractions. Furthermore, as consumer expectations evolve, centers must invest in upgrading or replacing attractions to maintain customer interest, which increases capital expenditure.

Opportunity

Multi-Entertainment Complexes Create Opportunities in the Indoor Amusement Center Market.

Multi-entertainment complexes that combine indoor amusement centers with shopping malls or dining areas offer a significant opportunity for market growth. According to the U.S. Department of Commerce, mixed-use developments, including entertainment and retail spaces, have become increasingly popular, with most shopping mall developments incorporating entertainment facilities.

These complexes cater to evolving consumer preferences for diverse experiences under one roof. The trend is supported by the National Association of Realtors, which found that U.S. consumers preferred mixed-use venues for leisure activities due to their convenience and variety.

Additionally, the U.S. Bureau of Labor Statistics (BLS) reported an increase in consumer spending on food and entertainment, indicating that consumers are seeking integrated experiences where dining, shopping, and entertainment converge. The expansion of multi-entertainment spaces aligns with this trend, creating a broader appeal for various demographic groups, as evidenced by the growing number of such complexes in urban areas.

Trends

Adoption of Themed Environments and Integrated F&B Options in Indoor Amusement Centers.

The adoption of themed environments and integrated food and beverage (F&B) options is a notable trend in the indoor amusement center market. The strategic integration of these services marks a structural shift in IAC design, moving from fragmented gaming halls to unified brand-immersion destinations. For instance, public disclosures regarding Nickelodeon Universe and DreamWorks Water Park at the American Dream complex show that thematic elements occupy nearly 100% of the visible guest environment to drive multi-generational engagement.

According to the U.S. National Restaurant Association (NRA), most entertainment venues incorporated themed dining experiences as part of their attractions. This trend is driven by consumer demand for more immersive and cohesive experiences, as evidenced by the rise in edutainment and adventure-themed centers, which blend entertainment with food offerings.

Furthermore, the U.S. Department of Commerce highlighted that venues integrating food services with entertainment experiences reported increased customer dwell time, as visitors tend to stay longer when food options are available on-site. Additionally, the U.S. Bureau of Labor Statistics observed an increase in employment within the leisure and hospitality sectors, partially attributed to the growing demand for integrated entertainment and dining experiences.

Geopolitical Impact Analysis

Opportunities for the Indoor Amusement Centers in the Wake of Geopolitical Tensions.

The geopolitical tensions have impacted the indoor amusement center market, primarily through supply chain disruptions, changes in consumer behavior, and shifts in disposable income. According to the U.S. Department of Commerce, global supply chain disruptions, exacerbated by tensions such as the Russia-Ukraine conflict, led to delays and price increases in essential materials, including construction supplies and imported entertainment equipment. This has raised operational costs for indoor amusement centers, particularly in regions heavily reliant on international trade.

Additionally, the consumer sentiment in countries experiencing geopolitical instability, such as the U.S. and Europe, saw a decline in discretionary spending. In these regions, consumers are adjusting their spending habits, prioritizing essential goods over entertainment. Furthermore, the U.S. State Department’s advisories on travel and security have influenced the tourism sector, leading to a decrease in international tourists visiting amusement centers. This is particularly notable in areas dependent on foreign visitors, where regional geopolitical factors have led to a decline in international leisure travel.

Regional Analysis

North America Held the Largest Share of the Global Indoor Amusement Center Market.

In 2024, North America dominated the global indoor amusement center market, holding about 40.2% of the total global consumption, supported by strong consumer demand and a well-established infrastructure for leisure and entertainment. The personal consumption expenditures on recreational services in the U.S. rose significantly, with a considerable portion directed toward indoor entertainment options such as amusement centers.

Furthermore, the U.S. Department of Commerce has noted the regional concentration of IACs in urban and suburban areas, where consumer access to entertainment services is high. This urban concentration is supported by infrastructure investments and high disposable income levels, particularly in states such as California, Florida, and Texas. American individuals are increasingly opting for indoor, year-round entertainment alternatives, further bolstering North America’s dominance in the IAC market.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Players in the indoor amusement center market focus on innovation in attractions, where centers continuously upgrade or introduce new, immersive experiences to attract repeat visitors. For instance, incorporating virtual reality (VR) and interactive gaming is a growing trend.

Additionally, IACs emphasize customer experience enhancement, such as offering integrated dining options, themed environments, and family-oriented packages to increase dwell time and satisfaction. Furthermore, operational efficiency, including optimized staffing and energy management, is another focus. Similarly, location strategies play a crucial role, with many centers positioning themselves near high-traffic retail or entertainment hubs to capture broader consumer bases.

The Major Players in The Industry

- Bandai Namco Holdings Inc.

- Bowlero

- CEC Entertainment Concepts, LP

- Cinergy Entertainment Group

- Dave and Buster’s, Inc.

- Funriders

- Inflatable Solutions International Limited

- KidZania

- Landmark Group (Funcity)

- Main Event Entertainment

- Merlin Entertainments

- Scene75 Entertainment Centers

- Smaaash Entertainment Private Limited

- TEEG

- Urban Air

- Other Key Players

Key Development

- In May 2025, Japanese entertainment conglomerate Bandai Namco announced to intensify its global expansion efforts, with plans to quintuple the number of its Cross Stores by 2030.

- In November 2025, Chuck E. Cheese (CEC), the world’s leading family entertainment brand, unveiled Chuck E. Cheese Adventure World, its inaugural 12,000-square-foot indoor playground dedicated exclusively to active play.

Report Scope:

Report Features Description Market Value (2024) US$52.4 Bn Forecast Revenue (2034) US$137.2 Bn CAGR (2025-2034) 10.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Facility Type (Arcade Games, AR-VR Games, Indoor Go-karts, Indoor Adventure Parks, Bowling Alleys, Children’s Entertainment & Education Area, Trampoline Park, and Others), By Age Group (Below 12 Years, 13-20 Years, 21-30 Years, and Above 30 Years), By Ownership Model (Franchised Centers, Independent Centers, and Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Bandai Namco Holdings Inc., Bowlero, CEC Entertainment Concepts, LP, Cinergy Entertainment Group, Dave and Buster’s, Inc., Funriders, Inflatable Solutions International Limited, KidZania, Landmark Group (Funcity), Main Event Entertainment, Merlin Entertainments, Scene75 Entertainment Centers, Smaaash Entertainment Private Limited, TEEG, Urban Air, and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Indoor Amusement Center MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Indoor Amusement Center MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Bandai Namco Holdings Inc.

- Bowlero

- CEC Entertainment Concepts, LP

- Cinergy Entertainment Group

- Dave and Buster’s, Inc.

- Funriders

- Inflatable Solutions International Limited

- KidZania

- Landmark Group (Funcity)

- Main Event Entertainment

- Merlin Entertainments

- Scene75 Entertainment Centers

- Smaaash Entertainment Private Limited

- TEEG

- Urban Air

- Other Key Players