India E-Waste Management System Market By Category (IT and Telecom Devices, Consumer Electrical and Electronics, and Solar Panels, Large and Small Electrical and Electronic Equipment, Electric and Electronic Tools (excluding Large Industrial Tools), Toys and Sports Gear, Medical Devices (excluding implanted and infected products), Laboratory Instruments), By Material (Metal (Non-precious Metal, Precious Metal), Plastic, Glass), By Application (Disposal (Incineration, Landfill, Reuse), Recycled), By Sector (Formal and Informal), States and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 165673

- Number of Pages: 396

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Category

- By Material

- By Application

- By Sector

- Key Market Segments

- Drivers

- Restraints

- Growth Factors

- Impact of Macroeconomic / Geopolitical Factors

- Emerging Trends

- State Analysis

- Key India E-Waste Management System Company Insights

- Key Opinion Leaders

- Recent Developments

- Report Scope

Report Overview

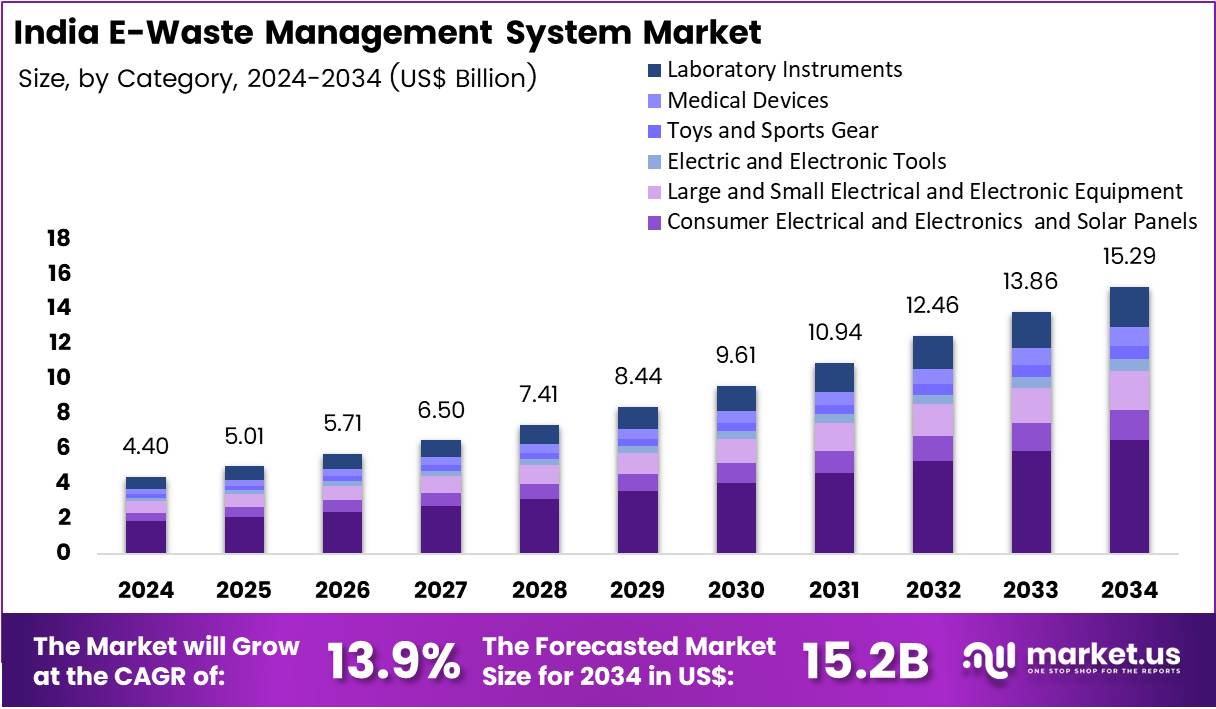

The India E-Waste Management System Market size is expected to be worth around US$ 15.29 billion by 2034 from US$ 4.40 billion in 2024, growing at a CAGR of 13.9% during the forecast period 2025 to 2034. The India E-Waste Management System Market is rapidly evolving due to increasing consumer electronics penetration, urbanization, and heightened regulatory awareness and actions regarding the proper disposal and recycling of e-waste.

Recognizing the growing problem of electronic waste, the Indian government has implemented strict regulations, such as the E-Waste (Management) Rules, 2016, which mandate producers to collect and channel e-waste to authorized recyclers. This has spurred the growth of formal recycling sectors within the country.

India E-Waste Management System Market, Analysis, 2020-2024 (US$ Billion)

India 2020 2021 2022 2023 2024 CAGR Revenue 1.98 2.70 3.39 3.86 4.40 13.9%

Several companies and initiatives stand out in the Indian market. Attero Recycling, India’s largest electronic asset management company, is an excellent instance of a business that not only recycles e-waste but also extracts precious metals like gold and silver, thus contributing to resource conservation and reduced environmental impact. Another example is E-Parisaraa Pvt. Ltd., India’s first government-authorized e-waste recycler, which is engaged in dismantling and recycling various types of e-waste efficiently and safely.

Furthermore, there is a significant drive towards increasing consumer awareness regarding the hazards of improper e-waste disposal and the benefits of recycling. Various NGOs and government initiatives focus on outreach and education to encourage the public to participate actively in e-waste management programs.

This educational approach helps in reducing the environmental footprint of electronic waste by diverting it from landfills to recycling facilities, thus fostering a more sustainable approach to electronics consumption and waste management in India. These efforts collectively aim to transform India’s e-waste sector into a more efficient, environmentally responsible, and economically viable part of the global recycling industry.

Currently, much of the e-waste recycling occurs in the non-formal sector, utilizing primitive and hazardous methods. Addressing this issue requires adequate legislative measures and the adoption of cost-effective, environmentally friendly technological solutions. This article aims to provide fundamental information on electronic waste management in India.

In India, Mumbai leads as the top e-waste generator among the top ten cities, followed by Delhi, Bangalore, Chennai, Kolkata, Ahmedabad, Hyderabad, Pune, Surat, and Nagpur. These 65 cities collectively contribute over 60% of the total e-waste generated in the country. Additionally, 10 states account for 70% of the total e-waste generated.

In May 2025, Casio India Co. Pvt. Ltd., a leading and trusted name in consumer electronics, highlighted the success of its ambitious two-week CSR initiative, “Recycle Responsibly,” launched in March 2025. The campaign, aimed at addressing the rapidly growing challenge of electronic waste, spanned the entire Delhi-NCR region. It resulted in the collection of an impressive 5,488 kilograms of e-waste from more than 450 touchpoints, including residential societies, corporate campuses, and major market areas.

Key Takeaways

- The India E-Waste Management System market was valued at US$ 4.40 billion in 2024 and is anticipated to register substantial growth of US$ 15.29 billion by 2034, with 13.9% CAGR.

- Based on Category, the market is bifurcated into IT and Telecom Devices, Consumer Electrical and Electronics, and Solar Panels, Large and Small Electrical and Electronic Equipment, Electric and Electronic Tools (excluding Large Industrial Tools), Toys and Sports Gear, Medical Devices (excluding implanted and infected products), and Laboratory Instruments with IT and Telecom Devices taking the lead in 2024 with 42.6% market share.

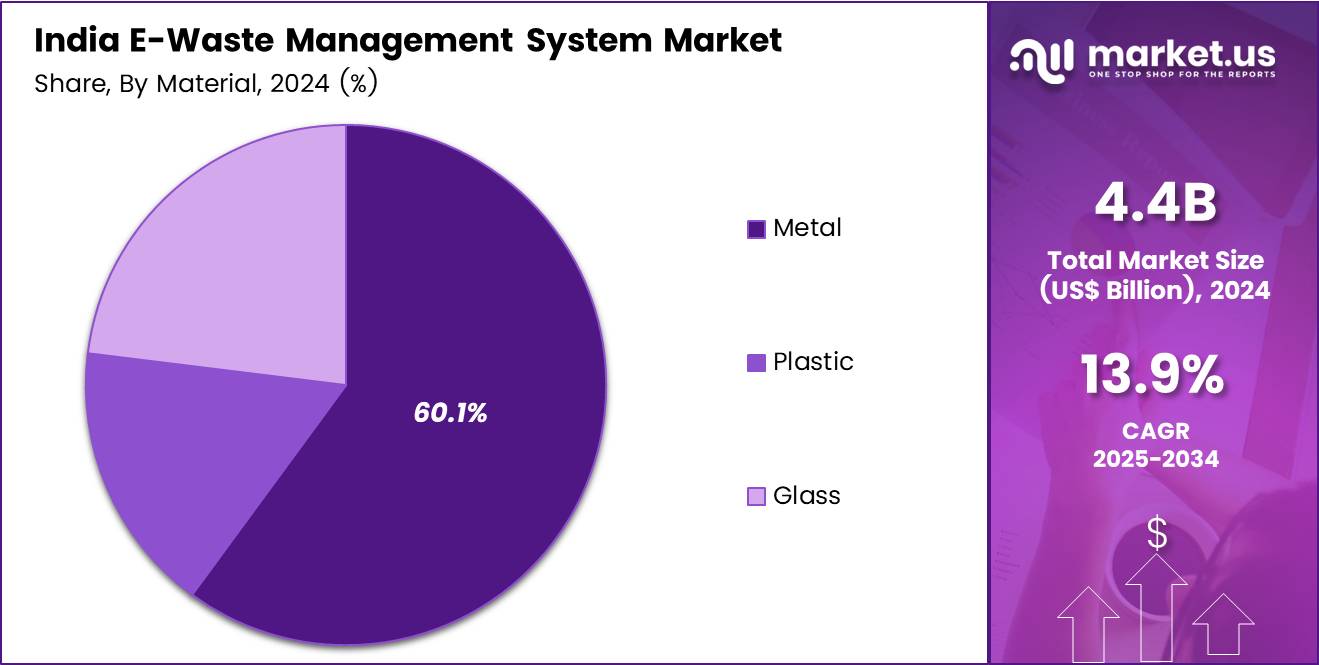

- By Material, the market is divided into Metal, Plastic, Glass, and, with Metal taking the lead market share in 2024 with 60.1%.

- By Application, the market is divided into Disposals, and Recycled, with Disposals taking the lead market share in 2024 with 92.5%.

- By Sector, the market is divided into Formal and Informal with Informal taking the lead in 2024 with 90.1% market share.

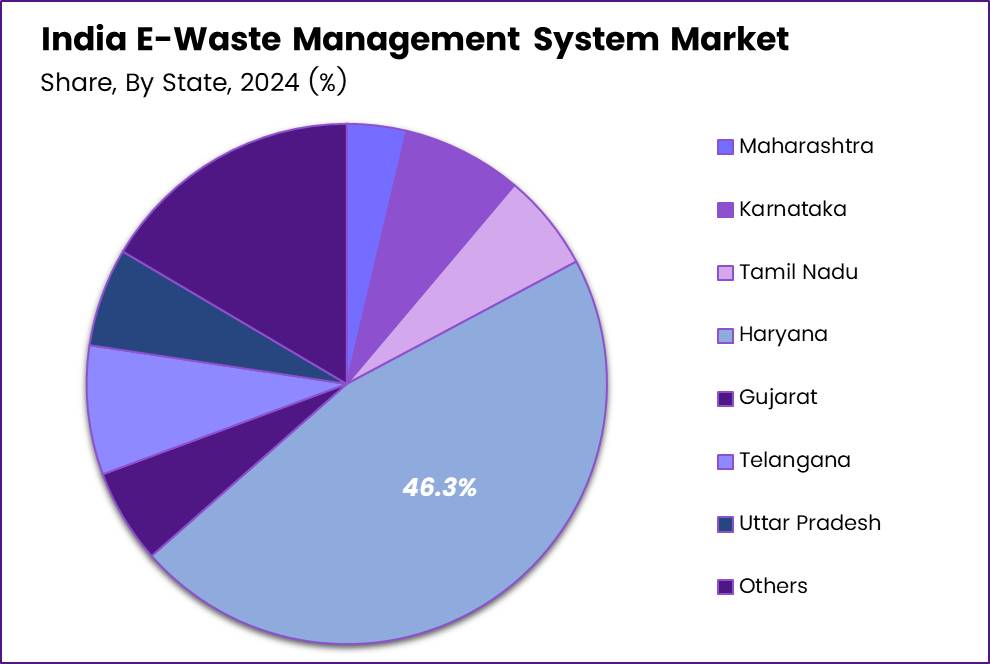

- Considering State, the market is classified into Maharashtra, Karnataka, Tamil Nadu, Haryana, Gujarat, Telangana, Uttar Pradesh, and Others, with Haryana accounting for major market share of 46.3%.

By Category

The IT and Telecom Devices segment dominated with 42.6% market share is a major contributor to e-waste in India, driven by the swift technological advancements and the increasing dependence on digital solutions. This category includes a broad array of devices such as computers, mobile phones, servers, and routers, which often have short life cycles due to rapid innovation and consumer demand for the latest technology. As these devices become obsolete at an accelerating rate, they generate a significant amount of e-waste, highlighting the urgent need for effective recycling solutions.

Efficient recycling systems are crucial for handling this type of e-waste because they contain valuable materials like copper, gold, and rare earth elements. These materials are not only economically valuable but also critical to reducing the environmental impact of mining for new resources. Recycling helps in the conservation of these materials and ensures they are reused in the manufacturing of new products.

In November 2025, Blue Planet Environmental Solutions Pte Ltd, a Singapore-based global leader in sustainable waste management and circular economy technologies, advanced its vision for resource recovery in India through a strategic move. The company completed the acquisition and integration of its subsidiaries—Pegasus Waste Management Pvt Ltd, located in Haryana (New Delhi) and Karnataka (Bengaluru). Following this consolidation, the entity has been rebranded and will now operate as Blue Planet E-waste Solutions Pvt Ltd.

India E-Waste Management System Market, Type, 2020-2024 (US$ Million)

Type 2020 2021 2022 2023 2024 CAGR IT and Telecom Devices 830.9 1,135.7 1,434.8 1,640.1 1,874.9 14.3% Consumer Electrical and Electronics and Solar Panels 225.0 306.5 386.0 439.9 501.4 14.0% Large and Small Electrical and Electronic Equipment 295.3 400.4 502.0 569.4 645.9 13.4% Electric and Electronic Tools (excluding Large Industrial Tools) 90.7 122.4 152.6 172.1 194.0 12.7% Toys and Sports Gear 101.0 136.1 169.6 191.0 215.0 12.6% Medical Devices (excluding implanted and infected products) 137.9 188.3 237.4 271.3 309.8 14.2% Laboratory Instruments 298.4 405.7 509.4 579.5 659.4 13.7% TOTAL 1,979.2 2,695.0 3,391.8 3,863.3 4,400.3 13.9% By Material

In India’s E-Waste Management System Market, the metal segment dominated the market with 60.1% market share as it is essential due to the recyclability and economic value of metals extracted from electronic waste. This segment encompasses both precious and non-precious metals, each offering specific benefits and challenges in recycling.

Precious metals such as gold, silver, palladium, and platinum are found in small quantities in electronic devices like mobile phones and computers. Their recovery is economically significant because of their high market value. Specialized recycling techniques, including chemical leaching and electrolysis, are used to extract these metals efficiently from discarded electronics, providing a substantial return on investment. These processes not only recover valuable resources but also reduce the environmental impact compared to primary mining operations.

Both categories of metals are integral to India’s recycling efforts, supporting the country’s transition towards sustainable material management by minimizing waste and maximizing resource recovery. This holistic approach not only helps conserve the environment but also bolsters economic development through the recycling industry.

According to the Material Recycling Association of India, E-waste presents both a growing problem and a lucrative business opportunity due to its substantial volume and the presence of toxic and valuable materials. Metals such as iron, copper, aluminum, gold, and others constitute over 60% of e-waste, while pollutants make up 2.7% of its composition.

India E-Waste Management System Market, Material, 2020-2024 (US$ Million)

Material 2020 2021 2022 2023 2024 CAGR Metal 1,197.8 1,628.0 2,045.3 2,325.3 2,643.6 13.7% Precious Metal 907.3 1,236.2 1,556.9 1,774.4 2,022.4 14.0% Non-precious Metal 1,071.9 1,458.8 1,835.0 2,088.9 2,377.9 13.8% Plastic 338.8 459.7 576.6 654.4 742.7 13.5% Glass 442.6 607.3 769.9 883.6 1,014.0 14.7% TOTAL 1,979.2 2,695.0 3,391.8 3,863.3 4,400.3 13.9%

By Application

The Disposal segment is estimated to account for 92.5% revenue share in the India E-Waste Management System market in the year 2024 during the forecast period. The disposal segment is further segmented into incineration, landfill, and reuse. Incineration involves the combustion of waste materials in controlled environments to reduce their volume and sometimes harness energy from the process.

However, incinerating e-waste must be approached with caution due to the potential release of toxic chemicals, such as dioxins and furans, which can occur if the waste contains plastics and other hazardous substances. Modern incineration plants are equipped with advanced emission control technologies to capture these harmful by-products, ensuring they do not escape into the atmosphere. In India, incineration is generally reserved for specific types of waste that are not suitable for recycling, under stringent environmental regulations.

In October 2025, “Pan-India E-Waste Recycling Drive under Special Campaign 5.0” announced a drive by the Ministry of Mines from 2-31 October 2025 to collect and recycle unserviceable computers, laptops, printers, LED displays, mobile phones and other obsolete EEE across government offices.

India E-Waste Management System Market, Application, 2020-2024 (US$ Million)

Application 2020 2021 2022 2023 2024 CAGR Disposable 1,835.1 2,497.2 3,140.8 3,575.1 4,069.4 13.8% Incineration 686.9 933.6 1,172.8 1,333.4 1,516.0 13.7% Landfill 933.1 1,266.3 1,588.4 1,803.1 2,046.7 13.5% Reuse 232.1 320.9 409.9 474.0 547.9 15.5% Recycled 144.1 197.8 251.0 288.2 330.9 14.8% TOTAL 1,979.2 2,695.0 3,391.8 3,863.3 4,400.3 13.9% By Sector

The Informal segment acquired the prominent revenue share of 90.1% in the overall market in 2024. The Informal sector includes those entities that are not officially sanctioned and typically do not adhere to regulated safety or environmental standards. This sector is often comprised of small workshops or individual collectors and recyclers who utilize primitive methods for extracting valuable components from e-waste. These methods often pose significant health risks to workers and can lead to environmental degradation.

For example, informal recyclers might burn cables to extract copper, releasing toxic fumes into the air, or use acid baths to recover gold from circuit boards, leading to severe chemical pollution. Despite these challenges, the informal sector handles a substantial portion of India’s e-waste due to the lack of adequate formal recycling facilities and the economic opportunities it presents to low-income populations. Efforts are being made to integrate the informal sector into the formal system by providing training and resources to informal workers, thus improving safety standards and environmental compliance.

According to ScienceDirect, each year, more than 3.23 million tonnes of e-waste are generated in India, with over 90% of this total being managed by the informal waste management sector.

India E-Waste Management System Market, Sector, 2020-2024 (US$ Million)

Sector 2020 2021 2022 2023 2024 CAGR Formal 192.4 263.0 332.4 380.1 434.7 14.4% Informal 1,786.8 2,432.0 3,059.4 3,483.2 3,965.6 13.8% TOTAL 1,979.2 2,695.0 3,391.8 3,863.3 4,400.3 13.9% Key Market Segments

By Category

- IT and Telecom Devices

- Consumer Electrical and Electronics and Solar Panels

- Large and Small Electrical and Electronic Equipment

- Electric and Electronic Tools (excluding Large Industrial Tools)

- Toys and Sports Gear

- Medical Devices (excluding implanted and infected products)

- Laboratory Instruments

By Material

- Metal

- Non-precious Metal

- Precious Metal

- Plastic

- Glass

By Application

- Disposal

- Incineration

- Landfill

- Reuse

- Recycled

By Sector

- Formal

- Informal

Drivers

Rapid Urbanization and Consumer Electronics Growth

Rapid urbanization in India, coupled with the burgeoning growth of consumer electronics, underscores a significant trend in the country’s evolving landscape. As India’s middle class expands, there is a noticeable uptick in the adoption of electronic devices across various socio-economic segments. This surge in consumer electronics is driven by factors such as rising disposable incomes, technological advancements, and the growing accessibility of digital infrastructure.

The increasing adoption of electronic devices among India’s growing middle class not only reflects changing consumer preferences but also underscores the need for robust e-waste management strategies to address the burgeoning volume of electronic waste generated across the nation.

According to the Central Pollution Control Board (CPCB), India generated nearly 1.7 million tonnes of e-waste in FY 2023–24, a sharp rise from just over 0.7 million tonnes in 2018–19—reflecting an annual growth rate of more than 25%. Broader assessments by ASSOCHAM-EY and NITI Aayog, which factor in unregistered collection and informal disposal streams, place the total volume at over 5 million tonnes a year, with projections indicating it may surpass 9 million tonnes by 2030.

According to the Organization for Economic Co-operation and Development, since 1990, India has experienced a notable increase in its urban population, surpassing 150 million individuals. Projections indicate a further surge of 500 million urban residents by 2050. This trajectory suggests that nearly 20% of the world’s new urban inhabitants by the midpoint of the century will hail from India.

As per the Trade Promotion Council of India, during the initial half of 2023, the Indian consumer electronics market demonstrated significant advancement and expansion. Specifically, the technical consumer goods (TCG) sector, encompassing various electronic products and gadgets, showcased a commendable 8% surge in its overall value compared to the corresponding period in the prior year.

Restraints

Lack of Proper Recycling Infrastructure

Despite recent improvements in e-waste management policies and practices, India continues to face challenges in establishing widespread and advanced recycling facilities. While there has been progress in the implementation of the E-Waste (Management) Rules, 2016, and the expansion of licensed e-waste recycling units, the scale and sophistication of these facilities remain limited compared to the volume of e-waste generated in the country.

Instances of this limitation can be observed in various regions across India, particularly in smaller towns and rural areas where access to formal recycling infrastructure is limited. In many cases, e-waste is still disposed of through informal channels, such as street vendors and unauthorized recycling units, leading to environmental pollution and health hazards due to improper handling of hazardous materials.

Advanced recycling facilities that meet international standards for e-waste management, thereby ensuring a sustainable and circular approach to electronic waste disposal. According to the Financial Express, in India, insufficient specialized infrastructure, such as recycling facilities, presents a barrier to effective e-waste disposal and recycling. The establishment of such infrastructure necessitates a collaborative effort and substantial time investment from both the governmental and private sectors.

Growth Factors

Technological Advancements and Investments

The opportunity for investment in technology and innovation within the e-waste recycling sector in India is substantial, driven by the need for more efficient, environmentally friendly, and economically viable recycling solutions. As the volume of e-waste continues to grow due to increased electronic consumption, there is a pressing need to adopt advanced recycling technologies that can enhance material recovery rates, reduce environmental impacts, and improve overall process efficiency. Such technologies include automated sorting systems, more efficient shredding and separation techniques, and advanced chemical treatment processes that can safely extract precious metals while minimizing the release of hazardous by-products.

For instance, Attero Recycling, an Indian company, has invested heavily in proprietary technologies that enable them to extract precious metals from e-waste more efficiently than traditional methods. Their innovations in nano-extraction technology allow them to recover these materials at a molecular level, which not only enhances yield but also reduces the environmental footprint compared to conventional recovery methods. This approach has attracted substantial investment from both domestic and international sources, highlighting the potential for profitable ventures within the sector.

In December 2023, Mahindra Last Mile Mobility Ltd (MLMML) has partnered with Attero, a lithium-ion battery recycling and e-waste management firm. This strategic alliance aims to enhance EV battery recycling, addressing environmental concerns associated with safe disposal.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical shifts are significantly impacting the India E-Waste Management System market. Rapid economic growth and rising consumer incomes have accelerated electronics adoption across both urban and peri-urban areas, thereby driving volumes of end-of-life devices that must be managed. Conversely, inflationary pressures and supply-chain disruptions—such as semiconductor shortages and trade restrictions—are increasing unit costs for electronics and recycling inputs, which in turn raise the cost base for e-waste collection and processing.

On the geopolitical front, India’s positioning as a global manufacturing hub under initiatives like “Make in India” is fostering increased electronics production domestically and thereby generating more e-waste downstream. At the same time, evolving trade policies and import bans on e-waste from other countries are forcing the formalisation of recycling infrastructure, while creating competitive pressure on informal recyclers entering the market. These regulatory-geopolitical moves are boosting demand for compliant, high-standard recyclers, and are expected to shift market share toward organised players.

However, such changes also raise capital investment requirements, which may constrain smaller players and raise barriers to entry. In sum, as India pursues both industrial growth and international trade integration, the e-waste management system market is projected to expand — but also to become more operationally complex and cost-sensitive due to macro-economic inflation risks and geopolitical policy shifts.

Emerging Trends

Integration of Informal Recyclers

There is a concerted effort underway to integrate informal e-waste recyclers into the formal economy in India, with the aim of enhancing working conditions and promoting more efficient recycling practices. Recognizing the significant role played by informal recyclers in managing electronic waste, government agencies, NGOs, and industry stakeholders are implementing various initiatives to formalize their operations and provide them with the necessary support and resources.

The Indian government introduced a law in 2011 to improve the informal sector, followed by the Extended Producer Responsibility (EPR) rule in 2016, making manufacturers responsible for the safe disposal of electronic goods.

Moreover, efforts are underway to provide informal recyclers with access to financial services and social protection schemes, thereby improving their socio-economic status and livelihood opportunities. By formalizing their involvement in the e-waste recycling value chain, these initiatives aim to uplift informal recyclers from marginalized communities and integrate them as valued contributors to the formal economy.

In August 25, 2023, the Ministry of Environment, Forest and Climate Change (MoEFCC) unveiled the E-Waste (Management) Second Amendment Rules, 2023, marking a substantial stride in bolstering e-waste management nationwide. These new rules seek to amend the existing E-Waste (Management) Rules, 2022 (“Rules 2022”).

State Analysis

Haryana accounted for dominating share of 46.3% in 2024. The dominant position of Haryana in India’s e-waste management system market is illustrated by its substantial collection and processing volumes, and significant recycling capacity.

Previously, the state’s installed recycling capacity was reported at around 124,000 tonnes per annum, placing it in fourth position nationally behind only a few larger states. The combination of robust policy support — including the draft “Haryana Electronics Waste Recycling Policy” — and proximity to the National Capital Region (NCR) electronics manufacturing and consumption cluster enhances its strategic advantage for e-waste management infrastructure.

Additionally, Haryana’s strong authorization regime under the Haryana State Pollution Control Board shows a dense network of authorized recyclers and dismantlers across districts such as Gurugram, Faridabad and Sonipat. These factors combine to make Haryana a leading state in India’s e-waste management system market, capturing core collection-processing flows and hosting key formal recycling capacity.

Key India E-Waste Management System Company Insights

Key players in the Bearings market include Green IT Recycling Center Pvt Ltd, Ecowise Waste Management Pvt. Ltd., Attero Recycling, Cosmos Recycling, Binbag Recycling Services Pvt Ltd., E-Parisaraa Pvt Ltd, Eco Recycling Ltd (Ecoreco), Cerebra Integrated Technologies Ltd, RecycleKaro, Karo Sambhav, GreenZon Recycling Pvt Ltd, Namo E-Waste Management Ltd, Virogreen India Pvt Ltd, ReSustainability, Hulladek Recycling Pvt Ltd, and 3R Recycler Private Limited.

Green IT Recycling Center Pvt Ltd, based in Pune, the company offers end-of-life IT asset management including data destruction, reverse logistics, recycling and remarketing of hardware. It is registered with the Maharashtra Pollution Control Board and focuses on data security, value recovery and environmental disposal. Ecowise Waste Management Pvt Ltd is headquartered in Noida and incorporated in 2006, Ecowise delivers waste-management solutions across residential, commercial and industrial clients in the NCR region. It emphasises eco-friendly collection, segregation and disposal services compliant with regulations. Attero is a leading e-waste recycling firm in India, specialising in advanced recycling of electronics and lithium-ion batteries, extracting critical materials and scaling capacity to meet upcoming regulatory demands.

Top Key Players in the Market

- Green IT Recycling Center Pvt Ltd

- Ecowise Waste Management Pvt. Ltd.

- Attero Recycling

- Cosmos Recycling

- Binbag Recycling Services Pvt Ltd.

- E-Parisaraa Pvt Ltd

- Eco Recycling Ltd (Ecoreco)

- Cerebra Integrated Technologies Ltd

- RecycleKaro

- Karo Sambhav

- GreenZon Recycling Pvt Ltd

- Namo E-Waste Management Ltd

- Virogreen India Pvt Ltd

- ReSustainability

- Hulladek Recycling Pvt Ltd

- 3R Recycler Private Limited

- Other key players

Key Opinion Leaders

Name & Designation Opinion Arjun Mehta, Head of Operations at Green IT Recycling Center Pvt Ltd “In India’s e-waste ecosystem, formalising reverse logistics is expected to unlock value streams from discarded IT assets. We anticipate growth which is driven by regulatory clarity and corporate data-security priorities, positioning our company to capture mainstream volumes from the informal sector.” Priya Singh, Director of Client Services at Ecowise Waste Management Pvt Ltd “The transition of e-waste management towards circular-economy models is projected to accelerate in India as enterprises seek compliant solutions. Our nationwide service network gives us an edge to manage bulk collections and asset remarketing efficiently, enhancing both sustainability and brand reputation.” Nitin Gupta, Co-Founder of Attero Recycling Pvt Ltd “With India generating increasing volumes of electronic devices, we are expected to integrate advanced recovery technologies into our operations and expand capacity. This shift will enable us to recover critical minerals domestically, reduce reliance on imports and support the national strategy for raw-material security.” Recent Developments

- In July 2025, Eco Recycling Ltd announced further expansion with overall e-waste processing capacity now stands at 31,200 MTPA (including Li-ion battery recycling) with commissioning of a 40,000 sq ft plant at Vasai near Mumbai.

- In March 2024, RecycleKaro announced the launch of India’s first Plasma Furnace Technology unit for e-waste, targeting an increase in recycling capacity to 75,000 MT per annum, using advanced technology to extract precious/rare metals from e-waste and industrial residue.

- In December 2023, Attero Recycling Pvt Ltd entered into collaboration with Mahindra Last Mile Mobility Ltd to process e-waste and Li-ion battery waste at its Roorkee plant (Uttarakhand) with advanced recycling capability.

Report Scope

Report Features Description Market Value (2024) USD 4.4 Billion Forecast Revenue (2034) USD 15.29 Billion CAGR (2025-2034) 13.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Category (IT and Telecom Devices, Consumer Electrical and Electronics, and Solar Panels, Large and Small Electrical and Electronic Equipment, Electric and Electronic Tools (excluding Large Industrial Tools), Toys and Sports Gear, Medical Devices (excluding implanted and infected products), Laboratory Instruments), By Material (Metal (Non-precious Metal, Precious Metal), Plastic, Glass), By Application (Disposal (Incineration, Landfill, Reuse), Recycled), By Sector (Formal and Informal) Competitive Landscape Green IT Recycling Center Pvt Ltd, Ecowise Waste Management Pvt. Ltd., Attero Recycling, Cosmos Recycling, Binbag Recycling Services Pvt Ltd., E-Parisaraa Pvt Ltd, Eco Recycling Ltd (Ecoreco), Cerebra Integrated Technologies Ltd, RecycleKaro, Karo Sambhav, GreenZon Recycling Pvt Ltd, Namo E-Waste Management Ltd, Virogreen India Pvt Ltd, ReSustainability, Hulladek Recycling Pvt Ltd, and 3R Recycler Private Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  India E-Waste Management System MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

India E-Waste Management System MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Green IT Recycling Center Pvt Ltd

- Ecowise Waste Management Pvt. Ltd.

- Attero Recycling

- Cosmos Recycling

- Binbag Recycling Services Pvt Ltd.

- E-Parisaraa Pvt Ltd

- Eco Recycling Ltd (Ecoreco)

- Cerebra Integrated Technologies Ltd

- RecycleKaro

- Karo Sambhav

- GreenZon Recycling Pvt Ltd

- Namo E-Waste Management Ltd

- Virogreen India Pvt Ltd

- ReSustainability

- Hulladek Recycling Pvt Ltd

- 3R Recycler Private Limited

- Other key players