Global Incentive Tourism Market Size, Share, Growth Analysis By Incentive Type (Monetary Incentives, Experience-Based Incentives, Recognition-Based Incentives), By Business Size (Large Enterprises, SMEs, Startups), By Industry (Finance, Technology, Healthcare, Others), By End User (Corporate Institutions, Individuals, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jul 2025

- Report ID: 154336

- Number of Pages: 310

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

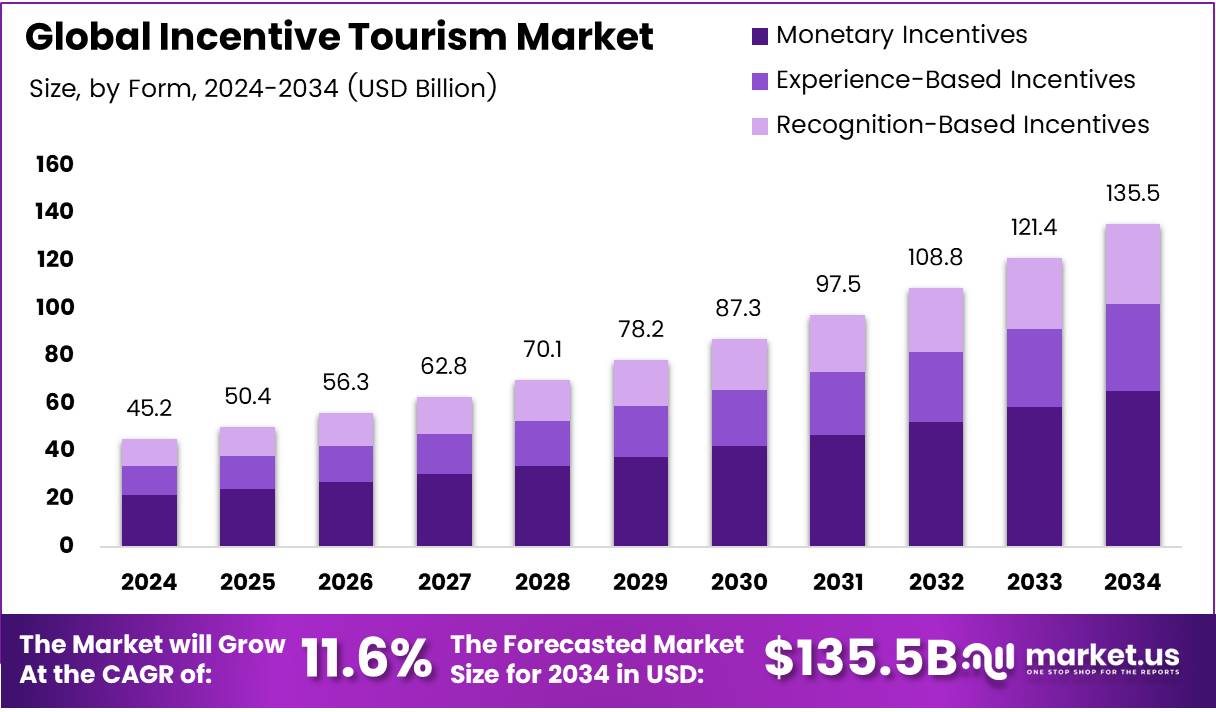

The Global Incentive Tourism Market size is expected to be worth around USD 135.5 Billion by 2034, from USD 45.2 Billion in 2024, growing at a CAGR of 11.6% during the forecast period from 2025 to 2034.

The Incentive Tourism Market refers to a travel segment focused on providing experiences or rewards for employees, partners, or clients to motivate and boost productivity. Organizations use incentive travel to recognize high performers, create loyalty, and foster relationships. These trips are often tailored to be luxurious, unique, and memorable.

Over the years, the growth of the Incentive Tourism Market has been notable. Companies are increasingly using incentive trips to engage employees and clients. This trend is driven by the growing need for businesses to enhance employee motivation and retention. As competition rises, companies are focusing more on this marketing tool to ensure a motivated workforce.

Moreover, the market is witnessing significant opportunities due to rising disposable incomes and changing consumer preferences. With the increasing desire for experiential travel, individuals and businesses alike are leaning toward offering rewarding travel experiences rather than just material incentives. This trend is helping expand the market’s reach and appeal, especially in developing regions.

Government investments and regulations also play a critical role in shaping the Incentive Tourism Market. Several countries are focusing on tourism infrastructure development and offering tax benefits for companies to invest in incentive travel programs. Governments are also promoting tourism as a strategic tool to enhance economic development through business trevel.

According to Access Development, 67% of high-income travelers prefer spending their vacation money on activities rather than upgrading to a more expensive hotel room. This shift towards experiential tourism opens new avenues for businesses to offer incentive travel that focuses on unique experiences rather than just accommodations.

Furthermore, a study by theirf in 2023 found that 84% of respondents indicated that individual incentive travel awards are ‘very’ or ‘extremely’ motivating. Similarly, 80% of respondents felt the same about group incentive travel awards. These statistics emphasize the strong demand for customized travel experiences that foster motivation and satisfaction among employees and clients.

Key Takeaways

- The Global Incentive Tourism Market is projected to reach USD 135.5 Billion by 2034, growing at a CAGR of 11.6% from 2025 to 2034.

- Monetary Incentives dominate the Incentive Type segment with a 48.3% market share in 2024.

- Large Enterprises hold the largest share in the Business Size segment, with 56.9% in 2024.

- The Finance sector leads the Industry segment, accounting for 34.8% of the market share in 2024.

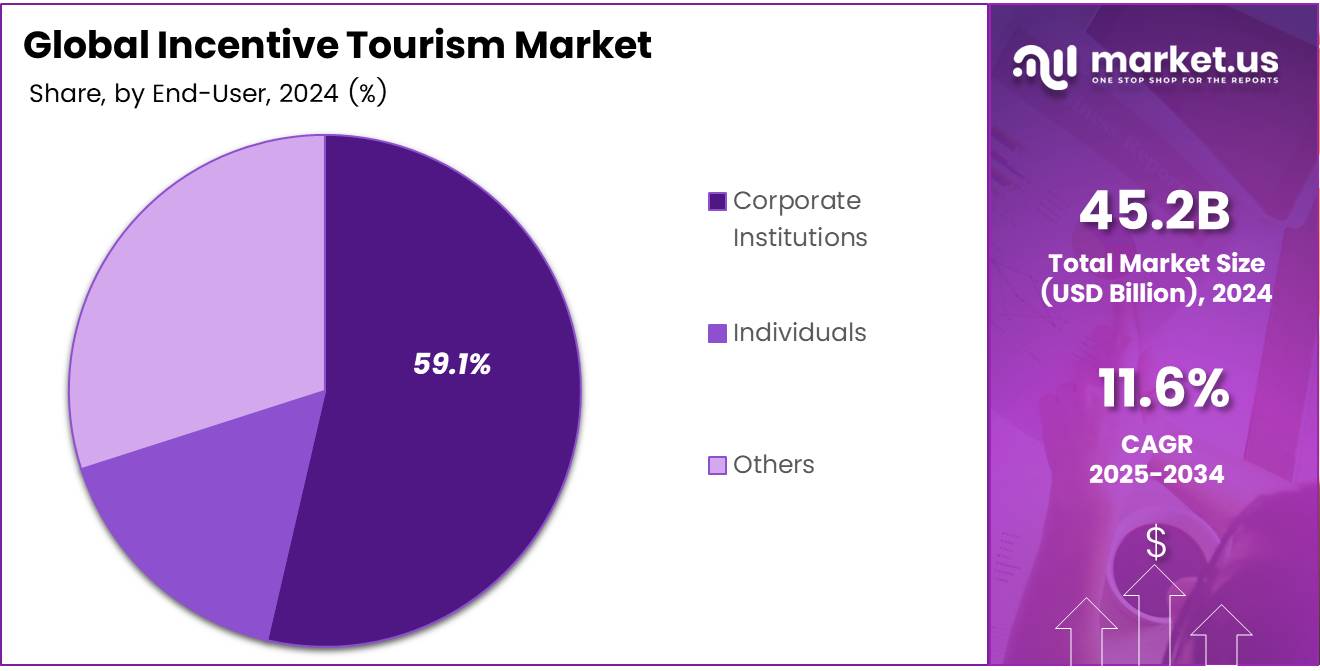

- Corporate Institutions hold the largest share in the End User segment, with 59.1% in 2024.

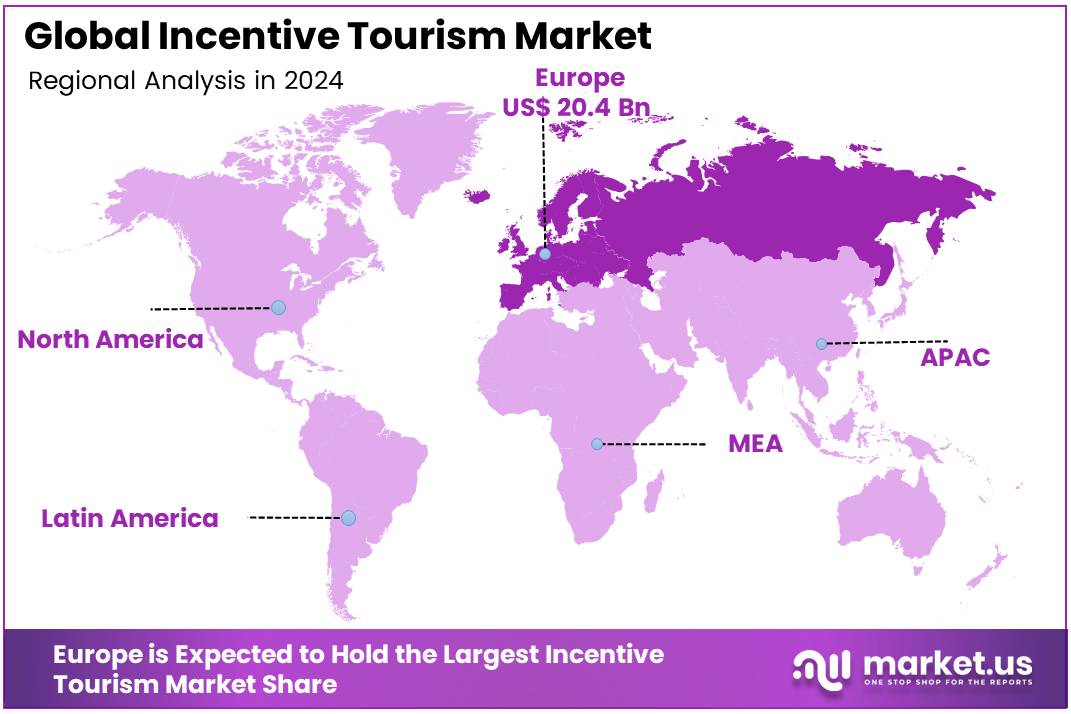

- Europe is the dominant region, capturing 45.2% of the market share, valued at USD 20.4 Billion in 2024.

Incentive Type Analysis

Monetary Incentives dominate with a 48.3% share due to their direct impact and widespread adoption in incentive tourism.

In 2024, Monetary Incentives held a dominant market position in the Incentive Type Analysis segment of the Incentive Tourism Market, capturing a strong 48.3% share. This type of incentive is preferred for its tangible value, often linked to performance or milestones, making it a key driver in motivating employees and rewarding top performers.

Experience-Based Incentives follow, with increasing adoption in the market. These incentives often include travel experiences, luxury vacations, or curated events that appeal to employees seeking unique and personalized rewards. Though still a significant segment, Experience-Based Incentives hold a smaller share compared to Monetary Incentives.

Recognition-Based Incentives, while effective, are less prevalent in comparison. These rewards focus on acknowledgment of achievement rather than material benefits. Despite their importance in fostering company culture, they account for a smaller portion of the market share.

Business Size Analysis

Large Enterprises dominate with a 56.9% share, driving the demand for incentive tourism due to their extensive budgets and employee base.

In 2024, Large Enterprises held a dominant market position in the Business Size Analysis segment of the Incentive Tourism Market, capturing a substantial 56.9% share. These organizations leverage incentive tourism to motivate large employee bases, enhance productivity, and foster loyalty, given their considerable financial resources.

Small and Medium Enterprises (SMEs) have also been active participants, but their market share remains smaller, as their incentive budgets tend to be more limited. Despite this, SMEs continue to implement incentive tourism programs as part of their employee engagement strategies.

Startups, with their rapidly growing teams, are still exploring incentive tourism as a strategy but make up a much smaller portion of the market, focusing primarily on cost-effective solutions.

Industry Analysis

Finance dominates with a 34.8% share, leading the demand for incentive tourism due to high employee turnover and competitive recruitment practices.

In 2024, the Finance sector held a dominant market position in the Industry Analysis segment of the Incentive Tourism Market, securing a 34.8% share. The financial services industry is highly competitive, with companies utilizing incentive tourism as a way to attract and retain top talent. Given the industry’s focus on performance-driven outcomes, this sector has been a significant contributor to market growth.

Technology follows closely, with companies offering innovative travel incentives to motivate employees and encourage creativity. Healthcare, with its essential yet demanding workforce, also utilizes incentive tourism but to a lesser extent compared to finance and technology. Other industries also participate in incentive tourism, though their contributions to the market are more varied and less dominant than the key players in finance and technology.

End User Analysis

Corporate Institutions dominate with a 59.1% share, utilizing incentive tourism to enhance employee engagement and reward top performers.

In 2024, Corporate Institutions held a dominant market position in the End User Analysis segment of the Incentive Tourism Market, capturing a commanding 59.1% share. These organizations prioritize employee recognition and motivation, using incentive tourism as a powerful tool to retain key talent and boost morale. Corporate institutions often have the resources and structure to implement large-scale incentive programs, making them the largest segment in the market.

Individuals are a growing segment as well, with many seeking personal incentive travel rewards. However, they represent a smaller portion of the market as corporate incentives continue to dominate. Other end users also contribute to the market but account for a limited share compared to corporate institutions.

Key Market Segments

By Incentive Type

- Monetary Incentives

- Experience-Based Incentives

- Recognition-Based Incentives

By Business Size

- Large Enterprises

- SMEs

- Startups

By Industry

- Finance

- Technology

- Healthcare

- Others

By End User

- Corporate Institutions

- Individuals

- Others

Drivers

Rise in Experiential Travel Preferences Drives Incentive Tourism Market Growth

The growing demand for experiential travel is significantly boosting the incentive tourism market. Companies are increasingly offering unique, immersive experiences such as cultural tours, adventure activities, and local engagements. This shift reflects travelers’ desire for memorable experiences over traditional sightseeing, which aligns well with incentive programs aimed at rewarding and motivating employees.

Globalization and the rise of cross-border incentives are further enhancing market growth. As businesses expand internationally, companies are increasingly providing incentive programs that span multiple countries.

These programs often include global travel packages, creating a seamless experience for recipients across borders. This trend is facilitated by improved international connectivity and streamlined travel logistics, making it easier for firms to offer these incentives.

Government support for tourism and business events plays a crucial role in the expansion of incentive tourism. Many governments actively promote tourism through policies, tax benefits, and event funding, attracting more incentive programs. These initiatives boost both local economies and the incentive tourism sector by encouraging international visitors, thereby creating additional business opportunities for travel agencies and event planners.

Restraints

Economic Uncertainty Affects Corporate Budgets and Restrains Incentive Tourism Market

Economic uncertainty has a significant impact on corporate budgets, resulting in companies cutting back on non-essential expenses, including incentive programs. The financial strain often leads businesses to prioritize cost-effective solutions, reducing the overall expenditure on incentive travel. This restraint slows down market growth as businesses become more cautious in their spending.

Rising travel costs and inflation further exacerbate challenges for the incentive tourism market. Increasing airfare, hotel rates, and service fees make incentive travel programs more expensive to organize. As a result, businesses face higher operational costs, which could lead to reduced participation in incentive travel programs. These factors hinder the overall growth of the sector, especially for companies operating in budget-conscious regions.

Growth Factors

Expansion of Wellness and Eco-Friendly Incentive Programs Drives Market Growth

The expansion of wellness and eco-friendly incentive programs offers significant growth opportunities in the incentive tourism market. With increasing health awareness, many companies are opting for wellness retreats and eco-conscious travel options to reward employees. These types of programs resonate well with the growing demand for sustainability and a focus on mental well-being, appealing to both recipients and companies alike.

Growth in virtual and hybrid incentive travel options is another promising opportunity. The pandemic accelerated the adoption of virtual platforms, and now many companies are incorporating hybrid formats for their incentive programs. This flexibility allows organizations to cater to remote or international employees, making incentive programs more inclusive and adaptable to diverse working environments.

Domestic incentive tourism is also gaining traction as businesses look for more cost-effective solutions. By focusing on local destinations, companies can significantly reduce travel expenses while still offering employees a high-quality experience. This growth opportunity is enhanced by the rise of domestic tourism in many regions, where companies are discovering untapped, affordable incentive options within their own countries.

Emerging Trends

Integration of Sustainability in Incentive Packages Drives Market Trends

Sustainability is becoming a key focus in incentive tourism, with companies increasingly integrating eco-friendly practices into their incentive packages. This shift reflects the growing importance of corporate social responsibility (CSR) and the desire to reduce the environmental impact of travel. As businesses strive to meet sustainability goals, incentive programs are evolving to incorporate green travel options, eco-friendly accommodations, and responsible tourism.

The emphasis on wellness and health-oriented travel is another major trend in the incentive tourism market. As employees place greater value on their mental and physical well-being, companies are responding by offering incentive packages that focus on health and relaxation. This includes wellness retreats, yoga sessions, spa treatments, and other health-focused activities, which are becoming popular choices for incentive programs.

The popularity of adventure and experiential incentives is on the rise as businesses seek to offer unique and exciting experiences. Whether it’s skydiving, mountain trekking, or cultural immersions, employees are increasingly being rewarded with adventure-based experiences. These incentives not only motivate employees but also align with their growing desire for meaningful and extraordinary travel experiences, enhancing the appeal of incentive tourism packages.

Regional Analysis

Europe Dominates the Incentive Tourism Market with a Market Share of 45.2%, Valued at USD 20.4 Billion

Europe holds the leading position in the incentive tourism market, accounting for 45.2% of the market share, valued at USD 20.4 Billion. The region benefits from its established tourism infrastructure, rich cultural heritage, and government-backed support for business events. This dominance is also driven by the rising demand for experiential travel and the growing preference for cross-border incentives.

North America Incentive Tourism Market Trends

North America follows closely with a strong presence in the incentive tourism market. The region’s emphasis on corporate incentive programs, coupled with its diverse and well-connected destinations, has led to significant growth in the market. With an expanding range of virtual and hybrid incentive offerings, the region is expected to maintain a strong trajectory in the coming years.

Asia Pacific Incentive Tourism Market Outlook

Asia Pacific is a rapidly growing market for incentive tourism, supported by the region’s increasing globalization and strong economic growth. This growth is propelled by a rising number of international business events, coupled with expanding government initiatives to enhance tourism and business travel. Countries like Japan, China, and India are expected to see significant investment in the sector.

Middle East and Africa Incentive Tourism Market Overview

The Middle East and Africa region is witnessing a gradual rise in incentive tourism, driven by high-end luxury offerings and significant investments in tourism infrastructure. Countries like the UAE and Saudi Arabia are becoming key destinations for incentive tourism, with a focus on innovative and experiential travel options. However, challenges like economic fluctuations and geopolitical instability affect the market’s growth.

Latin America Incentive Tourism Market Growth

Latin America is expected to experience steady growth in the incentive tourism market, with countries such as Brazil, Mexico, and Argentina becoming increasingly attractive for corporate incentive travel. The market is driven by the region’s diverse landscapes, vibrant cultures, and improving business environments. However, economic volatility and political factors continue to impact the sector’s overall growth potential.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Incentive Tourism Company Insights

In 2024, the global Incentive Tourism market sees strong contributions from several industry leaders, each bringing unique strengths to the market.

American Express Global Business Travel continues to lead the industry with its extensive global presence and innovative travel solutions, focusing on delivering customized incentive travel programs. The company’s ability to integrate technology with travel management solutions ensures it stays ahead of the competition.

BCD Travel is known for its data-driven approach to corporate travel management, which is a crucial factor in shaping the incentive tourism market. Their robust network of global partners and comprehensive offerings make them a preferred choice for large corporations seeking effective incentive programs.

Carlson Wagonlit Travel (CWT) has maintained a strong reputation for providing seamless travel management and event planning services. Their expertise in handling complex incentive travel logistics allows them to cater to diverse client needs, further boosting their market share in the incentive tourism sector.

FCM Travel Solutions stands out for its innovative use of technology to optimize travel management processes. Their focus on providing personalized travel experiences, backed by strong global resources, positions them as a key player in the competitive incentive tourism landscape.

These four companies, among others, are shaping the growth trajectory of the incentive tourism market by focusing on technological innovation, global connectivity, and personalized services to meet the evolving needs of corporate clients.

Top Key Players in the Market

- American Express Global Business Travel

- BCD Travel

- Carlson Wagonlit Travel (CWT)

- FCM Travel Solutions

- Maritz Travel Company

- Conference Direct

- Incentive Concepts

- Ovation Travel Group

- Reed Exhibitions

- HelmsBriscoe

- Travel Leaders Group

- TUI Group

- JTB Corporation

Recent Developments

- In July 2025, Bishop-McCann targets a ‘huge opportunity’ with the acquisition of a Kansas City-based company, enhancing its service offerings and expanding its presence in the event planning market.

- In July 2025, Gattinoni acquired a majority stake in H&A, a strategic move aimed at strengthening its position in the Italian events and incentive travel industry, solidifying its growth trajectory.

- In July 2025, Spring Hotels completed its acquisition of Mare Nostrum Resort for €430 million, marking Spain’s largest-ever hotel deal and expanding the company’s hospitality portfolio.

Report Scope

Report Features Description Market Value (2024) USD 45.2 Billion Forecast Revenue (2034) USD 135.5 Billion CAGR (2025-2034) 11.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Incentive Type (Monetary Incentives, Experience-Based Incentives, Recognition-Based Incentives), By Business Size (Large Enterprises, SMEs, Startups), By Industry (Finance, Technology, Healthcare, Others), By End User (Corporate Institutions, Individuals, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape American Express Global Business Travel, BCD Travel, Carlson Wagonlit Travel (CWT), FCM Travel Solutions, Maritz Travel Company, Conference Direct, Incentive Concepts, Ovation Travel Group, Reed Exhibitions, HelmsBriscoe, Travel Leaders Group, TUI Group, JTB Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-