Global Immersion Cooling Market By Cooling Fluid Type (Single-phase Immersion Cooling (Mineral Oil, Synthetic Fluids, Others), Two-phase Immersion Cooling (Fluorocarbon-based Fluids, Others)), By Component (Solutions (Immersion Cooling Tanks, Cooling Fluids, Others), Services (Installation and Deployment, Maintenance and Support, Others)), By Application (High-performance Computing, Artificial Intelligence and Machine Learning, Others), By End-User Industry (IT and Telecommunications, Banking, Others), By Data Center Type (Hyperscale Data Centers, Colocation Data Centers, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 174198

- Number of Pages: 312

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Drivers Impact Analysis

- Risk Impact Analysis

- Restraint Impact Analysis

- By Cooling Fluid Type

- By Component

- By Application

- End-User Industry Analysis

- Data Center Type Analysis

- Key Reasons for Adoption

- Benefits

- Usage

- Emerging Trends

- Growth Factors

- Key Market Segments

- Regional Analysis

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Driver analysis

- Restraint analysis

- Opportunity analysis

- Challenge analysis

- Competitive Analysis

- Future Outlook

- Recent Developments

- Report Scope

Report Overview

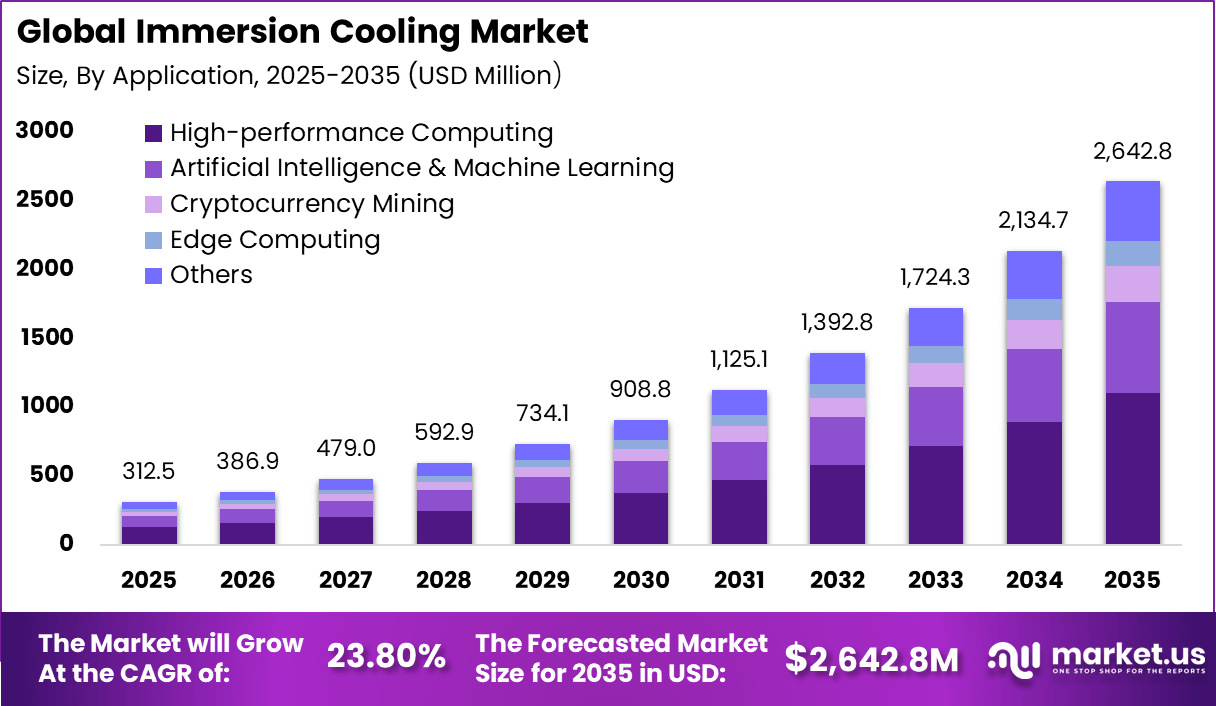

The Global Immersion Cooling Market generated USD 312.5 million in 2025 and is predicted to register growth from USD 386.9 million in 2026 to about USD 180.24 million by 2035, recording a CAGR of 23.80% throughout the forecast span. In 2025, North America held a dominan market position, capturing more than a 42.5% share, holding USD 132.81 Million revenue.

The immersion cooling market refers to cooling solutions where electronic components are submerged directly into thermally conductive, non-conductive liquids. This method removes heat more efficiently than traditional air or liquid cooling systems. Immersion cooling is mainly used in data centers, high performance computing environments, cryptocurrency mining, and advanced electronics. Adoption focuses on improving thermal management and system reliability.

One major driving factor of the immersion cooling market is rising energy consumption in data centers. High density servers generate significant heat that requires efficient cooling. Immersion cooling reduces cooling energy requirements by transferring heat directly to fluids. This efficiency supports adoption. Another key driver is the demand for compact and high performance computing infrastructure. Organizations seek to maximize computing power within limited physical space.

Demand for immersion cooling solutions is influenced by growth in data intensive workloads. Applications such as artificial intelligence, simulation, and analytics require dense computing environments. These workloads place pressure on traditional cooling systems. Immersion cooling meets this demand by supporting sustained high performance. It also shaped by sustainability and operational cost concerns. Energy efficiency and reduced water usage are priorities for operators.

Immersion cooling improves operational efficiency by lowering cooling power consumption. Reduced energy use lowers operating costs. Improved heat management extends hardware lifespan. These benefits improve return on investment. These systems also support higher computing performance and uptime. Stable thermal conditions reduce system throttling and failures. Reliable operation supports continuous workloads. Performance stability strengthens business outcomes.

Top Market Takeaways

- By cooling fluid type, single-phase immersion cooling dominated with 58.3% share, favored for its simplicity, lower costs, and compatibility with existing data center setups.

- By component, solutions led at 71.5%, encompassing integrated systems for efficient heat management in high-density environments.

- By application, high-performance computing captured 41.7%, driven by AI and HPC workloads generating extreme heat beyond air cooling limits.

- By end-user industry, IT and telecommunications held 52.6%, adopting immersion to enhance energy efficiency and support cloud infrastructure.

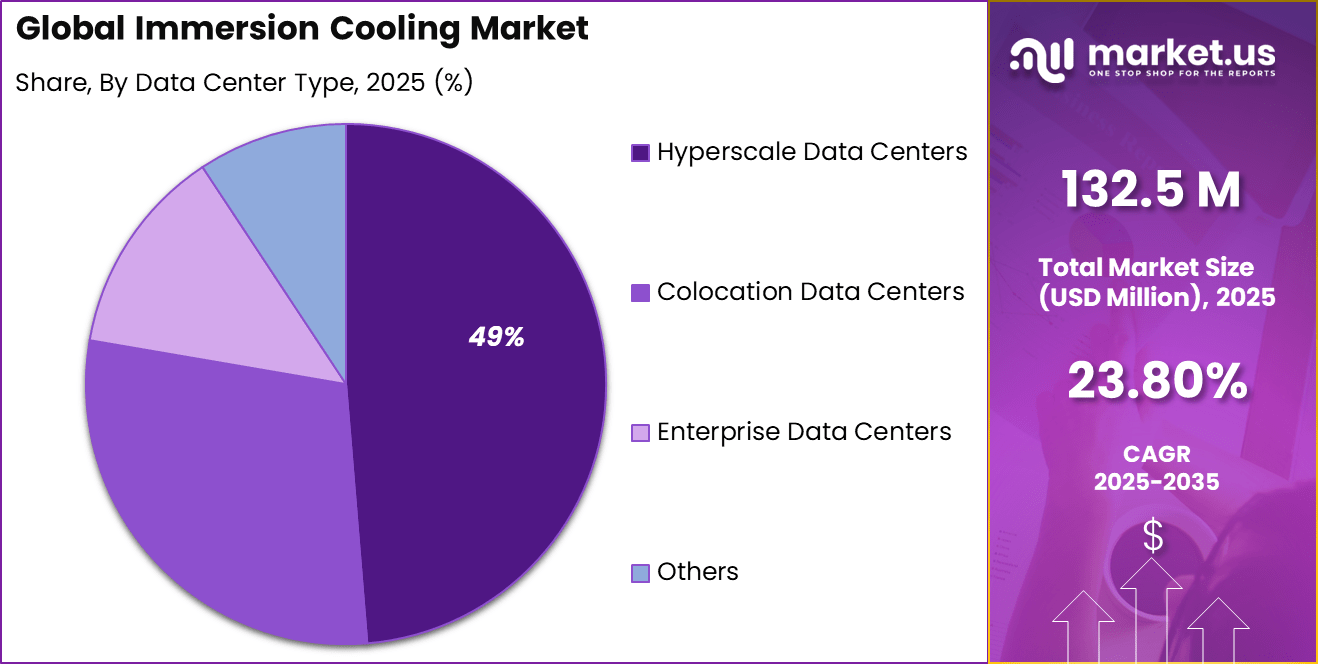

- By data center type, hyperscale data centers accounted for 48.7%, benefiting from scalable cooling for massive AI and cloud deployments.

Drivers Impact Analysis

Driver Category Key Driver Description Estimated Impact on CAGR (%) Geographic Relevance Impact Timeline Rising data center power density Increased heat from AI and HPC workloads ~6.2% North America, Europe Short Term Expansion of hyperscale data centers Need for efficient thermal management ~5.4% North America, Asia Pacific Short Term Energy efficiency regulations Focus on reducing cooling energy usage ~4.6% Europe, North America Mid Term Growth of high performance computing Thermal constraints in dense servers ~4.1% Global Mid Term Sustainability initiatives Lower carbon footprint of data centers ~3.5% Global Long Term Risk Impact Analysis

Risk Category Risk Description Estimated Negative Impact on CAGR (%) Geographic Exposure Risk Timeline High initial deployment cost Capital intensive cooling infrastructure ~5.1% Emerging Markets Short Term Limited industry familiarity Conservative adoption by operators ~4.3% Global Short Term Fluid compatibility concerns Hardware and material risks ~3.6% Global Mid Term Maintenance complexity Specialized operational skills required ~2.9% Global Mid Term Supply chain dependency Availability of dielectric fluids ~2.2% Global Long Term Restraint Impact Analysis

Restraint Factor Restraint Description Impact on Market Expansion (%) Most Affected Regions Duration of Impact High upfront investment Budget constraints for mid scale data centers ~5.6% Emerging Markets Short to Mid Term Retrofit challenges Difficulty upgrading legacy facilities ~4.2% Global Mid Term Vendor ecosystem limitations Limited standardized components ~3.4% Global Mid Term Training requirements Need for specialized cooling expertise ~2.7% Global Long Term Perceived operational risk Resistance to non traditional cooling ~2.1% Global Long Term By Cooling Fluid Type

Single-phase immersion cooling accounts for 58.3%, making it the most widely adopted fluid type. This method submerges hardware in a dielectric liquid that does not boil. It offers simpler system design and easier maintenance. Consistent thermal performance supports stable operations. Reliability remains a key advantage.

The dominance of single-phase cooling is driven by operational simplicity. Data center operators prefer predictable cooling behavior. Lower maintenance requirements reduce downtime. Compatibility with existing infrastructure improves adoption. This sustains strong preference for single-phase systems.

By Component

Solutions represent 71.5%, highlighting the importance of integrated cooling systems. These solutions include tanks, fluids, and control mechanisms. Integrated designs simplify deployment and operation. Turnkey systems reduce engineering complexity. Performance optimization is a core benefit.

Adoption of solution-based components is driven by end-to-end efficiency needs. Operators prefer complete systems over individual parts. Integrated solutions improve thermal management consistency. Vendor support simplifies maintenance. This keeps solution offerings dominant.

By Application

High-performance computing accounts for 41.7%, making it the leading application. HPC workloads generate high heat density. Immersion cooling efficiently manages extreme thermal loads. Stable temperatures improve compute reliability. Performance consistency is critical for HPC environments.

Growth in this application is driven by advanced computing demands. Research and analytics workloads continue to expand. Immersion cooling supports dense hardware configurations. Energy efficiency improves operational outcomes. This sustains strong HPC adoption.

End-User Industry Analysis

IT and telecommunications represent 52.6%, making them the largest end-user industry. These sectors operate large-scale data infrastructure. High availability and uptime are essential. Immersion cooling supports continuous operations. Thermal efficiency reduces operational stress.

Adoption in IT and telecom is driven by data traffic growth. Network services require reliable computing environments. Cooling efficiency supports service stability. Infrastructure expansion increases demand. This sustains strong industry adoption.

Data Center Type Analysis

Hyperscale data centers account for 48.7%, reflecting their growing use of immersion cooling. These facilities host dense computing resources. Efficient cooling is essential for scale operations. Immersion cooling supports high rack density. Space optimization remains important.

The dominance of hyperscale centers is driven by cloud expansion. Operators seek energy-efficient cooling methods. Immersion cooling reduces cooling footprint. Scalability supports long-term growth. This keeps hyperscale facilities as key adopters.

Key Reasons for Adoption

- Data center heat density is increasing due to high-performance computing workloads

- Energy efficiency requirements are becoming stricter across digital infrastructure

- Traditional air cooling methods are reaching technical and space limitations

- Sustainability goals are driving demand for lower power and water usage

- Reliable cooling is required to support continuous system performance

Benefits

- Thermal management efficiency is improved through direct heat removal

- Energy consumption is reduced compared to conventional cooling approaches

- Hardware lifespan is extended by maintaining stable operating temperatures

- Space utilization is optimized by reducing the need for large cooling systems

- Operational stability is strengthened for critical computing environments

Usage

- Used in data centers supporting high-density server deployments

- Applied in high-performance computing and artificial intelligence workloads

- Deployed in cryptocurrency mining facilities to manage continuous heat output

- Utilized in edge data centers with limited space and cooling capacity

- Integrated into enterprise infrastructure to support energy-efficient operations

Emerging Trends

Key Trend Description Single-phase immersion dominance Simpler dielectric fluid systems gain traction for ease of maintenance. Hybrid air-liquid solutions Combined approaches optimize retrofits in existing data centers. AI-optimized cooling management Intelligent controls dynamically adjust fluid flow and temperatures. Sustainable bio-based fluids Eco-friendly coolants reduce environmental impact. Modular rack-level deployments Scalable units suit edge and hyperscale facilities. Growth Factors

Key Factors Description AI and HPC workload explosion High-density racks exceed air cooling limits. Sustainability mandates Lower PUE meets carbon reduction goals. Data center expansion boom Hyperscalers build efficient new facilities. Energy cost pressures Reduces cooling electricity by up to 50%. Edge computing rise Compact solutions for distributed deployments. Key Market Segments

By Cooling Fluid Type

- Single-phase Immersion Cooling

- Mineral Oil

- Synthetic Fluids

- Others

- Two-phase Immersion Cooling

- Fluorocarbon-based Fluids

- Others

By Component

- Solutions

- Immersion Cooling Tanks

- Cooling Fluids

- Monitoring & Control Systems

- Others

- Services

- Installation & Deployment

- Maintenance & Support

- Others

By Application

- High-performance Computing

- Artificial Intelligence & Machine Learning

- Cryptocurrency Mining

- Edge Computing

- Others

By End-User Industry

- IT & Telecommunications

- Banking, Financial Services, and Insurance

- Energy & Utilities

- Government & Defense

- Healthcare & Life Sciences

- Others

By Data Center Type

- Hyperscale Data Centers

- Colocation Data Centers

- Enterprise Data Centers

- Others

Regional Analysis

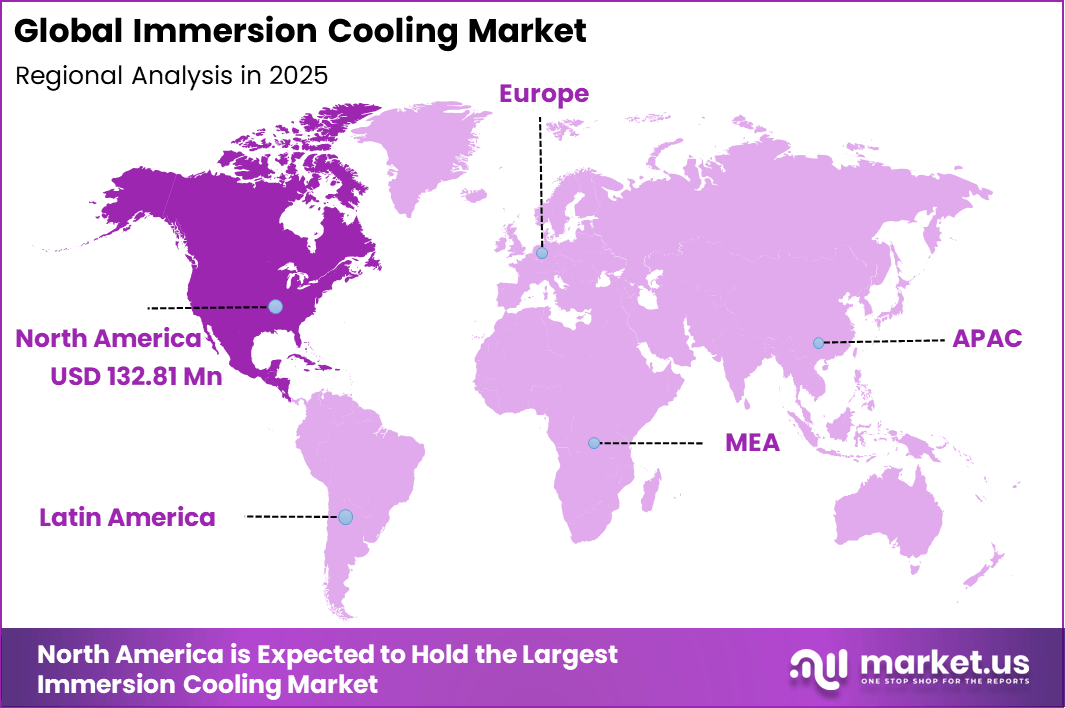

North America accounted for 42.5% share, supported by rising demand for high density computing across data centers, cloud service providers, and advanced computing facilities. Immersion cooling has been adopted to address increasing heat loads generated by high performance servers, AI workloads, and cryptocurrency mining operations.

Demand has been driven by the need to improve energy efficiency, reduce cooling costs, and support higher rack densities within limited data center space. The region’s strong focus on sustainability and power usage effectiveness has further supported adoption.

Region Primary Growth Driver Regional Share (%) Regional Value (USD Mn) Adoption Maturity North America AI driven hyperscale expansion 42.5% USD 132.8 Mn Advanced Europe Energy efficiency mandates 26.9% USD 84.1 Mn Advanced Asia Pacific Rapid data center construction 22.8% USD 71.3 Mn Developing to Advanced Latin America Colocation data center growth 4.6% USD 14.4 Mn Developing Middle East and Africa Early hyperscale investments 3.2% USD 10.0 Mn Early

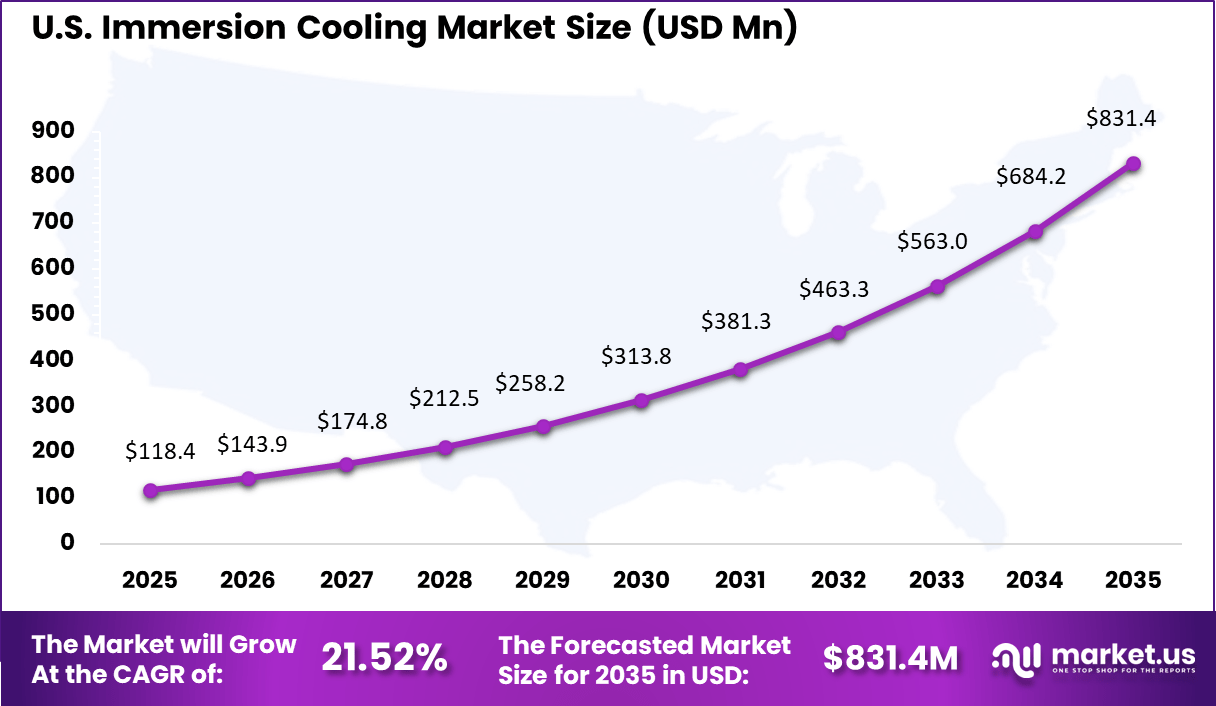

The U.S. market reached USD 118.4 Mn and is projected to grow at a 21.52% CAGR, reflecting rapid adoption in data intensive industries. Technology companies, research institutions, and digital service providers have increasingly deployed immersion cooling to manage heat from AI training, machine learning, and simulation workloads. These systems have helped reduce energy consumption and extend hardware lifespan under continuous high load conditions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Investor Type Impact Matrix

Investor Type Adoption Level Contribution to Market Growth (%) Key Motivation Investment Behavior Hyperscale operators Very High ~48.7% Power efficiency and scalability Large scale deployment IT and telecom firms High ~52.6% Network and compute optimization Phased rollout Cloud service providers High ~21% AI workload support Capital intensive Colocation operators Moderate ~15% Differentiated cooling offerings Selective adoption Enterprise data centers Low to Moderate ~11% Targeted HPC clusters Pilot deployments Technology Enablement Analysis

Technology Layer Enablement Role Impact on Market Growth (%) Adoption Status Single phase immersion systems Direct heat transfer efficiency ~6.0% Growing Dielectric cooling fluids Safe electronics immersion ~5.1% Growing Modular cooling tanks Scalable deployment ~4.3% Developing Thermal monitoring software Real time temperature control ~3.2% Developing Integration with data center design Optimized facility layouts ~2.5% Early Driver analysis

The main driver for the immersion cooling market is the steady rise in server heat levels, especially in AI training, cloud platforms, and high performance computing. Traditional air cooling struggles to manage dense racks without high energy use and space expansion. Immersion cooling allows heat to be removed directly from components, which improves thermal control in compact environments.

Data center operators are under pressure to improve energy efficiency and reduce cooling overhead. Immersion systems support lower cooling power use and stable performance under continuous heavy workloads. This makes the technology attractive for operators planning long term capacity growth.

Restraint analysis

A major restraint is the higher upfront cost compared with standard air cooling systems. Immersion cooling requires special tanks, dielectric fluids, and facility level changes, which can slow decision making. Smaller operators often delay adoption due to uncertainty around return on investment.

Design complexity also remains a concern, especially in existing data centers not built for liquid systems. Changes to layouts, safety procedures, and maintenance routines can disrupt operations. These factors limit faster adoption across traditional enterprise data centers.

Opportunity analysis

A strong opportunity exists in retrofitting existing data centers that need to support higher power servers without building new sites. Immersion cooling enables capacity upgrades within the same footprint, helping operators extend asset life. This is especially relevant in regions where land and power availability are limited.

Sustainability targets are also opening new growth paths for immersion cooling. Lower cooling energy use supports carbon reduction goals and improves overall facility efficiency. Operators looking to meet environmental commitments are increasingly evaluating liquid based cooling options.

Challenge analysis

One of the key challenges is operational readiness, as immersion cooling changes how servers are installed and serviced. Staff training, fluid handling, and equipment procedures differ from air cooled systems. This can create hesitation among operators focused on uptime and service consistency.

Another challenge is the lack of full industry standardization across hardware and cooling designs. Compatibility between servers, fluids, and tanks still requires careful validation. Until broader standards are established, large scale deployment decisions may continue to progress cautiously.

Competitive Analysis

Green Revolution Cooling Inc., Submer Technologies SL, LiquidStack B.V., and Asperitas BV lead the immersion cooling market with single phase and two phase liquid cooling solutions for high density data centers. Their technologies are widely adopted for AI, HPC, and hyperscale environments to manage extreme heat loads. These companies focus on energy efficiency, reduced water usage, and improved server performance.

Midas Green Technologies LLC, Allied Control Ltd., Iceotope Technologies Limited, and Fujitsu Limited strengthen the market with modular immersion systems and integrated cooling architectures. Their offerings support edge data centers, enterprise deployments, and retrofit projects. These providers emphasize reliability, ease of integration, and lower total cost of ownership.

Schneider Electric SE, Vertiv Holdings Co., Rittal GmbH & Co. KG, STULZ GmbH, and Alfa Laval AB expand the landscape by integrating immersion cooling into broader data center infrastructure and thermal management portfolios. Their solutions combine cooling distribution, heat exchangers, and monitoring systems. These companies focus on scalability and global service support.

Top Key Players in the Market

- Green Revolution Cooling Inc.

- Submer Technologies SL

- LiquidStack B.V.

- Asperitas BV

- Midas Green Technologies LLC

- Allied Control Ltd.

- ExaScaler Inc.

- DCX – The Liquid Cooling Company

- Iceotope Technologies Limited

- Fujitsu Limited

- Schneider Electric SE

- Vertiv Holdings Co.

- Rittal GmbH & Co. KG

- STULZ GmbH

- Alfa Laval AB

- Others

Future Outlook

Growth in the Immersion Cooling market is expected to increase as data centers manage higher computing density and rising energy costs. Immersion cooling is being adopted to handle heat generated by high performance servers, AI workloads, and edge data centers.

This approach improves thermal efficiency and reduces reliance on traditional air cooling systems. Over time, better fluid formulations, standardization, and compatibility with existing infrastructure are likely to support wider deployment.

Recent Developments

- In May 2025, Graphcore raised USD 200 million in a Series E funding round, with a large portion allocated to expanding its immersion cooling infrastructure to support energy efficient AI computing.

- In August 2025, Microsoft Azure deployed its first large scale immersion cooled data center in Quincy, Washington. This initiative aims to lower water use and energy consumption, strengthening sustainability across Microsoft’s cloud infrastructure.

- In January 2024, NVIDIA launched its H100 data center GPU with support for immersion cooling technology, enabling efficient cooling of high performance computing systems without traditional air cooling. This innovation helps reduce energy consumption and data center space requirements.

- In March 2024, Intel announced a strategic partnership with Cooling Data to develop and deploy immersion cooling solutions for upcoming data centers. The collaboration focuses on improving energy efficiency while significantly reducing water usage.

Report Scope

Report Features Description Market Value (2025) USD 312.5 Mn Forecast Revenue (2035) USD 2,642.8 Mn CAGR(2025-2035) 23.80% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Cooling Fluid Type (Single-phase Immersion Cooling (Mineral Oil,Synthetic Fluids,Others),Two-phase Immersion Cooling (Fluorocarbon-based Fluids,Others)), By Component (Solutions (Immersion Cooling Tanks,Cooling Fluids,Others), Services(Installation and Deployment,Maintenance and Support,Others)), By Application (High-performance Computing,Artificial Intelligence and Machine Learning,Others), By End-User Industry (IT and Telecommunications,Banking,Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Green Revolution Cooling Inc., Submer Technologies SL, LiquidStack B.V., Asperitas BV, Midas Green Technologies LLC, ExaScaler Inc., DCX – The Liquid Cooling Company, Iceotope Technologies Limited, Fujitsu Limited, Schneider Electric SE, Vertiv Holdings Co., Rittal GmbH & Co. KG, STULZ GmbH, Alfa Laval AB, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Green Revolution Cooling Inc.

- Submer Technologies SL

- LiquidStack B.V.

- Asperitas BV

- Midas Green Technologies LLC

- Allied Control Ltd.

- ExaScaler Inc.

- DCX - The Liquid Cooling Company

- Iceotope Technologies Limited

- Fujitsu Limited

- Schneider Electric SE

- Vertiv Holdings Co.

- Rittal GmbH & Co. KG

- STULZ GmbH

- Alfa Laval AB

- Others