Global iGaming Platform Market Size, Share, Industry Analysis Report Analysis By Platform Type (Casino Platform Providers (B2B), Sports Betting Platform Providers, Player Account Management (PAM) Systems, Game Aggregators & Content Providers, Others), By Game Type (Online Casino, Sports Betting, Poker, Others), By Deployment (Cloud-based, On-Premise), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 164372

- Number of Pages: 316

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

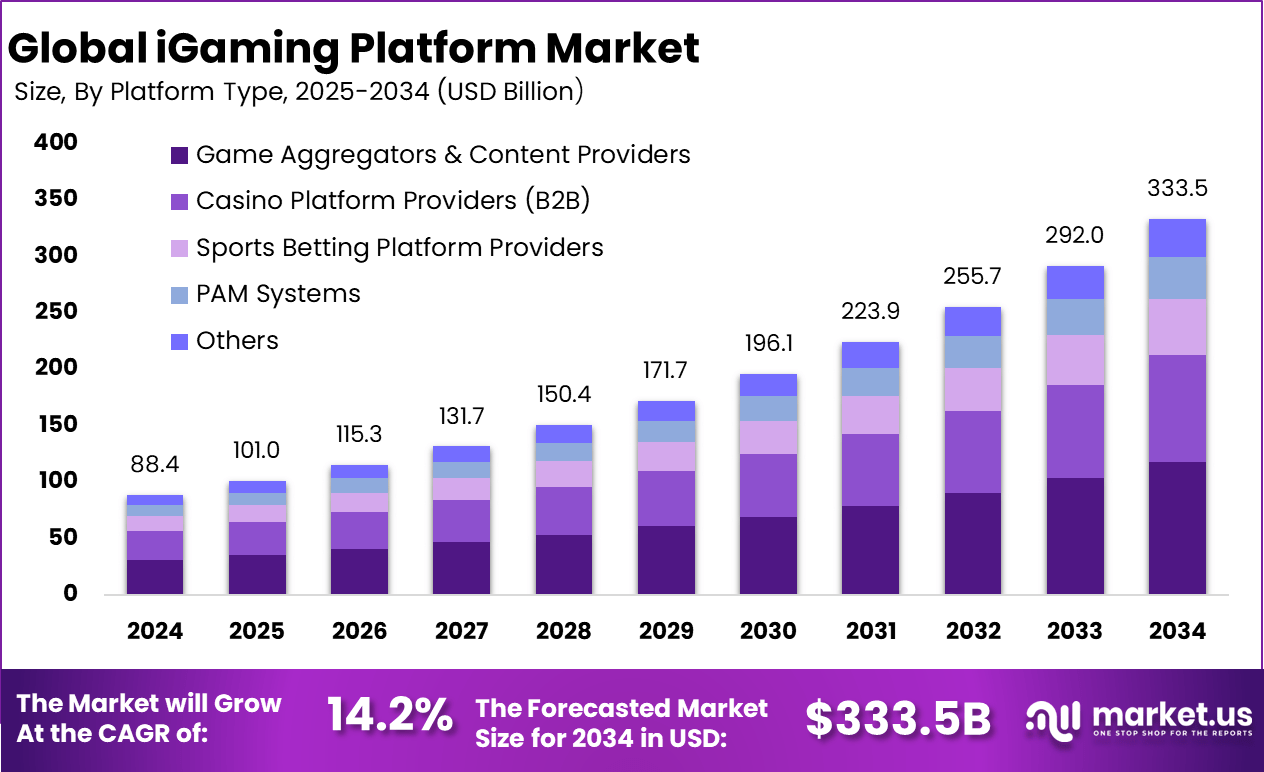

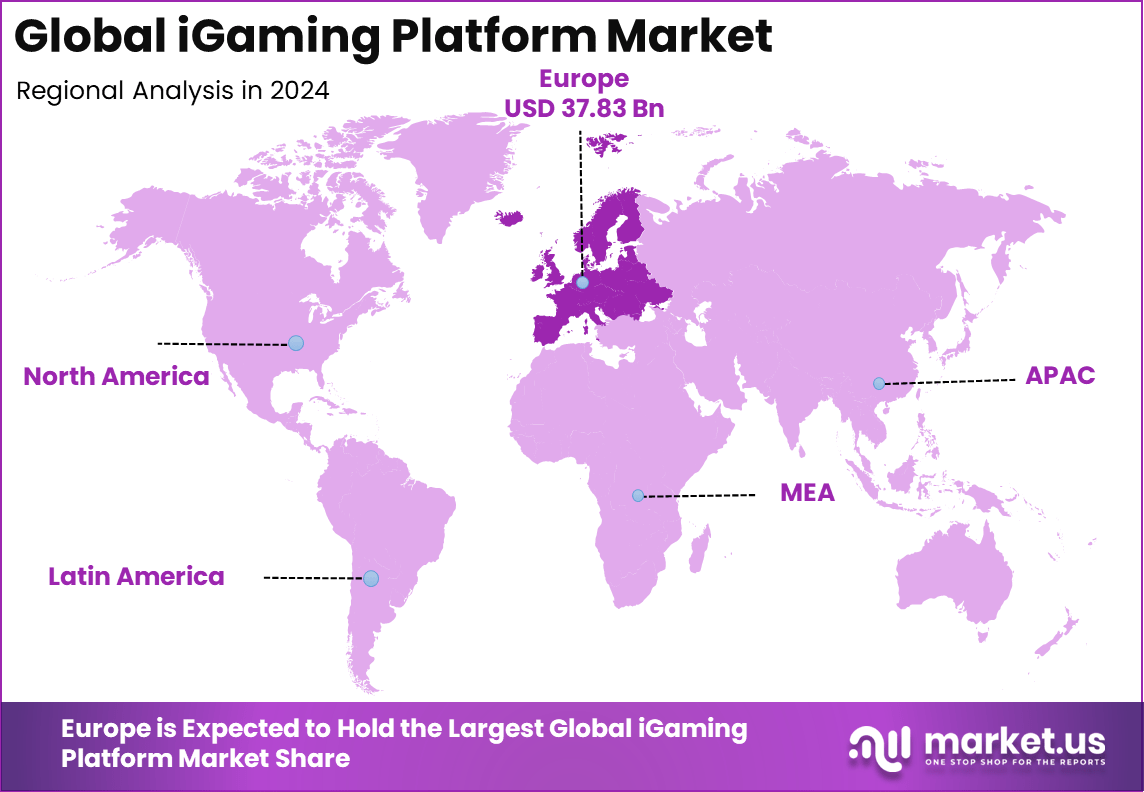

The Global IGaming Platform Market size is expected to be worth around USD 333.5 billion by 2034, from USD 88.4 billion in 2024, growing at a CAGR of 14.2% during the forecast period from 2025 to 2034. In 2024, Europe held a dominant market position, capturing more than a 42.8% share, holding USD 37.83 billion in revenue.

An iGaming platform is a technology solution that facilitates online gambling activities such as casino games, sports betting, poker, bingo, and lotteries. These platforms power virtual gaming environments where users can place bets and engage in interactive gaming experiences via the internet. They deliver a range of offerings from slots to live dealer games, and integrate payment gateways and secure transaction processes to ensure seamless and trusted player experiences.

The rapid spread of internet access, legalization of online betting in many regions, and advances in smartphone technologies are key factors driving the iGaming platform adoption. Additionally, players’ demand for instant, immersive, and personalized entertainment fuels growth. More players prefer mobile gaming due to its convenience and the ability to engage in real-time betting. The combination of these elements with better regulatory frameworks encourages operator confidence and market entry.

The iGaming platform market is driven by the increasing accessibility and convenience of online gambling. With the rise of smartphones and faster internet connections, more players can easily engage in gaming anytime and anywhere, expanding the user base. Operators use advanced technologies like AI to personalize experiences, making games more engaging and boosting player retention.

The study of Demographics and Consumer Behavior in iGaming reveals a strong tilt toward mobile engagement, with 20.5% of online gambling revenue coming from mobile devices. About 18.1% of gamblers prefer using mobile platforms, reflecting convenience as a key factor driving participation. However, 19.3% of problem gamblers face a risk of substance abuse, and 16.1% of gambling-related issues involve criminal activity, underlining the industry’s social and regulatory challenges.

The global gambling population accounts for 6.3%, and the average age group contributes 8.2% of participation, showing wide demographic reach. Nearly 7.2% of players favor live dealer games, suggesting a strong preference for interactive and immersive experiences. The male-to-female ratio remains minimal at 0.7%, confirming the male dominance in online gambling trends.

For instance, in May 2025, EveryMatrix launched EngageSuite, a unified loyalty and gamification ecosystem designed to enhance player engagement across verticals. This product integrates bonuses, levels, tournaments, mini-games, and jackpots into a single customizable system, aiming to boost operator retention and long-term player value with AI-driven personalization.

Key Takeaway

- The Game Aggregators & Content Providers segment dominated with 35.4%, reflecting the growing importance of diverse gaming content and integration services that enhance user engagement.

- The Online Casino segment led the market with 65.6%, driven by increasing adoption of virtual gambling platforms and the expansion of regulated online betting ecosystems.

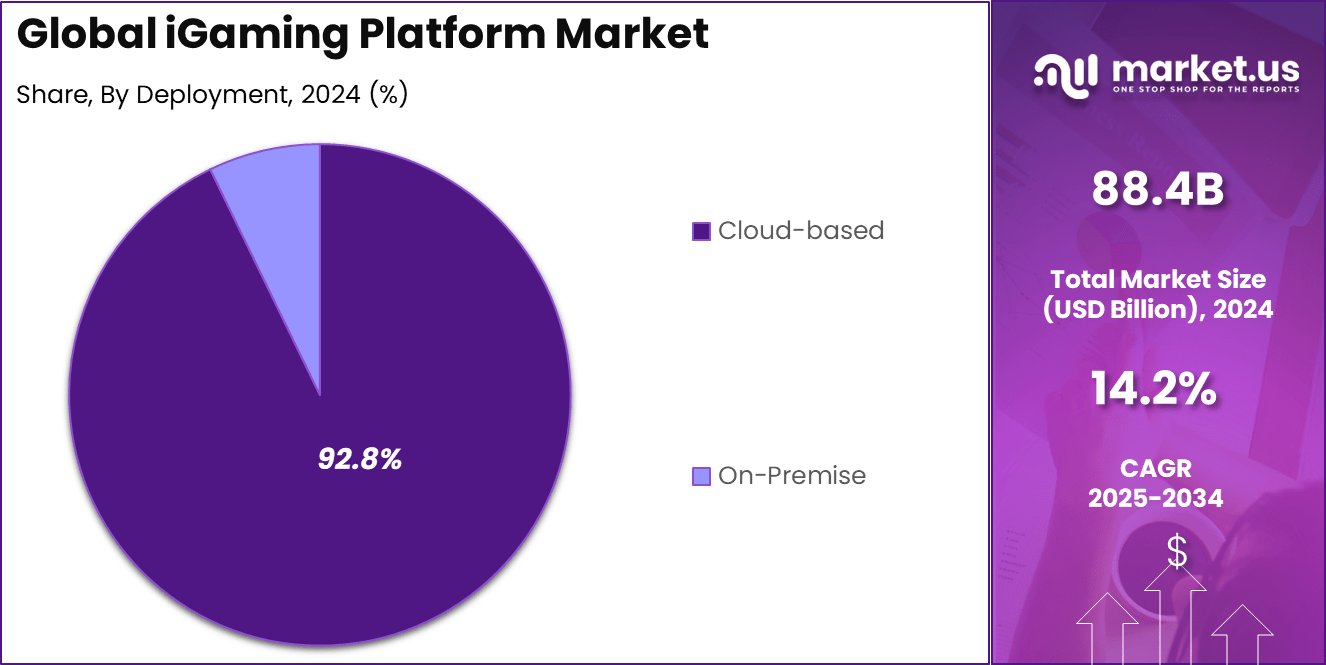

- Cloud-based deployment accounted for a commanding 92.8%, highlighting the industry’s shift toward scalable, secure, and high-performance infrastructure to support real-time gaming operations.

- The German iGaming Platform Market was valued at USD 5.75 Billion in 2024, expanding at a robust 10.1% CAGR, supported by regulatory modernization and rising participation in licensed online gaming.

- Europe held a leading 42.8% share of the global market, supported by strong digital infrastructure, mature gaming regulation, and increasing acceptance of cross-border online wagering platforms.

Role of Generative AI

The role of generative AI in the iGaming platform is transforming player interaction and game development. Generative AI enables highly immersive gaming experiences by creating real-time dynamic narratives and adaptive non-player characters that respond to player behavior. This technology powers personalized game environments and smart chatbots, offering tailored support and content that increases player engagement.

About 70% of leading iGaming platforms now use generative AI to enhance personalization and improve player retention through AI-driven marketing and in-game adjustments. Generative AI also speeds up game development by automating content creation, such as generating game characters, dialogues, and storylines, drastically reducing manual efforts.

Additionally, it boosts game quality by automating bug detection and testing processes, increasing the reliability of iGaming software. This automation can cut game development time by nearly 40%, enabling faster market launches and frequent updates, which retain the player base and attract new users.

Germany IGaming Platform Market Size

The market for IGaming Platform within Germany is growing tremendously and is currently valued at USD 5.75 billion, the market has a projected CAGR of 10.1%. This growth is driven by several factors, including increased internet penetration and widespread smartphone adoption, which make online gaming more accessible to a broad audience.

For instance, in June 2025, Amatic Industries made a strong comeback at this year’s Peru Gaming Show, held in June, showcasing its latest innovative gaming cabinets and multi-game packages. The company received positive feedback for its elegant design, advanced technology, and classic-to-modern game mix. This reaffirms Amatic’s focus on both innovation and regional expansion, especially in Latin America, following its previous success at gaming expos.

In 2024, Europe held a dominant market position in the Global IGaming Platform Market, capturing more than a 42.8% share, holding USD 37.83 billion in revenue. This growth is driven by several factors, including increased internet penetration and widespread smartphone adoption, which make online gaming more accessible to a broad audience. Additionally, evolving consumer preferences favor interactive and digital entertainment, fueling demand for online casino and sports betting platforms.

Furthermore, increased investments in gaming startups and innovations in cloud technology enhance user experience and platform scalability. Regulatory support and a young, tech-savvy population also contribute to the rising traction of iGaming in Germany, making it a rapidly expanding market with promising future potential.

For instance, in October 2025, NetEnt partnered with Gaming Arts to bring some of its most popular online slots, like Divine Fortune and Starburst, to land-based casinos, starting in North America in Q4 2025. This move marks a significant bridge from online dominance to physical casino presence, highlighting NetEnt’s strong brand appeal in Europe and beyond.

Platform Type Analysis

In 2024, The Game Aggregators & Content Providers segment held a dominant market position, capturing a 35.4% share of the Global IGaming Platform Market. These platforms play a key role by offering a wide portfolio of games from multiple developers, simplifying access for operators and players alike. Their aggregation capability supports a diverse gaming experience, attracting users with varied preferences and enhancing engagement.

This segment’s strong presence reflects the industry’s drive toward convenience and variety in gaming content. This platform type not only supports broad game availability but also enables quicker deployment of new titles, allowing operators to keep their offerings fresh and competitive. The role of content providers is pivotal in meeting player demand for innovative and high-quality games, securing their substantial share of the market.

For Instance, in April 2025, Relax Gaming launched its cluster pays game Kraken’s Cove, emphasizing innovative mechanics and engaging player experiences. Known as a leading B2B supplier and gaming aggregator, Relax Gaming offers more than 4,000 online casino games, blending proprietary titles with high-quality third-party content to ensure diversity for operators and players.

Game Type Analysis

In 2024, the Online Casino segment held a dominant market position, capturing a 65.6% share of the Global IGaming Platform Market. This includes a broad range of casino games such as slots, blackjack, poker, and live dealer games. The popularity of online casinos is fueled by their accessibility, game variety, and evolving technology that bridges the gap between virtual and real-world gaming experiences.

Players favor online casinos for their convenience and immersive features, including live streaming and interactive gameplay. This segment benefits from ongoing innovations that enhance user engagement and retention, making it the largest and most profitable segment within iGaming.

For instance, in April 2025, EveryMatrix reported a 39% year-on-year rise in net revenue driven by strong performance in the casino segment. Their casino operations alone contributed to net revenue increases, largely due to expanding live dealer and proprietary game production.

Deployment Analysis

In 2024, The Cloud-based segment held a dominant market position, capturing a 92.8% share of the Global IGaming Platform Market. Cloud technology offers unmatched scalability, flexibility, and security essential for managing high traffic during peak gaming periods and ensuring smooth user experiences globally.

The cloud enables operators to launch and update games swiftly while maintaining strong data protection and regulatory compliance. Its global reach allows iGaming businesses to expand rapidly into new markets without the heavy cost and complexity of physical infrastructure. This deployment model is critical for supporting the dynamic and competitive requirements of the industry today.

For Instance, in September 2025, Playtech strengthened its position with strategic progress in the Americas, notably expanding cloud-based operations for platform scalability and rapid deployment. Their live casino revenue grew by 9%, reflecting the benefits of cloud infrastructure supporting large user bases in regulated markets.

Emerging trends

Emerging trends in iGaming reflect growing player demand for immersive and tech-enhanced gameplay. Mobile gaming dominates, with over 60% of iGaming revenue coming from mobile platforms, driven by advancements in smartphone technology and 5G connectivity.

Live dealer games are surging in popularity, providing an authentic casino experience via high-definition streaming, attracting a broader and more engaged audience. Meanwhile, esports betting continues to grow substantially, expanding the industry beyond traditional gambling, with many platforms integrating competitive gaming into their offerings.

AI-driven personalized user experiences remain at the forefront of innovation, where machine learning tailors recommendations, difficulty levels, and rewards based on player data patterns. Virtual and augmented reality are also gaining traction, offering players new immersive environments that blend real and digital gameplay elements.

Growth Factors

Growth factors behind the iGaming industry’s expansion include improved internet infrastructure and wider smartphone usage. The global rollout of 5G networks has enhanced live streaming and multiplayer game responsiveness, reducing lag and making real-time betting more attractive and accessible.

The rise in digital payment methods, including e-wallets and cryptocurrency, facilitates fast, secure transactions, removing barriers for new and existing players to deposit and withdraw funds efficiently. Moreover, regulatory changes in various markets are creating safer, more transparent environments that build player trust and encourage participation.

Mobile accessibility drives user growth, with mobile accounting for around 50% of online gambling revenue in key regions. Industry experts estimate that over 4 billion smartphone users worldwide are potential iGaming customers, creating a vast base for continued market expansion and innovation.

Key Market Segments

By Platform Type

- Casino Platform Providers (B2B)

- Sports Betting Platform Providers

- Player Account Management (PAM) Systems

- Game Aggregators & Content Providers

- Others

By Game Type

- Online Casino

- Sports Betting

- Poker

- Others

By Deployment

- Cloud-based

- On-Premise

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Growing Popularity of Online Gambling

The iGaming platform market is driven strongly by the rising popularity and legal acceptance of online gambling and sports betting around the world. More regions are regulating and opening their markets to online gaming, allowing more players to participate. This growth is fueled by advancements in technology, such as mobile access, making it easy and convenient for users to play anytime and anywhere.

Furthermore, innovations like AI-driven personalization and secure payment gateways boost the player experience and trust, further raising demand. The surge in esports betting and virtual sports also expands market reach, attracting younger, tech-savvy audiences who seek engaging and interactive betting options.

For instance, in August 2025, Playtech announced the enhancement of its iGaming platform with personalized AI-driven features to improve player engagement and retention. This move reflects the rising demand for smarter, user-centric platforms that cater to evolving player preferences by offering seamless, enjoyable experiences.

Restraint

Regulatory Challenges and Costs

One major restraint is the complex and varying regulatory environments across different countries and states. Licensing costs and taxation can be very high, especially in newly regulated markets, which raises the cost of market entry and ongoing operation for platform providers. These financial barriers often favor large multinational companies over smaller local operators.

Additionally, operators face the challenge of complying with multiple sets of rules, which can slow market expansion. Regions with strict or unclear online gambling laws create uncertainty, making companies cautious about investing in growth or launching new products.

For instance, in October 2025, EveryMatrix highlighted challenges related to compliance with new gambling regulations in multiple European markets. The company had to invest significantly in legal and technical updates to maintain licenses, illustrating how increasing regulatory complexity raises operational costs and slows expansion.

Opportunities

Expansion in Regulated Markets

The ongoing legalization of online gambling in new territories presents a vast opportunity for iGaming platform operators. As more countries and even some U.S. states open up their markets, new customer bases become accessible. Operators can customize localized experiences by incorporating regional preferences and payment methods, enhancing market penetration.

Moreover, mobile gaming’s rise offers convenience and accessibility, increasing user engagement. Integration of cutting-edge technologies like AI, machine learning, and blockchain to personalize gaming and secure transactions presents additional avenues to attract players and build loyalty in growing markets.

For instance, in August 2022, LeoVegas Group partnered with MGM Resorts International to launch a combined online-offline gaming experience in emerging Asia-Pacific markets, leveraging mobile trends and regulatory openings to boost market penetration.

Challenges

Security and Responsible Gaming

The iGaming market faces significant challenges regarding security and responsible gaming. Platforms handle large volumes of user data, making them targets for cyberattacks and fraud attempts. Ensuring robust cybersecurity measures is critical to maintaining user trust and compliance with data privacy laws.

At the same time, operators must implement responsible gaming tools to prevent addiction and meet regulatory standards. Balancing growth ambitions with social responsibility is complex but essential to sustain long-term market success and reputation in an increasingly scrutinized industry.

For instance, in September 2025, BetConstruct strengthened its cybersecurity infrastructure following increased cyberattacks on the iGaming platforms industry-wide. The upgraded security measures aimed at protecting player data and ensuring transactional safety highlight ongoing challenges in combating cyber threats.

Key Players Analysis

The iGaming Platform Market is driven by industry veterans such as Playtech, Evolution, and NetEnt, which provide comprehensive casino and sportsbook solutions for operators worldwide. These companies deliver end-to-end platforms covering game content, player management, and back-office tools. Their global reach, technical reliability, and regulatory compliance frameworks make them preferred partners for high-volume gaming operators.

Notable platforms including Entain (formerly GVC Holdings) with Kambi, EveryMatrix Ltd, SoftSwiss, and Pragmatic Solutions focus on modular and scalable architecture that enables rapid market entry and localized content adaptation. Their offerings support full suite casino, sports betting, payments aggregation, and affiliate management. These firms help operators optimize conversion, retention, and regulatory compliance across multiple jurisdictions.

Emerging and niche providers such as BetConstruct, Relax Gaming, LeoVegas Group/MGM Resorts International, iGP Gaming, LimeUp, Finnplay, Push Gaming, Amatic Industries, Gamingtec, and other key participants supply specialized game engines, platform services, and vertical-specific integrations (such as live dealer and skill-based gaming). Their innovation in gamification, mobile optimization, and content partnerships continues to expand the competitive landscape of the iGaming platform market.

Top Key Players in the Market

- Playtech

- Evolution

- Entain (formerly GVC Holdings)/Kambi

- EveryMatrix Ltd

- SoftSwiss

- Pragmatic Solutions

- BetConstruct

- Relax Gaming

- LeoVegas Group/MGM Resorts International

- iGP Gaming

- Limeup

- NetEnt

- Finnplay

- Push Gaming

- Amatic Industries

- Gamingtec

- Others

Recent Developments

- In August 2025, Turbo Stars, a multi-product IT company specializing in B2B solutions for iGaming, highlighted its ability to accelerate platform launches within just 24 hours while maintaining predictable margins. The company focuses on fast, regulation-ready platforms pre-configured with essential modules like integrated payment systems, content management, bonus tools, and player personalization.

- In October 2025, Entain reaffirmed a positive outlook after reporting a 6% rise in net gaming revenue in Q3, driven by strong contributions from its BetMGM joint venture in the U.S. This continued growth highlights the success of Entain’s online and sports betting expansion, particularly with BetMGM, which forecasts significant stakeholder returns. Entain remains confident in achieving over £500 million in annual cash flow by 2028.

Report Scope

Report Features Description Market Value (2024) USD 88.4 Bn Forecast Revenue (2034) USD 335.5 Bn CAGR (2025-2034) 14.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Platform Type (Casino Platform Providers (B2B), Sports Betting Platform Providers, Player Account Management (PAM) Systems, Game Aggregators & Content Providers, Others), By Game Type (Online Casino, Sports Betting, Poker, Others), By Deployment (Cloud-based, On-Premise) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Playtech, Evolution, Entain (formerly GVC Holdings)/Kambi, EveryMatrix Ltd, SoftSwiss, Pragmatic Solutions, BetConstruct, Relax Gaming, LeoVegas Group/MGM Resorts International, iGP Gaming, Limeup, NetEnt, Finnplay, Push Gaming, Amatic Industries, Gamingtec, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Playtech

- Evolution

- Entain (formerly GVC Holdings)/Kambi

- EveryMatrix Ltd

- SoftSwiss

- Pragmatic Solutions

- BetConstruct

- Relax Gaming

- LeoVegas Group/MGM Resorts International

- iGP Gaming

- Limeup

- NetEnt

- Finnplay

- Push Gaming

- Amatic Industries

- Gamingtec

- Others