Global Hyper-Personalized Fitness Market Size, Share, Growth Analysis By Product Type (Wearables, Smart Equipment, Others), By Technology (Artificial Intelligence, Wearables & IoT, Big Data Analytics, Virtual Reality (VR) And Augmented Reality (AR), Genomic-Based Solutions), By Service (Personal Training Platforms, Wearable Technology Services, Others), By End Use (Residential, Commercial), By Sales Channel (Indirect Sales, Direct), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170165

- Number of Pages: 313

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

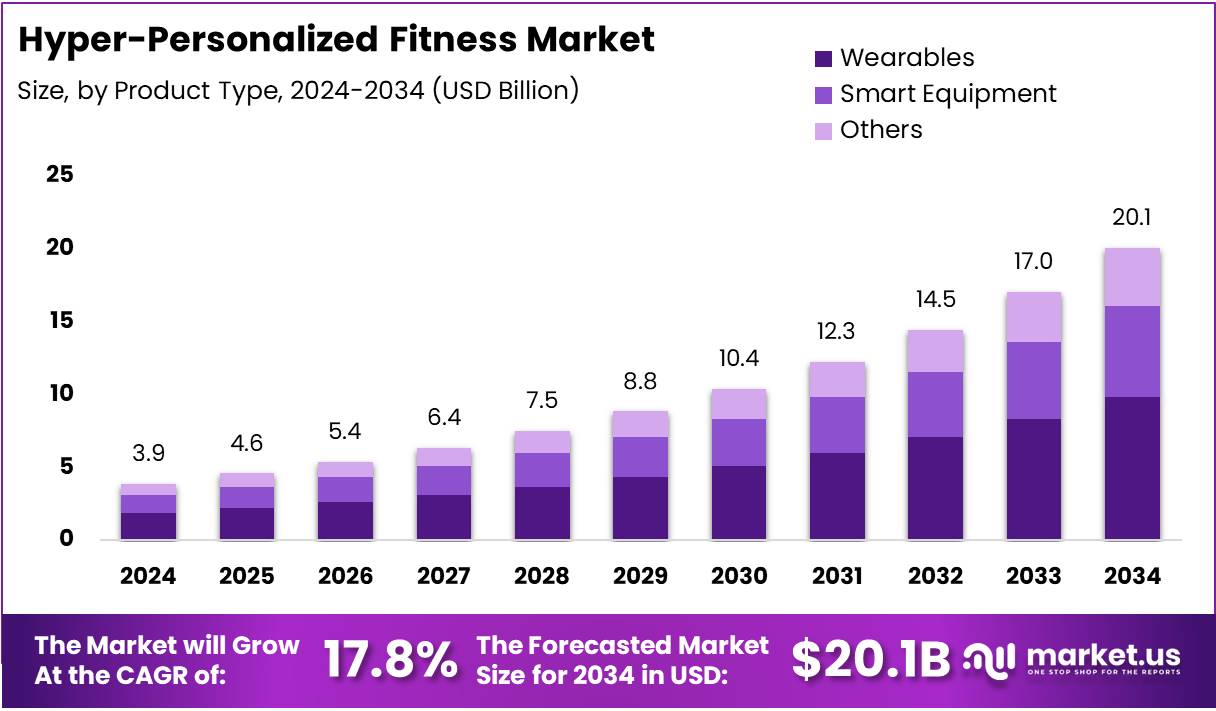

The Global Hyper-Personalized Fitness Market size is expected to be worth around USD 20.1 Billion by 2034, from USD 3.9 Billion in 2024, growing at a CAGR of 17.8% during the forecast period from 2025 to 2034.

The hyper-personalized fitness market represents a transformative shift in wellness technology. Consequently, this sector combines artificial intelligence, biometric data, and adaptive algorithms to deliver customized workout regimens. Furthermore, these solutions analyze individual health metrics, preferences, and goals. Traditional one-size-fits-all fitness programs are rapidly becoming obsolete. Modern consumers increasingly demand tailored experiences that address their unique physiological needs and lifestyle constraints.

Market growth accelerates as technology democratizes personalized wellness solutions. Moreover, wearable devices, smart equipment, and AI-powered coaching platforms drive widespread adoption. The integration of genetic testing and real-time health monitoring enhances customization capabilities. Subsequently, this convergence creates unprecedented opportunities for service providers and technology developers. The market encompasses digital fitness platforms, connected gym equipment, and personalized nutrition planning systems.

Government initiatives actively promote digital health adoption and preventive care solutions. Meanwhile, regulatory frameworks ensure data privacy and medical device compliance standards. Public health authorities recognize personalized fitness as a cost-effective preventive healthcare strategy. Therefore, policy support strengthens market legitimacy and consumer confidence. Investment in digital health infrastructure continues expanding across developed and emerging markets.

Consumer adoption metrics reveal strong engagement patterns with personalized fitness technologies. Research indicates 69% of smartwatch and fitness tracker owners report improved fitness outcomes. Additionally, 64% confirm enhanced overall health management capabilities through these connected devices. Current data shows approximately 30% of adults actively utilize wearable healthcare devices for monitoring purposes.

User engagement remains consistently high, with 47.33% of device owners utilizing their wearables daily. This demonstrates strong habit formation and sustained interest in personalized health tracking. Furthermore, the pandemic fundamentally accelerated digital fitness adoption across consumer segments. Data reveals 74% of individuals utilized at least one fitness application during quarantine periods. Consequently, the hyper-personalized fitness market stands positioned for sustained expansion as technology accessibility improves.

Key Takeaways

- The global market is projected to reach USD 20.1 Billion by 2034, up from USD 3.9 Billion in 2024.

- The market grows at a strong 17.8% CAGR between 2025–2034.

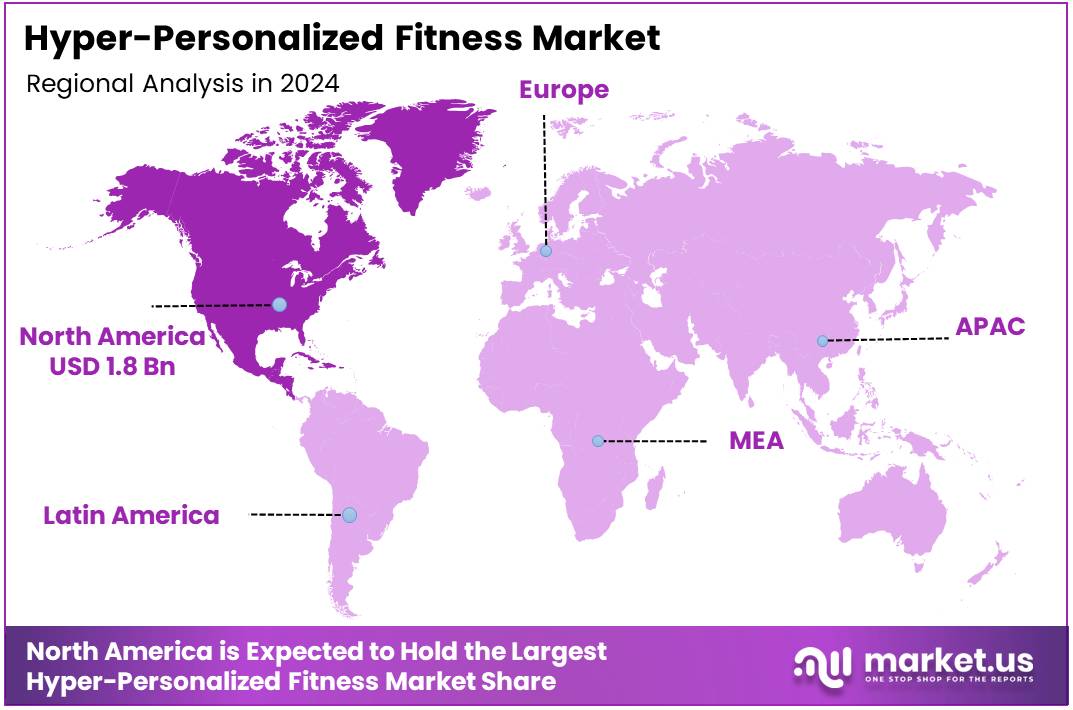

- North America leads with a 47.9% share valued at USD 1.8 Billion.

- Wearables dominate product type with a 48.9% share in 2024.

- Artificial Intelligence leads the technology segment with a 34.8% share.

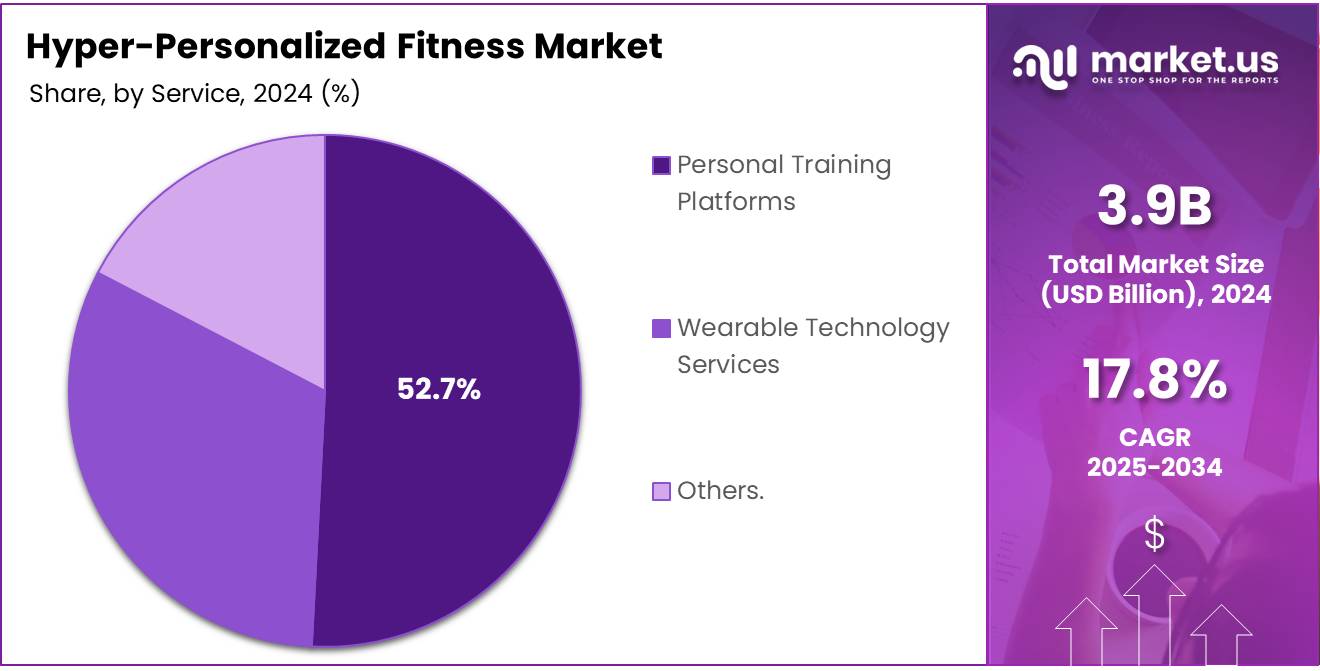

- Personal Training Platforms hold the highest service share at 52.7%.

- Residential end-use segment dominates with a 67.4% share.

- Indirect Sales remain the primary channel with a 62.6% share.

By Product Type Analysis

Wearables dominates with 48.9% due to its advanced health monitoring capabilities and seamless integration with mobile applications.

In 2024, Wearables held a dominant market position in the By Product Type Analysis segment of Hyper-Personalized Fitness Market, with a 48.9% share. This leadership stems from increasing consumer preference for real-time health tracking and fitness monitoring. Wearables offer comprehensive data collection through sensors monitoring heart rate, sleep patterns, and activity levels. The convenience of accessing personalized fitness insights directly from smartwatches has revolutionized wellness approaches. Continuous technological advancements have made these devices more accurate and affordable, driving widespread adoption.

Smart Equipment represents a growing segment offering connected exercise machines and intelligent workout tools. These products include smart treadmills, connected strength training equipment, and interactive mirrors providing real-time feedback. The integration of AI-powered form correction enhances workout effectiveness while minimizing injury risks. Smart equipment appeals particularly to home gym enthusiasts seeking professional-grade training experiences.

Others encompasses emerging product categories including personalized nutrition devices, recovery tools, and specialized fitness accessories. This segment features innovative solutions such as smart water bottles, posture correctors, and biometric scanners complementing primary fitness routines. As technology evolves, this category expands with novel products addressing specific wellness needs.

By Technology Analysis

Artificial Intelligence dominates with 34.8% due to its superior ability to create adaptive workout plans and predict user fitness outcomes.

In 2024, Artificial Intelligence held a dominant market position in the By Technology Analysis segment of Hyper-Personalized Fitness Market, with a 34.8% share. AI algorithms analyze vast user data to deliver highly customized fitness recommendations and real-time adjustments. Machine learning models continuously improve understanding of individual preferences and progress patterns. AI-powered virtual coaches provide instant feedback on exercise form and optimize workout intensity for maximum results.

Wearables & IoT technology facilitates seamless connectivity between fitness devices, smartphones, and cloud platforms. This ecosystem enables continuous data synchronization across multiple devices. IoT integration supports smart home gym setups where equipment communicates with wearables. The technology enhances user engagement through social features and community support networks.

Big Data Analytics processes massive datasets to identify patterns, trends, and optimal training methodologies. This technology enables predictive health insights, injury prevention alerts, and benchmark comparisons. Analytics platforms help users make data-driven decisions about training modifications and goal setting. Continuous algorithm refinement improves recommendation accuracy over time.

Virtual Reality (VR) And Augmented Reality (AR) creates immersive fitness experiences transforming workouts into engaging adventures. VR fitness games transport users to virtual environments where exercise becomes entertainment. AR overlays digital information providing real-time form guidance and gamified challenges. These technologies appeal to younger demographics seeking innovative fitness approaches.

Genomic-Based Solutions represent cutting-edge personalization by analyzing genetic profiles to recommend optimal exercise types and nutrition plans. DNA testing reveals predispositions toward fitness attributes and metabolic responses. This technology enables unprecedented customization by aligning programs with biological foundations. Though currently niche, genomic solutions gain traction among serious athletes.

By Service Analysis

Personal Training Platforms dominates with 52.7% due to the increasing demand for customized workout guidance and professional coaching accessibility.

In 2024, Personal Training Platforms held a dominant market position in the By Service Analysis segment of Hyper-Personalized Fitness Market, with a 52.7% share. These digital platforms democratize access to professional coaching by connecting users with certified trainers through video sessions. The convenience of receiving expert guidance from home eliminates geographical barriers and scheduling constraints. Platforms offer flexible subscription models and progress tracking tools maintaining accountability.

Wearable Technology Services provide ongoing support, data analysis, and premium features for fitness tracking devices. These services include advanced health insights, extended data history, and personalized coaching through device integration. Subscription-based services generate recurring revenue while delivering continuous value through feature updates. Users benefit from deeper health understanding and sophisticated goal management tools.

Others encompasses diverse services including nutrition planning apps, wellness coaching, and corporate fitness programs. This category serves niche markets with tailored solutions addressing unique fitness needs. Mental wellness integration and recovery optimization services represent growing opportunities as holistic health approaches gain prominence.

By End Use Analysis

Residential dominates with 67.4% due to the growing preference for home-based fitness solutions and convenient workout accessibility.

In 2024, Residential held a dominant market position in the By End Use Analysis segment of Hyper-Personalized Fitness Market, with a 67.4% share. The shift toward smart home fitness reflects changing lifestyle patterns and desire for private workout environments. Residential users invest in smart home gym equipment and they utilize wearable technology to maintain consistent routines without commuting. The flexibility to exercise anytime, combined with family accessibility, makes home-based solutions increasingly attractive.

Commercial applications span gyms, fitness studios, corporate wellness programs, and healthcare facilities. Commercial environments leverage hyper-personalized technology to differentiate offerings and enhance member experiences. Facilities integrate smart equipment and biometric tracking systems to deliver premium services. Corporate wellness programs utilize personalized solutions to improve employee health and boost productivity.

By Sales Channel Analysis

Indirect Sales dominates with 62.6% due to extensive retail networks and established consumer trust in traditional purchasing channels.

In 2024, Indirect Sales held a dominant market position in the By Sales Channel Analysis segment of Hyper-Personalized Fitness Market, with a 62.6% share. This channel encompasses retail partnerships with electronics stores, sporting goods retailers, and online marketplaces providing wide accessibility. Consumers benefit from physical product examination and established return policies through familiar retailers. E-commerce platforms offer comprehensive reviews and competitive pricing enhancing indirect sales appeal.

Direct sales through brand websites and company-owned stores offer manufacturers greater control over customer relationships and pricing strategies. Direct channels provide exclusive product launches and premium customer service experiences. Brands leverage direct sales to collect valuable customer data and build loyal communities. While requiring infrastructure investment, direct channels deliver higher profit margins.

Key Market Segments

By Product Type

- Wearables

- Smart Equipment

- Others

By Technology

- Artificial Intelligence

- Wearables & IoT

- Big Data Analytics

- Virtual Reality (VR) And Augmented Reality (AR)

- Genomic-Based Solutions

By Service

- Personal Training Platforms

- Wearable Technology Services

- Others

By End Use

- Residential

- Commercial

By Sales Channel

- Indirect Sales

- Direct

Drivers

Growing Consumer Focus on Preventive Health and Personalized Wellness Drives Market Growth

The hyper-personalized fitness market is expanding rapidly due to several key factors. More people now prioritize preventive health over reactive treatment. Consumers want fitness solutions tailored to their unique body types, goals, and lifestyle needs. This shift from generic workout plans to customized programs is pushing demand for personalized fitness services. People realize that one-size-fits-all approaches don’t deliver optimal results.

Technology plays a crucial role in this transformation. AI and IoT devices now track everything from heart rate to sleep patterns with remarkable accuracy. Wearable fitness trackers and smart gym equipment collect real-time health data. These innovations make it easier for users to monitor their progress and adjust their routines instantly. The integration of artificial intelligence helps create adaptive workout plans that evolve based on individual performance.

Data-driven insights are becoming essential for fitness enthusiasts. Users want detailed analytics showing how their bodies respond to different exercises. This information helps optimize workout efficiency and prevents injury. Athletes and casual gym-goers alike benefit from understanding metrics like calorie burn, muscle recovery, and performance trends. The ability to make informed decisions based on personal data encourages people to stay committed to their fitness journeys and achieve better outcomes.

Restraints

Privacy Concerns and Limited Device Accessibility Restrain Hyper-Personalized Fitness Market Growth

The hyper-personalized fitness market faces significant challenges limiting its expansion. Advanced wearable devices remain inaccessible in emerging markets due to high costs and poor infrastructure. These sophisticated fitness trackers are unaffordable for average consumers in developing regions, while inadequate internet connectivity and technical support further restrict adoption.

Privacy concerns create another major barrier. Consumers worry about how fitness platforms collect and use their personal health data, including heart rate, sleep patterns, and exercise habits. Fears of data breaches and unauthorized sharing with third parties make users hesitant to adopt these technologies. Recent security incidents have intensified these concerns.

Growth Factors

Integration of Advanced Technologies and Corporate Partnerships Drives Hyper-Personalized Fitness Market Growth

The hyper-personalized fitness market is experiencing significant growth through AI-driven nutrition planning combined with customized workout programs. This technology analyzes individual body metrics, dietary habits, and fitness goals to create tailored meal plans that work alongside exercise routines. Users receive real-time adjustments based on their progress, making fitness journeys more effective and sustainable. This integration helps people achieve better results faster, increasing market adoption.

Virtual Reality and Augmented Reality are transforming how people experience fitness training. VR workouts transport users to different environments, making exercise more engaging and fun. AR technology overlays digital instructions onto real-world settings, helping users maintain proper form and technique. These immersive experiences attract younger demographics and tech-savvy consumers who seek innovative workout solutions beyond traditional gym settings.

Corporate wellness programs represent a major expansion opportunity for hyper-personalized fitness providers. Companies are investing in employee health to reduce healthcare costs and improve productivity. Personalized fitness solutions can be scaled across entire organizations, offering customized plans for employees with different fitness levels and health conditions. This B2B channel opens new revenue streams while addressing the growing demand for workplace wellness initiatives that deliver measurable health outcomes.

Emerging Trends

Rising Adoption of Technology-Driven Personalization Drives Hyper-Personalized Fitness Market Growth

The hyper-personalized fitness market is growing rapidly as consumers seek customized workout experiences. Hybrid fitness models combining home and gym workouts are gaining popularity, offering flexibility to switch between digital sessions and traditional gym environments based on convenience and preference.

Biometric monitoring is becoming essential for real-time workout adjustments. Advanced sensors track heart rate, oxygen levels, and muscle activity, allowing immediate modifications to exercise intensity. This ensures optimal performance while reducing injury risks.

Social fitness platforms are transforming motivation through peer engagement. These communities connect users with similar goals, creating accountability and encouragement that helps maintain long-term commitment to fitness routines.

Wearable-integrated fitness challenges and gamified workouts are attracting younger users by making exercise fun and competitive. Virtual challenges, achievement badges, and progress tracking turn workouts into engaging games, significantly boosting participation and adherence to healthy lifestyles.

Regional Analysis

North America Dominates the Hyper-Personalized Fitness Market with a Market Share of 47.9%, Valued at USD 1.8 Billion

North America leads the hyper-personalized fitness market, holding a 47.9% share and generating around USD 1.8 Billion. The region benefits from high adoption of digital fitness platforms, strong consumer spending on health tech, and a mature ecosystem for AI-driven wellness tools. Growing demand for customized workout plans and biometric-based training further strengthens the region’s leadership position.

Europe Hyper-Personalized Fitness Market Trends

Europe shows steady expansion driven by rising interest in preventive healthcare and wider use of AI-enabled fitness solutions. Consumers in major countries increasingly prefer personalized training formats, supported by strong regulatory emphasis on digital wellness innovation. The region also benefits from a growing shift toward hybrid fitness models combining home-based and studio-based routines.

Asia Pacific Hyper-Personalized Fitness Market Trends

Asia Pacific is emerging as one of the fastest-growing regions due to a large digitally active population and increasing awareness of personalized health management. The adoption of real-time fitness monitoring and interactive workout platforms continues to expand rapidly. Urbanization and rising fitness spending further accelerate market penetration across key economies.

Middle East & Africa Hyper-Personalized Fitness Market Trends

The Middle East & Africa region is experiencing gradual growth supported by rising interest in technology-enabled health improvement and lifestyle transformation. Digital fitness subscriptions are gaining traction, particularly among younger consumers seeking tailored routines. Expanding investment in wellness infrastructure also supports market adoption.

Latin America Hyper-Personalized Fitness Market Trends

Latin America shows increasing adoption of hyper-personalized fitness solutions as consumers shift toward smarter workout planning and digital coaching. Economic urbanization and improving internet access are enabling wider usage of mobile-based fitness customization tools. The market is steadily developing as wellness awareness and technology engagement rise across the region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Hyper-Personalized Fitness Company Insights

Ergotron, Inc. is advancing its footprint in the hyper-personalized fitness ecosystem by integrating ergonomic wellness solutions with data-driven movement insights. The company’s smart workstation technologies help users track posture, activity, and daily mobility metrics in real time. This positions Ergotron as a key enabler of workplace-based fitness personalization. Its focus on preventive wellness and continuous activity optimization aligns with rising corporate health demands.

Peloton Interactive continues to expand its adaptive fitness model through AI-enhanced coaching and personalized workout recommendations. The brand’s connected equipment ecosystem offers user-specific class suggestions based on past performance, preferences, and training intensity. Peloton’s strength lies in its content innovation and behavioral data analytics engine. This supports deeper personalization and sustained engagement across global subscriber bases.

Whoop remains a performance analytics leader with its biometric-driven coaching platform centered on sleep, strain, and recovery scoring. Its wearable technology delivers granular physiological insights that inform precision training decisions. By focusing on high-performance athletes and wellness-focused consumers, Whoop accelerates adoption of hyper-personalized routines. Its continuous data capture model strengthens long-term user profiling and engagement.

Tonal enhances the hyper-personalized fitness market with its AI-powered strength-training system capable of adjusting resistance in real time. The platform’s motion sensors and form-correction algorithms offer individualized coaching at a granular level. Tonal’s ability to customize programs based on progression and workout history increases training efficiency. This positions it strongly in the premium smart-home fitness segment.

Top Key Players in the Market

- Ergotron, Inc.

- Peloton Interactive

- Whoop

- Tonal

- Garmin Ltd

- Strava

- Fitbit Inc

- Nike Training Club

Recent Developments

- In October 2025, Fitbit (owned by Google) launched a public preview of its AI-powered Personal Health Coach for Premium users.This feature uses machine learning to deliver highly personalized fitness insights, adaptive plans, and real-time recommendations.

- In May 2025, iFIT acquired Reform RX, a leading connected Pilates reformer brand, to expand its smart equipment ecosystem.The acquisition strengthens iFIT’s hybrid and home-based fitness offerings with advanced connected Pilates experiences.

- In February 2024, Zing Coach acquired Zenia, a leader in real-time workout tracking and voice-guided feedback technologies.This move enhances Zing Coach’s ability to offer precision-based performance monitoring and deeper workout personalization.

- In February 2024, Zing Coach further expanded by integrating Zenia’s interactive workout innovations into its AI-driven fitness platform.This acquisition boosts responsiveness, improving user engagement and delivering more tailored fitness journeys.

- In October 2024, DXFactor partnered with EGYM to unveil new AI-driven fitness solutions at the Fitness Tech Summit.The collaboration aims to improve digital fitness intelligence, enabling smarter workout planning and enhanced member experiences.

Report Scope

Report Features Description Market Value (2024) USD 3.9 Billion Forecast Revenue (2034) USD 20.1 Billion CAGR (2025-2034) 17.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Wearables, Smart Equipment, Others), By Technology (Artificial Intelligence, Wearables & IoT, Big Data Analytics, Virtual Reality (VR) And Augmented Reality (AR), Genomic-Based Solutions), By Service (Personal Training Platforms, Wearable Technology Services, Others), By End Use (Residential, Commercial), By Sales Channel (Indirect Sales, Direct) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Ergotron, Inc., Peloton Interactive, Whoop, Tonal, Garmin Ltd, Strava, Fitbit Inc, Nike Training Club Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Hyper-Personalized Fitness MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Hyper-Personalized Fitness MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Ergotron, Inc.

- Peloton Interactive

- Whoop

- Tonal

- Garmin Ltd

- Strava

- Fitbit Inc

- Nike Training Club