Global Hybrid Intelligence Market Size, Share, Industry Analysis Report By Component (Solutions [Machine Learning, Natural Language Processing, Computer Vision, Robotics, Others], Services [Consulting, Integration and Deployment, Support and Maintenance]), By Organization Size (Large Enterprises, Small and Medium-Sized Enterprises (SMEs)), By End User (Healthcare, BFSI, Retail and E-commerce, Manufacturing, Telecommunications, Government and Defense, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 161837

- Number of Pages: 262

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Global Hybrid Intelligence Market generated USD 101.22 billion in 2024 and is predicted to register growth from USD 107.23 billion in 2025 to about USD 180.24 billion by 2034, recording a CAGR of 5.94% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 38.7% share, holding USD 1.3 Billion revenue.

The hybrid intelligence market centers on systems that combine human decision-making with artificial intelligence to create outcomes neither could achieve alone. These solutions are used in research, customer service, analytics, design, risk assessment, compliance, and complex planning. The approach allows machines to handle pattern recognition, processing, and prediction, while humans provide judgment, ethics, creativity, and contextual understanding.

The growth of hybrid intelligence is reflected in the rapid adoption of generative AI, which increased from 33% of organizations in 2023 to 71% in 2024. Adoption varies by business function, with 36% of IT departments and 12% of manufacturing units using AI in 2024. In marketing and sales, usage reached 42% during the same year, compared to only 5% in manufacturing, highlighting stronger uptake in customer-facing areas than in production-focused functions.

Top Market Takeaways

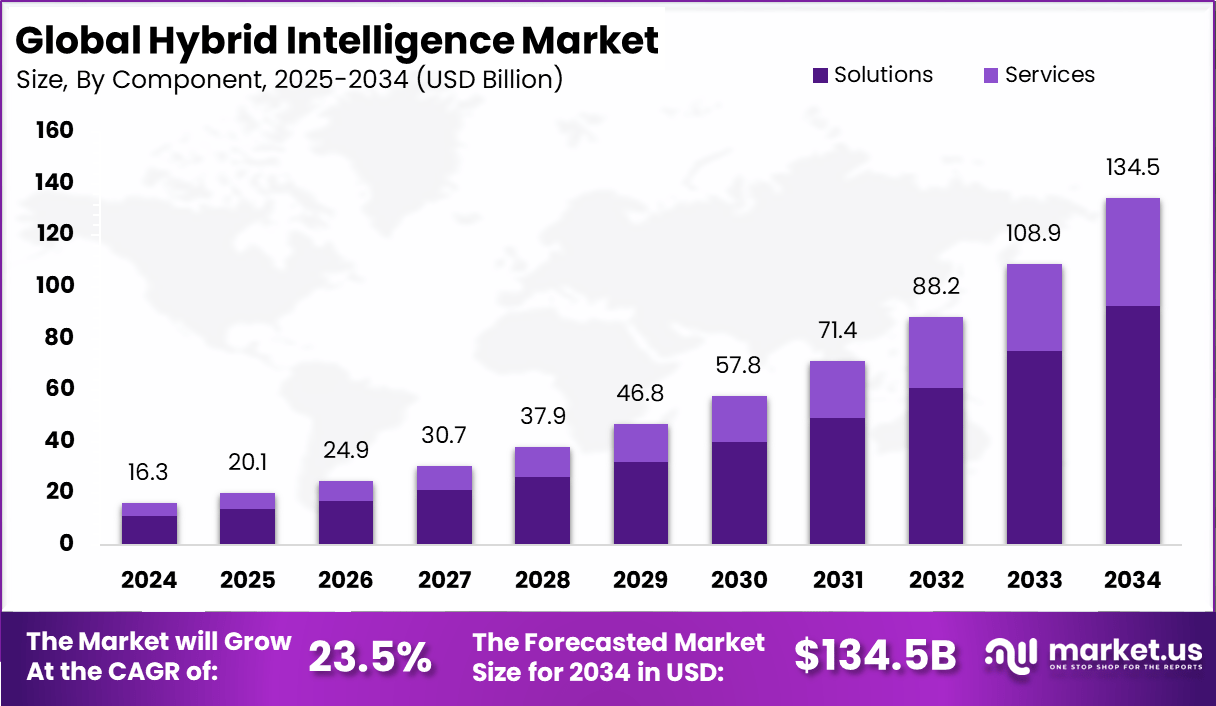

- Solutions dominate the market, accounting for 68.9%, as enterprises rely on ready-to-deploy hybrid intelligence platforms.

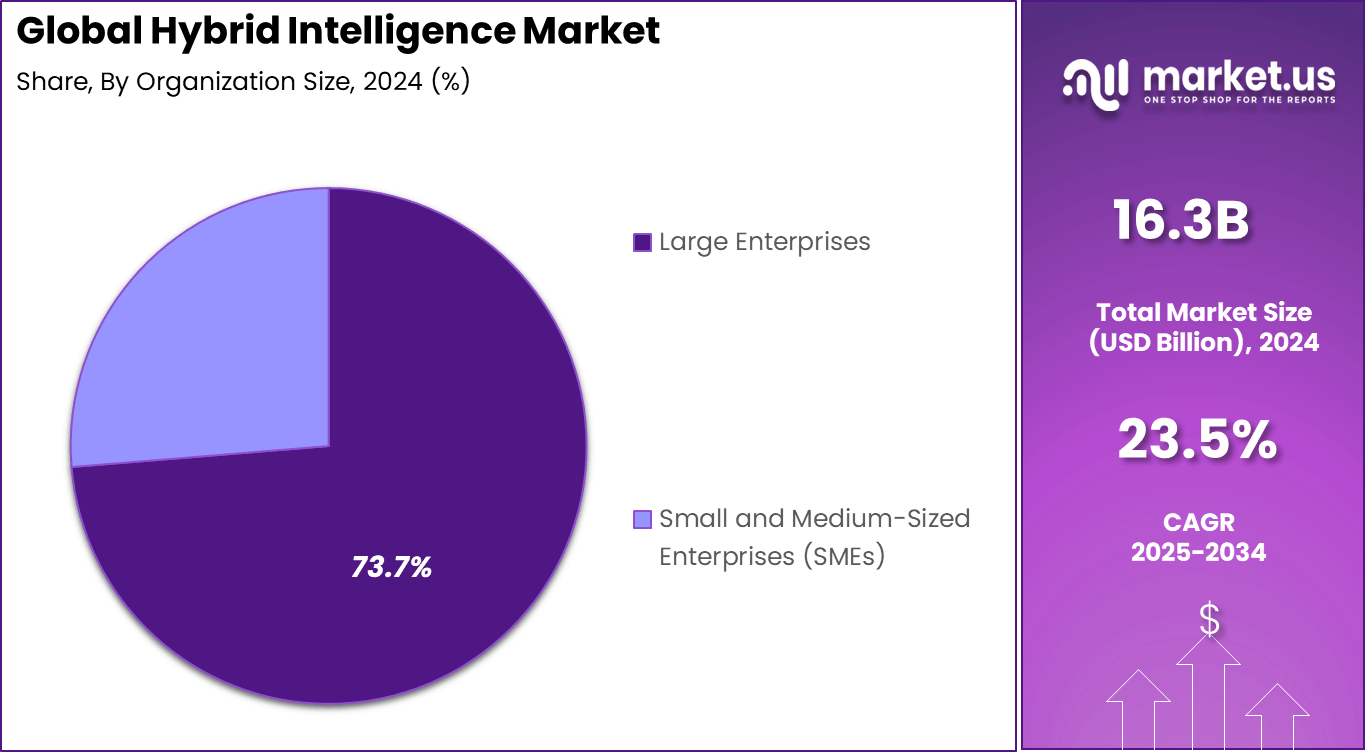

- Large enterprises lead adoption with 73.7%, driven by higher budgets and structured digital strategies.

- The BFSI sector contributes 27.4%, reflecting strong interest in automation, risk modelling, and decision support.

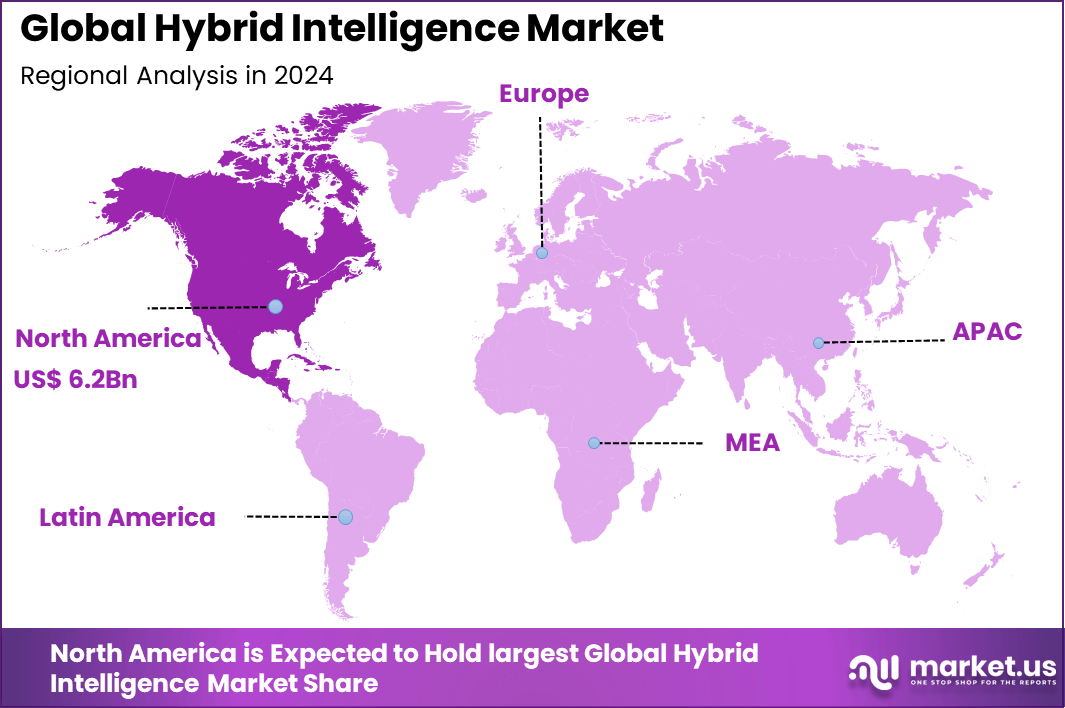

- North America captures 38.2%, showing strong integration of AI with enterprise systems.

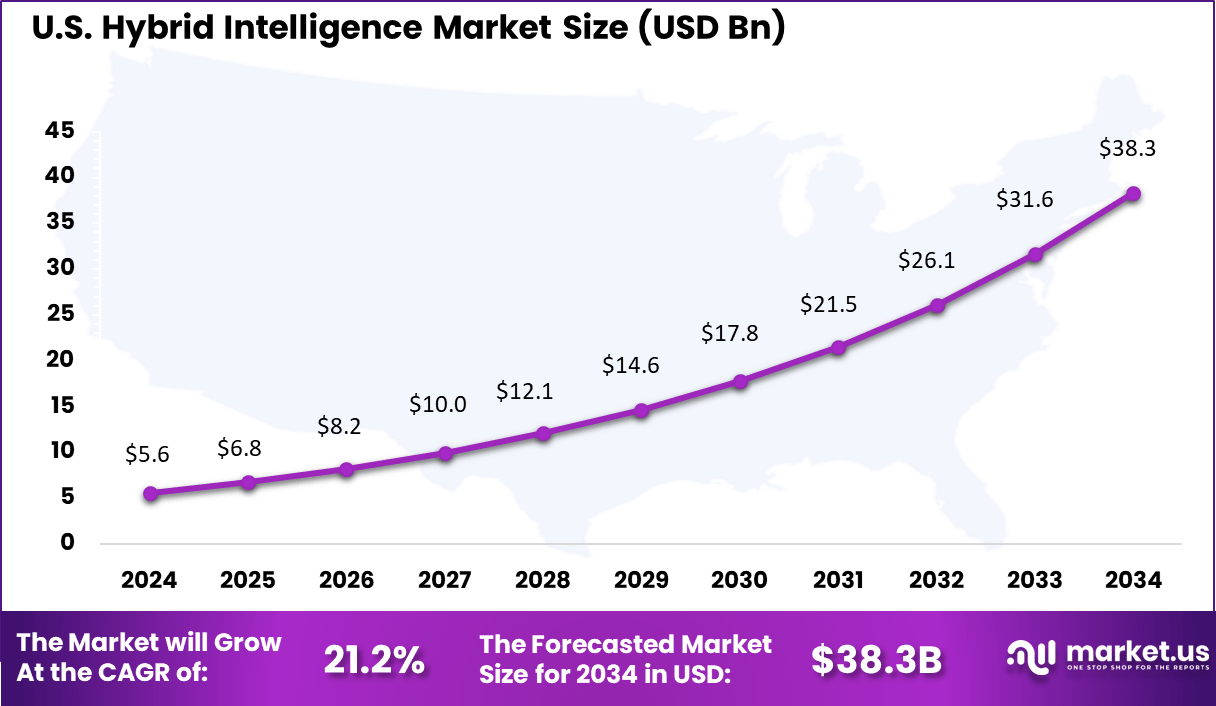

- The US alone generates USD 5.6 billion, supported by rapid implementation across industries.

- A strong CAGR of 21.2% highlights rising confidence in hybrid decision-making models.

Analysts’ Viewpoint

A major driver is the growing need for accurate and responsible decision-making in sectors where full automation is not trusted. Organizations want AI support without losing human oversight. The rise in data volume has made it difficult for human teams to extract timely insights without assistance. Regulatory pressure in areas like healthcare, defense, and finance has also encouraged models where human supervision remains central.

Demand is increasing in industries that require both analytical power and human interpretation. Financial services use hybrid systems for fraud detection, credit assessment, and portfolio decisions. Healthcare professionals use AI support for diagnostics while retaining clinical control. Legal, insurance, education, and manufacturing sectors apply hybrid intelligence for evaluations and process optimization.

Enterprises are also deploying it in product design and research workflows. For example, reports show that around 75% of large enterprises are adopting AI-based hybrid intelligence, particularly for optimizing processes and extending data analytics capabilities. With roughly 2,200 cyberattacks occurring each day, companies are turning to hybrid intelligence to strengthen threat detection and risk management.

US Market Size

The market in the US alone is valued at approximately USD 5.6 billion as of 2025, with a strong growth trajectory supported by an impressive CAGR of 21.2%. The US benefits from extensive investment in AI and hybrid intelligence, particularly in sectors such as healthcare, finance, and manufacturing.

The combination of high digital literacy, innovative startups, and a conducive regulatory environment has propelled the country to be a major hub for hybrid intelligence development and deployment, enabling organizations to improve operational efficiency and decision-making processes.

North America accounted for the largest share of the hybrid intelligence market in 2024, with around 37.4% of the global revenue. The region’s leadership is driven by the presence of many key players, startups, and advanced technological infrastructure that support the adoption of hybrid AI solutions across various industries.

Investment and Business Benefits

Investment opportunities in the hybrid intelligence space are abundant and expanding. The market’s rapid compound annual growth rate, exceeding 20%, indicates strong investor interest. There is notable traction in AI-driven cybersecurity, where the demand for intelligent threat detection systems creates substantial funding prospects.

Integration services and software-as-a-service models for hybrid intelligence are also attractive to investors due to their recurring revenue potential and scalability. Additionally, consultancy and managed service segments are growing rapidly as businesses seek expert guidance to implement and optimize hybrid solutions effectively. The convergence of AI advancements with cloud and edge technologies further opens avenues for strategic investments.

Business benefits realized through hybrid intelligence systems encompass improved operational efficiency, enhanced customer experiences, and better compliance management. Entities adopting these technologies report faster and more accurate business operations, boosted productivity, and a reduction in manual errors or redundancies.

Hybrid intelligence also facilitates smarter resource use and innovation through combined human and AI strengths. According to industry insights, AI integration in banking has increased by 35% recently, reflecting the growing business value seen in real-world applications. Overall, hybrid intelligence enables companies to stay competitive by smarter decision-making and harnessing both data-driven AI capabilities and human creativity.

Company Investments

- Microsoft and Siemens (2025): Formed a partnership to develop hybrid intelligence solutions for smart manufacturing, integrating AI with industrial automation to enhance efficiency and decision-making.

- IBM (2024): Launched its Hybrid Intelligence Suite, designed to help enterprises combine human expertise with AI-driven insights for improved business operations.

- Google (2024): Announced a $500 million investment in hybrid intelligence research, underscoring its commitment to advancing next-generation AI systems that merge human and machine capabilities.

By Component

In 2024, The solutions segment dominates the hybrid intelligence market with a share of 68.9%. This reflects the strong preference for integrated platforms that combine human expertise with artificial intelligence to deliver actionable insights.

Solutions such as machine learning tools, natural language processing, and computer vision software are key drivers, as they enable organizations to automate complex tasks while retaining human oversight and decision-making. Cloud-based delivery of these solutions enhances scalability and flexibility, making them accessible to a wide range of industries.

The growing demand for intelligent automation and data-driven decision-making is accelerating adoption. Organizations benefit from hybrid intelligence solutions by improving productivity, enhancing customer experience, and uncovering new business opportunities. These platforms continue to evolve with advances in AI algorithms and increasing integration with enterprise systems.

By Organization Size

In 2024, Large enterprises hold a commanding 73.7% share in the hybrid intelligence market. Their capacity to invest in advanced technologies and manage extensive data repositories positions them as main adopters. Large organizations deploy hybrid intelligence solutions to optimize operations, manage risks, and innovate products and services at scale.

These enterprises often face complex challenges that necessitate combining human intuition with AI’s computational power. By leveraging hybrid intelligence, large firms enhance compliance, customer satisfaction, and operational efficiency. The scalability and support offered by leading hybrid intelligence providers suit the needs of these complex and diverse organizations well.

By End User

In 2024, the banking, financial services, and insurance (BFSI) sector accounts for 27.4% of hybrid intelligence adoption. This industry demands sophisticated tools for fraud detection, risk assessment, customer insights, and regulatory compliance. Hybrid intelligence platforms assist in augmenting human expertise with AI’s ability to analyze vast datasets for better decision-making.

BFSI’s reliance on these technologies is due to the critical nature of security, accuracy, and speed required in financial transactions. Hybrid intelligence helps these institutions reduce fraud losses, improve customer experience, and comply efficiently with evolving regulations, making adoption essential.

Emerging Trends

Hybrid intelligence in 2025 is characterized by the growing presence of autonomous agents that collaborate with humans in managing complex workflows. These agents act independently but augment human capabilities by handling routine or data-heavy tasks, which frees human workers to focus on strategic decisions.

Hybrid intelligence systems increasingly combine multimodal AI, blending text, images, audio, and video to deliver more comprehensive insights that were previously unattainable. The trend toward on-device AI and federated intelligence supports privacy and quick decision-making at the edge, expanding hybrid intelligence applications beyond centralized cloud systems.

The rise of specialized open-source AI models is another notable trend that is driving innovation within hybrid intelligence. These models focus on niche areas and democratize access to advanced AI, fostering collaboration and rapid development across domains. Additionally, hybrid cloud solutions are becoming the preferred infrastructure as they balance security, scalability, and cost, supporting the complex needs of hybrid intelligence frameworks.

Growth Factors

The expansion of hybrid intelligence is primarily fueled by the need to integrate the computational power of AI with human intuition and expertise. This fusion allows organizations to handle complex tasks more efficiently and create new opportunities for innovation.

Increasing investments in AI research and development, alongside widespread digital transformation efforts, are pushing companies to adopt hybrid intelligence solutions. Growing demand for personalized customer experiences and real-time analytics also propels this growth by requiring AI systems that can adapt and learn from human feedback.

Technological advancements in machine learning, natural language processing, and human-in-the-loop systems play a vital role in enabling hybrid intelligence. These technologies improve decision-making accuracy and operational efficiency in sectors such as healthcare, finance, and manufacturing. Moreover, businesses see hybrid intelligence as a way to build ethical and transparent AI practices by combining automation with human oversight, which encourages adoption and trust in AI applications.

Key Market Segments

By Component

- Solutions

- Machine Learning

- Natural Language Processing

- Computer Vision

- Robotics

- Others

- Services

- Consulting

- Integration and Deployment

- Support and Maintenance

By Organization Size

- Large Enterprises

- Small and Medium-Sized Enterprises (SMEs)

By End User

- Healthcare

- BFSI

- Retail and E-commerce

- Manufacturing

- Telecommunications

- Government and Defense

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Growing Demand for Automation and Enhanced Decision-Making

The hybrid intelligence market is driven significantly by the rising demand for automation across various industries. Businesses are increasingly looking to integrate AI capabilities with human expertise to automate routine tasks and improve workflow efficiency.

This adoption aims to free employees from repetitive work, allowing them to focus on higher-value activities like strategy and innovation. The combination of human judgment and artificial intelligence improves decision-making capabilities, especially when handling large volumes of complex data, making operations faster and more accurate.

Furthermore, advancements in machine learning, natural language processing, and cloud-based solutions are making hybrid intelligence more accessible and scalable. These technologies enable real-time data processing and analytics, which help organizations anticipate trends and optimize resources effectively. As a result, many sectors such as healthcare, finance, and manufacturing are incorporating hybrid intelligence to stay competitive and agile in a rapidly evolving market landscape.

Restraint

High Implementation Costs Restrict Adoption

One major restraint slowing the widespread adoption of hybrid intelligence solutions is the high cost associated with implementation. Developing and deploying hybrid intelligence systems requires substantial investments in research and development, advanced computing infrastructure, and specialized software.

Smaller and medium-sized enterprises often find these upfront costs prohibitive, limiting their ability to benefit from these advanced technologies. Additionally, integrating hybrid intelligence into legacy systems adds complexity and further expense. The financial barrier can also extend to hiring and training personnel with the right skills to operate and manage these solutions effectively.

Because the return on investment from hybrid intelligence may take time, many businesses hesitate to commit resources, which in turn slows market growth. Overcoming these costs is essential to unlocking the full potential of hybrid intelligence across different business sizes and industries.

Opportunity

Expansion of Cloud-Based Hybrid Intelligence Solutions

Cloud computing presents a compelling opportunity for the hybrid intelligence market by offering scalable, cost-effective access to AI-powered analytics tools. Cloud platforms allow organizations to leverage hybrid intelligence capabilities without heavy upfront capital investments, thanks to flexible models like pay-per-use and on-demand scalability.

This lowers the entry barrier for companies of all sizes to adopt these technologies and benefit from data-driven insights. Moreover, the ongoing digital transformation initiatives in regions such as Asia-Pacific provide fertile ground for cloud-based hybrid intelligence growth.

Cloud solutions facilitate the integration of diverse data types and support real-time collaboration between human experts and AI systems. These advantages open new avenues for innovation, enabling businesses to improve productivity, customer engagement, and operational agility in ways that were previously difficult or cost-prohibitive.

Challenge

Scarcity of Skilled Workforce and Integration Complexity

A key challenge facing the hybrid intelligence market is the shortage of skilled professionals who possess both domain expertise and technical know-how in AI. Successful implementation depends on the ability to integrate human intelligence with sophisticated AI algorithms, requiring a workforce capable of bridging these two areas.

The talent gap slows the adoption process, especially in regions where AI education and training are still emerging. Additionally, integrating hybrid intelligence platforms with existing IT infrastructure is complex and can disrupt ongoing operations.

Organizations need to overcome technical hurdles such as data compatibility, system interoperability, and ensuring data privacy compliance. These challenges require careful planning and resources, which can deter businesses from embracing hybrid intelligence, even when the potential benefits are clear.

Competitive Analysis

The Hybrid Intelligence Market is supported by major enterprise technology providers such as Adobe, Open Text Corporation, and M-Files. These companies combine machine learning with human-in-the-loop systems to improve document management, content automation, and decision support.

Specialized software developers including ABBYY, Datameer, BellaDati, and Emplifi Czech Republic focus on blending human insight with AI-driven analytics for content classification, customer engagement, and predictive intelligence.

Emerging and niche participants such as Acrolinx GmbH, Ceralytics, CONCURED, Idio Web Services, Knotch, Scoop, Zywave, and Ignite Enterprise Software Solutions, along with other market contributors, offer hybrid intelligence tools for personalization, compliance checking, sales automation, and content intelligence.

Top Key Players in the Market

- ABBYY

- Acrolinx GmbH

- Adobe

- BellaDati

- Ceralytics

- CONCURED

- Datameer

- Emplifi Czech Republic

- Idio Web Services

- Knotch

- M-Files

- Open Text Corporation

- Scoop

- Zywave

- Ignite Enterprise Software Solutions

- Others

Recent Developments

- In 2025, Microsoft and Siemens partnered to build hybrid intelligence solutions for smart manufacturing. Their focus has been on combining industrial IoT systems with AI to improve automation, reduce downtimes, and support faster decision-making on factory floors. The collaboration reflects a broader industry shift toward connected production models that rely on data-driven insights rather than traditional control systems.

- In 2024, IBM launched the IBM Hybrid Intelligence Suite for enterprise use. The platform integrates human expertise with artificial intelligence and machine learning to support complex decision processes in areas like operations, risk, and workflow management. The introduction of this suite signaled rising demand for systems that do not replace human roles but support them with real-time analytical intelligence and adaptive learning capabilities.

Report Scope

Report Features Description Market Value (2024) USD 16.3 Bn Forecast Revenue (2034) USD 134.5 Bn CAGR(2025-2034) 23.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Solutions [Machine Learning, Natural Language Processing, Computer Vision, Robotics, Others], Services [Consulting, Integration and Deployment, Support and Maintenance]), By Organization Size (Large Enterprises, Small and Medium-Sized Enterprises (SMEs)), By End User (Healthcare, BFSI, Retail and E-commerce, Manufacturing, Telecommunications, Government and Defense, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ABBYY, Acrolinx GmbH, Adobe, BellaDati, Ceralytics, CONCURED, Datameer, Emplifi Czech Republic, Idio Web Services, Knotch, M-Files, Open Text Corporation, Scoop, Zywave, Ignite Enterprise Software Solutions, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Hybrid Intelligence MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample

Hybrid Intelligence MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ABBYY

- Acrolinx GmbH

- Adobe

- BellaDati

- Ceralytics

- CONCURED

- Datameer

- Emplifi Czech Republic

- Idio Web Services

- Knotch

- M-Files

- Open Text Corporation

- Scoop

- Zywave

- Ignite Enterprise Software Solutions

- Others