Global Hotel Furniture, Fixtures, and Equipment Market Size, Share, Growth Analysis By Product Type (Furniture, Fixtures, Equipment, Casegoods, Soft Goods, Others), By Material (Wood, Metal, Glass, Plastic, Upholstery, Composite Materials), By Application (Guest Rooms, Lobbies & Reception, Restaurants & Bars, Outdoor Areas, Back-of-House, Others), By Procurement Type (New Construction, Renovation), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 172825

- Number of Pages: 296

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

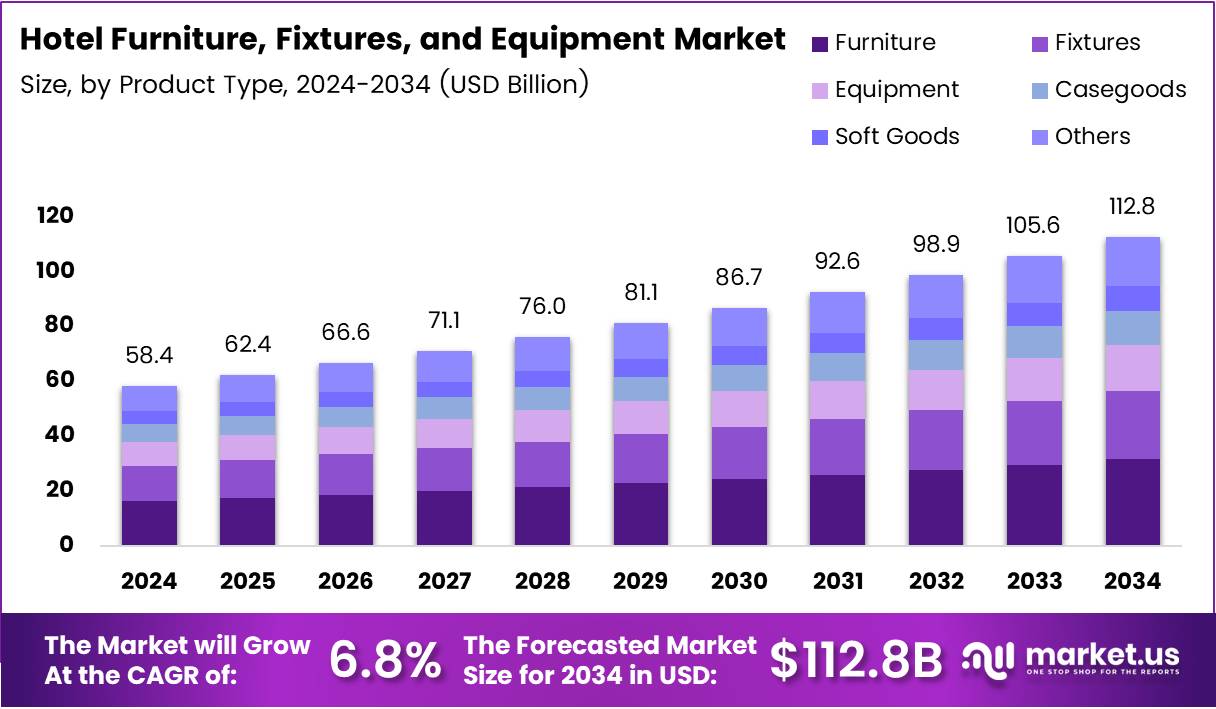

Global Hotel Furniture, Fixtures, and Equipment Market size is expected to be worth around USD 112.8 Billion by 2035 from USD 58.4 Billion in 2025, growing at a CAGR of 6.8% during the forecast period 2026 to 2035.

The Hotel Furniture, Fixtures, and Equipment (FF&E) Market encompasses specialized interior furnishings, decor elements, and operational equipment designed for hospitality establishments. This sector includes everything from guest room beds and lobby seating to lighting fixtures and operational equipment. FF&E represents critical capital investments that directly influence guest experience and brand positioning.

Market expansion reflects the accelerating global hotel construction pipeline and renovation activities. Hospitality operators increasingly prioritize distinctive, functional interiors that enhance guest satisfaction while supporting operational efficiency. This creates sustained demand across furniture, fixtures, and equipment categories.

Branded hotel chains drive standardized procurement models, ensuring consistency across properties. Meanwhile, boutique and independent hotels seek customized solutions that differentiate their guest experience. Both segments fuel market growth through distinct procurement strategies and design philosophies.

Emerging economies witness substantial hospitality infrastructure investments, particularly across Asia Pacific and Middle Eastern markets. Government tourism initiatives and rising business travel support new hotel developments. Additionally, existing properties undergo periodic refurbishment cycles, typically every seven to ten years, maintaining consistent replacement demand.

Sustainability considerations increasingly influence procurement decisions. Hotels adopt eco-certified materials and durable designs that reduce lifecycle costs. Technology integration transforms traditional FF&E into smart, connected solutions that enhance guest convenience and operational management.

According to Hotel Tech Report, approximately 86% of hoteliers have implemented or plan to implement in-room technology offerings as of 2022. Furthermore, 92% of hoteliers reported their guests are more accepting of contactless technology and in-room tech features compared to pre-pandemic levels. These statistics demonstrate shifting guest expectations toward tech-enabled hospitality environments, driving demand for modernized fixtures and equipment.

Key Takeaways

- Global Hotel FF&E Market valued at USD 58.4 Billion in 2025, projected to reach USD 112.8 Billion by 2035 at 6.8% CAGR

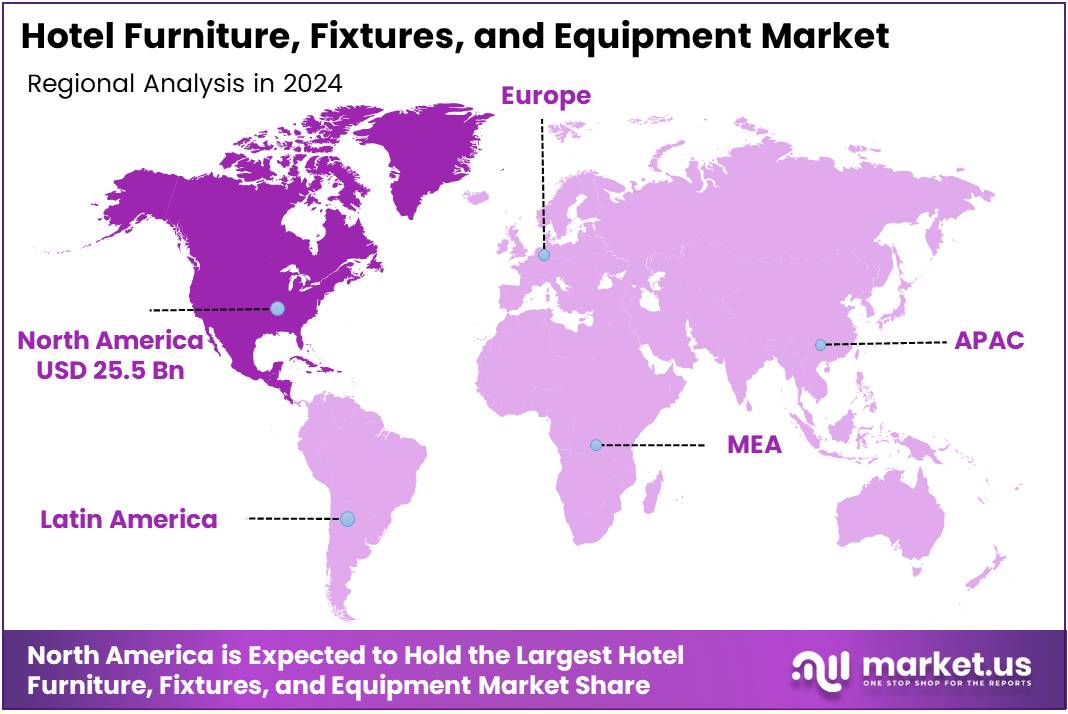

- North America dominates with 43.80% market share, valued at USD 25.5 Billion

- Furniture segment leads Product Type category with 38.9% share

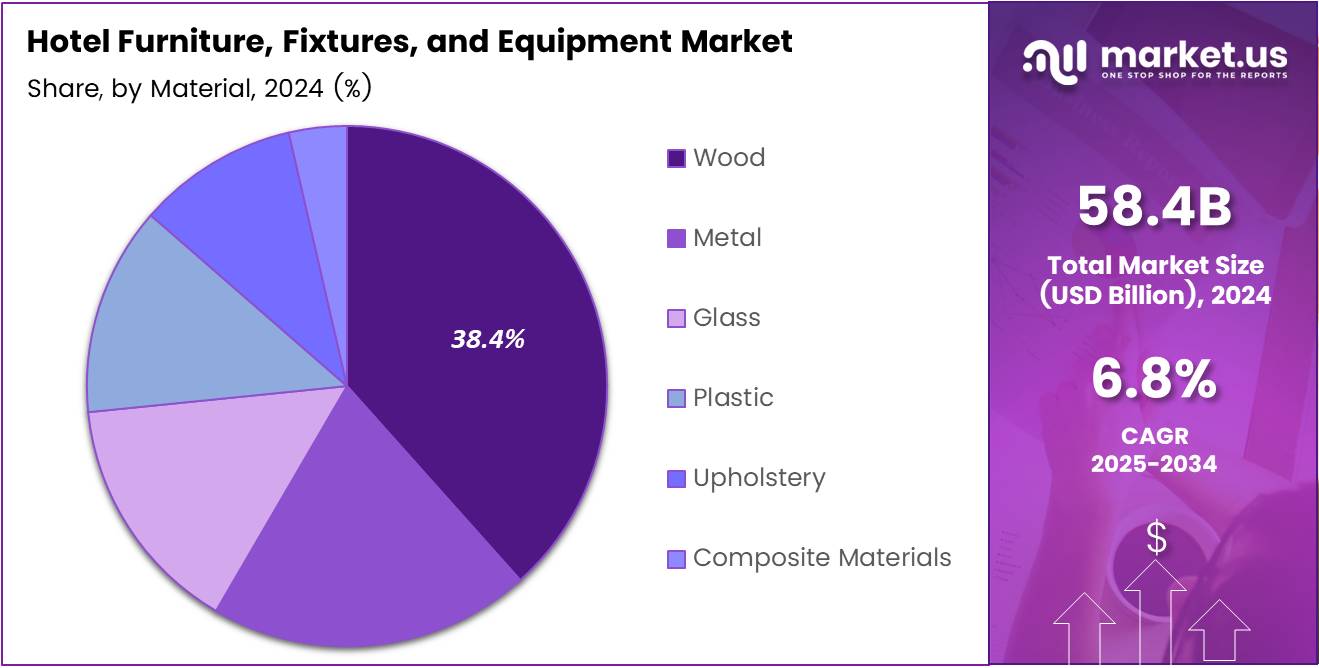

- Wood material holds 38.4% of Material segment

- Guest Rooms application accounts for 48.6% of market demand

- New Construction procurement represents 59.7% of total market

Product Type Analysis

Furniture dominates with 38.9% share due to extensive requirements across all hotel spaces and high replacement value.

In 2025, Furniture held a dominant market position in the By Product Type Analysis segment of Hotel FF&E Market, with a 38.9% share. This category encompasses beds, seating, tables, desks, and storage solutions deployed throughout hotel properties. Guest rooms require complete furniture packages, while public areas demand substantial seating and functional pieces. Hotels prioritize furniture investments as these elements directly impact guest comfort and property aesthetics. Replacement cycles typically span seven to ten years, creating consistent demand patterns across renovation projects.

Fixtures represent permanent or semi-permanent installations including lighting, plumbing elements, and built-in cabinetry. These components integrate with architectural designs and require professional installation. Hotels invest significantly in fixture quality as replacements involve higher labor costs and operational disruptions. Modern fixtures increasingly incorporate energy-efficient technologies and smart controls that reduce operational expenses.

Equipment includes operational items such as minibars, safes, televisions, and housekeeping tools. This segment experiences shorter replacement cycles due to technological advancements and wear from daily use. Hotels regularly update equipment to maintain competitive amenities and meet evolving guest expectations for in-room technology.

Casegoods comprise hard furniture pieces like dressers, nightstands, and desks constructed from wood or composite materials. These items require durability to withstand frequent guest use while maintaining aesthetic appeal. Hotels select casegoods based on design consistency, maintenance requirements, and expected lifespan across multiple refurbishment cycles.

Soft goods encompass textiles including bedding, curtains, upholstery, and decorative pillows. These elements experience the highest replacement frequency due to wear and changing design trends. Hotels refresh soft goods every two to four years to maintain visual appeal and hygiene standards.

Material Analysis

Wood dominates with 38.4% share due to traditional aesthetic preferences and versatile application across furniture categories.

In 2025, Wood held a dominant market position in the By Material Analysis segment of Hotel FF&E Market, with a 38.4% share. Natural wood materials deliver timeless elegance that appeals across hotel categories from luxury to mid-scale properties. Wood offers excellent workability for custom designs while providing durability in high-traffic environments. Hotels value wood for its ability to create warm, inviting atmospheres that enhance guest experiences.

Metal materials provide structural strength and modern aesthetic options for furniture frames, fixtures, and decorative elements. Stainless steel and aluminum resist corrosion in humid environments, making them ideal for bathrooms and outdoor applications. Metal components support contemporary design themes while offering extended lifespans with minimal maintenance requirements.

Glass elements add sophistication and visual spaciousness to hotel interiors through tabletops, partitions, and decorative features. Tempered glass ensures safety while maintaining aesthetic appeal. Hotels incorporate glass strategically to enhance natural light distribution and create modern, upscale atmospheres in lobbies and public spaces.

Plastic materials offer cost-effective solutions for outdoor furniture, housekeeping equipment, and select fixtures. Modern plastics provide weather resistance and easy maintenance for pool areas and terraces. Advanced polymers deliver improved durability and aesthetic finishes that support various design applications.

Upholstery fabrics and materials define comfort levels and visual character across seating and bedding applications. Performance fabrics withstand commercial use while resisting stains and wear. Hotels select upholstery based on durability ratings, cleaning requirements, and alignment with brand aesthetics.

Composite materials combine multiple substances to optimize strength, weight, and cost characteristics. Engineered wood products and fiber-reinforced plastics offer consistent quality and sustainable alternatives to solid materials. These innovations support eco-friendly procurement while maintaining performance standards.

Application Analysis

Guest Rooms dominate with 48.6% share due to high furniture density per room and property-wide scale requirements.

In 2025, Guest Rooms held a dominant market position in the By Application Analysis segment of Hotel FF&E Market, with a 48.6% share. Each guest room requires complete furniture packages including beds, seating, work surfaces, storage, and lighting fixtures. Hotels with hundreds of rooms create substantial demand volumes for standardized yet quality FF&E solutions. Guest satisfaction directly correlates with room comfort and aesthetics, driving continuous investment in superior furnishings.

Lobbies and Reception areas serve as critical first impression spaces requiring premium furniture and fixtures. These zones feature substantial seating arrangements, reception desks, and decorative elements that communicate brand identity. Hotels allocate significant budgets to lobby FF&E as these spaces influence guest perceptions and booking decisions.

Restaurants and Bars require specialized furniture combining durability with ambiance creation. Dining chairs, tables, and bar fixtures must withstand intensive daily use while supporting various service styles. Hotels invest in distinctive F&B area furnishings to create memorable dining experiences that drive ancillary revenue.

Outdoor Areas including pool decks, terraces, and gardens demand weather-resistant furniture and fixtures. These spaces extend hotel amenities and require materials that endure environmental exposure. Resort properties particularly emphasize outdoor FF&E to maximize guest enjoyment of natural settings.

Back-of-House areas require functional, durable equipment and furniture for staff operations. Housekeeping storage, administrative offices, and service corridors need cost-effective solutions that support operational efficiency. Though less visible, these investments ensure smooth daily operations and staff productivity.

Procurement Type Analysis

New Construction dominates with 59.7% share due to complete FF&E requirements and expanding global hotel development pipelines.

In 2025, New Construction held a dominant market position in the By Procurement Type Analysis segment of Hotel FF&E Market, with a 59.7% share. New hotel properties require comprehensive furniture, fixture, and equipment packages across all functional areas simultaneously. Developers coordinate large-scale FF&E procurement during construction timelines, creating substantial order volumes. Emerging markets particularly drive new construction demand as hospitality infrastructure expands to accommodate growing tourism and business travel.

Renovation procurement addresses periodic updates required for existing hotel properties to maintain competitiveness. Hotels typically undertake major renovations every seven to ten years, replacing worn furnishings and updating designs to current trends. Renovation projects may focus on specific areas like guest rooms or public spaces, creating targeted FF&E demand. Properties in mature markets generate consistent renovation activity as operators refresh aging assets and rebrand properties.

Key Market Segments

By Product Type

- Furniture

- Fixtures

- Equipment

- Casegoods

- Soft Goods

- Others

By Material

- Wood

- Metal

- Glass

- Plastic

- Upholstery

- Composite Materials

By Application

- Guest Rooms

- Lobbies & Reception

- Restaurants & Bars

- Outdoor Areas

- Back-of-House

- Others

By Procurement Type

- New Construction

- Renovation

Drivers

Rapid Expansion of Global Hotel Construction and Renovation Pipelines Drives Market Growth

The hospitality sector experiences robust development activity across established and emerging markets. New hotel openings require complete FF&E installations, generating substantial demand volumes. International hotel chains expand their portfolios aggressively, particularly in Asia Pacific and Middle Eastern regions where tourism infrastructure grows rapidly.

Existing properties undergo periodic renovations to maintain brand standards and guest appeal. Hotels typically refresh interiors every seven to ten years, creating predictable replacement cycles. Major metropolitan areas see continuous renovation activity as properties compete for business and leisure travelers through updated facilities.

Rising guest expectations compel hotels to invest in premium, aesthetically sophisticated interiors. Modern travelers prioritize comfort, design quality, and experiential elements when selecting accommodations. Hotels respond by upgrading furniture and fixtures that deliver distinctive atmospheres and enhanced functionality.

Branded hotel operators implement standardized FF&E procurement models ensuring consistency across properties worldwide. These systems streamline purchasing, maintain quality standards, and reinforce brand identity. Standardization creates efficient supply relationships while supporting rapid portfolio expansion across multiple markets.

Restraints

High Capital Expenditure and Long Replacement Cycles Limit Market Growth

Hotel FF&E represents significant capital investments requiring substantial upfront expenditure. Property owners face budget constraints when balancing FF&E quality against other operational priorities. Initial furniture and fixture purchases for new properties can represent fifteen to twenty percent of total development costs.

Extended replacement cycles mean hotels retain furnishings for seven to ten years before major updates. This longevity reduces annual purchase frequency compared to consumer furniture markets. Economic downturns further delay renovation timelines as operators defer discretionary capital spending during uncertain periods.

Raw material price volatility impacts FF&E procurement budgets and supplier pricing stability. Wood, metal, and petroleum-based materials experience price fluctuations based on commodity markets and supply chain conditions. Manufacturers face margin pressures when input costs rise, potentially limiting product innovation and quality improvements.

Long lead times for custom furniture and fixtures complicate project planning and execution. Hotels coordinating renovations or new openings must order FF&E months in advance to ensure timely delivery. Supply chain disruptions can delay property openings or renovation completions, affecting revenue generation and return on investment timelines.

Growth Factors

Rising Demand for Customized and Brand-Specific Hotel Interior Solutions Creates Opportunities

Boutique and independent hotels increasingly seek distinctive FF&E that differentiates their properties from standardized chain offerings. Customization allows properties to reflect local culture, target specific guest demographics, and create memorable experiences. This trend drives demand for specialized manufacturers and designers offering bespoke solutions.

Sustainability concerns push hotels toward eco-certified furniture and fixtures manufactured from responsibly sourced materials. Green building certifications like LEED require sustainable FF&E specifications. Hotels promote environmental credentials to attract conscious travelers while reducing long-term operational and replacement costs through durable, quality products.

Budget and mid-scale hotel segments expand rapidly, requiring cost-optimized FF&E solutions. These properties balance affordability with acceptable quality and aesthetics to serve price-sensitive travelers. Manufacturers develop streamlined product lines specifically targeting this segment, creating accessible entry points for growing hotel brands.

Resort, wellness, and experiential hospitality concepts gain popularity, requiring specialized furniture and fixtures. Wellness-focused properties need spa-grade furnishings, while adventure resorts require rugged outdoor equipment. These niche segments command premium pricing while driving innovation in materials and design approaches tailored to unique guest experiences.

Emerging Trends

Integration of Smart Furniture and Technology-Enabled Room Equipment Transforms Market Dynamics

Smart furniture incorporating charging ports, connectivity features, and integrated controls becomes standard in modern hotels. Guests expect seamless technology integration supporting their devices and digital lifestyles. Hotels invest in tech-enabled FF&E to meet these expectations while collecting operational data through connected systems.

Modular and flexible furniture designs allow hotels to reconfigure spaces efficiently for different uses. Multi-functional pieces maximize limited square footage in urban properties while supporting diverse guest needs. Space-saving solutions appeal particularly to select-service and compact hotel formats optimizing every available area.

Locally sourced and artisan-inspired furniture gains traction as hotels emphasize authentic, place-based experiences. Properties collaborate with regional craftspeople and manufacturers to create unique pieces reflecting local heritage. This approach supports community relationships while delivering distinctive interiors that resonate with experience-seeking travelers.

Durable, easy-maintenance FF&E with optimized lifecycles attracts operators focused on total cost of ownership. Hotels evaluate furniture based on expected lifespan, cleaning requirements, and repair accessibility. Manufacturers respond with engineered products using performance fabrics, reinforced construction, and replaceable components that extend useful life while reducing ongoing maintenance expenses.

Regional Analysis

North America Dominates the Hotel Furniture, Fixtures, and Equipment Market with a Market Share of 43.80%, Valued at USD 25.5 Billion

North America leads the global Hotel FF&E Market, holding a 43.80% share valued at USD 25.5 Billion. The region benefits from a mature hospitality sector with extensive renovation activity and continuous property upgrades. Major hotel chains headquartered in North America drive substantial procurement volumes through standardized FF&E programs. Strong economic conditions and robust business travel support ongoing investment in hotel infrastructure and interior improvements.

Europe Hotel Furniture, Fixtures, and Equipment Market Trends

Europe maintains significant market presence through historic hotel properties requiring periodic restoration and modernization. The region emphasizes sustainable, high-quality furnishings aligned with stringent environmental regulations. Luxury and boutique hotels proliferate across major European cities, demanding premium FF&E solutions. Tourism growth, particularly in Southern and Eastern European markets, stimulates new hotel development and renovation projects.

Asia Pacific Hotel Furniture, Fixtures, and Equipment Market Trends

Asia Pacific represents the fastest-growing regional market driven by explosive tourism expansion and hospitality infrastructure development. China, India, and Southeast Asian nations invest heavily in hotel construction to accommodate rising domestic and international travel. Growing middle-class populations increase demand for quality accommodations, spurring both budget and premium hotel segments. Regional manufacturers gain prominence by offering competitive pricing and localized design preferences.

Middle East and Africa Hotel Furniture, Fixtures, and Equipment Market Trends

The Middle East demonstrates strong growth through ambitious tourism initiatives and mega-project developments in Gulf Cooperation Council countries. Luxury resort properties and business hotels require premium FF&E meeting international standards. Africa shows emerging potential as tourism infrastructure improves across major destinations. Government investments in hospitality sectors support gradual market expansion despite economic challenges in certain regions.

Latin America Hotel Furniture, Fixtures, and Equipment Market Trends

Latin America experiences steady growth centered on beach resort destinations and major urban centers. Brazil, Mexico, and Caribbean nations attract international hotel brands requiring standardized FF&E packages. Economic volatility creates cyclical demand patterns, with growth concentrated during stable periods. Regional manufacturers serve local markets while international suppliers target premium hotel segments seeking globally recognized quality standards.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Hotel Furniture, Fixtures, and Equipment Company Insights

Kimball International, Inc. maintains a prominent position in the hospitality FF&E sector through comprehensive product portfolios spanning furniture, fixtures, and interior solutions. The company serves major hotel chains and independent properties with design-forward offerings that balance aesthetics with durability. Kimball’s recent launch of updated hospitality furniture lines demonstrates ongoing commitment to innovation and market relevance.

Consolidated Hospitality Supplies specializes in procurement services and FF&E coordination for hotel development and renovation projects. The company provides turnkey solutions managing sourcing, logistics, and installation across multiple vendors and product categories. Their expertise streamlines complex procurement processes for hotel owners and operators, ensuring timely project completion.

Hotel Spec International Inc. focuses on custom FF&E solutions tailored to individual property requirements and brand standards. The company works closely with designers and hotel operators to translate concepts into manufactured products meeting specifications. Hotel Spec International’s experience spans various hospitality segments from select-service to luxury properties.

Benjamin West offers premium furniture and interior solutions targeting upscale and luxury hotel segments. The company emphasizes craftsmanship, material quality, and design sophistication in product development. Benjamin West collaborates with renowned designers to create signature collections appealing to discerning hotel brands. Their manufacturing processes prioritize sustainable materials and ethical sourcing practices aligned with industry sustainability trends.

Key Companies

- Kimball International, Inc.

- Consolidated Hospitality Supplies

- Hotel Spec International Inc.

- Benjamin West

- The Carroll Adams Group, Inc.

- Innvision Hospitality, Inc.

- Beyer Brown

- Avendra, LLC

- Andreu World

- Beltmann Integrated Logistics

Recent Developments

- In March 2025, Kimball International launched the “Fringe 2.0” and “Connolly 2.0” hospitality furniture lines featuring updated designs and enhanced durability specifications. These collections target mid-scale and upscale hotel segments seeking contemporary aesthetics with commercial-grade construction for high-traffic environments.

Report Scope

Report Features Description Market Value (2025) USD 58.4 Billion Forecast Revenue (2035) USD 112.8 Billion CAGR (2026-2035) 6.8% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Furniture, Fixtures, Equipment, Casegoods, Soft Goods, Others), By Material (Wood, Metal, Glass, Plastic, Upholstery, Composite Materials), By Application (Guest Rooms, Lobbies & Reception, Restaurants & Bars, Outdoor Areas, Back-of-House, Others), By Procurement Type (New Construction, Renovation) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Kimball International, Inc., Consolidated Hospitality Supplies, Hotel Spec International Inc., Benjamin West, The Carroll Adams Group, Inc., Innvision Hospitality, Inc., Beyer Brown, Avendra, LLC, Andreu World, Beltmann Integrated Logistics Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Hotel Furniture, Fixtures, and Equipment MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Hotel Furniture, Fixtures, and Equipment MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Kimball International, Inc.

- Consolidated Hospitality Supplies

- Hotel Spec International Inc.

- Benjamin West

- The Carroll Adams Group, Inc.

- Innvision Hospitality, Inc.

- Beyer Brown

- Avendra, LLC

- Andreu World

- Beltmann Integrated Logistics