Global Hospital Acquired Infection Control Market By Type (Equipment, Services and Consumables) By End-user (Hospitals and Intensive Care Units (ICUs), Ambulatory Surgical, Diagnostic Centers and Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Industry Trends, and Forecast 2023-2032

- Published date: Nov 2023

- Report ID: 64490

- Number of Pages: 277

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

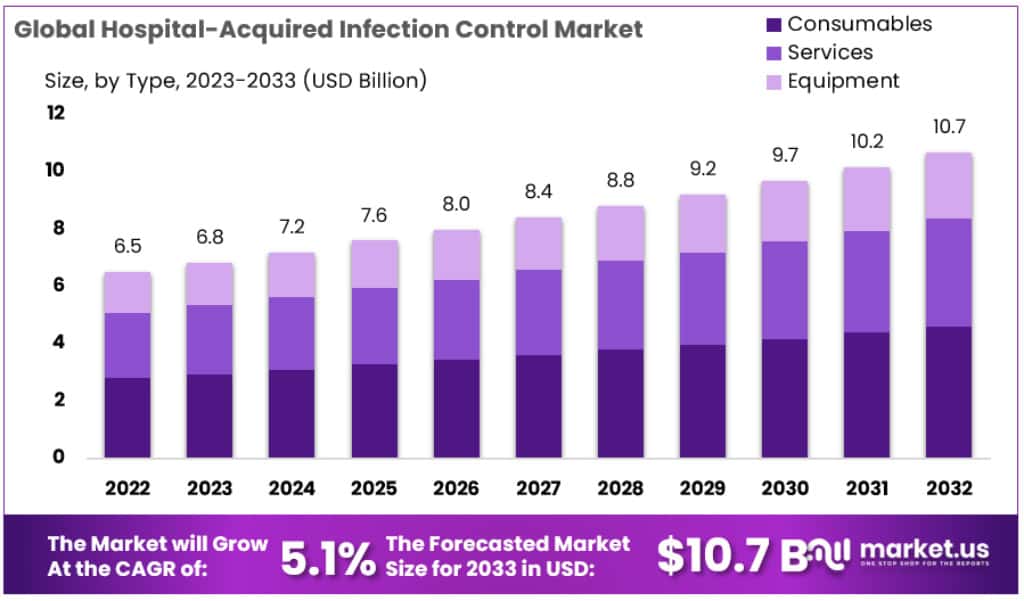

The Global Hospital Acquired Infection Control Market size is expected to be worth around USD 10.7 Billion by 2032, from USD 6.5 Billion in 2022, growing at a CAGR of 5.1% during the forecast period from 2023 to 2033.

Hospital-acquired infections, also known as healthcare-associated infections (HAI), are infections that patients acquire while receiving treatment at a healthcare facility, such as a hospital, or from a healthcare professional, such as a doctor or nurse. These infections can be caused by bacteria, viruses, fungi, or other pathogens and can affect different parts of the body, such as the bloodstream, lungs, skin, urinary tract, or digestive tract.

Growing public awareness of Hospital Acquired Infections (HAIs), the necessity of cross-infection prevention, the high prevalence of infectious diseases in healthcare facilities, and supportive initiatives by governments to enhance infection control procedures are all elements contributing to the growth of this market.

The implementation of infection prevention policies and standards at all healthcare levels, including at regional and national levels, as well as the growing use of monitoring instruments, are factors further boosting market expansion prospects.

The rising number of surgical procedures, the high rate of hospital-acquired infections, the rising incidence of chronic diseases, the growing geriatric population, technological advancements in sterilization equipment, and the growing awareness of personal and environmental hygiene are some of the factors that have contributed to the growth of the hospital-acquired infection control market.

Key Takeaways

- The Hospital Acquired Infection Control Market is expected to reach approximately USD 10.7 billion by the year 2032, up from USD 6.5 billion in 2022.

- This market is projected to experience a Compound Annual Growth Rate (CAGR) of 5.1% during the period from 2023 to 2033.

- Consumables, such as gloves, gowns, and masks, dominate the market with a share of over 48.2% in 2023.

- Services related to infection prevention and control consulting and training are expected to register the highest CAGR of 6%.

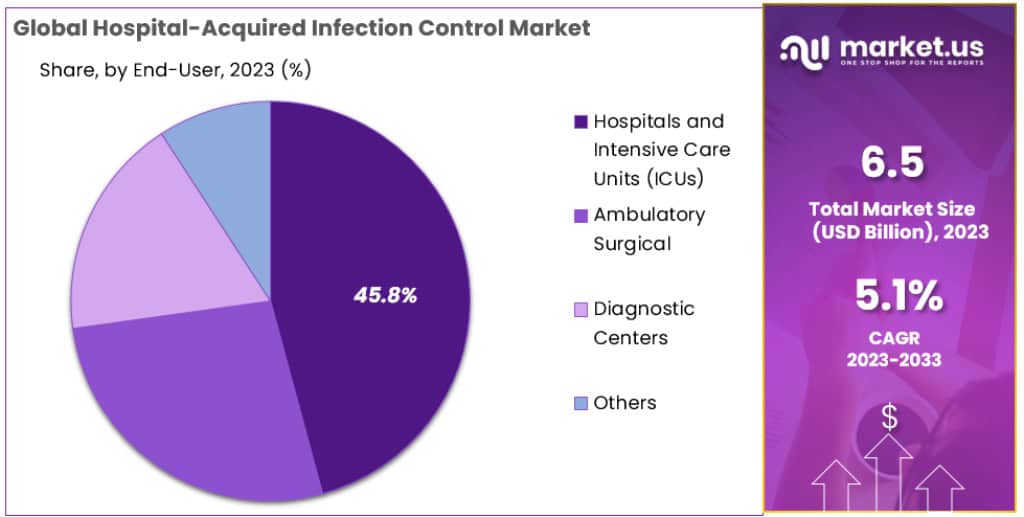

- Hospitals and Intensive Care Units (ICUs) hold a dominant market position with a share of 45.8% in 2023.

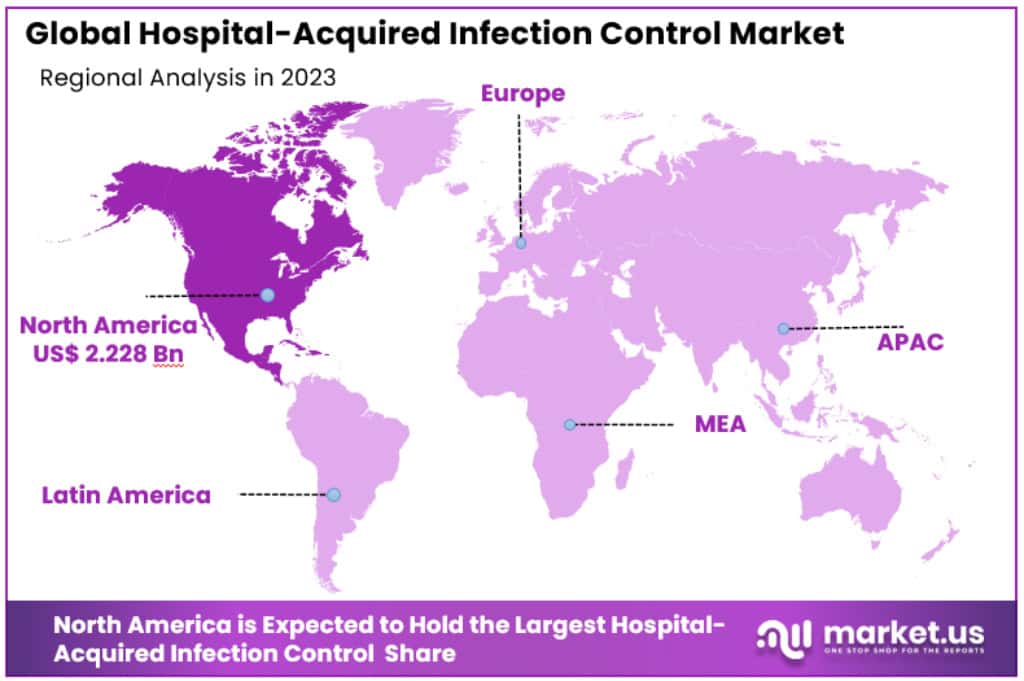

- North America is dominating Hospital Acquired Infection Control Market with 35.2% share, with USD 2.2 Billion in 2023

- The top five companies in the market, including Olympus Corporation and Getinge AB, hold over 50% of the market share, with Olympus Corporation leading with a 15% share.

Type Analysis

In 2023, Consumables held a dominant market position in the Hospital Acquired Infection Control Market, capturing more than a 48.2% share. This segment’s strong performance can be attributed to the high demand for single-use infection control products. These products are essential in preventing the spread of infections within healthcare settings. The consistent requirement for disposables like gloves, gowns, and masks, especially in the wake of global health crises, has significantly driven this segment’s growth.

The Equipment segment also plays a crucial role in infection control in hospitals. This includes a variety of tools and machinery designed to sterilize environments and equipment. The need for advanced sterilization and cleaning equipment is driven by stringent regulations and the growing awareness of infection risks in healthcare settings. While this segment does not hold as large a market share as Consumables, its importance cannot be underestimated, particularly in terms of technological advancements and long-term investments.

Lastly, the Services segment, encompassing infection prevention and control consulting and training, and it is expected to register the highest CAGR of 6%. Hospitals and healthcare facilities increasingly recognize the importance of professional expertise in infection control strategies. This segment’s growth is fueled by the need for continuous training and updating of hospital staff on new protocols and practices, underscoring the dynamic nature of infection control in healthcare environments.

End-User Analysis

In 2023, Hospitals and Intensive Care Units (ICUs) held a dominant market position in the Hospital Acquired Infection Control Market, capturing more than a 45.8% share. This leading position is largely due to the high risk of infection in these settings and the critical need for stringent infection control measures. Hospitals and ICUs, being primary healthcare delivery centers, constantly require advanced infection control solutions to ensure patient safety and prevent the spread of hospital-acquired infections.

The segment of Ambulatory Surgical Centers also forms a significant part of this market. These centers focus on providing outpatient surgical care, where infection control is crucial to prevent post-surgical complications. The growing number of surgical procedures performed in these settings has elevated the demand for effective infection control measures, contributing notably to the market’s expansion.

Diagnostic Centers, another vital segment, have experienced an increased need for infection control solutions. The frequent use of diagnostic equipment by multiple patients necessitates rigorous disinfection and sterilization practices to prevent cross-contamination. This need has been magnified by the growing volume of diagnostic tests and the rising awareness of infection risks in such environments.

The ‘Others’ category, encompassing various healthcare facilities like long-term care units and rehabilitation centers, also contributes to the market. While these settings may have different operational dynamics compared to hospitals or surgical centers, the fundamental requirement for infection control remains a unifying factor, underscoring the diverse applications of infection control solutions across the healthcare spectrum.

Key Маrkеt Segments

By Type

- Equipment

- Services

- Consumables

By End-User

- Hospitals and Intensive Care Units (ICUs)

- Ambulatory Surgical

- Diagnostic Centers

- Other End-Users

Driver

Growing Surgical Procedures

The increase in surgical procedures globally is a key driver for the Hospital Acquired Infection Control Market. A significant factor is the rising number of lifestyle-related diseases and an aging population, leading to more surgeries. The World Health Organization reported in 2019 that around 235 million major surgeries are performed annually worldwide. This surge in surgeries necessitates a higher demand for sterilized surgical equipment and medical devices, boosting the market for hospital-acquired infection control services.

Restraint

Safety Concerns with Reprocessed Instruments

Reprocessing reusable medical devices, such as surgical forceps and endoscopes, is cost-effective and reduces waste. However, safety concerns are a major restraint. Inadequate cleaning and sterilization can leave biological debris on these instruments, increasing the risk of surgical-site infections (SSIs). These safety concerns limit the acceptance of reprocessed instruments among healthcare providers.

Opportunity

Ethylene Oxide Sterilization

The reintroduction of ethylene oxide (EtO) sterilization presents a significant opportunity. EtO is effective for sterilizing temperature-sensitive instruments but has been scrutinized for its potential health risks. Despite these concerns, its usage has increased, particularly for sterilizing COVID-19 protective gear. The FDA notes that EtO sterilizes about 50% of devices in the U.S. that require sterilization, representing a significant part of the market.

Challenge

Complexities in Infection Control Procedures

The challenge lies in adequately cleaning, disinfecting, and sterilizing advanced medical devices. Improper procedures can expose patients to HAIs. Complex instruments, like endoscopes, require advanced sterilizers compatible with automated endoscope reprocessors (AERs). The challenge is heightened as hospitals now demand certified sterile processing staff due to the skill-intensive nature of this process.

Trends

Rising Demand for Disinfectants

The disinfectant segment is expected to hold a significant market share. Disinfectants are crucial for eliminating pathogens from objects. The rising incidence of HAIs, an aging population, and an increase in surgical procedures drive the demand for disinfectants. For instance, about 50% of HAIs occur in intensive care units. Additionally, new product launches, like Savlon Surface Disinfectant Spray in 2020, are boosting this segment’s growth.

Regional Analysis

North America

Leading the Hospital Acquired Infection Control Market

In 2023, North America dominates the Market with a significant 35.2% share, amounting to USD 2.2 Billion. This dominance is primarily due to the rising incidence of chronic diseases like cancer and Crohn’s disease, along with an increasing number of hospital-acquired infections. The region’s substantial elderly population, projected to surpass 9.5 million by 2030, further fuels this growth. Elderly patients, more prone to chronic ailments, are at a higher risk of hospital infections, necessitating enhanced infection control measures.

The North American market is also propelled by heightened awareness about infection control protocols and increased healthcare spending. Innovations in infection control technologies, the use of personalized medicines, and cost-effective treatments for hospital-acquired infections contribute significantly to this market growth.

Asia-Pacific

A Region of Lucrative Opportunities

Asia-Pacific presents substantial growth opportunities in the hospital-acquired infection control market. Factors driving this growth include the rising incidence of hospital-acquired infections in emerging economies and an increased adoption of sterilization and disinfection equipment. The region’s focus on R&D, healthcare reforms, and technological advancements in medical device manufacturing plays a crucial role.

Furthermore, the demand for medical nonwoven products, along with increased funding from governmental and non-governmental sectors for infection control awareness, bolsters the market growth. Asia-Pacific’s large population base and leading manufacturers’ efforts to expand their presence in this region are key contributors to the market’s expansion in hospital-acquired infection control.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

The Hospital Acquired Infection Control Market is largely influenced by a few major players, with the top five companies holding over 50% of the market share.

Leading the pack is Olympus Corporation, commanding a 15% share. Known globally for its medical technology, Olympus’ products are integral in numerous healthcare settings. Next is Getinge AB, holding a 12% market share. This Swedish multinational is a key player specializing in medical equipment and solutions.

In third place is Xenex Disinfection Services, with a 10% share. They are renowned for their automated room disinfection services. 3M, a diversified technology company with a wide product range including medical devices, holds the fourth spot with an 8% market share.

Rounding out the top five is STERIS, at 7%. They are a prominent provider of sterilization and infection prevention products and services. The remaining 20% of the market is divided among smaller players like Advanced Sterilization Products, Ecolab, Belimed AG, Kimberly-Clark Worldwide, and others, each contributing to the market dynamics with their unique offerings and services.

Маrkеt Key Players

- Olympus Corporation

- Getinge AB

- Xenex Disinfection Services

- 3M

- STERIS

- Advanced Sterilization Products

- Ecolab

- Belimed AG

- Kimberly-Clark Worldwide

- Other Key Players

Recent Development

- October 2023: BD (Becton, Dickinson and Company) launches the BD Phoenix Automated Microbiology System, a new platform for rapid and accurate identification and antimicrobial susceptibility testing of microorganisms. This system is designed to help hospitals reduce the time to diagnosis and treatment of infections, which can help to improve patient outcomes.

- September 2023: 3M launches the 3M Clean-Coat Surface Protectant, a new coating that can help to prevent the spread of infections in hospitals. This coating is designed to be applied to high-touch surfaces, such as doorknobs and bed rails, and can kill up to 99.9% of bacteria and viruses.

- August 2023: Cantel Medical acquires BioSpora, a developer of hydrogen peroxide-based decontamination systems. This acquisition is expected to strengthen Cantel Medical’s position in the HAIC market.

- July 2023: Stryker launches the Stryker Nexiva Patient Monitoring System, a new system that can help to prevent hospital-acquired infections by monitoring patients for signs of infection. This system can track a variety of patient data, including vital signs, respiratory status, and wound healing.

- June 2023: The Centers for Disease Control and Prevention (CDC) releases new guidelines for the prevention of catheter-associated urinary tract infections (CAUTIs). These guidelines recommend the use of a variety of interventions, including the use of coated catheters and chlorhexidine-gluconate solution for skin antisepsis.

Report Scope

Report Features Description Market Value (2022) USD 6.5 Billion Forecast Revenue (2032) USD 10.7 Billion CAGR (2023-2032) 5.1% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Equipment, Services and Consumables) By End-user (Hospitals and Intensive Care Units (ICUs), Ambulatory Surgical, Diagnostic Centers and Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Olympus Corporation, Getinge AB, Xenex Disinfection Services, 3M, STERIS, Advanced Sterilization Products, Ecolab, Belimed AG, Kimberly-Clark Worldwide And Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the hospital-acquired infection control market growth rate?The Global Hospital Acquired Infection Control Market size is expected to be worth around USD 10.7 Billion by 2032, from USD 6.5 Billion in 2022, growing at a CAGR of 5.1% during the forecast period from 2023 to 2033.

Which are the key players in the hospital-acquired infection control market?Key players in the hospital-acquired infection control market are Olympus Corporation, Getinge AB, Xenex Disinfection Services, 3M, STERIS, Advanced Sterilization Products, Ecolab, Belimed AG, Kimberly-Clark Worldwide And Other Key Players

Hospital Acquired Infection Control MarketPublished date: Nov 2023add_shopping_cartBuy Now get_appDownload Sample

Hospital Acquired Infection Control MarketPublished date: Nov 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Olympus Corporation

- Getinge AB

- Xenex Disinfection Services

- 3M

- STERIS

- Advanced Sterilization Products

- Ecolab

- Belimed AG

- Kimberly-Clark Worldwide

- Other Key Players