Global Heme Protein Market Size, Share Analysis Report By Protein Type (Hemoglobin, Myoglobin, Cytochromes, Peroxidases, Catalases, Nitric Oxide Synthase, Others), By Source (Animal-Based, Plant-Derived), By Application (Pharmaceutical And Drug Discovery, Biotechnology And Research, Food Technology, Clinical Diagnostics, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 165236

- Number of Pages: 198

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

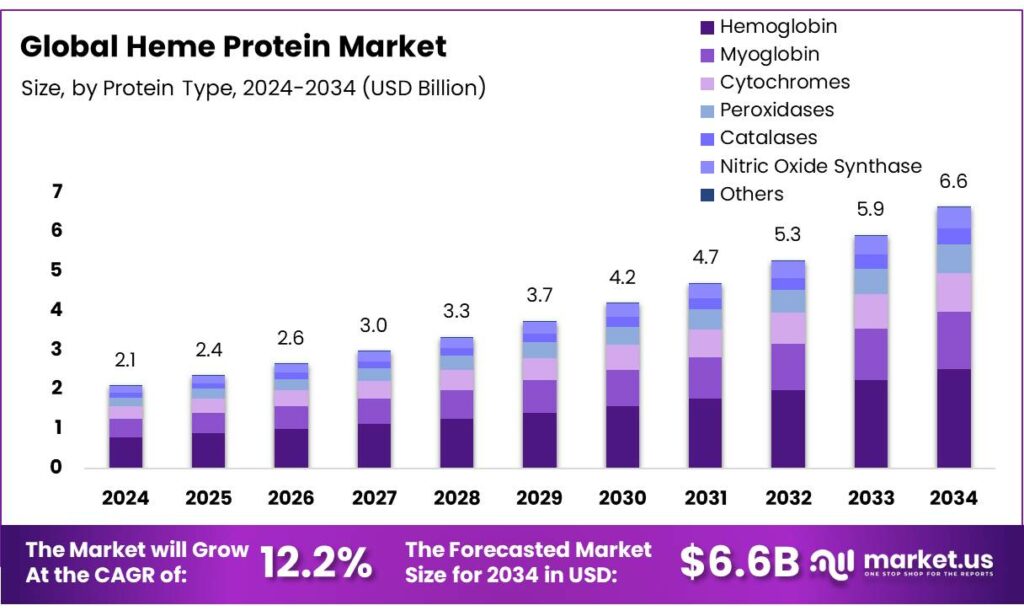

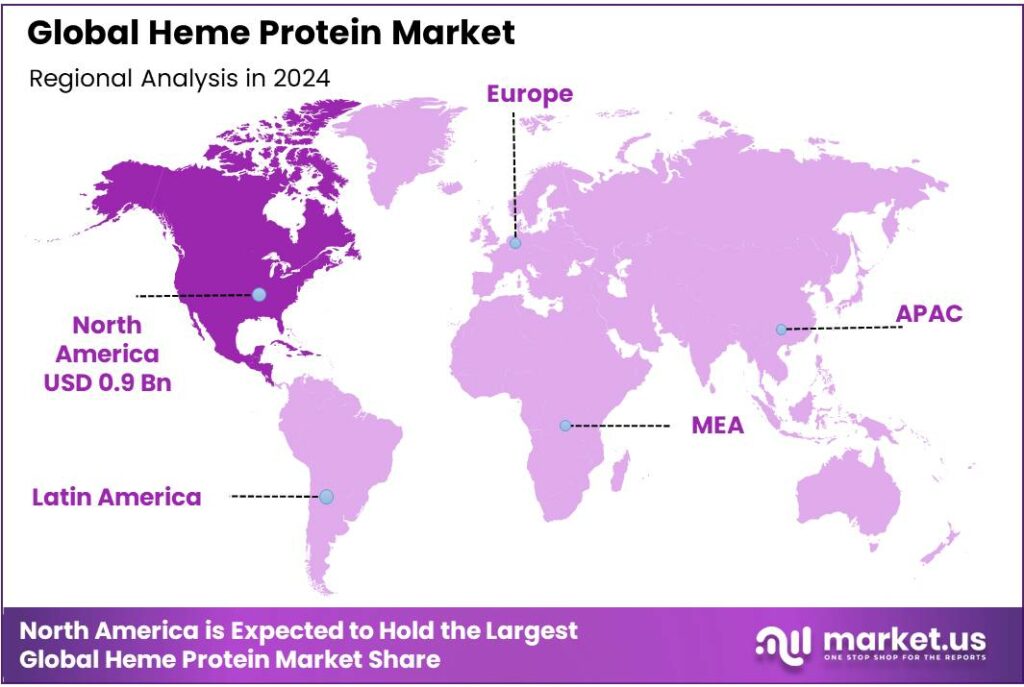

The Global Heme Protein Market size is expected to be worth around USD 6.6 Billion by 2034, from USD 2.1 Billion in 2024, growing at a CAGR of 12.2% during the forecast period from 2025 to 2034. In 2024 Asia-Pacific (APAC) held a dominant market position, capturing more than a 45.9% share, holding USD 1.2 Billion in revenue.

Heme proteins—such as hemoglobin and myoglobin—bind iron-containing heme groups that drive oxygen transport and meat-like flavor chemistry. In modern food applications, “heme protein” commonly refers to soy leghemoglobin (SLH) produced via precision fermentation to deliver aroma precursors and the characteristic “bloody” color in meat analogues. In the United States, FDA amended 21 CFR Part 73 in December 2019 to list soy leghemoglobin as a color additive for ground-beef analogs, capped so that SLH protein does not exceed 0.8% of uncooked product by weight, establishing a clear compliance threshold for formulators.

The industrial landscape is defined by regulatory clarity and scaling biomanufacturing. In June 2024, EFSA’s Panel on Food Additives concluded that SLH from genetically modified Komagataella phaffii “does not raise a safety concern” under the proposed uses—removing key uncertainty for EU market entrants. Singapore, an early mover, instituted a 2019 novel-foods pre-market allowance framework that requires safety dossiers before commercialization, providing process transparency for fermentation-derived heme.

Beyond regulation, the chief operational bottleneck is capacity: addressing precision-fermentation demand at scale has been estimated to require on the order of 6,000 new fermenters across 1,000 biofoundries delivering 2.4 billion liters of capacity by 2040, implying substantial capex and supply-chain coordination.

Agriculture itself represents 11.7% of global emissions, with livestock a major source—intensifying interest in ingredients that deliver meat sensory cues with a lower footprint. At the same time, FAO projects global consumption of meat proteins to rise 14% by 2030 versus 2018-2020, underscoring the need for scalable flavor and color systems that stretch animal protein or substitute for it without sensory compromise. Regulatory precedents also reduce commercialization risk: FDA’s final rule made the SLH color additive authorization effective December 17, 2019, enabling broad US retail deployment.

Energy and climate dynamics reinforce the case for heme protein in meat analogues. Livestock supply chains emit an estimated 7.1 gigatonnes CO₂-eq annually, ~14.5% of anthropogenic greenhouse gases—meaning even marginal displacement via better-tasting alternatives can matter in national mitigation plans. From an energy-systems lens, industry consumes 37% (166 EJ) of global final energy; shifting flavor and color functionality from animal agriculture to controlled fermentation allows operators to site production near low-carbon power and pursue electrification/heat-integration strategies that are harder on farms.

Key Takeaways

- Heme Protein Market size is expected to be worth around USD 6.6 Billion by 2034, from USD 2.1 Billion in 2024, growing at a CAGR of 12.2%.

- Hemoglobin held a dominant market position, capturing more than a 37.8% share of the global heme protein market.

- Animal-Based sources held a dominant market position, capturing more than a 61.4% share of the global heme protein market.

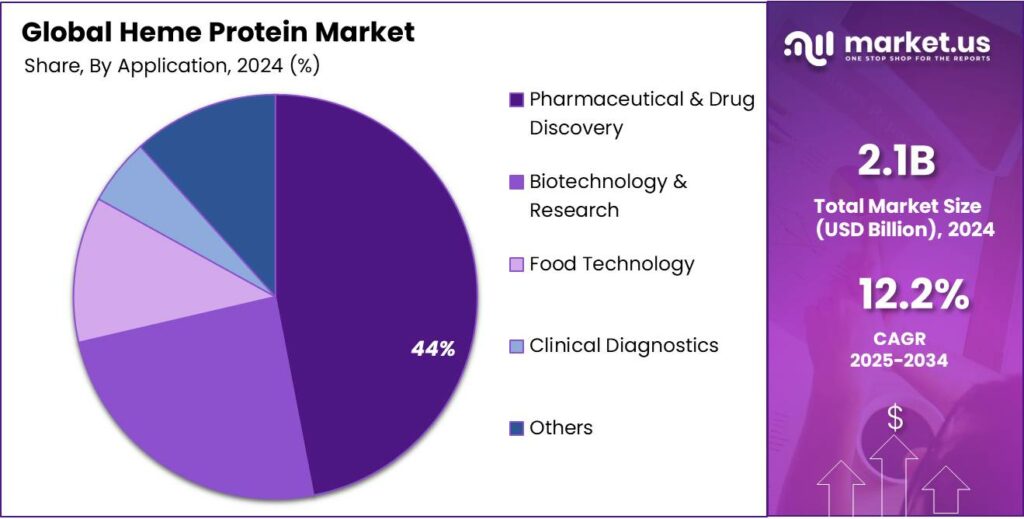

- Pharmaceutical & Drug Discovery held a dominant market position, capturing more than a 44.3% share of the global heme protein market.

- North America emerged as the leading region in the global heme protein market, accounting for 43.9% of total market share, valued at approximately USD 0.9 billion.

By Protein Type Analysis

Hemoglobin leads the Heme Protein Market with 37.8% share in 2024 due to its versatile biological and industrial applications

In 2024, Hemoglobin held a dominant market position, capturing more than a 37.8% share of the global heme protein market. The dominance of hemoglobin is mainly attributed to its crucial role in oxygen transport and its wide use across pharmaceutical, clinical, and food industries. Hemoglobin is extensively utilized in biotechnological research, synthetic biology, and the production of oxygen carriers for medical applications.

The growing emphasis on biomedical innovation and precision biomanufacturing in 2025 continues to strengthen hemoglobin’s market position. Several research programs and healthcare initiatives are advancing the use of recombinant hemoglobin to meet clinical needs, particularly in trauma care and organ preservation. Moreover, food technology companies are exploring plant-based and fermentation-derived hemoglobin to enhance flavor and color in meat alternatives, reflecting a broader trend toward sustainable protein innovation.

By Source Analysis

Animal-Based Source dominates the Heme Protein Market with 61.4% share in 2024 due to its high yield and established processing technologies

In 2024, Animal-Based sources held a dominant market position, capturing more than a 61.4% share of the global heme protein market. This strong lead is driven by the widespread use of animal-derived hemoglobin and myoglobin in pharmaceutical, food, and research applications. Animal-based heme proteins continue to be the preferred choice owing to their high bioavailability, structural similarity to human proteins, and well-established extraction and purification methods. These factors have allowed manufacturers to achieve consistent product quality and stable supply, particularly for clinical diagnostics and oxygen-carrying formulations.

In 2025, the demand for animal-based heme proteins remains strong, supported by ongoing utilization in biopharmaceutical production, clinical testing kits, and food fortification. The global meat processing and biomedical industries continue to provide abundant raw material availability, which sustains their cost advantage over alternative sources. While plant-based and microbial fermentation methods are gaining attention for sustainability, animal-derived heme proteins maintain dominance due to their mature production infrastructure and long-standing regulatory acceptance.

By Application Analysis

Pharmaceutical & Drug Discovery dominates the Heme Protein Market with 44.3% share in 2024 driven by rising biomedical research and therapeutic applications

In 2024, Pharmaceutical & Drug Discovery held a dominant market position, capturing more than a 44.3% share of the global heme protein market. This leadership is primarily attributed to the growing use of heme proteins in developing novel therapeutics, diagnostic assays, and biosensors. Heme-containing proteins, such as hemoglobin and cytochromes, are integral to drug metabolism studies, enzyme catalysis research, and oxygen transport analysis—making them indispensable in early-stage drug discovery and pharmacological testing.

By 2025, the segment’s growth remains steady, supported by increased research funding in life sciences and expanding biopharmaceutical innovation. Many pharmaceutical firms are incorporating heme proteins in high-throughput screening and toxicity testing to better understand cellular mechanisms and drug interactions. Furthermore, advancements in recombinant heme protein production are enhancing the reliability and scalability of these applications.

Key Market Segments

By Protein Type

- Hemoglobin

- Myoglobin

- Cytochromes

- Peroxidases

- Catalases

- Nitric Oxide Synthase

- Others

By Source

- Animal-Based

- Plant-Derived

By Application

- Pharmaceutical & Drug Discovery

- Biotechnology & Research

- Food Technology

- Clinical Diagnostics

- Others

Emerging Trends

Hybrid menus for climate goals: heme protein moves from “niche” to procurement standard

A clear trend is emerging: heme protein is shifting from specialty launches to hybrid and institutional menus that help large buyers hit climate targets without sacrificing taste. Food systems contribute about one-third of global greenhouse-gas emissions, keeping emissions reduction on every retailer and caterer’s agenda. Heme protein enables convincing meat-like color and aroma in plant-based or blended items, so operators can lower “emissions per bite” while protecting familiar dishes. This alignment with climate KPIs is why heme is appearing in school meals, corporate cafeterias, and quick-service pilots rather than only in premium retail aisles.

Policy momentum reinforces the shift. The Global Methane Pledge now counts 159 participating countries and the European Commission, targeting a 30% methane cut by 2030. Because agriculture contributes ~40% of anthropogenic methane and livestock systems alone account for ~32%, procurement teams are under pressure to trim ruminant-linked emissions in their food portfolios. Heme-enabled hybrids are a practical, consumer-friendly lever. Expect more tenders and vendor scorecards that prefer lower-methane menu items where sensory quality is held constant by heme chemistry.

Regulatory normalization is accelerating adoption. In the United States, FDA amended 21 CFR Part 73 to permit soy leghemoglobin (SLH) as a color additive in ground-beef analogs, with a clear cap: SLH protein must not exceed 0.8% of the uncooked product—a bright line that speeds national rollouts and label reviews. In the EU, EFSA’s 28 June 2024 opinion concluded SLH from Komagataella phaffii “does not raise a safety concern” under proposed uses, reducing scientific uncertainty for European launches.

The trend extends beyond burgers. Seafood is a fast-growing canvas for heme-based flavor systems and color stabilization. For the first time on record, aquaculture output of aquatic animals reached 94.4 million tonnes in 2022 and surpassed wild capture, reshaping recipes and supply chains in foodservice. FAO’s 2024 SOFIA notes aquatic food production hit 223.2 million tonnes in 2022, with aquaculture taking a bigger slice of the pie. As operators look for dependable, low-impact seafood formats, heme-enabled analogs and blends can help meet menu demand while managing cost and availability swings.

Drivers

Climate-aligned protein transition is the key driver

The biggest force behind heme protein today is simple: the world needs meat-like taste with a smaller climate footprint. Food systems already account for about one-third of all human-made greenhouse-gas emissions. That share comes not only from farms but also land-use change and the food supply chain. When policymakers and companies look for fast, scalable levers, they see ingredients that can deliver meat aroma, color, and juiciness—without expanding livestock herds. That’s the core space where heme protein fits.

Livestock methane is a particular pressure point. Agriculture produces roughly 40% of human methane, and livestock systems alone are responsible for ~32%. Methane’s strong warming effect over the short term makes it a front-burner target in national climate plans. When retailers and foodservice chains sign climate commitments, they need pathways to shrink enteric methane exposure in their assortments. Heme protein, used in plant-based or hybrid products, helps preserve a familiar meat experience while reducing dependence on ruminants.

Demand fundamentals add urgency. The FAO projects global consumption of meat proteins to rise by 14% by 2030 versus the 2018–2020 baseline. That means we must serve more “meat moments” with fewer emissions per bite. Heme protein enables this by supplying the iron-heme chemistry that drives browning aromas and color in patties, dumplings, and minced dishes. It lets manufacturers stretch animal protein through blends or replace it outright in certain formats—keeping the sensory bar high as volumes grow.

Finally, climate math meets factory math. To materially shift protein supply, precision-fermentation capacity must expand quickly. Governments are responding with targeted R&D and biomanufacturing initiatives, while buyers push for lower-carbon menus. Heme protein acts as a practical bridge: it lets product developers recreate the Maillard-driven flavors consumers expect, while aligning with climate commitments that require deep cuts this decade.

Restraints

Cost and scale hurdles remain a major bottleneck

One of the biggest headwinds for heme protein — and the broader category of meat-analog ingredients that depend on precision fermentation — is the cost and scale challenge. On the production side, building the manufacturing capacity, securing feedstocks and achieving price parity remain hard-wired barriers.

According to the Organisation for Economic Co‑operation and Development (OECD) / Food and Agriculture Organization of the United Nations report “Meat Protein Alternatives” (2022), while these innovations hold promise, “the costs of novel meat alternatives are substantially higher than the conventional meat they seek to substitute” and this limits their short-term impact on food systems.

To put that into numbers: in the U.S. plant-based meat category (which shares many cost-drivers with heme protein applications), the average price premium for plant-based meat and seafood was 77% higher per pound than conventional meat in 2023. In addition, in that same data-set, plant-based meat household penetration in the U.S. dropped from 19% in 2022 to 15% in 2023 — signalling that price and value are restraining adoption.

Another dimension of the scale challenge is supply-chain readiness. The OECD-FAO report emphasises that even if the technology is proven, “commercialisation and adoption of some of these alternatives remain limited by scale.” For a heme protein to be viable globally, production must operate at large volumes and low cost — otherwise it will remain niche or premium. The need for large fermenters, optimized biomanufacturing process flows, downstream separation, and consistency across batches all add risk.

Opportunity

Climate-aligned menu upgrades and seafood analogs are the big opening

Demand fundamentals reinforce the case. The FAO projects global consumption of meat proteins to rise 14% by 2030 versus the 2018–2020 baseline, which means billions more “meat moments” that must be supplied with lower emissions and resilient supply chains. Heme protein lets manufacturers build convincing patties, dumplings, and mince products that stretch animal inputs or replace them outright, supporting volume growth without a matching rise in livestock herds.

Short-term climate priorities add urgency. Livestock systems account for roughly 32% of human-caused methane, a greenhouse gas with high near-term warming impact. Menu swaps toward heme-enabled plant-based or hybrid items offer procurement teams a practical lever to trim methane exposure in corporate and public-sector catering. As governments translate methane pledges into buying standards, products that preserve familiar taste profiles will get the fastest traction—and heme is the enabling ingredient.

Seafood is a second, sizable opening—especially for ready-to-cook and foodservice channels. For the first time in history, global aquaculture output of aquatic animals hit 94.4 million tonnes in 2022 and surpassed wild capture. This rapid shift is reshaping supply, recipes, and consumer expectations. Heme-based flavor systems can anchor convincing seafood analogs and blended products for markets where fish consumption is rising but wild stocks are flat. The same aromatic chemistry that sells “browned beef” helps deliver appealing seafood notes and color stability in plant matrices.

Regulatory clarity is lowering risk and inviting investment. In the United States, FDA amended 21 CFR Part 73 to allow soy leghemoglobin as a color additive in ground-beef analogs, with a cap so that SLH protein does not exceed 0.8% of the uncooked product—a bright line that simplifies compliance and label reviews for national rollouts. In Europe, EFSA’s 28 June 2024 opinion concluded that soy leghemoglobin from Komagataella phaffii “does not raise a safety concern” under the proposed uses, a major step toward broader EU commercialization. Together these actions give R&D teams confidence to scale pilots into retail and QSR programs.

Regulatory clarity is lowering risk and inviting investment. In the United States, FDA amended 21 CFR Part 73 to allow soy leghemoglobin as a color additive in ground-beef analogs, with a cap so that SLH protein does not exceed 0.8% of the uncooked product—a bright line that simplifies compliance and label reviews for national rollouts. In Europe, EFSA’s 28 June 2024 opinion concluded that soy leghemoglobin from Komagataella phaffii “does not raise a safety concern” under the proposed uses, a major step toward broader EU commercialization. Together these actions give R&D teams confidence to scale pilots into retail and QSR programs.

Regional Insights

North America leads the Heme Protein Market with 43.9% share valued at USD 0.9 billion in 2024, driven by advanced biotechnology and pharmaceutical research

In 2024, North America emerged as the leading region in the global heme protein market, accounting for 43.9% of total market share, valued at approximately USD 0.9 billion. The regional dominance is strongly supported by the presence of advanced biotechnology infrastructure, high research investment in life sciences, and the strong foothold of major pharmaceutical and food technology companies across the United States and Canada.

The increasing application of heme proteins in drug discovery, diagnostics, and synthetic biology has positioned North America as a major hub for innovation and commercialization. The United States continues to lead with significant government support through institutions such as the National Institutes of Health (NIH) and National Science Foundation (NSF), which together fund billions of dollars annually toward biomedical and biotechnological research.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Abcam plc – Based in Cambridge, UK, Abcam supplies antibodies, proteins, kits and reagents for life-science research across more than 750,000 researchers worldwide. It posted revenue of £361.7 million for 2022. In August 2023, it agreed to be acquired by Danaher Corporation for approximately US $5.7 billion, reflecting its strong position in the global research-tools market. Abcam’s broad protein portfolio makes it a relevant player in the emerging heme-protein supply chain.

Creative BioMart – Founded around 10 years ago, Creative BioMart offers more than 100,000 protein and antibody products, including recombinant and native proteins, custom expression services and assay kits. Their expertise in recombinant proteins and manufacturing flexibility positions them as a significant supplier in heme-protein research and development applications.

Biomatik Corporation – Founded in 2002 and headquartered in Kitchener, Ontario, Canada, Biomatik has delivered over 72,000 custom-made products and offers more than 29,000 ELISA kits, 14,000 antibodies and 16,000 proteins to more than 10,000 scientists globally. Their scale in custom protein synthesis makes them a capable candidate for specialized heme-protein reagent production or contract services.

Top Key Players Outlook

- Abcam plc

- Creative BioMart

- Biorbyt Ltd.

- Promega Corporation

- BioVision Inc.

- Biomatik Corporation

- Enzo Life Sciences

- Genscript Biotech Corporation

- Novus Biologicals

- Rockland Immunochemicals Inc.

Recent Industry Developments

In 2024 Abcam plc it expects reported revenue of ~£475 million-£525 million, targeting adjusted operating margins of 32%-36% and adjusted EBITDA margins of 42%-46%.

In 2024 BioVision Inc, continues to anchor heme analytics with its Heme/Hemin Colorimetric Assay Kit (K672)—a 100-assay format used on diverse samples; the kit is offered with fluorometric (Ex/Em 535/587 nm) and colorimetric readouts and is widely referenced in lab workflows.

Report Scope

Report Features Description Market Value (2024) USD 2.1 Bn Forecast Revenue (2034) USD 6.6 Bn CAGR (2025-2034) 12.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Protein Type (Hemoglobin, Myoglobin, Cytochromes, Peroxidases, Catalases, Nitric Oxide Synthase, Others), By Source (Animal-Based, Plant-Derived), By Application (Pharmaceutical And Drug Discovery, Biotechnology And Research, Food Technology, Clinical Diagnostics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Abcam plc, Creative BioMart, Biorbyt Ltd., Promega Corporation, BioVision Inc., Biomatik Corporation, Enzo Life Sciences, Genscript Biotech Corporation, Novus Biologicals, Rockland Immunochemicals Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Abcam plc

- Creative BioMart

- Biorbyt Ltd.

- Promega Corporation

- BioVision Inc.

- Biomatik Corporation

- Enzo Life Sciences

- Genscript Biotech Corporation

- Novus Biologicals

- Rockland Immunochemicals Inc.