Healthcare Business Intelligence Market, By Component(Software, and Services), By Mode of Delivery (Cloud-based, On-premise, and Hybrid), By Application (Financial Analysis, Clinical Analysis, Operational Analysis, Patient Care, and Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2024

- Report ID: 102647

- Number of Pages: 350

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

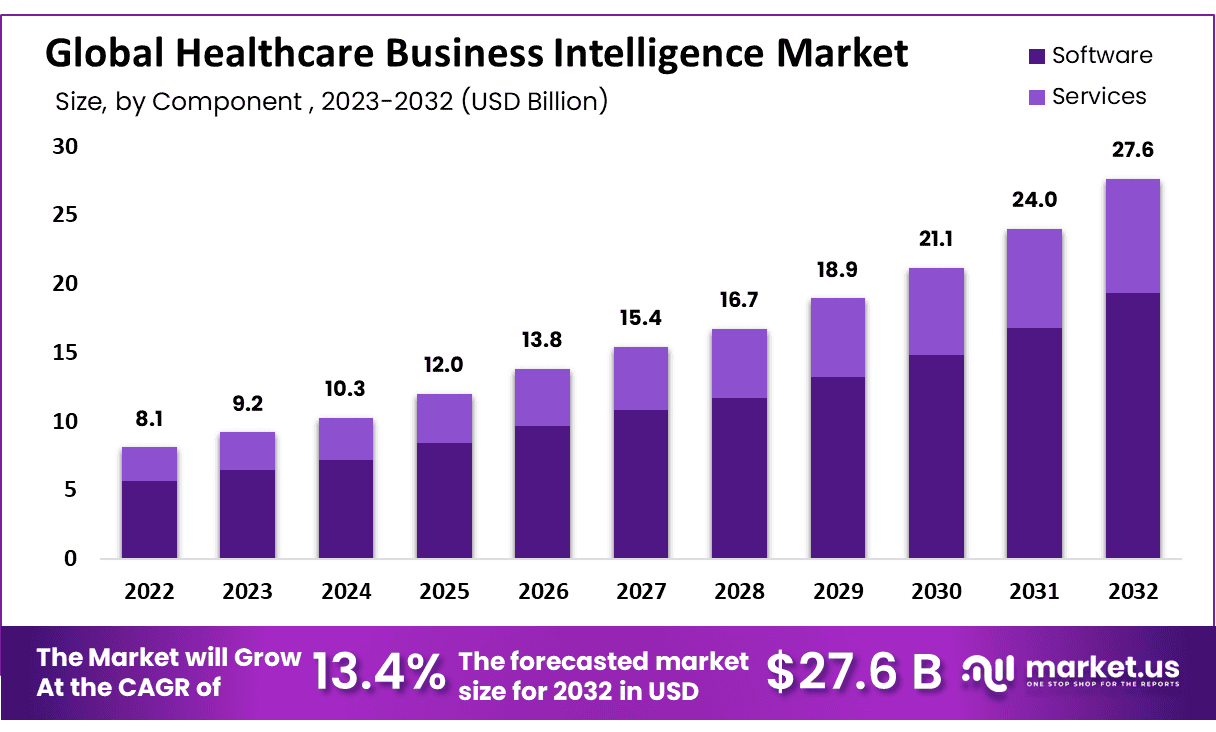

The Global Healthcare Business Intelligence Market size is expected to be worth around US$ 27.6 Billion by 2032, from US$ 8.1 Billion in 2023, growing at a CAGR of 13.4% during the forecast period from 2024 to 2033.

The healthcare business intelligence (BI) sector benefits from greater patient safety, reduced expenses, and higher revenue generation, all of which improve operational and financial performance. Moreover, it ensures improved clinical performance and patient outcomes. The need for BI tools is rising as the healthcare sector transitions to a data-driven environment. Using cloud-based software enables hospitals, healthcare organizations, payers, and producers of life sciences to convert their data into analytical dashboards and graphs, driving the market’s expansion.

The end-user-efficient data-supported decisions may be made using the BI-enabled analytics graphs to save operational costs, improve services, and promote market growth. The market for global healthcare business intelligence is expected to grow, due to the growing need for data mining applications to improve patient care and the need for better claim management solutions in the healthcare sector.

Key Takeaways

- In 2022, the global healthcare business intelligence market was valued at USD 8.1 Billion.

- It’s projected to reach a revised size of USD 27.6 Billion by 2032.

- The market is estimated to register a CAGR of 13.4% between 2023 and 2032.

- The software segment in the BI market contributed to 70% of total revenue in 2022.

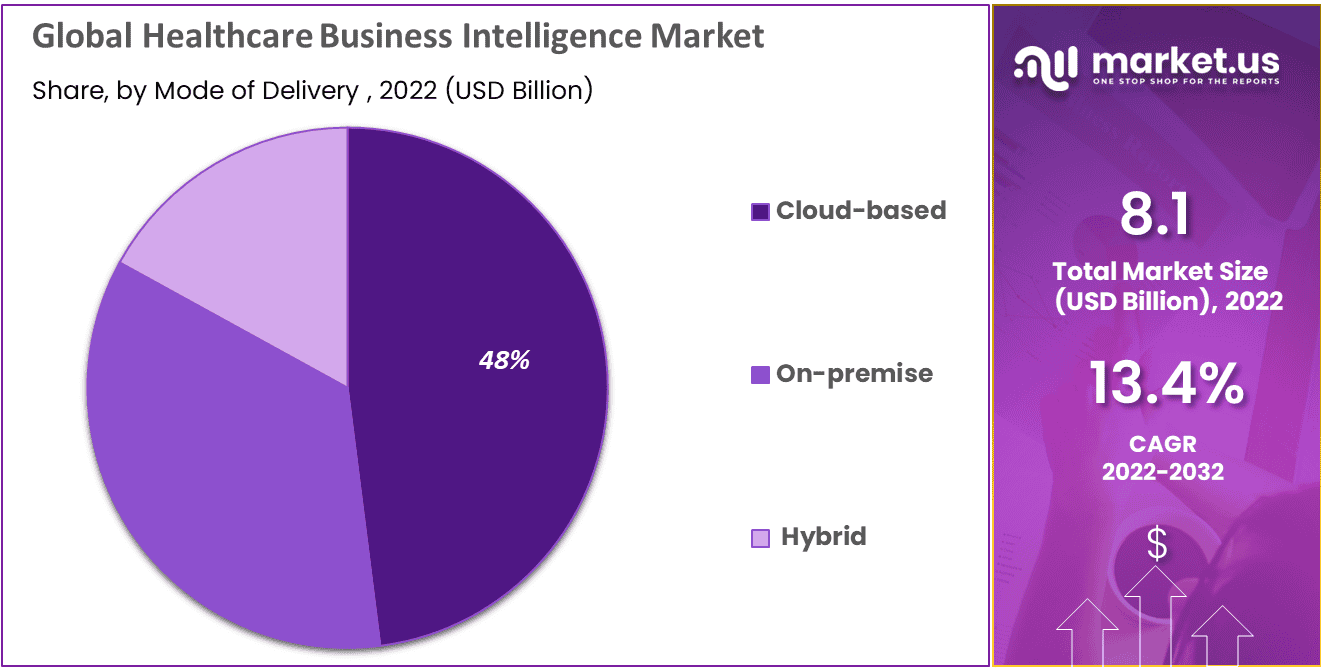

- In 2022, the cloud-based segment of the market held the top position with a 48% revenue share.

- The financial analysis segment dominated the market in 2022 with a 38% revenue share.

- By end-user, the segment that included healthcare payers had the highest revenue share in 2022, at over 40%.

- The global healthcare business intelligence market saw its distribution channels expand in emerging nations due to a large number of COVID-19 patients.

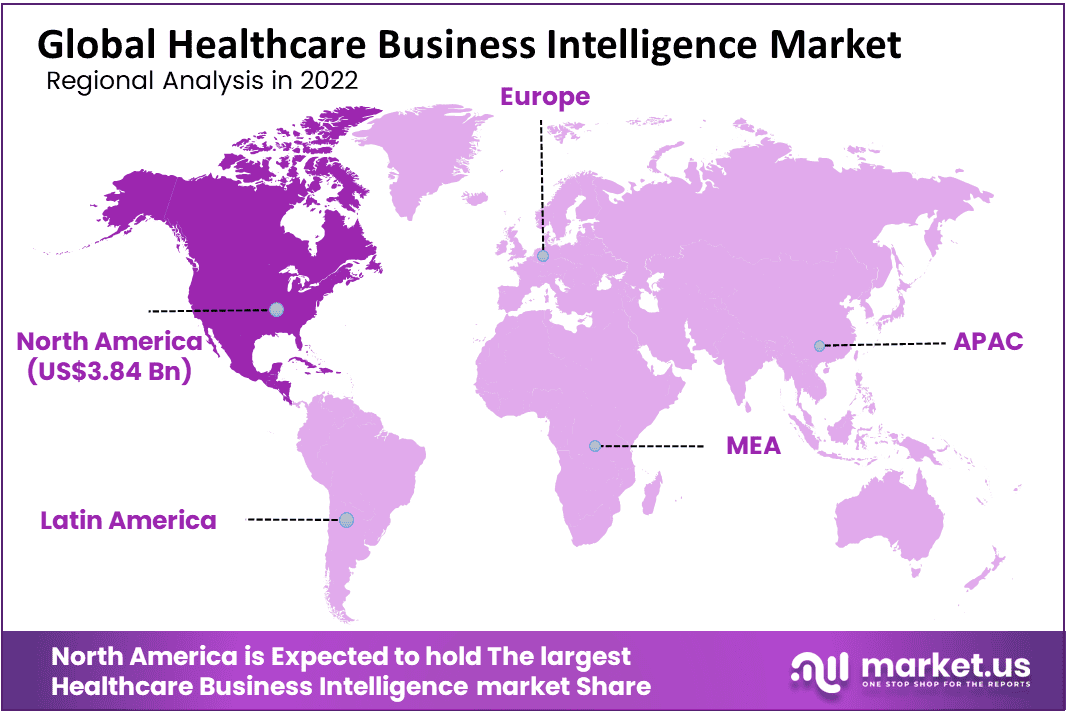

- In 2022, North America held a 47.5% revenue share of the market.

- The fastest growth in the healthcare business intelligence market during the forecast period is anticipated in the Asia-Pacific region.

- The software for healthcare business intelligence is widely used in all aspects of the healthcare sector’s operations.

- Data analytics is used by healthcare business intelligence tools to get accurate results.

Component Analysis

By component, this market is further categorized into software and services. In 2022, the software segment contributed 70% of total revenue. The software for healthcare business intelligence is widely used in all aspects of the healthcare sector’s operations. The business intelligence software enables administrators to monitor important performance that analyses, manages, and aids firms in adapting their performance based on precise data and analytics-based insights.

The real-time sharing of patient data along with the constant evolution of these apps and emphasis on improving patient outcomes are factors in the sector’s growth. Data analytics is used by healthcare business intelligence tools to get accurate results.

In 2022, the healthcare business intelligence market’s services segment will have the fastest growth. The expansion of the category is being driven by factors including the rise in the demand for services in the healthcare sector and the development of business intelligence software. Information technology companies are also providing services for healthcare business intelligence solutions.

Mode of Delivery Analysis

Based on the mode of delivery, this market is further segmented into cloud-based, on-premise, and hybrid. In 2022, the market’s cloud-based segment held the top position with a 48% revenue share. The main drivers of the large share of the sector are the rising need for efficient, user-friendly technology and a higher acceptance rate. The effective and efficient storing of large amounts of data is made possible by cloud computing.

The increasing usage and acceptance of cloud-based healthcare business intelligence solutions are driving the market for business intelligence in the healthcare sector. Healthcare professionals may manage the revenue cycle with the use of cloud-based business intelligence in healthcare, enabling them to give patients the best treatment possible.

By the use of on-premises healthcare business information, healthcare service providers and practitioners may aid in personalizing their needs. This has led to the large-scale adoption of on-premises healthcare business intelligence systems by hospitals and other healthcare facilities.

Application Analysis

By application, this market is further categorized into financial analysis, clinical analysis, operational analysis, patient care, and other applications. In 2022, the market was dominated by the financial analysis segment, which had a 38% revenue share. It includes a variety of capabilities, including administration of costs, cash flow, claims, sales, and profitability.

The expansion of the market is being driven by the providers’ increased usage of financial analytic software for the management of the revenue cycle, risk assessment, and claims processing. In terms of growth, the patient care segment will lead the healthcare business intelligence market in 2022.

The most common use of healthcare business intelligence is in patient care. Effective patient care is the primary goal of hospitals and other healthcare facilities. By examining the patient’s state, healthcare business intelligence also enables clinicians to deliver precise therapy.

End-User Analysis

By end-users, this market is further categorized into healthcare payers, healthcare providers, healthcare manufacturers, and other end-users. The segment that included healthcare payers was the highest revenue share in 2022, at over 40%. The market is expanding as a result of the growing need for provider network optimization, the use of different healthcare BI solutions to effectively save operational costs, and rising payer competition.

Moreover, rising healthcare expenses, along with the need to expand memberships and decrease fraudulent claims, are some of the drivers driving payers to employ healthcare business intelligence solutions. During the duration of the forecast period, the healthcare manufacturers market is anticipated to rise substantially.

The segment’s strong revenue growth is mostly attributable to the vast number of pharmaceutical and medical device manufacturers that are present in both established and emerging economies. Healthcare manufacturers have been using Software as a Service (SaaS) software increasingly as a way to save maintenance and development costs, which is projected to drive segment growth.

Key Market Segments

Based on Component

- Software

- Service

Based on Mode of Delivery

- Cloud-based

- On-premise

- Hybrid

Based on Application

- Financial Analysis

- Clinical Analysis

- Operational Analysis

- Patient Care

- Other Applications

Based on End-User

- Healthcare Payers

- Healthcare Providers

- Healthcare Manufacturers

- Other End-Users

Drivers

Several factors that promote market expansion drive the healthcare business intelligence market. the industry-wide use of innovative, cutting-edge technology, initiatives to conduct research and development, and significant financial investments. With an increase in patients, data is becoming more and more pervasive in the healthcare industry.

The need for healthcare business intelligence solutions is also being driven by the rise in chronic diseases and the healthcare support they need. It offers the sector data-centric strategic systems for storing data and offering useful solutions to users. The increasing need for regulatory compliance has led healthcare organizations to implement BI solutions that can help them manage their compliance requirements.

BI tools can help healthcare organizations track, report, and analyze compliance-related data, such as patient privacy and security, and ensure that they are meeting regulatory requirements. The high cost of healthcare is a major concern for patients, providers, and payers. Healthcare BI can help organizations identify areas where they can reduce costs, such as optimizing resource utilization, improving operational efficiency, and reducing waste.

Restraints

There are several restraints that could impact its growth. Some of these restraints include:

High Cost of Implementation

Implementing a healthcare BI solution can be costly, requiring significant investments in hardware, software, and personnel. This can be a barrier for smaller healthcare organizations that may not have the resources to support such investments.

Data Security and Privacy Concerns

Healthcare data is highly sensitive, and there are strict regulations governing how it can be collected, stored, and analyzed. Healthcare organizations must ensure that their BI solutions are compliant with regulations such as HIPAA to avoid costly fines and reputational damage.

The Complexity of Data Analysis

Healthcare data is often complex and heterogeneous, requiring sophisticated data analysis tools and techniques. Healthcare organizations may struggle to find the right tools and expertise to extract meaningful insights from their data.

Opportunity

Business intelligence in the healthcare industry is generating opportunities for the global healthcare sector to expand. Healthcare business intelligence systems are used to store all patient data. With this information, healthcare professionals may track and keep a close watch on their patients’ health.

Healthcare business intelligence enables providers of healthcare to make informed decisions that will enhance the health of their patients. Advances in artificial intelligence (AI) and machine learning are enabling healthcare organizations to analyze large volumes of data more efficiently. Healthcare BI tools that incorporate AI and machine learning can help organizations identify patterns and trends that might not be apparent using traditional data analysis techniques.

Cloud-based healthcare BI solutions offer several advantages, including scalability, flexibility, and cost-effectiveness. Cloud-based solutions can help healthcare organizations manage and analyze large volumes of data without having to make significant investments in hardware and software.

Trends

The global healthcare business intelligence (BI) market is growing rapidly, driven by a number of key trends, including:

Increasing Adoption of Electronic Health Records (EHRs)

The increasing adoption of EHRs is driving demand for healthcare BI solutions, as healthcare organizations look for ways to manage and analyze large amounts of patient data.

Growing Focus on Data-Driven Decision-Making

Healthcare organizations are increasingly focused on data-driven decision-making, which is driving demand for healthcare BI solutions that can provide real-time data analysis and predictive analytics.

Use of Artificial Intelligence (AI) and Machine Learning

The use of AI and machine learning is becoming more prevalent in healthcare BI solutions, enabling organizations to analyze data more effectively and identify patterns and trends that might not be apparent using traditional data analysis techniques.

Increased Adoption of Cloud-Based Solutions

Cloud-based healthcare BI solutions are becoming more popular, providing healthcare organizations with scalability, flexibility, and cost-effectiveness.

Regional Analysis

In 2022, North America held a 47.5% revenue share of the market. The expansion of the healthcare industry in North America is responsible for the market for healthcare business intelligence increasing. This region’s healthcare industry is significantly implementing business intelligence technologies to support industry growth.

Also, this technology supports the infrastructure of healthcare information technology. A significant number of market participants are also present in the area. The market for healthcare business intelligence in North America is expanding as a result of all of the aforementioned considerations. Throughout the forecast period, the fastest growth is anticipated in Asia-Pacific.

Growing knowledge of business intelligence tools and solutions in the healthcare sector is the primary driver of the Asia-Pacific region’s healthcare business intelligence market growth. The regional market for healthcare business intelligence is also being driven by the government’s continuing efforts to grow the healthcare sector. The government is also making investments to help the market for healthcare business intelligence expand.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Oracle Corporation, SAP, Microsoft, Salesforce, Tableau Software, TIBCO Software Inc., Sisense Inc., Domo, Inc., Looker Data Sciences Inc., and Infor Inc. are major players in the market, as well as QlikTech International AB, and MicroStrategy Incorporated. The market growth is being impacted by leading companies’ wide product portfolios, global footprints, and growing focus on improvements in healthcare business intelligence solutions.

Also, a significant element influencing revenue growth is the creation of mobile-based business intelligence applications by important manufacturers that enable consumers to access high-quality analytic services remotely.

Market Key Players

- Microsoft

- Oracle Corporation

- SAP SE

- Tableau Software Inc.

- Perficient Inc.

- TIBCO Software Inc.

- Infor Inc.

- Domo Inc.

- Sisense Inc.

- Panorama Software Inc.

- SAS Institute Inc.

- QlikTech International AB

- MicroStrategy Incorporated

- BOARD International

- Other Key Players

Recent Developments

- In March 2024: At the HIMSS24 conference, Microsoft revealed a public preview of its new healthcare data solutions integrated into Microsoft Fabric. These solutions are crafted to streamline data from disparate healthcare systems into a single architecture, employing standards like FHIR and DICOM for compliance and leveraging tools such as Azure Synapse Analytics, Azure Machine Learning, and Power BI. This approach is aimed at improving operational efficiency and patient outcomes by enabling better data accessibility and analysis.

- In May 2023: Oracle finalized its acquisition of Cerner, a healthcare IT company, for approximately $28.3 billion. This acquisition is integral to Oracle’s strategy, aiming to modernize and enhance healthcare systems worldwide through advanced cloud-based solutions and is expected to significantly contribute to Oracle’s earnings and growth in the healthcare sector.

- In April 2023: TIBCO Software Inc. completed a significant merger with Citrix Systems Inc., in a deal valued at $16.5 billion. This merger, facilitated by Vista Equity Partners and Evergreen Coast Capital Corp., positions the new entity as a global leader in enterprise software, aiming to enhance their product offerings in cloud and virtualization services. The strategic move aims to broaden their reach and capability in providing mission-critical software solutions across various sectors, including healthcare business intelligence.

Report Scope

Report Features Description Market Value (2022) US$ 8.1 Bn Forecast Revenue (2032) US$ 27.6 Bn CAGR (2023-2032) 13.4% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Component, Mode of Delivery, Application, End-User. Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Microsoft, Oracle Corporation, SAP SE, Tableau Software Inc., Perficient Inc., TIBCO Software Inc., Infor Inc., Domo Inc., Sisense Inc., Panorama Software Inc., SAS Institute Inc., QlikTech International AB, MicroStrategy Incorporated, BOARD International, Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Healthcare Business Intelligence (BI)?Healthcare Business Intelligence refers to the use of data analysis and reporting tools to gain insights and make informed decisions in the healthcare industry.

Why is Healthcare Business Intelligence important?Healthcare BI helps organizations improve operational efficiency, enhance patient care, optimize resource allocation, and identify trends and patterns in healthcare data.

What are the key components of Healthcare Business Intelligence?The key components of Healthcare BI include data integration, data warehousing, data analytics, data visualization, and reporting.

What are the benefits of implementing Healthcare Business Intelligence?Some benefits of Healthcare BI include improved decision-making, enhanced patient outcomes, reduced costs, streamlined operations, and compliance with regulatory requirements.

What are the major applications of Healthcare Business Intelligence?Healthcare BI can be applied in areas such as revenue cycle management, population health management, clinical performance analysis, financial analysis, and quality improvement initiatives.

What are the challenges in implementing Healthcare Business Intelligence?Common challenges in implementing Healthcare BI include data integration from diverse sources, data quality and accuracy, privacy and security concerns, and resistance to change among healthcare professionals.

Healthcare Business Intelligence MarketPublished date: Oct 2024add_shopping_cartBuy Now get_appDownload Sample

Healthcare Business Intelligence MarketPublished date: Oct 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Microsoft

- Oracle Corporation

- SAP SE

- Tableau Software Inc.

- Perficient Inc.

- TIBCO Software Inc.

- Infor Inc.

- Domo Inc.

- Sisense Inc.

- Panorama Software Inc.

- SAS Institute Inc.

- QlikTech International AB

- MicroStrategy Incorporated

- BOARD International

- Other Key Players