Global Hazelnut Chocolate Spread Market Size, Share, Growth Analysis By Product (Conventional, Organic), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Retailers, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 157516

- Number of Pages: 265

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

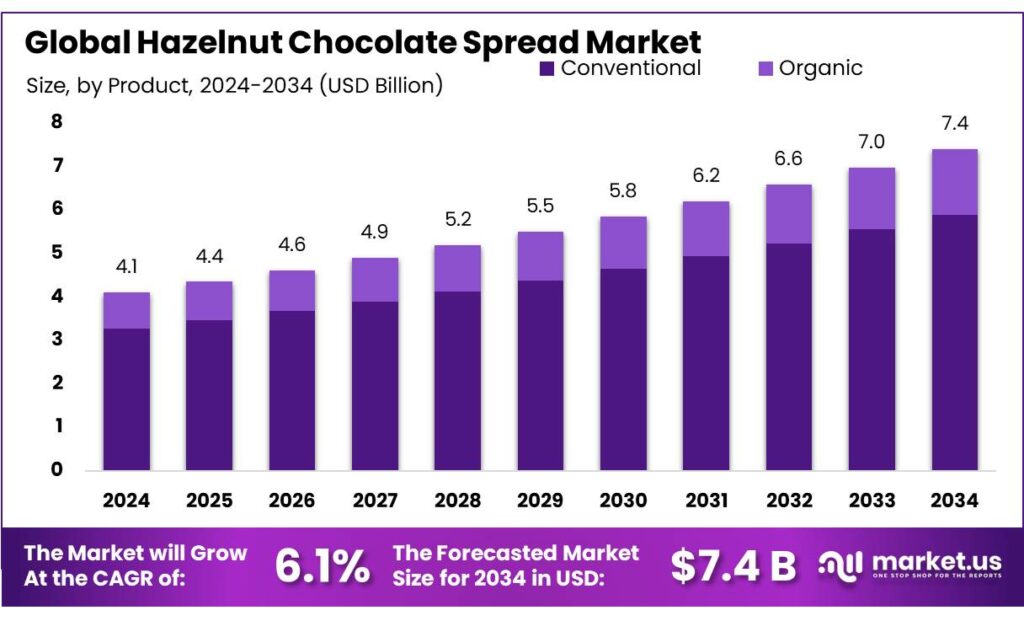

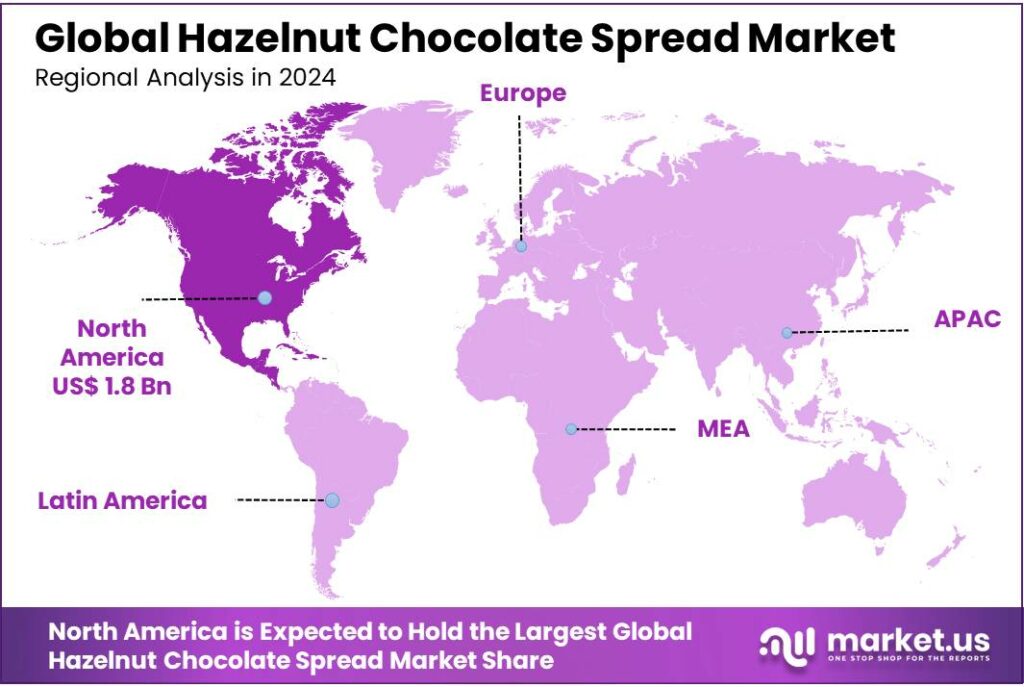

The Global Hazelnut Chocolate Spread Market size is expected to be worth around USD 7.4 Billion by 2034, from USD 4.1 Billion in 2024, growing at a CAGR of 6.1% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 44.8% share, holding USD 1.8 Billion in revenue.

The global hazelnut chocolate spread industry has experienced significant growth, driven by evolving consumer preferences, health trends, and innovation in product offerings. The market’s expansion is further supported by government initiatives aimed at enhancing food processing capabilities and promoting value-added products.

Product innovation plays a crucial role in market growth. For instance, Ferrero, the maker of Nutella, reported an 8.9% increase in revenues for the financial year ending August 31, reaching EUR 18.4 billion ($19.2 billion). The company also increased its investments by 18% to enhance manufacturing capabilities and expand its product range, including ice creams and biscuits. Additionally, Ferrero announced the launch of Nutella Peanut, marking the first new flavor of Nutella in over 60 years, scheduled for release in the U.S. in Spring 2026.

Government initiatives and policies are further supporting the growth of the hazelnut chocolate spread market. For instance, the Ministry of Food Processing Industries (MOFPI) in India has implemented programs such as the Pradhan Mantri Kisan Sampada Yojana (PMKSY) to reduce wastage and enhance value addition in the food processing sector. These efforts aim to achieve the target of a USD 5 trillion economy by 2025, with the food processing sector being a key contributor.

Government initiatives have further supported the industry’s growth. For instance, in Oregon, USA, the state government approved a forgivable loan of $675,000 from Business Oregon’s Strategic Reserve Fund to upgrade equipment and facilities for hazelnut growers, ensuring the continued growth and sustainability of the local hazelnut industry. Such support underscores the importance of governmental backing in fostering industry development.

In response to these market dynamics, companies are innovating to meet consumer demands. For instance, Ferrero North America announced the launch of Nutella Peanut, the first new flavor in over 60 years, combining the classic chocolate-hazelnut spread with roasted peanuts. This product, set to release in Spring 2026, is part of Ferrero’s strategy to cater to North American taste preferences and is supported by a $75 million investment in its Franklin Park factory.

Key Takeaways

- Hazelnut Chocolate Spread Market size is expected to be worth around USD 7.4 Billion by 2034, from USD 4.1 Billion in 2024, growing at a CAGR of 6.1%.

- Conventional hazelnut chocolate spread held a dominant market position, capturing more than a 79.6% share of the global chocolate spread market.

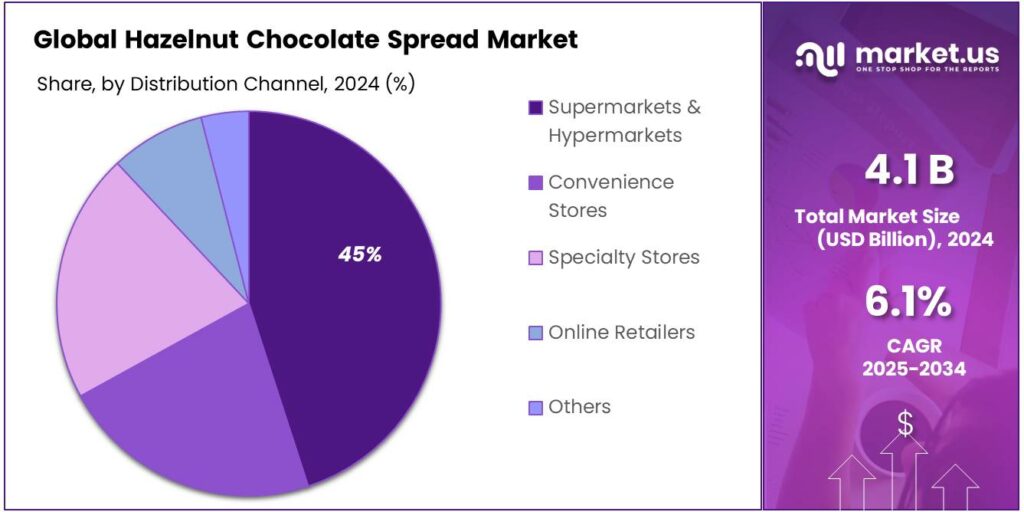

- Supermarkets and hypermarkets held a dominant market position in the global hazelnut chocolate spread market, capturing more than a 45.8% share.

- North America held a dominant position in the global hazelnut chocolate spread market, capturing more than a 44.8% share, translating to approximately USD 1.8 billion.

By Product Analysis

Conventional Hazelnut Chocolate Spread Maintains Market Leadership

In 2024, conventional hazelnut chocolate spread held a dominant market position, capturing more than a 79.6% share of the global chocolate spread market. This segment’s leadership is attributed to its widespread popularity, affordability, and established consumer base. Conventional spreads, often marketed as delightful treats that fit seamlessly into busy lifestyles, are popular for various applications like toppings for bread, pancakes, and desserts. Established brands in the conventional segment benefit from strong brand loyalty and recognition; products like Nutella dominate the market due to their widespread popularity and effective marketing strategies.

Additionally, conventional spreads are typically more affordable than their organic counterparts, making them accessible to a broader consumer base, an important factor during economic downturns when discretionary spending may decrease.

By Distribution Channel Analysis

Supermarkets and Hypermarkets Lead Hazelnut Chocolate Spread Sales

In 2024, supermarkets and hypermarkets held a dominant market position in the global hazelnut chocolate spread market, capturing more than a 45.8% share. This dominance is attributed to their extensive reach, competitive pricing, and the convenience they offer to consumers.

Supermarkets and hypermarkets provide consumers with easy access to both local and international brands, often at competitive prices, which significantly influences purchasing decisions. The wide product variety and frequent promotions available in these retail channels further enhance their appeal.

Key Market Segments

By Product

- Conventional

- Organic

By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Retailers

- Others

Emerging Trends

Premiumization and Artisanal Innovations

The hazelnut chocolate spread market is experiencing a notable shift towards premiumization, driven by consumer demand for higher-quality, artisanal products. This trend is characterized by the introduction of gourmet spreads that emphasize superior ingredients, unique flavor profiles, and sophisticated packaging. Consumers are increasingly seeking indulgent yet high-quality options, leading to the development of spreads that cater to these preferences.

A significant example of this trend is Ferrero’s launch of Nutella Peanut, marking the first new flavor innovation for the brand in over 60 years. This product combines the classic cocoa-hazelnut spread with roasted peanuts, offering a unique twist to the traditional flavor. The introduction of Nutella Peanut reflects Ferrero’s response to evolving consumer tastes and its commitment to innovation in the premium segment.

Similarly, Lindt has expanded its Les Grandes and Creation collections with new offerings such as Hazelnut Wafer and Pistachio Delight. These products feature high-quality ingredients and are positioned as premium options in the market. Lindt’s strategy underscores the growing consumer interest in sophisticated, indulgent chocolate spreads.

Drivers

Health and Wellness Trends

One of the most significant driving factors behind the growth of the hazelnut chocolate spread market is the increasing consumer preference for healthier and more natural food options. As consumers become more health-conscious, there is a noticeable shift towards products that offer nutritional benefits without compromising on taste. Hazelnut chocolate spreads, especially those labeled as organic or containing natural ingredients, are gaining popularity among health-conscious individuals seeking indulgent yet wholesome treats.

The demand for healthier variants of hazelnut chocolate spreads is further supported by consumer preferences for low-sugar, gluten-free, and dairy-free options. Manufacturers are responding to these demands by innovating and introducing products that cater to specific dietary needs, thereby expanding their consumer base. For instance, the introduction of Nutella Peanut by Ferrero North America marks the company’s first new flavor in over 60 years, combining the classic cocoa hazelnut spread with roasted peanuts to appeal to a broader audience.

In addition to consumer preferences, government initiatives and industry standards are also influencing the market dynamics. Regulatory bodies in various regions are implementing stricter guidelines on food labeling and ingredient transparency, encouraging manufacturers to adopt cleaner and more natural formulations. These regulations not only promote consumer trust but also drive the industry towards healthier product offerings.

Restraints

Supply Chain Vulnerabilities and Hazelnut Shortages

The hazelnut chocolate spread industry faces significant challenges due to supply chain vulnerabilities, particularly concerning the sourcing of hazelnuts. Turkey, the world’s largest producer, supplies approximately 70% of global hazelnut demand. However, recent climatic events, such as frost in the Black Sea region, have led to a projected 22% decrease in the 2025 hazelnut crop, from an initial estimate of 750,000 metric tons to about 601,000 metric tons.

This reduction in supply has prompted Ferrero, a major consumer of hazelnuts, to explore alternative sourcing options and adjust production strategies. The company has diversified its hazelnut procurement to include regions like Italy, Chile, and the United States to mitigate risks associated with over-reliance on a single source.

These supply chain disruptions have broader implications for the industry. Manufacturers may face increased production costs, which could lead to higher retail prices for consumers. Additionally, the scarcity of raw materials may necessitate recipe reformulations or product size reductions, as observed with brands like Quality Street and Celebrations, which have reduced their packaging sizes in response to rising input costs.

Addressing these challenges requires a multifaceted approach. Companies are investing in sustainable sourcing practices, such as supporting summer schools for children involved in seasonal hazelnut harvesting, to combat child labor risks in regions like Turkey’s Black Sea area. Furthermore, adherence to regulations like the EU’s Deforestation-Free Supply Chains Regulation is essential for ensuring ethical sourcing and maintaining consumer trust.

Opportunity

Health-Conscious Consumer Trends

Consumers are increasingly seeking indulgent yet health-conscious options. This trend is driving the popularity of organic, low-sugar, and plant-based hazelnut chocolate spreads. For instance, Ferrero’s introduction of Nutella Peanut, combining cocoa-hazelnut spread with roasted peanuts, is a response to this evolving consumer preference.

Government initiatives also support this shift. In India, the Ministry of Food Processing Industries (MOFPI) has implemented programs like the Pradhan Mantri Kisan Sampada Yojana (PMKSY), aiming to reduce food wastage and enhance value addition in the food processing sector. Such initiatives encourage the development of healthier food products, including hazelnut chocolate spreads.

The convergence of consumer demand for healthier options and supportive government policies presents a substantial growth opportunity for the hazelnut chocolate spread industry. Brands that innovate to meet these preferences are well-positioned to capitalize on this trend.

Regional Insights

North America Dominates Hazelnut Chocolate Spread Market with 44.8% Share

In 2024, North America held a dominant position in the global hazelnut chocolate spread market, capturing more than a 44.8% share, translating to approximately USD 1.8 billion in revenue. This leadership is primarily driven by strong consumer demand, established retail infrastructure, and a growing preference for premium and indulgent food products.

Canada and Mexico also contribute to the region’s robust market performance, benefiting from similar trends in consumer behavior and retail expansion. The presence of major chocolate manufacturers and the increasing adoption of online retail platforms are expected to bolster market growth across North America.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The Hershey Company is a significant competitor in the hazelnut chocolate spread market. Known for its premium chocolate products, Hershey expanded into spreads with its Hershey’s Chocolate and Hazelnut spread. The company emphasizes sustainability and quality by using responsibly sourced cocoa and providing a wide range of flavors. With a strong retail presence and brand recognition, Hershey is positioned for continued success in the hazelnut spread sector.

Nestlé S.A. plays a prominent role in the hazelnut chocolate spread market, offering products like its Nescafé Hazelnut Spread. Nestlé focuses on healthy eating trends, with innovations in sugar-free, organic, and reduced-fat options. The company’s global footprint, combined with a strong focus on nutrition and wellness, allows Nestlé to cater to diverse consumer needs, driving its growth in the hazelnut chocolate spread market.

Mondelez International, Inc., a global snack leader, competes in the hazelnut chocolate spread market through brands like Cadbury and BelVita. Mondelez focuses on premium, indulgent offerings that cater to evolving consumer tastes, such as organic and low-sugar alternatives. The company’s strategy includes expanding its product portfolio and leveraging its extensive distribution channels, ensuring strong visibility in supermarkets, hypermarkets, and online platforms.

Top Key Players Outlook

- Ferrero International S.A.

- The Hershey Company

- Nestlé S.A.

- Mondelez International, Inc.

- NUTKAO S.r.l.

- Dr. Oetker

- Pernigotti S.p.A.

- Valsoia

- Rigoni di Asiago

- Lindt & Sprüngli

Recent Industry Developments

In August 31, 2024 Ferrero International S.A, reported a consolidated turnover of €18.4 billion, marking an 8.9% increase from the previous year.

In 2024, Mondelez reported a 5.92% increase in chocolate revenue, reaching $11.25 billion, up from $10.62 billion in 2023.

Report Scope

Report Features Description Market Value (2024) USD 4.1 Bn Forecast Revenue (2034) USD 7.4 Bn CAGR (2025-2034) 6.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Conventional, Organic), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Retailers, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Ferrero International S.A., The Hershey Company, Nestlé S.A., Mondelez International, Inc., NUTKAO S.r.l., Dr. Oetker, Pernigotti S.p.A., Valsoia, Rigoni di Asiago, Lindt & Sprüngli Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Hazelnut Chocolate Spread MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Hazelnut Chocolate Spread MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Ferrero International S.A.

- The Hershey Company

- Nestlé S.A.

- Mondelez International, Inc.

- NUTKAO S.r.l.

- Dr. Oetker

- Pernigotti S.p.A.

- Valsoia

- Rigoni di Asiago

- Lindt & Sprüngli