Global Greenhouse Irrigation Systems Market Size, Share, Growth Analysis By Power Source (Renewable and Non-Renewable), By Product Part (Spinners And Sprays, Micro Sprinklers /Emitters, Regulators, Drip Tape And Drip Lines, Hoses, Valves, and Others), By Crop Type (Vegetables, Flowers And Ornamentals, Fruit Plants, Nursery Crops, and Others), By Application (Misting And Spraying, Drip, Ebb And Flow Bench, Mat, Hand Watering, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034.

- Published date: Nov 2025

- Report ID: 159611

- Number of Pages: 277

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

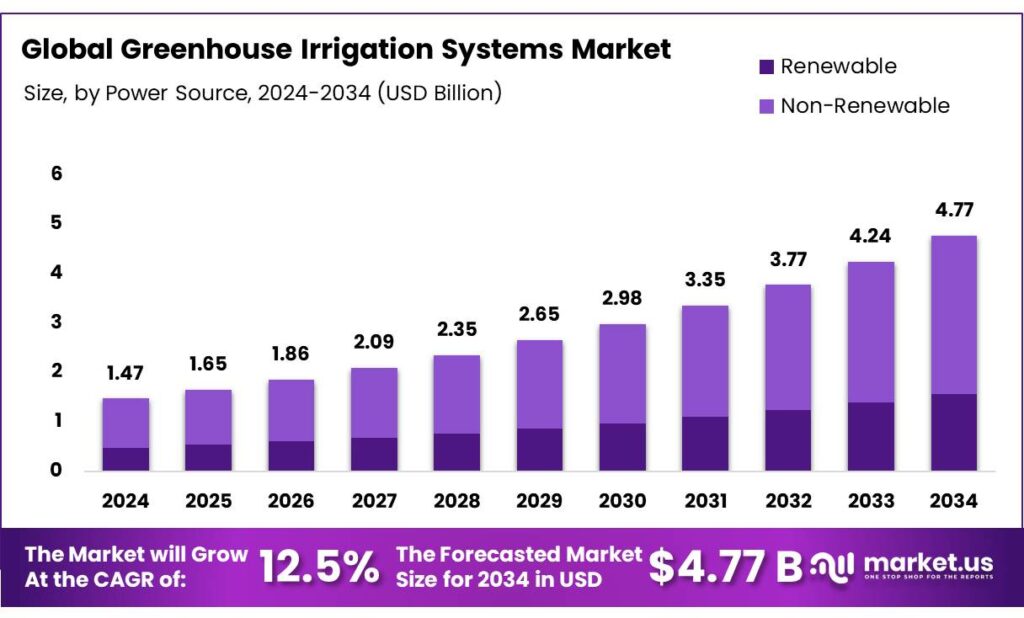

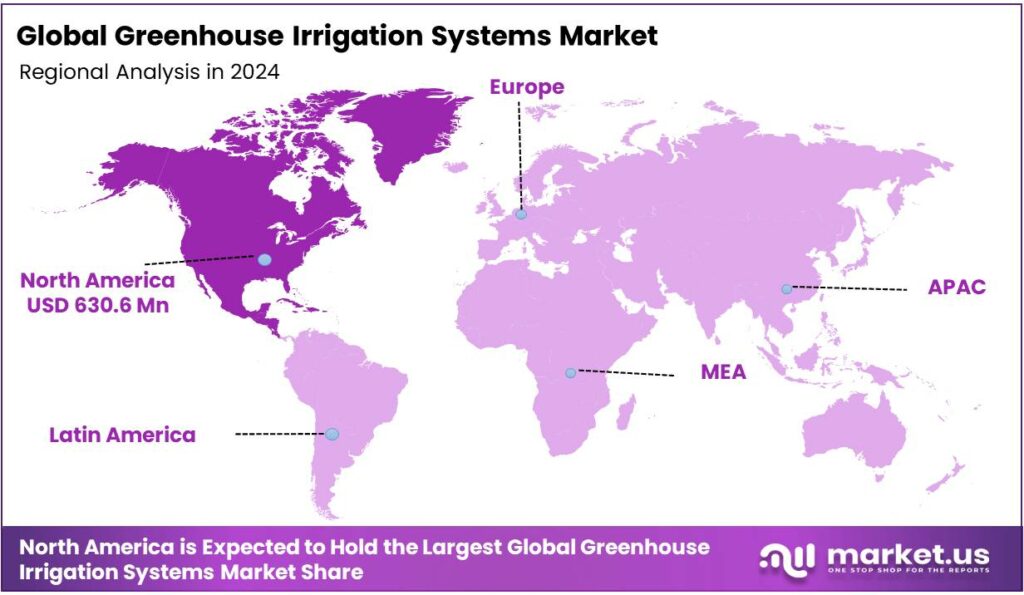

The Global Greenhouse Irrigation Systems Market size is expected to be worth around USD 4.77 Billion by 2034, from USD 1.47 Billion in 2024, growing at a CAGR of 12.5% during the forecast period from 2025 to 2034. In 2024, North America held a dominan market position, capturing more than a 42.9% share, holding USD 456.7 Million revenue.

Greenhouse irrigation systems are automated or manual setups that deliver water and nutrients directly to plant roots, minimizing waste by using methods such as drip lines, overhead sprinklers, or capillary matting. These systems are essential for providing optimal growing conditions within a controlled greenhouse environment, supporting plant health, and improving crop quality and yield.

The major driver of the market is the increasing global population, which leads to demand for food security. As the demand for food security increases, the need for a robust agricultural ecosystem increases. The robust agricultural ecosystem can be formed with precision agriculture, which aims to deliver maximum output with minimum input.

Additionally, in recent years, consumer preference has shifted towards sustainable practices, including farming. Despite the advantages of the irrigation systems, high initial costs and the need for technical expertise during setup might deter consumers from adopting the technology, particularly in the developing regions where capital and knowledge are limited.

- According to the Food and Agriculture Organization (FAO), the global production of primary crops reached 9.9 billion tons in 2023. As agricultural production increases, it creates demand for agricultural tools, including irrigation systems.

Key Takeaways

- The global greenhouse irrigation systems market was valued at US$ 1.47 billion in 2024.

- The global greenhouse irrigation systems market is projected to grow at a CAGR of 12.5% and is estimated to reach US$4.77 billion by 2034.

- On the basis of power source, non-renewable irrigation systems dominated the market in 2024, comprising about 67.3% share of the total global market.

- Based on the parts of the greenhouse irrigation systems, drip tape & drip lines led the market with 31.6% market share.

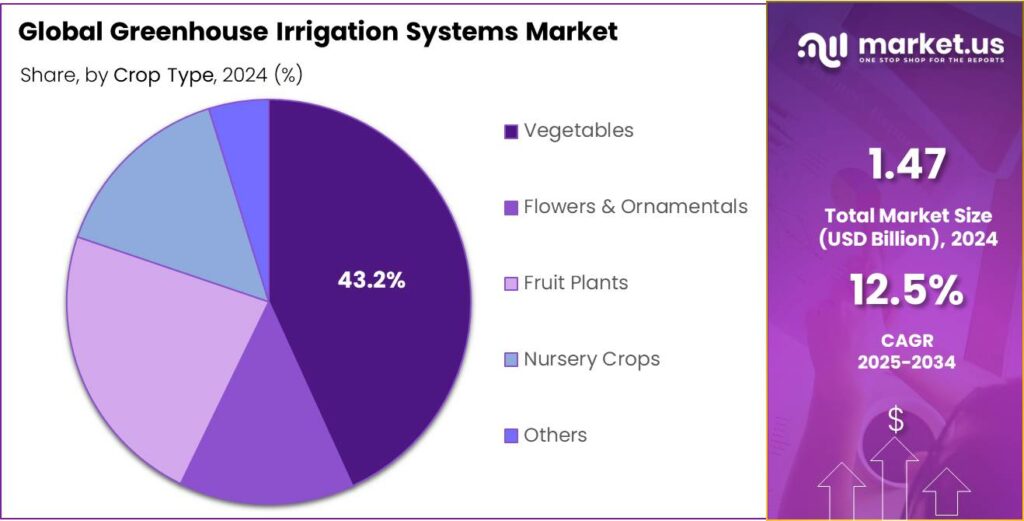

- In 2024, the greenhouse irrigation systems market was being driven by vegetable crops, with approximately 43.2% of the total global market.

- Among the applications of greenhouse irrigation systems, dripping dominated the market in 2024, accounting for around 64.1% of the market share.

- North America was the largest market for greenhouse irrigation systems in 2024, accounting for around 42.9% of the total market share.

Power Source Analysis

Non-renewable greenhouse Irrigation Systems Dominated the Market in 2024.

On the basis of power source, the greenhouse irrigation systems market is segmented into renewable and non-renewable systems. Non-renewable greenhouse irrigation systems dominated the market in 2024 with a market share of 67.3%. Non-renewable greenhouse irrigation systems are more widely utilized than renewable ones primarily due to their lower initial setup costs, widespread availability, and established infrastructure.

Conventional systems, which often rely on electricity from fossil fuels or diesel-powered pumps, are easier to install and maintain, especially in areas lacking access to renewable technologies. Additionally, many farmers and commercial growers are more familiar with these traditional systems, making them the default choice despite their environmental impact. In contrast, renewable systems, such as those powered by solar or wind, require slightly higher upfront investments, technical expertise, and consistent environmental conditions, which can limit their practical adoption.

Product Part Analysis

Drip Tape & Drip Lines Emerged as the Leading Segments in the Greenhouse Irrigation Systems Market.

On the basis of the parts of the system, the greenhouse irrigation systems market is segmented into spinners & sprays, micro sprinklers/emitters, regulators, drip tape & drip lines, hoses, valves, and others. Drip tape & drip lines dominated the market in 2024 with a market share of 31.6%. Drip tape and drip lines are more widely utilized than other greenhouse irrigation components like spinners, sprays, or micro sprinklers because they offer superior water efficiency and targeted delivery directly to plant roots.

This precise irrigation minimizes water wastage and reduces evaporation, making it ideal for controlled environments such as greenhouses. Additionally, drip tape and lines are relatively easy to install, flexible for various crop layouts, and require less maintenance compared to more complex systems such as sprinklers or valves. Their ability to deliver consistent moisture levels helps improve crop health and yields, making them a preferred choice among growers seeking cost-effective and efficient irrigation solutions.

Crop Type Analysis

In 2024, the Greenhouse Irrigation Systems Market was Primarily Driven by Vegetable Crops.

Based on the type of crops, the market is divided into vegetables, flowers & ornamentals, fruit plants, nursery crops, and others. These greenhouse irrigation systems are mainly used for vegetable crops, with around 43.2% of the market share. Vegetable crops are more commonly produced using greenhouse irrigation systems because they typically require precise and consistent water management to achieve optimal growth and yield. Vegetables are often sensitive to water stress and benefit from controlled irrigation that delivers moisture directly to the root zone, enhancing nutrient uptake and reducing disease risk.

Additionally, vegetables usually have shorter growing cycles and higher market demand for quality and uniformity, making efficient irrigation essential. In contrast, crops such as flowers, ornamentals, fruit plants, and nursery crops may have different water needs or longer growth periods, allowing for less intensive irrigation methods. The efficiency and cost-effectiveness of greenhouse irrigation make it especially suited for vegetable cultivation.

Application Analysis

The Major Application of the Greenhouse Irrigation Systems is Dripping.

Based on the applications of greenhouse irrigation systems, the market is divided into misting & spraying, drip, ebb & flow bench, mat, hand watering, and others. These irrigation systems are primarily used for drip applications, with around 34.1% of the market share. Drip irrigation is the major application in greenhouse systems because it delivers water directly to the plant roots with high precision, minimizing water waste and reducing humidity levels that can encourage disease.

Unlike misting or spraying, which wet the entire plant and surrounding air, drip systems provide targeted moisture, promoting healthier root development and more efficient nutrient absorption. Additionally, drip irrigation offers better control over water distribution compared to ebb and flow benching or mat watering, which can be less consistent and may lead to overwatering. Hand watering, while flexible, is labor-intensive and less precise, making drip irrigation the preferred choice for scalable and efficient greenhouse operations.

Key Market Segments

By Power Source

- Renewable

- Non-Renewable

By Product Part

- Spinners & Sprays

- Micro Sprinklers/Emitters

- Regulators

- Drip Tape & Drip Lines

- Hoses

- Valves

- Others

By Crop Type

- Vegetables

- Flowers & Ornamentals

- Fruit Plants

- Nursery Crops

- Others

By Application

- Misting & Spraying

- Drip

- Ebb & Flow Bench

- Mat

- Hand Watering

- Others

Drivers

Increasing Global Population and Food Demand Drive the Greenhouse Irrigation Systems Market.

The rising global population, projected to reach nearly 10 billion by 2050 according to the United Nations, is placing unprecedented pressure on agricultural systems to meet the growing food demand. As arable land becomes increasingly scarce and water resources are more constrained, efficient agricultural practices are increasing in demand. Greenhouse irrigation systems, particularly those that utilize drip and micro-irrigation technologies, offer a sustainable solution by maximizing water use efficiency and supporting high-yield crop production in controlled environments.

These systems minimize water loss due to evaporation and runoff, making them ideal for regions facing water scarcity. For instance, countries such as Israel and the Netherlands have successfully implemented advanced greenhouse irrigation to grow vegetables and fruits year-round, despite limited natural resources. Additionally, the need to ensure food security in densely populated nations such as India and China is accelerating the adoption of such technologies. The combined challenges of population growth and food demand are key drivers behind the increasing adoption of greenhouse irrigation systems worldwide.

Restraints

The Need for High Initial Investments and Technical Expertise Might Hamper the Growth of the Market.

Despite the numerous benefits of greenhouse irrigation systems, their widespread adoption can be hindered by the need for high initial investments and technical expertise. Setting up a modern greenhouse irrigation system often requires significant capital for infrastructure such as automated drip lines, control units, sensors, and water filtration systems. This can be particularly challenging for small and marginal farmers, especially in developing countries, where access to credit and government support may be limited.

Additionally, operating advanced irrigation technologies demands a certain level of technical knowledge. Farmers need to understand system calibration, water pressure management, and data interpretation for sensor-based systems, which can be a barrier in regions with limited access to training or education. Without targeted efforts to reduce costs and enhance capacity-building, this challenge may slow down the market’s potential growth.

Opportunity

Demand for Sustainable Agricultural Practices Creates Opportunities in the Greenhouse Irrigation Systems Market.

The global push toward sustainable agricultural practices is creating significant opportunities in the greenhouse irrigation systems market. The Food and Agriculture Organization (FAO) statistics reveal that agriculture consumes the largest share of freshwater globally, accounting for approximately 70% of total withdrawals. Due to these large numbers, there is a growing urgency to adopt water-efficient technologies. Greenhouse irrigation systems, especially those utilizing precision techniques such as drip and micro-sprinkler irrigation, help conserve water, reduce fertilizer runoff, and minimize energy use, while boosting crop productivity.

These systems align with sustainable development goals by promoting resource efficiency and reducing environmental impact. For instance, in water-scarce regions such as parts of sub-Saharan Africa and the Middle East, farmers are increasingly turning to controlled-environment agriculture using greenhouse irrigation to produce food more sustainably.

Moreover, consumer demand for environmentally responsible food production is pushing growers in developed nations to transition from traditional open-field farming to greenhouse cultivation. This shift is fostering innovation and investment in advanced irrigation solutions designed to support long-term agricultural sustainability.

Trends

Shift Towards Precision Irrigation.

The ongoing shift toward precision irrigation is a key trend shaping the greenhouse irrigation systems market, driven by the need for optimized resource use and improved crop yields. Precision irrigation involves the targeted application of water and nutrients based on plant needs, soil conditions, and real-time environmental data.

According to the International Water Management Institute, precision irrigation can reduce water usage by up to 30-50% compared to conventional methods. In greenhouse settings, this approach enables growers to maintain optimal growing conditions while minimizing waste. There are several companies that develop smart products for precision irrigation.

For instance, Rain Bird Agriculture’s GritX dual seal valve (DSV) and the GritX sub-surface drip irrigation (SDI), which are pressure-compensating heavywall driplines that deliver water directly to the plant while preventing debris from clogging emitters through a self-flushing action.

Similarly, the coastal plains found in Southern Spain’s Provincia de Almeria are home to greenhouses that span 31,000 hectares. These facilities produce 3.5 million tons of fruits and vegetables per year, and represent one of the largest fruit and vegetable providers in Europe. Farmers in this arid region receive only 213 mm of annual rainfall and manage water shortages using smart drip irrigation technology. This shift reflects a broader commitment to sustainability, productivity, and technological innovation in modern agriculture.

Geopolitical Impact Analysis

Geopolitical Tensions Leading to Supply Chain Disruptions in the Greenhouse Irrigation Systems Market.

Geopolitical tensions can significantly impact the greenhouse irrigation systems market by disrupting global supply chains, increasing the cost of raw materials, and creating uncertainty for investors and farmers alike. Many components used in advanced irrigation systems, such as sensors, controllers, filters, and plastic tubing, are sourced internationally. Conflicts or strained trade relations between major manufacturing countries can lead to delays in shipments, price hikes, or shortages of critical parts.

For instance, recent trade tensions between the U.S. and China have affected the availability of microelectronic components essential for smart irrigation systems. Additionally, conflicts in regions such as Eastern Europe and the Middle East can disrupt the supply of energy and petrochemical products used in irrigation infrastructure.

For instance, the Russia-Ukraine conflict and the Hamas conflict have led to doubled prices of energy since early 2022. Sanctions and export restrictions can further complicate cross-border business operations, making it difficult for manufacturers and suppliers to operate smoothly. This geopolitical instability can delay project implementation, increase operational costs, and discourage adoption of greenhouse irrigation technologies, particularly in import-dependent countries.

Regional Analysis

North America was the Largest Market for Greenhouse Irrigation Systems in 2024.

North America held the major share of the global greenhouse irrigation systems market, valued at around US$643.5 million, commanding an estimated 42.9% of the total revenue share. The region has emerged as the largest market for greenhouse irrigation systems, supported by advanced agricultural infrastructure, technological innovation, and a strong focus on resource efficiency. The region is home to a significant number of commercial greenhouses, particularly in the United States and Canada, which produce a wide range of high-value crops with high adoption of technologies such as GPS-guided machinery and variable rate technology (VRT).

Additionally, the region has seen significant adoption of precision agriculture, and numerous precision technologies are now widespread. For instance, according to the United States Department of Agriculture, guidance auto-steering systems on tractors, harvesters, and other equipment were used by 52% of midsize farms and 70% of large-scale crop-producing farms in the country in 2023, up from adoption rates in the single digits in the early 2000s.

Similarly, yield monitors, yield maps, and soil maps were used on 68% of large-scale crop-producing farms. Furthermore, research institutions and government programs across the region promote sustainable farming practices, further accelerating the shift toward efficient greenhouse irrigation. These factors collectively contribute to North America’s leadership position in this evolving market.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The major global participants in the greenhouse irrigation systems market are The Toro Company, Netafim Ltd., Jain Irrigation Systems Ltd., Nelson Irrigation, Micro Grow Greenhouse Systems, Rain Bird Corporation, Valmont Industries, Inc., Rivulis Irrigation, EPC Industries Limited, and Irritec S.p.A.

The Toro Company is a global provider of irrigation solutions and is an active participant in the greenhouse irrigation systems market. The company is known for its commitment to developing innovative solutions, which include its offerings in the irrigation sector.

Netafim invented the drip irrigation revolution and continues to lead in digital farming and integrated irrigation and fertigation systems. The company is dedicated to fighting the scarcity of food, water, and land by enabling sustainable agriculture through resource-efficient irrigation.

Jain Irrigation Systems is a global agri-business conglomerate known for its comprehensive micro-irrigation systems and other agricultural solutions. The company positions itself as a farmer-centric company, focusing its products and services on improving farm productivity and water management.

The major players in the industry

- The Toro Company

- Netafim Ltd.

- Jain Irrigation Systems Ltd.

- Nelson Irrigation

- Micro Grow Greenhouse Systems

- Rain Bird Corporation

- Valmont Industries, Inc.

- Rivulis Irrigation

- EPC Industries Limited

- Irritec S.p.A.

- Other Key Players

Key Developments

- In February 2025, Toro announced an exclusive partnership with Terra Rad to introduce a first-of-its-kind software tool for precision irrigation control. The Spatial Adjust software from Toro integrates exclusively with the Toro Lynx Central Control platform.

- In April 2023, Rivulis Irrigation announced that it had received full regulatory approval for the acquisition of multiple overseas subsidiaries that comprise the International Irrigation Business of Jain Irrigation.

Report Scope

Report Features Description Market Value (2024) US$1.47 Bn Forecast Revenue (2034) US$4.77 Bn CAGR (2025-2034) 12.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Power Source (Renewable, Non-Renewable), By Product Part (Spinners & Sprays, Micro Sprinklers /Emitters, Regulators, Drip Tape & Drip Lines, Hoses, Valves, Others), By Crop Type (Vegetables, Flowers & Ornamentals, Fruit Plants, Nursery Crops, Others), By Application (Misting & Spraying, Drip, Ebb & Flow Bench, Mat, Hand Watering, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape The Toro Company, Netafim Ltd., Jain Irrigation Systems Ltd., Nelson Irrigation, Micro Grow Greenhouse Systems, Rain Bird Corporation, Valmont Industries, Inc., Rivulis Irrigation, EPC Industries Limited, Irritec S.p.A., Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Greenhouse Irrigation Systems MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Greenhouse Irrigation Systems MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- The Toro Company

- Netafim Ltd.

- Jain Irrigation Systems Ltd.

- Nelson Irrigation

- Micro Grow Greenhouse Systems

- Rain Bird Corporation

- Valmont Industries, Inc.

- Rivulis Irrigation

- EPC Industries Limited

- Irritec S.p.A.

- Other Key Players