Global Gout Therapeutics Market By Drug Class (NSAIDs, Corticosteroids, Colchicine, and Urate-Lowering Agents), By Disease Condition (Acute Gout, and Chronic Gout), By End-User (Hospitals, Clinics, and Home Care Setting), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 64332

- Number of Pages: 393

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

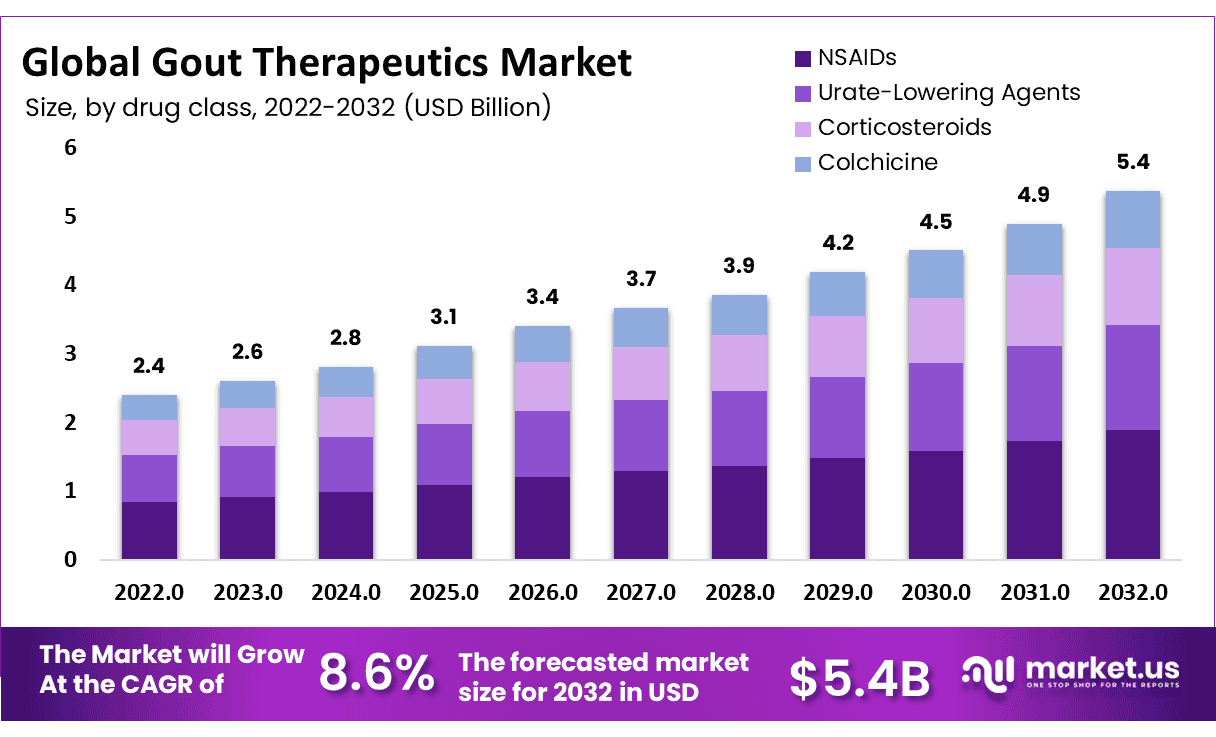

Gout Therapeutics Market size is expected to be worth around USD 5.4 Billion by 2032 from USD 2.4 Billion in 2022, growing at a CAGR of 8.6% during the forecast period from 2023 to 2032.

The market’s expansion is linked to rising biologics usage, expanding regenerative medication R&D, and cutting-edge imaging modalities technology. Also, a crucial aspect of the market expansion is revealed by the high prevalence of gout brought on by excessive alcohol intake.

A severe form of arthritis known as gout, affects many joints throughout the body, including those in the hands, feet, ankles, knees, wrists, heels, and elbows. Some of the primary signs and symptoms of gout are redness, excruciating pain, and joint soreness. There are numerous gout therapies on the market today, and they all work to reduce uric acid levels in the body and enhance the kidneys’ capacity to clear uric acid through urination.

Unexpected effects of the COVID-19 pandemic epidemic include considerable delays in disease detection and treatment. Hospitals and healthcare services, on the other hand, were severely restricted as a result of quarantine and social segregation measures enacted by numerous countries around the world. The COVID-19 pandemic also had a substantial negative impact on how well hospitals treated patients who did not have the virus.

Key Takeaways

- Market Growth: Gout therapeutics market is forecasted to grow at an 8.6% CAGR, reaching USD 5.4 billion by 2032 from USD 2.4 billion in 2022.

- NSAIDs Dominance: NSAIDs hold the largest market share at 46% in the drug class segment.

- Chronic Gout Prevalence: Chronic gout commands 67% market share due to increasing medication options.

- Hospital Usage: Hospitals dominate end-users, offering acute gout care with the highest market share.

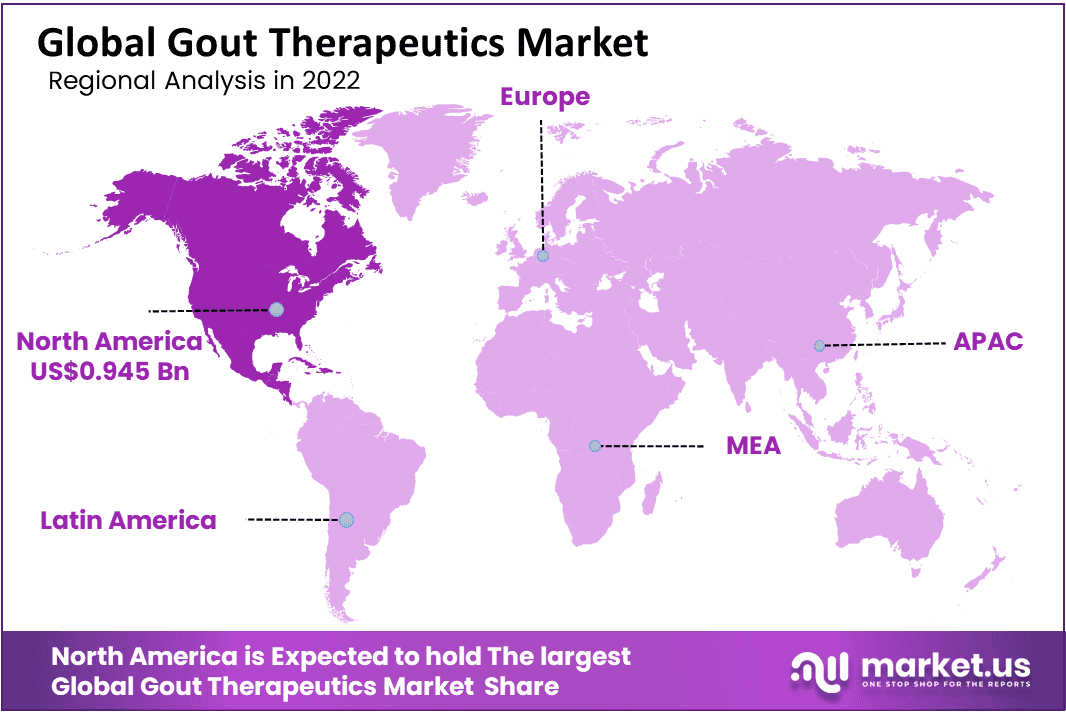

- North America Lead: North America leads with a 39.4% market share, driven by gout prevalence and advanced healthcare.

- Asia Pacific Growth: The Asia Pacific market is the fastest-growing, led by Japan, China, and India.

- Biologics Adoption: Biologics gain popularity in treating gout, enhancing market dynamics.

- Combination Therapies: Combination therapies targeting multiple pathways in gout treatment are on the rise.

- Aging Population Impact: Gout’s increasing prevalence is fueled by an aging global population.

- Early Diagnosis: Rising awareness leads to early diagnosis, increasing demand for gout therapeutics.

Drug Class Analysis

Based on Drug Class, the NSAIDs segment is the largest in the gout therapeutics market with a 46% market share.

Based on drug class, this market is further categorized into nonsteroidal anti-inflammatory medications (NSAIDs), urate-lowering agents, corticosteroids, and colchicine. NSAIDs dominated the market. This is explained by the medications’ high level of penetration, their affordability when compared to drugs of other classes, and their capacity to provide pain relief in the event of a severe gout attack.

The category for ureta-lowering medicines is predicted to develop at the fastest rate over the projected period. Agents that decrease urate mostly include xanthine oxidase inhibitors and uricosurics. Increasing use of this treatment and the launch of many new medications are projected to propel the market throughout the forecast period.

Those who are intolerant to colchicine or NSAIDs are typically treated with corticosteroids. Moreover, rebound gout attacks following the discontinuation of the steroids are frequent and may limit the corticosteroid market. Due to its capacity to reduce neutrophil adhesion and hence decrease the acute inflammatory response, colchicine accounted for a sizable portion of the market.

Disease Condition Analysis

Due to the increasing commercialization of numerous medications for chronic diseases chronic gout segment dominated the market with a 67% market share

By disease condition, this market is further categorized into two categories: chronic gout and acute gout. Due to the increasing commercialization of numerous medications for chronic diseases, the chronic gout market is anticipated to rise at a sizable CAGR over the targeted period. Moreover, uricosuric drugs and xanthine oxidase inhibitors are included in this group of urate-lowering medications.

In the acute phase, medications such as colchicine, NSAIDs, and corticosteroids are administered. Due to low-cost pharmaceuticals, poor treatment adherence, and the drugs’ capacity to relieve pain for a shorter period of time than chronic therapies, it is anticipated that this market sector will earn a smaller share than chronic therapies.

When uric acid crystals accumulate in the joints, acute gout is a painful disorder that results in excruciating pain, swelling, and redness. Nonsteroidal anti-inflammatory medications (NSAIDs), colchicine, and corticosteroids are some of the treatments used to treat acute gout with the goal of reducing inflammation and pain.

End-User Analysis

hospital segment dominated the market with the highest share

Based on end-user, this market is further categorized into hospitals, clinics, and home care settings. Hospitals are the primary end-users of gout therapeutics, as they provide acute care for patients experiencing gout attacks. They often have specialized rheumatology departments or clinics that provide long-term management for patients with chronic gout.

Clinics, including rheumatology clinics, primary care clinics, and urgent care centers, are also important end-users of gout therapeutics. They provide both acute and long-term care for patients with gout and may work in collaboration with hospitals and other healthcare providers.

Key Market Segments

Based on Drug Class

- NSAIDs

- Corticosteroids

- Colchicine

- Urate-Lowering Agents

Based on Disease Condition

- Acute Gout

- Chronic Gout

Based on End-User

- Hospital

- Clinics

- Home Care Setting

Drivers

The prevalence of gout is increasing globally, which is one of the major drivers of the market. Gout is a common form of arthritis, and the rising incidence of this condition is driving the demand for gout therapeutics. The aging population is also contributing to the growth of the gout therapeutics market. Gout is more common in older adults, and as the global population continues to age, the demand for gout therapeutics is likely to increase.

There is an increasing awareness of gout and its symptoms, which is leading to early diagnosis and treatment. This is expected to boost the demand for gout therapeutics in the coming years. There are significant ongoing research and development activities aimed at developing more effective and targeted gout therapies.

The introduction of new and innovative therapies is expected to drive the growth of the market. Advances in drug delivery systems are also expected to drive the growth of the gout therapeutics market. Novel drug delivery systems can improve the effectiveness of gout therapies and reduce their side effects, leading to higher patient compliance and better outcomes.

Restraints

Lack of awareness about gout and its treatment options among patients and healthcare professionals may lead to a delay in diagnosis and treatment, resulting in the progression of the disease and ultimately impacting the growth of the gout therapeutics market. Some gout medications can be expensive, making them inaccessible to some patients, particularly those without health insurance or adequate coverage, which may limit the growth of the gout therapeutics market.

Opportunity

The global gout therapeutics market presents a significant opportunity for growth due to the increasing prevalence of gout, the adoption of biologics and targeted therapies, the development of novel therapeutics, and the growing awareness about the importance of early diagnosis and treatment. the increasing awareness about the importance of early diagnosis and treatment of gout is also expected to contribute to market growth. This is because early diagnosis and treatment can help prevent the progression of the disease and reduce the risk of complications.

Trends

The number of people diagnosed with gout has been increasing in recent years, largely due to changes in lifestyle and aging populations. This has led to an increased demand for gout therapeutics. As precision medicine gains momentum, there is an increased focus on developing personalized treatments for gout patients. This has led to the development of new drugs that target specific subtypes of the disease.

Biologic drugs have become increasingly popular in the treatment of gout, as they are highly effective in reducing inflammation and pain. This has led to a surge in the development of new biologics for gout treatment. Combination therapies that target multiple pathways involved in gout development and progression have become more popular in recent years. This approach has been shown to be highly effective in reducing symptoms and improving patient outcomes.

Regional Analysis

North America is estimated to be the most lucrative market in the global gout therapeutics market, with the largest market share of 39.4%.

North America dominates the global gout therapeutics market owing to the increasing prevalence of gout in the region. The United States and Canada are the major markets in this region, with an increasing number of cases of gout and growing awareness about its treatment. The availability of advanced healthcare infrastructure and favorable reimbursement policies are the key drivers of market growth in North America.

The Asia Pacific is the fastest-growing market for gout therapeutics, owing to the increasing prevalence of gout and the growing awareness about its treatment. Japan, China, and India are the major markets in this region. The increasing disposable income and the improving healthcare infrastructure are the key drivers of the market growth in Asia Pacific.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The gout therapeutics market is large, fragmented, and home to several well-known businesses. In terms of market share, a select few large companies currently rule the industry. With the increasing frequency of cases around the world, there are unlikely to be many more businesses entering the sector in the ensuing years.

Listed below are some of the most prominent Gout Therapeutics Market industry players.

Market Key Players

- Pfizer Inc

- Abbvie Inc

- Novartis AG

- Amgen Inc

- Merck & Co Inc

- Sun Pharmaceutical Industries Ltd

- Teva Pharmaceuticals Industries Ltd

- AstraZeneca

- Boehringer Ingelheim International GmbH

- GSK plc

- Antares Pharma

- Astellas Pharma Inc

- JW Pharmaceutical Corporation

- Addex Therapeutics

- Takeda Pharmaceutical Company Limited

- TEIJIN LIMITED

- Lilly

Recent Developments

- In March 2022 – The Phase 2a clinical trial of ABP-671 to treat chronic gout was randomized double-blind, and placebo-controlled, and Atom Bioscience recently reported good results.

- In March 2022 – Colchicine tablets USP, 0.6 mg, made by Strides Pharma and used for the treatment and prevention of gout, received approval from the US Food and Drug Administration.

Report Scope

Report Features Description Market Value (2022) USD 2.4 Bn Forecast Revenue (2032) USD 5.4 Bn CAGR (2023-2032) 8.6% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Drugs Class, By Disease Condition, By End-User Regional Analysis North America – The US, Canada,&Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, &Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, &Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, &Rest of MEA Competitive Landscape Pfizer Inc, Abbvie Inc, Novartis AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is gout?Gout is a type of arthritis that occurs due to the buildup of uric acid crystals in the joints, causing inflammation, swelling, and intense pain.

What is the gout therapeutics market?The gout therapeutics market comprises medications and treatments used to manage and alleviate the symptoms of gout, including reducing inflammation, relieving pain, and lowering uric acid levels in the body.

What are the common medications used in gout therapeutics?Common medications used in gout therapeutics include nonsteroidal anti-inflammatory drugs (NSAIDs), colchicine, corticosteroids, and urate-lowering agents such as xanthine oxidase inhibitors and uricosuric agents.

How is the gout therapeutics market growing?The gout therapeutics market has been growing steadily due to the increasing prevalence of gout worldwide, rising awareness and diagnosis rates, and the development of novel and more effective therapies for gout management.

What are the key factors driving the gout therapeutics market?Key factors driving the gout therapeutics market include the growing aging population, unhealthy dietary habits, sedentary lifestyles, obesity, and the rising incidence of comorbidities such as hypertension and diabetes, which are associated with gout.

-

-

- Pfizer Inc

- Abbvie Inc

- Novartis AG

- Amgen Inc

- Merck & Co Inc

- Sun Pharmaceutical Industries Ltd

- Teva Pharmaceuticals Industries Ltd

- AstraZeneca

- Boehringer Ingelheim International GmbH

- GSK plc

- Antares Pharma

- Astellas Pharma Inc

- JW Pharmaceutical Corporation

- Addex Therapeutics

- Takeda Pharmaceutical Company Limited

- TEIJIN LIMITED

- Lilly