Global Wooden Decking Market Size, Share, Growth Analysis By Type (Composite Decking, Hardwood Decking, Redwood, Cedar Decking, Tropical Hardwoods, Pressure Treated Pine Decking, Wood Plastic Composite (WPC), and Others), By Application (Floor, Walls, Railing, and Others), By End User (Residential and Non-Residential), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173419

- Number of Pages: 274

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

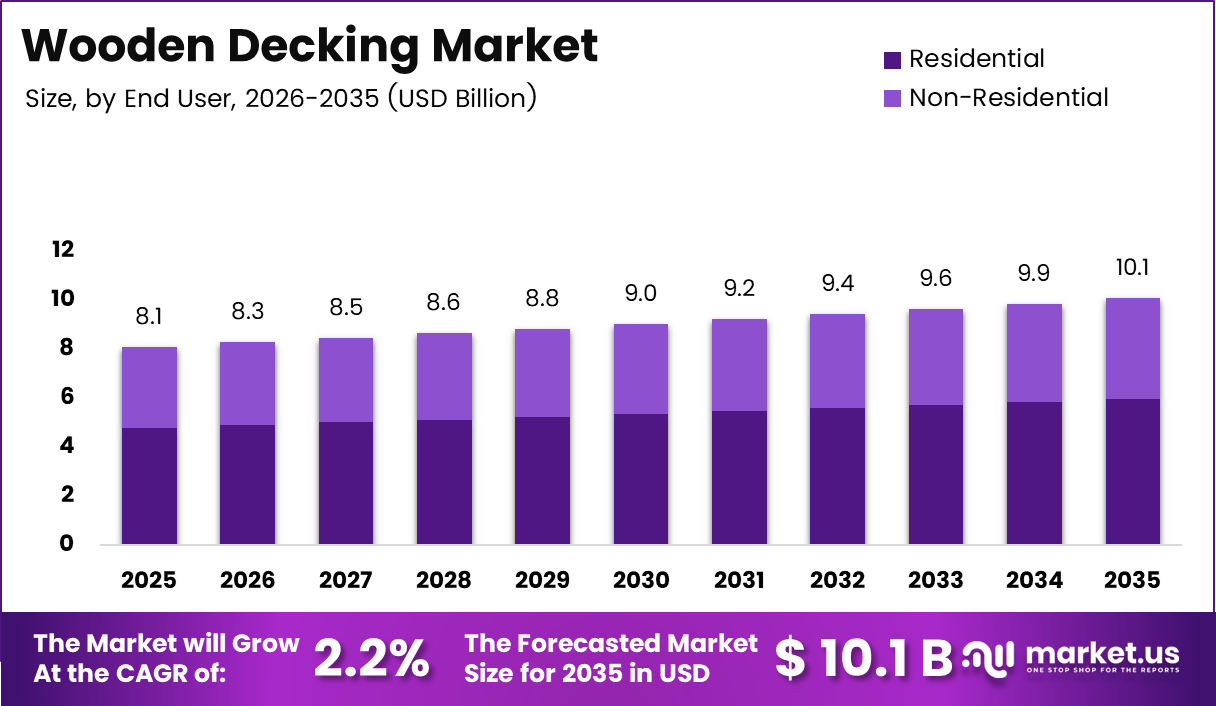

The Global Wooden Decking Market size is expected to be worth around USD 10.1 billion by 2035, from USD 8.1 billion in 2025, growing at a CAGR of 2.2% during the forecast period from 2026 to 2035.

The wooden decking market represents the commercial ecosystem supplying natural wood boards for outdoor flooring applications across residential and non residential spaces. From a market perspective, wooden decking combines functional durability with visual appeal, supporting patios, balconies, walkways, and recreational platforms. Consequently, demand remains linked to construction activity, renovation spending, and lifestyle driven outdoor upgrades.

Wooden decking continues to grow steadily as homeowners prioritize outdoor living extensions. Developers increasingly integrate decks into housing layouts to enhance usable space and property value. Moreover, the market benefits from premiumization trends, where consumers select hardwood, cedar, and treated pine for longevity, texture, and architectural consistency.

Growth opportunities emerge from urban redevelopment, resort construction, and mixed use commercial projects emphasizing outdoor engagement. In parallel, eco conscious buyers support certified timber and responsibly sourced wood, strengthening sustainability positioning. Additionally, customization options in board width, finish, and layout enable suppliers to address diverse climatic and aesthetic requirements across regions.

Government investment and regulations indirectly support the wooden decking market through housing programs, tourism infrastructure funding, and building code modernization. Many authorities promote safe, durable outdoor structures with proper spacing, drainage, and load compliance. As a result, standardized installation practices improve long term deck performance and reinforce professional construction demand.

From an operational standpoint, proper installation standards influence material consumption and replacement cycles. According to TimberTech installation guidance, recommended gaps for air dried decking range from 1/8 inch (3.5 mm) to 1/4 inch (6.5 mm) depending on climate and moisture exposure. Such specifications directly affect board usage, labor planning, and project cost estimation.

Accurate layout and squaring methods further shape decking efficiency and waste reduction. According to professional carpentry standards referenced by TimberTech, the 3-4-5 or 6-8-10 method ensures right angle alignment during deck framing. These techniques enhance structural precision, supporting long term durability and compliance with building codes.

Material planning also drives transactional decisions in the wooden decking market. According to TimberTech board dimension data, a 12′ board covers 5.4 sq. ft., a 16′ board covers 7.2 sq. ft., and a 20′ board covers 9 sq. ft. For example, converting a 5.5 inch board width equals 0.45 feet, multiplied by 16 feet, resulting in 7.2 square feet, enabling accurate project budgeting and procurement.

Key Takeaways

- The Global Wooden Decking Market is projected to grow from USD 8.1 billion in 2025 to USD 10.1 billion by 2035, registering a CAGR of 2.2% during 2026 to 2035.

- Wood Plastic Composite (WPC) dominated the type segment with a market share of 31.6% in 2025, supported by durability and low maintenance benefits.

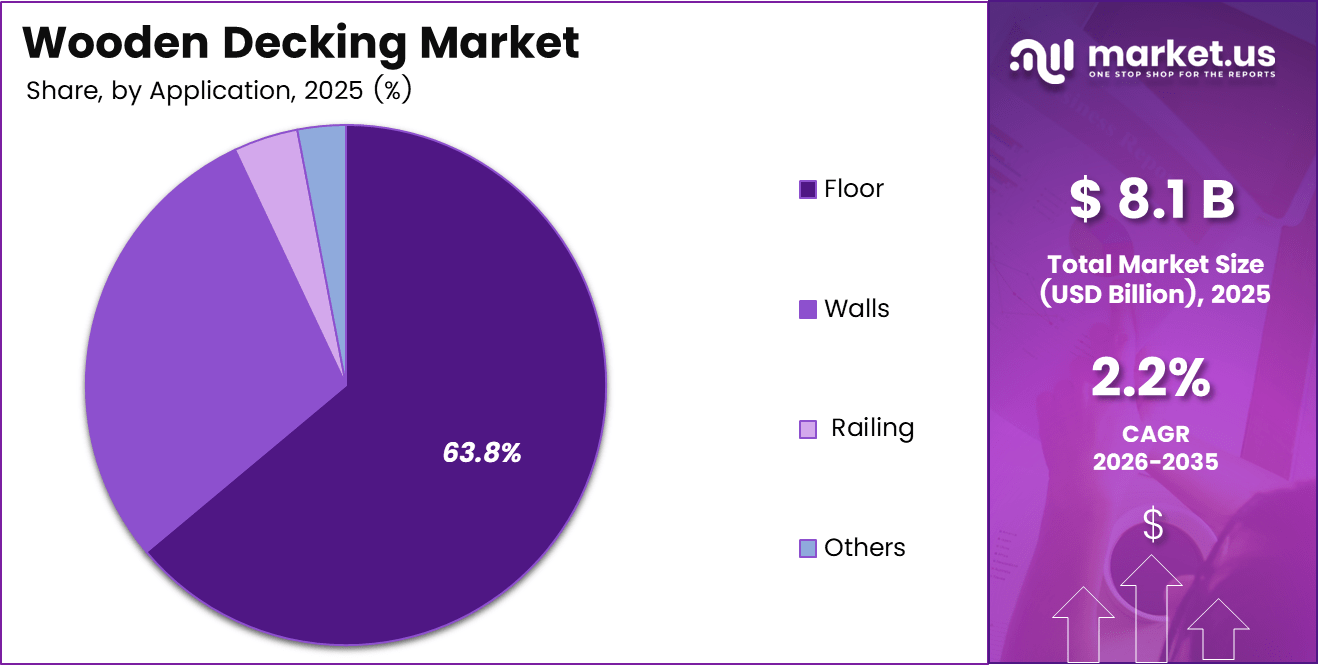

- Floor applications led the market with a share of 63.8% in 2025, driven by widespread use in patios and outdoor living spaces.

- The residential end user segment accounted for 59.1% of total demand in 2025, reflecting strong home renovation and outdoor lifestyle trends.

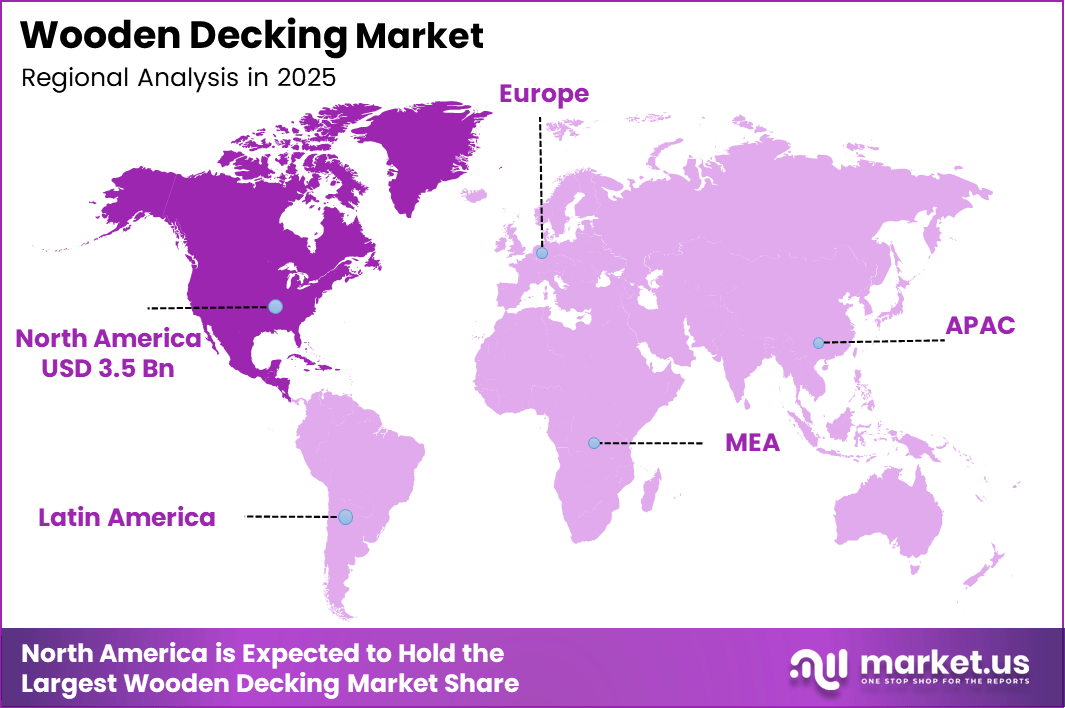

- North America dominated the regional landscape with a market share of 43.8% in 2025, valued at USD 3.5 billion.

By Type Analysis

Wood Plastic Composite (WPC) dominates with 31.6% due to its durability and low maintenance appeal.

In 2025, Wood Plastic Composite (WPC) held a dominant market position in the By Type Analysis segment of Wooden Decking Market, with a 31.6% share. WPC benefits from resistance to moisture, termites, and weathering. As a result, it attracts homeowners seeking long lasting decking with minimal upkeep.

Composite decking continues to gain traction as it blends natural aesthetics with enhanced performance. It supports consistent appearance over time and aligns well with renovation focused demand. Consequently, composite materials remain a practical alternative where durability and appearance matter equally.

Hardwood decking maintains demand due to its premium appearance and strength. It is widely used in high end residential and commercial projects where natural textures add visual value. However, maintenance requirements influence buying decisions across cost sensitive markets.

Redwood decking remains preferred in regions that value rich color tones and natural resistance to decay. Its warm appearance enhances outdoor living designs and blends well with landscapes. However, limited geographic availability and higher material costs restrict wider adoption, keeping its use concentrated in specific residential and lifestyle driven markets.

Cedar decking is widely recognized for its natural resistance to insects and moisture related decay. Its lightweight structure and distinctive aroma make it attractive for residential applications. Moderate pricing supports steady demand, although softer wood properties and maintenance needs limit its suitability for high traffic or heavy load environments.

Tropical hardwoods attract luxury residential and commercial projects due to exceptional strength, durability, and exotic visual appeal. These materials perform well in demanding outdoor conditions. However, sourcing challenges, sustainability concerns, and premium pricing limit broader market penetration, confining demand largely to high end and design focused developments.

Pressure treated wood remains a widely used option for cost effective decking solutions. It supports mass residential construction by offering improved durability at lower prices. Despite functional advantages, aesthetic limitations and chemical treatment concerns reduce its appeal in premium or visually focused outdoor applications.

Pine decking continues to serve entry level markets because of its affordability and widespread availability. It is commonly used in budget sensitive residential projects. However, regular treatment requirements, susceptibility to wear, and a shorter lifespan influence its limited long term appeal compared to higher quality wood options.

Other decking types collectively serve niche applications where specific performance, design, or budget requirements are prioritized. These materials support customized solutions across residential and commercial projects. While their individual market shares remain small, they contribute to overall product diversity and specialized use cases.

By Application Analysis

Floor dominates with 63.8% owing to its extensive use in patios, balconies, walkways, and outdoor living extensions.

In 2025, Sub-segment held a dominant market position in the By Main Segment Analysis segment of Wooden Decking Market, with a 63.8% share. Floor applications drive volume demand as homeowners increasingly expand functional outdoor spaces. Furthermore, flooring requires frequent refurbishment, reinforcing steady material consumption.

Wall applications use wooden decking for façade accents and exterior cladding. Gradually, architects adopt decking walls to improve visual appeal and thermal comfort. Consequently, demand grows in premium residential and boutique commercial projects focusing on natural textures.

Railing applications support safety and design continuity in decks and terraces. Wooden railings enhance aesthetic coherence with floors. As a result, railing demand grows alongside decking floor installations in both new builds and renovation activities.

The Others category includes stairs, pergolas, and decorative outdoor structures. These applications remain niche but stable. Additionally, customized outdoor designs increasingly integrate decking materials for cohesive landscape planning.

By End User Analysis

Residential dominates with 59.1% driven by home renovation activity and rising preference for outdoor leisure spaces.

In 2025, Sub-segment held a dominant market position in the By Main Segment Analysis segment of Wooden Decking Market, with a 59.1% share. Residential demand benefits from lifestyle upgrades, backyard remodeling, and patio extensions. Moreover, homeowners favor decking for comfort, visual warmth, and property value enhancement.

The Non-Residential segment includes hospitality, commercial buildings, and public infrastructure. Demand remains consistent as hotels, resorts, and recreational facilities adopt decking for aesthetics and durability. Consequently, this segment supports long-term market stability through periodic refurbishment cycles.

Key Market Segments

By Type

- Composite Decking

- Hardwood Decking

- Redwood

- Cedar Decking

- Tropical Hardwoods

- Pressure Treated Pine Decking

- Wood Plastic Composite (WPC)

- Others

By Application

- Floor

- Walls

- Railing

- Others

By End User

- Residential

- Non-Residential

Drivers

Rising Preference for Outdoor Living Spaces in Residential Construction Drives Market Growth

Rising preference for outdoor living spaces strongly supports the wooden decking market. Homeowners increasingly treat decks as extensions of indoor areas for relaxation, dining, and social gatherings. This shift is especially visible in suburban housing, where decks enhance usable living space and overall property appeal.

Architects and designers also favor wooden decking due to its natural look and warm feel. Premium wood materials help create visually appealing outdoor environments that align with modern architectural trends. As a result, wooden decking remains a preferred choice for projects focused on aesthetics and long term value.

Growth in home renovation and remodeling spending further strengthens demand. Many homeowners upgrade old patios or unused outdoor areas into functional decks. Renovation projects often prioritize wood to maintain consistency with existing structures and to improve resale value.

The hospitality and recreation sector adds another demand layer. Hotels, resorts, cafés, and public parks use wooden decking to create inviting outdoor experiences. This expanding commercial use supports steady market demand beyond residential construction.

Restraints

High Maintenance Requirements Compared to Composite Alternatives Limit Market Expansion

High maintenance needs act as a key restraint for the wooden decking market. Natural wood requires regular cleaning, sealing, and staining to maintain appearance and durability. These ongoing efforts increase ownership costs and discourage some buyers from choosing wood.

Exposure to moisture presents another challenge. Rain, humidity, and temperature changes can cause warping, cracking, or rotting over time. In regions with heavy rainfall or coastal climates, this vulnerability reduces the long term reliability of wooden decks.

Termite infestation and insect damage also affect market adoption. Many wood types need chemical treatments to resist pests, which raises maintenance complexity. Some consumers prefer low maintenance alternatives to avoid these risks.

Weathering remains a concern in outdoor environments. Sun exposure leads to fading and surface degradation. Compared to composite materials that offer longer life with less upkeep, natural wood faces stronger resistance in cost conscious markets.

Growth Factors

Growing Demand for Sustainably Sourced and Certified Wood Materials Creates New Opportunities

Demand for sustainably sourced wood creates strong growth opportunities. Environmentally aware consumers increasingly prefer certified wood from responsibly managed forests. This trend supports premium wooden decking products with sustainability credentials.

Expansion of luxury housing and waterfront developments further boosts opportunities. High end residential projects favor wooden decking for its natural elegance and compatibility with scenic locations. These developments often prioritize customized outdoor spaces.

Customization demand is rising across residential and commercial projects. Buyers seek unique deck layouts, finishes, and wood textures. This trend allows manufacturers and installers to offer value added solutions and differentiated products.

Urban living also opens new applications. Rooftops, balconies, and compact outdoor areas increasingly use wooden decking to create functional spaces. These emerging uses support steady demand in densely populated cities.

Emerging Trends

Shift Toward Thermally Modified and Engineered Wood Decking Shapes Market Trends

Thermally modified and engineered wood decking is gaining attention. These products improve durability, moisture resistance, and dimensional stability while maintaining a natural appearance. This trend helps address traditional wood limitations.

Advanced coatings and wood treatments are also becoming common. Protective finishes extend deck lifespan and reduce maintenance frequency. As treatment technologies improve, consumer confidence in wooden decking increases.

Integration of smart outdoor lighting and modular deck systems is another trend. Decks now combine lighting, seating, and modular components for flexible use. This enhances functionality and user experience.

Design preferences are shifting toward minimalist and natural textures. Simple layouts, clean lines, and organic finishes dominate modern outdoor design. Wooden decking aligns well with these preferences, supporting its continued relevance.

Regional Analysis

North America Dominates the Wooden Decking Market with a Market Share of 43.8%, Valued at USD 3.5 Billion

North America holds a dominant position in the wooden decking market, supported by strong residential construction and renovation activity. In 2025, the region accounted for a 43.8% share, with the market valued at USD 3.5 billion, reflecting high consumer spending on outdoor living upgrades. The popularity of backyards, patios, and outdoor entertainment areas continues to drive demand for wooden decking across both new builds and remodeling projects. In addition, favorable housing policies and steady investment in suburban development strengthen regional market performance.

Europe Wooden Decking Market Trends

Europe represents a mature yet steadily growing market for wooden decking, driven by architectural emphasis on natural materials and sustainable construction practices. Demand remains strong in residential renovations, public landscaping, and hospitality projects such as cafés and resorts. Environmental awareness and preference for certified wood materials further support adoption. However, climatic diversity across the region influences material selection and maintenance considerations.

Asia Pacific Wooden Decking Market Trends

Asia Pacific shows strong growth potential due to rapid urbanization and rising disposable incomes. Increasing adoption of modern housing concepts and lifestyle driven outdoor spaces supports market expansion. The hospitality and tourism sectors also contribute significantly, with resorts and recreational facilities incorporating wooden decking for aesthetic appeal. Growing awareness of premium outdoor design continues to accelerate demand.

Middle East and Africa Wooden Decking Market Trends

The Middle East and Africa market is driven by luxury residential projects, hotels, and commercial developments. Wooden decking is widely used in resorts, poolside areas, and leisure spaces to enhance visual appeal. While harsh climatic conditions limit widespread adoption, premium projects continue to create steady demand, particularly in tourism focused economies.

Latin America Wooden Decking Market Trends

Latin America presents moderate growth opportunities, supported by residential construction and hospitality infrastructure development. Outdoor living culture and favorable climate conditions encourage the use of decking in homes and public spaces. Although price sensitivity remains a challenge, gradual improvement in housing standards supports long term market growth.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Wooden Decking Company Insights

From an analyst viewpoint, the global wooden decking market in 2025 reflects a balance between natural aesthetics and performance driven innovation. Leading players focus on durability, sustainability positioning, and design flexibility to address evolving residential and commercial outdoor needs. The competitive landscape remains shaped by premium product portfolios, strong distribution reach, and continuous material enhancements aimed at reducing maintenance concerns while preserving visual appeal.

Trex Company, Inc. continues to influence market direction through its strong brand recognition and emphasis on long lasting decking solutions. The company’s focus on low maintenance products aligns well with homeowner preferences for durability and ease of upkeep. Its ability to scale across residential and commercial applications supports steady demand.

AZEK Building Products maintains a premium positioning in the market by emphasizing aesthetics, performance, and weather resistance. The company benefits from growing demand for high end outdoor living spaces, particularly in renovation projects. Its product strategy supports architects and designers seeking refined finishes and long term performance.

Fiberon strengthens its market presence through a broad product range that addresses both affordability and premium requirements. The company’s approach supports adoption across residential developments and light commercial projects. Its focus on consistent quality helps attract buyers looking for balanced cost and durability.

TimberTech remains a key player by aligning innovation with design focused outdoor solutions. The brand appeals to consumers prioritizing natural wood appearance with enhanced structural reliability. Its positioning supports growth in luxury housing and lifestyle oriented decking installations.

Overall, these players shape market dynamics through product differentiation and strong alignment with outdoor living trends. Their strategic focus on durability, design, and long term value continues to support market expansion in 2025.

Top Key Players in the Market

- Trex Company, Inc.

- AZEK Building Products

- Fiberon

- TimberTech

- Cali Bamboo

- DuraLife Decking & Railing Systems

- MoistureShield

- Deckorators

- UPM ProFi

Recent Developments

- In November 2025, SRS Distribution announced its expansion in Colorado and Texas through the acquisition of Specialty Wood Products, Inc., a distributor focused on premium decking, siding, heavy timber products, and other architectural grade building materials. The company did not disclose the transaction terms.

- In March 24, 2025, James Hardie Industries plc announced a definitive agreement to acquire The AZEK Company Inc. for a total transaction value of $8.75 billion, including AZEK’s net debt of approximately $386 million as of December 31, 2024. The deal structure includes a combination of cash and James Hardie shares, aligning the companies around low maintenance, high performance, and sustainability oriented building products.

Report Scope

Report Features Description Market Value (2025) USD 8.1 billion Forecast Revenue (2035) USD 10.1 billion CAGR (2026-2035) 2.2% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Composite Decking, Hardwood Decking, Redwood, Cedar Decking, Tropical Hardwoods, Pressure Treated Pine Decking, Wood Plastic Composite (WPC), and Others), By Application (Floor, Walls, Railing, and Others), By End User (Residential and Non-Residential) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Trex Company, Inc., AZEK Building Products, Fiberon, TimberTech, Cali Bamboo, DuraLife Decking & Railing Systems, MoistureShield, Deckorators, UPM ProFi Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Trex Company, Inc.

- AZEK Building Products

- Fiberon

- TimberTech

- Cali Bamboo

- DuraLife Decking & Railing Systems

- MoistureShield

- Deckorators

- UPM ProFi