Global Wood Tar Market Size, Share, And Enhanced Productivity By Product Type (Resinous Tars, Hardwood Tars, Others), By Production Technology (Destructive Distillation, Pyrolysis, Others), By Application (Construction Coatings, Ship Coatings, Animal Husbandry, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2026

- Report ID: 176908

- Number of Pages: 318

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

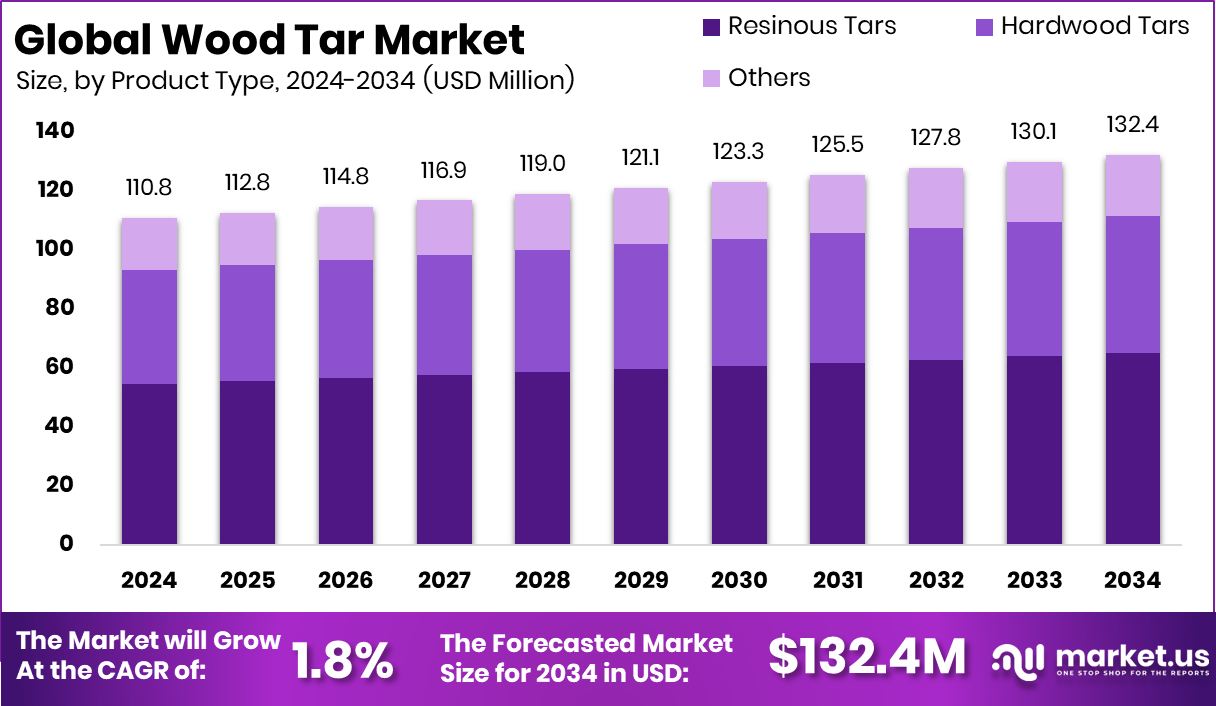

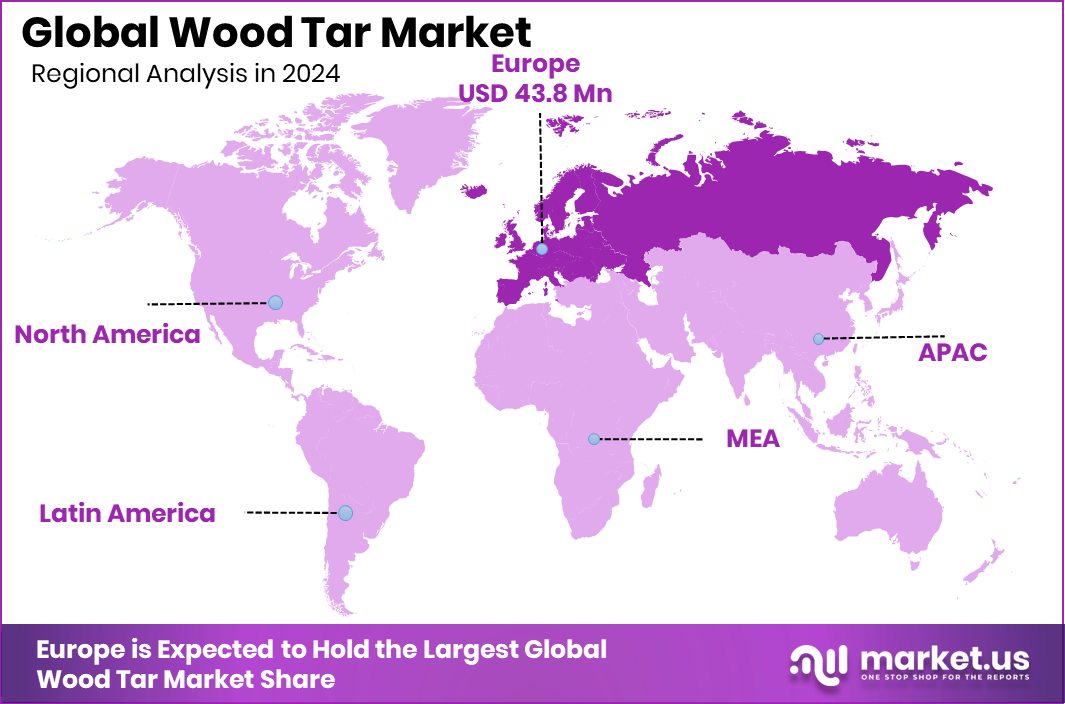

The Global Wood Tar Market is expected to be worth around USD 132.4 million by 2034, up from USD 110.8 million in 2024, and is projected to grow at a CAGR of 1.8% from 2025 to 2034. In 2024, Europe maintained a strong wood tar market position at 39.6% and USD 43.8 Mn.

Wood tar is a thick, dark, sticky substance produced by heating wood in the absence of oxygen. It has been used for centuries as a natural preservative because it protects wood against moisture, insects, and decay. In the modern context, wood tar is applied in construction coatings, ship protection, animal husbandry, and several traditional maintenance practices. The Wood Tar Market represents the commercial system that manufactures, distributes, and uses these materials across industries, following product categories such as resinous tars, hardwood tars, and other specialty forms, produced mainly through destructive distillation, pyrolysis, and similar thermal processes.

Growth in the market is supported by steady demand for natural protective coatings, driven by construction and marine applications. Countries funding pyrolysis technologies—such as the $8 million plant in the Northern Territory and $11.3M investment in the Thorold South facility—create indirect opportunities for wood-derived products as thermal-conversion processes gain industrial attention. The rise of sustainable materials further strengthens long-term demand.

Market expansion is also influenced by growing interest in alternative coating solutions and traditional agricultural uses. Funding announcements like GBP 1 million for a UK-based recycler, €12.5M agreements for Circtec and bp, and €40 million support for LyondellBasell’s chemical recycling project indicate broader confidence in biomass and thermal-conversion sectors, opening opportunities for wood tar producers aligned with these technologies.

Opportunities also emerge as pyrolysis gains visibility, with Resynergi securing $18M to advance decentralized systems. Although unrelated to wood tar directly, such investments normalize pyrolysis as a mainstream industrial method, indirectly benefiting producers using similar techniques. Even broader market sentiment—seen in bold capital moves such as Cathie Wood’s $173 million investment—reflects a period where alternative materials and innovative processing technologies attract attention, supporting long-term optimism around wood-derived products.

Key Takeaways

- The Global Wood Tar Market is expected to be worth around USD 132.4 million by 2034, up from USD 110.8 million in 2024, and is projected to grow at a CAGR of 1.8% from 2025 to 2034. In 2024,

- The wood tar market is growing steadily as resinous tars gain 49.2% market share across industries.

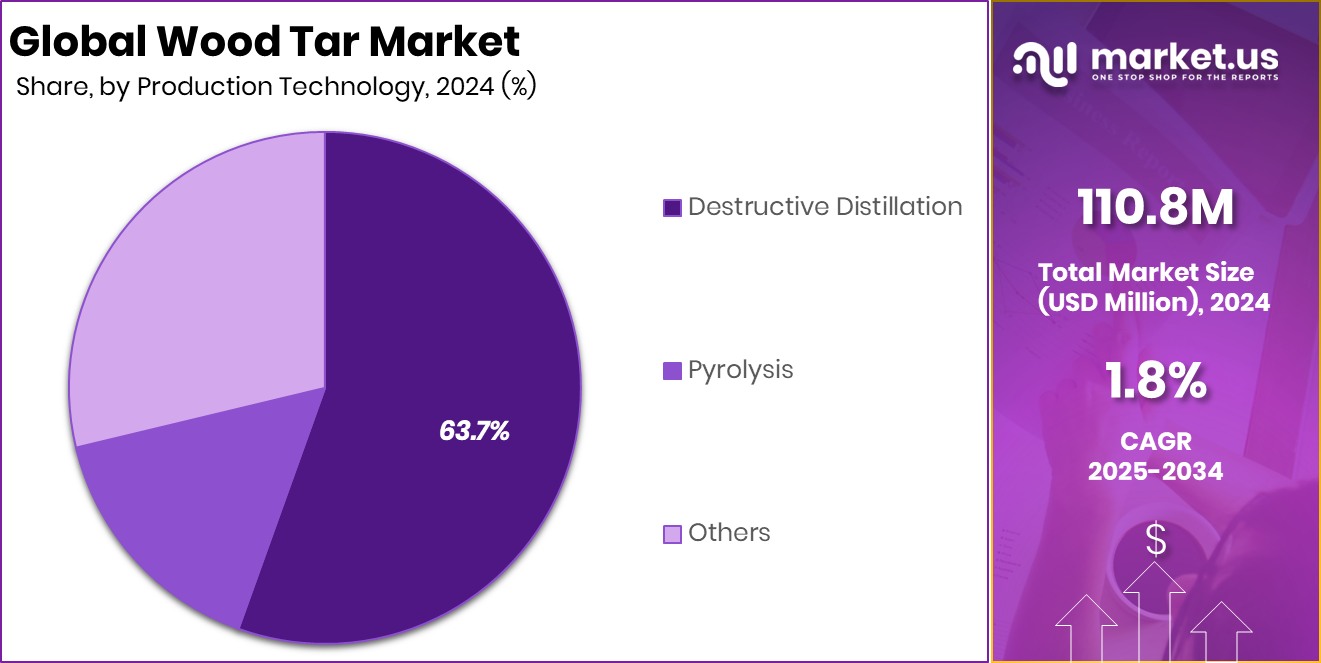

- Strong adoption of destructive distillation is boosting the wood tar market, driving 63.7% technological adoption worldwide.

- Rising demand for construction coatings strengthens the wood tar market, supported by a 49.4% application share.

- In Europe, the wood tar market growth reached 39.6%, totaling USD 43.8 Mn.

By Product Type Analysis

The wood tar market was dominated by resinous tars with a strong 49.2% share.

In 2024, the Wood Tar Market saw resinous tars holding a dominant 49.2% share, reflecting their strong demand across industrial and protective applications. These tars are valued for their natural adhesive properties, durability, and weather-resistant performance, which makes them suitable for wood preservation, sealants, and traditional waterproofing compounds.

The preference for bio-based materials is also helping expand their use among small- and medium-scale manufacturers. Their ability to provide long-lasting protection against moisture and decay supports adoption across rural construction and marine wooden structures. With industries shifting toward sustainable ingredients and safe coating materials, resinous tars continue to secure a high market share, acting as a dependable alternative to synthetic protective chemicals.

By Production Technology Analysis

The wood tar market was dominated by destructive distillation, capturing a leading 63.7% share.

In 2024, Destructive Distillation accounted for a strong 63.7% share in the global Wood Tar Market, driven by its efficiency in extracting high-quality tar from various wood species. This method supports consistent production output and preserves the chemical richness required for industrial coatings, preservatives, and specialty chemical formulations. Its long-established role in traditional tar production gives manufacturers a reliable and scalable pathway for meeting growing commercial demand.

Industries that rely on naturally derived protective materials prefer this technology due to its predictable yield and ability to produce tar with stable viscosity and high thermal resistance. As sustainability trends rise, destructive distillation continues to stand out as the most practical and resource-efficient method for commercial wood tar production.

By Application Analysis

The Wood Tar Market was dominated by construction coatings, holding a notable 49.4% share.

In 2024, Construction Coatings led the Wood Tar Market with a 49.4% share, highlighting the product’s strong relevance in protecting wooden structures, beams, roofs, and exterior surfaces. Wood tar is valued in the construction sector for its natural waterproofing performance, anti-fungal properties, and ability to extend the life of treated surfaces.

Its use remains widespread in traditional building, restoration work, and rural infrastructure, where natural protective agents are preferred. Many builders choose wood tar for its deep penetration and ability to shield surfaces from moisture, pests, and harsh climates. With more emphasis on heritage conservation and sustainable construction materials, wood tar continues to secure a stable position in coating applications worldwide.

Key Market Segments

By Product Type

- Resinous Tars

- Hardwood Tars

- Others

By Production Technology

- Destructive Distillation

- Pyrolysis

- Others

By Application

- Construction Coatings

- Ship Coatings

- Animal Husbandry

- Others

Driving Factors

Rising demand for natural protective coatings

Growing interest in natural protective coatings continues to support the Wood Tar Market, especially as restoration and infrastructure projects rise across multiple regions. Investments also strengthen this demand, such as the Akzo Nobel announcement of a EUR 20 million upgrade across two sites in France, creating around 30 new jobs and expanding production capacity for coating-related materials.

Large-scale maintenance work further reinforces market momentum, including the repainting of the Verrazzano-Narrows Bridge as part of a $128.5 million project, which highlights the ongoing requirement for durable, long-lasting surface protection. These activities create an encouraging environment for wood tar applications, especially in segments where natural preservation, moisture resistance, and long-term durability remain essential.

Restraining Factors

Limited availability of high-quality raw materials

Despite positive market movement, the Wood Tar Market faces constraints due to inconsistent access to high-quality raw wood and rising competition from advanced coating materials. Strategic activity in the broader coatings sector also affects supply dynamics, such as Nippon Paint Holdings entering a $2.3 billion deal for AOC, reinforcing consolidation pressures within the industry. Infrastructure projects like the Angus L. Macdonald Bridge, undergoing a $75 million makeover, further emphasize the challenge of securing reliable material supply when large-scale maintenance requires significant coating volumes. As demand grows, the limited availability of specific wood types suitable for tar production remains a notable restraint, shaping procurement strategies and influencing production stability.

Growth Opportunity

Expansion into eco-friendly coating solutions

The Wood Tar Market is gaining fresh opportunities as interest in eco-friendly coating alternatives expands across construction, restoration, and outdoor structural protection. Supportive funding climate strengthens this direction, including Pioneering Queen’s chemistry research receiving a $24 million boost aimed at advancing sustainable material innovations, which aligns with wood-based protective technologies.

Community development projects also influence opportunities, such as the City of Emporia securing $500,000 Hope VI funding for downtown housing, encouraging the use of natural and durable coatings in revitalization plans. As municipalities and developers look for safer, environmentally aligned materials, wood tar emerges as a practical candidate in specific applications requiring strong protection, natural composition, and compatibility with heritage or low-impact building practices.

Latest Trends

Renewed interest in heritage wood restoration

A notable trend shaping the Wood Tar Market is the revival of heritage wood restoration, where traditional preservation materials are increasingly preferred for authenticity and long-term stability. Broader investments in civic and energy-related projects also reflect this renewed focus. For example, Rivers Casino contributed a $3.1 million payment supporting operations of the PPG Paints Arena, highlighting ongoing commitments to community infrastructure.

Additionally, Swansea received £36 million in UK government funding to advance a clean-energy technology breakthrough, signaling increasing recognition of sustainable materials and historic site maintenance. These developments support an environment where wood tar aligns naturally with restoration goals, traditional architecture care, and environmentally conscious upkeep practices.

Regional Analysis

Europe leads the wood tar market with a 39.6% share worth USD 43.8 Mn.

Europe dominated the Wood Tar Market with a 39.6% share valued at USD 43.8 Mn, supported by steady demand for wood-based protective materials across construction and restoration activities. North America followed with consistent usage in traditional sealing applications and niche industrial needs, benefiting from a stable supply chain and mature wood-treatment practices.

Asia Pacific reflected rising consumption as regional construction expansion and interest in natural protective coatings gradually strengthened market adoption. The Middle East & Africa showed selective growth driven by the use of wood tar in heritage preservation and protective surface applications, where climate-resistant materials hold importance.

Latin America maintained moderate demand, supported by ongoing usage in rural infrastructure and traditional wooden structure maintenance, keeping the region steadily engaged within the global market landscape.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Auson maintained strong relevance through its focus on high-quality wood tar formulations widely used for surface protection and traditional coating applications. The company’s consistent product standards and long-standing industry presence supported stable demand in both construction and preservation segments.

Verdi Life contributed to market growth with offerings centered on natural wood treatment solutions. Its emphasis on environmentally aligned wood tar products positioned the company well among customers seeking sustainable surface-protection materials. This focus helped strengthen its appeal across niche industrial and restoration activities.

Albert Kerbl continued to influence the market through wood tar products used in rural, farming, and maintenance applications. Its distribution strength and broad agricultural customer base supported consistent market visibility, particularly in regions where wood tar remains a common protective material for structures and equipment.

S.P.S. BV added further value with its specialization in wood-protection solutions, supporting versatility in coatings and surface treatment needs. The company’s practical product range aligned effectively with construction maintenance and renovation requirements, reinforcing its role in the overall competitive landscape.

Top Key Players in the Market

- Auson

- Verdi Life

- Albert Kerbl

- S.P.S. BV

- Lacq

- Others

Recent Developments

- In December 2024, Auson updated the safety data sheet (SDS) for its Pine Tar Oil Black product, refining hazard and handling information for professional and consumer users. This revision reflects Auson’s ongoing effort to keep its wood tar products compliant with updated EU chemical safety regulations and improve user awareness about product handling and safety.

- In May 2024, Albert Kerbl’s team participated in Interzoo 2024, the world’s largest pet industry trade fair, in Nuremberg, Germany. The company presented several of its brands—such as Kerbl Pet, MagicBrush, and Aesculap—with new shelving and display solutions, which helped attendees better understand its product offerings for animal care and pet retail environments.

Report Scope

Report Features Description Market Value (2024) USD 110.8 Million Forecast Revenue (2034) USD 132.4 Million CAGR (2025-2034) 1.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Resinous Tars, Hardwood Tars, Others), By Production Technology (Destructive Distillation, Pyrolysis, Others), By Application (Construction Coatings, Ship Coatings, Animal Husbandry, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Auson, Verdi Life, Albert Kerbl, S.P.S. BV, Lacq, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Auson

- Verdi Life

- Albert Kerbl

- S.P.S. BV

- Lacq

- Others