Global Water Infrastructure Repair Technologies Market Size, Share, And Enhanced Productivity By Product Type (Pipes and Connectors, Fittings, Couplings, Valves, Others), By Repair Type (Spot Repair, Full Length Repair, Others), By Application (Potable Water, Wastewater, Industrial Water, Others), By End Use (Drinking Water Distribution, Wastewater Collection), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 171625

- Number of Pages: 211

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

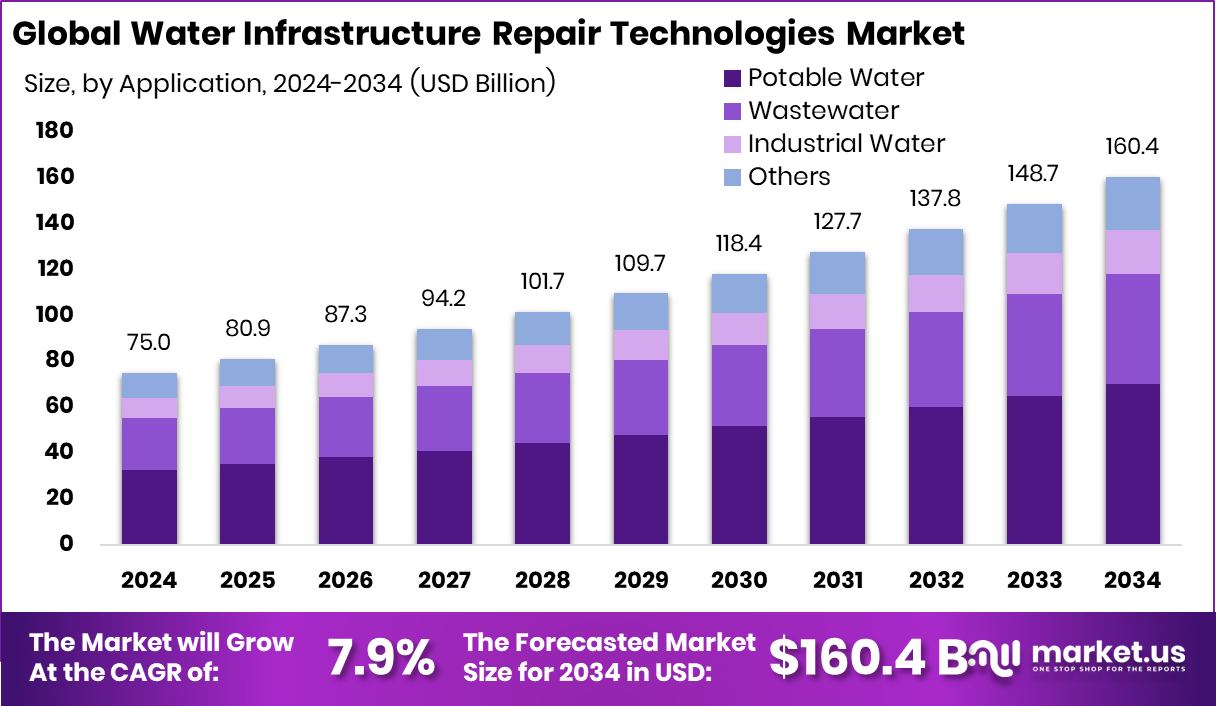

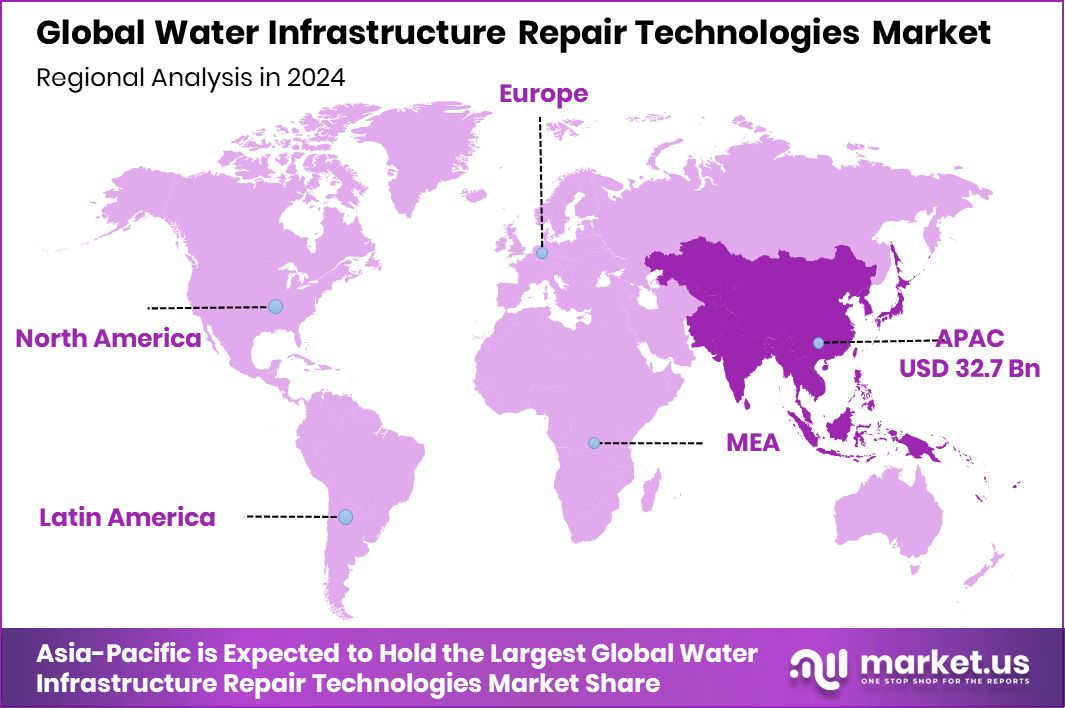

The Global Water Infrastructure Repair Technologies Market is expected to be worth around USD 160.4 billion by 2034, up from USD 75.0 billion in 2024, and is projected to grow at a CAGR of 7.9% from 2025 to 2034. Asia Pacific maintained leadership at 43.70% share, valued at around USD 32.7 Bn.

Water infrastructure repair technologies include the tools, materials, and modern techniques used to fix aging pipelines, leaking joints, damaged sewers, and wastewater systems. These solutions help cities reduce water loss, maintain pressure levels, and extend the lifespan of buried networks without major excavation. The Water Infrastructure Repair Technologies Market refers to the global ecosystem that provides these repair and rehabilitation solutions to municipalities and communities working to maintain dependable drinking-water and wastewater services.

Growth in this market is strongly supported by rising urban demand and large-scale public investment. Several regions have increased funding to modernize deteriorating networks, such as Bradenton securing $54 million for water system improvements and the EPA announcing $7 billion in new WIFIA funding along with five major loan approvals, which directly encourage upgrades and repairs. International momentum is also visible as Aegea obtained $250 million to strengthen sewage infrastructure in Manaus, Brazil, while the Gov. Sanders directed $153 million toward Arkansas water projects.

Additional investment continues to shape market demand. New Brunswick, California, allocated $150 million for wastewater infrastructure, and communities in Northeast South Dakota benefited from nearly $140 million for water and waste upgrades. Support also extends to smaller regions, with Montana awarding $23.7 million to 39 communities and Croatia receiving €39 million to enhance wastewater treatment in Velika Gorica. These commitments expand opportunities for advanced repair technologies as utilities upgrade essential systems worldwide.

Key Takeaways

- The Global Water Infrastructure Repair Technologies Market is expected to be worth around USD 160.4 billion by 2034, up from USD 75.0 billion in 2024, and is projected to grow at a CAGR of 7.9% from 2025 to 2034.

- The Water Infrastructure Repair Technologies Market shows strong demand for pipes and connectors, holding a 38.2% share.

- Within repair methods, spot repair dominates the Water Infrastructure Repair Technologies Market with a 47.8% contribution.

- In application areas, potable water leads the Water Infrastructure Repair Technologies Market, capturing 43.6% share globally.

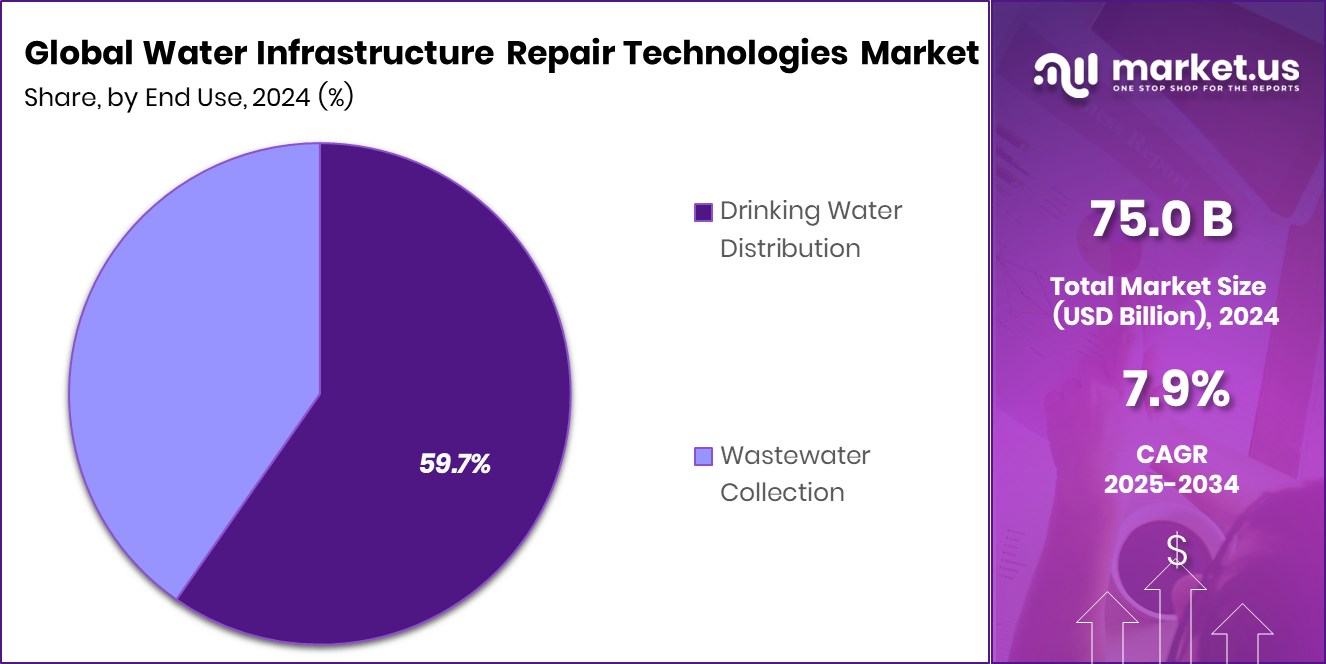

- For end-use segments, drinking water distribution drives the Water Infrastructure Repair Technologies Market with 59.7% prominence.

- In 2024, the Asia Pacific dominated with a 43.70% share and USD 32.7 Bn.

By Product Type Analysis

Water Infrastructure Repair Technologies Market grows as pipes and connectors hold 38.2% share.

In 2024, Pipes and Connectors held a dominant market position in the By Product Type segment of the water infrastructure repair technologies market, with a 38.2% share. This segment remained essential as utilities prioritized direct pipeline rehabilitation to maintain flow efficiency and reduce water loss.

The strong share of Pipes and Connectors reflects the sector’s reliance on durable replacement components, particularly in aging networks where leakage reduction is a priority. Their widespread use across municipal systems ensured steady demand, making them a central part of maintenance strategies.

As urban water grids expanded, the need for dependable pipeline joints and connectors further strengthened the segment’s position, supporting long-term infrastructure continuity through standardized repair solutions.

By Repair Type Analysis

Spot repair dominates the Water Infrastructure Repair Technologies Market with a 47.8% segment share.

In 2024, Spot Repair held a dominant market position in the By Repair Type segment of the Water Infrastructure Repair Technologies Market, with a 47.8% share. Its leadership stemmed from the increasing preference for localized interventions that minimize excavation and reduce service disruptions.

Spot Repair became a widely adopted method as utilities sought cost-efficient solutions for isolated defects such as cracks, leaks, or joint failures. The technique’s ability to resolve issues quickly without extensive system downtime strengthened its acceptance across municipal repair programs.

Its dominant share also reflects a shift toward targeted maintenance strategies, where operators focus on extending asset life through precise, small-area rehabilitation instead of large-scale replacements.

By Application Analysis

Potable water applications lead the Water Infrastructure Repair Technologies Market, capturing 43.6% share.

In 2024, Potable Water held a dominant market position in the By Application segment of the Water Infrastructure Repair Technologies Market, with a 47.8% share. This segment led due to the critical need to maintain safe drinking-water networks and prevent contamination risks in distribution lines.

Repair activities in potable water systems focused heavily on preventing leakage and ensuring consistent pressure levels, making infrastructure upkeep a priority for utilities. The segment’s strong share highlights the continued investment in safeguarding water quality across urban and rural service areas.

Its leadership reflects how essential repair solutions are for maintaining regulatory compliance and ensuring consumers receive uninterrupted access to treated, safe water.

By End Use Analysis

Drinking water distribution drives the Water Infrastructure Repair Technologies Market with 59.7% dominance.

In 2024, Drinking Water Distribution held a dominant market position in the By End Use segment of the Water Infrastructure Repair Technologies Market, with a 59.7% share. This substantial share reflects the importance of maintaining extensive distribution networks that deliver treated water directly to households and commercial users.

The segment’s dominance is tied to the growing need for restoring pipes, valves, and joints that support high-volume movement of drinking water across diverse geographies. Utilities focused repair activities on minimizing leakages and improving the reliability of delivery systems.

With distribution networks forming the backbone of public water supply, the high share underscores their priority in long-term infrastructure management and day-to-day operational stability.

Key Market Segments

By Product Type

- Pipes and Connectors

- Fittings

- Couplings

- Valves

- Others

By Repair Type

- Spot Repair

- Full Length Repair

- Others

By Application

- Potable Water

- Wastewater

- Industrial Water

- Others

By End Use

- Drinking Water Distribution

- Wastewater Collection

Driving Factors

Rising Public Funding Strengthens Repair Needs

Growing public investment has become one of the strongest driving factors for the Water Infrastructure Repair Technologies Market, as many communities now focus on long-term solutions for aging water and wastewater systems. Several regions have committed dedicated funds to protect local water bodies and improve treatment systems, directly increasing the demand for reliable repair technologies.

In the U.S., Mashpee’s request for $26 million reflects the need to protect ponds and bays through stronger infrastructure. Similarly, the Department of Natural Resources awarded $5.98 million to Mountain View highlights continued investment in maintaining safe water services.

Additional support, such as Solvang securing a $1 million federal grant for wastewater treatment upgrades and Hartsburg receiving a $50K grant to evaluate its treatment system, shows how both major and small-scale funding encourages communities to modernize pipelines, improve treatment reliability, and adopt repair technologies that extend the life of existing networks.

Restraining Factors

High Project Costs Slow Infrastructure Repairs

One of the main restraining factors for the Water Infrastructure Repair Technologies Market is the high cost of large-scale water and wastewater repair projects, which often delays upgrades even when the need is urgent. Many regions face financial gaps that make it difficult to repair aging pipelines, update treatment plants, or introduce modern rehabilitation technologies. Even with new funding support, the overall expenses remain significant for many local authorities. Recent financial commitments show this challenge clearly, such as the €22 million European Union grant provided to Montenegro to strengthen sustainable water use and climate resilience.

Similarly, the City of Monett receiving a $4.59 million grant for its wastewater project highlights how communities must rely on external support to move forward. In Africa, the African Development Fund approving an additional $8.6 million grant for rural Burundi also reflects the scale of investment required to maintain reliable water supply systems. These examples show that although funding helps, the large capital needs, complex project requirements, and long installation timelines continue to restrain faster adoption of repair technologies across many regions.

Growth Opportunity

Expanding Investments Create Strong Repair Opportunities

A major growth opportunity for the Water Infrastructure Repair Technologies Market comes from the rising focus on improving and reusing water resources through stronger financial support. Many regions are increasing investment in repairing pipelines, upgrading treatment plants, and improving long-term water system performance. The market benefits when governments and regulators direct funds toward infrastructure renewal, making room for modern repair tools, trenchless technologies, and monitoring systems that extend the life of old networks. One of the strongest examples is the EPA announcing $7 billion in WIFIA funds with five new loan approvals, which directly boost large repair and rehabilitation programs.

Additional opportunities continue to grow as industries move toward wastewater reuse, supported by new financing such as the $20 million Series B1 fund dedicated to advancing industrial wastewater reuse. This trend encourages companies and utilities to adopt advanced repair technologies that ensure pipelines and treatment components can support higher-quality reclaimed water.

In the UK, £42 million in funding awarded to water treatment projects by the regulator shows how multiple regions are prioritizing better treatment and distribution systems. These commitments open new space for repair technologies that help utilities upgrade aging assets and meet future water sustainability goals.

Latest Trends

Modern Financing Boosts Digital Repair Innovation

One of the latest trends in the Water Infrastructure Repair Technologies Market is the growing shift toward digitally enabled repair solutions supported by stronger financial backing. Utilities and technology developers are increasingly focusing on smarter monitoring, advanced filtration, and predictive repair methods that help reduce water loss and extend pipeline life. This trend is becoming more visible as large water operators secure major financial support to stabilize and modernize their networks. A clear example is Thames Water receiving key creditor support for a £3bn funding lifeline, which strengthens its ability to invest in improved repair and operational technologies.

Innovation is also rising through smaller technology companies that introduce new filtration and treatment ideas to support cleaner water systems. A good example is a Manchester spin-out receiving £500,000 in new funding to advance next-generation water filtration. These developments show how both large utilities and emerging innovators are using financial backing to accelerate digital tools, improve repair accuracy, and reduce long-term system failures.

Regional Analysis

Asia Pacific captured 43.70% share, reaching USD 32.7 Bn in market value.

In the Water Infrastructure Repair Technologies Market, Asia Pacific remained the dominant region, holding a 43.70% share valued at USD 32.7 Bn. Its leadership reflects large-scale pipeline networks and a sustained focus on restoring urban water systems across rapidly expanding cities. The region’s strong share also highlights its ongoing need for leak reduction, structural rehabilitation, and improved distribution reliability, positioning Asia Pacific as the central hub of market activity during the period.

North America followed with steady demand driven by aging municipal pipelines and continuous repair requirements across established water distribution grids. The region’s focus on preventing service interruptions supported consistent adoption of proven repair solutions. Europe showed similar momentum as utilities prioritized maintaining long-term operational integrity of water infrastructure across both mature and emerging urban areas.

In the Middle East & Africa, growing population clusters and expanding service connections contributed to rising interest in pipeline restoration strategies. Latin America also showed meaningful activity as urban utilities concentrated on reducing system losses.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Aegion Corporation continued to serve as a key player by supporting trenchless rehabilitation approaches that help utilities reduce downtime and extend the life of buried assets. Its long-standing experience in pipeline strengthening positioned it effectively as cities prioritized non-disruptive restoration methods. The company’s operational capabilities remained closely aligned with municipal needs to improve long-term water flow efficiency.

Mueller Water Products, Inc. maintained relevance by focusing on components essential for leak detection, pressure management, and network performance. Its offerings supported utilities in addressing recurring issues in older pipeline systems, allowing municipalities to manage failures more proactively and maintain consistent service levels.

3M Company remained influential through its material-based solutions used across various water repair applications. Its emphasis on protective materials, sealing products, and reinforcement systems supported infrastructure operators looking for dependable, standardized repair methods to maintain the structural integrity of key water assets.

Top Key Players in the Market

- Aegion Corporation

- Mueller Water Products, Inc.

- 3M Company

- Xylem Inc.

- Kurita Water Industries Ltd.

- Suez SA

- Uponor Corporation

- Advanced Drainage Systems, Inc.

- Atlantis D-Raintank, LLC

- Brandenburger Liner GmbH & Co. KG

Recent Developments

- In October 2025, Mueller highlighted its push into smart technology for water infrastructure at the WEFTEC event. The company discussed innovations like acoustic leak detection, pressure monitoring, and hydrant renewal solutions that turn traditional systems smarter and more efficient, helping utilities detect issues earlier and repair pipelines faster. These advancements support modern repair strategies that go beyond basic hardware.

- In April 2024, Aegion Corporation changed its name to Azuria Water Solutions to show its stronger focus on water infrastructure repair and rehabilitation technologies. The new name and identity support its goal of delivering better technology-enabled products and services for pipeline maintenance and rehabilitation in water systems. This rebranding also aligns the company’s operations under a unified water-centric strategy.

Report Scope

Report Features Description Market Value (2024) USD 75.0 Billion Forecast Revenue (2034) USD 160.4 Billion CAGR (2025-2034) 7.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Pipes and Connectors, Fittings, Couplings, Valves, Others), By Repair Type (Spot Repair, Full Length Repair, Others), By Application (Potable Water, Wastewater, Industrial Water, Others), By End Use (Drinking Water Distribution, Wastewater Collection) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Aegion Corporation, Mueller Water Products, Inc., 3M Company, Xylem Inc., Kurita Water Industries Ltd., Suez SA, Uponor Corporation, Advanced Drainage Systems, Inc., Atlantis D-Raintank, LLC, Brandenburger Liner GmbH & Co. KG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Water Infrastructure Repair Technologies MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Water Infrastructure Repair Technologies MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Aegion Corporation

- Mueller Water Products, Inc.

- 3M Company

- Xylem Inc.

- Kurita Water Industries Ltd.

- Suez SA

- Uponor Corporation

- Advanced Drainage Systems, Inc.

- Atlantis D-Raintank, LLC

- Brandenburger Liner GmbH & Co. KG