Global Vinyl Ester Market Size, Share, And Business Benefit By Type (Bisphenol-A, Novolac, Brominated Fire Retardant, Others), By Application (Pipes and Tanks, Marine, Wind Energy, FGD and Precipitators, Pulp and Paper, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 161634

- Number of Pages: 360

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

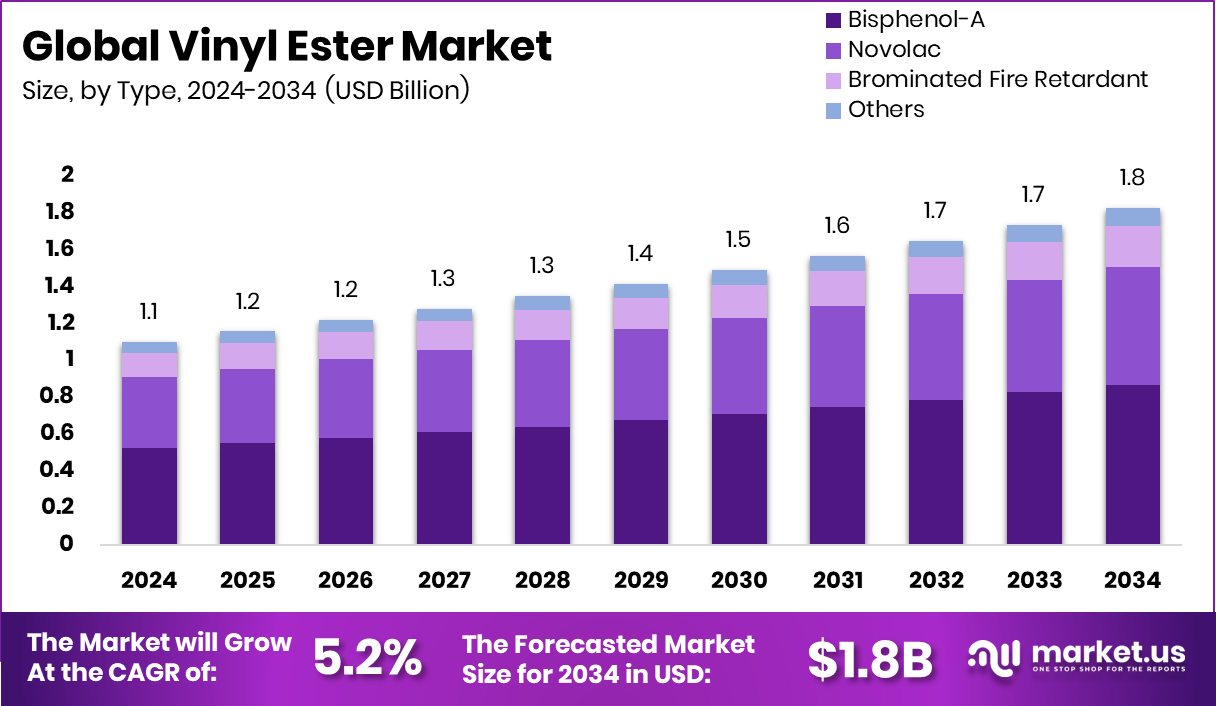

The Global Vinyl Ester Market is expected to be worth around USD 1.8 billion by 2034, up from USD 1.1 billion in 2024, and is projected to grow at a CAGR of 5.2% from 2025 to 2034. Expanding construction and marine projects across the Asia Pacific, 43.90% continue to drive sustained market demand.

Vinyl ester is a resin derived from epoxy and methacrylic acid, combining features of both epoxy and polyester. It cures via free radical polymerization and offers excellent corrosion resistance, mechanical strength, and low shrinkage. It is often used as a protective coating, in composite materials, and in harsh chemical environments because of its durability under stress.

The vinyl ester market refers to the global trade and use of vinyl ester resins in industries such as marine, chemical processing, oil & gas, water treatment, and infrastructure. It includes raw resin production, formulation, downstream composite manufacturing, and end-use deployment of components or coatings made from vinyl ester.

One key growth driver is increasing demand in harsh-environment applications: industries needing materials that resist acid, salt water, and chemical attack push for vinyl ester use. Infrastructure rehabilitation and expansion, especially in coastal or industrial zones, further boost demand. Public funding in water and infrastructure also helps: for example, Wisconsin communities receive $273 M for drinking water projects, which can indirectly support demand for high-performance resins in containment and processing systems.

Opportunities lie in specialty formulations and expanding into emerging markets with rising industrialization. Also, novel coating or composite technologies can open new niches—for instance, technologies that reduce waste or improve performance. Supporting that, LiquiGlide raises $16 million to get every last drop out of packages or tanks, showing investor appetite for advanced surface or coating solutions. Another funding boost: DANR announces more than $5.8 million in additional ARPA grants for statewide projects, which can stimulate infrastructure and materials demand.

Key Takeaways

- The Global Vinyl Ester Market is expected to be worth around USD 1.8 billion by 2034, up from USD 1.1 billion in 2024, and is projected to grow at a CAGR of 5.2% from 2025 to 2034.

- In 2024, Bisphenol-A dominated the Vinyl Ester Market with a 47.6% share due to superior durability.

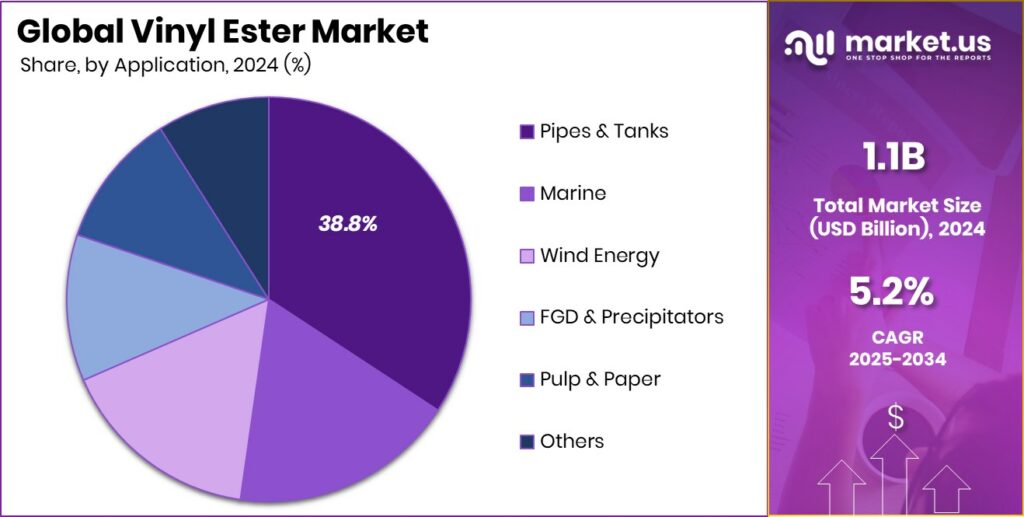

- Pipes and Tanks accounted for a 38.8% share in the Vinyl Ester Market, ensuring efficient fluid containment.

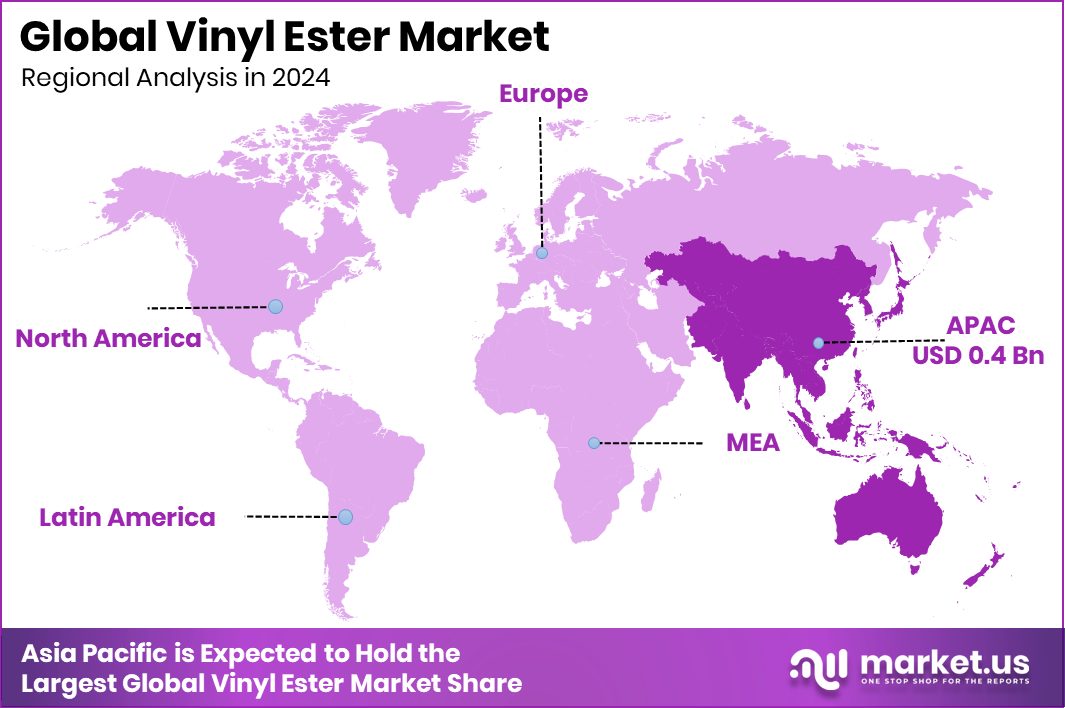

- The Asia Pacific’s strong industrial infrastructure supported market valuation reaching USD 0.4 billion overall.

By Type Analysis

In 2024, the vinyl ester market saw bisphenol-A holding a 47.6% share.

In 2024, Bisphenol-A held a dominant market position in the By Type segment of the Vinyl Ester Market, with a 47.6% share. This dominance is attributed to its superior mechanical strength, excellent chemical resistance, and strong bonding properties that make it widely preferred in industrial applications. Bisphenol-A-based vinyl esters are extensively used in corrosion-resistant tanks, pipes, and marine structures, where long-term performance under harsh environments is critical.

The segment’s strong share also reflects its cost-effectiveness and adaptability across infrastructure, chemical processing, and coatings applications. Its durability and compatibility with fiberglass reinforcements have positioned Bisphenol-A vinyl esters as the most reliable choice for manufacturers seeking a balance between performance and processing efficiency in the global market.

By Application Analysis

The vinyl ester market recorded a 38.8% share for the pipes and tanks segment.

In 2024, Pipes and Tanks held a dominant market position in the By Application segment of the Vinyl Ester Market, with a 38.8% share. This dominance is mainly due to the resin’s excellent resistance to corrosion, chemicals, and moisture, making it ideal for manufacturing storage tanks, process vessels, and industrial pipelines.

Industries such as water treatment, chemical processing, and marine rely heavily on vinyl ester-based composites for long-lasting performance under aggressive operating conditions. Its ability to withstand high temperatures and harsh environments has also encouraged widespread adoption across infrastructure and energy sectors. The segment’s strong presence reflects growing demand for durable, low-maintenance materials that extend service life while reducing replacement costs.

Key Market Segments

By Type

- Bisphenol-A

- Novolac

- Brominated Fire Retardant

- Others

By Application

- Pipes and Tanks

- Marine

- Wind Energy

- FGD and Precipitators

- Pulp and Paper

- Others

Driving Factors

Rising Demand for Durable Corrosion-Resistant Materials

One of the top driving factors for the vinyl ester market is its increasing demand in applications that require long-life, corrosion-resistant materials. Because vinyl ester resins resist chemicals, saltwater, and harsh industrial environments, they are widely chosen for pipes, tanks, and marine structures. Many infrastructure and coastal protection projects prefer these materials to reduce maintenance and replacement costs.

Public and private funding trends also support this growth: for example, Ocean protection needs $15.8 billion annually but is receiving only $1.2 billion, which underscores the urgency of durable and resilient materials in coastal and marine projects. Such budget constraints push decision-makers toward long-lasting solutions—making vinyl esters more attractive for critical systems in water treatment, offshore structures, and industrial settings.

Restraining Factors

High Production and Processing Cost Challenges

One major restraining factor for the vinyl ester market is its high production and processing cost compared to traditional resins. The manufacturing process involves expensive raw materials such as epoxy and special curing agents, which increase overall costs. Additionally, vinyl ester requires careful handling during formulation and curing to achieve the desired strength and performance, adding more labor and energy expenses.

These higher costs often discourage small and medium industries from adopting vinyl ester materials, especially in cost-sensitive projects. The need for temperature-controlled environments and advanced molding systems further limits large-scale production efficiency, making it challenging for manufacturers to compete with cheaper alternatives like polyester resins in certain industrial applications.

Growth Opportunity

High Production Cost Limits Market Expansion

One of the main restraining factors for the vinyl ester market is the high production cost associated with resin synthesis and processing. Vinyl esters are made through complex reactions involving epoxy resins and unsaturated acids, requiring controlled conditions and expensive raw materials. This makes their overall manufacturing cost higher compared to conventional polyester resins.

Industries with tight budgets, especially in developing regions, often prefer lower-cost alternatives even if performance is compromised. Additionally, the curing and handling of vinyl ester resins demand skilled labor and specific catalysts, adding further to operational expenses. These higher costs limit widespread adoption, particularly among small and medium manufacturers, slowing the market’s expansion despite its strong performance advantages.

Latest Trends

Growing Use in Advanced Marine & Coastal Applications

A key recent trend in the vinyl ester market is its increased use in advanced marine and coastal infrastructure applications. Governments and industries are investing more in shipbuilding, offshore platforms, and coastal defenses, where materials must resist saltwater, waves, and erosion. Vinyl ester resins, with their strong corrosion resistance and toughness, are becoming a go-to material for structural composites and protective coatings in these environments.

Supporting this shift, the government plans to boost the Maritime Development Fund to ₹70,000 crore, nearly tripling the budget allocation—this kind of emphasis on maritime growth pushes demand for materials suited to marine conditions. As marine projects expand, the trend for vinyl ester usage in hulls, offshore structures, and coastal protection is expected to accelerate.

Regional Analysis

In 2024, the Asia Pacific dominated the Vinyl Ester Market with a 43.90% share.

In 2024, Asia Pacific held a dominant position in the global Vinyl Ester Market, accounting for 43.90% share with a market value of USD 0.4 billion. The region’s dominance is driven by rapid industrialization, infrastructure expansion, and growing chemical processing and marine activities across China, India, Japan, and Southeast Asia. Increasing investments in corrosion-resistant materials for water treatment and construction sectors have further strengthened regional growth.

North America follows, supported by strong demand for advanced composites in the oil & gas and transportation sectors, particularly in the United States. Europe maintains steady consumption driven by environmental regulations encouraging the use of durable, low-emission materials.

Meanwhile, the Middle East & Africa show rising potential due to infrastructure development and desalination projects, while Latin America exhibits gradual adoption of vinyl ester resins in industrial storage and marine applications, signaling emerging opportunities for future market expansion.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Allnex GmbH continued to demonstrate a strong presence in the global Vinyl Ester Market through its wide portfolio of high-performance resin systems. The company’s focus on innovation and sustainable product development has reinforced its leadership in corrosion-resistant and composite applications. Allnex’s ongoing efforts in low-VOC and environmentally compatible vinyl ester formulations align with the growing demand from infrastructure, marine, and industrial sectors. Its robust global network supports efficient supply chains and customer-specific solutions across regions.

AOC has maintained a competitive edge by expanding its advanced composite resin technologies and strengthening its product quality for high-end industrial use. The company’s continuous focus on performance improvement and process optimization enables it to deliver resins that meet stringent standards in chemical containment and marine construction. AOC’s manufacturing efficiency and global presence have positioned it as a reliable supplier in long-term industrial projects.

BUFA Composites remains an important contributor to the vinyl ester sector with its specialized range of composite materials tailored for demanding applications. The company emphasizes consistent quality, technical support, and customized resin solutions for diverse end users. BUFA’s integration of innovation in production and adherence to environmental standards have helped enhance its brand reliability, supporting stable growth within the vinyl ester value chain.

Top Key Players in the Market

- Allnex GmbH

- AOC

- BUFA Composites

- DIC Corporation

- Hexion Inc.

- INEOS Composites

- Interplastic Corporation

- Nivitex Fibreglass & Resins

- Poliya

- Reichhold LLC

Recent Developments

- In August 2025, Allnex announced its participation in CAMX 2025, where it would present advanced vinyl ester and resin formulations targeted at marine, pool, and other composite applications.

- In October 2024, Nippon Paint Holdings (NPHD) announced the acquisition of AOC, making AOC a subsidiary focused on specialty resins, including vinyl ester and unsaturated polyester.

Report Scope

Report Features Description Market Value (2024) USD 1.1 Billion Forecast Revenue (2034) USD 1.8 Billion CAGR (2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Bisphenol-A, Novolac, Brominated Fire Retardant, Others), By Application (Pipes and Tanks, Marine, Wind Energy, FGD and Precipitators, Pulp and Paper, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Allnex GmbH, AOC, BUFA Composites, DIC Corporation, Hexion Inc., INEOS Composites, Interplastic Corporation, Nivitex Fibreglass & Resins, Poliya, Reichhold LLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Allnex GmbH

- AOC

- BUFA Composites

- DIC Corporation

- Hexion Inc.

- INEOS Composites

- Interplastic Corporation

- Nivitex Fibreglass & Resins

- Poliya

- Reichhold LLC