Global Turbine Oils Market Size, Share, And Enhanced Productivity By Type (Mineral Oils, Bio-Based Oils, Synthetic Oils), By Turbine Type (Steam Turbine, Gas Turbine, Wind Turbine, Hydraulic Systems, Others), By End-use (Automotive, Aerospace, Energy Generation, Marine, Mining, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 168411

- Number of Pages: 309

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

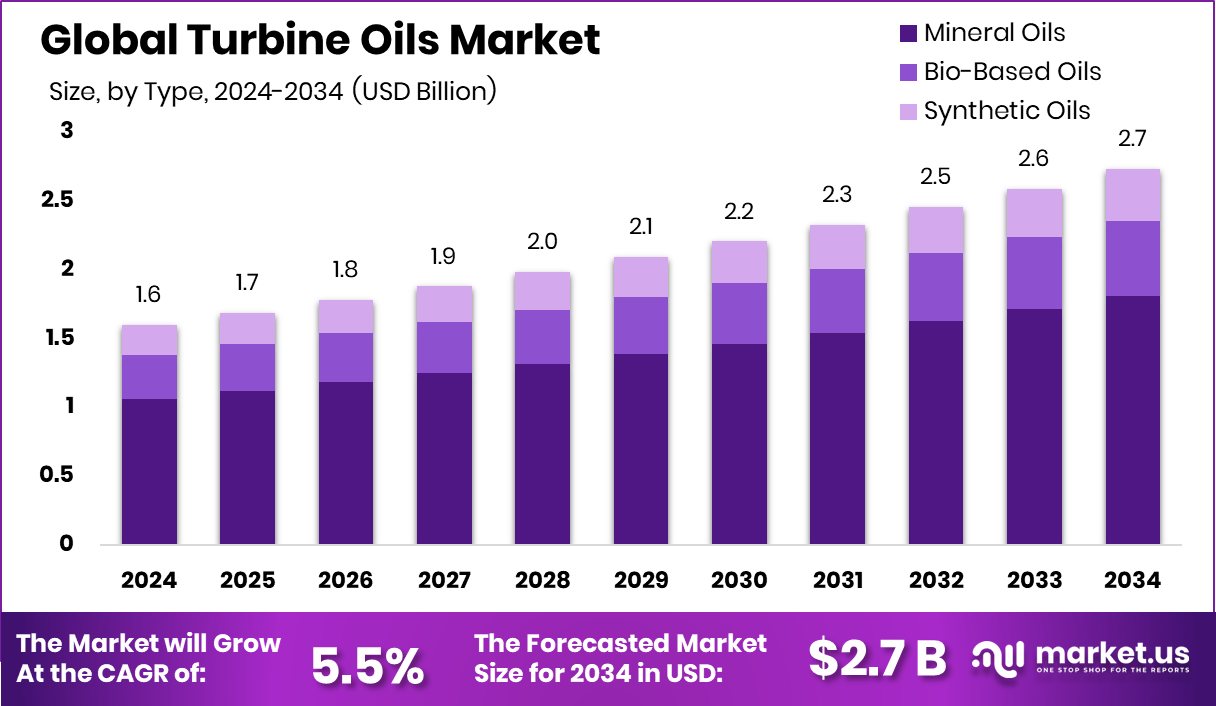

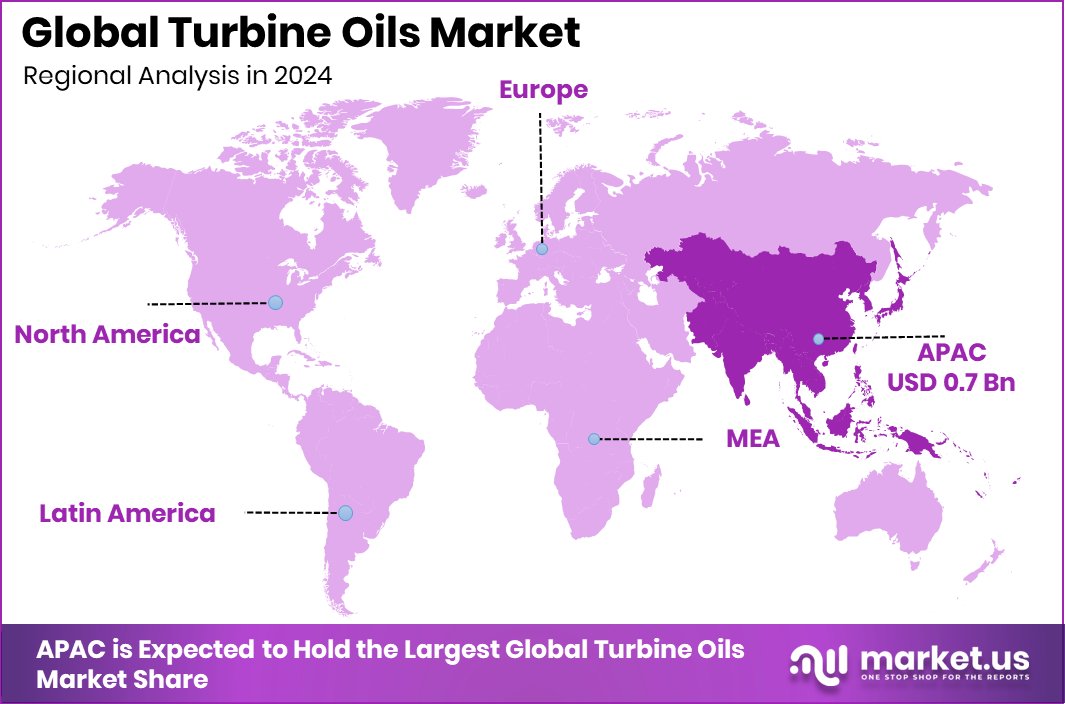

The Global Turbine Oils Market is expected to be worth around USD 2.7 billion by 2034, up from USD 1.6 billion in 2024, and is projected to grow at a CAGR of 5.5% from 2025 to 2034. Asia-Pacific accounts for 43.90% of Turbine Oils Market totaling USD 0.7 Bn today.

Turbine oils are specialized lubricants designed to protect turbines used in power generation, aviation, marine propulsion, and industrial processes. Their main role is to reduce friction, control heat, prevent corrosion, and keep internal turbine components clean during continuous operation. These oils are formulated to remain stable under high temperatures, heavy loads, and long service intervals, helping turbines run smoothly and reliably.

The turbine oils market covers the production, supply, and use of these lubricants across thermal power plants, hydroelectric stations, wind farms, and large industrial facilities. As turbines operate for long hours with minimal shutdowns, operators depend on high-quality oils to maintain performance, reduce wear, and avoid costly breakdowns, making turbine oils a critical part of energy and industrial infrastructure.

One key growth factor is rising investment in energy systems and heavy industry. Government support for advanced materials and energy reliability is strengthening this trend. For example, the U.S. Department of Energy announced $19.5 million to produce critical minerals and materials, indirectly supporting lubricant innovation. In Europe, approval of up to EUR 360 million as a Czech government grant is also helping industrial projects expand.

Demand for turbine oils continues to grow with the expansion of power generation assets and industrial machinery. Financial strength in infrastructure-linked sectors supports this need, highlighted by MIIF posting record profits and GH¢1.96 billion income in 2024. In emerging markets, funding pressures and capital raises, such as Premier African Minerals securing £500,000, indicate ongoing industrial operations that require reliable turbine lubrication.

A major opportunity lies in developing sustainable and high-performance oils. ÄIO securing €1 million to develop fermentation-based oils shows rising interest in alternative lubricant sources. Similarly, Neo raising $25 million to fuel growth and operations reflects strong investor confidence in advanced oil technologies, opening new pathways for innovation in turbine oil formulations.

Key Takeaways

- The Global Turbine Oils Market is expected to be worth around USD 2.7 billion by 2034, up from USD 1.6 billion in 2024, and is projected to grow at a CAGR of 5.5% from 2025 to 2034.

- In the Turbine Oils Market, mineral oils dominate with 66.30% share due to cost efficiency.

- In the Turbine Oils Market, steam turbines hold a 39.70% share driven by power plants.

- Energy generation leads the Turbine Oils Market by end-use with a 47.20% share overall.

- In Asia-Pacific, turbine oils demand reached 43.90%, generating USD 0.7 Bn revenue regionally.

By Type Analysis

In Turbine Oils Market, mineral oils dominate with a 66.30% share due to cost efficiency.

In 2024, Mineral Oils held a dominant market position in the By Type segment of the Turbine Oils Market, with a 66.30% share. This dominance reflects the long-standing reliability and widespread acceptance of mineral oil–based formulations in turbine applications.

Mineral oils continue to be preferred due to their stable lubricating performance, thermal resistance, and compatibility with existing turbine systems. Their proven ability to manage wear, oxidation, and heat under continuous operating conditions supports consistent turbine efficiency across power generation and industrial environments.

Operators favor mineral oils because they offer predictable performance over extended service periods, reducing maintenance risks and operational interruptions. The established supply base and operational familiarity further reinforce their strong position, making mineral oils the primary choice for turbine lubrication needs in 2024.

By Turbine Type Analysis

In Turbine Oils Market, steam turbines hold 39.70% share driven by utility-scale power plants.

In 2024, Steam Turbine held a dominant market position in the By Turbine Type segment of the Turbine Oils Market, with a 39.70% share. This leadership is driven by the critical role steam turbines play in large-scale power generation and industrial operations.

Steam turbines operate under continuous high-temperature and high-pressure conditions, which increases dependence on reliable lubrication to maintain smooth performance. Turbine oils used in steam turbine systems are essential for controlling friction, managing heat, and protecting internal components from wear and corrosion.

Operators prioritize consistent oil quality to support long operating cycles and prevent unplanned shutdowns. As power plants and industrial facilities rely heavily on steam turbines for stable output, lubrication requirements remain strong, reinforcing steam turbines’ leading position within the turbine oils demand structure in 2024.

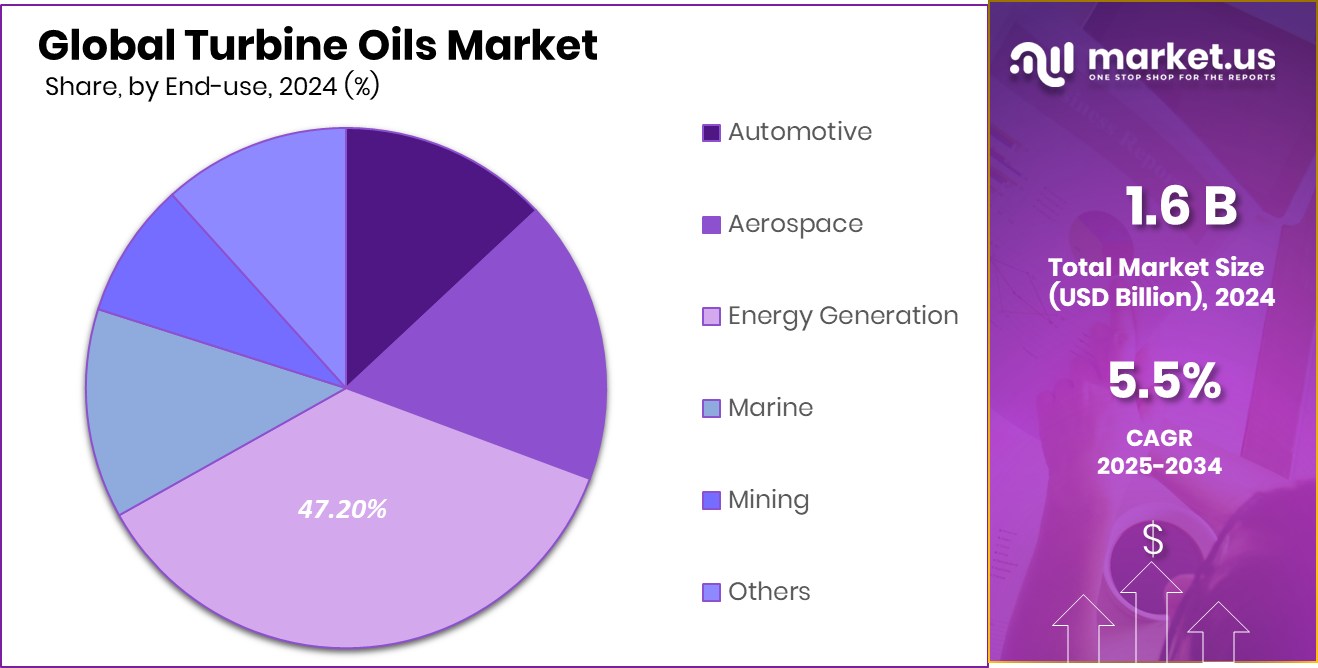

By End-use Analysis

In Turbine Oils Market, energy generation accounts for 47.20% of the share across installations.

In 2024, Energy Generation held a dominant market position in the By End-use segment of the Turbine Oils Market, with a 47.20% share. This dominance reflects the essential role of turbine oils in supporting reliable electricity production across large and continuously operating facilities.

Energy generation systems depend on turbines that run for extended periods, making effective lubrication vital for maintaining efficiency and operational stability. Turbine oils in this end-use are valued for their ability to handle thermal stress, reduce mechanical wear, and protect equipment under demanding conditions.

Regular operation cycles and high load requirements increase oil consumption and replacement needs. As energy infrastructure continues to rely on dependable turbine performance, the energy generation segment remains the largest contributor to turbine oil usage in 2024.

Key Market Segments

By Type

- Mineral Oils

- Bio-Based Oils

- Synthetic Oils

By Turbine Type

- Steam Turbine

- Gas Turbine

- Wind Turbine

- Hydraulic Systems

- Others

By End-use

- Automotive

- Aerospace

- Energy Generation

- Marine

- Mining

- Others

Driving Factors

Expansion of Power Infrastructure Drives Turbine Oil Demand

One major driving factor for the Turbine Oils Market is the continuous expansion and modernization of power infrastructure. New power plants and the revival of legacy energy assets directly increase the need for reliable turbine lubrication. For example, Tripura is set to launch India’s first 120 MW combined cycle gas turbine plant, which will rely on turbine oils to ensure smooth operation, temperature control, and long equipment life.

At the same time, aging energy and steam-based facilities are being restored rather than retired. The London Museum of Water and Steam has begun urgent restoration work after receiving a £2.63 million government grant, highlighting continued use of steam turbine systems.

Both new installations and refurbishment projects require dependable turbine oils to prevent wear, avoid breakdowns, and support long-term operational efficiency, making power infrastructure growth a strong and sustained market driver.

Restraining Factors

Changing Turbine Ownership And Technology Slows Oil Demand

A key restraining factor for the Turbine Oils Market is the shift in turbine ownership structures and changing technology focus in the energy sector. When companies realign their turbine-related assets, lubricant demand can become uncertain or delayed.

For instance, Triveni Engineering sold its entire 21.85% stake in Triveni Turbines for Rs 1,600 crore, signaling strategic exits and restructuring rather than expansion of turbine operations. Such moves often slow fresh investments in turbine maintenance and associated oil procurement.

At the same time, the U.S. Department of Energy investing $56 million in coal technology projects reflects a focus on efficiency improvements and alternative systems that may reduce lubrication intensity over time. These transitions can limit short-term growth, as operators reassess turbine usage, life cycles, and oil consumption needs.

Growth Opportunity

Low-Carbon Turbine Upgrades Create Oil Growth

One major growth opportunity for the Turbine Oils Market comes from the upgrade of turbines to support low-carbon and cleaner power systems. As power producers invest in emission reduction technologies, turbines continue to operate intensively while running under more controlled and demanding conditions.

The U.S. Department of Energy awarded $5.7 million for a GE-led carbon capture technology integration project, targeting a 95% reduction in carbon emissions. Such projects extend the operating life of existing turbines rather than replacing them, increasing the need for high-performance turbine oils that can handle continuous operation and thermal stress.

Carbon capture systems often add additional load and operating hours to turbines, which raises lubrication requirements. This shift creates strong long-term demand for advanced turbine oils that support efficiency, reliability, and cleaner power generation goals.

Latest Trends

Clean Fuel Turbines Redefine Modern Lubrication Needs

A major latest trend in the Turbine Oils Market is the rising use of gas turbines linked with cleaner fuels and large-scale power financing. Partners recently achieved financial close on $4 billion Saudi power plants, showing strong momentum toward high-capacity, modern turbine infrastructure.

At the same time, Swiss climate-tech startup Crosstown raised €3.2 million to enable gas turbines to run on renewable fuels, pushing turbines to operate under new combustion conditions. In the U.S., Macquarie Asset Management provided $450 million in financing for a Texas combined cycle gas turbine project, reinforcing long-term turbine operation plans.

These developments increase demand for turbine oils that can handle higher efficiency cycles, cleaner fuels, and longer operating hours without performance loss.

Regional Analysis

Asia-Pacific dominates Turbine Oils Market with 43.90% share valued at USD 0.7 Bn.

Asia-Pacific stands as the dominating region in the Turbine Oils Market, holding a 43.90% share and valued at USD 0.7 Bn. This leadership reflects the region’s wide base of power generation assets and continuous industrial activity requiring stable turbine operations. Strong dependence on thermal, gas, and steam-based turbines drives consistent lubrication needs, while long operating hours increase oil consumption cycles. The scale of energy infrastructure across the region positions Asia-Pacific as the primary contributor to market demand.

North America represents a mature yet steady regional market for turbine oils, supported by established power plants and industrial turbines operating under strict performance standards. Regular maintenance practices and extended turbine lifecycles sustain ongoing demand. Operators in the region prioritize operational reliability, supporting steady usage of turbine oils across energy and industrial applications.

Europe shows stable consumption patterns driven by a mix of conventional power generation and industrial turbine use. Aging infrastructure across parts of the region increases maintenance requirements, reinforcing the importance of turbine oils for efficient heat control and component protection within existing systems.

Middle East & Africa market growth is supported by energy-intensive industries and large utility-scale turbine installations. High operating temperatures and continuous turbine usage make lubricants essential for ensuring reliability and minimizing downtime across power facilities.

Latin America remains a developing regional market where expanding energy infrastructure and industrial activities are gradually increasing turbine oil demand, supported by broader efforts to improve power generation efficiency and operational stability.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BP Lubricants plays a strategic role in the global Turbine Oils Market through its strong focus on product reliability and long-term equipment protection. In 2024, the company continues to emphasize turbine oils designed for consistent performance under high thermal and mechanical stress. Its approach centers on improving oil stability and oxidation control to support longer service intervals in power generation and industrial turbines. This focus aligns well with operators seeking reduced downtime and predictable maintenance cycles.

Chevron U.S.A. remains a significant participant in turbine oils through its emphasis on operational efficiency and lubricant durability. In 2024, Chevron’s turbine oil portfolio is positioned around supporting continuous turbine operation in demanding environments. The company’s strength lies in delivering consistent lubrication performance that helps manage heat, minimize wear, and support turbine reliability across long operating periods, particularly in energy and industrial applications.

Eastern Petroleum maintains its presence in the turbine oils space by supplying dependable lubrication solutions tailored to regional and industrial requirements. In 2024, the company focuses on meeting day-to-day operational needs of turbines through stable and cost-effective oil formulations. Eastern Petroleum’s role is shaped by its ability to serve ongoing turbine maintenance demand, supporting smooth operations and extending equipment life within its served markets.

Top Key Players in the Market

- BP Lubricants

- Chevron U.S.A

- Eastern Petroleum

- Eastman Chemical Company

- Exxon Mobil Corporation

- FUCHS

- Idemitsu

- Indian Oil Corporation

- Kluber Lubrication

- Lubrizol

Recent Developments

- In May 2025, BP initiated a formal sale process for its lubricants unit (which includes its industrial and turbine-oil offerings), signaling possible exit or reorganization.

- In March 2025, Chevron signed an agreement with Azelis for distribution of Chevron’s NEXBASE Group III base oils in Turkey.

Report Scope

Report Features Description Market Value (2024) USD 1.6 Billion Forecast Revenue (2034) USD 2.7 Billion CAGR (2025-2034) 5.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Mineral Oils, Bio-Based Oils, Synthetic Oils), By Turbine Type (Steam Turbine, Gas Turbine, Wind Turbine, Hydraulic Systems, Others), By End-use (Automotive, Aerospace, Energy Generation, Marine, Mining, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BP Lubricants, Chevron U.S.A, Eastern Petroleum, Eastman Chemical Company, Exxon Mobil Corporation, FUCHS, Idemitsu, Indian Oil Corporation, Kluber Lubrication, Lubrizol Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BP Lubricants

- Chevron U.S.A

- Eastern Petroleum

- Eastman Chemical Company

- Exxon Mobil Corporation

- FUCHS

- Idemitsu

- Indian Oil Corporation

- Kluber Lubrication

- Lubrizo