Global Transformer Substation Inspecting Robot Market Size, Share Analysis Report By Product Type (Wheel-type, Crawler-type), By Application (Single Station Type, Multi-station Type) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171475

- Number of Pages: 301

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

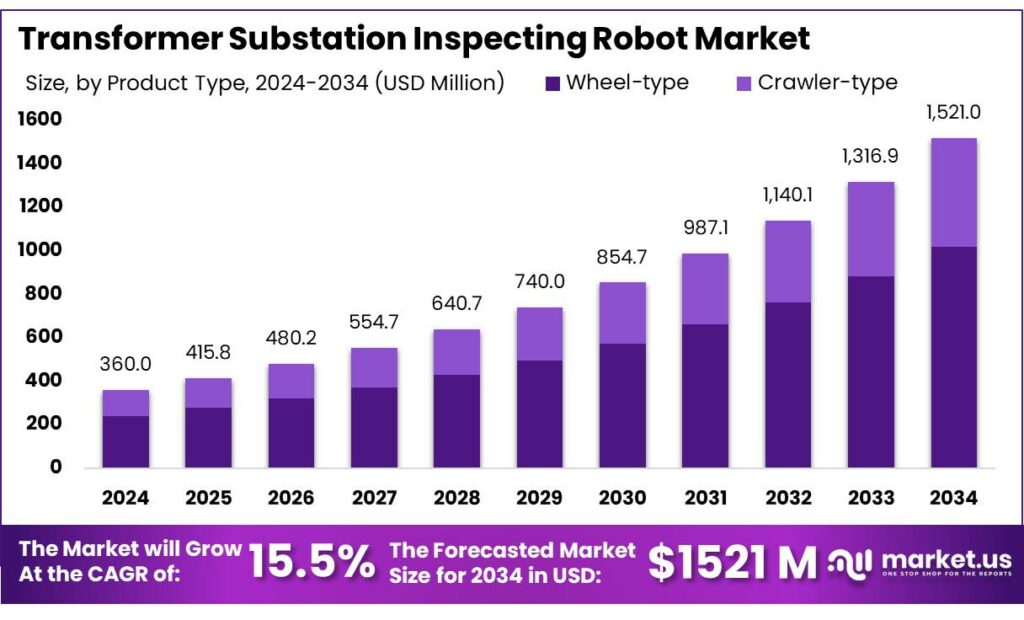

The Global Transformer Substation Inspecting Robot Market size is expected to be worth around USD 360 Million by 2034, from USD 1521 Million in 2024, growing at a CAGR of 15.5% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 43.8% share, holding USD 158.0 Billion in revenue.

Transformer substation inspecting robots are purpose-built mobile platforms that combine rugged sensors—HD/thermal cameras, LiDAR, ultrasonic/partial-discharge pickup, gas “sniffers,” and acoustic/vibration probes—with autonomous navigation to patrol yards, scan assets, and flag early-stage defects. Their industrial value is straightforward: substations are asset-dense, safety-critical environments where routine visual checks, hotspot detection, corrosion tracking, and anomaly hunting must happen frequently, yet manual inspection exposes crews to high-voltage hazards, extreme weather, and site-access constraints.

The industrial scenario is being shaped by faster grid loading and higher reliability expectations. The International Energy Agency reports global electricity demand rose 4.3% in 2024 (up from 2.5% in 2023) and expects continued strong growth into the mid-2020s—pressure that increases substation utilization and makes unplanned downtime more costly.

- In the U.S., capital intensity is rising as well: the EIA notes annual spending by major utilities to produce and deliver electricity reached $320 billion in 2023, driven largely by infrastructure investment. On the policy side, the U.S. DOE’s Grid Resilience and Innovation Partnerships (GRIP) program announced about $4.2 billion for 46 projects across 47 states (plus D.C.) to harden the grid and expand capacity—creating a larger installed base that needs inspection and predictive maintenance.

Policy and public funding are accelerating “grid hardening” and digitalization programs that indirectly expand the runway for inspection robotics. In the United States, DOE’s Grid Resilience and Innovation Partnerships (GRIP) program has announced about USD 4.2 billion in federal investments for 46 projects across 47 states plus DC, aimed at improving resilience and enabling additional capacity for load growth. DOE also announced more than USD 600 million in October 2024 to bolster grid resilience and reliability in areas impacted by major hurricanes—programs that commonly include substation upgrades, automation, and monitoring.

- Government initiatives are directly reinforcing this shift toward digital, resilient substations. In the United States, the Department of Energy’s Grid Resilience and Innovation Partnerships (GRIP) program totals USD 10.5 billion and has already announced USD 7.6 billion for 105 selected projects across all 50 states and D.C., explicitly targeting resilience and capacity under extreme weather and load growth. This kind of funding environment supports procurement of smart-grid technologies because it ties reliability outcomes to modernized operational practices.

Key Takeaways

- Transformer Substation Inspecting Robot Market size is expected to be worth around USD 360 Million by 2034, from USD 1521 Million in 2024, growing at a CAGR of 15.5%.

- Wheel-type held a dominant market position, capturing more than a 67.3% share.

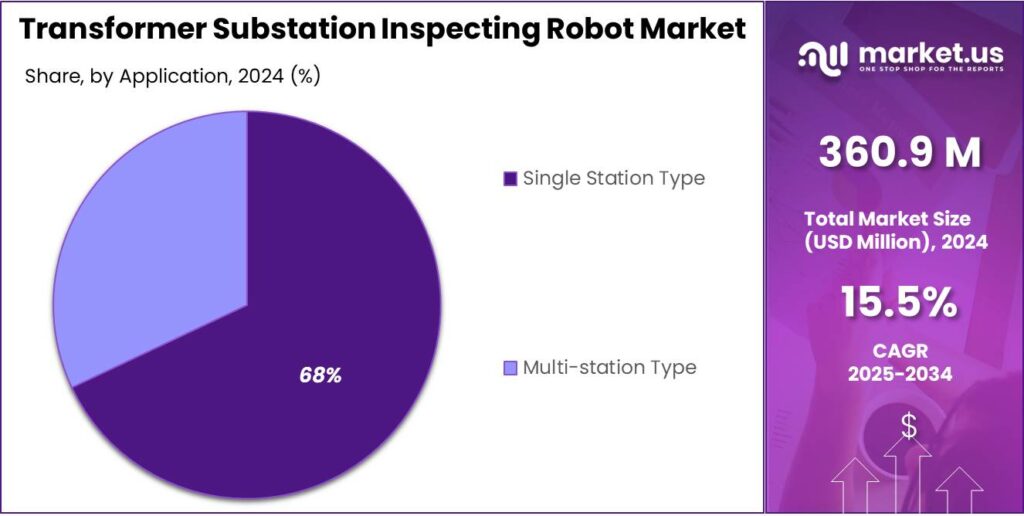

- Single Station Type held a dominant market position, capturing more than a 67.9% share.

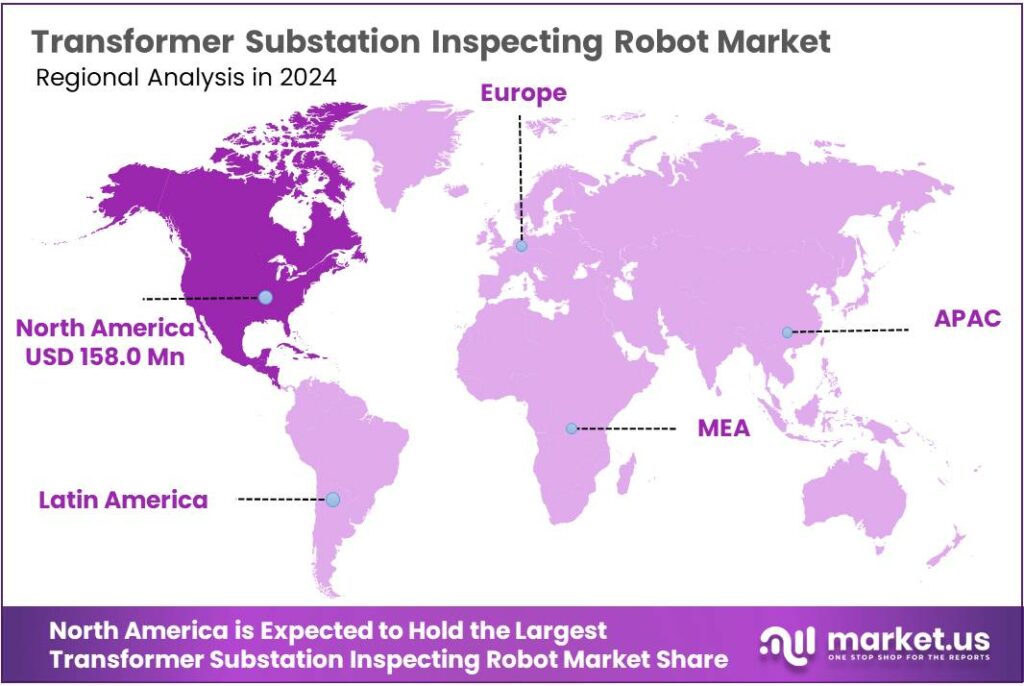

- North America held a dominant position in the transformer substation inspecting robot market, accounting for 43.80% of regional share and an estimated USD 158.0 million.

By Product Type Analysis

Wheel-type robots lead with a 67.3% share, supported by stable movement and lower operating complexity.

In 2024, Wheel-type held a dominant market position, capturing more than a 67.3% share, as this product type remained the most practical choice for routine transformer substation inspections. The strong position was supported by smooth mobility on flat substation floors, predictable performance, and lower mechanical risk compared to legged or hybrid designs. Wheel-type robots were widely preferred for visual inspection, thermal imaging, gas leakage checks, and basic fault detection, where steady movement and long operating hours are required. In 2024, utilities increasingly relied on these robots to reduce manual inspection frequency and improve worker safety, especially in high-voltage environments.

By Application Analysis

Single station inspection leads with a 67.9% share, driven by focused monitoring and easier deployment.

In 2024, Single Station Type held a dominant market position, capturing more than a 67.9% share, as utilities continued to prioritize targeted inspection solutions for individual transformer substations. This application type was widely adopted because it allows robots to operate within a fixed and well-defined area, resulting in higher inspection accuracy and simpler navigation. Single station systems were mainly used for routine visual checks, temperature monitoring, partial discharge detection, and equipment status verification, all within one substation boundary.

Key Market Segments

By Product Type

- Wheel-type

- Crawler-type

By Application

- Single Station Type

- Multi-station Type

Emerging Trends

AI-Driven “Patrol-to-Work-Order” Automation Becomes the New Standard

A clear latest trend in transformer substation inspecting robots is the shift from “robot as a roaming camera” to “robot as a maintenance workflow engine.” Utilities are no longer satisfied with a robot that only streams video; they want a system that patrols, spots anomalies, and automatically turns those findings into action—inspection notes, risk flags, and work orders. This is happening because substations are being asked to do more, more often. The International Energy Agency reports global electricity demand grew by 4.3% in 2024, a step change from 2.5% in 2023.

- A second part of this trend is inspection “standardization at scale,” pushed by modern grid programs. In the U.S., the Department of Energy has announced about $4.2 billion in federal investments through GRIP round-two selections for 46 projects in 47 states plus D.C., explicitly tied to resilience, extreme weather, and enabling more capacity for manufacturing, data centers, and electrification.

What’s driving the automation push is also the reality of long replacement timelines for critical equipment. A NIAC report posted by CISA notes that large transformers can have lead times ranging from 80 to 210 weeks. When the most expensive assets can take years to replace, utilities want earlier warnings and cleaner evidence before dispatching crews. This is where the newest robot deployments focus: repeatable thermal baselines, visual change detection, and “exception reporting” that tells engineers what changed since the last patrol, not just what the robot saw.

Another trend is closer alignment with digital-substation practices—especially around data formats and interoperability. A NEMA paper notes that nearly 100% of European utilities use IEC 61850, while very few do so in North America. That gap is shaping product strategy. In markets with stronger IEC 61850 adoption, robot findings are increasingly expected to connect to standardized asset and event models. In markets with more legacy protocols, vendors are pushing edge gateways and integration layers so robot data can still flow into asset management systems without touching sensitive protection networks.

Drivers

Rising Grid Load and Reliability Pressure Drives Robot Inspections

One major driver for transformer substation inspecting robots is the simple fact that grids are being pushed harder, and the cost of “missing” an early warning keeps rising. The International Energy Agency (IEA) reports global electricity demand increased by 4.3% in 2024, a step up from 2.5% in 2023. That jump matters at the substation level because higher demand usually means more stressed transformers, busbars, breakers, and connectors—exactly the assets where small issues (loose joints, contamination, moisture ingress, or overheating) can quietly grow into unplanned outages.

When reliability becomes harder to guarantee, utilities lean toward more frequent, more consistent inspection—without putting people in harm’s way. A robot can patrol on a schedule, take thermal images every day, and spot abnormal heating trends early. That “trend visibility” is a practical advantage when demand growth is strong and equipment cycles more often. It also helps during heatwaves, storms, or restricted-access periods, when sending crews into energized yards is slower and riskier. The same driver is amplified by electrification and new loads like data centers and manufacturing, which the DOE explicitly calls out as part of the load-growth context behind major grid investment programs.

- Investment levels show how seriously infrastructure owners are treating resilience and capacity. In the United States, the Energy Information Administration (EIA) notes annual spending by major utilities to produce and deliver electricity reached $320 billion in 2023, with capital investment in electric infrastructure a key driver. In parallel, the U.S. Department of Energy’s Grid Resilience and Innovation Partnerships (GRIP) program announced about $4.2 billion in federal investments in round-two selections for 46 projects across 47 states plus the District of Columbia.

- The National Electrical Manufacturers Association (NEMA) has said transformer lead times have been steadily increasing, reaching a current average of 120 weeks. When spares take that long, avoiding failures becomes a top operational priority, not a nice-to-have. Robots support that goal by enabling condition-based maintenance: they repeatedly scan the same assets, compare today’s readings with last week’s baseline, and flag “small but worsening” changes before they become forced outages.

Restraints

Cybersecurity, Compliance, and Legacy Integration Slow Deployments

A major restraint for transformer substation inspecting robots is not the robot itself—it’s everything the robot has to plug into. The International Energy Agency notes that the average cost of a data breach in the energy sector reached USD 4.72 million in 2022. Even if a robot is intended only for inspection, utilities often worry about the pathway it creates into operational technology (OT) networks, especially when vendors want remote access for troubleshooting and software updates.

Compliance adds another layer of friction. In North America, utilities that operate in the Bulk Electric System must align with NERC CIP reliability standards, which require categorization and protection of “BES Cyber Systems” based on impact and risk. Even when a substation robot is positioned as a maintenance tool, buyers may still treat it like a cyber system that needs documented controls, controlled access, and auditable processes.

Legacy integration is the other big limiter. Substations are often a mix of old and new—different relay generations, different protocols, and site-by-site variation in communications. The substation automation standard IEC 61850 helps, but adoption is uneven. A NEMA paper notes that nearly 100% of European utilities use IEC 61850, while very few do so in North America, where perceived risk and limited perceived benefits slow migration. For robots, that unevenness matters because inspection value increases when robot findings can be linked cleanly to asset records, alarms, and maintenance systems.

- Government programs are pushing modernization, but they can also raise the bar for cyber readiness. For example, the U.S. Department of Energy’s GRIP program announced around $4.2 billion for 46 projects across 47 states plus D.C., reinforcing that grid upgrades must be scalable and resilient. As utilities expand and harden the grid, many will choose proven, security-audited deployments over fast pilots.

Opportunity

Condition-Based Maintenance at Scale Creates the Biggest Growth Opportunity

The clearest growth opportunity for transformer substation inspecting robots is helping utilities move from “inspection by calendar” to condition-based maintenance across a much larger and more stressed grid. Global electricity demand is rising fast, and that pushes more current through the same network of transformers, breakers, and connectors. The International Energy Agency reports global electricity demand grew by 4.3% in 2024, up from 2.5% in 2023, and it describes a structural shift driven by electrification, manufacturing, and digitalisation.

- In the U.S., the Energy Information Administration (EIA) reports annual spending by major utilities to produce and deliver electricity reached $320 billion in 2023 (real 2023 dollars), with grid infrastructure investments driving the increase. On the public-program side, the U.S. Department of Energy’s Grid Resilience and Innovation Partnerships (GRIP) program has announced about $4.2 billion in federal investments through the second round of GRIP funding for 46 projects in 47 states plus the District of Columbia.

The National Infrastructure Advisory Council (NIAC), in a report hosted by CISA, notes that large transformers have lead times ranging from 80 to 210 weeks. NEMA has also highlighted that transformer lead times have climbed to a current average of 120 weeks. When a critical asset may take years to replace, preventing failure becomes the priority. Robots directly support that prevention goal by spotting early warning signals—hotspots, oil leaks, abnormal sounds, corrosion, or vegetation encroachment—more frequently and more consistently than manual rounds can usually achieve.

Regional Insights

North America leads with 43.8% share and US$158.0 Mn in 2024, supported by grid automation and safety investments

In 2024, North America held a dominant position in the transformer substation inspecting robot market, accounting for 43.80% of regional share and an estimated USD 158.0 million in value. This leadership was backed by sustained investments from utilities and grid operators in advanced inspection automation to improve reliability, reduce outage risks, and enhance worker safety in high-voltage environments.

Aging electrical infrastructure in the United States and Canada has driven demand for technologies that enable frequent, non-intrusive condition monitoring of transformers and related assets, especially in areas prone to extreme weather events where manual inspection poses safety challenges and operational delays. In 2024, grid modernisation programmes emphasised predictive maintenance and real-time data acquisition, encouraging the adoption of robotic systems equipped with high-resolution cameras, thermal imaging, gas sensors, and partial discharge detectors.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Zhengzhou Wanda Technology offered transformer substation inspecting robots with obstacle avoidance and autonomous patrolling features. The company deployed 70+ robotic units, contributing to revenue of ~USD 6.4 million. Its designs focused on stable performance in varied indoor substation environments, emphasising ease of use and integration with existing grid monitoring systems.

In 2024, Yijiahe Technology delivered advanced substation inspection robots equipped with laser ranging and environmental mapping capabilities. The company recorded total sales of around ~USD 7.8 million from 65+ units deployed. Its solutions emphasised rugged design and real-time data reporting, helping utilities conduct regular inspections in remote and high-risk transformer sites.

In 2024, Hangzhou Shenhao Tech strengthened its presence in inspection automation with transformer substation robots designed for visual, thermal, and partial-discharge monitoring. The firm sold 80+ robotic systems domestically and internationally, generating ~USD 9.5 million in revenue. Its focus on modular sensor platforms and AI-enabled fault detection supported higher inspection accuracy and reduced downtime for grid operators.

Top Key Players Outlook

- Zhejiang Guozi Robotics

- Hangzhou Shenhao Tech

- Yijiahe Technology

- Dali Technology

- Zhengzhou Wanda Technology

- SMP Robotics

- Hydro Québec

Recent Industry Developments

Yijiahe Technology Co., Ltd. is a Chinese robotics company that has been expanding its work into transformer substation inspecting robots through its Smart Power product line, especially with the SI300 Intelligent Simple Inspection Robot in 2024; this robot is designed to cut inspection time dramatically from about 4 hours per station (manual) to <30 minutes and achieve a 99% defect recognition rate, helping utilities move faster and safer during routine patrols.

In 2024, Hangzhou Shenhao Technology Co. portfolio in the transformer inspection space includes several models such as the SIRD-3000S indoor wheeled substation inspection robot, the SHIR-3000M outdoor wheeled inspection robot, and the IR-ET8040A tracked substation inspection robot—all capable of autonomous navigation, thermal and visible imaging, and multi-sensor detection to support substation patrol and condition assessment.

Report Scope

Report Features Description Market Value (2024) USD 360 Mn Forecast Revenue (2034) USD 1521 Mn CAGR (2025-2034) 13.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Wheel-type, Crawler-type), By Application (Single Station Type, Multi-station Type) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Zhejiang Guozi Robotics, Hangzhou Shenhao Tech, Yijiahe Technology, Dali Technology, Zhengzhou Wanda Technology, SMP Robotics, Hydro Québec Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Transformer Substation Inspecting Robot MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Transformer Substation Inspecting Robot MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Zhejiang Guozi Robotics

- Hangzhou Shenhao Tech

- Yijiahe Technology

- Dali Technology

- Zhengzhou Wanda Technology

- SMP Robotics

- Hydro Québec