Global Trail Mixes Market By Ingredient (Nuts, Dried Fruits, Seeds, Chocolates and Sweets, Grains and Cereals), By Flavor Profile (Sweet, Savory, Spicy, Mixed), By Source (Conventional, Organic), By Packaging (Pouches, Jars, Boxes, Single-Serve Packs, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151712

- Number of Pages: 312

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

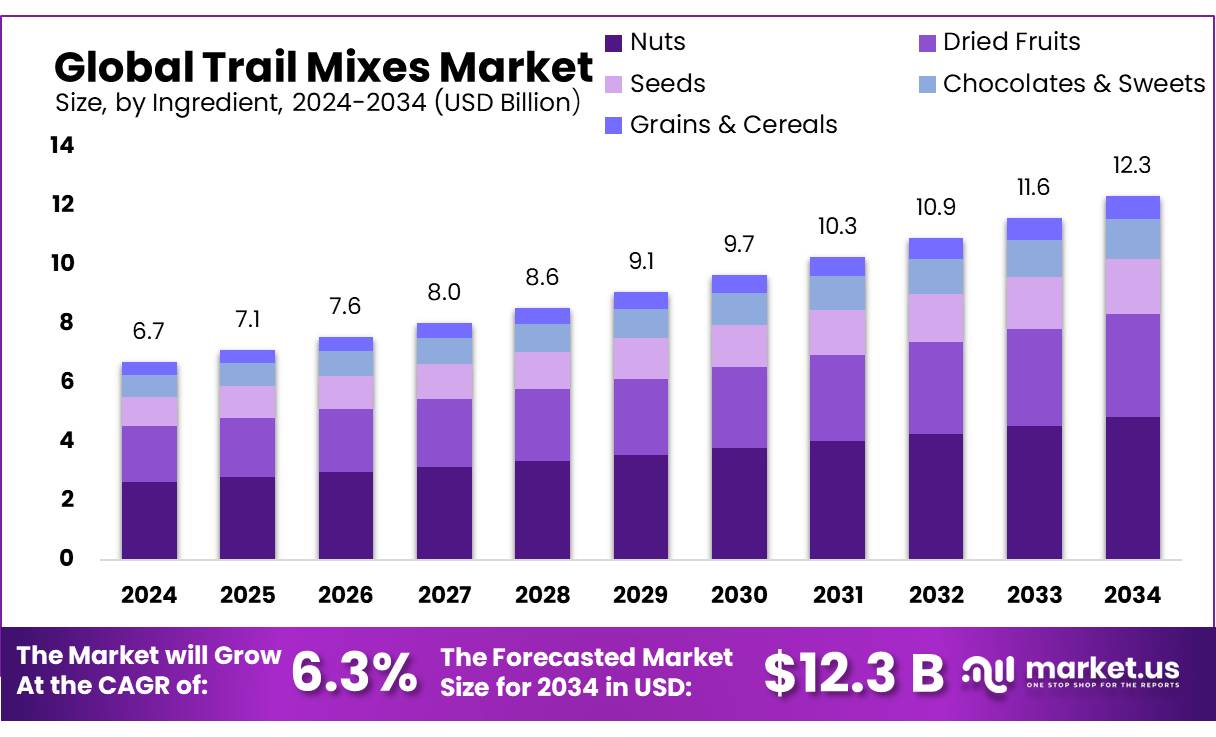

The Global Trail Mixes Market size is expected to be worth around USD 12.3 Billion by 2034, from USD 6.7 Billion in 2024, growing at a CAGR of 6.3% during the forecast period from 2025 to 2034.

Trail mix concentrates—composite snack blends composed of nuts, seeds, dried fruits, and occasionally granola—have evolved from niche outdoor hiking provisions to a mainstream, health-driven consumer segment. Their elevated nutritional profile, combining protein, fiber, healthy fats, and carbohydrates, caters to consumers seeking nutritious, on-the-go snack options. Demand is particularly strong among individuals pursuing fitness and active lifestyles, intensified by an increasing global preference for “better for you” snacking.

Several key drivers underpin this expansion. First, increasing health awareness globally has led to a preference for nutrient-rich ingredients. In the U.S., 91% of households reported purchasing nuts in the prior quarter, while 37% purchased trail mix, indicating mainstream acceptance of the core ingredients. Second, regulatory initiatives further enhance consumer confidence.

The U.S. Food and Drug Administration’s FSMA (effective January 4, 2011) mandates comprehensive hazard analysis and preventive controls, as well as routine inspections and traceability measures for food manufacturers. Meanwhile, in India, the FSSAI (established under the Food Safety and Standards Act, 2006) enforces science based standards and oversees over 112 NABL accredited labs in the food testing network

From a supply-chain perspective, the adoption of global food safety frameworks has become critical. International standards such as ISO 22000—incorporating HACCP principles—are now widely adopted by processors to ensure product safety across cross-border trade. In India, the Ministry of Food Processing Industries (MOFPI), with an annual budget for 2025–26, is actively promoting the modernization of processing units, rural employment, and farmer integration

On a policy level, countries are supporting value-added processing. In India, the Ministry of Food Processing Industries hosts flagship schemes like Mega Food Parks (42 parks approved, increasing perishables processing) and Operation Greens (Rs 500 crore aimed at TOP crops logistics and processing support). USDA reports show India’s imports of consumer oriented foods reached USD 7 billion in Jan–Nov 2023, 15% of which came from the U.S., reflecting rising processed ingredient demand.

Meanwhile, in the United States, specialty crop support via government Farm Bills backs tree nut and dried fruit production—key raw materials for trail mix concentrates—covering over 350 crops and specialist growers, with aid through marketing and technical assistance programs

Key Takeaways

- Trail Mixes Market size is expected to be worth around USD 12.3 Billion by 2034, from USD 6.7 Billion in 2024, growing at a CAGR of 6.3%.

- Nuts held a dominant position in the global trail mixes market, capturing more than a 39.2% share.

- Sweet flavor profiles held a dominant position in the global trail mixes market, capturing more than a 42.9% share.

- Conventional trail mixes held a dominant market position, capturing more than a 78.4% share.

- Pouches held a dominant market position in the global trail mixes market, capturing more than a 44.1% share.

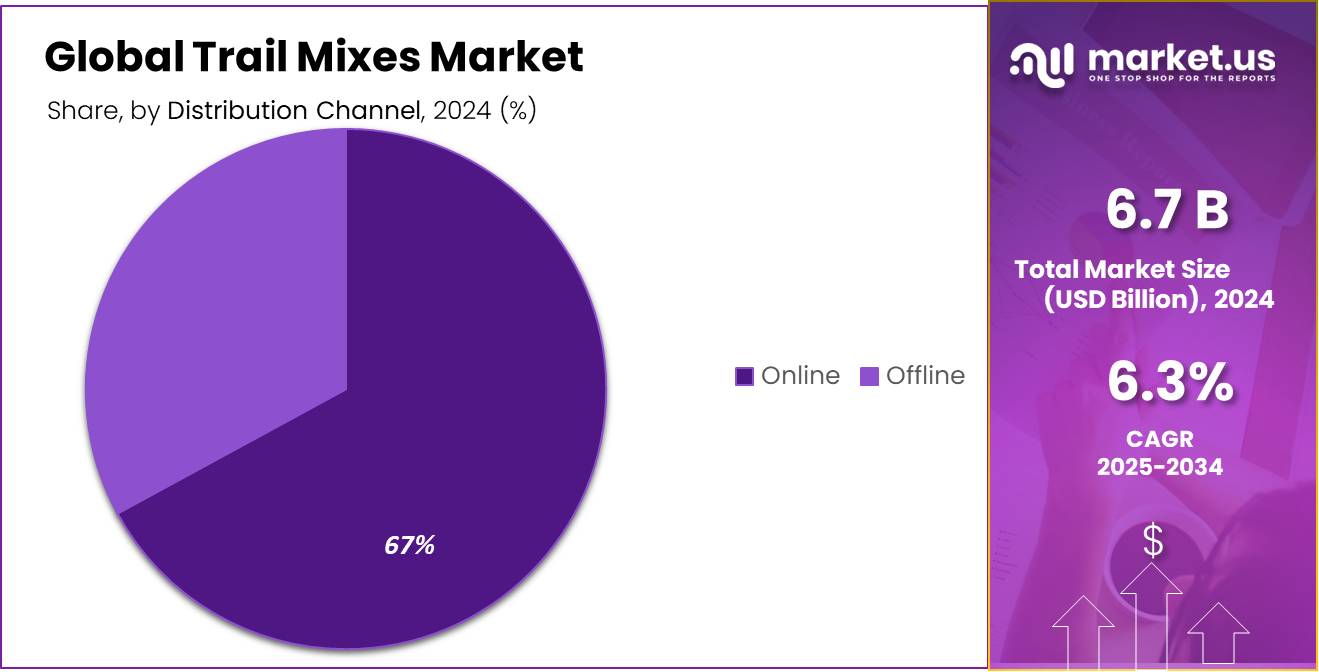

- Online distribution held a dominant market position in the trail mixes market, capturing more than a 67.2% share.

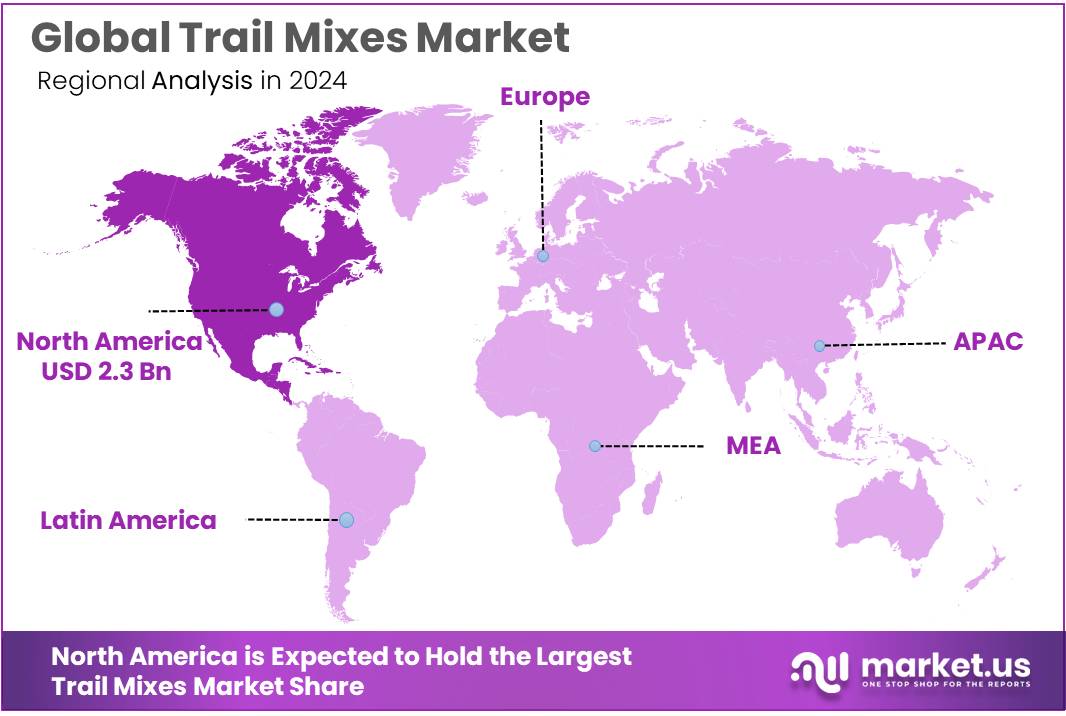

- North America emerged as the dominant region in the global trail mixes market in 2024, accounting for about 34.9% of total revenue—equivalent to roughly USD 2.3 billion.

By Ingredient

Nuts dominate with 39.2% share due to their high protein and energy value

In 2024, nuts held a dominant position in the global trail mixes market, capturing more than a 39.2% share. Their popularity is driven by the fact that they are naturally rich in protein, healthy fats, fiber, and essential micronutrients, making them a preferred base ingredient in trail mix formulations. Consumers worldwide are increasingly choosing snacks that offer both taste and nutrition, and nuts provide the ideal balance. Almonds, cashews, walnuts, and peanuts are among the most commonly used types, each contributing unique texture, flavor, and health benefits. The growing awareness about plant-based proteins and clean-label snacking has further supported the demand for nut-based trail mixes.

By Flavor Profile

Sweet flavor leads with 42.9% share driven by consumer preference for indulgent snacking

In 2024, sweet flavor profiles held a dominant position in the global trail mixes market, capturing more than a 42.9% share. This segment continues to grow due to strong consumer demand for snacks that combine indulgence with perceived health benefits. Ingredients such as chocolate chips, dried fruits like raisins and cranberries, honey-roasted nuts, and yogurt-covered pieces have played a key role in boosting the appeal of sweet trail mix varieties. These combinations not only satisfy sweet cravings but also offer nutritional value, making them a popular choice for both kids and adults. The versatility of sweet trail mixes allows brands to target multiple consumer segments, including those looking for better-for-you dessert alternatives.

By Source

Conventional trail mixes lead with 78.4% share due to their affordability and wide availability

In 2024, conventional trail mixes held a dominant market position, capturing more than a 78.4% share. This strong hold in the market is largely due to their cost-effectiveness, broad consumer acceptance, and easy availability across supermarkets, convenience stores, and online platforms. Conventional trail mixes are typically made using non-organic ingredients, which helps manufacturers keep prices lower and ensure large-scale distribution. These products often include standard nuts, dried fruits, seeds, and flavor additives that are familiar to a wide audience, making them a practical snacking choice for daily consumption. The affordability and mass-market appeal of conventional mixes have made them a top pick among both value-conscious consumers and food service operators.

By Packaging

Pouches dominate with 44.1% share owing to convenience and portability

In 2024, pouches held a dominant market position in the global trail mixes market, capturing more than a 44.1% share. Their popularity stems from the growing demand for on-the-go snacking options and lightweight, resealable packaging. Pouches offer excellent portability, extended shelf life, and portion control, which appeals to busy consumers, especially working professionals, students, and fitness enthusiasts. The flexible packaging format also allows manufacturers to use creative designs and transparent windows to boost shelf appeal and consumer trust.

By Distribution Channel

Online sales lead with 67.2% share as digital shopping grows globally

In 2024, online distribution held a dominant market position in the trail mixes market, capturing more than a 67.2% share. The sharp rise in this segment is mainly due to the rapid shift in consumer shopping behavior toward digital platforms, especially after the global pandemic. Online channels offer unmatched convenience, wider product variety, doorstep delivery, and exclusive discounts, which have made them the preferred choice for purchasing trail mixes. Platforms such as brand websites, third-party e-commerce portals, and grocery delivery apps have enabled consumers to access both local and international trail mix products with ease.

Key Market Segments

By Ingredient

- Nuts

- Dried Fruits

- Seeds

- Chocolates & Sweets

- Grains & Cereals

By Flavor Profile

- Sweet

- Savory

- Spicy

- Mixed

By Source

- Conventional

- Organic

By Packaging

- Pouches

- Jars

- Boxes

- Single-Serve Packs

- Others

By Distribution Channel

- Online

- Offline

Drivers

Rising Health Consciousness and Nutrition Awareness

In India, nut consumption has significantly increased, largely driven by their recognized health benefits. According to USDA’s 2024 report, walnut imports are expected to reach 70,000 MT for the marketing year 2024/25—up 17% from the previous year—underscoring rising domestic demand for nuts in both household and snack formats. This shift reflects wider dietary trends favoring plant-based proteins and healthy fats.

The Food Safety and Standards Authority of India (FSSAI) has reinforced this trend through its updated dietary guidelines, explicitly defining nuts as part of a “healthy meal” and recommending daily nut intake to support balanced nutrition. Such government-endorsed guidance increases consumer trust and encourages habitual nut consumption in snacks like trail mixes.

Cumulatively, these dynamics translate into a clear growth driver: health awareness leading consumers to choose trail mixes as practical, nutritious snacks. Nuts offer high protein, fiber, and heart-healthy fats—attributes increasingly sought after in everyday diets. The combination of rising import volumes, official dietary endorsements, and rapid market growth in packaged nuts affirm that nutritional considerations are fueling increased product adoption.

Restraints

Rising Input Costs & Safety Risks

In 2022, real (inflation-adjusted) grower prices for walnuts reached a record low of approximately $0.25 per pound—a sharp decline from earlier years—while almonds and hazelnuts also dropped to historic lows of $1.10 and $0.51 per pound respectively. Though low farm prices may appear advantageous for processors, they often reflect underlying instability in supply due to weather fluctuations, pests, and global market shifts. These conditions create uncertainty for manufacturers of trail mixes, who must balance sourcing costs and maintain stable retail prices.

The global sensitivity of nut markets is well-documented. When farmer prices plunged in 2022, American walnut acreage decreased from 400,000 acres in 2022 to 375,000 acres in 2023. Reduced acreage can limit future nut supplies and trigger a rebound in prices—potentially squeezing margins for trail mix producers. This farmer-level contraction highlights broader supply chain vulnerabilities.

Furthermore, public health policies aimed at reducing unhealthy consumption are gaining momentum. India’s FSSAI and GST Council have evaluated taxation on foods high in fat, sugar, and salt (HFSS), and modelling suggests adding a 20% health tax could reduce HFSS food consumption by 12–18%. While trail mixes aren’t uniformly classified under HFSS, many popular varieties contain added sugars and fats. If future labeling and taxation policies extend to snacks like trail mixes, manufacturers may face higher taxes, higher retail prices, and decreased demand.

These combined pressures—volatile nut prices, uncertain supply, and looming regulatory changes—create a challenging operating environment. Manufacturers are forced to either absorb increased costs, which reduces profitability, or transfer them to consumers, which risks demand erosion. As a result, some producers may slow down innovation, limit product launches, or seek cheaper ingredient substitutes to maintain price competitiveness.

Opportunity

Expansion via E-Commerce & D2C Channels

One of the most promising growth opportunities for the trail mix market lies in tapping into online grocery and direct-to-consumer (D2C) channels. E-commerce has become a lifeline for food brands, reshaping how consumers discover and buy snacks. In the United States, retail e-commerce sales rose by 6.1% in Q1 2025 compared to the same period in 2024, comprising 16.2% of all retail sales and totaling $275.8 billion. Simply put, more people are turning online—trail mix brands included.

If we look closer to home, in India—one of the fastest-growing digital economies—online retail hit $147.3 billion in 2024 and is growing at around 18.7% annually through 2028. Three in five online orders now come from Tier II and III cities, while D2C brands’ share has tripled over five years, reaching 15% of e-commerce sales. This across-the-board boom is powered by rising smartphone use, low data costs, and programs aimed at democratizing farmer access to markets, such as India’s Open Network for Digital Commerce (ONDC), which onboards thousands of farmers and cooperatives

Governments are helping too. The U.S. Census Bureau tracks e-commerce data to support small business digital initiatives, while India’s ONDC brings agricultural value-added products online, facilitating nationwide distribution. This helps brands scale up without large retail budgets or complicated export logistics.

Trends

Functional & Flavorful Trail Mixes

A powerful and recent trend transforming the trail mix market is the rise of functional, high-protein and low-sugar blends that do more than just taste good—they support overall wellbeing. According to a December 2024 report by Better Homes & Gardens, 65% of U.S. consumers prefer less sweet foods, with a growing shift toward natural sweeteners like dates and monk fruit—ingredients that are gradually appearing in trail mixes to reduce sugar without losing flavor.

At the same time, there’s an expanding interest in functional foods—snacks enhanced with vitamins, probiotics, adaptogens, or ingredients that aid gut health, cognition, and immunity. Trail mix makers are responding by adding super seeds (like chia or flax), roasted chickpeas, or even turmeric-coated nuts. These blends don’t just aim to satisfy hunger; they offer real health benefits in a convenient, grab and go format.

This shift is being reinforced by dietary guidance. The USDA Dietary Guidelines for Americans encourage reducing added sugars and increasing nutrient-dense whole foods. Trail mixes that include nuts, seeds, dried fruit, and low-sugar flavorings align well with those guidelines and are even suitable for procurement in federally backed nutrition programs like school lunches and SNAP.

Regional Analysis

North America emerged as the dominant region in the global trail mixes market in 2024, accounting for about 34.9% of total revenue—equivalent to roughly USD 2.3 billion. This significant share is underpinned by widespread consumer preference for healthy, convenient snacks, supported by high disposable incomes and extensive retail infrastructure.

The region’s retail landscape is highly diversified, combining large supermarkets, convenience stores, specialty health food outlets, and fast-growing e-commerce platforms. North American consumers frequently report health and wellness as primary motivators, with 91% of households purchasing nuts and 37% buying trail mix in recent months. This behavior aligns with a broader trend toward nutritious snacking, fueling demand for trail mixes that blend protein-rich nuts, seeds, dried fruits, and superfood ingredients.

E-commerce’s expansion further strengthens the region’s market position. Online sales—capturing 67.2% of total trail mix distribution—have been particularly significant in the U.S. and Canada, as digital platforms enable targeted health-focused marketing and convenient subscription models. Moreover, the culture of outdoor recreation and fitness in North America supports trail mix adoption as a go-to snack for hiking, sports, and travel.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

General Mills, known for its Nature Valley and Cascadian Farm brands, plays a leading role in the trail mix segment by offering health-focused, ready-to-eat snacks. The company has emphasized whole ingredients and clean-label formulations in response to growing consumer demand for transparency. General Mills leverages its global distribution network and strong brand trust to target both grocery and e-commerce sales channels across North America and select international markets.

PepsiCo Inc. its Frito-Lay division, PepsiCo offers trail mix products under the “Sunchips” and “TrueNorth” brands. The company integrates its advanced logistics and wide retail footprint to ensure strong market penetration. PepsiCo also tailors product innovation around plant-based protein and heart-healthy formulations, aligning with nutritional trends. Its R&D and flavor innovation teams allow rapid rollout of seasonal and functional trail mixes to meet evolving consumer demands.

Mars, Incorporated enters the trail mix market through its snack portfolio, particularly with M&M’s-containing trail mix blends. These appeal to consumers looking for a mix of indulgence and nutrition. Mars leverages strong brand loyalty and global presence to maintain a steady share in both convenience and retail formats. The company is investing in sustainable ingredient sourcing, which supports its long-term trail mix growth, particularly among environmentally conscious consumers.

Top Key Players in the Market

- General Mills, Inc.

- PepsiCo Inc.

- Mars, Incorporated

- Hormel Foods Corporation

- The Kellogg Company

- Texas Star Nut & Food Co

- Oberto Snacks Inc.

- Creative Snacks Co.

- The J.M. Smucker Company

- Whitworths

- CapVest Limited

Recent Developments

In 2024, General Mills, Inc. reported net sales of USD 19.86 billion, down 1% from the prior year, with organic net sales also decreasing by 1%.

In 2024, Hormel Foods reported net sales of USD 11.92 billion, down slightly from USD 12.11 billion in 2023—a 1.6% decline.

Report Scope

Report Features Description Market Value (2024) USD 6.7 Bn Forecast Revenue (2034) USD 12.3 Bn CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Ingredient (Nuts, Dried Fruits, Seeds, Chocolates and Sweets, Grains and Cereals), By Flavor Profile (Sweet, Savory, Spicy, Mixed), By Source (Conventional, Organic), By Packaging (Pouches, Jars, Boxes, Single-Serve Packs, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape General Mills, Inc., PepsiCo Inc., Mars, Incorporated, Hormel Foods Corporation, The Kellogg Company, Texas Star Nut & Food Co, Oberto Snacks Inc., Creative Snacks Co., The J.M. Smucker Company, Whitworths, CapVest Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- General Mills, Inc.

- PepsiCo Inc.

- Mars, Incorporated

- Hormel Foods Corporation

- The Kellogg Company

- Texas Star Nut & Food Co

- Oberto Snacks Inc.

- Creative Snacks Co.

- The J.M. Smucker Company

- Whitworths

- CapVest Limited